Global Pet Skin & Coat Care Products Market Size, Share, Growth Analysis By Type (Prescription, Over-the-Counter (OTC)), By Pet Type (Dog, Cat, Others), By Product (Spray, Supplements, Shampoo, Conditioner, Others), By Application (Household, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171008

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

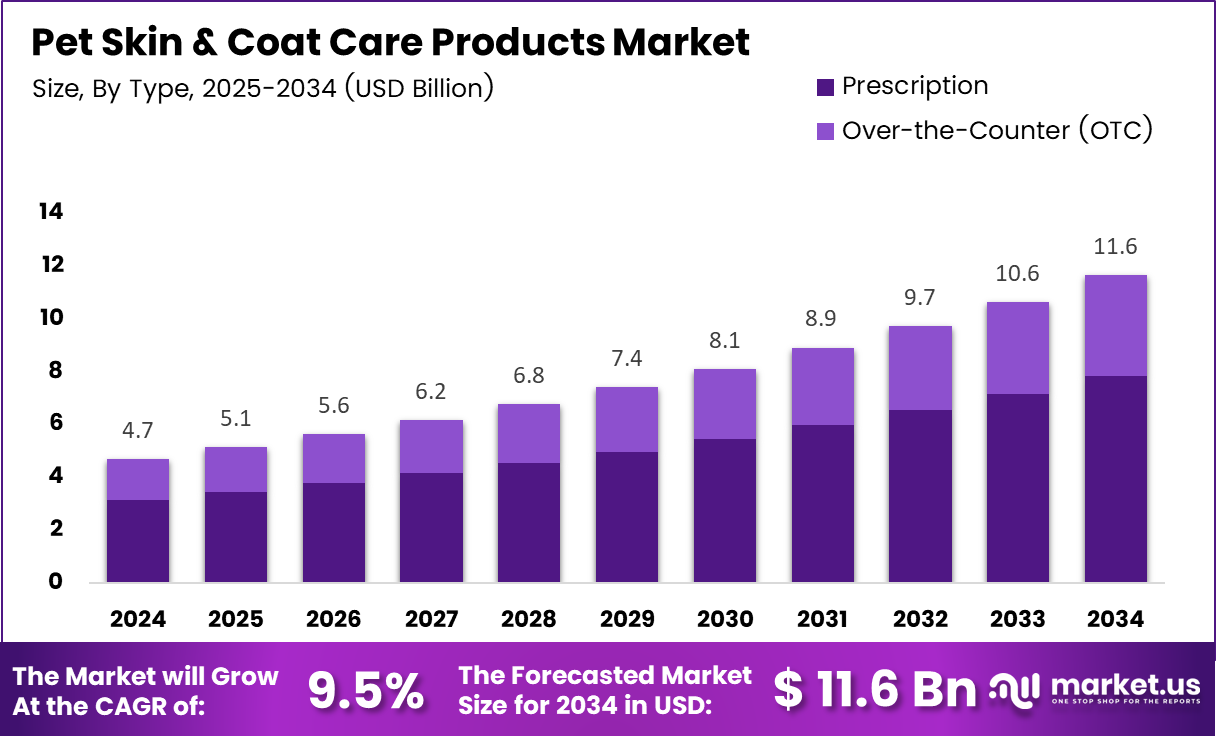

The Global Pet Skin & Coat Care Products Market size is expected to be worth around USD 11.6 by 2034, from USD 4.7 Billion in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034.

The Pet Skin and Coat Care Products market represents the commercial ecosystem focused on maintaining dermatological health, coat hygiene, and aesthetic appearance of companion animals. Importantly, this market includes medicated shampoos, conditioners, pet sprays, supplements, and medicated solutions designed for dogs, cats, and other pets. Overall, rising pet ownership and preventive care awareness continue strengthening baseline demand.

From an analyst perspective, Pet Skin and Coat Care Products address both functional health needs and lifestyle driven grooming preferences. Consequently, products increasingly align with pet wellness, allergy management, and skin sensitivity concerns. Moreover, demand extends beyond treatment toward routine maintenance, positioning this market at the intersection of veterinary care and consumer lifestyle spending.

