Global Pet Tick and Flea Prevention Market Size, Share, Growth Analysis By Product Type (Oral Pills, Spray, Spot On, Powder, Shampoo, Collar, Others), By Animals (Dogs, Cats, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 163979

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

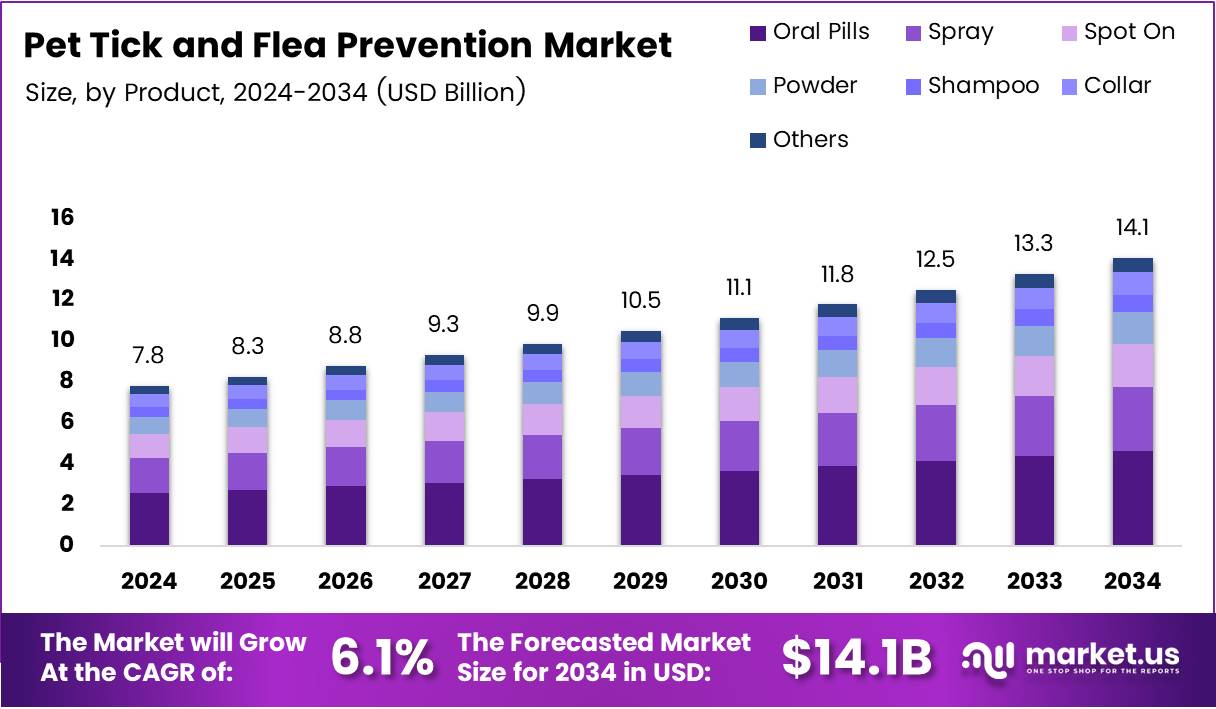

The Global Pet Tick and Flea Prevention Market size is expected to be worth around USD 14.1 Billion by 2034, from USD 7.8 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Pet Tick and Flea Prevention Market focuses on the development and distribution of solutions designed to protect pets from parasites that cause discomfort and diseases. It includes topical treatments, oral medications, collars, and sprays that ensure effective parasite control. Increasing pet ownership and awareness of animal health continue to drive consistent market expansion globally.

The market is witnessing notable growth as consumers shift toward advanced, long-lasting, and veterinarian-approved solutions. Pet owners increasingly prefer preventive healthcare products that align with modern lifestyles, where convenience and efficacy are key purchase factors. This has encouraged brands to innovate extended-duration and low-frequency treatment formulations to enhance compliance and convenience.

Additionally, government agencies and animal health organizations are promoting pet wellness programs emphasizing parasite control. Regulatory bodies ensure strict approval processes for product safety and efficacy, boosting consumer confidence. Policies encouraging responsible pet ownership and disease control also strengthen product adoption in both developed and emerging economies, fueling consistent market growth.

Furthermore, pet humanization trends have heightened spending on premium pet care products. As pet owners treat animals as family members, demand for sustainable and chemical-free prevention solutions is rising. This consumer shift supports innovation in bio-based and prescription-strength formulas that offer enhanced protection while minimizing environmental impact and side effects.

