Global Polyurethane Adhesives Market Size, Share Analysis Report By Type (Thermoset, Thermoplastic), By Technology (Hot Melt, Reactiv, Solvent-borne, UV Cured Adhesives, Water-borne), By End-use (Building And Construction, Footwear, Automotive, Packaging, Electrical And Electronics, Furniture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161780

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

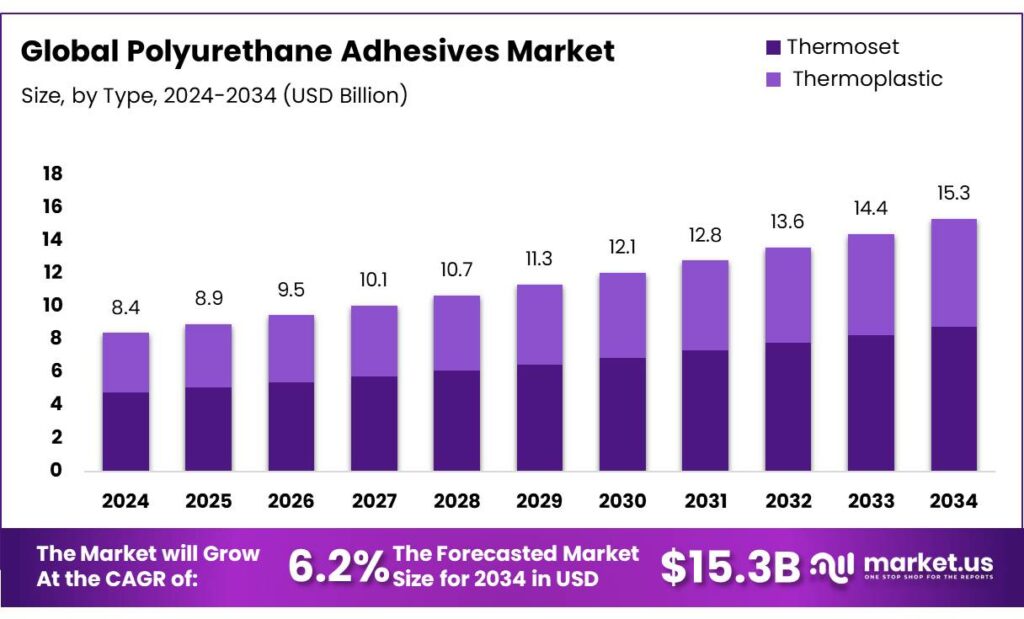

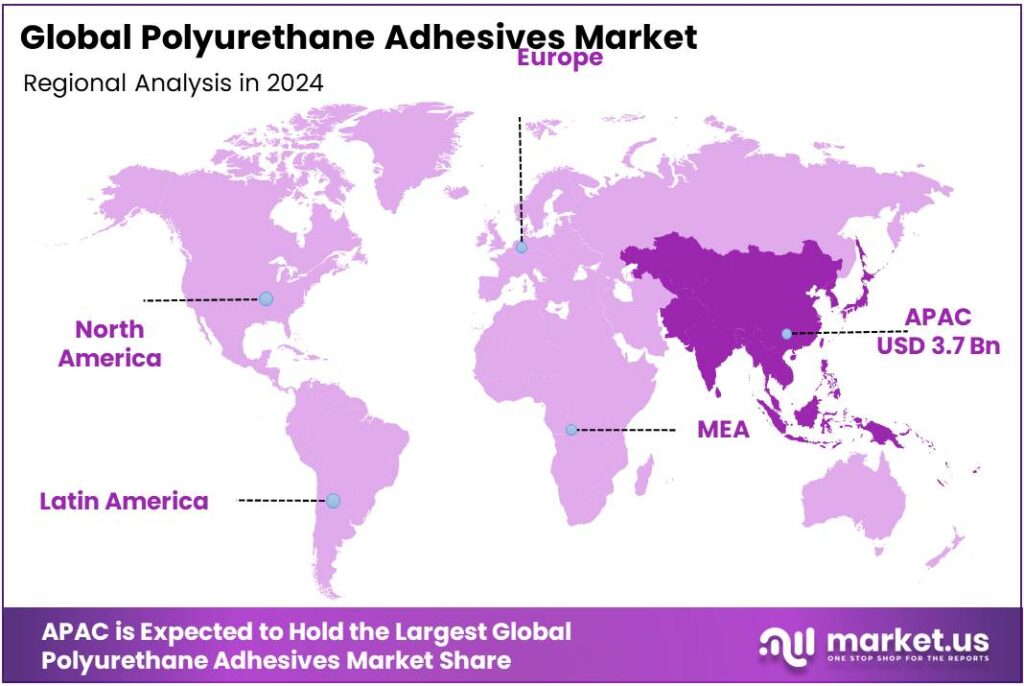

The Global Polyurethane Adhesives Market size is expected to be worth around USD 15.3 Billion by 2034, from USD 8.4 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 45.1% share, holding USD 3.7 Billion in revenue.

