Global Polyvinylpyrrolidone Market By Grade (PVP K12, PVP K15, PVP K25, PVP K30, PVP K60, PVP K90, and Others), By Application (Pharmaceuticals, Personal Care And Cosmetics, Food And Beverage, and Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: Feb 2026

- Report ID: 178281

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

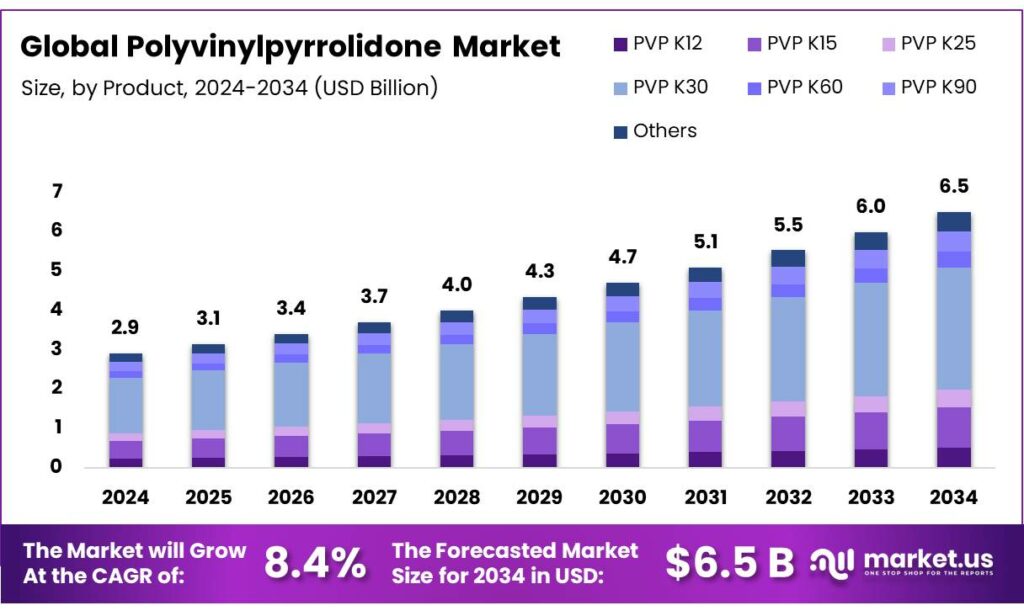

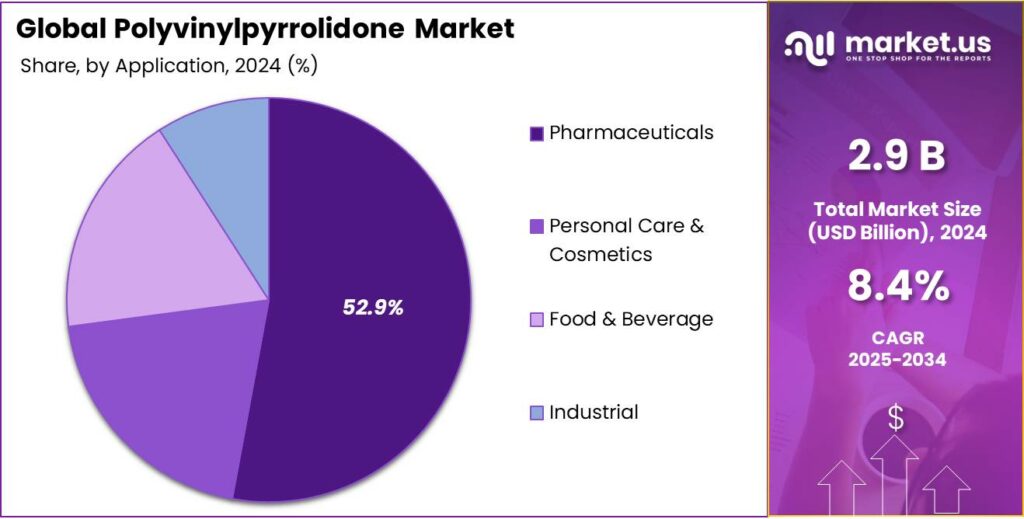

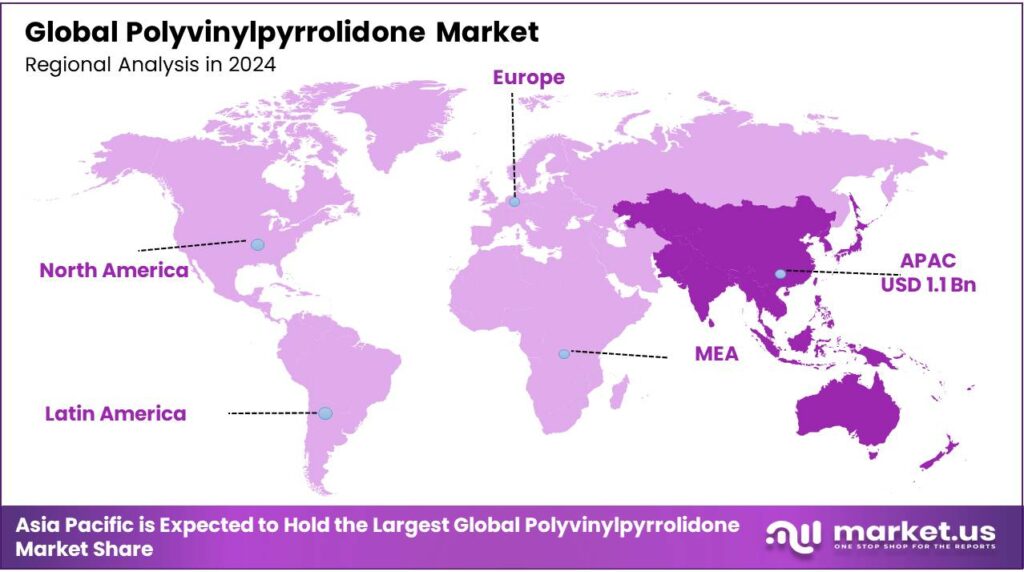

The Global Polyvinylpyrrolidone Market is expected to be worth around USD 6.5 Billion by 2034, up from USD 2.9 Billion in 2024, and is projected to grow at a CAGR of 8.4%, from 2025 to 2034. Asia Pacific accounted for 36.4%, reaching USD 1.1 Bn.

Polyvinylpyrrolidone (PVP), known as povidone or polyvidone, is a versatile, water-soluble, multifunctional synthetic polymer used across pharmaceuticals, personal care and cosmetics, food, and selected industrial applications due to its biocompatibility and unique chemical properties. The market is structurally anchored in pharmaceutical demand, where PVP’s roles as a tablet binder, solubilizer, stabilizer, and coating agent require high-purity, pharmacopoeia-compliant grades and long-term qualified supply. Grades such as PVP K30 dominate due to their balanced molecular weight and versatile performance across formulations.

- In January 2026, international standards maintain an Acceptable Daily Intake (ADI) of 0-50 mg/kg body weight for PVP, as established by the Joint FAO/WHO Expert Committee on Food Additives (JECFA).

Beyond pharmaceuticals, PVP is used in hair styling, skin care, and color cosmetics as a film former and rheology modifier, and in food as E1201, mainly for tablets and special medical foods under defined regulatory conditions. In addition, the Asia Pacific functions as a key regional hub due to its large pharmaceutical and chemical manufacturing base.

- Under REACH Annex XVII (Entry 78), manufacturers of synthetic polymer microparticles (SPMs), including PVP, must report annual emissions starting May 31, 2026.

However, the market faces challenges from environmental persistence and limited biodegradability, which draw regulatory attention. Moreover, geopolitical tensions further influence supply chains through feedstock availability and trade exposure.

Key Takeaways:

- The global polyvinylpyrrolidone market was valued at USD 2.9 billion in 2024.

- The global polyvinylpyrrolidone market is projected to grow at a CAGR of 8.4% and is estimated to reach USD 6.5 billion by 2034.

- Based on grade, PVP K30 polyvinylpyrrolidone dominated the market in 2024, comprising about 48.1% share of the total global market.

