Global Photoelectric Sensors Market By Type (Through-beam photoelectric sensor, Retroreflective photoelectric sensor, diffused photoelectric sensor), By Range (Up to 100 mm, 100 to 1000 mm, above 1000 mm), By End-User (Consumer Electronics, Automotive and Transportation, Packaging, Pharmaceuticals and Medical, Food and Beverages, Building Automation, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121658

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

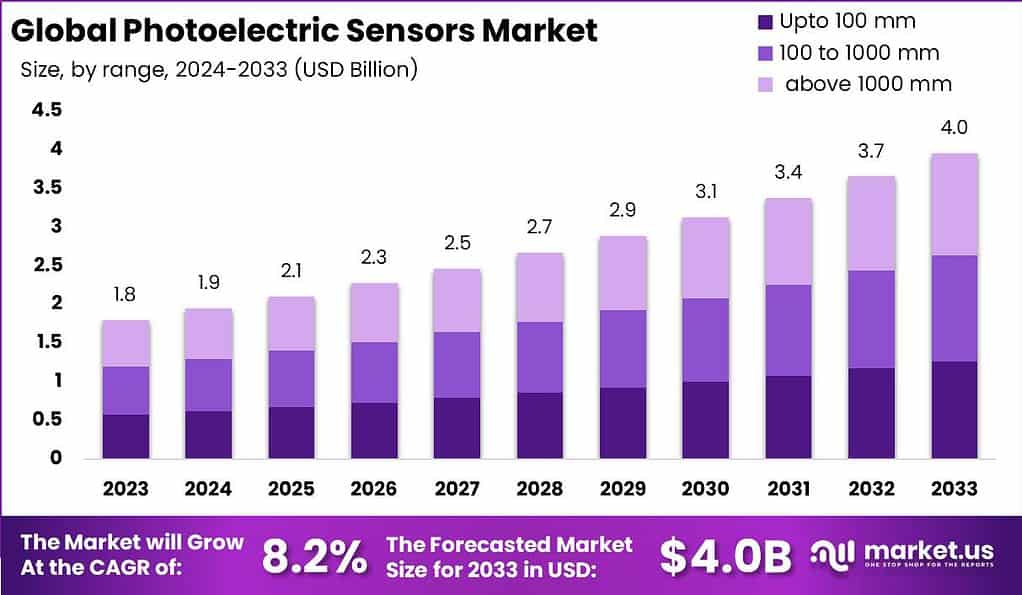

The Global Photoelectric Sensors Market size is expected to be worth around USD 4.0 Billion By 2033, from USD 1.8 Billion in 2023, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

Photoelectric sensors are electronic devices that utilize light to detect the presence, absence, or distance of an object. These sensors work by emitting a light beam (visible or infrared) from a light-emitting element. When this light beam is interrupted or reflected by an object, the change in light patterns is detected by a light receiver.

The photoelectric sensors market has witnessed significant growth in recent years, driven by various factors. One of the key growth factors is the increasing adoption of automation across industries. As more organizations strive to improve efficiency and productivity, the demand for photoelectric sensors for accurate and reliable object detection and measurement has risen. These sensors play a crucial role in industrial automation, manufacturing processes, robotics, and other applications.

Additionally, the emphasis on safety in industrial environments has created opportunities for the photoelectric sensors market. These sensors are widely used in safety systems to detect the presence of personnel or objects in hazardous areas, triggering appropriate safety measures to prevent accidents. The growing focus on workplace safety regulations and the need to minimize risks further contribute to the demand for photoelectric sensors.

However, the photoelectric sensors market is not without its challenges. One of the primary challenges is the competition from other types of sensors, such as proximity sensors, ultrasonic sensors, and vision systems. These alternative sensing technologies offer different capabilities and may be preferred in certain applications, posing a challenge to the growth of photoelectric sensors.

Moreover, the market faces the challenge of price competition. The presence of numerous players in the market leads to price pressure, as organizations seek cost-effective solutions. Manufacturers need to balance the demand for competitive pricing with maintaining high-quality products and technological innovation.