In terms of growth dynamics, expanding urban pet populations and rising disposable income support sustained market expansion. Additionally, pet humanization trends encourage owners to adopt premium grooming routines similar to personal care practices. As a result, manufacturers increasingly focus on natural ingredients, dermatology tested formulations, and breed specific solutions to capture evolving consumer expectations.

Government involvement also plays a role in shaping the market landscape. Regulatory agencies continue strengthening guidelines around animal safety, ingredient disclosure, and product labeling. Meanwhile, several governments support veterinary healthcare infrastructure and animal welfare initiatives, indirectly promoting preventive skin and coat care adoption across both developed and emerging economies.

From a market structure standpoint, the industry remains highly fragmented. According to pet study, more than 500 active brands compete globally. Furthermore, the top 5 companies collectively account for only about 30% market share, reflecting limited consolidation and strong room for niche players.

Consumer purchasing behavior further influences competitive intensity. According to consumer surveys, nearly 40% of pet owners prioritize product cost over brand loyalty when purchasing skin and coat care items. Consequently, pricing strategies, private labels, and value positioning significantly influence volume sales across mass retail and online channels.

Looking ahead, the market offers attractive opportunities across e commerce expansion, subscription based grooming products, and condition specific care solutions. Additionally, rising awareness of pet allergies and climate driven skin conditions is expected to support long term demand. Overall, the Pet Skin and Coat Care Products market remains positioned for steady, broad based growth supported by health awareness, regulatory oversight, and evolving consumer behavior.

Key Takeaways

- The global Pet Skin and Coat Care Products Market is projected to reach USD 11.6 by 2034, expanding from USD 4.7 billion in 2024 at a CAGR of 9.5% during 2025 to 2034.

- Over the Counter (OTC) products represent a key market segment, driven by growing demand for routine and preventive skin and coat care solutions.

- Dogs remain the dominant pet type segment, supported by higher ownership levels and more frequent grooming and dermatological care needs.

- Shampoos and conditioners form a core product segment, benefiting from recurring household usage and regular coat hygiene practices.

- Household application accounts for a significant share of demand, reflecting rising adoption of at home grooming routines.

