Global Payments Market Size, Share Report Analysis By Mode of Payment (Point-of-Sale, Card (Debit, Credit, Pre-paid), Digital Wallets (Apple Pay, Google Pay, Interac Flash), Cash, Other POS (Gift-cards, QR, Wearables), Online, Card (Card-Not-Present), Digital Wallet & Account-to-Account (Interac e-Transfer, PayPal), Other Online (COD, BNPL, Bank Transfer)), By Interaction Channel (Point-of-Sale, E-commerce/M-commerce), By Transaction Type (Person-to-Person (P2P), Consumer-to-Business (C2B), Business-to-Business (B2B), Remittances & Cross-border), By End-user Industry (Retail, Entertainment & Digital Content, Healthcare, Hospitality & Travel, Government & Utilities, Other End-user Industries), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170769

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- By Mode of Payment

- By Interaction Channel

- By Transaction Type

- By End User Industry

- By Region

- Emerging Trends

- Growth Factors

- Investment and Business Benefits

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Future Outlook and Opportunities

- Report Scope

Report Overview

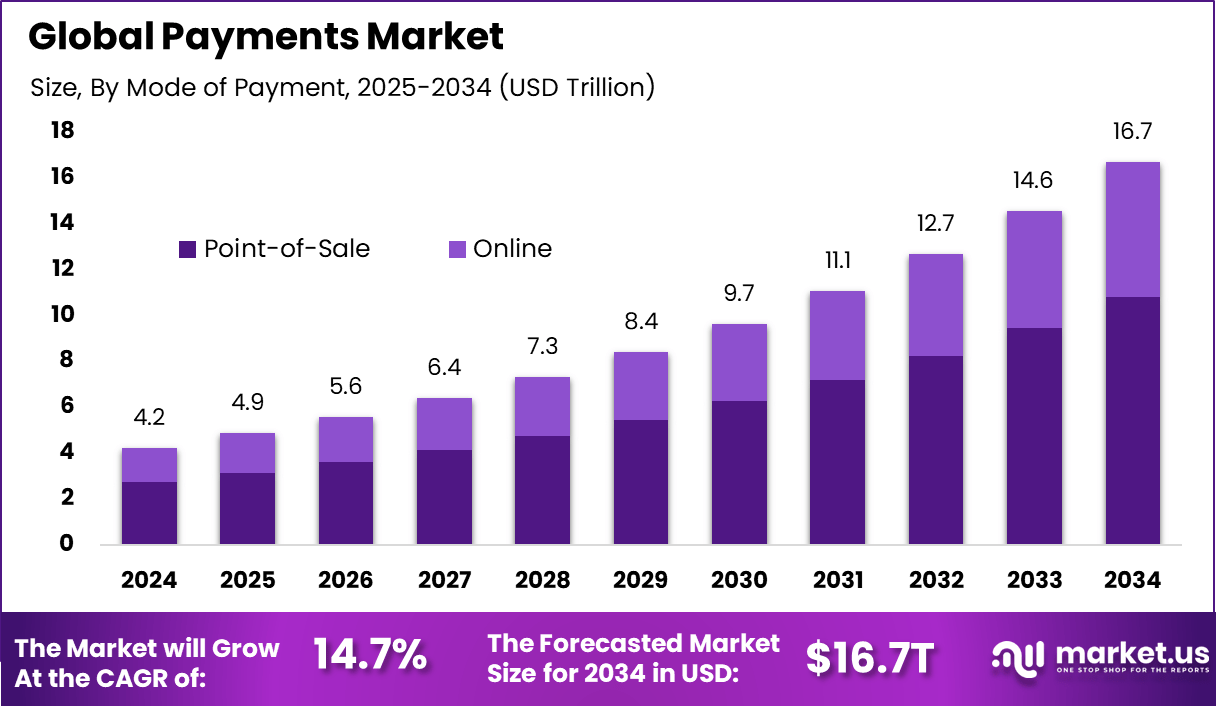

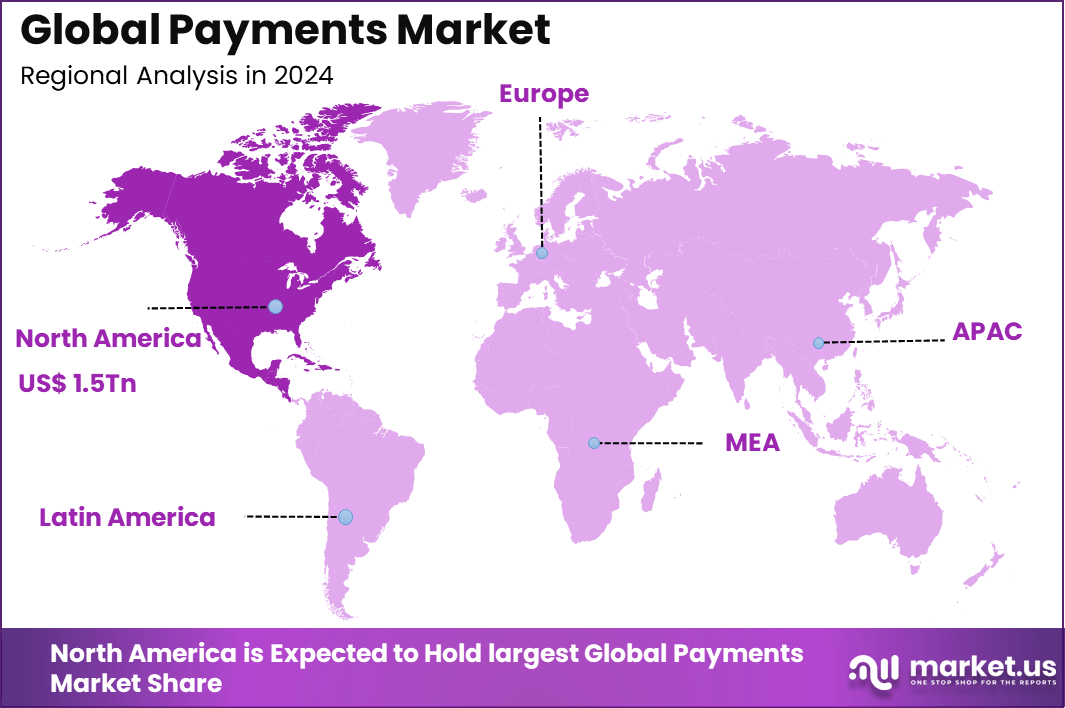

The Global Payments Market size is expected to be worth around USD 16.7 Trillion By 2034, from USD 4.2 Trillion in 2024, growing at a CAGR of 14.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan Market position, capturing more than a 36.4% share, holding USD 1.5 Trillion revenue.

