Global Payment Analytic Software Market Size, Share, Industry Analysis Report By Deployment (Cloud-based, On-premise), By Enterprise Size (Large Enterprises, SMEs (Small & Medium Enterprises)), By End-User Industry (BFSI, Healthcare, Government, Others (Transportation, Hospitality, etc.)), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158904

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Investment and Businesses Benefit

- Role of Generative AI

- U.S. Market Size

- By Deployment Analysis

- By Enterprise Size Analysis

- By End-User Industry

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

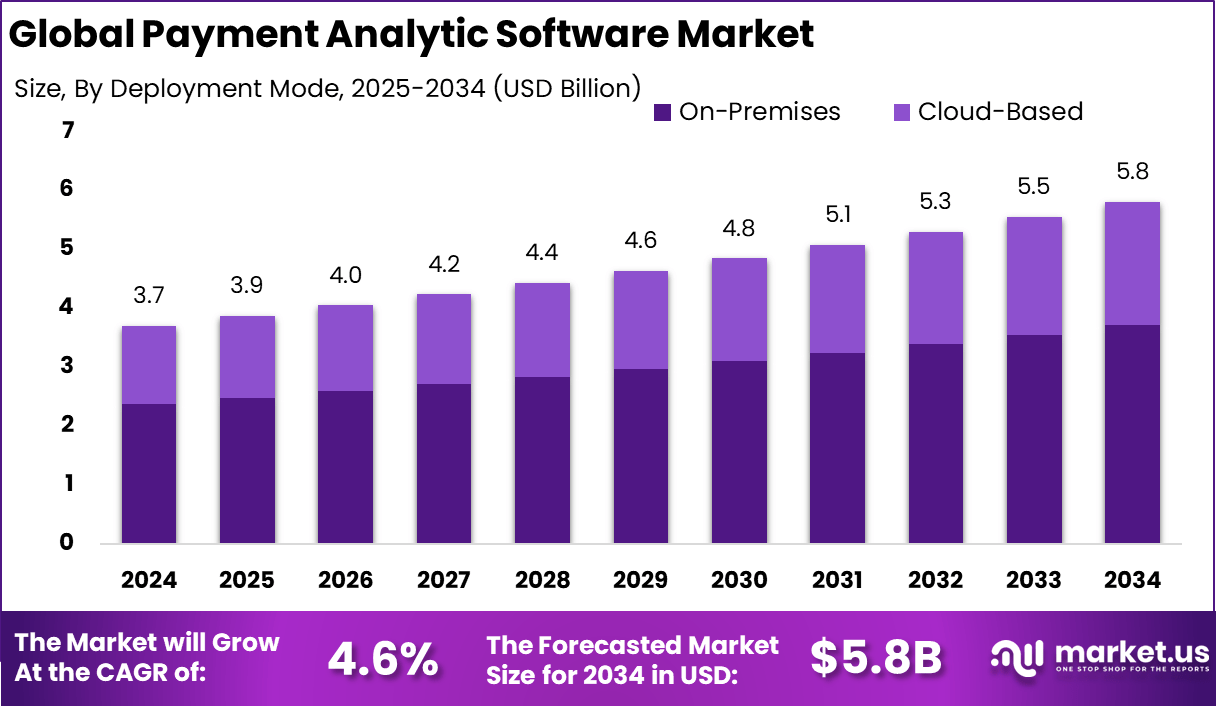

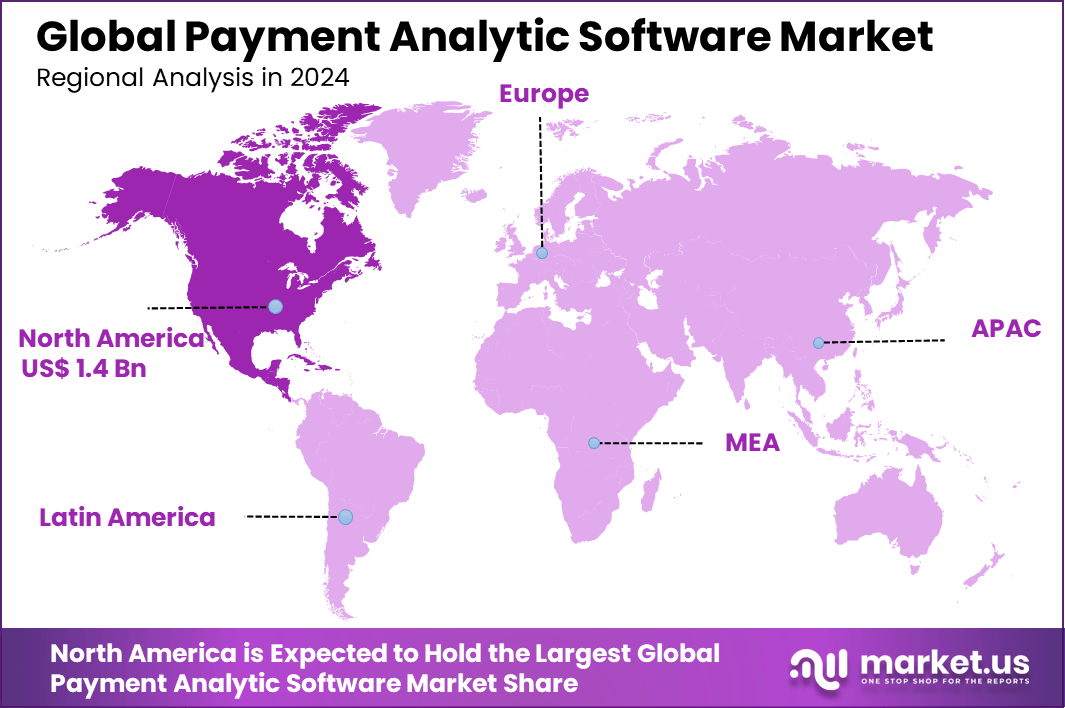

The Global Payment Analytic Software Market size is expected to be worth around USD 5.8 billion by 2034, from USD 3.7 billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38% share, holding USD 1.4 Billion revenue.

The Payment Analytics Software Market refers to the industry that provides platforms and tools for analyzing payment transactions, customer behavior, and financial data in real time. These solutions help businesses and financial institutions optimize payment processes, identify trends, detect fraud, improve customer experiences, and make data-driven decisions.

The market is driven by the rapid growth of digital transactions and the rising adoption of mobile wallets, contactless payments, and online banking. Businesses are under pressure to optimize transaction performance and reduce payment failures. The increasing threat of payment fraud and cybercrime is further fueling adoption, as analytics platforms help detect anomalies in real time.

Demand is strong in retail and e-commerce, where businesses rely on analytics to track consumer preferences and optimize checkout processes. Banks and financial institutions use these solutions to monitor transaction patterns, detect suspicious activity, and ensure compliance with regulatory frameworks. The hospitality and travel sectors are adopting payment analytics to improve customer experiences and reduce chargebacks.

Key Takeaways

- In 2024, the Cloud-based segment dominated, capturing 64% share, supported by demand for scalable and cost-efficient analytics platforms.

