Global Plastic Compounding Market Size, Share Analysis Report By Source (Fossil-based, Bio-based, Recycled), By Product (Polyethylene, Polypropylene, Thermoplastic Vulcanizates, Thermoplastic Polyolefins, Polyvinyl Chloride, Polystyrene, Polyethylene Terephthalate, Polybutylene Terephthalate, Polyamide, Polycarbonate, Polyurethane, Polymethyl Methacrylate, Acrylonitrile Butadiene Styrene, Others, By Application (Automotive, Building and construction, Electrical and Electronics, Packaging, Consumer Goods, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153206

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

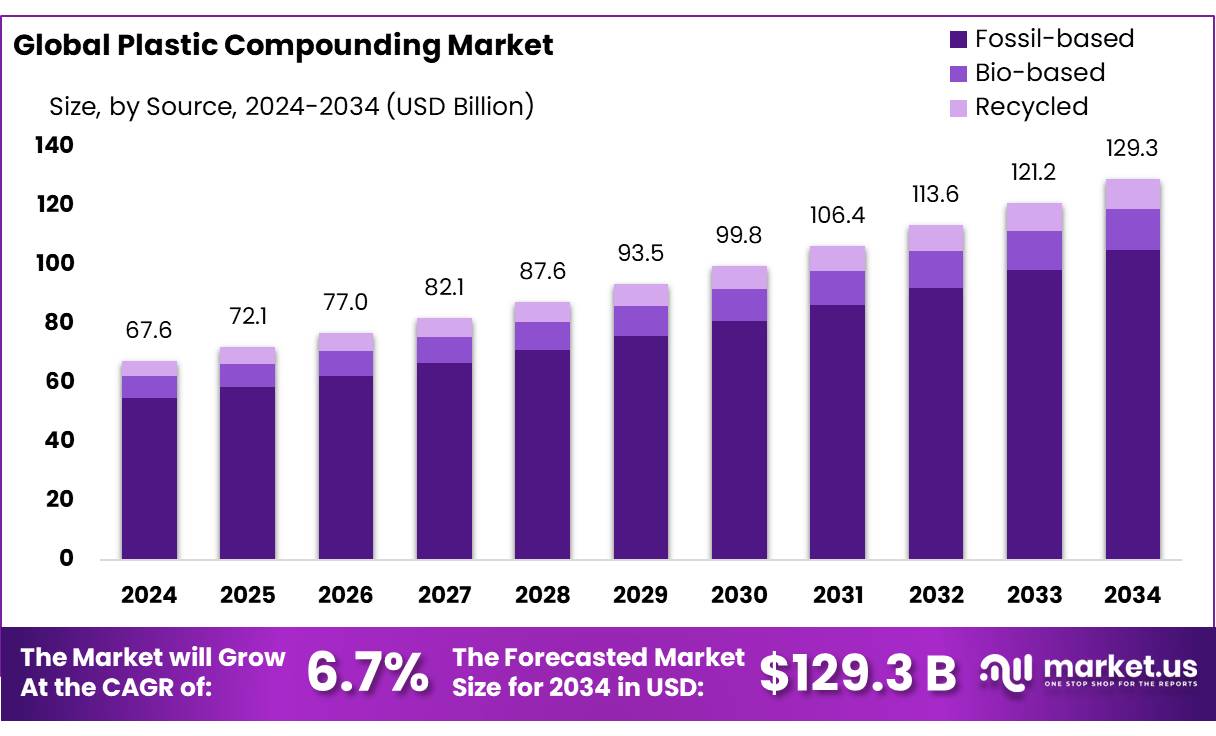

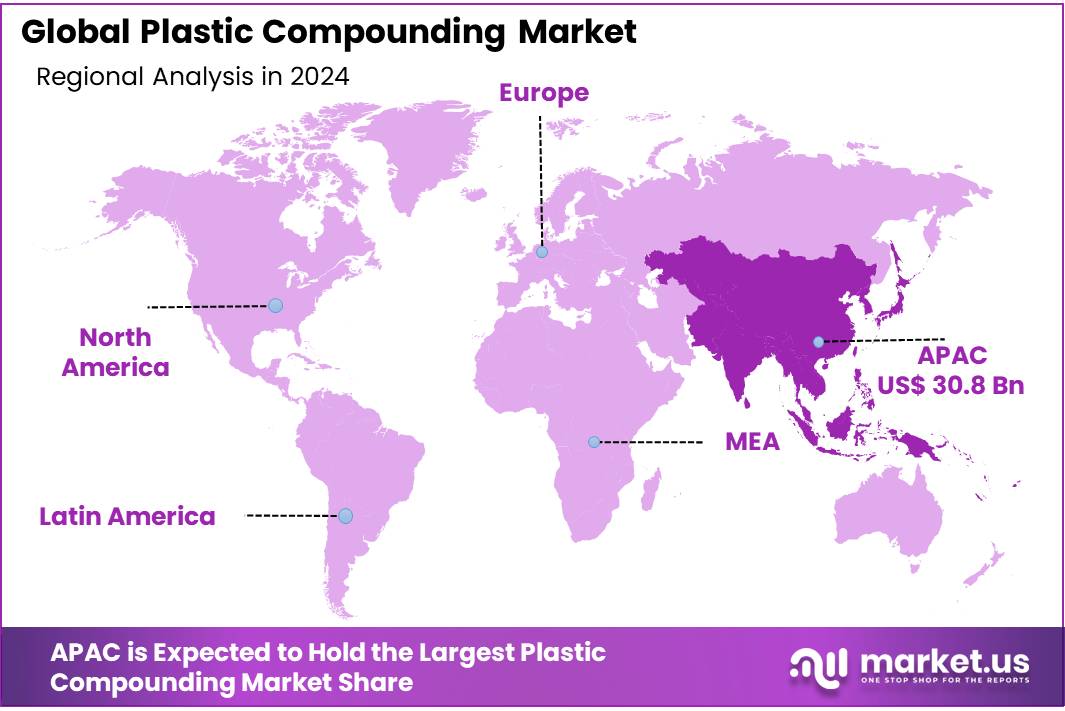

The Global Plastic Compounding Market size is expected to be worth around USD 129.3 Billion by 2034, from USD 67.6 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 45.7% share, holding USD 30.8 Billion revenue.

The plastic compounding and concentrates sector encompasses the blending of base polymers with various additives—such as stabilizers, plasticizers, colorants, fillers and reinforcements—to achieve specified mechanical, thermal, or aesthetic properties. This process is primarily executed via extrusion or compounding equipment, after which materials are pelletized and distributed for use in applications ranging from automotive components to food packaging. The sector’s importance has grown in response to demands for lightweight, high-performance, and cost-effective alternatives to traditional materials such as metals and glass.