- Among the applications of polyvinylpyrrolidone, the pharmaceuticals industry dominated the market in 2024, accounting for around 52.9% of the market share.

- In 2024, the Asia Pacific was at the forefront of the polyvinylpyrrolidone market, comprising 36.4% of the market share.

Grade Analysis

PVP K30 Polyvinylpyrrolidone Held the Largest Share in the Market.

On the basis of grade, the polyvinylpyrrolidone market is segmented into PVP K12, PVP K15, PVP K25, PVP K30, PVP K60, PVP K90, and others. The PVP K30 polyvinylpyrrolidone dominated the market in 2024 with a market share of 48.1%, as its intermediate molecular weight, around 45,000 Da, provides a balanced combination of key functional properties, including solubility, binding strength, and viscosity control, that suit a broad range of applications. For instance, in solid dosage pharmaceuticals, K30 offers effective tablet binding without excessive viscosity in aqueous systems.

Similarly, in cosmetics and personal care, it forms clear, flexible films and stabilizes formulations without overly thickening. In contrast, lower-molecular-weight grades, such as K12 and K15, may dissolve very rapidly but lack sufficient binding or film-forming performance, while higher-molecular-weight grades, such as K60 and K90, increase solution viscosity, complicating processing and limiting use where low to moderate viscosities are needed. K30’s functional versatility and manageable solution behavior make it a preferred, general-purpose PVP grade across regulatory and formulation contexts.

Application Analysis

In 2024, the Pharmaceuticals Industry Dominated the Polyvinylpyrrolidone Market.

In 2024, the pharmaceuticals industry emerged as the largest application of polyvinylpyrrolidone, accounting for nearly 52.9% of the product’s global consumption, outperforming applications such as personal care & cosmetics, food & beverage, and industrial. Most polyvinylpyrrolidone demand from the pharmaceutical sector reflects the stringent functional and regulatory requirements in drug formulation rather than sheer volumetric use in other categories.

In pharmaceuticals, PVP must meet pharmacopoeial and Good Manufacturing Practice (GMP) specifications, necessitating high-purity grades. In contrast, applications in personal care & cosmetics, food, and industrial uses typically tolerate broader grade ranges and lower purity thresholds. The criticality of performance and regulatory compliance in medicinal products leads to higher value exchange per unit of PVP supplied, concentrating industry focus and commercial emphasis on pharmaceutical applications.

Key Market Segments

By Grade

- PVP K12

- PVP K15

- PVP K25

- PVP K30

- PVP K60

- PVP K90

- Others

By Application

- Pharmaceuticals

- Oral Drugs

- Injectable Formulations

- Others

- Personal Care & Cosmetics

- Skin Care

- Hair Care

- Others

- Food & Beverage

- Confectionery

- Beverages

- Others

- Industrial

- Adhesives

- Coatings & Inks

- Water Treatment

- Electronics

- Others

Drivers

Demand from Pharmaceuticals Industry Drives the Demand for Polyvinylpyrrolidone.

Polyvinylpyrrolidone is a water-soluble, biocompatible polymer widely used as an excipient in pharmaceutical formulations due to its inertness and multifunctional properties. It plays roles as a binder, coating agent, solubilizer, stabilizer, and release modifier across conventional and controlled drug delivery systems, with molecular weight and concentration tailored to specific dosage forms.

The U.S. Food and Drug Administration (FDA) classifies PVP as Generally Recognized As Safe (GRAS) and includes it in the Inactive Ingredient Database for approved drug products, including high-purity injectable grades, tablet binders, and povidone-iodine antiseptics, reflecting regulatory acceptance of its safety profile.

Similarly, data published via the National Institutes of Health (NIH) indicates that low-molecular-weight PVP is rapidly excreted by the kidneys and does not accumulate in biological systems, supporting its widespread use in oral and topical formulations. Pharmaceutical demand drives production capacity decisions by major chemical suppliers.

Restraints

Environmental Impact of the Polyvinylpyrrolidone Might Hamper the Growth of the Market.

