Global Post Production Market Size, Share, Statistics Analysis Report By Service Type (Video Editing, Visual Effects (VFX), Sound Editing/Mixing, COlor Grading, Motion Graphics), By Application (Movies, TV Shows & Streaming, Advertising, Gaming, Corporate/Education, Others), By End-User (Production Houses, Independent Filmmakers, Television Studios, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148531

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

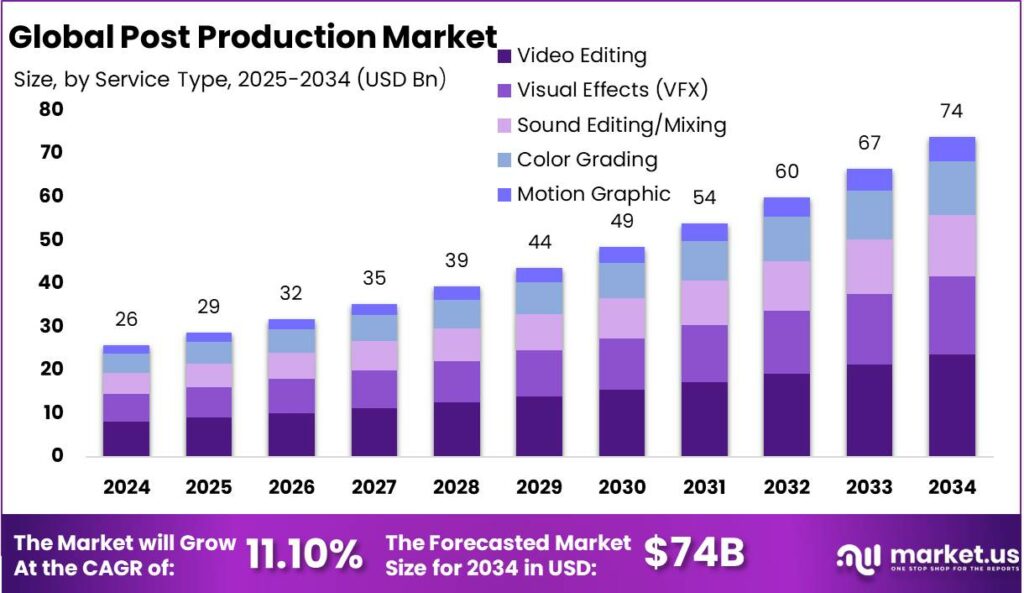