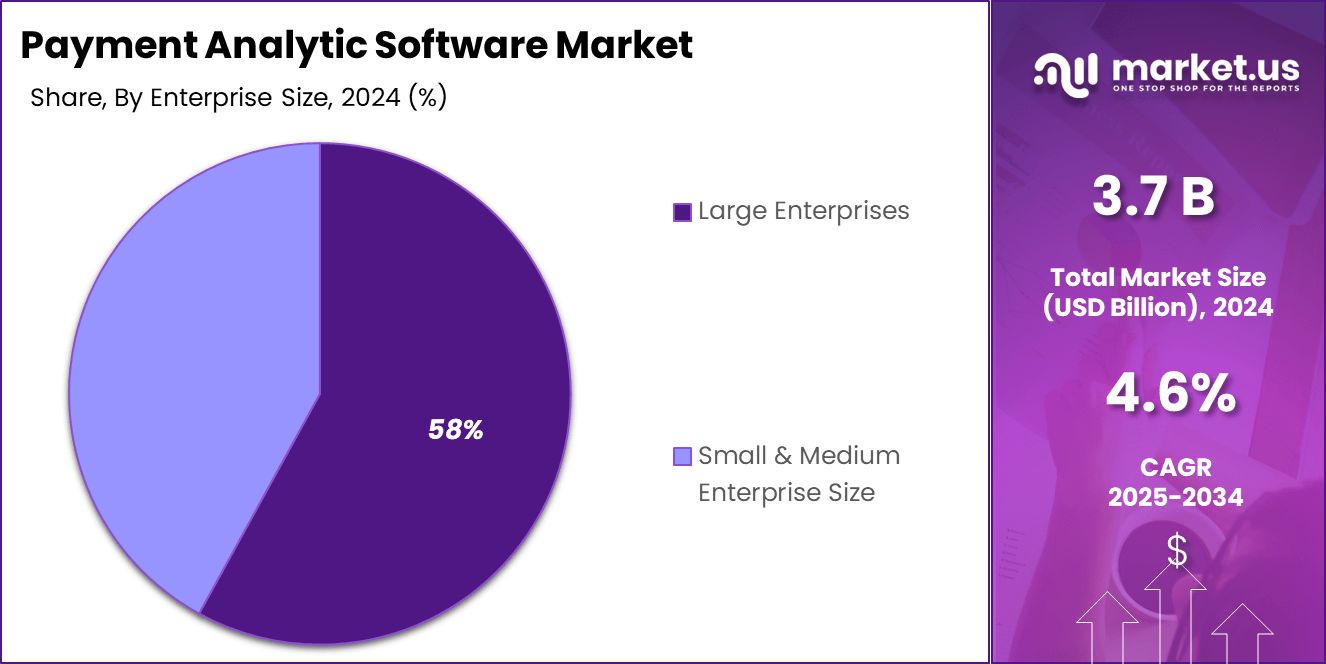

- By enterprise size, Large Enterprises led the market with 58% share, driven by complex transaction volumes and advanced fraud detection needs.

- By industry, the Retail sector held a 35% share, reflecting the sector’s reliance on payment analytics for customer insights and revenue optimization.

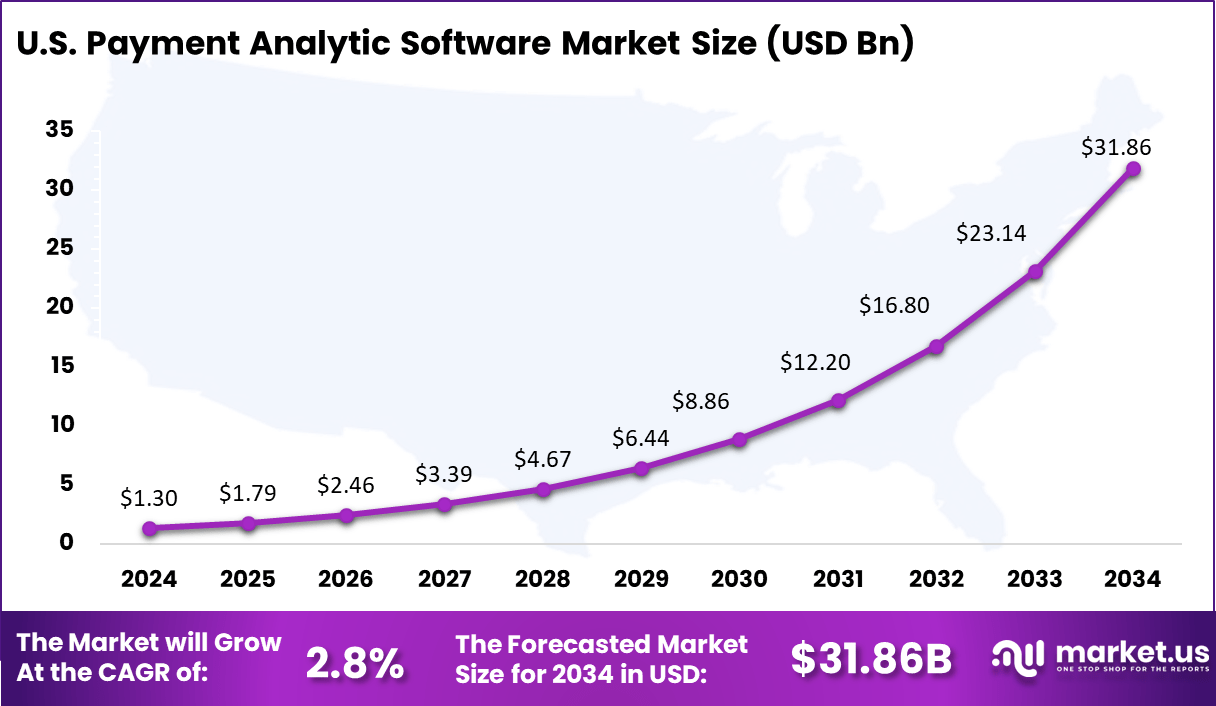

- The U.S. market was valued at USD 1.3 Billion in 2024, expanding at a steady CAGR of 2.8%.

