Global Potty Training and Step Stools Market Size, Share, Growth Analysis By Product Type (Potty Training, Potty Chair, Toilet Training Seat, 3 in 1 seat, Step Stools, Single Step Stools, Dual Step Stools, Foldable Stools), By Material (Plastic, Wood, Others), By Age Group (Newborn (0-6 months), Infants (6 months-2 years), Toddlers (2-5 years), Others (above 5 years)), By End Use (Individual Use, Commercial Use), By Distribution Channel (Online, Mega Retail Stores, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169931

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Material Analysis

- By Age Group Analysis

- By End Use Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Potty Training and Step Stools Company Insights

- Recent Developments

- Report Scope

Report Overview

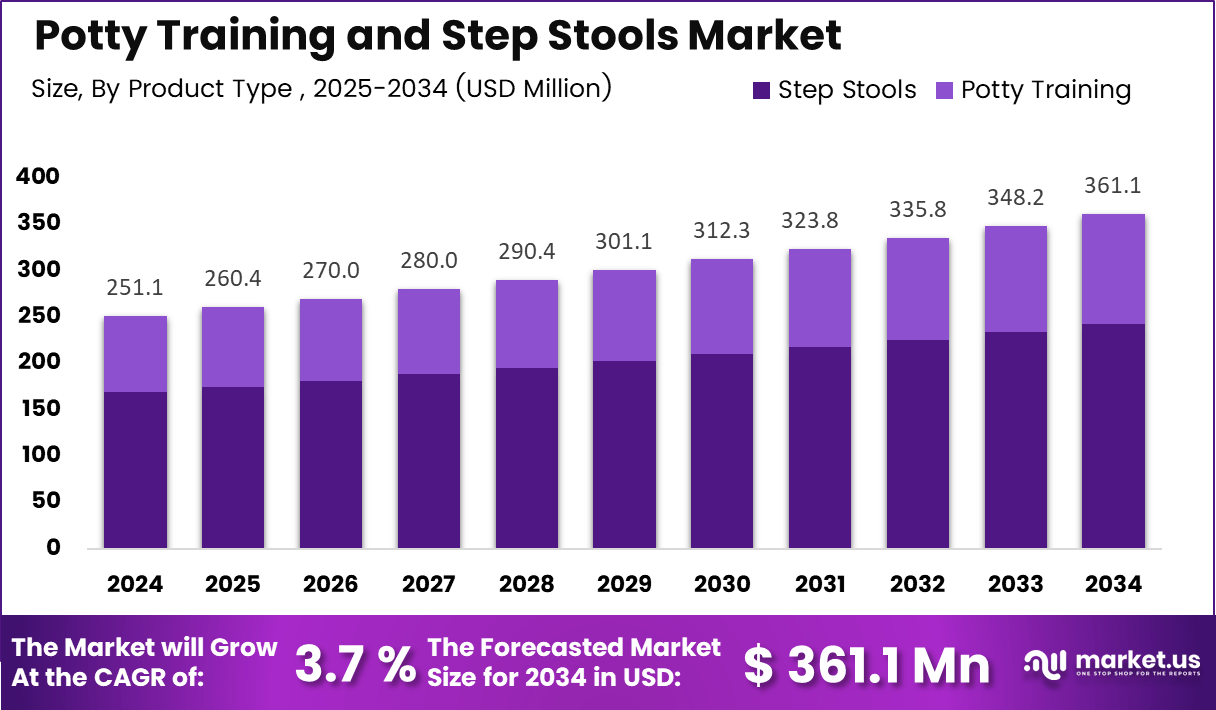

The Global Potty Training and Step Stools Market size is expected to be worth around USD 361.1 Million by 2034, from USD 251.1 Million in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034.

The Potty Training and Step Stools Market represents a growing consumer segment driven by rising parental focus on early child independence and home safety. The market encompasses multipurpose step stools, convertible potty systems, and ergonomic child-support tools designed to simplify developmental milestones for toddlers while improving day-to-day household routines.

Steadily, the market experiences growth as caregivers increasingly adopt structured potty-training methods supported by pediatric recommendations. Manufacturers integrate ergonomic designs, softer materials, and safety rails to enhance comfort and reduce training anxiety. Additionally, urban households prefer compact and multi-use solutions, expanding product demand across premium and budget categories.

Furthermore, opportunities emerge as parents embrace hybrid learning at home, encouraging self-service habits such as washing hands, climbing safely, or reaching elevated surfaces. Step stools with adjustable heights, slip-resistant bases, and convertible potty seats strongly appeal to households seeking multifunctionality and long-term usability.

