Global Potassium Sorbate Market Report By Type (Pharmaceutical Grade, Food Grade, Technical Grade), By Application (Food and Beverages, Pharmaceuticals, Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123182

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

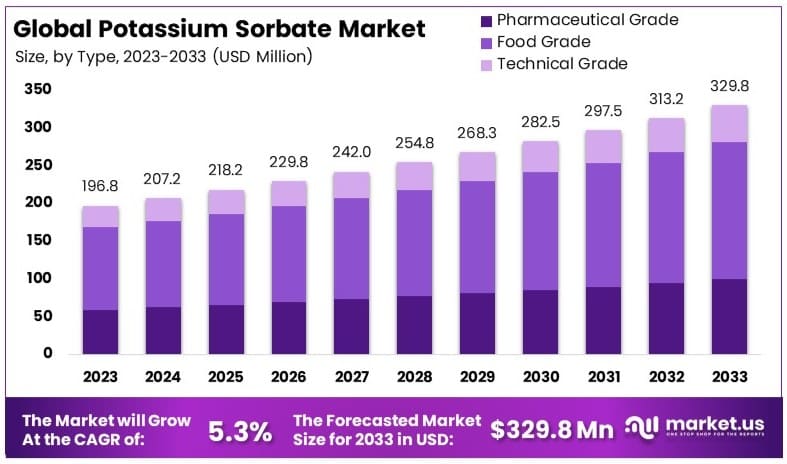

The Global Potassium Sorbate Market size is expected to be worth around USD 329.8 Million by 2033, from USD 196.8 Million in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

The Potassium Sorbate Market involves the production and distribution of potassium sorbate, a chemical used extensively as a preservative in food, beverages, and personal care products. This compound prevents the growth of mold, yeast, and microbes, thereby extending the shelf life of products.

Its effectiveness and non-toxic nature make it a preferred choice in industries seeking to ensure product safety and quality. The market is driven by the rising demand for preserved food products and natural preservatives. Key players in the market focus on innovations and global regulatory compliance to cater to the growing consumer preferences for safety and sustainability.

The competitive landscape of the potassium sorbate market is characterized by the presence of both large multinational corporations and specialized local companies, which ensures a diverse and competitive market environment. Strategic investments in production capacity expansion and innovations in preservation technology are pivotal as companies strive to meet the rising global demand.

Governments globally regulate its use through specific food safety guidelines. For instance, the U.S. Food and Drug Administration (FDA) permits the use of potassium sorbate in various food products up to a concentration of 0.1%, ensuring consumer safety.

Internationally, the trade of potassium sorbate is substantial, with China being a leading exporter. The country has invested significantly in the production capabilities of food preservatives, enhancing its export potential to North America and Europe. In terms of market dynamics, the import and export activities are closely monitored by regulatory agencies in respective countries to comply with food safety standards.

Key Takeaways

- Potassium Sorbate Market was valued at USD 196.8 million in 2023, and is expected to reach USD 329.8 million by 2033, with a CAGR of 5.3%.

- Food Grade dominates the type segment with 55.4% due to its extensive use in preserving food products.

- Food and Beverages lead the application segment with 48.3% owing to high demand for food preservation solutions.

- North America holds the largest market share at 38.6%, attributed to the region’s strong food and beverage industry.

Driving Factors

Increasing Demand from the Food and Beverage Industry Drives Market Growth

The demand for potassium sorbate in the food and beverage industry is a primary driver of its market growth. This preservative is essential in extending the shelf life of various food products, including baked goods, beverages, and dairy items.

With the global population’s increase and the rising preference for convenient, ready-to-cook food products, particularly in developing countries, the demand for effective preservatives like potassium sorbate has surged. This trend is further fueled by the increasing consumption of packaged foods, making potassium sorbate indispensable for maintaining food quality and safety, thus propelling its market demand.

Rise in Organic and Natural Food Products Drives Market Growth

Potassium sorbate’s appeal is significantly enhanced by the shift towards organic and natural food products. As consumers become more health-conscious, the demand for natural alternatives to synthetic preservatives has grown.

Being a naturally occurring compound, potassium sorbate is favored by manufacturers aiming to meet consumer demands for cleaner labels. It is widely used in products like organic wines, where it ensures preservation without compromising the natural quality. This growing consumer preference directly influences the expanded use and market penetration of potassium sorbate in the organic food sector.