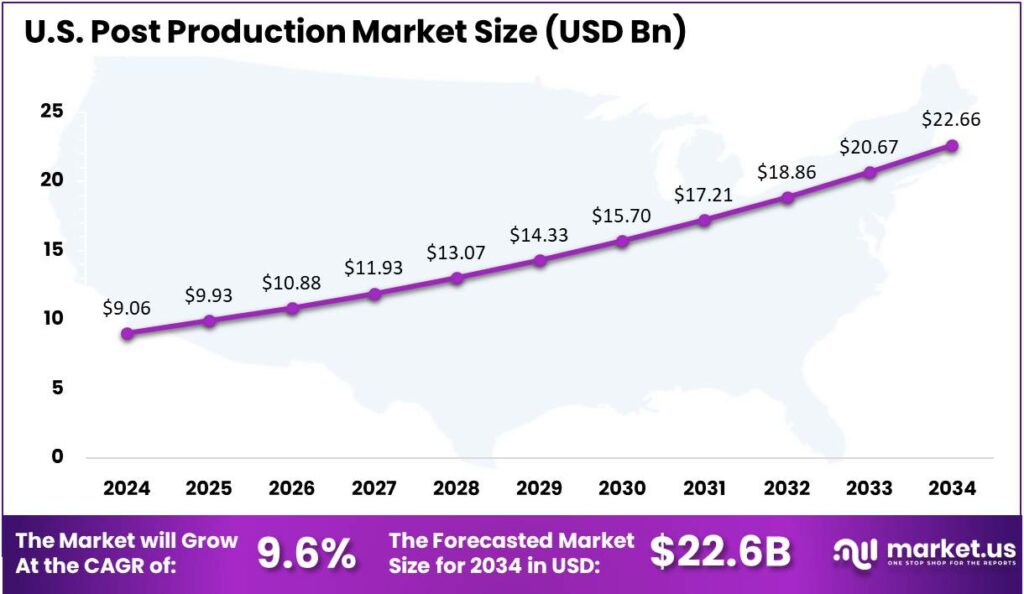

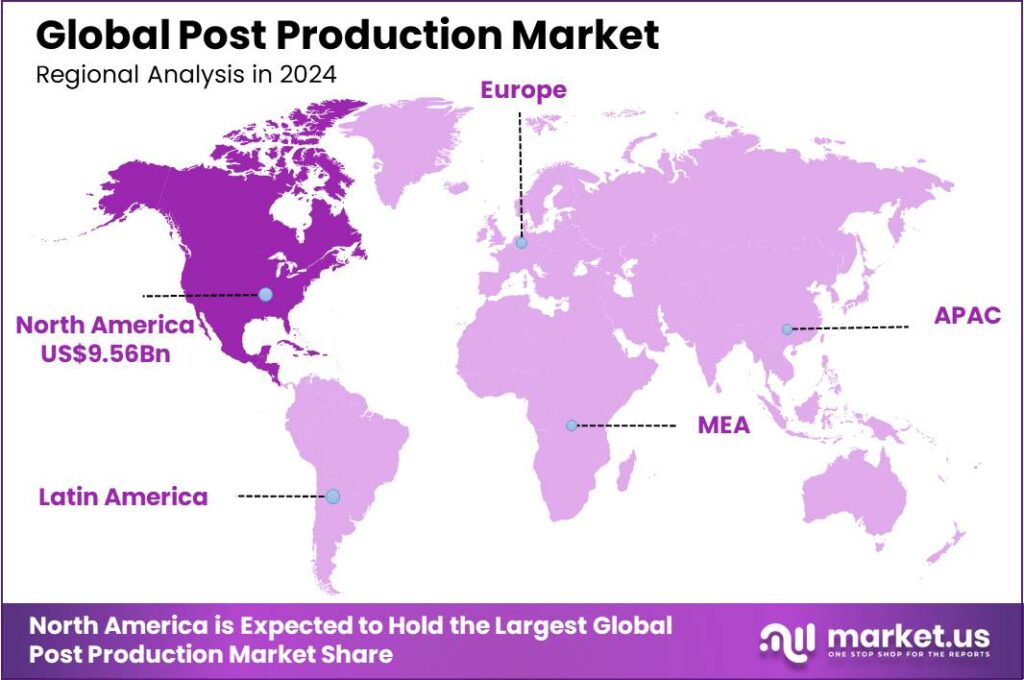

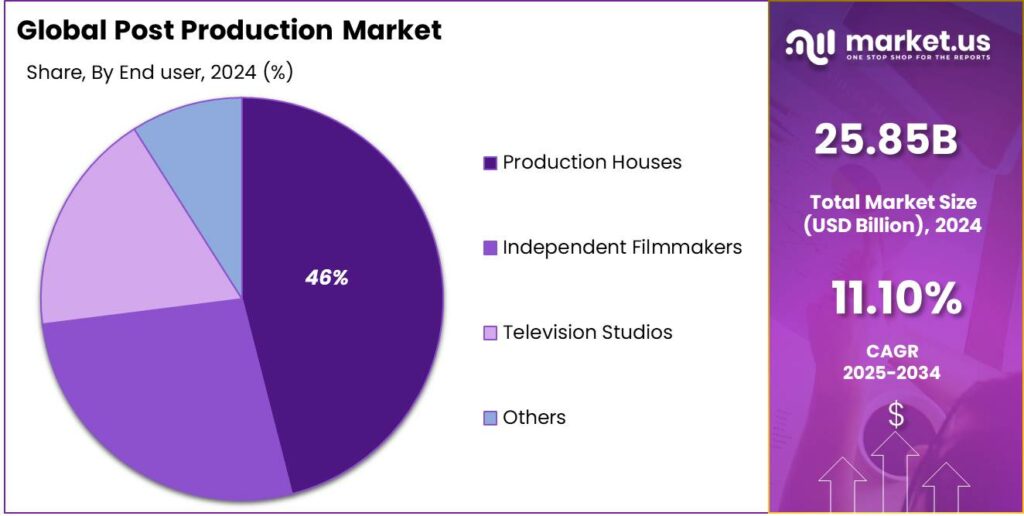

The Global Post Production Market size is expected to be worth around USD 74 Billion By 2034, from USD 25.85 Billion in 2024, growing at a CAGR of 11.10% during the forecast period from 2025 to 2034. In 2024, North America held a 37% share of the global post-production market, with an estimated revenue of USD 9.56 billion. The U.S. market was valued at USD 9.06 billion and is expected to grow at a 9.6% CAGR.