According to industry reports, around 39.1% of dog owners use tick and flea prevention products monthly, 34.7% every three months, and 16.1% annually, reflecting diverse treatment preferences. Additionally, 58% of U.S. pet owners express a desire for less frequent treatments, while 73% are willing to try once-yearly medications. Moreover, 76% of veterinarians support recommending such yearly prevention options, highlighting an opportunity for long-duration products.

Key Takeaways

- The Global Pet Tick and Flea Prevention Market was valued at USD 7.8 Billion in 2024 and is projected to reach USD 14.1 Billion by 2034.

- The market is expected to grow at a CAGR of 6.1% during the forecast period 2025–2034.

- Oral Pills dominated the market by product type, capturing a 31.2% share in 2024 due to ease of administration and long-lasting effects.

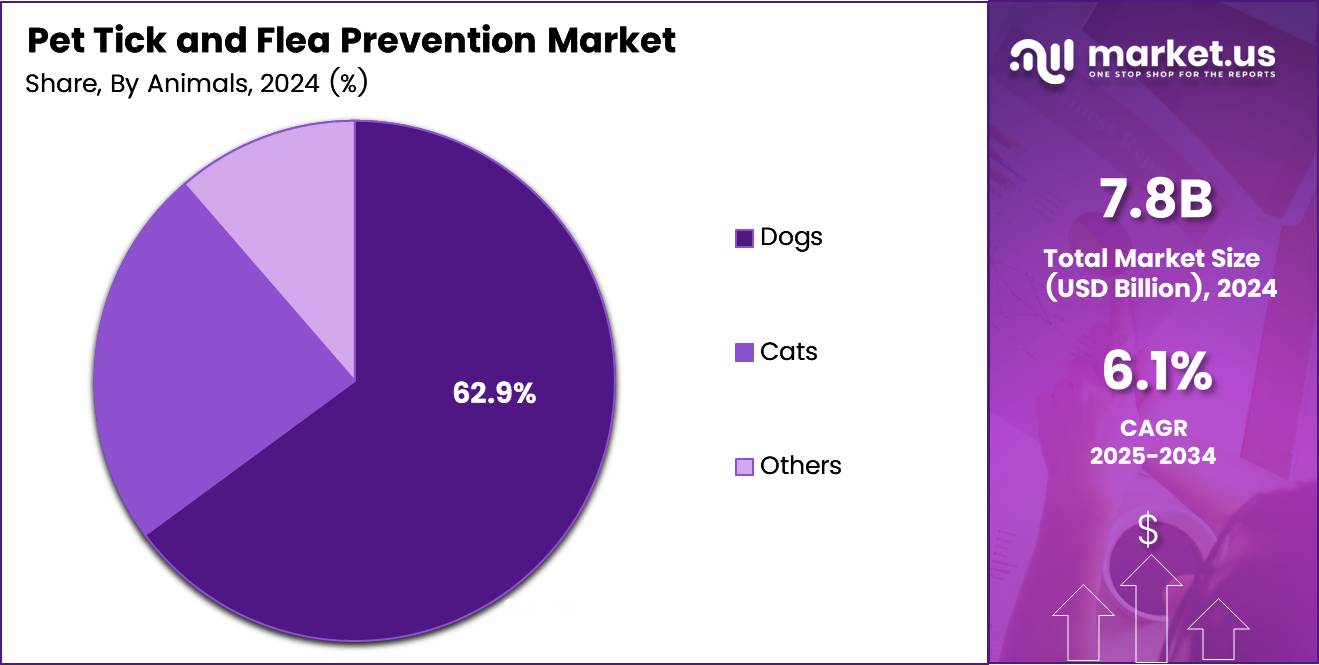

- Dogs led the market by animal type with a 62.9% share, attributed to higher outdoor exposure and preventive care adoption.

