Global Pin Insertion Machine Market Size, Share, Growth Analysis By Method (Automatic, Semi-automatic, Manual), By Technology (Press-fit, Through-hole, Surface-mount), By Insertion Platform (PCBs, Coil Frames, Lead Frames, Transformers, Plastic Connectors, Metal Components), By Application (Consumer Electronics, Telecommunications, Medical, Automotive, Aerospace & Defense, Energy & Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175052

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

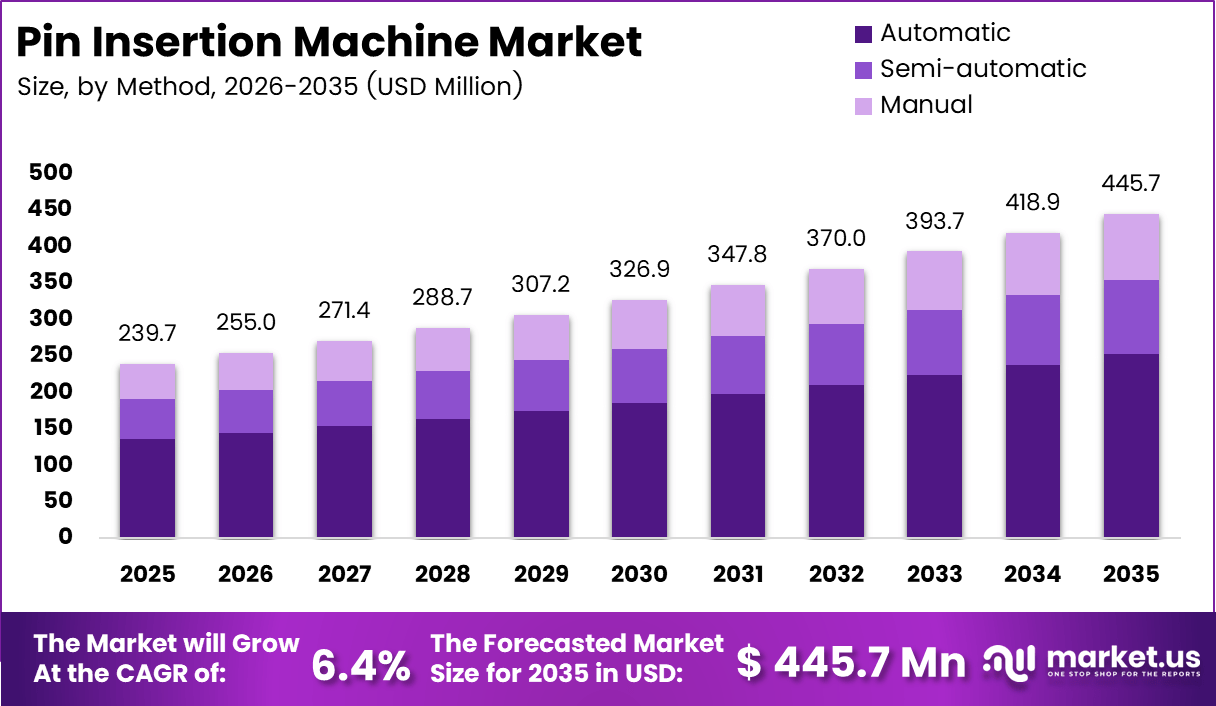

The Global Pin Insertion Machine Market size is expected to be worth around USD 445.7 Million by 2035, from USD 239.7 Million in 2025, growing at a CAGR of 6.4% during the forecast period from 2026 to 2035.

The Pin Insertion Machine market represents a specialized segment of electronics manufacturing equipment supporting reliable through-hole and press-fit assembly. These machines automate pin placement into printed circuit boards, improving accuracy and consistency. As electronics complexity increases, manufacturers increasingly adopt pin insertion systems to maintain throughput while meeting stringent quality expectations.

Market growth is supported by expanding demand for automotive electronics, industrial controls, and power modules. As production volumes rise, automated pin insertion reduces rework and scrap rates. Consequently, manufacturers prioritize equipment that balances speed, precision, and floor-space efficiency, strengthening long-term investment momentum across electronics assembly lines.

Government investment further reinforces adoption through programs supporting domestic electronics manufacturing and smart factory connectivity. Regulatory frameworks emphasizing product safety, traceability, and process validation indirectly favor automated insertion equipment. As compliance requirements tighten, manufacturers shift from manual operations toward repeatable, controlled pin insertion processes aligned with audited production environments.