Polyurethane (PU) adhesives are high-performance, moisture-curing or two-component systems valued for their strong, flexible bonds across metals, plastics, composites, glass, wood, and foams. They enable lightweighting, noise-vibration damping, and fast assembly—traits that make them indispensable in automotive, construction, appliances, wind, footwear, and electronics. The industrial backdrop in 2024–2025 is unusually supportive: end-market activity in vehicles, buildings, and clean-energy infrastructure is creating steady pull for structural and elastic PU adhesive chemistries.

Automotive electrification is a clear demand anchor. The International Energy Agency (IEA) reports electric-car sales exceeded 17 million units in 2024, taking >20% global share—momentum that sustains adhesive demand for battery pack gasketing, module bonding, and lightweight multi-material body structures.

- China alone sold >11 million electric cars in 2024, underscoring Asia’s weight in the supply chain. In parallel, total vehicle output remains vast; OICA’s 2024 datasets remain the industry reference point used by OEMs and tier-1 suppliers to benchmark production planning, supporting baseline volumes for body-in-white bonding and NVH applications.

In buildings, PU adhesives and sealants benefit from both new construction and retrofit. In the United States, put-in-place construction spending ran at a $2.14 trillion seasonally adjusted annual rate in July 2025, reflecting ongoing activity in residential, non-residential, and public works—key channels for flooring, panel lamination, façades, and window/door bonding.

- In Europe, policy is an even stronger tailwind: the EU’s Renovation Wave targets renovating 35 million buildings by 2030, explicitly aiming to double annual energy-renovation rates—workstreams that routinely specify low-VOC, high-performance PU adhesives for insulation boards, sandwich panels, and timber elements.

Clean-energy buildout adds another secular pillar. IRENA confirms a record 585 GW of renewable power capacity added in 2024, lifting global renewables to ≈4,448 GW (about 46% of total installed capacity). These programs sustain adhesive use in turbine blades, nacelle/tower assemblies, and balance-of-plant components. Within that, the wind sector installed a record 117 GW in 2024, with multi-year pipelines through 2030—supportive for toughened PU and hybrid adhesive systems specified for fatigue-resistant joints.

Key Takeaways

- Polyurethane Adhesives Market size is expected to be worth around USD 15.3 Billion by 2034, from USD 8.4 Billion in 2024, growing at a CAGR of 6.2%.

- Thermoset held a dominant market position, capturing more than a 57.3% share of the global polyurethane adhesives market.

- Hot Melt held a dominant market position, capturing more than a 34.2% share of the global polyurethane adhesives market.

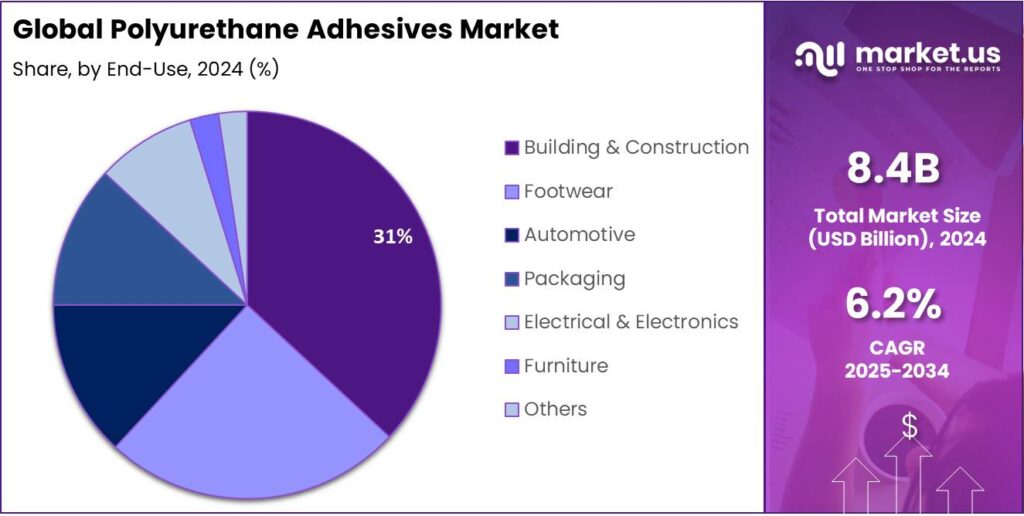

- Building & Construction held a dominant market position, capturing more than a 31.1% share of the global polyurethane adhesives market.