Key industrial drivers include growing adoption of plastic compounds in place of metals and glass, especially in automotive and packaging, to reduce weight, lower emissions, and improve fuel efficiency. In the automotive segment, compounded plastics accounted for ~40–50% of revenue in North America, driven by lightweighting initiatives and tighter fuel economy standards. Electric vehicle production and push for sustainability are accelerating the shift toward bio-based, recycled, and heat-resistant compounds.

Government initiatives are steadily influencing the industry’s evolution. In May 2024, Dow and SCG Chemicals announced an MoU aiming to convert 200 kt/year of plastic waste into circular products in Asia Pacific. In India, prime ministerial and ministry-level plans—including support for recycling infrastructure under the Swachh Bharat Mission and Plastic Waste Management Rules—have accelerated establishment of compounding facilities; notably, Sirmax inaugurated a polypropylene/bio compound plant in December 2023. Meanwhile, tight fuel-efficiency mandates from the U.S. EPA and regulations from UL, ICC, and NFPA encourage lightweight, fire‑resistant, and certified compounded materials.

Moving ahead, future growth opportunities lie in adopting high-performance engineering plastics, bio based polymers, and TPV/TPU concentrates for specialty applications. Government incentives to foster Industry 4.0 modernization via smart industrial parks and digital infrastructure will further uplift compounding operations. On the recycling front, digitization platforms like Recykal have already enabled collection and recycling of 200,000 MT of plastic waste by 2021, expanding EPR and digital deposit schemes. These trends offer compounders pathways to integrate recycled content, reduce dependence on virgin resins, and meet ESG compliance.