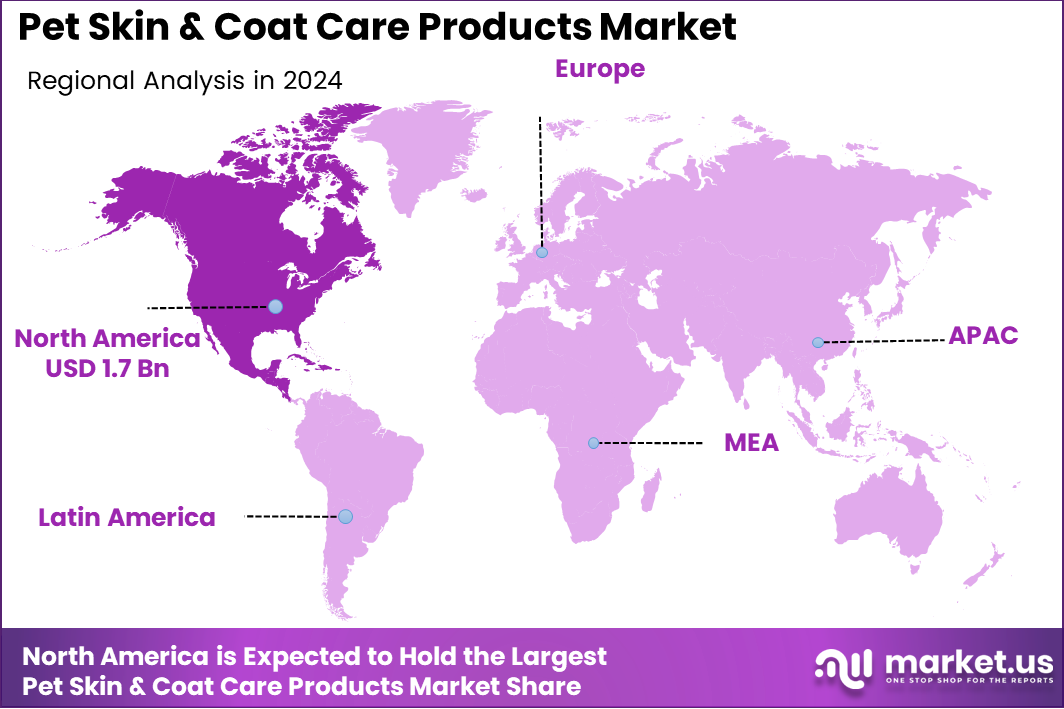

- North America dominates the market with a regional share of 37.8%, valued at USD 1.7 billion in 2024.

By Type Analysis

Over-the-Counter (OTC) dominates with 67.3% due to its easy availability, lower cost, and growing preference for routine preventive pet care.

In 2024, Over-the-Counter (OTC) held a dominant market position in the By Type Analysis segment of Pet Skin & Coat Care Products Market, with a 67.3% share. Moreover, pet owners increasingly prefer OTC products for routine grooming and minor skin concerns. Additionally, wide retail availability and online accessibility further strengthen consistent adoption across urban and semi urban households.

Prescription products represented a smaller yet essential share within the By Type Analysis segment. However, veterinarians continue to recommend prescription solutions for chronic skin infections and severe dermatological conditions. Consequently, clinical credibility and targeted formulations support steady demand, especially among pets requiring long term medical supervision and monitored treatment outcomes.

By Pet Type Analysis

Dog dominates with 62.8% driven by higher grooming frequency, larger pet population, and increased awareness of canine dermatological health.

In 2024, Dog held a dominant market position in the By Pet Type Analysis segment of Pet Skin & Coat Care Products Market, with a 62.8% share. Moreover, dogs experience higher exposure to outdoor allergens and parasites. As a result, owners prioritize regular skin and coat maintenance to ensure hygiene, comfort, and overall wellness.

Cat products maintained a notable presence within the By Pet Type Analysis segment. However, cats require specialized formulations due to sensitive skin and grooming behavior. Consequently, demand grows steadily as awareness improves regarding feline specific skin conditions and the importance of gentle, species appropriate care routines.

Others category accounted for a limited yet emerging share in the By Pet Type Analysis segment. Nevertheless, increasing adoption of small mammals and exotic pets gradually supports niche product development. Subsequently, brands focus on customized formulations to address unique skin sensitivities across diverse pet categories.

By Product Analysis

Shampoo dominates with 36.9% supported by frequent usage cycles and its role as a primary grooming solution.

Shampoo held a dominant market position in the By Product Analysis segment of Pet Skin & Coat Care Products Market, with a 36.9% share. Moreover, shampoos serve as the foundation of routine grooming. Therefore, demand remains stable due to repeat purchases and growing preference for medicated and natural formulations.

Spray products showed steady adoption within the By Product Analysis segment. Additionally, sprays offer convenience for quick application between baths. As a result, busy pet owners increasingly use sprays for odor control, itch relief, and coat conditioning without extensive grooming time.

Supplements contributed to supportive growth in the By Product Analysis segment. Consequently, oral supplements addressing skin hydration and coat strength gain attention. Furthermore, rising focus on preventive pet nutrition encourages integration of supplements into daily wellness routines.

Conditioner and Others segments maintained complementary roles within the By Product Analysis segment. However, conditioners enhance coat texture post washing, while other niche products address targeted concerns. Thus, these categories benefit from premium grooming trends and specialized pet care demand.