Government investments in child safety awareness and early childhood development programs also strengthen adoption. Regulatory bodies emphasize non-toxic materials, stability standards, and safety-tested components, prompting manufacturers to innovate responsibly. As sustainability gains traction, eco-friendly polymers and cleaner manufacturing practices further influence product differentiation.

In addition, increasing disposable income and rising nuclear families accelerate product penetration across emerging markets. Digital commerce boosts visibility through parenting communities and online tutorials, encouraging informed purchases. The market benefits from transparent product demos, safety certifications, and user-friendly modular designs supporting child mobility and independence.

According to product specifications from Baybee, multifunctional designs gain strong traction as caregivers seek value-driven solutions. The Baybee 4-in-1 Toddler Step Stool supports ages 0–2 years and weighs 4.7 pounds, featuring an odor-neutralizing disc, splash guard, and a 15.5 x 13 x 8-inch build. Its 3-step ladder mechanism and handles reinforce the demand for adaptable training products.

According to Baybee product data, the rising preference for 3-in-1 and 4-in-1 systems highlights a shift toward multi-utility formats in the Potty Training and Step Stools Market. These advanced products support independence, safety, and habit-building, positioning the market for continuous expansion across global household consumers seeking long-lasting child-friendly solutions.

Key Takeaways

- The global Potty Training and Step Stools Market reached USD 251.1 million in 2024, supported by rising early childhood hygiene adoption.

- The market is projected to grow to USD 361.1 million by 2034, driven by a steady 3.65% CAGR.

- Potty Training led the product type segment with a dominant 67.2% share in 2024.

- Plastic remained the leading material segment, accounting for 78.3% of total market demand.

- Toddlers aged 2–5 years represented the largest age group segment with 56.9% share.

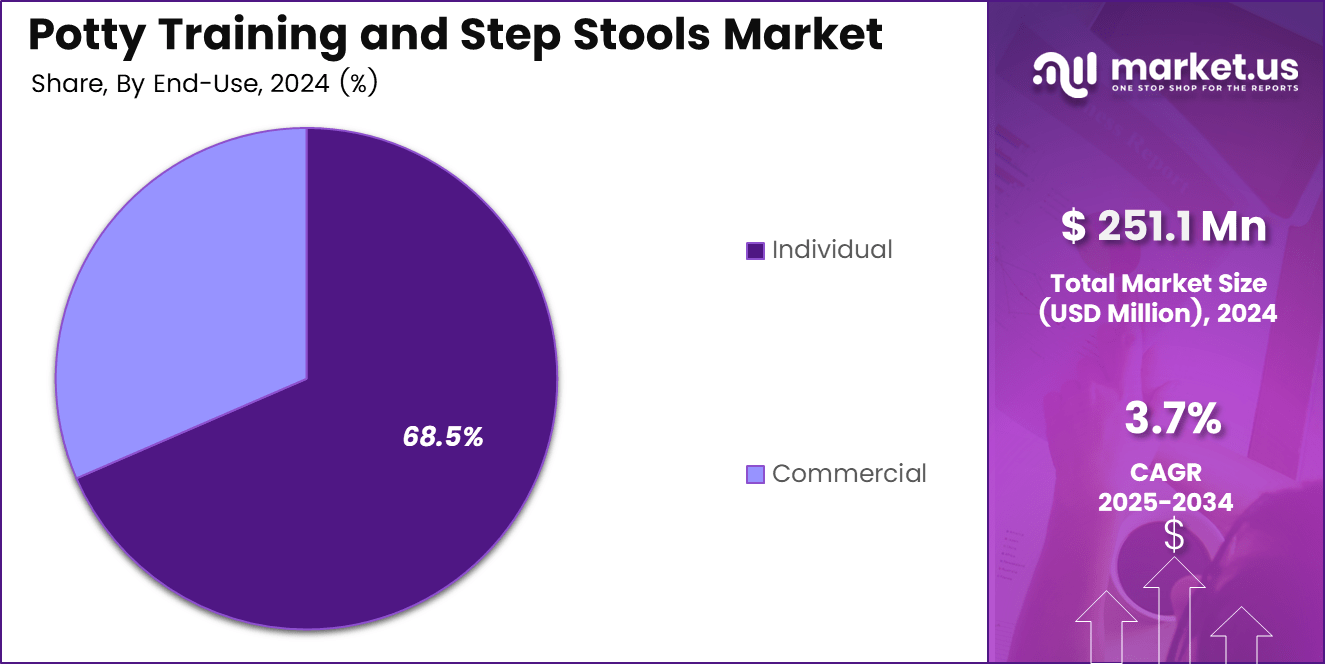

- Individual Use dominated end-use adoption with 68.5% contribution in 2024.