Increasing Shelf-Life Requirements Drives Market Growth

The globalized nature of today’s marketplaces necessitates longer shelf lives for food and beverage products, particularly those that are exported. Potassium sorbate plays a crucial role in fulfilling this requirement by preventing microbial growth and extending product freshness during long transportation and storage periods.

This need is pronounced in the export-oriented sectors of fruit juices and soft drinks, where maintaining product integrity is vital. As international trade in food products continues to grow, the demand for reliable and effective preservatives like potassium sorbate escalates, significantly impacting its market growth.

Restraining Factors

Availability of Alternative Preservatives Restrains Potassium Sorbate Market Growth

The market for potassium sorbate faces significant competition from other preservatives, such as sodium benzoate, sorbic acid, and natural options like vinegar and salt. These alternatives may be preferred by manufacturers due to factors like cost, effectiveness, or consumer preferences.

For example, some manufacturers may opt for sodium benzoate over potassium sorbate because of its lower cost and similar preservative properties. This competition reduces the demand for potassium sorbate, limiting its market growth as manufacturers seek more economical or consumer-friendly options.

Stringent Regulations and Labeling Requirements Restrain Potassium Sorbate Market Growth

Despite being generally recognized as safe, potassium sorbate is subject to strict regulations and labeling requirements in various regions. These regulations can vary significantly across countries, creating challenges for manufacturers operating in multiple markets. Compliance with these regulations can be costly and time-consuming.

For instance, in the European Union, potassium sorbate must be listed on the ingredient label, which may deter some manufacturers concerned about consumer perceptions. These regulatory hurdles increase operational costs and complexity, thereby restraining market growth.

Type Analysis

Food Grade dominates with 55.4% due to its critical role in food preservation and safety.

In the Potassium Sorbate market, the product is segmented by quality into Pharmaceutical Grade, Food Grade, and Technical Grade. Among these, Food Grade holds the largest market share at 55.4%. This dominance is primarily due to the widespread use of potassium sorbate as a food preservative. It is highly valued in the food industry for its ability to inhibit molds, yeasts, and bacteria, thus extending the shelf life of a wide variety of food products without compromising their taste or edibility.

Food Grade potassium sorbate is crucial in many food processing applications, including dairy products, bakery products, and beverages, where it helps maintain product quality and safety during extended storage periods. The increasing global demand for processed and convenience foods drives the continued growth of this segment, fueled by changing consumer lifestyles and a growing preference for packaged foods.

While Food Grade leads in usage, Pharmaceutical Grade potassium sorbate also plays an important role in the pharmaceutical industry, where it is used as a preservative in medications to ensure their safety and efficacy over time. Technical Grade, used in various industrial applications such as cosmetics and personal care products, though smaller in market share, is essential for products requiring preservation but not direct ingestion.

The prominent role of Food Grade in the market is supported by stringent food safety regulations worldwide, ensuring that food products are safe for consumption. This regulatory environment, coupled with ongoing innovation in food processing technology, ensures that Food Grade potassium sorbate will remain a key segment in the market.

Application Analysis

Food and Beverages dominates with 48.3% due to increasing demand for longer shelf life and safer food products.

Potassium sorbate is utilized across several application sectors, with Food and Beverages being the largest, accounting for 48.3% of the market. This segment’s prominence is supported by the global increase in demand for preserved food products, where potassium sorbate serves as an effective solution to extend shelf life and prevent spoilage caused by microorganisms. Its ability to maintain the natural taste and quality of food products makes it a preferred choice among food manufacturers.

The use of potassium sorbate in the Food and Beverages sector is particularly significant in processed foods, dairy products, and bakery items, where it helps to maintain freshness and prevents the growth of fungi and bacteria. The expansion of the global food market, alongside increasing consumer awareness about food safety, has driven the demand for reliable and safe preservatives, bolstering the growth of this segment.

In Pharmaceuticals, potassium sorbate is used to preserve drugs and ointments, ensuring they remain effective and free from microbial contamination throughout their shelf life. The Personal Care segment also relies on potassium sorbate to extend the stability and usability of products ranging from cosmetics to hair care formulations.

The ‘Others’ category, encompassing uses in animal feeds, textiles, and packaging materials, shows the adaptability of potassium sorbate to various industrial needs. Each application contributes uniquely to the market dynamics, with Food and Beverages leading due to the critical need for effective preservation solutions in consumer products. This segment’s growth is expected to continue as the global demand for high-quality, safe, and long-lasting food products remains strong.

