Photomedicine Market By Product Type (Lasers, Polychromatic Polarised Light, Light Emitting Diodes, Full Spectrum Light, Fluorescent Lamps, and Dichroic Lamps), By Application (Dermatology, Pain Management, Ophthalmology, Oncology, Aesthetics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151698

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

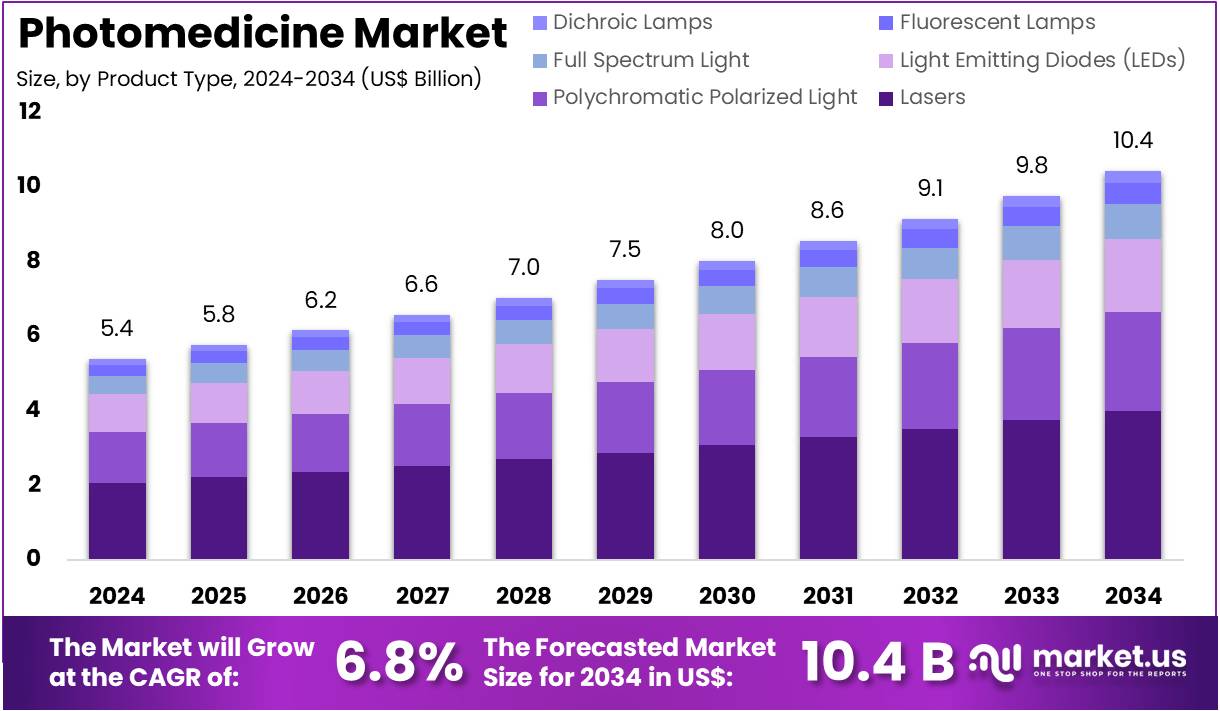

The Photomedicine Market size is expected to be worth around US$ 10.4 billion by 2034 from US$ 5.4 billion in 2024, growing at a CAGR of 6.8% during the forecast period 2025 to 2034.

Rising demand for non-invasive medical treatments and increasing awareness of the benefits of light-based therapies are driving the growth of the photomedicine market. Photomedicine applies light technologies, such as lasers, LEDs, and intense pulsed light, to diagnose, treat, and manage a variety of medical conditions. These applications include dermatological treatments like acne and wrinkle reduction, as well as more complex procedures such as cancer therapy and wound healing.

The market is experiencing a surge in demand due to advancements in technology that offer precise, safe, and efficient treatments with minimal side effects. As patients increasingly seek alternatives to invasive procedures, photomedicine systems are gaining popularity in both clinical and aesthetic settings. Additionally, the use of light therapies in pain management and regenerative medicine is creating new growth opportunities.