- Asia-Pacific (APAC) held a dominant position in the global polyurethane adhesives market, capturing more than 45.1% share, equivalent to approximately USD 3.7 billion.

By Type Analysis

Thermoset PU Adhesives leads the market with 57.3% share in 2024

In 2024, Thermoset held a dominant market position, capturing more than a 57.3% share of the global polyurethane adhesives market. This strong position can be attributed to its excellent bonding strength, resistance to heat, chemicals, and moisture, which makes it the preferred choice across automotive, construction, and furniture applications. Thermoset adhesives offer durable and permanent bonds that support heavy-load and structural applications, giving them a clear advantage over thermoplastic alternatives.

In 2025, the segment is expected to maintain its leadership, supported by ongoing demand in industries that require high-performance adhesives for long-lasting assemblies. The growth is further encouraged by innovations in formulation, including low-VOC and solvent-free options, which meet evolving regulatory standards while maintaining superior adhesion. Overall, Thermoset continues to dominate due to its reliability, performance, and adaptability to critical industrial applications.

By Technology Analysis

Hot Melt PU Adhesives leads with 34.2% share in 2024 due to quick-setting advantage

In 2024, Hot Melt held a dominant market position, capturing more than a 34.2% share of the global polyurethane adhesives market. The segment’s leadership is driven by its rapid setting time, ease of application, and ability to bond a variety of substrates without the need for solvents. Hot Melt adhesives are widely adopted in packaging, woodworking, footwear, and automotive assembly where fast processing and immediate handling strength are essential.

By 2025, the segment is expected to sustain its strong position as industries continue to seek efficient bonding solutions that reduce production time and energy consumption. Continuous improvements in formulation, including lower temperature variants and enhanced durability, are further supporting the growth of Hot Melt PU adhesives, making them a reliable and practical choice for both industrial and commercial applications.

By End-use Analysis

Building & Construction leads with 31.1% share in 2024 driven by rising infrastructure demand

In 2024, Building & Construction held a dominant market position, capturing more than a 31.1% share of the global polyurethane adhesives market. The segment’s strong performance is supported by the growing demand for residential, commercial, and industrial infrastructure, where PU adhesives are widely used for flooring, wall panels, insulation, and structural bonding. The adhesives offer excellent durability, moisture resistance, and long-term performance, making them ideal for construction applications in diverse climates.

By 2025, the segment is expected to continue its leadership as urbanization and large-scale infrastructure projects expand, particularly in emerging economies. Additionally, innovations in low-VOC and eco-friendly formulations are further encouraging the use of PU adhesives in building projects, aligning with sustainable construction practices and regulatory standards, while providing reliable and long-lasting bonding solutions.

Key Market Segments

By Type

- Thermoset

- Thermoplastic

By Technology

- Hot Melt

- Reactiv

- Solvent-borne

- UV Cured Adhesives

- Water-borne

By End-use

- Building & Construction

- Footwear

- Automotive

- Packaging

- Electrical & Electronics

- Furniture

- Others

Emerging Trends

Low-migration, solvent-free PU laminating adhesives for tougher food packs

Food systems are pushing packaging to do more with less. Converters are rapidly shifting toward low-migration, solvent-free polyurethane (PU) laminating adhesives that can hold multilayer films and foils together through heat, moisture, and long logistics—without risking chemical transfer to food. The reason is practical: the world still wastes too much food, and better barrier packs last longer.

- The UN Environment Programme estimates 1.05 billion tonnes of food were wasted in 2022, roughly 19% of food available to consumers, with households responsible for 60% of that waste. Every pouch that resists delamination, every seal that survives a hot truck or a cold warehouse, keeps meals edible for longer. That is the performance window where modern PU systems shine—strong bonds at low coat weight, fast cure, and stable adhesion across PET/Alu/PE, OPP/PE, and paper/film structures.

