Global Power Circuit Meter Market Size, Share Analysis Report By Product (Single Circuit Meters, Multi Circuit Meters, AC, DC, Hybrid), By Technology (Analog Meters, Digital Meters, Smart Meters), By Density (Low Density (2-16 Circuits), Medium Density (17-48 Circuits), High Density (49 And Above Circuits)), By Connectivity (Wired, Wireless), By Installation (Indoor, Outdoor), By Application (Residential, Commercial, Industrial, Utility) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174566

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

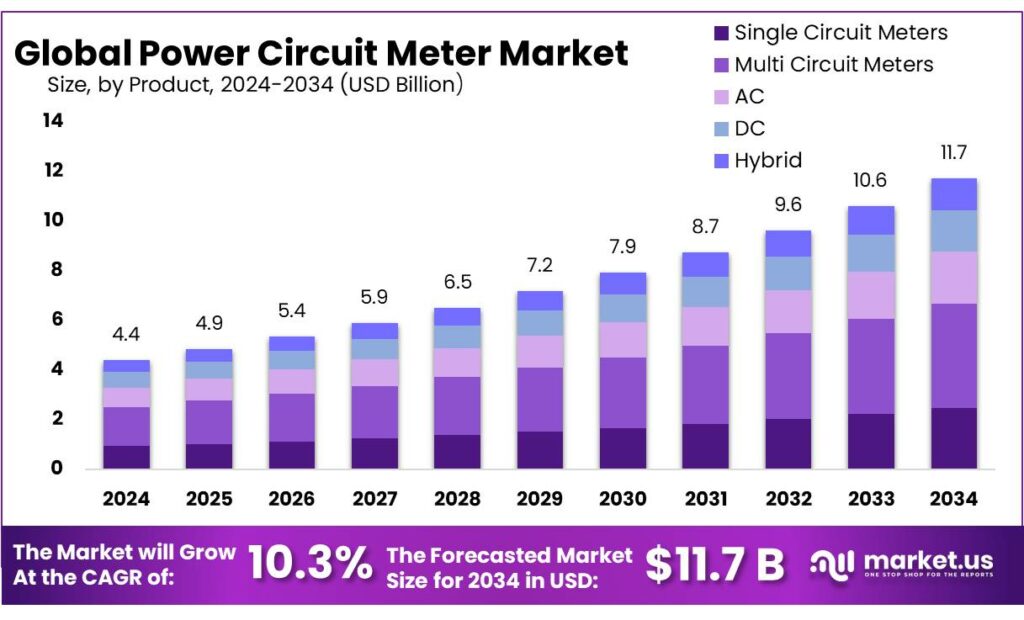

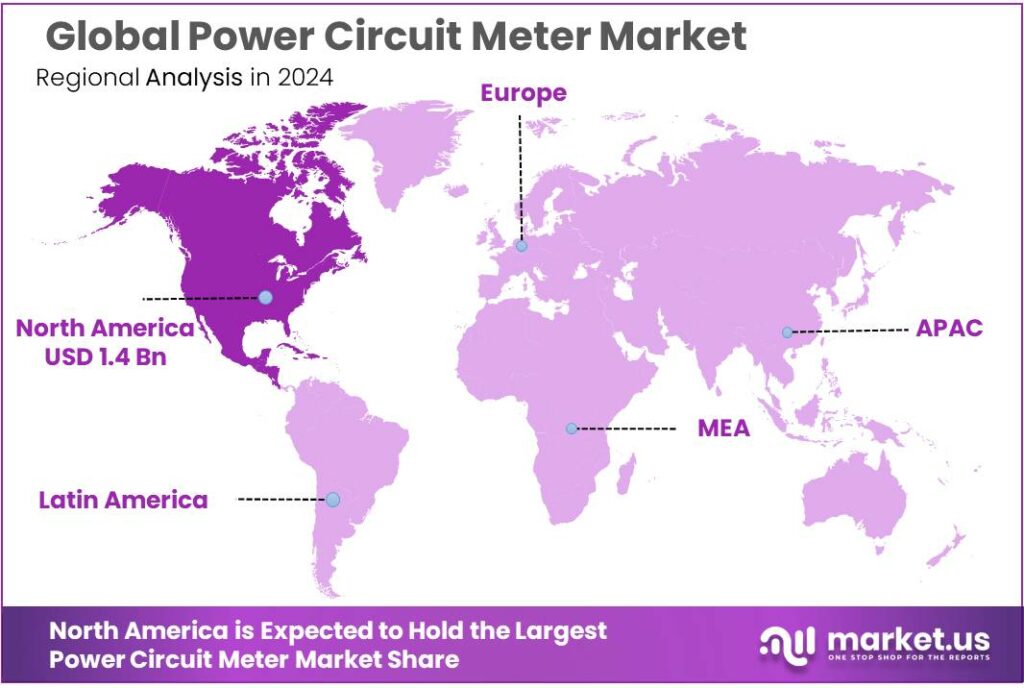

Global Power Circuit Meter Market size is expected to be worth around USD 11.7 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.4% share, holding USD 1.4 Billion in revenue.

Power circuit meters (also called power/energy meters or multifunction power meters) are industrial-grade devices used to measure real-time electrical parameters—such as voltage, current, power factor, demand, frequency, and energy (kWh)—at key points in a facility’s distribution network. In modern plants, they sit inside switchboards, MCCs, and panel meters to make electrical performance visible at the feeder, machine, or process level. This visibility is becoming more valuable as global electricity demand accelerates: electricity consumption rose 4.3% in 2024 and is forecast to keep growing at close to 4% through 2027.

The industrial scenario increasingly favors “measurement-led operations.” Industry accounts for 37% of global energy use (2022), which keeps metering central to both cost control and decarbonisation programs. In fact, industry contributed nearly 40% of the total growth in electricity demand in 2024, while industrial electricity use grew by nearly 4% that year—raising the payback of accurate demand tracking and power-quality visibility.