In May 2022, Clayton, Dubilier & Rice, the lead investor, announced a US$ 60 million investment in Cynosure, LLC, a prominent player in medical aesthetics. This investment is aimed at accelerating innovation within the company’s portfolio of photomedicine systems, which are integral to the development of non-invasive treatments. It further emphasizes the increasing focus on expanding clinical efficacy and ensuring market leadership in the global photomedicine space. With continuous innovation and a growing array of applications, the photomedicine market is poised for sustained growth.

Key Takeaways

- In 2024, the market for photomedicine generated a revenue of US$ 5.4 billion, with a CAGR of 6.8%, and is expected to reach US$ 10.4 billion by the year 2034.

- The product type segment is divided into lasers, polychromatic polarised light, light emitting diodes, full spectrum light, fluorescent lamps, and dichroic lamps, with lasers taking the lead in 2023 with a market share of 38.5%.

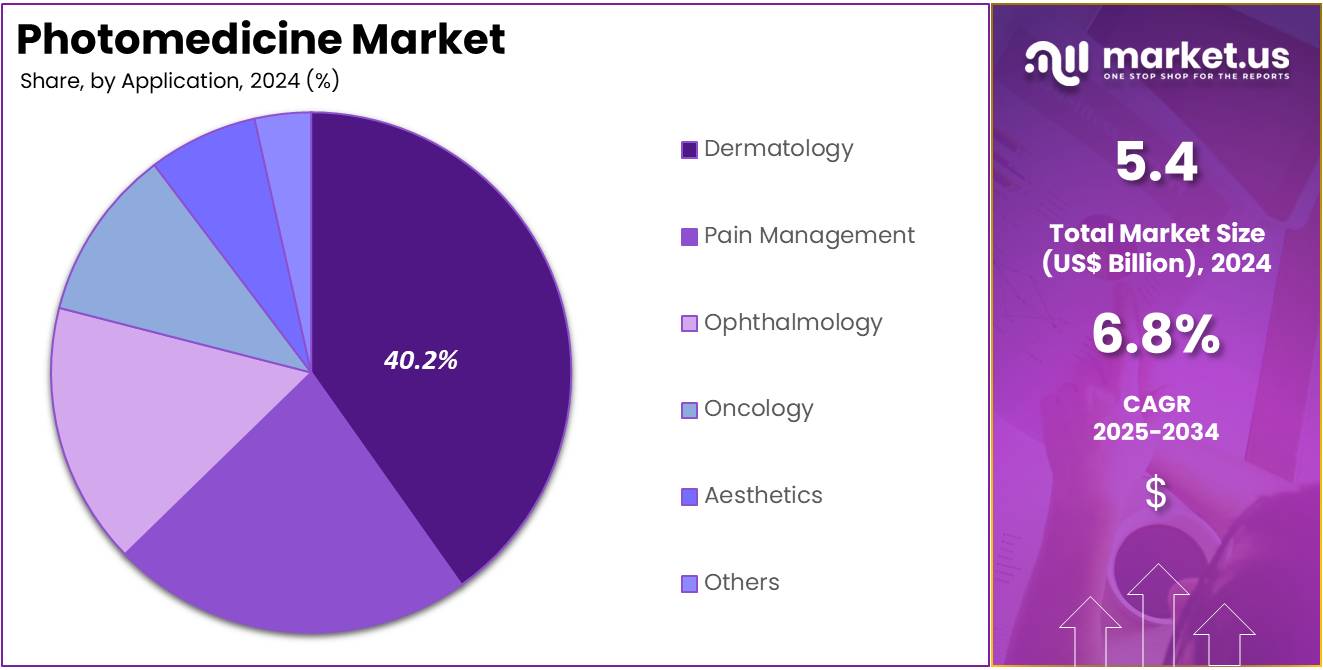

- Considering application, the market is divided into dermatology, pain management, ophthalmology, oncology, aesthetics, and others. Among these, dermatology held a significant share of 40.2%.