Despite the challenges, there are opportunities for new entrants in the photoelectric sensors market. As industries continue to adopt automation and invest in advanced sensing technologies, there is room for innovative and specialized sensor solutions. New entrants can differentiate themselves by offering unique features, customized solutions, or niche applications. Additionally, emerging markets and industries that are yet to fully embrace automation present untapped opportunities for new players to establish their presence.

Key Takeaways

- The photoelectric sensors market size was valued at USD 1.8 billion in the year 2923 and is estimated to reach USD 4.0 billion in the year 2033 with a CAGR of 8.2% during the forecast period.

- Based on the type, the Retroreflective photoelectric sensor has dominated the market with a share of 36.4% in the year 2023.

- Based on the range, the 100 to 1000 mm segment has dominated the market in the year 2023 with a share of 34.6%.

- Based on the end user, the food and beverages segment has the largest market share of 17.5% in the year 2023.

- In 2023, the Asia Pacific (APAC) region held a dominant market position in the Photoelectric Sensors market, capturing more than a 35.8% share with revenues amounting to USD 0.64 billion.

Type Analysis

Based on the type, the market is segmented into through-beam photoelectric sensor, Retroreflective photoelectric sensor, and Diffused photoelectric sensor segments. Among these, the Retroreflective photoelectric sensor has dominated the market with a share of 36.4% in the year 2023. This segment’s leadership can be attributed to its versatility and cost-effectiveness in a variety of applications.

Retroreflective sensors, which use a reflector to return the light beam to the detector, are particularly favored for their ease of alignment and shorter response time compared to other types. These attributes make them highly suitable for industrial environments where precision and reliability are paramount. The sensors are commonly used in packaging lines, material handling, and automated door systems, where objects vary in size and other characteristics.

The significant advantage of Retroreflective sensors is their ability to operate efficiently over moderate distances without the need for precise sender and receiver alignment, unlike through-beam sensors. This ease of installation, coupled with their lower cost, drives their adoption in both large-scale industrial settings and smaller, more compact areas. Additionally, advancements in sensor technology have enhanced their ability to discriminate between the target and the background, further boosting their applicability in complex automation tasks.

Market trends suggest continued growth for this segment, driven by innovation in sensor design and integration capabilities. As industries increasingly adopt smart manufacturing processes that require more efficient and reliable detection systems, the demand for Retroreflective photoelectric sensors is expected to rise.

Furthermore, the development of sensors that can withstand harsh environmental conditions and offer high resistance to electrical noise is opening new opportunities for their application, ensuring their leading position in the photoelectric sensors market remains secure.

Range Analysis

Based on the range, the market is segmented into Upto 100 mm, 100 to 1000 mm, and above 1000 mm segments. Among these, the 100 to 1000 mm segment has dominated the market in the year 2023 with a share of 34.6%. This range is particularly popular because it balances the need for precision with a sufficient operational distance, making it ideal for a variety of industrial applications.

Sensors in this range are widely used in automated assembly lines, robotics, and packaging industries, where moderate distance detection is crucial without the necessity for close proximity, which can risk damage to the sensors or the objects being detected.

The 100 to 1000 mm photoelectric sensors offer enhanced flexibility and utility in medium-range applications, where they can accurately detect and measure objects within a significant yet manageable distance. This ability makes them suitable for tasks such as product counting, machine safety measures, and object positioning, which are common in manufacturing and logistics operations.

Moreover, the adaptability of these sensors to different light conditions and surfaces enhances their effectiveness in diverse operational environments, contributing to their widespread adoption. The sustained growth of this segment is also driven by continual advancements in sensor technology, which improve the accuracy, durability, and energy efficiency of these devices.

Innovations such as increased ambient light tolerance and improved power efficiency cater to an evolving industry demand for more robust and cost-effective sensing solutions. As automation expands further into various sectors, the strategic importance of this sensor range in optimizing production processes and enhancing safety protocols is expected to bolster its market share and maintain its leadership position.

End-User Analysis

Based on the end user, the market is segmented into Consumer Electronics, Automotive and Transportation, Packaging, Pharmaceuticals and Medical, Food and Beverages, Building Automation, and Others segments. Among these, the food and beverages segment has the largest market share of 17.5% in the year 2023. This segment’s leadership is primarily driven by the escalating demand for automation and precision in food processing and packaging industries.