The payments market refers to the broad ecosystem of systems, technologies, and services that enable the transfer of money between buyers and sellers, consumers and businesses, or across borders. This includes cashless payments, card transactions, digital wallets, online banking, mobile payments, and real-time settlement systems. The shift from physical cash to digital modes has been significant, with non-cash transaction volumes increasing more than tenfold over the last two decades.

The payments market plays a crucial role in supporting economic activity by ensuring secure, quick, and reliable value transfer. It underpins retail purchases, e-commerce, bill payments, subscription services, and business-to-business settlements. Modern payment systems also support cross-border commerce and remittances by connecting financial networks globally.

According to Gr4vy, global digital payment volumes reached USD 18.7 trillion in 2024, up sharply from USD 1.7 trillion in 2014, and are projected to exceed USD 33.5 trillion by 2030 as economies digitize and consumers adopt contactless, wallet, and online payments. Digital methods now account for 66% of global e commerce transaction value and 38% of in store payments, highlighting a structural shift away from cash.

Digital wallets and account to account payments are leading this transition, with wallets expected to power 61% of e commerce and 46% of point of sale transactions by 2027. Overall digital payment transaction value stood at USD 11.55 trillion in 2024 and is forecast to reach USD 16.62 trillion by 2028, driven by smartphone adoption, contactless usage, and cross border commerce.

Top Market Takeaways

- Point-of-Sale payments lead by 64.8%, showing strong reliance on in-store and checkout-based payment methods.