Post-production is the final phase in the filmmaking process, where raw footage is transformed into a polished and cohesive final product. This stage encompasses various tasks such as video editing, sound design, visual effects (VFX), color grading, and audio mixing. The primary objective is to enhance the narrative, ensure continuity, and prepare the content for distribution across different platforms.

Key factors driving the growth of the post-production market include the rising global demand for digital content on streaming platforms like Netflix, Amazon Prime Video, Disney+, and YouTube. As consumer preferences shift towards high-definition, immersive viewing experiences, the need for advanced editing, 4K/8K resolution processing, and complex VFX has significantly increased.

Content production growth in emerging markets like India, Brazil, and Southeast Asia is expanding the post-production industry’s global reach. AI integration in editing tools and cloud-based workflows is boosting efficiency and accessibility. The growth of gaming, VR, and online advertising further pushes post-production boundaries, making it a key part of the digital media ecosystem.

Emerging trends in post-production include the use of AI and machine learning for tasks like automated editing and scene detection, as well as cloud-based tools enabling real-time collaboration across locations. The rise of AR and VR technologies is also creating new opportunities for immersive storytelling, requiring advanced post-production techniques to merge real and virtual elements.

As reported by Market.us, The global Visual Effects (VFX) market is witnessing a consistent upward trajectory, driven by growing demand for immersive visual storytelling in films, television, advertising, and gaming. In 2023, the market was valued at approximately USD 10,440.5 million, and is projected to reach nearly USD 28,073.92 million by 2033, expanding at a steady CAGR of 10.7% over the forecast period from 2024 to 2033.

Concurrently, the AI in Visual Effects market is evolving rapidly, unlocking new efficiencies in content generation, animation, scene reconstruction, and real-time editing. As of 2023, this segment stood at around USD 1.6 billion, and is forecast to reach USD 9.6 billion by 2033, advancing at an impressive CAGR of 19.6%.

Investment opportunities in the post-production sector are huge, particularly in emerging markets where the demand for high-quality content is growing. Investors are focusing on companies that offer innovative solutions and services, as well as those that cater to the increasing need for localized and culturally relevant content.

The regulatory environment for post-production varies across regions. In some countries, there are specific guidelines and standards that post-production companies must adhere to, especially concerning content rating, censorship, and distribution rights. Compliance with these regulations is crucial for the successful release and distribution of content.

Key Takeaways

- The global post-production market is projected to reach USD 74 billion by 2034, growing from USD 25.85 billion in 2024, at a compound annual growth rate (CAGR) of 11.10% during the forecast period from 2025 to 2034.

- In 2024, the Video Editing segment dominated the market, accounting for more than 32% of the global post-production market share.

- The TV Shows & Streaming segment held a dominant market position in 2024, representing more than 35% of the global post-production market share.

- The Production Houses segment led the market in 2024, capturing more than 46% of the global post-production market share.

- In 2024, North America held the largest share of the global post-production market, with a 37% market share and an estimated revenue of USD 9.56 billion.

- The U.S. post-production market was valued at USD 9.06 billion in 2024 and is expected to grow at a CAGR of 9.6%.

U.S. Market Size

In 2024, the U.S. post production market reached a significant valuation of USD 9.06 billion, reflecting the growing influence of digital transformation and the increasing demand for high-quality content across film, television, advertising, and streaming platforms. Robust investments in editing, VFX, sound, and color grading have enabled production houses to deliver more polished, immersive content.

The market is projected to grow at a compound annual growth rate (CAGR) of 9.6%, driven largely by the surge in original content production by streaming giants such as Netflix, Amazon Prime Video, Disney+, and others. These platforms are investing heavily in high-budget, effects-heavy productions that rely significantly on post production services.

Additionally, there is a growing trend toward remote and cloud-based post production workflows, which offer scalable, collaborative, and cost-effective solutions to content creators. This shift not only reduces infrastructure costs but also allows geographically distributed teams to work on the same project simultaneously, accelerating delivery timelines.