Growth opportunities continue to emerge from electric vehicle platforms, renewable energy infrastructure, and power electronics assemblies. These applications require consistent pin geometry and stable insertion forces. Therefore, pin insertion machines play a key role in reducing failure risks while supporting higher current densities and compact connector designs across evolving product architectures.

From a market definition standpoint, the Pin Insertion Machine market includes standalone and integrated systems for straight and angled pin placement. These machines handle round, square, and flat pins across diverse PCB formats. Increasingly, buyers seek configurable equipment that supports rapid changeovers and mixed-production requirements without sacrificing operational stability.

According to TE Connectivity, performance-focused platforms illustrate current buyer expectations. The P4 and P550 systems deliver multi-head operation exceeding 5 strokes per second on a 30 millimeter pitch. With up to 4 heads and 3.3 cycles per second, compact footprints near 2.0 meters enhance production line flexibility.

Additionally, according to Teeming Machinery studies, typical systems operate on AC 380 volt, 50 hertz, 3 phase power. Machine dimensions of 660 by 1300 by 2100 millimeters, weights around 180 kilograms, air pressure of 6 kg per square centimeter, and cycle rates of 40–60 pieces per minute highlight practical deployment across modern electronics manufacturing facilities.

Key Takeaways

- The global Pin Insertion Machine Market is projected to reach USD 445.7 Million by 2035, growing from USD 239.7 Million in 2025 at a 6.4% CAGR.

- By method, the Automatic segment leads with a market share of 56.8%, driven by high-volume and precision-driven electronics manufacturing demand.

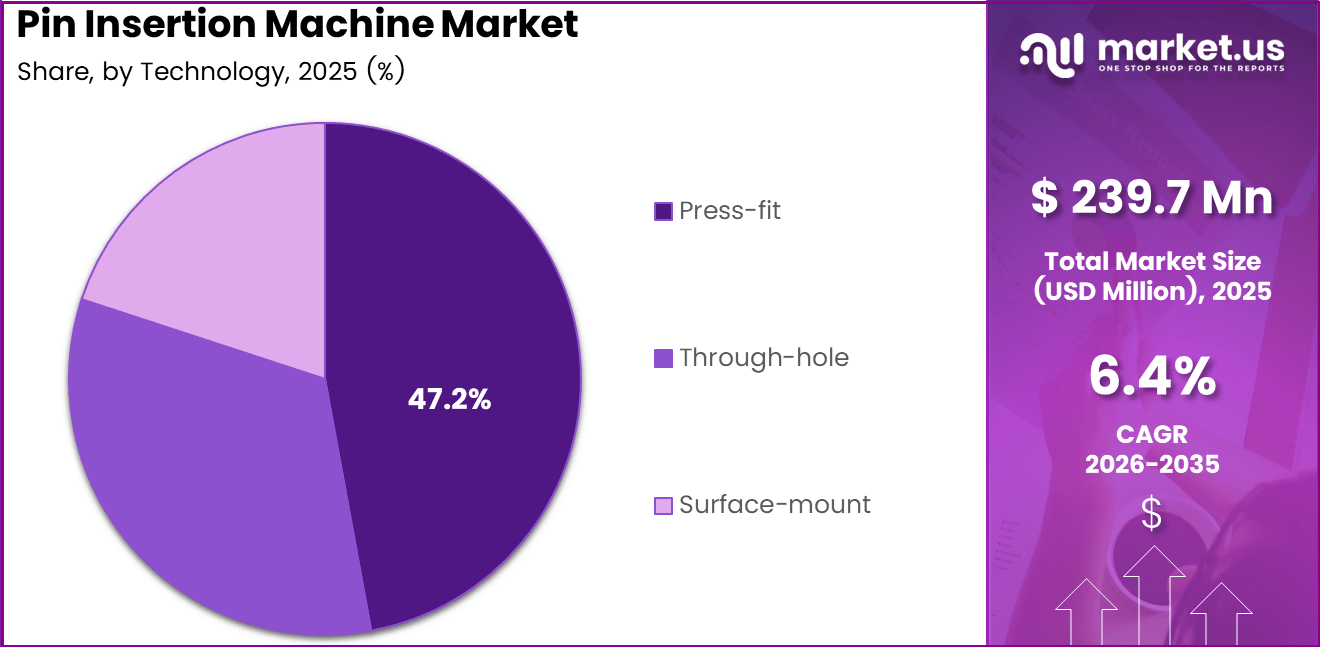

- By technology, Press-fit insertion holds a dominant share of 47.2%, supported by solder-free assembly requirements in power and industrial electronics.