Key Takeaways

- The plastic compounding market is projected to reach USD 129.3 billion by 2034, up from USD 67.6 billion in 2024, growing at a CAGR of 6.7% during the forecast period.

- Fossil-based materials dominated the market in 2024, accounting for over 81.2% of the global plastic compounding segment.

- Polypropylene (PP) emerged as the leading product type, capturing more than 19.3% share in the overall plastic compounding market in 2024.

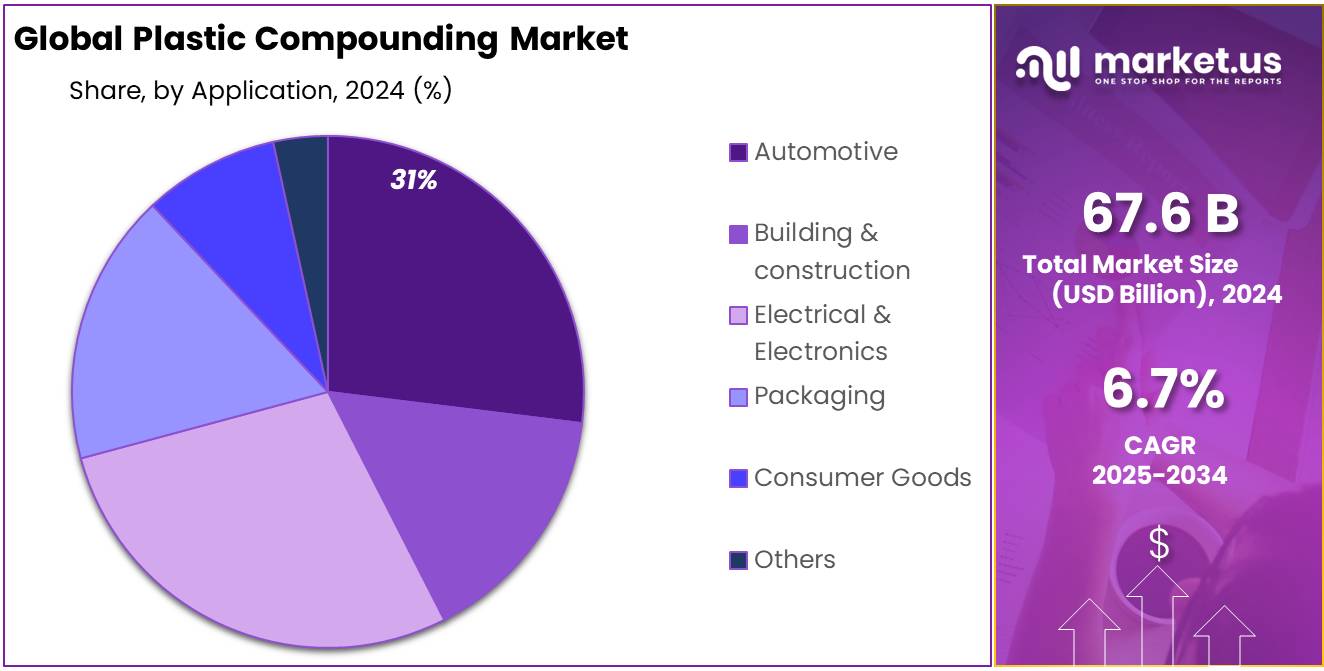

- The automotive sector held the largest application share, contributing to over 31.4% of the global plastic compounding demand in 2024.

- The Asia-Pacific (APAC) region led the global market with a commanding 45.7% share, valued at approximately USD 30.8 billion in 2024.

By Source Analysis

Fossil-based dominates with 81.2% share in 2024 due to its strong industrial demand and established supply chains

In 2024, fossil-based held a dominant market position, capturing more than an 81.2% share in the global plastic compounding market. This overwhelming lead is largely due to the continued reliance of manufacturers on traditional petrochemical feedstocks like polypropylene, polyethylene, and polystyrene. These materials are preferred because of their proven performance, wide availability, and cost efficiency. Despite growing attention toward sustainability, the global plastics industry still leans heavily on fossil-based compounds for large-scale production across automotive, construction, and consumer goods sectors. Their well-established processing technologies and compatibility with existing infrastructure have made the transition to alternatives slower.