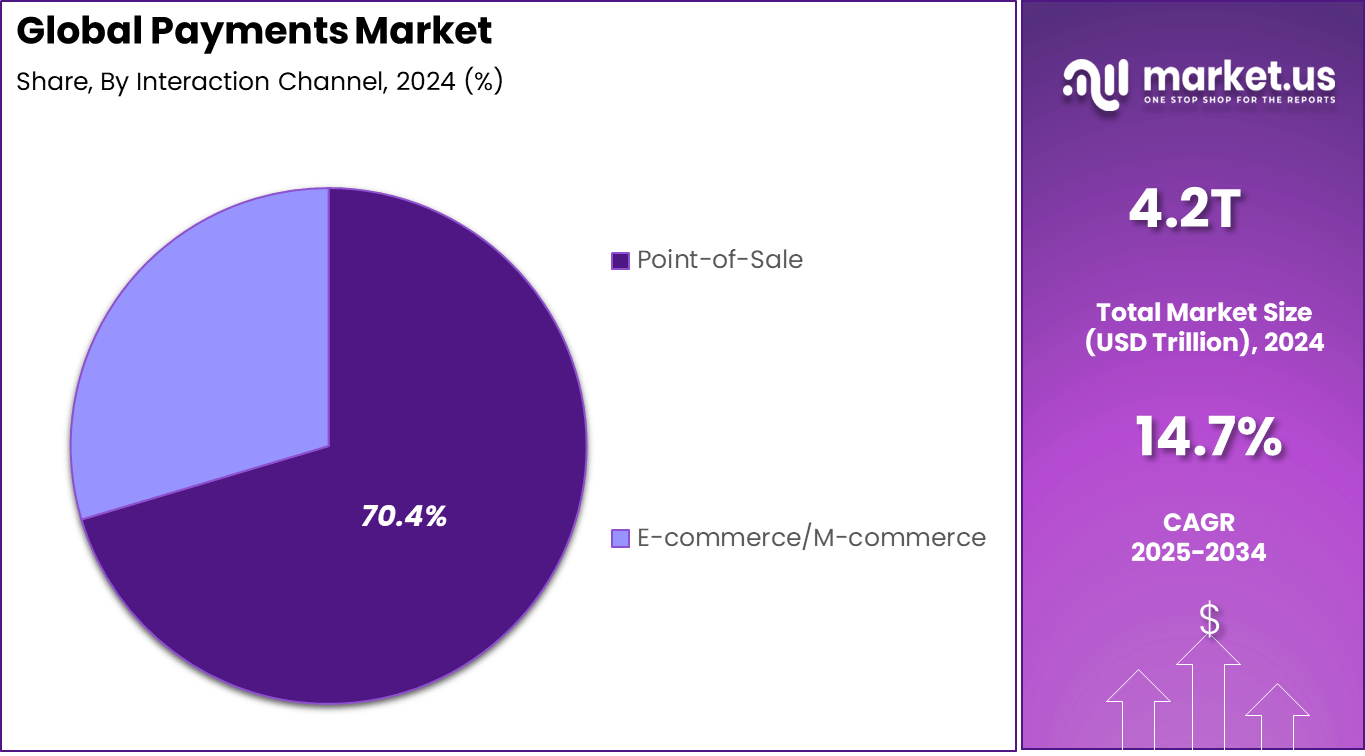

- Point-of-Sale interaction channels dominate with 70.4%, reflecting widespread use of terminals, contactless cards, and digital wallets at physical locations.

- Person-to-Person (P2P) transactions account for 45.3%, driven by everyday money transfers, peer payments, and mobile payment apps.

- The retail sector holds 37.8%, supported by high transaction volumes, omnichannel sales, and growing digital payment acceptance.

- North America captures 36.4% of the global market, backed by advanced payment infrastructure and high consumer adoption.