- By insertion platform, PCBs account for the largest share at 56.9%, reflecting their widespread use across electronic assembly applications.

- By application, Consumer Electronics dominates with a share of 38.4%, supported by large-scale production of personal and home electronic devices.

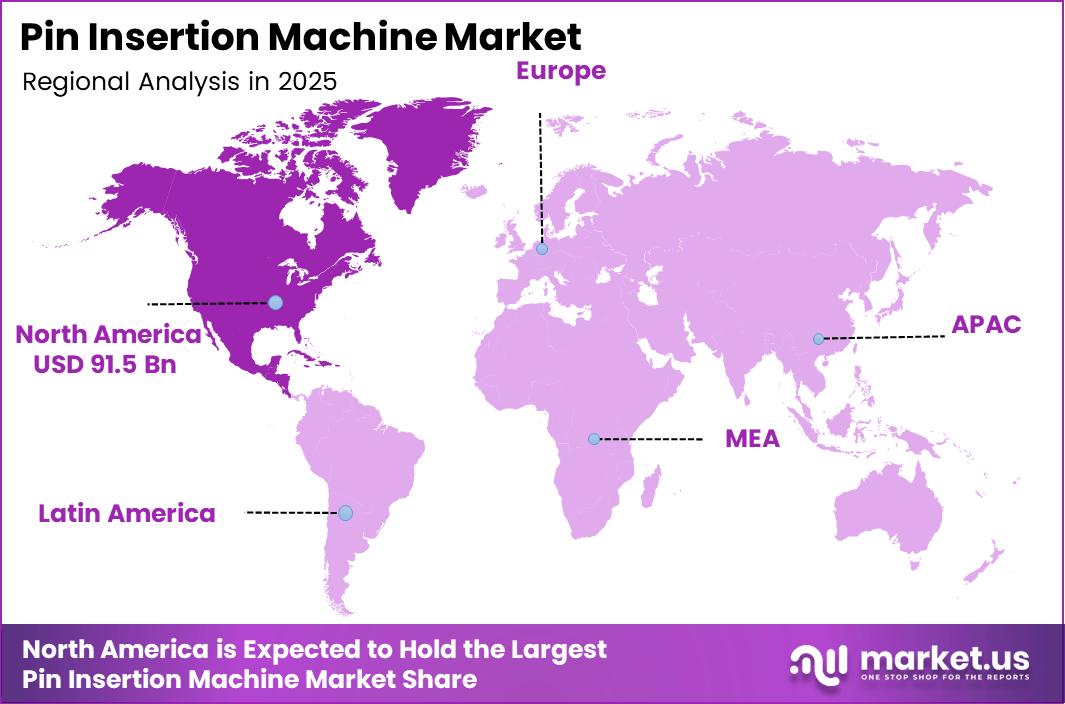

- Regionally, North America leads the market with a 38.2% share, valued at USD 91.5 Million, driven by early adoption of automated manufacturing technologies.

Method Analysis

Automatic dominates with 56.8% due to its efficiency, consistency, and suitability for high-volume production.

In 2025, Automatic held a dominant market position in the By Method Analysis segment of Pin Insertion Machine Market, with a 56.8% share. Automatic systems support faster cycle times and consistent pin placement, making them well suited for large-scale electronics manufacturing. Their ability to reduce manual handling improves accuracy and supports continuous production environments.

Semi-automatic machines maintain relevance where moderate volumes and flexibility are required. These systems allow operators to control certain steps while benefiting from mechanized insertion. As a result, manufacturers adopt them to balance cost and productivity, especially in facilities transitioning from manual to automated assembly workflows.

Manual pin insertion machines remain in use for low-volume production, prototyping, and repair applications. Their simple design supports easy operation and low capital investment. Although slower, manual systems are preferred where customization, frequent changeovers, and direct operator control are more critical than speed.

Technology Analysis

Press-fit dominates with 47.2% due to strong mechanical retention and solder-free assembly advantages.

In 2025, Press-fit held a dominant market position in the By Technology Analysis segment of Pin Insertion Machine Market, with a 47.2% share. Press-fit technology enables reliable electrical connections without soldering, reducing thermal stress on components. This supports higher durability and aligns with modern high-density electronic designs.

Through-hole technology continues to be used where mechanical strength and long-term reliability are priorities. It supports deeper pin penetration into substrates, making it suitable for components exposed to vibration or stress. Manufacturers retain through-hole insertion for specific industrial and power-related electronics.

