Global Power Purchase Agreement Platform Market Size, Share Analysis Report By Solution (PPA Valuation And Risk Management, Contract And Portfolio Management, Marketplace/Tendering Platforms, Distributed Energy/ Microgrid PPA Platforms), By Deployment (Cloud, On-premises), By End Use (Industrial, Energy Developers, Utility, Financial Institutions) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174616

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

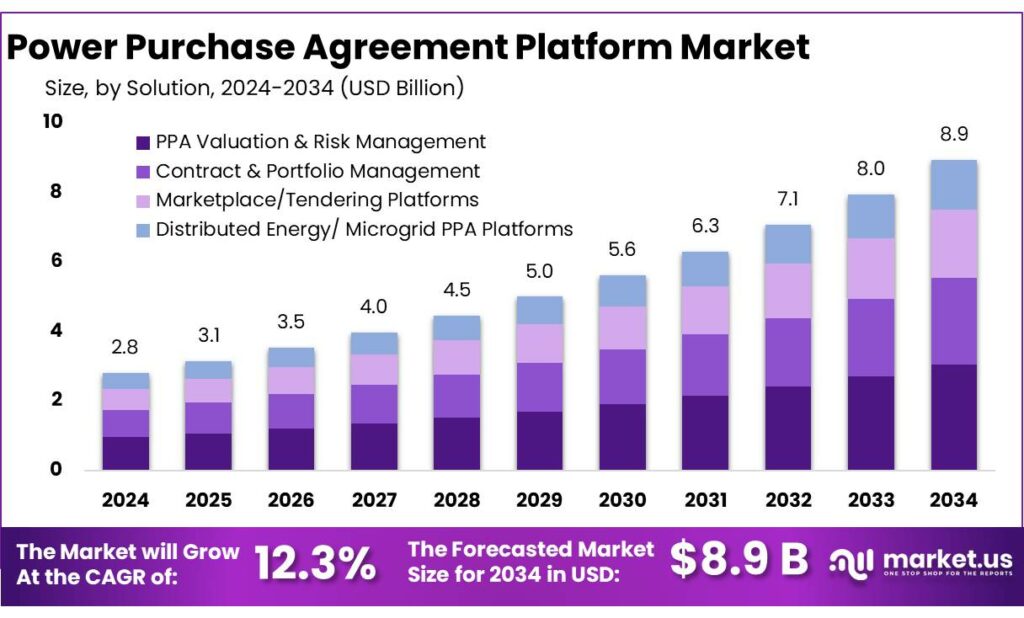

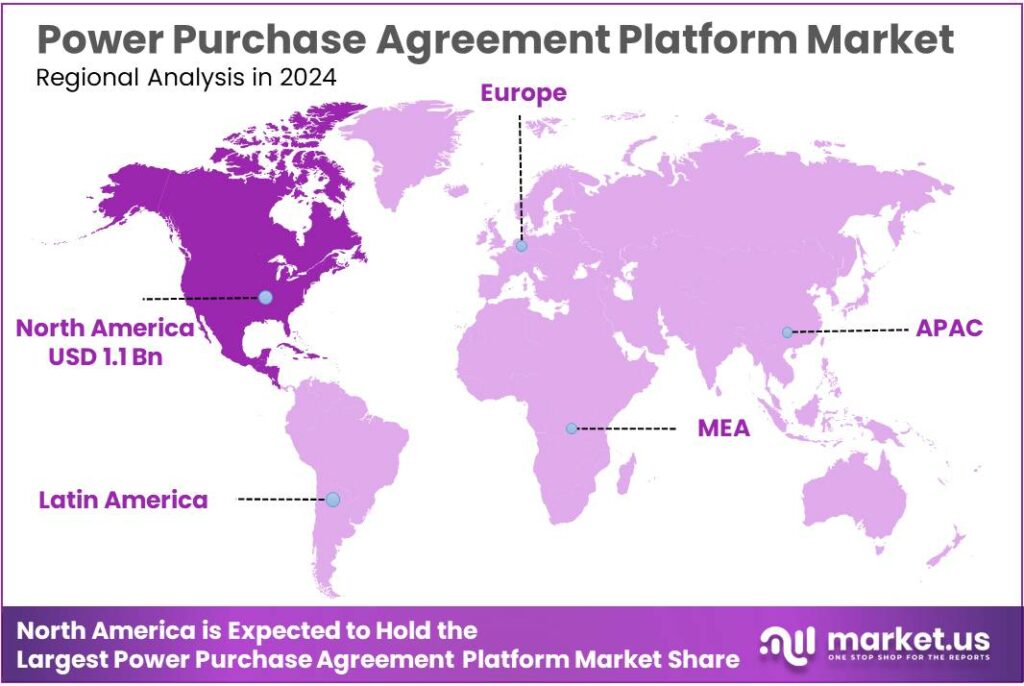

Global Power Purchase Agreement Platform Market size is expected to be worth around USD 8.9 Billion by 2034, from USD 2.8 Billion in 2024, growing at a CAGR of 12.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 39.6% share, holding USD 1.1 Billion in revenue.

Power Purchase Agreement (PPA) platforms sit at the intersection of corporate energy procurement, risk management, and sustainability reporting. Their role has expanded as electricity has become a larger strategic input cost for industry: the industrial sector used 37% (166 EJ) of global energy in 2022, underscoring why price stability and decarbonisation tools are moving into core procurement workflows.

The industry scenario is defined by scale and complexity. BloombergNEF reported corporations publicly announced a record 46 GW of solar and wind contracts in 2023, and 198 GW of corporate solar and wind PPAs have been announced since 2008. BNEF also estimates RE100 members will need an additional 105 GW by 2030 to meet 100% clean power targets. These volumes create operational friction—multi-country contracting, credit screening, shaping/volume risk, settlement, guarantees of origin/RECs, and audit-ready reporting—where PPA platforms increasingly standardize documentation, automate analytics, and shorten cycle times.