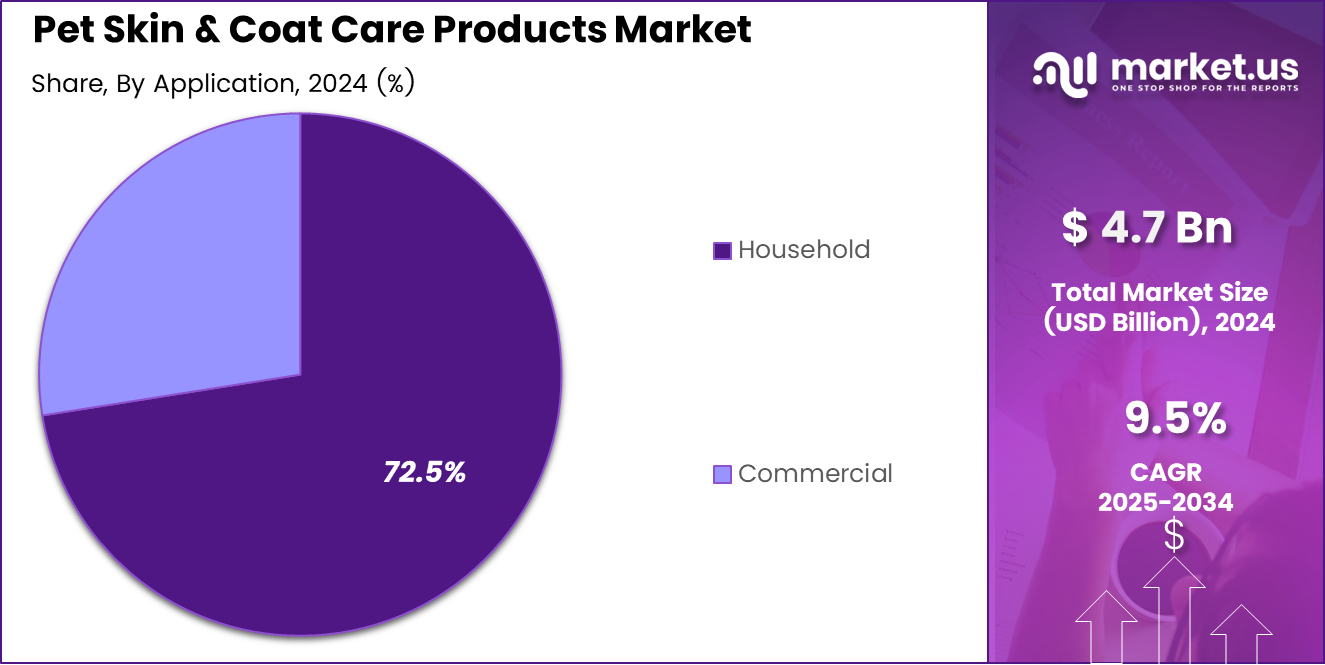

By Application Analysis

Household dominates with 72.5% due to increasing pet humanization and rising at home grooming practices.

In 2024, Household held a dominant market position in the By Application Analysis segment of Pet Skin & Coat Care Products Market, with a 72.5% share. Moreover, pet owners increasingly adopt DIY grooming routines. Consequently, frequent product usage supports higher consumption within residential settings globally.

Commercial applications represented a smaller yet stable share in the By Application Analysis segment. However, professional grooming salons and veterinary clinics continue to use specialized products. As a result, consistent service demand sustains commercial adoption, particularly in urban regions with organized pet care services.

Key Market Segments

By Type

- Prescription

- Over-the-Counter (OTC)

By Pet Type

- Dog

- Cat

- Others

By Product

- Spray

- Supplements

- Shampoo

- Conditioner

- Others

By Application

- Household

- Commercial

Drivers

Increasing Humanization of Pets Drives Market Growth

Rising skin related issues among companion animals is supporting steady demand for specialized skin and coat care products. Allergies, pollution exposure, and dietary sensitivities are increasingly observed in pets, especially in urban environments. As a result, pet owners are seeking solutions that help manage itching, dryness, hair fall, and infections through regular grooming routines.

At the same time, growing emotional attachment between owners and pets is reshaping spending behavior. Pets are increasingly treated as family members, which is encouraging higher expenditure on preventive grooming and wellness products. Owners are prioritizing routine coat care to avoid medical complications and maintain pet comfort.

Urbanization and nuclear family structures are further accelerating pet adoption rates. Busy lifestyles and smaller households are driving preference for companion animals, particularly dogs and cats. This trend directly increases demand for easy to use skin and coat care products suitable for home use.