Regulators are reinforcing this trend. In Europe, food-contact materials must meet Regulation (EC) No 1935/2004, which sets strict principles on inertness and migration. That framework pushes adhesive suppliers toward cleaner, solvent-free, low-residual systems and better documentation of what can migrate through a laminate into food. As private-label retailers tighten specifications, converters increasingly prefer PU chemistries that are engineered for low overall migration while keeping line speeds high.

Policy and industry scale are adding momentum, especially in Asia. India’s food-processing ecosystem is expanding, and with it the need for robust, export-ready packaging. The government’s Production Linked Incentive Scheme for Food Processing (PLISFPI) runs 2021–22 to 2026–27 with an outlay of ₹10,900 crore, supporting capacity, branding, and modern packaging—conditions that favor high-performance laminating adhesives on new lines. As plants upgrade from solvent-based systems to solvent-free or water-borne PU, they cut emissions and energy use while improving bond reliability in humid conditions.

Drivers

Growth of Food Packaging Demand and Processed Food Industry

One major driving force behind the rising demand for polyurethane (PU) adhesives is the explosive growth in the food packaging sector and processed food industry. As more food moves through industrial processing, longer distribution chains, and retail packaging, the need for strong, durable, and safe adhesives intensifies.

Because food and beverage account for more than half of all consumer packaging, any incremental growth in food processing has a disproportionate impact on adhesives used in packaging. Producers of snacks, ready-to-eat foods, frozen items, dairy, and beverages consistently demand packaging films, foils, multilayer laminates, and barrier structures. PU adhesives are prized here for their flexibility, bond strength across dissimilar materials, resistance to humidity, and durability under temperature changes.

- The food processing industry there is projected to reach Rs 47,13,350 crore by the end of fiscal year 2025–26. That’s a massive downstream scale for adhesives, coatings, and packaging materials. The government is pushing this via schemes like the Production Linked Incentive Scheme for Food Processing Industry, approved in March 2021, with a fund outlay of ₹10,900 crore, running from 2021-22 to 2026-27. PLISFPI incentivizes infrastructure, supply chain efficiency, branding, and value addition in processed foods, which in turn increases demand for advanced packaging and adhesives in the value chain.

Restraints

Stringent Food-Contact Regulation & Migration Limits

One of the strongest brakes on the growth of polyurethane (PU) adhesives in food-packaging and related applications is the strict regulatory environment governing food contact materials. Whenever an adhesive is used in a packaging structure that touches or is very near food, regulators demand assurance that no harmful substances migrate from adhesive into the food. That requirement imposes high testing costs, slows product approvals, and limits formulation flexibility.

- In the U.S., for example, adhesives used in food packaging must comply with 21 CFR 175.105, which sets general criteria for adhesives so that they do not transfer harmful components, odor or taste to food. Under European rules, food-contact materials fall under EU Regulation 1935/2004, which demands that materials should not release constituents in quantities harmful to human health, and adhesives must satisfy migration limits. For instance, if an adhesive is between layers in a laminate structure, even trace migrants must be tested and documented.

Another layer of constraint comes from consumers and food regulators demanding low volatile organic compounds (VOCs) or low residual monomers in adhesives. Some jurisdictions impose limits on VOC emissions in consumer products. For instance, the California Air Resources Board (CARB) defines VOC content limits for adhesives and sealants in regulations such as Section 94509(a) and exempts only small containers (1 fl oz or less) from those limits. Adhesive producers must ensure that their formulations stay under these thresholds while still meeting performance specs — a delicate balancing act.

Opportunity

Shelf-Life Extension & Waste Reduction in Food Systems

A powerful opportunity for polyurethane (PU) adhesives sits at the heart of a real-world problem: too much food is lost or wasted before it is eaten. The United Nations shows 1.05 billion tonnes of food were wasted in 2022, equal to about 19% of all food available to consumers—“over one billion meals a day” thrown away. Households accounted for 60%, with 28% from food service and 12% from retail. Packaging that better protects food and survives long, hot, and humid supply chains is part of the solution—and that is where tougher, low-migration PU laminating adhesives can make a material difference.

Upstream, large volumes never even reach stores. FAO’s analysis finds around 14% of food is lost between post-harvest and the retail stage due to damage, spoilage, or poor handling. Extending shelf life with robust, high-barrier laminates, peel-reseal features, and secure film-to-foil bonds reduces oxygen and moisture ingress that accelerate spoilage. PU adhesives enable these multi-layer structures by bonding dissimilar substrates while staying flexible and durable through chilling, retort, and distribution. The technical need is simple: strong bonds that don’t delaminate when the package is bent, dropped, or heated—so the food inside lasts longer.