Key drivers are also visible in end-market demand signals, including food and beverage buyers who need scalable decarbonization tools. For example, Nestlé disclosed that its Texas solar investment includes purchasing 100% of the project’s output—estimated at over 522,000 MWh per year—under a 15-year arrangement. McDonald’s has reported renewable project participation totaling 1,130 MW across five wind and solar projects. PepsiCo Canada tied its 100% renewable electricity matching target in 2023 partly to a 12-year VPPA linked to a wind project expected to produce 130 MW.

Policy is also making platforms more relevant because it widens the addressable buyer base and clarifies “how” green power can be procured. In India, the Electricity Rules, 2022 were notified on 06 June 2022, and government communication later highlighted that the open-access threshold for green energy was reduced from 1 MW to 100 kW, enabling smaller consumers to participate.

Key Takeaways

- Power Purchase Agreement Platform Market size is expected to be worth around USD 8.9 Billion by 2034, from USD 2.8 Billion in 2024, growing at a CAGR of 12.3%.

- PPA Valuation & Risk Management held a dominant market position, capturing more than a 34.2% share.

- Cloud held a dominant market position, capturing more than a 69.5% share.

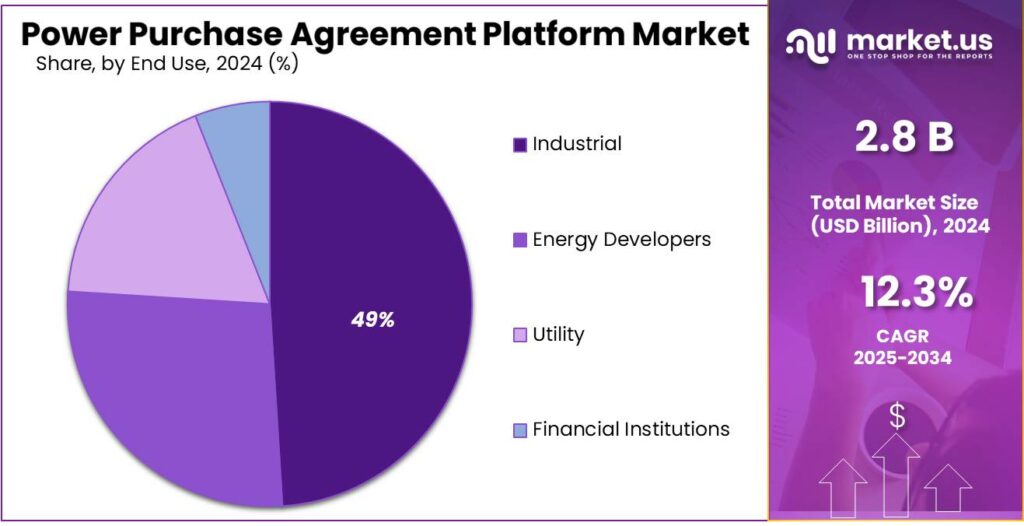

- Industrial held a dominant market position, capturing more than a 49.1% share.