Key demand drivers for power circuit meters therefore cluster around cost control through submetering and peak management, reliability and safety via early detection of overloads, imbalance, and harmonic stress, and auditability—especially where regulations or programs reward verified energy savings. India’s Bureau of Energy Efficiency reports that the Perform, Achieve and Trade (PAT) Cycle I delivered 8.67 MTOE of savings and avoided ~31 million tonnes of CO₂, while PAT Cycle II delivered ~14.08 MTOE and avoided ~68 million tonnes of CO₂.

Government initiatives and trusted public programs are accelerating adoption by modernizing distribution and AMI ecosystems that depend on accurate metering. In India, the Government of India reported 20.33 crore smart meters sanctioned under RDSS and 4.76 crore installed, signaling large-scale investment momentum in metering and grid digitization.

In the EU, the European Commission references a study estimating €47 billion investment by 2030 if 266 million smart meters are installed, reinforcing the broader metering upgrade cycle that also lifts industrial metering expectations. In the U.S., DOE’s GRIP program announced $7.6 billion across 105 selected projects, while related IIJA documentation frames approximately $10.5 billion over FY22–FY26 to strengthen grid resilience—programs that indirectly expand requirements for monitoring, protection, and verification equipment at the facility edge.

Key Takeaways

- Power Circuit Meter Market size is expected to be worth around USD 11.7 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 10.3%.

- Multi Circuit Meters held a dominant market position, capturing more than a 36.9% share.

- Digital Meters held a dominant market position, capturing more than a 47.2% share.

- Medium Density (17–48 Circuits) held a dominant market position, capturing more than a 41.6% share

- Wired held a dominant market position, capturing more than a 67.7% share.