In addition, veterinarians and professional groomers are playing a stronger advisory role. Their recommendations influence product selection and usage frequency, especially for medicated shampoos, sprays, and pet dietary supplements. This professional guidance continues to strengthen consumer confidence and market growth.

Restraints

Presence of Counterfeit Products Limits Consumer Confidence

The availability of counterfeit and low quality pet grooming products remains a major restraint. Such products often fail to deliver expected results and may cause adverse skin reactions, reducing trust in branded formulations. This challenge is more visible in price sensitive and unorganized markets.

Limited awareness about ingredient safety also affects purchasing decisions. Many pet owners lack knowledge about suitable formulations for different breeds, skin types, and age groups. This gap can result in incorrect product usage and inconsistent outcomes.

Regulatory complexity further restrains market expansion. Animal care product regulations vary widely across regions, covering labeling, ingredient approval, and safety testing. These differences increase compliance costs for manufacturers and delay product launches in new markets.

Together, these factors slow down adoption rates and create hesitation among first time buyers, especially in emerging economies.

Growth Factors

Development of Breed Specific Solutions Creates New Growth Avenues

Growing focus on breed specific and condition targeted solutions is opening new opportunities. Products designed for sensitive skin, anti shedding, or allergy prone breeds are gaining attention. This specialization allows brands to address unmet needs more effectively.

Demand for organic and plant based grooming products is also rising. Pet owners increasingly prefer chemical free formulations due to safety concerns and long term health awareness. Natural oils, herbal extracts, and mild cleansers are becoming key differentiators.

E commerce and direct to consumer channels are further expanding market reach. Online platforms improve product accessibility, enable subscription models, and support educational content. These channels are particularly effective in urban and semi urban areas.

Collectively, innovation and digital distribution are expected to support sustained market expansion.

Emerging Trends

Shift Toward Clean Label Formulations Shapes Market Trends

Transparency in ingredient disclosure is emerging as a key trend. Pet owners increasingly check labels and prefer products with clearly stated, recognizable ingredients. Clean label positioning helps brands build trust and long term loyalty.

Dermatology tested and vet endorsed claims are also gaining importance. Such validations reassure consumers about product safety and effectiveness, especially for pets with chronic skin conditions.

Another notable trend is the rise of multifunctional products. Solutions that combine cleansing, treatment, and prevention in one formulation are gaining popularity. These products simplify grooming routines and appeal to time constrained pet owners.

Overall, these trends indicate a shift toward informed purchasing and value driven product selection.

Regional Analysis

North America Dominates the Pet Skin & Coat Care Products Market with a Market Share of 37.8%, Valued at USD 1.7 Billion

North America remains the leading region in the pet skin and coat care products market, supported by high pet ownership rates and premium spending behavior. In 2024, the region accounted for a dominant 37.8% market share, with a valuation of USD 1.7 billion, reflecting strong demand for specialized grooming, dermatology focused, and preventive care products. High awareness of pet allergies, skin disorders, and ingredient transparency continues to support consistent product usage across households. Additionally, established veterinary infrastructure and professional grooming adoption further reinforce market leadership in this region.

Europe Pet Skin & Coat Care Products Market Trends

Europe represents a mature yet steadily expanding market, driven by rising focus on animal welfare and regulated pet care standards. Pet owners increasingly prioritize dermatologist tested and natural formulations to address skin sensitivity issues. Growth is also supported by growing awareness around breed specific skin conditions and preventive grooming routines. Regulatory oversight on animal care products further enhances consumer confidence across major European countries.

Asia Pacific Pet Skin & Coat Care Products Market Trends

Asia Pacific is witnessing accelerated growth due to rapid urbanization, rising disposable incomes, and increasing pet adoption among younger households. Changing lifestyle patterns and growing influence of western pet care practices are encouraging higher spending on skin and coat wellness products. Expanding access to organized retail and online platforms is improving product availability across emerging economies. The region is expected to remain a key growth engine over the forecast period.