- Online channels held the leading distribution share at 37.1%, reflecting strong e-commerce penetration.

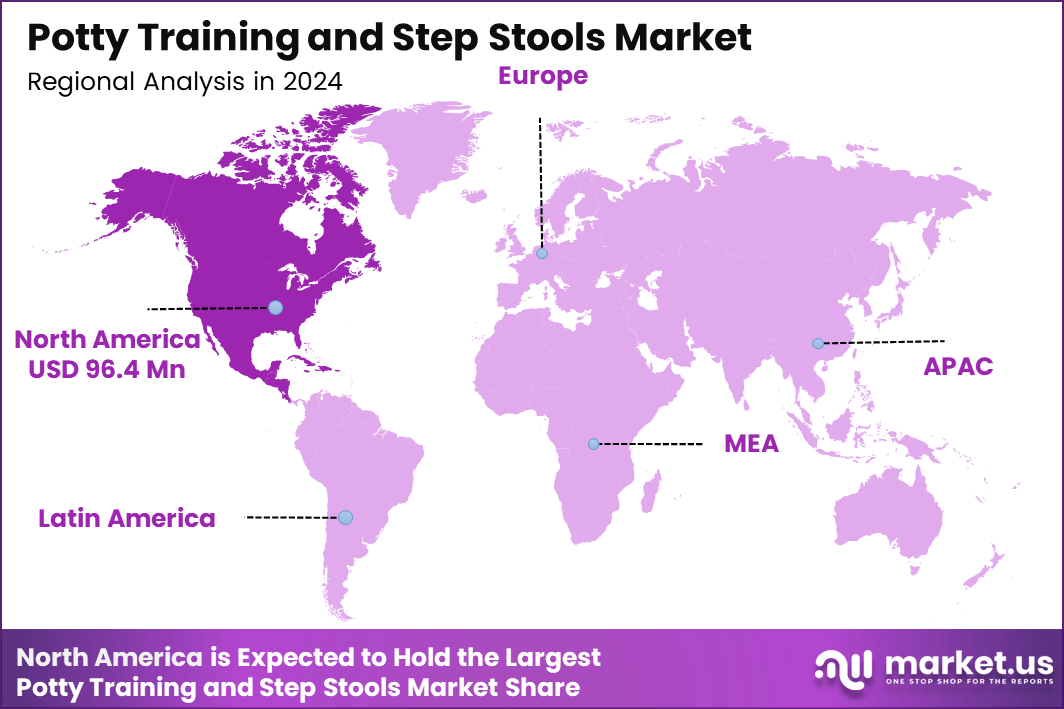

- North America emerged as the dominant regional market with 38.4%, valued at USD 96.4 million in 2024.

By Product Type Analysis

Potty Training dominates with 67.2 percent due to rising early training awareness and multifunctional toddler solutions.

In 2024, Potty Training held a dominant market position in the By Product Type segment of the Potty Training and Step Stools Market, with a 67.2% share. This category grows as parents adopt structured routines and invest in hygiene-friendly solutions supporting faster learning cycles, improving daily independence, and reducing diaper reliance.

Potty Chair continues expanding as families shift toward stable, toddler-friendly seating designs. Increasing ergonomic innovation encourages adoption among first-time parents seeking comfort and safety. Manufacturers focus on splash-guard features, easy-clean surfaces, and bright designs appealing to children, helping households transition confidently during early toilet-training stages.

Toilet Training Seat gains traction as parents prefer compact, travel-friendly training aids. Its lightweight structure supports consistent toilet familiarity, even during travel. Growing awareness of seat stability, non-slip bases, and adjustable designs strengthens segment adoption. This option often complements training chairs, enabling smoother migration from introductory to advanced training stages.

3 in 1 seat grows steadily with multifunctionality, allowing toddlers to use it as a chair, a booster seat, and a step platform. Step Stools, Single Step Stools, Dual Step Stools, and Foldable Stools also rise as homes emphasize accessibility. These designs help children reach sinks, toilets, and shelves safely and independently.

By Material Analysis

Plastic dominates with 78.3 percent due to its durability, affordability, and child-safe design flexibility.