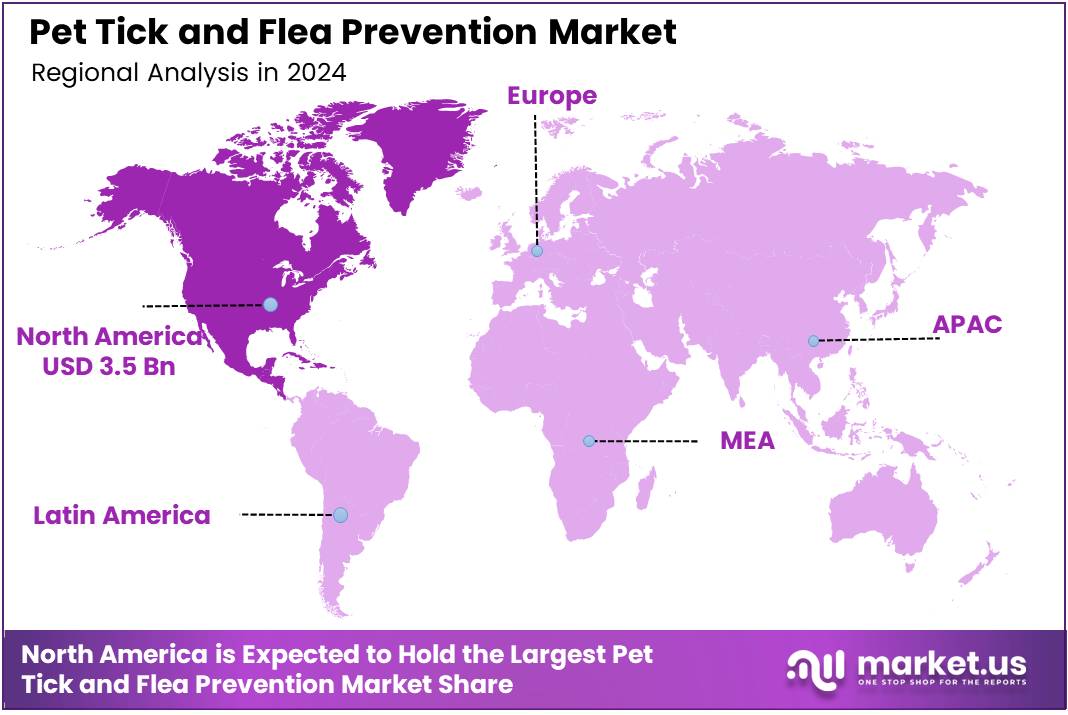

- North America dominated the global market with a 45.9% share, valued at USD 3.5 Billion in 2024.

By Product Type Analysis

Oral Pills dominate with 31.2% due to their convenience and long-lasting protection against ticks and fleas.

In 2024, Oral Pills held a dominant market position in the By Product Type segment of the Pet Tick and Flea Prevention Market, with a 31.2% share. These pills are favored for their ease of administration and precise dosage, ensuring consistent results. Moreover, they provide extended protection, making them popular among pet owners seeking hassle-free prevention methods.

Spray products are gaining traction due to their quick action and affordability. Pet owners use sprays for instant flea and tick control, especially in outdoor environments. Their ability to cover large surface areas efficiently has supported their steady adoption in both domestic and commercial pet care applications.

Spot On treatments remain a preferred topical choice due to their monthly protection and easy application. They are designed to target parasites directly through skin absorption, offering reliable defense for pets. The growing availability of veterinarian-approved formulations continues to drive this segment’s growth worldwide.

Powder-based flea and tick preventives cater to pet owners looking for cost-effective options. Their dry formulation offers flexibility and quick application, particularly for smaller animals. However, limited long-term effectiveness compared to other solutions slightly restricts their wider market adoption.

Shampoo products serve as a dual-purpose solution for cleansing and parasite control. Many pet owners prefer these for regular grooming routines, ensuring both hygiene and protection. Their integration with herbal and chemical formulations enhances usability and market demand.

Collar-based preventives offer prolonged protection by releasing active ingredients gradually. They are particularly popular among busy pet owners seeking low-maintenance solutions. The segment benefits from innovations like adjustable, water-resistant collars that improve comfort and longevity.

Others include emerging products such as wipes, lotions, and natural oils. These alternatives are expanding as consumers lean toward organic and chemical-free options. Growing awareness of pet safety and sustainable care products supports steady demand across global markets.

By Animals Analysis

Dogs dominate with 62.9% due to their high ownership rate and greater exposure to outdoor environments.

In 2024, Dogs held a dominant market position in the By Animals segment of the Pet Tick and Flea Prevention Market, with a 62.9% share. Their frequent outdoor activities increase exposure to parasites, driving demand for preventive solutions. Manufacturers continue developing specialized oral, topical, and collar-based treatments for dogs.

Cats represent a significant portion of the market owing to rising pet adoption and indoor pet care trends. Owners prefer lightweight and safe formulations such as sprays and spot-on treatments. Enhanced awareness about parasite-borne diseases in cats further fuels steady product consumption globally.

Others include small mammals and exotic pets that require niche flea and tick solutions. Market growth in this category is supported by increasing pet diversification and tailored veterinary care. Product innovation focusing on mild, species-specific ingredients is expected to enhance adoption among these pet owners.