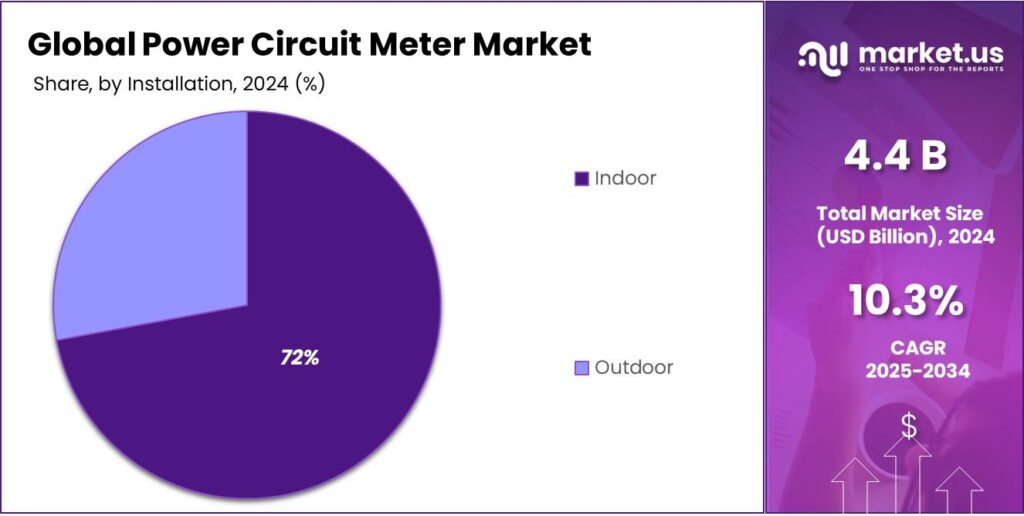

- Indoor held a dominant market position, capturing more than a 72.1% share.

- Commercial held a dominant market position, capturing more than a 37.8% share.

- North America – 37.40%, valued at USD 1.4 Bn.

By Product Analysis

Multi Circuit Meters dominate with a 36.9% share driven by rising demand for multi-load monitoring.

In 2024, Multi Circuit Meters held a dominant market position, capturing more than a 36.9% share, reflecting their growing relevance in modern electrical infrastructure. These devices allow simultaneous monitoring of multiple branch circuits from a single compact unit, making them highly efficient for commercial buildings, manufacturing plants, data centers, and multi-load industrial environments. Their adoption accelerated as facilities looked for ways to reduce energy waste, monitor real-time consumption, and comply with tightening electrical safety and energy-reporting norms.

By Technology Analysis

Digital Meters lead the market with a strong 47.2% share as industries shift toward advanced monitoring.

In 2024, Digital Meters held a dominant market position, capturing more than a 47.2% share, driven by the increasing need for accurate, real-time measurement across industrial and commercial power systems. Their ability to display multidimensional electrical parameters—such as voltage, current, harmonics, and power factor—with high precision makes them the preferred choice for facilities that rely on dependable energy insights. This shift is also supported by the growing emphasis on electrical safety, predictive maintenance, and compliance reporting, all of which require data-rich digital monitoring tools.

By Density Analysis

Medium Density (17–48 Circuits) leads with 41.6% share due to balanced capacity and installation flexibility.

In 2024, Medium Density (17–48 Circuits) held a dominant market position, capturing more than a 41.6% share, reflecting its strong suitability for diverse commercial and industrial applications. This category is widely preferred because it offers the right balance between monitoring capacity and panel space usage. For facilities with expanding electrical loads—such as mid-sized manufacturing units, logistics centers, and commercial buildings—medium-density meters provide enough circuit coverage without the cost and complexity of high-density systems. Their flexibility supports both new installations and retrofit upgrades, making them a natural choice for facilities modernizing their power infrastructure.

By Connectivity Analysis

Wired connectivity dominates with a 67.7% share due to its reliability and secure data transmission.

In 2024, Wired held a dominant market position, capturing more than a 67.7% share, highlighting its continued importance in power circuit metering applications. Wired connectivity remains the preferred choice in industrial and commercial environments where stable, uninterrupted data flow is critical. Facilities such as factories, data centers, and large buildings rely on wired systems because they deliver consistent performance, minimal signal interference, and high data accuracy. This reliability makes wired meters especially suitable for monitoring critical electrical loads and supporting compliance-related reporting.