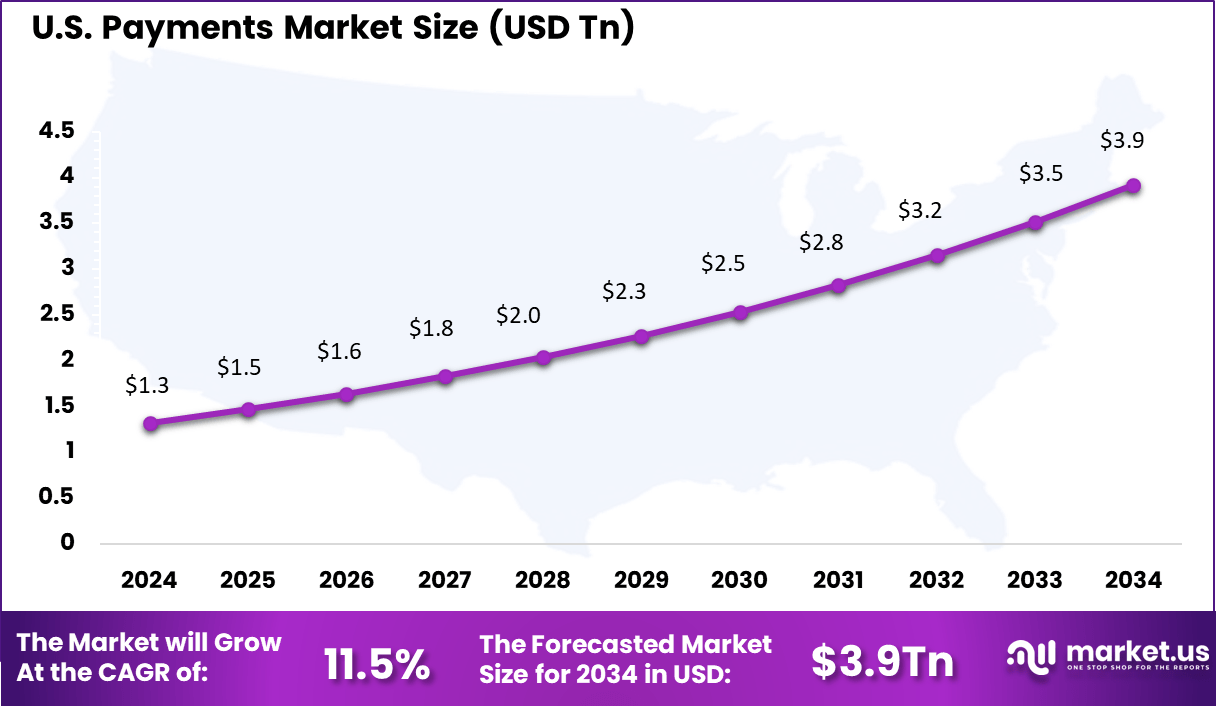

- The U.S. payments market reached USD 1.32 trillion and is expanding at an 11.5% CAGR, driven by contactless payments, real-time transfers, and mobile-first payment behavior.

Quick Market Facts

Growth in the payments market is driven by rising internet penetration, mobile device adoption, and consumer preference for cashless transactions. Digital wallets, contactless cards, and QR code solutions are widely used across urban and rural markets.

Increasing e-commerce activity and the integration of payments into digital platforms support ongoing expansion. Regulatory reforms and infrastructure improvements have further accelerated adoption in many regions. Industry analysis indicates that real-time and digital payment services are increasingly becoming standard across developed and emerging economies.

Demand for payment services continues to rise as businesses seek seamless checkout experiences and consumers prefer fast and secure payment methods. Retail point-of-sale systems, online marketplaces, and peer-to-peer transfers contribute significantly to transaction volumes.

Payment processing infrastructure is evolving to handle varied transaction types and volumes, and businesses increasingly prioritize localization of pricing and payment options to match consumer expectations. Rapid growth in digital payment platforms is reflected in widespread use of wallets, mobile apps, and integrated payment gateways.

By Mode of Payment

Point-of-sale payments lead with 64.8%, showing that in-store and physical transaction environments remain central to global payment activity. Consumers continue to rely on POS systems for everyday purchases such as groceries, fuel, dining, and retail shopping.

The strength of this segment is supported by widespread card acceptance, contactless payment adoption, and digital POS upgrades. Retailers invest in modern POS terminals to improve checkout speed, transaction security, and customer convenience.