As manufacturers aim to enhance efficiency and reduce human error, the integration of advanced sensor technology becomes crucial. Photoelectric sensors, with their ability to detect and manage a wide range of materials and surfaces without physical contact, are ideal for these applications. They are extensively used in processes such as bottle filling, packaging, and labeling, where accuracy and speed are paramount.

The robust growth of this segment is further supported by stringent food safety regulations globally, which mandate high standards of hygiene and quality control in food production and handling. Photoelectric sensors facilitate compliance with these regulations by ensuring precise operations in environments that must remain free from contaminants.

Additionally, the rising trend of smart factories and Industry 4.0 in the food and beverage industry fuels the adoption of these sensors. They play a vital role in the automation of production lines, contributing to the optimization of operations and the minimization of waste and downtime.

Overall, the integration of photoelectric radiotherapy in the Food and Beverages industry not only boosts operational efficiency but also supports compliance with health and safety standards, making it a leading segment in the Photoelectric Sensors market. The continued innovation and advancements in sensor technology are expected to further drive the growth of this segment, as industry players seek new ways to improve productivity and sustainability.

Key Market Segments

By Type

- Through-beam photoelectric sensor

- Retroreflective photoelectric sensor

- Diffused photoelectric sensor

By Range

- Up to 100 mm

- 100 to 1000 mm

- above 1000 mm

By End-User

- Consumer Electronics

- Automotive and Transportation

- Packaging

- Pharmaceuticals and Medical

- Food and Beverages

- Building Automation

- Others

Drivers

Increasing use of smart sensors

The market for photoelectric sensors has been completely transformed by the introduction of smart sensors, which has greatly accelerated the market’s expansion. These sensors offer more features and capabilities than conventional photoelectric sensors because they integrate cutting-edge technology like artificial intelligence, machine learning, and Internet of Things connectivity.

The increasing need for automation and smart manufacturing processes across several industries is one of the main factors propelling the market’s growth. In these settings, smart photoelectric sensors are essential because they offer accurate object recognition and monitoring, which boosts productivity, safety, and efficiency. Furthermore, these sensors may constantly modify parameters, respond to shifting environmental circumstances, and send real-time data to other linked systems and devices thanks to the integration of smart features.

This feature lowers operational costs and downtime by enabling predictive maintenance, which enhances overall system performance. Furthermore, developments in sensor technology have produced smart photoelectric sensors that are more affordable, dependable, and compact, opening up a new variety of applications for them. In conclusion, the development of smart photoelectric sensors has stimulated market expansion by advancing sensor technology and satisfying the evolving demands of contemporary industrial automation.

Restraints

Incapacity to function well in challenging conditions

The market for photoelectric sensors is severely constrained by their incapacity to function well in challenging conditions. Even though photoelectric sensors are very advantageous – they can operate without touch, are very accurate, and respond quickly – their performance can be negatively impacted by extremes in temperature, humidity, vibration, dust, and electromagnetic interference.

Sensor components can deteriorate in harsh environments, resulting in decreased accuracy, dependability, and longevity. For instance, thermal drift brought on by high temperatures can alter the calibration and accuracy of sensors. Similarly, optical components may be impacted by exposure to moisture or dust, which could result in inaccurate readings or sensor failure.

The aforementioned constraint curtails the suitability of photoelectric sensors for sectors such as the automobile industry, food and beverage production, and severe outdoor environments. Consequently, businesses might have to spend more on supplementary safety precautions or select different detection systems that are better suited for challenging conditions, which would raise overall expenses and complexity.

Furthermore, photoelectric sensors in hostile environments require regular maintenance and replacement, which can cause disruptions to operations and increase downtime, which lowers productivity and efficiency. In conclusion, the market for photoelectric sensors is severely hampered by their incapacity to function in hard conditions. This hinders their acceptance in crucial industrial applications and necessitates constant innovation to overcome.

Opportunities

Rising need for non-contact sensors

The market for photoelectric sensors has a lot of potential due to the rising need for non-contact sensors. Due to its many advantages over contact sensing methods, non-contact sensing technology, including photoelectric sensing technology, is becoming more and more common in a variety of industries.