Middle East and Africa Pet Skin & Coat Care Products Market Trends

The Middle East and Africa market is gradually expanding, supported by growing awareness of pet hygiene and basic grooming needs. Urban pet ownership is increasing, particularly in premium residential communities, driving demand for essential skin and coat care solutions. Veterinary service expansion and education initiatives are improving understanding of pet dermatological health. However, market growth remains uneven across countries due to income disparities.

Latin America Pet Skin & Coat Care Products Market Trends

Latin America shows steady adoption of pet skin and coat care products, driven by rising companionship trends and increasing focus on pet wellness. Cost effective grooming solutions and multi functional products remain popular among price sensitive consumers. Growing retail penetration and improving awareness of skin related pet issues are supporting market development. The region is expected to maintain moderate but stable growth momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pet Skin & Coat Care Products Company Insights

Nestlé Purina Petcare has established a robust presence in the pet skin and coat care products market through comprehensive product portfolios that address a variety of dermatological needs. The company’s offerings are backed by extensive nutritional science and brand trust, which support sustained consumer preference. Continued investment in research and targeted formulations for specific coat conditions positions Purina for steady influence and relevance in 2024 as pet owners increasingly seek holistic skin and coat solutions.

Virbac stands out for its veterinary-centric approach to skin and coat care, leveraging clinical expertise to develop therapeutic products that address underlying dermatological issues. The company’s strong relationships with veterinary professionals enhance product adoption and credibility within clinical settings. Virbac’s focus on evidence-based formulations, combined with tailored solutions for sensitive skin, underscores its role as a key player catering to both preventive and corrective care needs in the global market landscape.

Groomer’s Choice has carved a niche by concentrating on professional-grade grooming formulations that deliver targeted benefits for skin and coat health. The brand’s emphasis on quality, performance, and results resonates with professional groomers and discerning pet owners alike. Groomer’s Choice’s strategic positioning in the premium segment supports its market differentiation, with products designed to improve coat texture and skin condition while aligning with trends toward specialized grooming solutions.

SynergyLabs continues to leverage innovation in natural and plant-based ingredients to address growing consumer demand for gentle yet effective skin and coat care products. The company’s commitment to formulations that balance efficacy with safety appeals to health-conscious pet owners seeking alternatives to conventional chemical treatments. SynergyLabs’s agility in responding to emerging wellness trends positions it for continued expansion and influence in the competitive pet care market in 2024.

Top Key Players in the Market

- Nestlé Purina Petcare

- Virbac

- Groomer’s Choice

- SynergyLabs

- Zesty Paws

- Petco Animal Supplies, Inc.

- Logic Product Group LLC

- Wahl Clipper Corporation

- Earthwhile Endeavors, Inc.

- Nutramax Laboratories, Inc.

Recent Developments

- In Sep 2025, Miller Manufacturing acquired Lixit Animal Care Products, marking a strategic expansion into the small pets market. The acquisition fulfills a long held goal of the company’s leadership and broadens Miller Manufacturing’s product portfolio across diversified animal care segments.

- In Nov 2024, WagWell, a leading innovator in pet care products, announced the launch of the world’s first microbiome friendly certified paw balm for dogs. The product introduction reinforces WagWell’s focus on science backed, skin safe solutions within the premium pet wellness category.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 11.6 Billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Prescription, Over-the-Counter (OTC)), By Pet Type (Dog, Cat, Others), By Product (Spray, Supplements, Shampoo, Conditioner, Others), By Application (Household, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Nestlé Purina Petcare, Virbac, Groomer’s Choice, SynergyLabs, Zesty Paws, Petco Animal Supplies, Inc., Logic Product Group LLC, Wahl Clipper Corporation, Earthwhile Endeavors, Inc., Nutramax Laboratories, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pet Skin & Coat Care Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Pet Skin & Coat Care Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé Purina Petcare

- Virbac

- Groomer's Choice

- SynergyLabs

- Zesty Paws

- Petco Animal Supplies, Inc.

- Logic Product Group LLC

- Wahl Clipper Corporation

- Earthwhile Endeavors, Inc.

- Nutramax Laboratories, Inc.