By Interaction Channel

The point-of-sale interaction channel accounts for 70.4%, reflecting high transaction volumes processed through physical terminals. POS interaction remains critical for customer-facing payments where immediate confirmation and receipt generation are required.

This segment benefits from rising use of contactless cards, QR codes, and mobile wallets at checkout counters. Improved POS software integration also enables loyalty programs, inventory tracking, and real-time payment analytics.

By Transaction Type

Person-to-person transactions represent 45.3%, highlighting the growing role of digital money transfers between individuals. P2P payments are widely used for bill sharing, peer transfers, and small personal transactions.

Growth in this segment is driven by mobile payment apps and instant transfer capabilities. Users value speed, low transaction cost, and ease of use, which continue to support rising adoption of P2P payment solutions.

By End User Industry

The retail sector holds 37.8%, making it the largest end-user industry in the payments market. Retailers process high volumes of daily transactions across physical stores and omnichannel environments.

Retail payment demand is supported by rising consumer spending and digital checkout options. Retailers focus on payment flexibility, security, and fast processing to improve customer experience and reduce transaction friction.

By Region

North America accounts for 36.4%, supported by advanced payment infrastructure and strong consumer adoption of digital and contactless payments. The region benefits from high card usage and widespread POS penetration across industries.

The United States reached USD 1.32 Trillion with a CAGR of 11.5%, reflecting steady growth in electronic payments. Expansion of mobile wallets, real-time payments, and digital commerce continues to strengthen the payments ecosystem.

Emerging Trends

Shift Toward Contactless and Wallet-Based Payments

A key trend in the payments market is the shift toward contactless and wallet-based spending. Consumers are increasingly using tap-to-pay cards, QR codes, and mobile apps for daily purchases. These methods reduce waiting times and offer smoother payment experiences. As retailers upgrade point-of-sale systems, contactless adoption is rising across both small stores and large chains.

Another important trend is the integration of payments into everyday platforms such as ride-hailing apps, food delivery services, and online marketplaces. These platforms allow users to complete transactions without entering payment information repeatedly. This convenience encourages more people to adopt mobile and in-app payments, strengthening the role of digital systems in routine spending.

Growth Factors

Expansion of E-Commerce and Digital Banking

A major growth factor is the rise of e-commerce. Online shopping continues to grow across all age groups, leading to higher demand for secure and efficient payment systems. Digital payment methods support quick checkout, recurring billing, and refunds, which helps businesses manage larger customer volumes. As more people shop online, electronic payment usage expands naturally.

Another growth factor is the growing availability of digital banking services. Many banks now offer mobile apps that support instant transfers, bill payments, and wallet loading. These tools make digital payments easier for users who previously relied on cash. As more customers gain access to app-based banking, the overall volume of electronic payments increases steadily.

Investment and Business Benefits

Investment opportunities in the payments market exist in digital wallet technologies, cross-border payment platforms, security and fraud prevention solutions, and real-time settlement infrastructure. The growth of embedded payments and partnerships between traditional financial institutions and technology providers also creates new avenues for investment.

Startups and fintechs are innovating in niche payments areas such as buy-now-pay-later services, peer-to-peer remittances, and programmable payments, attracting interest from strategic and financial investors. For businesses, modern payment technologies offer improved customer experience, faster transaction processing, and lower operational costs.

Enhanced payment security and fraud mitigation reduce financial risk. Digital payment data also supports business insights and loyalty programs that can strengthen customer relationships. Payment solutions that support multiple channels and currencies help businesses expand into new markets and serve global customers more effectively.