Polyvinylpyrrolidone, a synthetic water-soluble polymer extensively used as a pharmaceutical excipient, presents environmental challenges tied to its persistence and limited biodegradation in natural and engineered systems. The chemical is a biologically resistant xenobiotic. Standardized biodegradation assessments following OECD 301 guidelines classify PVP as non-biodegradable, exhibiting less than 10% degradation over 42 days under test conditions, indicating environmental persistence after wastewater release post-use.

A study by the National Institutes of Health (NIH) quantifies PVP concentrations in urban wastewater at approximately 7 mg/L, and notes that PVP is biologically resistant, passing through conventional wastewater treatment systems with minimal decomposition due to poor sorption to activated sludge. Additionally, in controlled exposure studies with Daphnia magna, a freshwater model species, inhibitory effects, including reduced growth and lethal outcomes, were observed at environmentally relevant concentrations for certain molecular weights of PVP, dependent on feeding regimes.

Opportunity

Applications in Personal Care and Cosmetics Create Opportunities in the Polyvinylpyrrolidone Market.

The personal care and cosmetics sector represents a high-growth segment for polyvinylpyrrolidone, driven by its specialized physical properties and broad regulatory approval. It serves multiple verified functional roles in personal care and cosmetic formulations, presenting well-documented opportunities rooted in ingredient utility. In the EU Cosmetic Ingredient Database (Cosmile), PVP is officially recognized for seven functions, including antistatic, binding, emulsion stabilizing, film-forming, hair fixing, fragrance functional, and viscosity controlling in cosmetic products, often used at 1-10% concentrations depending on formulation type.

Additionally, the Cosmetic Ingredient Review (CIR) Expert Panel, supported by the Personal Care Products Council, reaffirmed PVP’s safety in 2017 and 2019, noting use concentrations as high as 12% in leave-on products and 35% in historical formulations. Similarly, it remains a staple in global markets due to its compliance with EU Cosmetics Regulation and FDA safety standards for non-irritating topical applications.

In hair care applications, PVP’s film-forming properties create a thin, flexible coating on hair strands that inhibits moisture absorption and supports style retention across conditioning products, sprays, and gels. Similarly, in decorative cosmetics, the polymer promotes pigment dispersion and adhesion, contributing to enhanced wear characteristics in mascaras, eyeliners, and foundations.

Trends

Focus on the Use of Polyvinylpyrrolidone in the Food Sector.

The utilization of polyvinylpyrrolidone in the food and beverage sector has consolidated into a significant market trend, primarily driven by the demand for beverage stabilization and high-purity additives. It is recognized internationally as an authorized food additive, designated E1201 under European Commission Regulation (EU) No 231/2012, with defined functional roles primarily as a binder and stabilizer in food products such as supplements and foods for special medical purposes.

The European Food Safety Authority (EFSA) has re-evaluated PVP’s safety and use levels, concluding that at authorized use levels the polymer does not raise safety concerns and that acceptable daily intake (ADI) levels are not necessary as its absorption is very low. The 95th percentile exposure estimate for PVP in children, based on maximum reported use levels, was up to 23.7mg/kg body weight per day, while this was considered an overestimate given consumption assumptions.

However, the FDA mandates strict usage caps under 21 CFR 173.55, limiting PVPP usage in beer to 60 g/hL to ensure safety while preserving organoleptic properties. In addition, the transition to ready-to-eat (RTE) food globally is driving the use of PVP as a stabilizer and bodying agent to maintain texture in packaged products.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Polyvinylpyrrolidone Market.

The geopolitical tensions materially affect the PVP market through raw material supply and supply chain exposure. The production of PVP depends on monomer N-vinylpyrrolidone (NVP) and petrochemical feedstock. The disruptions or trade policy shifts in these upstream inputs can propagate through the value chain.

Geopolitical volatility in energy and trade policy contributes to volatility in raw material sourcing and pricing, complicating inventory planning and production continuity for manufacturers reliant on imports, particularly in regions with limited domestic NVP capacity. For instance, European PVP producers face dependency on imports from Asia (China and South Korea), exposing supply chains to logistical barriers and trade policy changes that can impact feedstock availability and pricing stability.