In 2024, Plastic held a dominant market position in the By Material segment of the Potty Training and Step Stools Market, with a 78.3% share. The material’s lightweight structure, smooth edges, and low-cost production support widespread consumer demand. Easy cleaning and vibrant design options further enhance its adoption across households.

Wood experiences consistent demand as eco-friendly parenting trends strengthen. Parents who value natural aesthetics and sturdy structure increasingly choose wooden stools for long-term durability. Although heavier than plastic, its premium appearance, sustainability perception, and non-toxic finishes support niche growth among environmentally conscious families focusing on natural-material infant products.

Others include composite materials and hybrid builds offering improved strength and flexibility. These materials support evolving design innovation across multifunctional seats and foldable stools. Brands experiment with silicone grips, reinforced frames, and recyclable blends to improve child safety. Their adaptability helps manufacturers introduce new ergonomic solutions addressing hygiene, comfort, and stability.

The category’s expansion accelerates as consumers prioritize long-lasting, easy-to-maintain training essentials. Hybrid materials improve moisture resistance and reduce breakage risk, appealing to families seeking reliability. Such developments widen choices across premium, mid-range, and entry-level price points. As toddler product design evolves, diversified materials ensure balanced safety and usability.

By Age Group Analysis

Toddlers (2-5 years) dominate with 56.9 percent, as this age group actively transitions into structured toilet training routines.

In 2024, Toddlers (2-5 years) held a dominant market position in the By Age Group segment of the Potty Training and Step Stools Market, with a 56.9% share. Parents increasingly introduce guided learning tools during this developmental period, boosting demand for seats, ladders, and supportive step stools, enhancing daily independence.

Newborns (0-6 months) show limited adoption, as potty training typically begins later. However, parents purchase early-prep accessories such as small stools to support nursery routines. Product designs emphasizing safety and soft edges attract families preparing early environments for future training milestones during infancy and toddlerhood transitions.

Infants (6 months-2 years) represent a rising segment as early training philosophies gain popularity. Parents begin familiarizing children with potty setups, encouraging exploratory behaviour. Lightweight chairs, compact reducers, and stable stools support early engagement. Growth accelerates as manufacturers introduce colourful themes and interactive elements, fostering comfort and routine adaptation within this age group.

Others (above 5 years) show slower demand but serve special developmental needs, including delayed training stages. Step stools remain relevant for sink access and independent hygiene routines. This category grows where children require extra stability, height assistance, or confidence-building aids, especially in shared household and learning environments.

By End Use Analysis

Individual Use dominates with 68.5 percent, driven by rising household investment in independent toddler hygiene routines.

In 2024, Individual Use held a dominant market position in the By End Use segment of the Potty Training and Step Stools Market, with a 68.5% share. Parents increasingly focus on structured training, purchasing multipurpose seats and stools to support consistent, safe learning environments across home bathrooms and play areas.

Commercial Use gains traction across daycare centres, preschools, and early learning facilities, emphasizing hygiene compliance and structured guidance. Institutions adopt durable training chairs and height-support stools to maintain standardized routines for multiple children. Growing childcare enrolment and facility expansion stimulate new procurement cycles, supporting broader segment adoption.

Commercial buyers prefer products with long-lasting materials, anti-slip bases, and easy sanitation features. These models reduce operational maintenance while ensuring safety. Adoption increases as regulatory guidelines emphasise child-safe environments, promoting wider use of training aids across public and semi-public child-care settings, supporting developmental independence.

Demand grows as institutions adopt universal-access training solutions, ensuring all age groups receive supportive tools. Commercial adoption remains steady with procurement cycles influenced by school expansions, hygiene upgrades, and facility renovations. These factors strengthen the presence of training and stool products across public childcare ecosystems.

By Distribution Channel Analysis

Online dominates with 37.1 percent due to rising e-commerce penetration and easy access to product variety.

In 2024, Online held a dominant market position in the By Distribution Channel segment of the Potty Training and Step Stools Market, with a 37.1% share. Parents increasingly prefer e-commerce for comparing features, reading reviews, and accessing bundled deals. Fast delivery and return policies enhance online purchasing confidence.

Mega Retail Stores remain important as parents value in-store product evaluation. Physical outlets enable customers to assess stability, height, and build quality before buying. Retail chains introduce curated baby sections, promotional events, and exclusive designs supporting steady foot traffic and purchase decisions for training seats and stools.

Specialty Stores attract parents seeking expert guidance and premium product assortments. These stores offer curated materials, ergonomic designs, and specialized accessories supporting specific training methods. Professional staff and tailored recommendations help parents choose age-appropriate models, enhancing consumer trust and strengthening this segment’s market relevance.