By Product Analysis

Polypropylene (PP) leads with 19.3% share in 2024 due to its versatility and cost efficiency across applications

In 2024, Polypropylene (PP) held a dominant market position, capturing more than a 19.3% share in the overall plastic compounding market. Its popularity stems from its lightweight nature, excellent chemical resistance, and affordability, making it suitable for a wide range of industries including automotive, packaging, consumer goods, and medical devices. PP compounds are especially favored in automotive applications for parts like bumpers, battery housings, and interior trims due to their durability and ease of molding. In packaging, its resistance to moisture and flexibility make it ideal for both rigid and flexible solutions. As global industries continue to demand materials that balance performance with cost, PP remains a go-to choice for manufacturers.

By Application Analysis

Automotive leads with 31.4% share in 2024 as lightweight plastics power next-gen vehicle manufacturing

In 2024, Automotive held a dominant market position, capturing more than a 31.4% share in the global plastic compounding market. This strong demand is driven by the auto industry’s continuous shift toward lightweight materials to meet fuel efficiency standards, lower emissions, and improve overall vehicle performance. Compounded plastics such as polypropylene, polyamide, and ABS are widely used in making interior panels, bumpers, under-the-hood components, and electric vehicle housings due to their strength, flexibility, and cost-effectiveness. As electric vehicles continue to gain traction worldwide, the need for high-performance plastic compounds with thermal and electrical insulation properties has grown sharply.

Key Market Segments

By Source

- Fossil-based

- Bio-based

- Recycled

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride

- Polystyrene

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

By Application

- Automotive

- Building & construction

- Electrical & Electronics

- Packaging

- Consumer Goods

- Others

Emerging Trends

Integration of Recycled Content into Food-Grade Plastic Compounds

One of the most noticeable trends in the plastic compounding industry is the increasing integration of post-consumer recycled (PCR) materials into food-grade applications. With global concerns over plastic waste growing louder, both public and private sectors are pushing for circular material use, and food packaging is now a central focus of that movement.

The European Union, through its Green Deal and Circular Economy Action Plan, has set ambitious targets to ensure that all plastic packaging placed on the EU market is either reusable or recyclable by 2030. In support of this, the European Food Safety Authority (EFSA) has approved several mechanical recycling processes for PET plastics used in food contact materials, promoting safe re-use and reducing dependence on virgin plastics.

Major food companies are now actively demanding high-quality recycled plastics for packaging. For example, Nestlé has pledged to reduce its use of virgin plastic by one-third by 2025 and is investing heavily in food-grade recycled materials. This growing demand is pushing compounders to innovate new formulations that meet regulatory requirements while incorporating recycled content.

In India, the FSSAI mandates that no recycled plastics can come into direct contact with food. However, it allows multilayered and secondary packaging to include recycled materials, which has created space for growth in non-direct contact food applications using compounded recycled plastics. This nuance is fueling innovation in the compounding process, encouraging dual-layer structures where only the outer packaging contains recycled content.

Drivers

Growing Demand for Sustainable and Recyclable Packaging in the Food Industry

One of the biggest driving forces behind the rising demand for plastic compounding is the increasing push for sustainable, recyclable, and food-safe packaging solutions. As global food consumption continues to rise and urbanization accelerates, the food industry faces mounting pressure to reduce its environmental footprint. This has led manufacturers to shift towards high-performance compounded plastics, especially biodegradable and food-grade variants.

According to the Food and Agriculture Organization (FAO), global food production is projected to increase by 60% by 2050 to feed a population expected to reach 9.7 billion. This surge translates into a massive need for reliable packaging materials that extend shelf life, maintain hygiene, and comply with environmental norms. Compounded plastics like polypropylene and polyethylene blends are being engineered to offer barrier protection, thermal resistance, and recyclability—key traits for modern food packaging.

Moreover, regulatory efforts by governments around the world have accelerated the use of food-safe plastics. For instance, the U.S. Food and Drug Administration (FDA) has imposed strict migration limits and safety evaluations for plastics used in direct food contact. In India, the Food Safety and Standards Authority of India (FSSAI) banned recycled plastic in direct contact with food but encouraged innovation in multilayer food packaging using approved virgin plastics—creating a surge in demand for compliant, custom-compounded plastic materials.