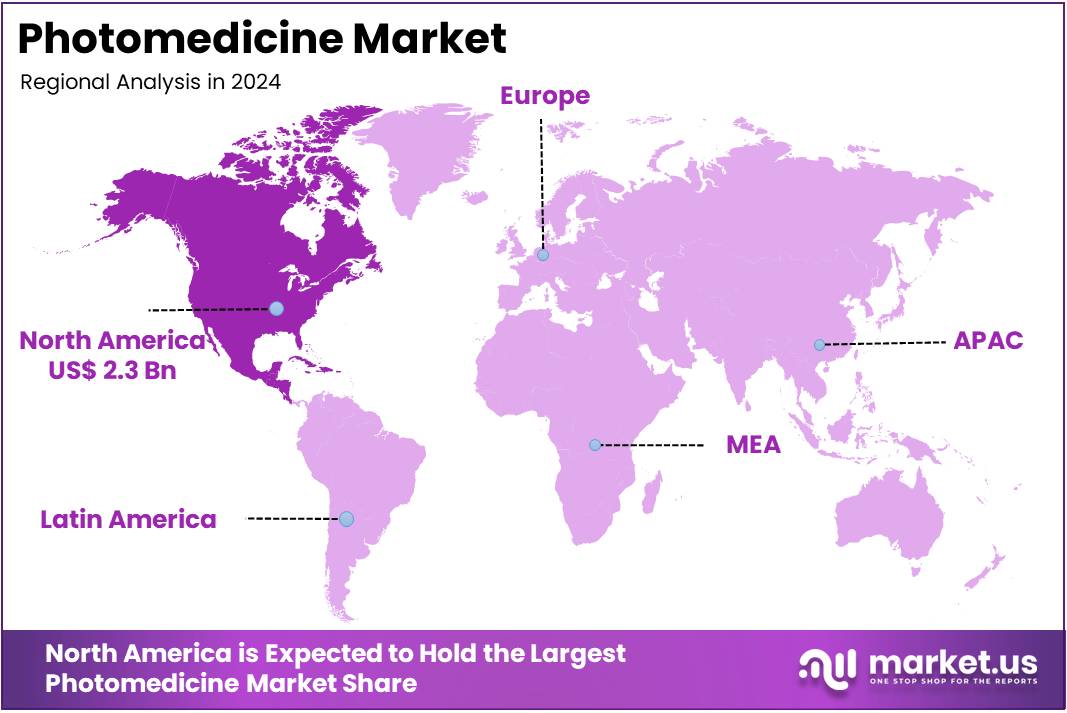

- North America led the market by securing a market share of 43.2% in 2023.

Product Type Analysis

Lasers are expected to dominate the photomedicine market, comprising 38.5% of the share. Lasers are widely used in various therapeutic and diagnostic applications due to their precision, control, and ability to target specific tissues. This segment is anticipated to grow significantly as medical professionals increasingly adopt laser technologies for non-invasive treatments in dermatology, ophthalmology, and pain management.

The rise in demand for minimally invasive procedures, combined with advancements in laser technologies that improve treatment outcomes and reduce recovery times, will likely propel market growth. As lasers continue to prove their effectiveness in treating a wide range of conditions, including skin disorders, eye diseases, and chronic pain, their adoption is expected to increase across both medical and aesthetic practices, solidifying their position in the photomedicine market.

Application Analysis

Dermatology is expected to be the leading application in the photomedicine market, holding 40.2% of the market share. The increasing prevalence of skin conditions, such as acne, psoriasis, and wrinkles, is expected to drive the demand for photomedicine treatments in dermatology.

The segment’s growth is anticipated to be fueled by the rising preference for non-invasive, effective therapies, such as laser treatments, light-emitting diodes (LEDs), and photodynamic therapy. As more dermatology clinics and hospitals adopt photomedicine technologies, the market for treatments like acne phototherapy, skin rejuvenation, and scar removal will continue to expand.

Furthermore, as advancements in laser and light technologies improve treatment efficacy and patient comfort, dermatology is projected to remain a significant and rapidly growing application in the photomedicine market. The rising demand for aesthetic treatments and the increasing focus on skincare will likely continue to drive this segment’s market growth.