The capacity to detect items without making physical touch with them reduces wear and tear on both the sensor and the detected object, which is one of the key benefits of non-contact sensors. Businesses save money as a result of the extended sensor life and less maintenance needs. Non-contact sensors can make remote measurements possible, giving location and object detection options for sensors more freedom.

This is particularly helpful in settings with restricted accessibility or where proximity to items is prohibited due to safety concerns. Non-contact sensors are also more accurate and dependable than contact-based techniques, particularly in dynamic or quickly changing applications. This guarantees precise object recognition and monitoring, enhancing process effectiveness and product quality.

The need for smart manufacturing techniques and non-contact sensing systems, such as photoelectric sensors, is predicted to increase quickly as industries continue to automate. This is a profitable chance for the photoelectric sensors market to grow into new applications and sectors.

Challenges

Lack of raw materials

The market for photoelectric sensors is seriously hampered by the lack of raw materials. For photoelectric sensors to function properly, a range of parts and materials are needed, such as semiconductors, lenses, and packaging materials. The production and accessibility of photovoltaic sensors could be severely impacted by any interruption or scarcity in the supply chain of these raw materials.

Photovoltaic sensors rely heavily on semiconductors, which are particularly susceptible to supply chain disruptions because of their intricate production processes and global interdependence. Variations in semiconductor availability brought on by events like natural disasters, geopolitical unrest, or surges in demand can cause production delays and raise producer costs.

In addition, supply chain difficulties for producers of photoelectric sensors may be made worse by shortages or changes in the cost of optical components like lenses or filters. Businesses could find it challenging to satisfy client demands or uphold standards for product quality if they do not have access to these crucial resources.

Furthermore, a lack of raw materials could impede technological innovation and growth in the photoelectric sensors market, restricting the creation of new features or products. To summarize, the market for photovoltaic sensors is facing a major issue due to the shortage of raw materials. This underscores the significance of having a robust supply chain management strategy and a diverse range of sourcing choices to mitigate risks and guarantee production continuity.

Latest Trends

Increasing demand for nanotechnology

The market for photoelectric sensors has a lot of room to develop given the trend of increasing demand for nanotechnology. Photoelectric sensors can be made more sensitive, effective, and functional through the use of nanotechnology, which manipulates materials at the nanoscale.

The creation of nanomaterials for sensor components is one significant way that nanotechnology is influencing the photoelectric sensors market. With their special qualities including high electrical conductivity, light sensitivity, and surface-to-volume ratio, nanomaterials like carbon nanotubes and quantum dots are excellent choices for enhanced sensor performance.

Furthermore, photoelectric sensors may now be miniaturized thanks to nanotechnology, making devices more compact and smaller without sacrificing functionality. The market can expand into new areas by the integration of these miniaturized sensors into a range of applications and products, such as medical devices, wearable electronics, and Internet of Things devices.

Furthermore, the development of extremely selective and sensitive sensors that can reliably and accurately detect a large range of substances is made possible by nanotechnology. Photoelectric sensors now have more uses in biomedical diagnostics, security, and environmental monitoring. All things considered, the market for photoelectric sensors has a lot of room to develop and innovate thanks to the growing demand for nanotechnology, which will open the door for higher-performing next-generation sensor technologies.

Regional Analysis

In 2023, the Asia Pacific (APAC) region held a dominant market position in the Photoelectric Sensors market, capturing more than a 35.8% share with revenues amounting to USD 0.64 billion. This leadership can be attributed to the significant industrial growth across major APAC economies such as China, Japan, and South Korea.

These countries are pivotal manufacturing hubs, where there is a high demand for automation technologies to enhance productivity and efficiency. Photoelectric sensors, renowned for their precision and reliability, are extensively utilized in sectors such as automotive, electronics, and manufacturing, which are particularly robust in this region.

Moreover, the rapid expansion of the consumer electronics industry in APAC, coupled with increasing automation in the automotive sector, drives the demand for photoelectric sensors. The region’s focus on adopting cutting-edge technologies to streamline production processes and improve safety standards further boosts the market growth. Additionally, government initiatives across APAC countries to promote industrial automation as part of digital transformation strategies also play a crucial role in the adoption of these sensors.