Key Market Segments

By Type

- Pharmaceutical Grade

- Food Grade

- Technical Grade

By Application

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Others

Growth Opportunities

Expansion in Emerging Markets Offers Growth Opportunity

The rapid urbanization and industrialization in emerging markets are key drivers for the increasing demand for processed and packaged food products. Countries like China and India, with their burgeoning middle-class populations, are prime examples of regions where consumption patterns are evolving towards more convenience foods. This shift presents a significant growth opportunity for the potassium sorbate market, as these foods often require effective preservatives to maintain freshness and extend shelf life.

Potassium sorbate, known for its safety and efficacy as a food preservative, stands to gain from this trend. By focusing on these dynamic markets, companies can capitalize on new sales opportunities, meeting the rising demand for preserved food and beverage products as consumer preferences and lifestyles continue to change.

Increasing Demand for Natural Preservatives Offers Growth Opportunity

There is a notable shift among consumers towards clean-label and natural products, driven by an increased awareness of health and ingredient transparency. Potassium sorbate, derived from sorbic acid which occurs naturally in some berries, is well-positioned to benefit from this trend. By promoting potassium sorbate as a natural and clean-label preservative, manufacturers can appeal to health-conscious consumers looking for products free from synthetic additives.

Highlighting the natural origins and safety profile of potassium sorbate in marketing and product labels can enhance consumer trust and preference for brands that use it. For instance, organic food manufacturers are increasingly opting for potassium sorbate to ensure the longevity of their products while maintaining compliance with organic certification standards. This trend not only supports market growth but also aligns with evolving consumer preferences towards healthier and more natural food choices.

Trending Factors

Trend Towards Clean-Label and Transparency in Food Labeling Are Trending Factors

The trend towards clean-label and transparency in food labeling is positively impacting the potassium sorbate market. Consumers increasingly prefer products with recognizable and easily understood ingredients. Potassium sorbate, a simple and well-known compound, fits this demand well.

Manufacturers can benefit by highlighting the use of potassium sorbate on product labels as a natural and recognizable preservative. This approach appeals to consumers seeking transparency and clean-label products. By aligning with consumer preferences for clear labeling, the demand for potassium sorbate is expected to grow, expanding its market presence and driving increased usage in various food products.

Increasing Focus on Sustainability and Eco-Friendly Products Are Trending Factors

The increasing focus on sustainability and eco-friendly products is enhancing the potassium sorbate market. As environmental concerns grow, there is a rising demand for sustainable and eco-friendly products. Potassium sorbate, derived from plant sources, can be positioned as an eco-friendly alternative to synthetic preservatives.

Producers can leverage this trend by showcasing the sustainability aspects of potassium sorbate in their marketing efforts. Emphasizing the use of potassium sorbate as a step towards reducing environmental footprints and promoting sustainable practices appeals to eco-conscious consumers. This trend supports market expansion by aligning with global sustainability goals and enhancing the appeal of potassium sorbate in the market.

Regional Analysis

North America Dominates with 38.6% Market Share in the Potassium Sorbate Market

North America holds a significant 38.6% market share of the potassium sorbate market, valued at USD 75.9 billion. This dominance is largely due to the region’s advanced food processing industry and stringent food safety regulations. North America’s emphasis on extending product shelf life while maintaining food safety standards has led to widespread use of potassium sorbate as a preferred food preservative.

The region’s strong agricultural and food production capabilities support the extensive use of potassium sorbate. Moreover, North America’s robust consumer market demands high-quality food products with longer shelf life, driving the demand for effective preservatives like potassium sorbate. The presence of major food and beverage companies in the region also enhances market penetration and distribution.

Europe: Europe accounts for 32.4% of the global potassium sorbate market, translating to a value of USD 63.8 billion. The region’s market is driven by high consumer demand for food safety and quality, coupled with strict EU regulations on food additives. European manufacturers prioritize potassium sorbate due to its effectiveness and minimal impact on taste and aroma.

Asia Pacific: Asia Pacific holds a 21.0% market share, with a market value of USD 41.34 billion. Rapid urbanization, increasing disposable incomes, and the expansion of the food and beverage industry significantly contribute to the demand for potassium sorbate in this region. APAC’s growing processed food sector, particularly in China and India, is a major factor in its market growth.