Further, a report by PlasticsEurope, a major polymer producers’ association, stated that 39.6% of all plastics used in Europe in 2022 were consumed by the packaging sector, with a significant share dedicated to food applications. As companies aim to meet circular economy goals and reduce landfill dependency, plastic compounding provides tailored formulations that balance performance and sustainability.

Restraints

Strict Food Safety Regulations and Compliance Costs

A key factor slowing down the growth of plastic compounding—especially for food-contact applications—is the burden of strict food safety regulations and the high cost of compliance. As awareness about chemical migration from plastic packaging into food grows, so do the regulations surrounding the approval and testing of compounded plastics. While these rules are essential for public health, they often increase production costs and delay product development timelines for manufacturers.

For example, the U.S. Food and Drug Administration (FDA) requires all materials intended for food contact to meet extensive safety standards under Title 21 CFR. This includes thorough migration testing, chemical stability evaluations, and full traceability documentation. Each new additive or filler used in plastic compounding must be cleared through this process, which can take months or even years. Smaller compounding firms often find these procedures too costly or complex to manage.

In Europe, the European Food Safety Authority (EFSA) enforces even stricter norms. Plastics must comply with EU Regulation No. 10/2011, which limits the use of certain substances and sets specific migration limits. A 2023 EFSA report noted that more than 400 food packaging alerts were issued in one year alone due to non-compliance or chemical leaching, showing how difficult and unforgiving the compliance environment has become for plastic producers.

Opportunity

Shift Toward Biodegradable and Bio-Based Compounded Plastics

A major growth opportunity in plastic compounding is the rising demand for biodegradable and bio-based plastics, especially within the food industry. As environmental concerns over plastic waste continue to mount, food manufacturers and packaging producers are actively looking for eco-friendly alternatives that don’t compromise on performance. This transition is opening doors for compounders to innovate with materials like polylactic acid (PLA), starch blends, and other bio-resins.

According to the Food and Agriculture Organization (FAO), around 931 million tonnes of food are wasted globally each year, and a large share of this is linked to poor packaging and spoilage. Better, biodegradable packaging could reduce this waste while also aligning with environmental goals. Compounders are now being asked to tailor plastics not just for performance but also for compostability, recyclability, and minimal environmental impact.

Government efforts are also encouraging this shift. The European Union has banned many single-use plastic items and is promoting the use of bio-based alternatives through its Circular Economy Action Plan. Similarly, in India, the Ministry of Environment, Forest and Climate Change (MoEFCC) has enforced the phase-out of certain plastic categories while urging the development of compostable packaging for food-grade use. In 2022, India banned single-use plastic items like cutlery and plates, pushing innovation toward bio-based plastic compounding.

The U.S. Department of Agriculture (USDA) supports bioplastic innovation through its BioPreferred Program, offering certification and market visibility for USDA-certified bio-based plastic products. As of 2024, over 3,000 bio-based products are certified under this program, a significant number of which are used in food packaging.

Regional Insights

Asia-Pacific commands 45.7% share in plastic compounding market, valued at USD 30.8 billion in 2024

In 2024, the Asia-Pacific (APAC) region emerged as the leading force in the global plastic compounding market, capturing a dominant 45.7% share, which translates to a market value of approximately USD 30.8 billion. This commanding position is driven by several structural and economic factors, including rapid industrialization, expanding automotive production, and robust demand for packaged consumer goods. Countries such as China, India, Japan, and South Korea are key contributors to this regional strength, with China continuing to act as a global manufacturing hub for plastics, electronics, and automotive components.

China remains a significant consumer and producer of compounded plastics, driven by its large-scale electronics, automotive, and construction sectors. Moreover, the regional focus on electric vehicle (EV) production has increased the demand for high-performance plastic compounds used in battery casings and lightweight structural parts. South Korea and Japan, known for advanced automotive and electronics manufacturing, further reinforce APAC’s dominance with their reliance on engineered compounds like ABS, PC, and polyamides.