- North America dominates the PPA Platform Market with 39.6% share, valued at USD 1.1 Bn.

By Solution Analysis

PPA Valuation & Risk Management leads the market with a strong 34.2% share in 2024

In 2024, PPA Valuation & Risk Management held a dominant market position, capturing more than a 34.2% share, reflecting its growing importance for developers, utilities, and corporate buyers navigating long-term clean-energy contracts. As Power Purchase Agreements become more complex—especially with hybrid assets, storage integration, and merchant-price exposure—organizations increasingly rely on valuation tools to forecast revenues, compare contract structures, and assess long-term financial exposure. The segment continued to expand in 2025, supported by rising renewable capacity additions and higher volatility in wholesale electricity prices, which pushed more buyers to adopt advanced digital platforms for modeling project risk.

By Deployment Analysis

Cloud Deployment dominates the market with a strong 69.5% share in 2024

In 2024, Cloud held a dominant market position, capturing more than a 69.5% share, driven by the growing need for flexible, scalable, and easily integrated PPA management solutions. As renewable energy portfolios grow more diverse and long-term energy contracts become more complex, energy buyers and developers prefer cloud platforms for their ability to handle real-time data, automate updates, and support remote collaboration. The shift toward digital procurement and cloud-native analytics further strengthened the segment, making cloud deployment the preferred choice for both corporate sustainability teams and utilities.

By End Use Analysis

Industrial segment leads the market with a strong 49.1% share in 2024

In 2024, Industrial held a dominant market position, capturing more than a 49.1% share, supported by the sector’s rising demand for long-term clean energy contracts and the need to manage electricity cost volatility. Large manufacturing units, chemical plants, mining operations, and heavy-processing industries increasingly relied on Power Purchase Agreement platforms to secure predictable energy prices while meeting emissions-reduction goals. With energy-intensive operations facing high grid tariffs and pressure to decarbonize, industrial players turned to digital PPA tools for contract evaluation, performance tracking, and renewable energy planning.

Key Market Segments

By Solution

- PPA Valuation & Risk Management

- Contract & Portfolio Management

- Marketplace/Tendering Platforms

- Distributed Energy/ Microgrid PPA Platforms

By Deployment

- Cloud

- On-premises

By End Use

- Industrial

- Energy Developers

- Utility

- Financial Institutions

Emerging Trends

Hourly matching and granular certificates are reshaping PPA platforms

One major latest trend in the Power Purchase Agreement (PPA) Platform space is the move from “annual renewable claims” to hour-by-hour (24/7) tracking and matching, supported by time-stamped energy attribute data. In plain terms, many buyers no longer want to say, “We bought enough renewable electricity over the year.” They want to show that their electricity use is matched with clean generation in the same hour, because that is a stronger claim and closer to how grids actually work.

A big reason the trend is accelerating is that leading global companies have made 24/7 carbon-free energy a visible goal. Google has publicly set a target to operate on 24/7 carbon-free energy by 2030, which requires tracking clean energy performance much more precisely than traditional annual accounting. A UK system operator report on 24/7 CFE trading also points to how the market is evolving: it notes that current 24/7 tariffs often show 70%–95% matching on a granular basis, while some major buyers are aiming for full granular matching by 2030.

Food and beverage companies are a strong signal for why platforms must evolve. Their renewable electricity progress is significant, but the next step is proving it with better time-based evidence—especially across many plants and countries. PepsiCo reports that in 2024, 89% (about 3,900 GWh) of its direct global electricity needs were met with renewable electricity, including through PPAs and EACs. Nestlé reports 95.3% renewable electricity sourced in its manufacturing sites by the end of 2024, with a 2025 target of 100%.