The government is amplifying this momentum. India’s Production Linked Incentive Scheme for Food Processing (PLISFPI) carries an outlay of ₹10,900 crore over 2021–22 to 2026–27, encouraging investment in processing capacity, branding, cold-chain, and modern packaging. As new lines come online and existing ones upgrade, converters will prioritize adhesives that meet food-contact rules, cut solvent/VOC footprints, and maintain bond strength under refrigeration or heat—an opening tailored to modern PU chemistries.

Regional Insights

Asia-Pacific leads the PU adhesives market with 45.1% share, valued at USD 3.7 billion in 2024

In 2024, Asia-Pacific (APAC) held a dominant position in the global polyurethane adhesives market, capturing more than 45.1% share, equivalent to approximately USD 3.7 billion. The region’s leadership can be attributed to rapid industrialization, expanding automotive manufacturing, and accelerated construction and infrastructure development across countries such as China, India, Japan, and South Korea.

The growth in the APAC PU adhesives market is further supported by the robust electronics and packaging industries, where quick-setting and durable adhesives are essential for assembly and manufacturing processes. China, being the largest contributor in the region, continues to drive volume consumption due to its focus on automotive electrification and lightweight construction materials, which favor structural and thermoset polyurethane adhesives.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

H.B. Fuller Company specializes in adhesive technologies, including polyurethane adhesives for construction, automotive, packaging, and industrial applications. In 2024, the company emphasizes high-strength, durable, and low-VOC PU formulations suitable for demanding environments. H.B. Fuller invests in innovation to develop hot melt, solvent-free, and structural adhesives that meet evolving industrial standards. Its global reach, technical expertise, and focus on customer-centric solutions support continued growth in the polyurethane adhesives market. The company maintains a competitive position by addressing both large-scale industrial requirements and specialized application needs.

Sika AG is a leading manufacturer of polyurethane adhesives, serving construction, automotive, and industrial sectors. In 2024, Sika focuses on high-performance PU adhesives with properties such as elasticity, thermal resistance, and moisture durability. The company invests in low-VOC and sustainable formulations to meet regulatory and environmental requirements. Sika’s global presence, technical support, and customized solutions enable it to serve large infrastructure, commercial, and industrial projects. Its strategic emphasis on innovation, quality, and performance positions Sika as a key player in the growing polyurethane adhesives market.

Dow Inc. is a major producer of polyurethane adhesives, providing solutions across construction, automotive, electronics, and packaging sectors. In 2024, the company focuses on high-performance, durable, and environmentally friendly PU adhesives, including solvent-free and low-VOC formulations. Dow leverages its global manufacturing capabilities and strong R&D network to innovate products that meet industrial standards for strength, thermal resistance, and multi-substrate bonding. Its strategic partnerships and commitment to sustainable chemistry enhance its leadership position in the polyurethane adhesives market, particularly in high-growth regions such as APAC and North America.

Top Key Players Outlook

- 3M Company

- Dow Inc.

- BASF SE

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Sika AG

- Huntsman Corporation

- Arkema S.A.

- Others

Recent Industry Developments

In 2024, 3M Company maintained a strong position in the global polyurethane adhesives market, driven by its diversified product offerings and strategic focus on high-performance bonding solutions. The company’s Safety and Industrial segment, which encompasses its adhesives portfolio, generated approximately USD 10.96 billion, accounting for 45.16% of 3M’s total revenue.

In 2024, Sika AG achieved record sales of CHF 11.76 billion (approximately USD 12.83 billion), marking a 7.4% increase in local currencies compared to the previous year.

Report Scope

Report Features Description Market Value (2024) USD 8.4 Bn Forecast Revenue (2034) USD 15.3 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Thermoset, Thermoplastic), By Technology (Hot Melt, Reactiv, Solvent-borne, UV Cured Adhesives, Water-borne), By End-use (Building And Construction, Footwear, Automotive, Packaging, Electrical And Electronics, Furniture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M Company, Dow Inc., BASF SE, Henkel AG & Co. KGaA, H.B. Fuller Company, Sika AG, Huntsman Corporation, Arkema S.A., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyurethane Adhesives MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Polyurethane Adhesives MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Dow Inc.

- BASF SE

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Sika AG

- Huntsman Corporation

- Arkema S.A.

- Others