Innovations in AI-powered editing, automation in color correction, and virtual production tools are also contributing to the market’s evolution, making the post production phase not just a technical necessity, but a strategic creative function. As these technologies continue to mature and gain adoption, the U.S. post production industry is poised for sustained growth in the coming years.

In 2024, North America held a dominant market position, capturing more than a 37% share of the global post production market, with an estimated revenue of USD 9.56 billion. This leadership is primarily attributed to the region’s deep-rooted media and entertainment ecosystem, particularly in the United States, where Hollywood continues to set global standards for high-end content creation.

The strong presence of leading post production studios, advanced VFX houses, and innovative sound design firms has enabled North America to stay ahead in both volume and quality of post production work. Moreover, the high concentration of skilled professionals and access to cutting-edge software and hardware further strengthens the region’s global competitiveness.

One of the key reasons behind North America’s dominance is the aggressive content production strategy adopted by major streaming platforms such as Netflix, Hulu, Apple TV+, and Disney+, all headquartered in the region. These players are investing heavily in original programming, which heavily relies on intensive post production processes including CGI, motion graphics, and immersive sound mixing.

Furthermore, the adoption of remote and cloud-based post production workflows has gained significant traction in North America, enabling seamless collaboration between teams across different cities or even countries. Technologies such as AI-assisted editing, cloud rendering, and real-time color grading tools are being rapidly deployed to reduce turnaround times while enhancing creative output.

Service Type Analysis

In 2024, the Video Editing segment held a dominant market position, capturing more than a 32% share of the global post-production market. This leadership is attributed to the escalating demand for high-quality video content across various platforms, including streaming services, social media, and corporate communications.

The proliferation of user-friendly and affordable video editing software has further democratized content creation, enabling a broader range of users to produce professional-grade videos. Additionally, the integration of artificial intelligence (AI) and machine learning technologies into editing tools has streamlined workflows, enhancing efficiency and reducing production time.

The surge in demand for short-form video content on platforms like TikTok, Instagram Reels, and YouTube Shorts has significantly contributed to the prominence of the Video Editing segment. Content creators and marketers are increasingly focusing on producing engaging, concise videos to capture audience attention in a saturated digital landscape.

In the corporate sector, video has become an essential medium for marketing, training, and internal communications. Businesses are investing in high-quality video content to enhance brand visibility and engage stakeholders effectively. The demand for polished corporate videos has led to increased reliance on professional video editing services, further expanding the segment’s market share.

Application Analysis

In 2024, the TV Shows & Streaming segment held a dominant market position, capturing more than a 35% share of the global post-production market. This dominance is largely attributed to the dramatic rise in global consumption of on-demand video content and binge-worthy series across platforms.

These platforms are continuously investing in original programming, increasing the volume of episodic content that requires intensive post-production work such as color grading, visual effects, subtitling, sound mixing, and frame rate optimization. The demand for faster turnaround times and high production quality has further elevated the need for streamlined post-production workflows tailored specifically to streaming content.

Streaming content leads the post-production segment due to its high volume, faster release cycles, and demand for episodic formats. The rise of 4K and HDR increases technical needs, which streaming-focused teams manage well. Additionally, localization through dubbing and subtitles drives further post-production demand, especially in Asia-Pacific and Latin America.

Furthermore, partnerships between post-production studios and streaming giants have become increasingly common, allowing for long-term service agreements that ensure both scalability and consistency in output. As a result, the TV Shows & Streaming segment is not only leading in terms of revenue share but also driving innovation and efficiency in the post-production industry.

End-User Analysis

In 2024, the Production Houses segment held a dominant market position, capturing more than a 46% share of the global post production market. This leadership can be primarily attributed to the high volume of large-scale content projects commissioned by production houses, particularly for theatrical releases, high-budget streaming content, and branded media.

Production houses are adapting to evolving audience demands by creating high-quality, effects-heavy content for platforms like Netflix and HBO. This drives greater reliance on advanced post-production tools and teams for tasks like 3D rendering and Dolby Atmos mastering, leading to increased spending and extended timelines in post-production.

Production houses often have in-house post facilities or long-term studio partnerships, ensuring creative control and efficient execution. Their work on global, multi-language content drives demand for localization services, deepening their dependence on post-production support.