Key Market Segments

By Product Type

- Lasers

- Polychromatic Polarised Light

- Light Emitting Diodes

- Full Spectrum Light

- Fluorescent Lamps

- Dichroic Lamps

By Application

- Dermatology

- Pain Management

- Ophthalmology

- Oncology

- Aesthetics

- Others

Drivers

Rising Prevalence of Chronic Diseases is Driving the Market

The increasing global prevalence of various chronic diseases, particularly dermatological conditions, chronic pain, and certain types of cancers, significantly drives the photomedicine market. Photomedicine offers non-invasive or minimally invasive therapeutic options with fewer systemic side effects compared to traditional pharmaceutical approaches.

Conditions like psoriasis, eczema, acne, and vitiligo, which often require long-term management, are increasingly treated with light-based therapies. The Centers for Disease Control and Prevention (CDC) provides extensive data on chronic diseases; their “Chronic Disease Indicators” for 2022–2024 were refreshed to include 113 measures across 21 topic areas, continuously highlighting the substantial public health burden of these conditions across the US population. This widespread and growing patient population actively seeks less invasive and effective treatment alternatives, directly fueling the expansion of the photomedicine market as a viable therapeutic option.

Restraints

High Cost of Equipment and Specialized Training are Restraining the Market

The photomedicine market faces significant restraint due to the substantial initial investment costs associated with advanced photomedicine equipment, such as sophisticated laser systems and specialized light sources, and the concurrent demand for specialized training. The capital expenditure required for purchasing and maintaining these cutting-edge devices can be prohibitive for smaller clinics or healthcare providers in resource-constrained regions, limiting their ability to offer these treatments.

For example, while specific government price lists are not readily available, the general consensus among healthcare providers, as reflected in discussions by major medical organizations, indicates that advanced medical laser equipment represents a significant capital outlay for healthcare facilities.

Furthermore, the complex nature of photomedicine procedures necessitates extensive training and expertise for clinicians, adding another layer of cost and reducing the pool of qualified practitioners. This combination of high cost and specialized requirements limits the broader penetration of photomedicine, particularly in developing economies or underserved areas.

Opportunities

Advancements in Laser and Light-Emitting Diode (LED) Technologies Create Growth Opportunities

Ongoing advancements in laser technology, particularly the development of more precise, versatile, and compact laser systems, as well as innovations in light-emitting diode (LED) technology, present significant growth opportunities in the photomedicine market. These technological improvements lead to enhanced treatment efficacy, reduced side effects, and shorter recovery times for patients across various applications, from dermatology to ophthalmology and oncology.

Recent publications, such as a June 2025 article on “Advancements in Medical Laser Technology,” highlight continuous improvements in laser sources, delivery systems, and the integration of AI and robotics for enhanced precision in medical applications. Similarly, LED technology is becoming more powerful and customizable, offering therapeutic benefits for a range of conditions with lower cost and increased portability. These continuous innovations are expanding the capabilities and accessibility of photomedicine, making it an increasingly attractive option for patients and clinicians.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the photomedicine market, primarily through their impact on healthcare expenditure, disposable income for aesthetic procedures, and government funding for medical research. During periods of robust economic growth, public and private investment in healthcare infrastructure and technology generally increases, supporting the adoption of innovative photomedicine devices.

Disposable income also plays a crucial role, as many photomedicine procedures, especially in aesthetics and dermatology, are considered elective and more readily pursued when consumers feel financially secure. The World Health Organization (WHO) reported in April 2025 that public funding for healthcare faltered in 2022 as the COVID-19 pandemic waned and global inflation surged, indicating a more cautious spending environment that could influence healthcare investment in photomedicine.

Geopolitical factors, such as international trade policies, intellectual property protections, and the stability of global supply chains for specialized optical components, laser diodes, and imaging sensors, also play a crucial role. Disruptions caused by geopolitical tensions, as observed in global logistics during 2024, can increase costs and delay the delivery of critical raw materials, impacting the production and pricing of photomedicine devices. However, the continuous demand for non-invasive aesthetic treatments and effective solutions for chronic conditions ensures sustained investment and innovation in the market, providing a degree of resilience against broader economic and political volatility.