Surface-mount insertion technology is gradually expanding alongside compact device designs. It supports smaller footprints and higher component density. While requiring precise control, surface-mount pin insertion aligns with trends toward miniaturization and automated assembly in advanced electronics production lines.

Insertion Platform Analysis

PCBs dominate with 56.9% due to widespread use across electronics manufacturing.

In 2025, PCBs held a dominant market position in the By Insertion Platform Analysis segment of Pin Insertion Machine Market, with a 56.9% share. Printed circuit boards represent the core platform for electronic assembly, driving consistent demand for accurate and repeatable pin insertion solutions.

Coil frames rely on pin insertion for electrical continuity in inductive components. Machines serving this platform focus on alignment precision to support stable electromagnetic performance. Demand remains steady from power electronics and industrial equipment applications.

Lead frames require precise pin insertion to maintain stable electrical connectivity in semiconductor packaging processes. High accuracy and repeatability are essential to avoid misalignment and ensure consistent bonding quality. Equipment designed for this platform supports high volume component production while maintaining tight process control.

Transformers use pin insertion machines to create secure electrical connections that can withstand continuous load and thermal stress. Reliability of insertion directly affects operational safety and performance. As power and electrical equipment demand increases, adoption in this segment remains steady.

Plastic connectors depend on controlled pin insertion to prevent cracking or deformation of the housing material. Machines serving this platform focus on accurate force regulation and uniform insertion depth. Consistency is critical to maintain connector integrity and long term functionality.

Metal components require robust pin insertion capabilities to handle higher resistance and durability requirements. Equipment in this segment is designed to manage stronger insertion forces without compromising precision. This supports industrial grade applications where mechanical strength and reliability are essential.

Application Analysis

Consumer Electronics dominates with 38.4% due to large-scale device production and rapid innovation cycles.

In 2025, Consumer Electronics held a dominant market position in the By Application Analysis segment of Pin Insertion Machine Market, with a 38.4% share. High production volumes of smartphones, appliances, and personal devices drive strong demand for fast and precise pin insertion systems.

Telecommunications applications rely on pin insertion machines for assembling network hardware and connectivity equipment used in data transmission and switching. Consistency in pin placement is essential to maintain signal integrity and minimize transmission losses. As telecom operators continue infrastructure upgrades for 5G and fiber networks, steady adoption of reliable pin insertion systems is supported across this segment.

Medical applications emphasize high precision and repeatability to meet strict regulatory and quality standards. Pin insertion systems are widely used in diagnostic, imaging, and patient monitoring equipment where performance stability directly affects accuracy. Manufacturers prioritize machines that reduce defect rates and support traceability, making reliability a core requirement in this segment.

Automotive applications use pin insertion machines to support electronic control units, infotainment systems, and advanced sensor technologies. The growing integration of electronics in vehicles increases the need for durable and vibration resistant pin connections. Technology selection in this segment is guided by long term reliability, thermal tolerance, and the ability to support high volume production.

Aerospace and defense applications demand extremely high reliability for mission critical electronic assemblies. Pin insertion machines used in this segment focus on tight accuracy, process control, and compliance with stringent industry standards. Low tolerance for failure drives the use of advanced systems capable of consistent performance under demanding operating conditions.

Energy and power systems depend on robust pin connections to ensure long term performance in harsh environments. Pin insertion machines support components used in power generation, transmission, and control equipment where durability is essential. The Others category includes industrial and niche electronics that require specialized insertion solutions tailored to unique design and application requirements.

Key Market Segments

By Method

- Automatic

- Semi-automatic

- Manual

By Technology

- Press-fit

- Through-hole

- Surface-mount

By Insertion Platform

- PCBs

- Coil Frames

- Lead Frames

- Transformers

- Plastic Connectors

- Metal Components

By Application

- Consumer Electronics

- Telecommunications

- Medical

- Automotive

- Aerospace & Defense

- Energy & Power

- Others

Drivers

Rising Demand for High Density PCB Assemblies Drives Market Growth

The pin insertion machine market is gaining momentum as electronics designs continue to move toward high density PCB assemblies, especially in automotive and industrial electronics. Modern vehicles use multiple control units, sensors, and power modules that require reliable through hole connections. Pin insertion machines help ensure strong mechanical and electrical joints in these compact boards, supporting long product life and stable performance.