Unlike independent filmmakers or TV studios, production houses benefit from larger budgets and scale, allowing them to adopt advanced technologies like virtual production and AI-driven editing. These innovations enhance content quality and set industry standards, reinforcing their leadership in the global post-production market.

Key Market Segments

By Service Type

- Video Editing

- Visual Effects (VFX)

- Sound Editing/Mixing

- Color Grading

- Motion Graphics

By Application

- Movies

- TV Shows & Streaming

- Advertising

- Gaming

- Corporate/Education

- Others

By End-User

- Production Houses

- Independent Filmmakers

- Television Studios

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Expansion of Digital Content and Streaming Platforms

The proliferation of digital content and the rise of streaming platforms have significantly propelled the post-production industry. With audiences increasingly consuming content online, there is a heightened demand for high-quality visual and auditory experiences. Streaming services, in particular, require a continuous flow of engaging content to retain and grow their subscriber base.

This necessitates extensive post-production work, including editing, visual effects, sound design, and color grading, to meet the quality standards expected by viewers. The surge in digital content creation has also led to a diversification of genres and formats, further expanding the scope and complexity of post-production tasks. As a result, post-production services have become integral to the content creation process, driving growth and innovation within the industry.

Restraint

High Costs and Complexity of Advanced Technologies

The adoption of advanced technologies in post-production, while enhancing the quality and efficiency of content creation, has introduced significant financial and operational challenges. High-end software and hardware required for sophisticated editing, visual effects, and sound design are often expensive, making them less accessible to smaller studios and independent creators.

Additionally, the complexity of integrating these technologies into existing workflows can lead to increased training requirements and potential disruptions in production timelines. The rapid pace of technological advancements also necessitates continual investment to stay current, placing additional financial strain on post-production entities. These factors collectively act as barriers to entry and growth, particularly for emerging players in the industry.

Opportunity

Growth in Emerging Markets and Localization Services

Emerging markets present a significant opportunity for the post-production industry, driven by increasing demand for localized content. As global audiences seek content that resonates with their cultural and linguistic contexts, there is a growing need for services such as dubbing, subtitling, and cultural adaptation.

The expansion of internet access and mobile device usage in these markets further amplifies the demand for localized digital content. Post-production companies that can effectively deliver high-quality localization services are well-positioned to capitalize on this growing segment, fostering global reach and inclusivity in media consumption.

Challenge

Shortage of Skilled Talent in Post-Production

The post-production industry is currently facing a significant shortage of skilled professionals, impacting its ability to meet the growing demand for high-quality content. This talent gap spans various roles, including editors, visual effects artists, and sound designers.

Factors contributing to this shortage include the rapid evolution of technology outpacing the current workforce’s skill sets, and a lack of comprehensive training programs aligned with industry needs. Additionally, the freelance nature of many post-production roles can lead to inconsistencies in workforce availability and quality.

Emerging Trends

A notable trend is the integration of artificial intelligence (AI) into editing workflows. AI tools are now capable of automating tasks such as scene detection, color correction, and even generating visual effects, thereby enhancing efficiency and reducing manual labor. This shift allows creative professionals to focus more on storytelling and less on repetitive tasks.

Another emerging trend is the adoption of virtual production techniques. Utilizing real-time rendering engines like Unreal Engine, filmmakers can create immersive environments on set, blending physical and digital elements seamlessly. This approach not only streamlines the production process but also offers greater creative flexibility, enabling real-time adjustments to scenes and settings.

Remote collaboration has also become increasingly prevalent in post-production. Cloud-based platforms facilitate real-time collaboration among geographically dispersed teams, allowing for efficient sharing of assets and feedback. This model has proven especially valuable in the current global context, where remote work has become more commonplace.

Business Benefits

Investing in advanced post-production processes offers numerous business advantages for content creators and production companies. One primary benefit is the enhancement of content quality. Through meticulous editing, color grading, and sound design, post-production ensures that the final product meets high aesthetic and technical standards, which is crucial for audience engagement and satisfaction.

Efficiency gains are another significant advantage. The integration of AI and automation tools in post-production workflows accelerates the editing process, reducing turnaround times and allowing for quicker content delivery. This speed is vital in today’s fast-paced media landscape, where timely releases can impact a project’s success.