The other category includes pharmacies, baby boutiques, and local convenience stores offering quick-buy options. These outlets cater to parents needing immediate replacements or affordable solutions. Their accessibility strengthens distribution reach, especially in suburban and semi-urban markets where large retail presence may be limited.

Key Market Segments

By Product Type

- Potty Training

- Potty Chair

- Toilet Training Seat

- 3 in 1 seat

- Step Stools

- Single Step Stools

- Dual Step Stools

- Foldable Stools

By Material

- Plastic

- Wood

- Others

By Age Group

- Newborn (0-6 months)

- Infants (6 months-2 years)

- Toddlers (2-5 years)

- Others (above 5 years)

By End Use

- Individual Use

- Commercial Use

By Distribution Channel

- Online

- Mega Retail Stores

- Specialty Stores

- Others

Drivers

Rising Parental Focus on Early Childhood Independence Drives Market Growth

Growing parental emphasis on early independence strengthens demand as families increasingly prioritize structured hygiene routines. Consumers look for training products that support confidence-building habits, encouraging steady adoption in urban and semi-urban households. This shift expands the market’s base as parents invest in reliable, child-friendly designs. Premium childcare brands are introducing ergonomic, safer stool designs that reduce slipping and improve balance during daily routines.

This movement toward improved comfort and stability boosts brand loyalty and encourages families to upgrade from basic to advanced designs. Enhancements in build quality and child-centric engineering further support market expansion. Urban households continue adopting compact, multi-functional solutions that meet space-saving needs while supporting multiple training stages. Portable and foldable accessories appeal to modern families managing smaller living environments.

These features increase product appeal and help manufacturers target high-density regions. Awareness campaigns by pediatric clinics and parenting networks strengthen understanding of structured potty-training practices. As guidance becomes more widely available, parents feel more confident adopting these accessories. This ecosystem of education, support, and product development contributes to consistent market demand.

Restraints

Limited Product Differentiation Increases Market Challenges

Price sensitivity remains a significant barrier because many products offer similar designs, prompting consumers to prioritize affordability over brand identity. This limits premium segment growth and intensifies competition among manufacturers targeting mass-market buyers. Safety concerns affecting low-quality stools create hesitation among parents who prioritize stability and durability.

Reports of slipping, breakage, or poor material strength lead families to delay purchases or shift toward established brands. This slows market penetration in cost-sensitive regions. Adoption progresses slowly in low-income areas due to limited access to training accessories and lower awareness of structured potty routines. Affordability gaps remain high, reducing the market’s ability to scale across underserved regions. This creates uneven adoption between developed and emerging markets.

Growth Factors

Integration of Smart Features Unlocks New Market Opportunities

Smart features such as timers, reward sounds, and app-based progress tracking are transforming traditional training products into interactive tools. These enhancements appeal to tech-savvy parents seeking structured ways to motivate toddlers.

This shift supports premiumization and attracts new-age buyers. Demand for eco-friendly, non-toxic materials is rising as parents prioritize chemical-free, safe products for daily use. Bamboo, recycled plastics, and BPA-free materials strengthen premium categories and align with global sustainability trends. This encourages innovative product lines targeting environmentally aware households.

Emerging Trends

Social-Media Trends Accelerate Product Visibility and Adoption

Parenting influencers are driving awareness through viral potty-training challenges and product recommendations. Their reach helps parents discover new tools, increasing brand engagement and shaping buying decisions. This trend strengthens digital-led market expansion.

Foldable and travel-friendly stools are gaining popularity among mobile families who prefer lightweight accessories for outdoor and on-the-go routines. This enhances versatility and encourages the development of multipurpose products.

Minimalistic Scandinavian-style aesthetics are becoming a strong trend, reflecting consumer preference for neutral colors, soft contours, and simple forms. These designs integrate well into modern homes, increasing adoption among style-conscious parents.

Regional Analysis

North America Dominates the Potty Training and Step Stools Market with a Market Share of 38.4%, Valued at USD 96.4 million

North America holds the leading position due to strong parental awareness, higher spending on premium childcare products, and widespread adoption of structured potty-training routines. The region’s market strength is further supported by growing demand for ergonomic, safety-certified stools designed for modern homes. The presence of well-organized retail and online distribution channels enhances accessibility, sustaining the region’s dominance at 38.4% and USD 96.4 million.