Smart manufacturing expansion is another key driver shaping demand. Production lines increasingly rely on precise and repeatable placement of through hole components to maintain consistent quality. Pin insertion machines fit well into automated lines, allowing manufacturers to meet tight tolerances while maintaining steady output across large production runs.

Automation adoption is also rising as manufacturers look to reduce manual assembly errors and dependency on skilled labor. Manual pin insertion can lead to misalignment, uneven force, and quality variations. Automated machines improve accuracy, reduce rework, and help stabilize production costs over time.

Growth in power electronics and control units further supports the market. Press fit pin technology is widely used in power modules, inverters, and industrial drives. Pin insertion machines provide the controlled force and alignment needed for these applications, making them essential tools in modern electronics manufacturing.

Restraints

High Capital Investment Requirements Limit Market Expansion

One of the main restraints in the pin insertion machine market is the high upfront investment needed for advanced systems. Modern machines include precision mechanics, control software, and safety features, which raise initial purchase costs. For small manufacturers, this investment can be difficult to justify, especially when production volumes are uncertain.

Installation and setup costs also add to the financial burden. Pin insertion machines often require integration with existing production lines, conveyors, and inspection systems. This can lead to additional spending on customization, training, and commissioning, slowing down adoption for cost sensitive users.

Limited flexibility is another important challenge, particularly for manufacturers handling frequent PCB design changes. Pin insertion machines are typically optimized for specific board layouts and pin types. When designs change often, retooling and reprogramming can take time and increase downtime.

Low volume and prototype production further reduce the appeal of these machines. In such cases, manual or semi automated methods may appear more economical. As a result, some manufacturers delay investment until production volumes grow, which restrains short term market expansion despite long term demand potential.

Growth Factors

Growing Electronics Manufacturing Investments Create New Opportunities

The integration of AI based vision systems presents a strong growth opportunity for the pin insertion machine market. Advanced cameras and software can automatically detect pin position, alignment, and insertion quality. This helps reduce defects, improves yield, and allows machines to adapt to minor variations in components or boards.

Electronics manufacturing investments across Asia Pacific are also opening new doors. Countries in this region continue to expand automotive, industrial, and consumer electronics production. As new factories are built, demand for reliable and automated assembly equipment, including pin insertion machines, is expected to rise steadily.

The rapid growth of electric vehicle powertrain and charging infrastructure electronics adds another layer of opportunity. These systems rely heavily on power electronics that use press fit pins for strong and vibration resistant connections. Pin insertion machines are well suited for these applications, supporting consistent quality at scale.

Demand for compact and modular equipment is increasing among small and mid sized factories. Manufacturers are looking for machines that fit limited floor space and allow gradual automation. Modular pin insertion machines can meet these needs, helping suppliers reach a broader customer base.

Emerging Trends

Shift Toward Servo Driven Systems Shapes Market Trends

A major trend in the pin insertion machine market is the shift toward servo driven and fully electric mechanisms. These systems offer better control over insertion force and speed compared to pneumatic designs. Improved precision helps protect PCBs and pins while supporting consistent quality across production batches.

The development of multi head pin insertion machines is also gaining attention. These machines can insert multiple pins in a single cycle, significantly improving throughput. High volume manufacturers benefit from faster production without sacrificing accuracy, making multi head systems attractive for large scale operations.

Industry 4.0 connectivity is becoming increasingly important. Manufacturers want machines that can share data with factory systems in real time. Pin insertion machines with connectivity features support production monitoring, predictive maintenance, and process optimization, helping factories run more efficiently.

Quick change tooling systems are another growing trend. These systems reduce downtime during product changeovers by allowing faster replacement of pin heads and fixtures. This trend supports flexible manufacturing needs and helps companies respond quickly to changing customer demands.

Regional Analysis

North America Dominates the Pin Insertion Machine Market with a Market Share of 38.2%, Valued at USD 91.5 Million

North America held the leading position in the Pin Insertion Machine Market, accounting for a 38.2% share and reaching USD 91.5 Million. The region benefits from strong electronics manufacturing activity and early adoption of automated assembly technologies. High focus on productivity, precision, and quality standards continues to support steady demand across industrial and electronic applications.

Europe Pin Insertion Machine Market Trends

Europe represents a mature and technology-driven market for pin insertion machines. The region emphasizes advanced manufacturing practices and compliance-driven production environments. Consistent demand is supported by industrial electronics, automotive systems, and medical device manufacturing requiring reliable and precise insertion processes.