Strong supply chain infrastructure, lower production costs, and access to raw materials have made APAC the preferred destination for global plastic compounders. The region is expected to maintain its leadership position, driven by consistent demand, export potential, and growing emphasis on both high-performance and sustainable plastic solutions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a global leader in plastic compounding, offering a wide range of engineered thermoplastics and biodegradable plastics tailored for food packaging, automotive, and consumer goods. The company emphasizes sustainability and innovation, with its Ultramid® and Ecovio® product lines addressing demands for high-performance and compostable materials. BASF also participates in circular economy initiatives and partners with industries to develop customized compound solutions, enhancing recyclability, barrier protection, and compliance with food safety standards across global markets.

SABIC plays a pivotal role in the plastic compounding market with its strong portfolio of polymer compounds used in food packaging, healthcare, and electronics. Its Trucircle™ initiative focuses on circular polymers, enabling food-grade applications through certified recycled content. SABIC’s global R&D capabilities and strategic partnerships help advance sustainable compounding solutions, especially for high-clarity and heat-resistant food containers. The company supports regional regulations while meeting stringent FDA and EU food contact requirements through innovative product development.

Dow, Inc. is a leading plastic compounder offering advanced material solutions across sectors, including food packaging, hygiene, and industrial applications. Its INFUSE™ and ELITE™ polymer technologies enhance sealing, strength, and recyclability in flexible food packaging. Dow’s efforts in mechanical recycling and design for recyclability align with global food safety standards. The company partners with governments and NGOs on plastic waste reduction, promoting sustainable compounding practices that ensure food safety and improve environmental performance.

Top Key Players Outlook

- BASF SE

- SABIC

- Dow, Inc.

- KRATON CORPORATION

- LyondellBasell Industries Holdings B.V.

- DuPont de Nemours, Inc.

- RTP Company

- Asahi Kasei Corporation

- Covestro AG

- Washington Penn

- Eurostar Engineering Plastics

- KURARAY CO., LTD.

- Arkema

- TEIJIN LIMITED

- LANXESS

- Solvay

- Polyvisions, Inc.

- Ravago

Recent Industry Developments

In 2024, SABIC continued its strong role in the plastic compounding market, particularly through its Petrochemicals segment—which includes polymers and plastics—recording full-year revenue of SAR 129.50 billion (US$34.53 billion), down just 1% from 2023.

In 2024, Dow Inc. reported total net sales of USD 43.0 billion, reflecting a 4 percent decline from 2023’s USD 44.6 billion, largely influenced by headwinds in its Packaging & Specialty Plastics segment—including plastic compounding activities—which saw quarterly revenue of USD 5.315 billion in Q4 and declined 6 percent year-over-year.

Report Scope

Report Features Description Market Value (2024) USD 67.6 Bn Forecast Revenue (2034) USD 129.3 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Fossil-based, Bio-based, Recycled), By Product (Polyethylene, Polypropylene, Thermoplastic Vulcanizates, Thermoplastic Polyolefins, Polyvinyl Chloride, Polystyrene, Polyethylene Terephthalate, Polybutylene Terephthalate, Polyamide, Polycarbonate, Polyurethane, Polymethyl Methacrylate, Acrylonitrile Butadiene Styrene, Others, By Application (Automotive, Building and construction, Electrical and Electronics, Packaging, Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, SABIC, Dow, Inc., KRATON CORPORATION, LyondellBasell Industries Holdings B.V., DuPont de Nemours, Inc., RTP Company, Asahi Kasei Corporation, Covestro AG, Washington Penn, Eurostar Engineering Plastics, KURARAY CO., LTD., Arkema, TEIJIN LIMITED, LANXESS, Solvay, Polyvisions, Inc., Ravago Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plastic Compounding MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Plastic Compounding MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- SABIC

- Dow, Inc.

- KRATON CORPORATION

- LyondellBasell Industries Holdings B.V.

- DuPont de Nemours, Inc.

- RTP Company

- Asahi Kasei Corporation

- Covestro AG

- Washington Penn

- Eurostar Engineering Plastics

- KURARAY CO., LTD.

- Arkema

- TEIJIN LIMITED

- LANXESS

- Solvay

- Polyvisions, Inc.

- Ravago