Europe Potty Training and Step Stools Market Trends

Europe demonstrates steady growth driven by rising emphasis on child hygiene standards and government-led early childhood education initiatives. Parents increasingly prefer multifunctional and eco-friendly training accessories, reinforcing product innovation. Strong adoption in Western Europe and expanding demand in Eastern Europe support the region’s long-term market potential.

Asia Pacific Potty Training and Step Stools Market Trends

Asia Pacific represents one of the fastest-expanding markets due to rising birth rates, urbanization, and shifting parental preferences toward structured toddler training routines. Affordable and compact stool designs appeal to middle-income households, especially in China, India, and Southeast Asia. Growing e-commerce penetration further accelerates adoption.

Middle East and Africa Potty Training and Step Stools Market Trends

The Middle East and Africa show gradual adoption supported by improving household income and expanding awareness of child-care products. Urban centers in GCC countries lead demand due to preference for premium and safety-focused training solutions. Growth remains moderate but promising as retail modernization increases product availability.

Latin America Potty Training and Step Stools Market Trends

Latin America experiences rising interest in toddler-training accessories as families increasingly prioritize hygiene and early childhood development. Countries such as Brazil and Mexico benefit from growing online retail and wider exposure to modern parenting practices. Economic fluctuations slow premium adoption, yet demand for cost-effective designs continues to rise.

U.S. Potty Training and Step Stools Market Trends

The U.S. contributes a major share of North America’s dominance due to strong consumer preference for multifunctional, safety-enhanced products. High awareness of developmental routines and widespread pediatric recommendations support consistent product uptake. Continuous innovation in ergonomic designs strengthens the market’s performance across urban and suburban households.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Potty Training and Step Stools Company Insights

The global Potty Training and Step Stools Market in 2024 reflects steady consumer demand supported by ergonomic design improvements and rising emphasis on child independence. Leading brands continue shaping product innovation, with a strong focus on multifunctionality, material safety, and user comfort that aligns with evolving parental expectations across developed and emerging markets.

Baby Bjorn strengthens market credibility through its emphasis on minimalistic, child-friendly designs that promote stability and intuitive use. Its approach to integrating smooth contours and easy-clean materials appeals to caregivers seeking hygienic and durable training tools suitable for early developmental stages.

Dream Baby expands its presence by offering safety-driven products that integrate non-slip features and supportive frames. The brand’s focus on household child-proofing aligns naturally with step stool and potty-training solutions designed to reduce risk, enhancing adoption across first-time parents.

Gatvin Technologies contributes to market modernization by adopting functional design engineering across toddler support systems. Its emphasis on structural strength and adaptability caters to households prioritizing longevity and multi-use convenience in training accessories.

Kids2 accelerates product usability by focusing on lightweight, portable, and child-engaging designs that integrate playful elements without compromising safety. Its ability to merge developmental support and ease of handling resonates strongly with parents transitioning toddlers into early independence tasks.

Collectively, these companies shape the competitive landscape by addressing comfort, functionality, and long-term value. Their continued product refinement and alignment with global child-safety expectations further enhance the growth trajectory of the Potty Training and Step Stools Market in 2024.

Top Key Players in the Market

- Baby Bjorn

- Dream Baby

- Gatvin Technologies

- Kids2

- Kol craft

- Munchkin

- Mattel

- Oxo

- Prince Lionheart

Recent Developments

- In Jun 2025, Chicco USA expanded into a new product category with the launch of its first ever potty training line, designed to support a key toddler development milestone.The launch includes four products developed by parents with recent potty training experience, focused on ease of use, confidence building, and practical daily support for families.

Report Scope

Report Features Description Market Value (2024) USD 251.1 Million Forecast Revenue (2034) USD 361.1 Million CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Potty Training, Potty Chair, Toilet Training Seat, 3 in 1 seat, Step Stools, Single Step Stools, Dual Step Stools, Foldable Stools), By Material (Plastic, Wood, Others), By Age Group (Newborn (0-6 months), Infants (6 months-2 years), Toddlers (2-5 years), Others (above 5 years)), By End Use (Individual Use, Commercial Use), By Distribution Channel (Online, Mega Retail Stores, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Baby Bjorn, Dream Baby, Gatvin Technologies, Kids2, Kol craft, Munchkin, Mattel, Oxo, Prince Lionheart Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Potty Training and Step Stools MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Potty Training and Step Stools MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Baby Bjorn

- Dream Baby

- Gatvin Technologies

- Kids2

- Kol craft

- Munchkin

- Mattel

- Oxo

- Prince Lionheart