Key Market Segments

By Product Type

- Oral Pills

- Spray

- Spot On

- Powder

- Shampoo

- Collar

- Others

By Animals

- Dogs

- Cats

- Others

Drivers

Rising Pet Ownership and Increasing Expenditure on Pet Healthcare Globally Drives Market Growth

The global rise in pet ownership is fueling the demand for tick and flea prevention products. Pet parents are increasingly treating animals as family members, leading to higher spending on preventive healthcare. This growing emotional attachment and awareness of pet wellness is expanding the overall market scope.

Additionally, increasing awareness of vector-borne diseases such as Lyme disease and flea allergies is boosting demand for preventive solutions. Pet owners are becoming proactive, opting for regular protection rather than reactive treatments. This shift toward prevention is positively influencing sales across both developed and emerging economies.

The growth of veterinary clinics and online pharmacies is also improving access to tick and flea prevention products. With easy online ordering and home delivery, pet owners now find it more convenient to maintain regular preventive care.

Technological advancements have led to more effective and longer-lasting formulations. New oral and topical treatments with extended protection periods are attracting consumers seeking safe and convenient options. These innovations continue to strengthen market growth and enhance product reliability.

Restraints

Adverse Side Effects and Allergic Reactions Associated with Chemical-Based Products Restrain Market Growth

One of the key challenges in the pet tick and flea prevention market is the concern over chemical-based formulations. Some products have been linked to side effects such as skin irritation, vomiting, or allergic reactions, which reduce consumer confidence and limit adoption.

In many developing and rural areas, awareness of tick and flea control remains limited. Pet owners often lack proper knowledge about preventive care, relying on traditional or infrequent treatments. This lack of awareness slows market penetration in emerging regions.

Moreover, stringent government regulations for approval and labeling of pet healthcare products create entry barriers for new manufacturers. Companies must comply with complex testing and safety requirements before launching products, which can delay commercialization.

Such strict rules, while ensuring animal safety, also increase operational costs and limit smaller companies from entering the market. Together, these factors act as significant restraints, affecting overall market expansion.

Growth Factors

Development of Natural and Plant-Based Flea Repellents with Minimal Side Effects Creates Growth Opportunities

The growing demand for natural, non-toxic, and plant-based tick and flea prevention solutions is creating new opportunities in the market. Consumers are increasingly choosing herbal and essential oil–based repellents to minimize the risk of allergic reactions.

There is also rising interest in customized preventive solutions designed for specific breeds, sizes, and regional climates. Tailored products help improve effectiveness and comfort, especially for sensitive pets or those living in high-risk environments.

E-commerce platforms and subscription-based models are expanding access to preventive products. Pet owners can now receive monthly or seasonal supplies automatically, improving adherence to treatment schedules and strengthening brand loyalty.

Furthermore, companies are investing heavily in R&D to develop combination products offering both long-duration and broad-spectrum protection. Such innovation-focused strategies will likely open new revenue streams and enhance competitiveness in the market.

Emerging Trends

Growing Preference for Eco-Friendly and Chemical-Free Preventive Formulations Shapes Market Trends

Sustainability is becoming a key trend as pet owners increasingly prefer eco-friendly and chemical-free tick prevention products. Brands are responding with biodegradable packaging and formulations derived from natural ingredients, aligning with the clean-label movement.

Smart wearable collars and IoT-enabled devices are also transforming pet care. These technologies can monitor pest activity, track pet behavior, and even send alerts, offering real-time prevention and peace of mind to owners.

Veterinary endorsements remain an influential factor driving consumer trust. Pet owners are more likely to purchase premium preventive products recommended by veterinarians, further supporting the market’s shift toward quality-focused brands.

Additionally, preventive wellness programs that combine regular health check-ups with bundled tick and flea control services are gaining popularity. This integrated approach promotes consistent care and supports long-term market growth.

Regional Analysis

North America Dominates the Pet Tick and Flea Prevention Market with a Market Share of 45.9%, Valued at USD 3.5 Billion

North America holds a leading position in the Pet Tick and Flea Prevention Market, driven by high pet ownership rates and increased spending on pet health. The presence of advanced veterinary infrastructure and awareness of tick-borne diseases also fuel market growth. Moreover, strong e-commerce penetration and frequent product innovations support continuous market expansion in the region.