Key Market Segments

By Mode of Payment

- Point-of-Sale

- Card (Debit, Credit, Pre-paid)

- Digital Wallets (Apple Pay, Google Pay, Interac Flash)

- Cash

- Other POS (Gift-cards, QR, Wearables)

- Online

- Card (Card-Not-Present)

- Digital Wallet & Account-to-Account (Interac e-Transfer, PayPal)

- Other Online (COD, BNPL, Bank Transfer)

By Interaction Channel

- Point-of-Sale

- E-commerce/M-commerce

By Transaction Type

- Person-to-Person (P2P)

- Consumer-to-Business (C2B)

- Business-to-Business (B2B)

- Remittances & Cross-border

By End-user Industry

- Retail

- Entertainment & Digital Content

- Healthcare

- Hospitality & Travel

- Government & Utilities

- Other End-user Industries

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growth of Digital Commerce and Mobile Adoption

A major driver for the payments market is the rapid expansion of digital commerce. Consumers increasingly shop online for goods and services, creating demand for secure and efficient payment systems. Businesses also adopt online billing and invoicing tools that rely on electronic payments. This shift requires payment providers to support high transaction volumes and offer reliable settlement processes.

Another driver is widespread smartphone usage. Mobile devices serve as a gateway to banking apps, digital wallets, and contactless payments. This encourages users to adopt electronic transactions for everyday spending. As mobile adoption increases across both urban and rural regions, digital payments become more accessible to a larger segment of the population.

Restraint Analysis

Security Concerns and Infrastructure Gaps

A key restraint in the payments market is the presence of fraud risks and security concerns. Payment systems must protect users against unauthorized transactions, data breaches, and identity theft. Implementing secure authentication, encryption, and monitoring tools increases operational costs for service providers. These risks may discourage users from adopting digital payments, especially in regions with limited cyber awareness.

Another restraint is uneven payment infrastructure across countries. Some regions lack reliable internet access, secure banking networks, or merchant acceptance systems. This limits the ability of consumers to use digital payments in daily life. Infrastructure gaps also restrict financial institutions from rolling out advanced payment solutions, slowing market expansion in specific areas.

Opportunity Analysis

Expansion of Financial Inclusion and Digital Wallet Usage

There is a strong opportunity in promoting financial inclusion through digital payment solutions. In many developing regions, large populations remain outside the formal banking system. Mobile wallets, prepaid cards, and simple digital transfer tools allow these users to participate in financial activities without traditional bank accounts. Payment providers that offer low-cost and easy-to-use services can reach new customer segments.

Another opportunity arises from increasing demand for digital wallets and contactless payments. Consumers prefer systems that allow quick, tap-based transactions or QR-based payments. This demand extends to public transport, retail purchases, and peer-to-peer transfers. Payment companies that offer smooth and integrated digital wallet experiences can gain strong market growth across multiple sectors.

Challenge Analysis

Regulatory Compliance and Cross-Border Payment Complexity

A major challenge for the payments market is navigating complex regulatory requirements. Payment providers must comply with rules related to anti-money-laundering, identity verification, data protection, and transaction monitoring. Meeting these obligations requires investment in technology and compliance teams. Failure to comply can lead to penalties or operational restrictions, which increases the overall risk for market participants.

Another challenge involves the complexity of cross-border payments. Differences in currency rules, banking standards, and settlement frameworks can slow transaction processing and increase costs. Users often face delays and unfavorable exchange conversions when sending money internationally. Payment providers must coordinate with multiple financial systems to improve cross-border speed and reliability, which is a difficult and resource-intensive task.

Competitive Analysis

Visa, Mastercard, China UnionPay, Ant Group, PayPal, Apple Pay, and Google Pay lead the payments market through large scale card networks and digital wallet ecosystems. Their platforms enable secure, high volume transactions across online, mobile, and in store channels. These companies focus on global acceptance, fraud prevention, and seamless user experience. Rising cashless adoption and growth in digital commerce continue to reinforce their leadership.

American Express, Adyen, Stripe, Block, Worldline, FIS, Fiserv, and Global Payments strengthen the market with merchant acquiring, payment processing, and value added services. Their solutions support omnichannel payments, subscription billing, and cross border transactions. These providers emphasize scalability, API based integration, and real time settlement. Growing demand from enterprises and small businesses supports their expanding role.

Klarna, Razorpay, PayU, Revolut, and other players broaden the landscape with alternative payment methods, BNPL services, and region focused platforms. Their offerings improve payment flexibility, financial inclusion, and local market penetration. These companies focus on speed, transparency, and customer centric design. Increasing fintech innovation and mobile payment usage continue to drive steady growth in the global payments market.