Asia Pacific Pin Insertion Machine Market Trends

Asia Pacific shows strong momentum due to expanding electronics production and increasing automation across manufacturing hubs. The region benefits from large-scale PCB assembly and component manufacturing activities. Growing investments in production efficiency and volume scalability continue to support adoption of pin insertion solutions.

Middle East and Africa Pin Insertion Machine Market Trends

The Middle East and Africa market is gradually developing, supported by industrial diversification and infrastructure-related electronics demand. Adoption remains selective, focusing on durability and cost efficiency. Growth is linked to gradual expansion of local manufacturing and assembly capabilities.

Latin America Pin Insertion Machine Market Trends

Latin America demonstrates steady uptake of pin insertion machines driven by localized electronics assembly and industrial production. Manufacturers focus on improving consistency and reducing manual labor. Demand is supported by gradual modernization of production facilities across key economies.

U.S. Pin Insertion Machine Market Trends

The U.S. market benefits from advanced manufacturing infrastructure and high adoption of automated assembly systems. Strong emphasis on innovation, productivity, and quality assurance supports consistent use of pin insertion machines. Demand is sustained across electronics, automotive, and industrial equipment manufacturing segments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pin Insertion Machine Company Insights

The global Pin Insertion Machine Market in 2025 reflects a strong shift toward precision automation, reliability, and scalable manufacturing solutions. Leading players are focusing on improving insertion accuracy, cycle time efficiency, and adaptability across multiple electronics assembly environments. The competitive landscape is shaped by companies that combine engineering depth with application-specific customization, supporting evolving requirements across high-volume and specialized production lines.

TE Connectivity plays a critical role in shaping pin insertion system demand through its deep integration across electronic interconnect ecosystems. Its alignment with high-reliability assembly requirements supports consistent adoption of advanced insertion platforms. The company’s strength lies in addressing precision and durability needs across complex electronic assemblies.

Autosplice is recognized for its specialization in automated insertion solutions tailored for connector and terminal applications. The company’s systems emphasize repeatability and throughput, making them suitable for high-volume manufacturing environments. Its focus on automation supports manufacturers aiming to reduce manual variability.

ShinMaywa Industries brings strong industrial engineering expertise into pin insertion machinery development. The company supports applications that require mechanical robustness and stable long-term performance. Its solutions align well with manufacturers seeking dependable equipment for demanding production conditions.

Weber Assembly Systems is positioned around flexible automation concepts that support diverse insertion tasks. The company’s approach emphasizes modularity and integration within broader assembly lines. This flexibility allows manufacturers to adapt pin insertion processes to changing product designs and production volumes.

Overall, these players collectively influence market direction by prioritizing automation efficiency, process consistency, and equipment reliability. Their continued focus on supporting modern electronics manufacturing needs is expected to sustain their relevance within the global pin insertion machine landscape in 2025.

Top Key Players in the Market

- TE Connectivity

- Autosplice

- ShinMaywa Industries

- Weber Assembly Systems

- Arburg

- ASM Assembly Systems

- Fischer Connectors

- Schleuniger AG

- BDM Electronics

Recent Developments

- In April 2025, TE Connectivity a world leader in connectors and sensors completed the acquisition of Richards Manufacturing Co., a North American leader in utility grid products, including underground distribution equipment. This move enables stronger participation in regional grid replacement and upgrade cycles, reinforcing leadership in serving utilities and global energy customers.

- In Feb 2025, PENCOM announced the acquisition of Integrated Defense Products (IDP), a Texas-based machining specialist recognized for precision and quality. The acquisition strengthens manufacturing capabilities and supports expanded delivery of advanced component solutions across multiple industrial and defense-related applications.

Report Scope

Report Features Description Market Value (2025) USD 239.7 Million Forecast Revenue (2035) USD 445.7 Million CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Method (Automatic, Semi-automatic, Manual), By Technology (Press-fit, Through-hole, Surface-mount), By Insertion Platform (PCBs, Coil Frames, Lead Frames, Transformers, Plastic Connectors, Metal Components), By Application (Consumer Electronics, Telecommunications, Medical, Automotive, Aerospace & Defense, Energy & Power, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape TE Connectivity, Autosplice, ShinMaywa Industries, Weber Assembly Systems, Arburg, ASM Assembly Systems, Fischer Connectors, Schleuniger AG, BDM Electronics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pin Insertion Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Pin Insertion Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- TE Connectivity

- Autosplice

- ShinMaywa Industries

- Weber Assembly Systems

- Arburg

- ASM Assembly Systems

- Fischer Connectors

- Schleuniger AG

- BDM Electronics