By Installation Analysis

Indoor installations lead with a 72.1% share driven by controlled environments and easier maintenance.

In 2024, Indoor held a dominant market position, capturing more than a 72.1% share, reflecting the strong preference for installing power circuit meters within protected electrical rooms and panels. Indoor installation offers clear advantages, including stable operating conditions, reduced exposure to dust, moisture, and temperature fluctuations, and improved meter lifespan. These benefits make indoor setups especially common in commercial buildings, manufacturing facilities, hospitals, and data centers where electrical systems are centralized and closely managed.

By Application Analysis

Commercial applications lead with a 37.8% share supported by rising energy monitoring needs in modern buildings.

In 2024, Commercial held a dominant market position, capturing more than a 37.8% share, reflecting the growing emphasis on energy visibility and cost control across offices, retail centers, hospitals, hotels, educational buildings, and mixed-use complexes. Commercial facilities typically have varied and fluctuating electrical loads—such as HVAC systems, lighting networks, elevators, refrigeration units, and IT infrastructure—which makes circuit-level monitoring essential. Power circuit meters help these buildings understand consumption patterns, avoid peak-demand penalties, and maintain compliance with energy-efficiency guidelines increasingly adopted by cities and regulatory bodies.

Key Market Segments

By Product

- Single Circuit Meters

- Multi Circuit Meters

- AC

- DC

- Hybrid

By Technology

- Analog Meters

- Digital Meters

- Smart Meters

By Density

- Low Density (2-16 Circuits)

- Medium Density (17-48 Circuits)

- High Density (49 & Above Circuits)

By Connectivity

- Wired

- Wireless

By Installation

- Indoor

- Outdoor

By Application

- Residential

- Commercial

- Data Centers

- Offices

- Retail & shopping Centers

- Hospitality

- Educational institutions

- Healthcare facilities

- Others

- Industrial

- Automotive

- Process plants

- Food & beverage

- Chemical

- Metals & mining

- Pulp & paper

- Others

- Utility

Emerging Trends

Smart, connected circuit metering is becoming the new standard as food plants chase real-time energy control

A clear latest trend in power circuit meters is the shift from “basic measurement” to always-connected, software-ready monitoring. Instead of reading energy totals once a month, many facilities now treat the meter as a live data point that feeds dashboards, alarms, and automated reports. The International Energy Agency reports that global electricity demand surged 4.3% in 2024, showing how quickly the power system is tightening.

Food and beverage sites are right in the middle of this shift because their loads are both heavy and sensitive. FAO notes that producing food and moving it from farm to fork accounts for about 30% of global energy consumption and contributes 31% of greenhouse gas emissions. That scale is one reason food processors are moving toward circuit-level visibility—especially for refrigeration, compressed air, motors, and packaging lines—where small inefficiencies repeat every hour and become serious costs over a year.

This move is also tied to broader industrial electrification. The IEA’s Global Energy Review 2025 highlights that electricity use in industry grew by nearly 4% in 2024, and that the industry sector made up nearly 40% of total growth in electricity demand that year. As factories and processing plants add more electric equipment and automation, the risk of hidden demand spikes and power-quality issues increases.

Government efficiency programs are reinforcing this trend by making “measured savings” more valuable than “assumed savings.” In India, the Bureau of Energy Efficiency reports that PAT Cycle II resulted in total energy savings of about 14.08 MTOE, translating into avoiding about 68 million tonnes of CO₂ emissions.

Drivers

Energy-cost pressure and verified efficiency targets are pushing power circuit meters into the “must-have” category

One major driving factor for power circuit meters is the need for measurable energy control in energy-hungry industries—especially food and beverage plants that run refrigeration, compressed air, packaging lines, pumps, and sanitation systems around the clock. These sites cannot improve what they cannot see. Circuit-level metering turns “one utility bill” into actionable data by showing which panels, lines, and equipment groups are driving peaks, wasting power, or drifting out of normal performance.