The combination of these factors positions APAC as a leader in the Photoelectric Sensors market. The region’s ongoing industrial advancements, supported by technological innovation and supportive government policies, suggest that APAC will continue to lead and possibly expand its market share in the coming years. This continued growth underscores the critical role of photoelectric sensors in supporting the region’s automation and manufacturing sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Photoelectric Sensors market, several key players dominate with their advanced technologies and extensive product portfolios. Omron Corporation, a leader in the field, is renowned for its innovative approach and reliable sensor solutions that cater to a diverse range of industrial applications. Similarly, Schneider Electric SE leverages its global presence to deliver high-performance sensors that enhance operational efficiency and safety across multiple sectors.

Rockwell Automation Inc. and Panasonic Corporation are also prominent players, known for their cutting-edge technologies and contributions to the automation of manufacturing processes. Rockwell’s sensors are integral to smart manufacturing solutions, while Panasonic’s sensors are lauded for their precision and durability, particularly in harsh industrial environments.

Pepperl + Fuchs and Banner Engineering stand out for their specialization in intrinsically safe sensors for explosive environments and their robust data acquisition technologies, respectively. Fargo Controls and HTM Sensors, although smaller in scale, deliver specialized solutions that meet specific industry needs, emphasizing customization and flexibility.

Sensopart Industriesensorik, known for its innovative optical sensors, and Keyence Corporation, with its powerful and precise sensors, continue to push the boundaries of what is possible in automation. Sick AG, another major player, offers a range of sensors that are critical for ensuring high-quality standards in automation processes.

Top Key Players in the Market

- Omron Corporation

- Schneider Electric SE

- Rockwell Automation Inc.

- Panasonic Corporation

- Pepperl + Fuchs

- Fargo Controls

- Banner Engineering

- HTM Sensors

- Sensopart Industriesensorik

- Keyence Corporation

- Sick AG

- Other key players

Recent Developments

Report Scope

Report Features Description Market Value (2023) USD 1.8 Bn Forecast Revenue (2033) USD 4.0 Bn CAGR (2024-2033) 8.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Through-beam photoelectric sensor, Retroreflective photoelectric sensor, diffused photoelectric sensor), By Range (Up to 100 mm, 100 to 1000 mm, above 1000 mm), By End-User (Consumer Electronics, Automotive and Transportation, Packaging, Pharmaceuticals and Medical, Food and Beverages, Building Automation, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Omron Corporation, Schneider Electric SE, Rockwell Automation Inc., Panasonic Corporation, Pepperl + Fuchs, Fargo Controls, Banner Engineering, HTM Sensors, Sensopart Industriesensorik, Keyence Corporation, Sick AG, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current size and growth forecast for the photoelectric sensors market?The Global Photoelectric Sensors Market size is expected to be worth around USD 4.0 Billion By 2033, from USD 1.8 Billion in 2023, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Photoelectric Sensors Market?Increasing automation in industries such as manufacturing, automotive, and consumer electronics, coupled with technological advancements in sensor technology, are primary drivers of market growth.

What are the current trends and advancements in Photoelectric Sensors Market?The market is witnessing trends towards miniaturization, enhanced communication capabilities, and integration with IoT, which improve the functionality and applicability of photoelectric sensors in various applications.

What are the major challenges and opportunities in the Photoelectric Sensors Market?Key challenges include the high cost of advanced sensors and the need for customization in diverse applications. Opportunities lie in the rising demand for smarter and more efficient sensors in emerging markets and the expansion of smart manufacturing practices.

Who are the leading players in the Photoelectric Sensors Market?Major companies include Omron Corporation, Schneider Electric SE, Rockwell Automation Inc., Panasonic Corporation, Pepperl + Fuchs, Fargo Controls, Banner Engineering, HTM Sensors, Sensopart Industriesensorik, Keyence Corporation, Sick AG, Other key players

Photoelectric Sensors MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Photoelectric Sensors MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Omron Corporation

- Schneider Electric SE

- Rockwell Automation Inc.

- Panasonic Corporation

- Pepperl + Fuchs

- Fargo Controls

- Banner Engineering

- HTM Sensors

- Sensopart Industriesensorik

- Keyence Corporation

- Sick AG

- Other key players