Government initiatives are also feeding this trend by expanding who can participate and increasing the volume of contracts that need structured tracking. In India, the government highlighted that Green Energy Open Access reduced the transaction limit from 1 MW to 100 kW, enabling smaller consumers to buy renewable power through open access—meaning more PPAs, more sites, and more reporting needs.

Drivers

Corporate renewable buying is pushing PPA platforms fast

One major driving factor for Power Purchase Agreement (PPA) platforms is the steady rise in corporate renewable electricity procurement, especially from large food and beverage manufacturers that need stable power costs and clearer emissions reporting. In 2024, many of these companies were no longer “testing” renewable sourcing—they were scaling it across factories, warehouses, and offices.

The numbers from leading food organizations show why this driver is real. PepsiCo states that in 2024, 89% of its direct global electricity needs were met with renewable electricity—about 3,900 GWh—including through PPAs and energy attribute certificates. Nestlé reports that by the end of 2024, it had reached 95.3% sourced renewable electricity across its manufacturing sites. Unilever notes that in 2024, 85% of the electricity used across its offices, factories, R&D centres, and warehouses was renewable.

In India, Hindustan Unilever (HUL) adds a very operational indicator of progress: as of December 2024, 15 manufacturing sites had achieved 100% renewable energy status, and by March 2025 it reported 97% of total energy (electrical + thermal) coming from renewable sources, with all electricity sourced from renewables.

Government policy is also amplifying this platform demand by making renewable procurement easier and more attractive, which increases the volume and variety of PPAs to manage. In India, the Green Energy Open Access Rules lowered the open-access threshold for green power from 1 MW to 100 kW, widening eligibility to smaller commercial and industrial consumers and encouraging more structured renewable contracts. In the EU, the revised Renewable Energy Directive raises the binding 2030 renewables target to 42.5%, and the Commission has also issued guidance aimed at facilitating PPAs.

Restraints

Grid integration and policy hurdles slow down PPA platform adoption

One major restraining factor for Power Purchase Agreement (PPA) platforms is the difficulty of integrating renewable energy into existing power systems and navigating complex regulatory environments, which creates real barriers for companies trying to adopt long-term renewable contracts. While many corporations in the food and other sectors want to shift toward clean power to reduce cost volatility and lower greenhouse gas emissions, the variable nature of renewable energy—like solar and wind—makes reliable integration challenging.

For food manufacturers and other industrial buyers, this grid limitation has a knock-on effect. Without stable renewable delivery, organizations can struggle to meet sustainability goals or justify the time and cost spent on digital PPA platforms. According to a report on energy use in global food, beverage, and agriculture companies, 31 companies together reported 39 TWh of electricity use in 2024, with a 57% renewable energy share—a number that is growing but still shows there is a long way to go for consistent renewables penetration in industrial energy consumption.

Another important constraint is regulatory complexity and inconsistency across regions. In markets like India, corporate renewable procurement through PPAs has historically been described as challenging due to fragmented policy frameworks and variable open access rules across states. In earlier industry surveys, companies ranked India among the most difficult markets for corporate renewable sourcing because unclear rules and uncertain charges added cost and risk to deals.

Governments are trying to address these restraints. For instance, many countries are investing in grid modernization and storage technologies to better handle renewable variability, and some regulators are revisiting open access and transmission fee structures to make long-term contracts more feasible. However, these improvements take time and often require coordination between utilities, policymakers, and corporate buyers.

Opportunity

Smaller buyers joining renewable PPAs is the next big platform opportunity

One major growth opportunity for Power Purchase Agreement (PPA) platforms is the expansion of renewable procurement beyond only the largest corporates, especially as policy changes make it easier for smaller industrial and commercial users to sign green power contracts. In simple terms: when more companies become eligible to buy renewable electricity through structured arrangements, the number of PPAs and contract variations rises.

This opportunity becomes more visible in 2024–2025 because major food and beverage companies are already proving that renewable electricity can be scaled—and their progress is pushing supply chains and peer companies to follow. For example, PepsiCo reports that in 2024 it met 89% of its direct global electricity needs with renewable electricity—about 3,900 GWh—using tools like PPAs and energy attribute certificates. Nestlé states that by the end of 2024, it reached 95.3% sourced renewable electricity at its manufacturing sites. Unilever notes that in 2024, 85% of the electricity used across its offices, factories, R&D centres, and warehouses was renewable.