The scale of the energy problem is big enough to justify investment. The International Energy Agency reports that the industrial sector used 37% (166 EJ) of global energy in 2022. At the same time, industry’s electricity use is rising: the IEA notes electricity use in industry grew by nearly 4% in 2024, and industry accounted for nearly 40% of total growth in electricity demand that year. As more processes electrify and automation expands, plants need accurate circuit-level measurement to keep energy costs predictable and avoid unplanned shutdowns from overloads or poor power quality.

Food manufacturing is a clear example of why this is happening. The U.S. Energy Information Administration’s International Energy Outlook materials note that, in 2012, the food industry accounted for about 4% of total delivered industrial energy consumption in OECD countries and 2% in non-OECD countries. That may sound like a small share, but it represents a very large absolute load when viewed across national industrial systems—and food plants tend to operate with tight margins and strict quality requirements. When a refrigeration rack, boiler feed pump, or packaging line is inefficient, the cost shows up every day.

Government-led efficiency programs also make “verified savings” a practical business requirement, not just a sustainability slogan. India’s Bureau of Energy Efficiency states that PAT Cycle I delivered energy savings of 8.67 MTOE, equivalent to avoiding about 31 million tonnes of CO₂. The BEE also reports PAT Cycle II energy savings of about 14.08 MTOE, translating into avoiding about 68 million tonnes of CO₂.

Restraints

High installation costs and limited technical capacity are slowing the wider adoption of power circuit meters

One major restraining factor for the adoption of power circuit meters is the high upfront cost of installation combined with the lack of in-house technical expertise—a barrier that is especially visible in food and beverage processing facilities and small industrial plants. Even though the long-term benefits of circuit-level monitoring are clear, many organizations struggle to justify the short-term expense of hardware, wiring, CT installation, commissioning, and integration with their existing energy systems.

Food processing operations illustrate this challenge well. These facilities already operate on tight cost structures, and energy is a major portion of those operating expenses. According to the U.S. Energy Information Administration (EIA), the food industry accounted for about 4% of total delivered industrial energy consumption in OECD countries and 2% in non-OECD regions.

Government data reinforces the scale of the technical capacity challenge. The International Energy Agency notes that industry used 166 EJ of energy in 2022, accounting for 37% of global consumption. A large portion of this industrial consumption remains undermonitored, simply because plants lack the personnel or the budget to manage sophisticated energy instrumentation. When operations teams are already stretched, adding new digital energy tools—especially those requiring integration with SCADA, EMS, or cloud dashboards—can feel overwhelming.

Opportunity

Rising energy consumption and efficiency policies open the door for power circuit meters in industrial food processing

One of the biggest growth opportunities for power circuit meters lies in the increasing energy use in industrial sectors, especially food processing and manufacturing, coupled with government policies pushing for better energy efficiency and monitoring. As food industries expand to meet global demand, their energy requirements are rising fast, making it more important than ever for facility managers to know exactly how electricity is being used—and where waste can be cut.

The industrial sector globally accounts for a significant share of energy consumption. According to the International Energy Agency (IEA), the industrial sector used 37% (166 EJ) of global energy in 2022, up from 34% in 2002, with electricity’s role steadily increasing as processes electrify and manufacturing activity grows. Food processing sits within this large energy picture.

This growth in energy demand is creating urgent need for better monitoring tools. For example, recent research highlights that the food industry accounts for about 30% of global energy consumption and emissions when the entire food production and supply chain is considered—pulling together farming, processing, transport, and retail. These numbers show the scale at which food systems interact with energy markets and emphasize the potential benefits of metering at finer granularity rather than relying solely on facility-level utility billing.

As energy consumption expands, governments are responding with policies and incentives to improve efficiency. In India, for instance, energy efficiency drives such as the Assistance in Deploying Energy Efficient Technologies in Industries and Establishments (ADEETIE) scheme—backed by a ₹1,000 crore budget—are focused on helping MSMEs adopt advanced energy-saving solutions, including metering technologies. ADEETIE is expected to support ₹9,000 crore in overall energy efficiency investments across participating clusters and sectors.