Current U.S. tariff policies have the potential to impact the photomedicine market significantly. These policies can alter the cost of importing essential optical components, including laser diodes, LEDs, and advanced phototherapy devices. Since photomedicine equipment relies heavily on global manufacturing, any changes in import duties could disrupt the existing supply chain. According to the U.S. Census Bureau’s 2023–2024 foreign trade data, the country remains highly dependent on imported medical, surgical, and optical instruments. Any imposed tariffs on these items could raise input costs for U.S.-based photomedicine manufacturers.

Rising import duties may lead to increased production expenses for companies that depend on internationally sourced photomedicine components. These cost escalations may directly affect healthcare providers by increasing the price of diagnostic and therapeutic photomedicine systems. In turn, this could reduce affordability and access to treatments for patients. In May 2025, the American Hospital Association (AHA) warned that such tariff changes could have “significant implications for healthcare,” especially for vital devices and supplies. These added financial pressures could strain hospital budgets and delay the adoption of innovative photomedicine technologies in clinical settings.

However, current U.S. tariff policies may also encourage long-term growth in domestic production. By creating financial disincentives for foreign sourcing, these tariffs push manufacturers to explore local supply chain alternatives. Companies may invest in establishing or expanding photomedicine production facilities within the United States. Although this transition involves substantial upfront investments and regulatory compliance costs, it offers strategic benefits. A localized production base can strengthen supply chain security, reduce international dependencies, and improve national readiness in producing advanced medical technologies.

Latest Trends

Integration of Artificial Intelligence (AI) for Personalized Treatments is a Recent Trend

A prominent recent trend in the photomedicine market is the increasing integration of Artificial Intelligence (AI) and machine learning (ML) for personalized treatment planning and optimization. AI algorithms can analyze vast amounts of patient data, including skin type, lesion characteristics, and treatment responses, to recommend optimal light parameters, predict outcomes, and refine treatment protocols.

A February 2025 article in Global Journal of Emerging AI and Computing discussed how AI is transforming personalized medicine, enabling better prognosis, customized interventions, and improved results across various health disorders through analysis of genetic profiles, medical history, and environmental factors. This allows for more precise, efficient, and safer photomedicine procedures, moving beyond a one-size-fits-all approach. AI-powered diagnostic tools can also assist in early detection and characterization of conditions treatable with light, further enhancing the utility and adoption of photomedicine techniques for improved patient outcomes.

Regional Analysis

North America is leading the Photomedicine Market

North America dominated the market with the highest revenue share of 43.2% owing to technological advancements in light-based therapies, increasing adoption in various medical fields, and continuous regulatory support for new devices. While specific, granular data on NIH funding exclusively for photomedicine research is not readily available, the overall NIH budget was approximately US$ 47.311 billion in fiscal year 2024, with a portion supporting research into light-based diagnostics and treatments.

The U.S. Food and Drug Administration (FDA) continues to provide approvals and clearances for a range of laser and light-emitting medical devices across diverse applications, indicating a dynamic and evolving regulatory landscape that supports market expansion. Key players in the medical technology sector also demonstrate this growth through their financial performance.

For example, Hologic, a company with a significant medical aesthetics segment that includes light-based products, reported US$ 4.03 billion in annual revenue for 2024. Although Cutera Inc., another company in the aesthetic energy-based device market, reported consolidated revenue of US$ 140 million to US$ 145 million for 2024, this still reflects ongoing product sales in a segment where photomedicine plays a crucial role. These combined factors highlight the expanding utilization and commercial success of photomedicine in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare expenditures, rising awareness of advanced therapeutic options, and government initiatives promoting medical device innovation and adoption. China’s government actively invests in medical device research, with total R&D expenditure exceeding CNY 3.6 trillion (approximately US$0.5 trillion) in 2024, which includes support for advanced medical technologies relevant to light-based therapies.