Government initiatives are directly widening this addressable market. In India, the government has highlighted that under the Green Energy Open Access Rules, the eligibility threshold for green open access was reduced from 1 MW to 100 kW, enabling smaller consumers to purchase renewable power through open access.

Regional Insights

North America dominates the PPA Platform Market with 39.6% share, valued at USD 1.1 Bn

In 2024, North America led adoption because corporate renewable procurement is already mainstream, and buyers want software that can standardize complex contracting, approvals, and reporting across multiple sites. In the United States, solar and wind output rose by 25% and 8% in 2024 as new generators came online—an expansion that typically increases deal volume and contract monitoring needs. The EIA also expected U.S. solar generation to jump from 163 billion kWh in 2023 to 286 billion kWh in 2025, reinforcing why digital platforms are used to manage more variable generation and contract performance.

Canada strengthens the regional story because the grid is already highly renewable, making long-term clean electricity sourcing easier to operationalize through structured contracts. In 2024, renewable sources accounted for 63.9% of Canada’s total electricity production, with hydropower providing 55.2% (343.5 million MWh). As more companies pursue traceable clean power in 2025, this high-renewables baseline supports more PPA activity and more demand for platform features like certificate tracking, contract compliance documentation, and performance dashboards.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CFP FlexPower delivers digital risk-management tools for renewable PPAs, balancing portfolios across thousands of smart devices. The platform manages flexibility assets exceeding 500 MW and supports commercial partners in stabilizing contract performance. Founded in 2019, the company focuses on automated optimization and real-time decision engines for clean-energy buyers and distributed-energy aggregators.

Ecohz, operating since 2002, supplies renewable energy solutions across 70+ countries and delivers more than 80 TWh of renewable electricity documentation annually. The company works with 600+ clients and manages Guarantees of Origin, PPAs, and carbon-tracking services. Ecohz supports large corporates seeking time-stamped renewable certificates and structured clean-energy procurement.

Enel, founded in 1962, is one of the world’s largest clean-energy owners with 59 GW+ of renewable capacity and operations in 30+ countries. In 2024, Enel Green Power delivered more than 120 TWh of renewable output. The company signs corporate PPAs globally and uses digital platforms to manage generation, pricing, and risk at scale.

Top Key Players Outlook

- Anthesis

- Aurora Energy Research

- CFP FlexPower

- cQuant.io

- Ecohz

- Enel Spa

- ENGIE

- FlexiDAO

- KYOS

- LevelTen Energy

- Enel Spa

- ENGIE

- FlexiDAO

- KYOS

- LevelTen Energy

Recent Industry Developments

In 2024, Aurora supported 1,000+ clients across 40+ countries, enabled over 930 transactions, and helped structure €22 billion in debt financing—numbers that show how much its analytics are used in shaping renewable energy contracts and investments.

In 2024, Ecohz focused on expanding its advisory services so buyers could align contracts with regulatory changes like EU reporting rules and evolving corporate targets, and the company reported a 98 % retention rate among its top 100 customers, showing strong trust in its platform offerings.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Bn Forecast Revenue (2034) USD 8.9 Bn CAGR (2025-2034) 12.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Solution (PPA Valuation And Risk Management, Contract And Portfolio Management, Marketplace/Tendering Platforms, Distributed Energy/ Microgrid PPA Platforms), By Deployment (Cloud, On-premises), By End Use (Industrial, Energy Developers, Utility, Financial Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anthesis, Aurora Energy Research, CFP FlexPower, cQuant.io, Ecohz, Enel Spa, ENGIE, FlexiDAO, KYOS, LevelTen Energy, Enel Spa, ENGIE, FlexiDAO, KYOS, LevelTen Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Power Purchase Agreement (PPA) Platform MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Power Purchase Agreement (PPA) Platform MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Anthesis

- Aurora Energy Research

- CFP FlexPower

- cQuant.io

- Ecohz

- Enel Spa

- ENGIE

- FlexiDAO

- KYOS

- LevelTen Energy

- Enel Spa

- ENGIE

- FlexiDAO

- KYOS

- LevelTen Energy