The escalating geopolitical tensions, including sanctions and regional conflicts, are potential sources of supply chain interruptions, and unfavorable energy markets could materially impact procurement and delivery networks. Similarly, the reliance on foreign suppliers, particularly in geopolitically sensitive regions, could lead to operational disruptions requiring alternative sourcing strategies.

Regional Analysis

Asia Pacific is at the Forefront of the Global Polyvinylpyrrolidone Market.

The Asia Pacific held the major share of the global polyvinylpyrrolidone market, led by China and India, commanding an estimated 36.4% of total revenue share, underpinned by diversified end-use industries and chemical manufacturing infrastructure. China’s chemical sector functions as a major regional hub for PVP supply and downstream pharmaceuticals. The country’s broad manufacturing capacity supports high-purity excipient production for tablets, capsules, and oral formulations.

- According to the Indian Ministry of Commerce and Industry, India’s drugs and pharmaceuticals exports reached US$ 30.38 billion in FY25, up from US$ 27.82 billion in FY24.

Similarly, India features prominently, with its large pharmaceuticals and personal care industries generating substantive regional PVP demand. Beyond pharmaceuticals, widespread application domains such as adhesives and cosmetics in Japan, South Korea, and ASEAN economies contribute to aggregated regional usage. Fragmented regional production includes multinational firms and local chemical manufacturers in China and India, serving domestic and export markets with medium-to-high-purity PVP grades.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of polyvinylpyrrolidone focus on several strategic activities to strengthen competitive positioning and expand market presence. The companies put emphasis on capacity expansion and process optimization to ensure a reliable supply of high-purity grades that meet pharmaceutical, food, and personal care regulatory standards.

Additionally, companies prioritize regulatory compliance and quality certifications to access regulated end-use sectors. Geographic diversification of production and sourcing is emphasized to reduce supply chain risk and improve proximity to major consuming regions. Furthermore, manufacturers invest in application development and technical collaboration with customers, enabling formulation support and long-term supply relationships.

The Major players in the industry

- Nippon Shokubai Co., Ltd.

- Ashland

- BASF SE

- Boai NKY Pharmaceuticals Ltd

- Henan Pengfei New Materials Co., Ltd.

- Glide Chem Private Limited

- Yuking Technologies Co., Ltd

- JH Nanhang Life Sciences Co., Ltd.

- Hangzhou Motto Science & Technology Co., Ltd.

- Synvent Materials Corporation

- Hefei TNJ Chemical Industry Co., Ltd.

- Zhejiang Polymer Chemical Co., Ltd.

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Other Key Players

Report Scope

Report Features Description Market Value (2024) US$2.9 Bn Forecast Revenue (2034) US$6.5 Bn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (PVP K12, PVP K15, PVP K25, PVP K30, PVP K60, PVP K90, and Others), By Application (Pharmaceuticals, Personal Care & Cosmetics, Food & Beverage, and Industrial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Nippon Shokubai Co., Ltd., Ashland, BASF SE, Boai NKY Pharmaceuticals Ltd., Henan Pengfei New Materials Co., Ltd., Glide Chem Private Limited, Yuking Technologies Co., Ltd., JH Nanhang Life Sciences Co., Ltd., Hangzhou Motto Science & Technology Co., Ltd., Synvent Materials Corporation, Hefei TNJ Chemical Industry Co., Ltd., Zhejiang Polymer Chemical Co., Ltd., Merck KGaA, Thermo Fisher Scientific Inc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polyvinylpyrrolidone MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Polyvinylpyrrolidone MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Nippon Shokubai Co., Ltd.

- Ashland

- BASF SE

- Boai NKY Pharmaceuticals Ltd

- Henan Pengfei New Materials Co., Ltd.

- Glide Chem Private Limited

- Yuking Technologies Co., Ltd

- JH Nanhang Life Sciences Co., Ltd.

- Hangzhou Motto Science & Technology Co., Ltd.

- Synvent Materials Corporation

- Hefei TNJ Chemical Industry Co., Ltd.

- Zhejiang Polymer Chemical Co., Ltd.

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Other Key Players