Cost savings are also realized through streamlined post-production processes. By minimizing the need for reshoots and enabling more precise editing, production companies can allocate resources more effectively, reducing overall expenses. Additionally, remote collaboration tools decrease the necessity for travel and on-site meetings, further cutting costs.

Key Player Analysis

As demand grows for high-quality content across streaming platforms and cinema, certain companies have stood out as key leaders.

Technicolor is a long-standing name in the entertainment world, known for pushing the boundaries of color and visual effects. The company offers a wide range of post-production services, including visual effects (VFX), animation, and color grading. Technicolor stands out for its deep industry experience and partnerships with major studios.

DNEG (Double Negative) has built a strong reputation for delivering stunning visual effects in both film and television.Their ability to seamlessly combine real-world footage with digital elements has made them a trusted name for directors and producers looking for immersive storytelling. DNEG also invests heavily in new technologies like AI-driven workflows and virtual reality, setting them apart in a fast-evolving industry.

Industrial Light & Magic, or ILM, is a pioneer in the visual effects space. Founded by George Lucas, ILM has been behind some of the most iconic visuals in film history, including Star Wars, Jurassic Park, and The Avengers series. ILM’s innovation in VFX is unmatched, often setting the standard for the entire industry. Their ability to deliver large-scale effects while keeping storytelling at the center is what keeps them at the top of the post-production world.

Top Key Players in the Market

- Technicolor

- DNEG

- Industrial Light & Magic

- Framestore

- Company 3

- Weta Digital

- Deluxe Entertainment

- MPC (Moving Picture Company)

- The Mill

- Digital Domain

- Pixomondo

- Method Studious

- Scanline VFX

- Others

Top Opportunities for Players

- Integration of Artificial Intelligence (AI) in Workflows: AI technologies are increasingly being adopted to streamline post-production processes. AI is enhancing tasks like automated editing, noise reduction, and upscaling, improving efficiency, lowering costs, and enabling professionals to focus on creative work.

- Expansion of Virtual and Augmented Reality (VR/AR) Content: The growing demand for immersive experiences has led to a surge in VR and AR content. Post-production plays a crucial role in stitching together 360-degree footage and integrating computer-generated elements into these experiences. This trend opens new avenues for post-production professionals to apply their skills in emerging formats .

- Growth of Streaming Platforms and Original Content: The proliferation of streaming services has resulted in an increased demand for original content. The surge in demand requires intensive post-production work, offering ongoing opportunities for collaboration between post-production houses, content creators, and streaming platforms.

- Remote Collaboration and Cloud-Based Workflows: Advancements in cloud technology have facilitated remote collaboration among post-production teams. Professionals can now work together in real-time, regardless of location, enhancing flexibility and productivity. This shift not only broadens the talent pool but also allows for more dynamic and efficient workflows.

- Emphasis on Personalized and Interactive Content: Audiences are increasingly seeking personalized and interactive viewing experiences. Post-production is evolving with dynamic metadata and adaptive editing to enable personalized content delivery, creating both challenges and opportunities for innovation.

Recent Developments

- In April 2024, DNEG launched DNEG 360, a new division in partnership with Dimension Studio, offering end-to-end virtual production services with two of the world’s largest LED volume stages.

- In June 2024, Pixomondo, in collaboration with Sony PCL and Vook, expanded its Virtual Production Academy in Japan. This initiative aims to train professionals in virtual art department (VAD) techniques.

Report Scope

Report Features Description Market Value (2024) USD 25.85 Bn Forecast Revenue (2034) USD 74 Bn CAGR (2025-2034) 11.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Video Editing, Visual Effects (VFX), Sound Editing/Mixing, COlor Grading, Motion Graphics), By Application (Movies, TV Shows & Streaming, Advertising, Gaming, Corporate/Education, Others), By End-User (Production Houses, Independent Filmmakers, Television Studios, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Technicolor, DNEG, Industrial Light & Magic, Framestore, Company 3, Weta Digital, Deluxe Entertainment, MPC (Moving Picture Company), The Mill, Digital Domain, Pixomondo, Method Studious, Scanline VFX, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Technicolor

- DNEG

- Industrial Light & Magic

- Framestore

- Company 3

- Weta Digital

- Deluxe Entertainment

- MPC (Moving Picture Company)

- The Mill

- Digital Domain

- Pixomondo

- Method Studious

- Scanline VFX

- Others