Regional Insights

North America dominates with 37.40% share, valued at USD 1.4 Bn, supported by strong building energy spend and fast-rising digital load demand.

North America leads the Power Circuit Meter market because the region combines high electricity intensity with mature building automation and strict uptime expectations across commercial and industrial sites. Dominating Region(s): North America – 37.40%, valued at USD 1.4 Bn (2024), supported by broad deployment of submetering in offices, healthcare campuses, universities, retail chains, and light manufacturing where circuit-level visibility is needed for cost control and reliability.

A major structural driver is the size of the commercial building base: the U.S. EIA estimates 5.9 million commercial buildings consumed 6.8 quadrillion Btu of energy and spent $141 billion on energy in 2018, reinforcing why building owners invest in panel and branch monitoring to manage loads and verify savings.

Another key tailwind is the acceleration of data-center and high-density electrical loads, which pushes facilities to track demand spikes, power quality, and panel capacity more precisely. Pew Research reports that U.S. data centers accounted for 4% of total U.S. electricity use in 2024, and their energy demand is expected to more than double by 2030, which raises the value of circuit meters in both new builds and retrofits.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Accuenergy’s growth is closely tied to submetering rollouts in commercial and industrial sites. The company states it has delivered 1,000,000+ instruments, with meters deployed in 170+ countries, supported by 300+ employees and 4 worldwide locations. Those deployment numbers signal a strong footprint in projects where multi-circuit and panel metering are scaled across buildings and portfolio-level energy programs.

Acrel benefits from China’s ongoing buildout of digital energy management in factories and buildings. For 2024, reported figures from its annual-report coverage show operating revenue of 10.63 billion yuan and net profit attributable to shareholders of 1.70 billion yuan. This financial base supports continued product iteration in metering, monitoring, and enterprise microgrid management solutions.

ABB’s scale supports broad adoption of circuit metering across utilities, industry, and buildings. In 2024, the group reported $32.9B in revenues and generated $3.9B in free cash flow, giving it strong capacity to fund grid and monitoring innovation. It also reported ~105,000 employees at year-end, supporting global service coverage for installed meter bases.

Top Key Players Outlook

- ABB

- Accuenergy

- Acrel

- Blue Jay Technology

- Camille Bauer Metrawatt

- Continental Control Systems

- Delta Electronics

- DENT

- Dranetz Technologies

- Ducab

Recent Industry Developments

Acrel benefits from China’s ongoing buildout of digital energy management in factories and buildings. For 2024, reported figures from its annual-report coverage show operating revenue of 10.63 billion yuan and net profit attributable to shareholders of 1.70 billion yuan. This financial base supports continued product iteration in metering, monitoring, and enterprise microgrid management solutions.

ABB’s scale supports broad adoption of circuit metering across utilities, industry, and buildings. In 2024, the group reported $32.9B in revenues and generated $3.9B in free cash flow, giving it strong capacity to fund grid and monitoring innovation. It also reported ~105,000 employees at year-end, supporting global service coverage for installed meter bases.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 11.7 Bn CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Single Circuit Meters, Multi Circuit Meters, AC, DC, Hybrid), By Technology (Analog Meters, Digital Meters, Smart Meters), By Density (Low Density (2-16 Circuits), Medium Density (17-48 Circuits), High Density (49 And Above Circuits)), By Connectivity (Wired, Wireless), By Installation (Indoor, Outdoor), By Application (Residential, Commercial, Industrial, Utility) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Accuenergy, Acrel, Blue Jay Technology, Camille Bauer Metrawatt, Continental Control Systems, Delta Electronics, DENT, Dranetz Technologies, Ducab Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- Accuenergy

- Acrel

- Blue Jay Technology

- Camille Bauer Metrawatt

- Continental Control Systems

- Delta Electronics

- DENT

- Dranetz Technologies

- Ducab