Japan’s Agency for Medical Research and Development (AMED) also allocates significant funds to medical research and development, fostering a conducive environment for developing and integrating innovative devices into clinical practice. The “Health at a Glance: Asia/Pacific 2024” report by the OECD and WHO indicates a general increase in health expenditure across many countries in the region, suggesting improved access to advanced medical treatments.

Large medical technology companies, recognizing this potential, are increasing their presence and product offerings in Asia Pacific; Siemens Healthineers, for example, maintains operations in the Asia-Pacific region within its Advanced Therapies segment, which includes imaging and therapy solutions relevant to photomedicine applications, reflecting continuous investment and commercial activity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the photomedicine market employ various strategies to drive growth, including expanding their product portfolios through the development of novel therapies and research tools targeting light-based medical treatments. They focus on enhancing the efficacy and safety profiles of their offerings by investing in research and development.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Companies also aim to strengthen their market presence by establishing manufacturing facilities and distribution networks in key regions, ensuring timely and efficient delivery of products to support the growing demand for photomedicine solutions. Additionally, players engage in mergers and acquisitions to broaden their capabilities and market reach.

Sisram Medical Ltd., headquartered in Hong Kong, is a prominent player in the photomedicine market. The company specializes in developing and manufacturing medical aesthetics devices, including laser systems, intense pulsed light (IPL) systems, and radiofrequency devices.

Sisram Medical’s product portfolio caters to various applications such as dermatology, ophthalmology, and aesthetics. The company emphasizes innovation and quality, providing solutions that enable healthcare professionals to offer effective treatments to patients. Through its global presence and commitment to research and development, Sisram Medical continues to contribute to the advancement of photomedicine technologies.

Top Key Players in the Photomedicine Market

- Sisram Medical Ltd

- PhotoMedex Inc

- Koninklijke Philips

- Colorado Skin and Vein

- Aspen Laser Systems, LLC

- CLINUVEL

- Apax Partners Llp

- AVAVA, Inc

Recent Developments

- In July 2024: Aspen Laser Systems, LLC introduced the Ascent Laser Series, which incorporates a quad-wave laser with wavelengths of 670 nm, 810 nm, 980 nm, and 1064 nm, delivering a combined power of 32 watts. This new product enhances the photomedicine market by expanding the range of therapeutic laser technologies available for various treatments, further driving growth in non-invasive, targeted therapies for conditions that benefit from photobiomodulation.

- In March 2024: CLINUVEL, a leader in biopharmaceuticals, held a market briefing in Düsseldorf, Germany, to discuss the future direction of photomedicine and their innovative drug, SCENESSE (afamelanotide). The company’s continued focus on integrating photomedicine with drug development demonstrates how biopharmaceutical advances are pushing the boundaries of treatments that harness the power of light for therapeutic purposes, which is set to further accelerate the photomedicine market.

- In June 2024: AVAVA, Inc., a cutting-edge medical aesthetics platform, secured US$35 million in additional funding to develop its image-guided, targeted intradermal laser treatments suitable for all skin tones. This advancement is set to drive the growth of the photomedicine market by offering highly effective treatments for a wider range of patients, particularly in the aesthetic and dermatological fields, where light-based therapies continue to gain traction.

Report Scope

Report Features Description Market Value (2024) US$ 5.4 billion Forecast Revenue (2034) US$ 10.4 billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Lasers, Polychromatic Polarised Light, Light Emitting Diodes, Full Spectrum Light, Fluorescent Lamps, and Dichroic Lamps), By Application (Dermatology, Pain Management, Ophthalmology, Oncology, Aesthetics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sisram Medical Ltd, PhotoMedex Inc, Koninklijke Philips, Colorado Skin and Vein, Aspen Laser Systems, LLC, CLINUVEL, Apax Partners Llp, AVAVA, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sisram Medical Ltd

- PhotoMedex Inc

- Koninklijke Philips

- Colorado Skin and Vein

- Aspen Laser Systems, LLC

- CLINUVEL

- Apax Partners Llp

- AVAVA, Inc