Top Key Players in the Market

- Visa Inc.

- Mastercard Incorporated

- China UnionPay Co., Ltd.

- Ant Group Co., Ltd. (Alipay)

- PayPal Holdings, Inc.

- Apple Inc. (Apple Pay)

- Google LLC (Google Pay)

- Amazon.com, Inc. (Amazon Pay)

- American Express Company

- Adyen N.V.

- Stripe, Inc.

- Block, Inc. (Square & Afterpay)

- Worldline SA

- Fidelity National Information Services, Inc. (FIS)

- Fiserv, Inc.

- Global Payments Inc.

- Klarna Bank AB

- Razorpay Software Pvt. Ltd.

- PayU Payments Pvt. Ltd.

- Revolut Ltd.

- Others

Recent Developments

- December, 2025: Visa launched stablecoin settlement using USDC for U.S. institutions, handling over $3.5 billion in annualized volume to speed up cross-border payouts.

- November, 2025: Visa expanded Visa Intelligent Commerce in Asia Pacific with partners like Ant International, Microsoft, and Stripe, planning pilots by early 2026 for AI-agent transactions.

- November, 2025: Visa expanded Visa Intelligent Commerce in Asia Pacific with partners like Ant International, Microsoft, and Stripe, planning pilots by early 2026 for AI-agent transactions.

Future Outlook and Opportunities

The future outlook for the payments market remains positive, with expectations of continued digital transformation and expanded use of advanced technologies such as artificial intelligence and machine learning for risk management and personalization. Real-time payments, embedded commerce solutions, and interoperable digital wallets are likely to shape the next phase of growth.

Collaboration between financial institutions, regulators, and technology firms will be essential to support innovation and maintain secure, scalable systems. Continued growth in digital commerce and financial inclusion initiatives will sustain long term demand for diverse payment solutions.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Bn Forecast Revenue (2034) USD 16.7 Bn CAGR(2025-2034) 14.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Mode of Payment (Point-of-Sale, Card (Debit, Credit, Pre-paid), Digital Wallets (Apple Pay, Google Pay, Interac Flash), Cash, Other POS (Gift-cards, QR, Wearables), Online, Card (Card-Not-Present), Digital Wallet & Account-to-Account (Interac e-Transfer, PayPal), Other Online (COD, BNPL, Bank Transfer)), By Interaction Channel (Point-of-Sale, E-commerce/M-commerce), By Transaction Type (Person-to-Person (P2P), Consumer-to-Business (C2B), Business-to-Business (B2B), Remittances & Cross-border), By End-user Industry (Retail, Entertainment & Digital Content, Healthcare, Hospitality & Travel, Government & Utilities, Other End-user Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Visa Inc., Mastercard Incorporated, China UnionPay Co., Ltd., Ant Group Co., Ltd. (Alipay), PayPal Holdings, Inc., Apple Inc. (Apple Pay), Google LLC (Google Pay), Amazon.com, Inc. (Amazon Pay), American Express Company, Adyen N.V., Stripe, Inc., Block, Inc. (Square & Afterpay), Worldline SA, Fidelity National Information Services, Inc. (FIS), Fiserv, Inc., Global Payments Inc., Klarna Bank AB, Razorpay Software Pvt. Ltd., PayU Payments Pvt. Ltd., Revolut Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Visa Inc.

- Mastercard Incorporated

- China UnionPay Co., Ltd.

- Ant Group Co., Ltd. (Alipay)

- PayPal Holdings, Inc.

- Apple Inc. (Apple Pay)

- Google LLC (Google Pay)

- Amazon.com, Inc. (Amazon Pay)

- American Express Company

- Adyen N.V.

- Stripe, Inc.

- Block, Inc. (Square & Afterpay)

- Worldline SA

- Fidelity National Information Services, Inc. (FIS)

- Fiserv, Inc.

- Global Payments Inc.

- Klarna Bank AB

- Razorpay Software Pvt. Ltd.

- PayU Payments Pvt. Ltd.

- Revolut Ltd.

- Others