Middle East & Africa: MEA has a smaller share of 3.0%, valued at USD 5.904 billion. While the market is less mature, there is potential for growth due to increasing industrialization and the rising standards of food safety in the region.

Latin America: Latin America commands a market share of 5.0%, with a value of USD 9.840 billion. The region shows growth potential with a burgeoning food industry and increasing awareness among consumers about food preservation.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Potassium Sorbate Market features several influential companies. Celanese Corporation and Archer Daniels Midland Company lead with their strong production capabilities and extensive distribution networks. FBC Industries, Inc. and Hawkins, Inc. leverage their innovative solutions and strategic partnerships to maintain competitive positions.

Nantong Acetic Acid Chemical Co., Ltd. and Nantong Alchemy Biotech Development Co., Ltd. focus on high-quality products and expanding their market reach. Sorbent Technologies and The Lubrizol Corporation emphasize sustainable practices and strong customer relationships. McCormick & Company, Inc. and Tengzhou Aolong Fine Chemical Co., Ltd. invest heavily in research and development to drive product innovation.

Ningbo Wanglong Technology Co., Ltd. and Shanghai Hongying Trading Co., Ltd. maintain robust market positions through diversified product portfolios and strategic collaborations. These companies collectively drive market growth by ensuring high-quality potassium sorbate, meeting global demand and promoting industry stability.

Their strategic positioning, commitment to sustainability, and strong supply chains influence market trends and set industry standards. Through continuous improvement and strategic initiatives, these market leaders shape the future of the potassium sorbate market.

Market Key Players

- Celanese Corporation

- Archer Daniels Midland Company

- FBC Industries, Inc.

- Hawkins, Inc.

- Nantong Acetic Acid Chemical Co., Ltd.

- Nantong Alchemy Biotech Development Co., Ltd.

- Sorbent Technologies

- The Lubrizol Corporation

- McCormick & Company, Inc.

- Tengzhou Aolong Fine Chemical Co., Ltd.

- Ningbo Wanglong Technology Co., Ltd.

- Shanghai Hongying Trading Co., Ltd.

Recent Developments

- ADM reported a revenue of $93.9 billion in FY 2023, with a gross profit of $7.5 billion and a net income of $3.5 billion. The company operates over 330 food and feed ingredient manufacturing facilities and 62 innovation centers globally, ensuring a robust production and innovation capability to meet diverse market demands.

- In 2022, McCormick achieved annual sales of $4.8 billion, reflecting a 1% increase compared to the previous year. This growth was driven by an 8% increase from pricing actions, which offset a 5% decrease in volume and product mix

Report Scope

Report Features Description Market Value (2023) USD 196.8 Million Forecast Revenue (2033) USD 329.8 Million CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pharmaceutical Grade, Food Grade, Technical Grade), By Application (Food and Beverages, Pharmaceuticals, Personal Care, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Celanese Corporation, Archer Daniels Midland Company, FBC Industries, Inc., Hawkins, Inc., Nantong Acetic Acid Chemical Co., Ltd., Nantong Alchemy Biotech Development Co., Ltd., Sorbent Technologies, The Lubrizol Corporation, McCormick & Company, Inc., Tengzhou Aolong Fine Chemical Co., Ltd., Ningbo Wanglong Technology Co., Ltd., Shanghai Hongying Trading Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market value of the Global Potassium Sorbate Market by 2033?The market is expected to reach USD 329.8 million by 2033.

What is the expected Compound Annual Growth Rate (CAGR) for the Potassium Sorbate Market during 2024-2033?The Potassium Sorbate market is expected to grow at a CAGR of 5.3%.

Which region holds the largest market share for potassium sorbate?North America holds the largest market share, accounting for 38.6%.

Who are the key players in the potassium sorbate market?Key players include Celanese Corporation, Archer Daniels Midland Company, FBC Industries, Inc., Hawkins, Inc., Nantong Acetic Acid Chemical Co., Ltd., and others.

-

-

- Celanese Corporation

- Archer Daniels Midland Company

- FBC Industries, Inc.

- Hawkins, Inc.

- Nantong Acetic Acid Chemical Co., Ltd.

- Nantong Alchemy Biotech Development Co., Ltd.

- Sorbent Technologies

- The Lubrizol Corporation

- McCormick & Company, Inc.

- Tengzhou Aolong Fine Chemical Co., Ltd.

- Ningbo Wanglong Technology Co., Ltd.

- Shanghai Hongying Trading Co., Ltd.