Europe Pet Tick and Flea Prevention Market Trends

Europe shows steady growth, supported by stringent animal welfare regulations and rising awareness among pet owners regarding preventive healthcare. The increasing adoption of companion animals in countries like Germany, France, and the U.K. strengthens product demand. Additionally, the trend toward natural and eco-friendly formulations is reshaping regional product preferences.

Asia Pacific Pet Tick and Flea Prevention Market Trends

The Asia Pacific region is emerging as a fast-growing market, fueled by increasing pet adoption in urban areas and expanding veterinary networks. Rising disposable income and growing awareness about zoonotic diseases are improving market penetration. Governments in countries such as Japan, China, and Australia are also promoting responsible pet care practices.

Middle East and Africa Pet Tick and Flea Prevention Market Trends

The Middle East and Africa region is witnessing gradual adoption of flea and tick prevention products, primarily driven by rising pet ownership among urban households. Growing awareness of pet health and an expanding retail pharmacy network are contributing to market development. However, limited product accessibility in rural regions still poses a challenge.

Latin America Pet Tick and Flea Prevention Market Trends

Latin America represents a promising market, led by increasing awareness of pet hygiene and preventive healthcare. Countries such as Brazil and Mexico are showing stronger sales through veterinary clinics and online channels. The market is expected to gain traction as local production and distribution networks expand across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pet Tick and Flea Prevention Company Insights

The global pet tick and flea prevention market in 2024 continues to evolve, with several leading companies driving innovation and competitive growth.

Boehringer Ingelheim Group remains a dominant force through its wide range of products designed to protect companion animals from parasites. The company’s continuous investment in research and development, particularly in advanced formulations for systemic and topical solutions, reinforces its leadership in the global market and helps it maintain strong veterinary partnerships.

Ceva Sante Animale S.A. has strengthened its market presence by focusing on holistic parasite management solutions and expanding into emerging regions. Its commitment to animal welfare and emphasis on integrated care have enhanced its brand reputation, making it a key competitor in preventive pet care. Ceva’s agility and product diversification strategies are expected to help sustain its growth momentum despite intense competition.

Ecto Development Corporation plays a crucial niche role by offering specialized flea and tick prevention formulations. The company’s focus on innovation within spot-on treatments and affordable solutions positions it well among cost-conscious consumers. However, Ecto’s limited global distribution and reliance on specific product categories may challenge its scalability in the long term.

Sergeant’s Pet Care Products, Inc. continues to target the mass-market segment with its accessible and affordable pet protection products. Its strength lies in broad retail distribution and brand familiarity among everyday pet owners. To maintain competitiveness, the company will likely emphasize improved formulations and packaging innovations to align with changing consumer expectations for convenience and effectiveness.

Top Key Players in the Market

- Boehringer Ingelheim Group

- Ceva Sante Animale S.A.

- Ecto Development Corporation

- Sergeant’s Pet Care Products, Inc.

- The Hartz Mountain Corporation

- Virbac Corporation

- Central Life Sciences

- Advanced PetCare of Northern Nevada

- Petsburgh Pet Care Inc.

Recent Developments

- In Jul 2025, Fredun Pharmaceuticals made a strategic move into the pet care sector by acquiring One Pet Stop. This acquisition marks the company’s entry into the rapidly growing animal health and wellness market.

- In Mar 2025, private equity firm PAI Partners announced its plan to acquire Nuzoa from Abac Capital. The deal strengthens PAI’s presence in the veterinary distribution space across Europe.

- In Jan 2024, Wind Point Partners’ portfolio company Targeted PetCare completed the acquisition of Pet Brands. The move expands Targeted PetCare’s product range in the pet-treat category and enhances its market footprint.

Report Scope

Report Features Description Market Value (2024) USD 7.8 Billion Forecast Revenue (2034) USD 14.1 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oral Pills, Spray, Spot On, Powder, Shampoo, Collar, Others), By Animals (Dogs, Cats, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Boehringer Ingelheim Group, Ceva Sante Animale S.A., Ecto Development Corporation, Sergeant’s Pet Care Products, Inc., The Hartz Mountain Corporation, Virbac Corporation, Central Life Sciences, Advanced PetCare of Northern Nevada, Petsburgh Pet Care Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pet Tick and Flea Prevention MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Pet Tick and Flea Prevention MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Boehringer Ingelheim Group

- Ceva Sante Animale S.A.

- Ecto Development Corporation

- Sergeant's Pet Care Products, Inc.

- The Hartz Mountain Corporation

- Virbac Corporation

- Central Life Sciences

- Advanced PetCare of Northern Nevada

- Petsburgh Pet Care Inc.