- Regionally, North America accounted for 38% share in 2024, underscoring its advanced digital payment infrastructure.

- According to the Federal Reserve Board, general-purpose (GP) card payments in the U.S. reached 153.3 billion transactions, amounting to USD 9.76 Trillion in value.

Analysts’ Viewpoint

The market is witnessing rapid adoption of artificial intelligence and machine learning to enhance predictive capabilities and detect fraudulent transactions. Cloud-based payment analytics platforms are becoming mainstream, providing scalability and real-time reporting across multiple channels. Advanced data visualization tools are being integrated for better interpretation of payment trends.

Blockchain is also being explored for transparent and secure payment analysis, particularly in cross-border transactions. Integration with big data platforms is allowing companies to combine payment analytics with broader business intelligence strategies. Organizations adopt payment analytics software to reduce operational risks, improve customer satisfaction, and maximize revenue opportunities.

Investment and Businesses Benefit

Investment opportunities exist in AI-powered fraud detection platforms, cloud-native payment analytics solutions, and industry-specific applications tailored to e-commerce, healthcare, and fintech. Startups focusing on real-time payment intelligence and cross-border payment monitoring are attracting strong interest.

The rapid adoption of digital payments in emerging markets offers further opportunities for investors and solution providers. Strategic collaborations between analytics providers and payment gateways are also opening new growth avenues.

Businesses benefit from payment analytics software through improved revenue assurance, reduced fraud-related losses, and enhanced customer engagement. Real-time insights allow companies to respond quickly to issues such as failed transactions or unusual activity. Analytics supports better financial planning and improved operational efficiency.

Role of Generative AI

Generative AI is increasingly critical in payment analytics for its ability to automate complex data interpretation and enhance user experience. Nearly half of executives recognize generative AI boosts productivity by offering actionable insights that simplify payment data management.

AI now extends beyond large language models focusing instead on practical application in payment solutions such as embedded finance, where it helps gig workers efficiently categorize income and expenses, offering transparency and financial optimization.

AI also improves fraud detection by identifying sophisticated threats like deepfakes, helping payment providers reduce fraud losses by over 50%. Payment providers using AI-driven analytics report up to 45% productivity improvement in team workflows and accelerated accounts payable processes by 80% or more, driving cost savings and operational efficiency.

U.S. Market Size

The U.S. Payment Analytic Software Market was valued at USD 1.3 Billion in 2024 and is anticipated to reach approximately USD 31.86 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 2.8% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 38% share and generating USD 1.4 billion in revenue in the payment analytic software market. The region’s leadership is driven by the strong presence of digital payment ecosystems, high credit and debit card usage, and rapid adoption of mobile wallets.

Financial institutions and retailers in the United States and Canada are increasingly relying on payment analytic software to track transaction patterns, enhance fraud detection, and optimize customer experiences. This reliance has created steady demand for advanced platforms that can process massive volumes of payment data in real time.

North America’s dominance is further supported by a mature fintech landscape and significant investment in artificial intelligence and machine learning. These technologies are being widely integrated into payment analytics to generate deeper insights, enabling businesses to better predict customer behavior and improve revenue streams.

Europe’s payment analytics software market is expanding with a CAGR estimated around 4.0%. Growth is supported by increasing smartphone usage, development of mobile commerce, and growing adoption of technologies like NFC and RFID for quick payment solutions. Regulatory initiatives encouraging digital payments also foster market expansion across the region.

Asia Pacific is growing rapidly with a CAGR over 5%, fueled by smartphone penetration, rising e-commerce adoption, and increasing use of digital wallets. Countries like China and India lead this growth through broad consumer demand for convenient mobile payments and strong fintech ecosystems. The increasing digitalization of payments across sectors strengthens market traction in this region.

Latin America shows a growth trajectory exceeding 4.5% CAGR, driven by expanding e-commerce, higher smartphone usage, and adoption of real-time payment systems like Pix in Brazil. The region faces some regulatory and infrastructure challenges, but innovations in mobile wallets and open banking are shaping a dynamic payments landscape that supports increased use of payment analytics software.

By Deployment Analysis

In 2024, Cloud-based deployment dominates the payment analytics software market with a share of 64%. This is largely due to the flexibility it offers businesses in scaling operations and managing data without the need for heavy upfront investment in infrastructure. Cloud solutions provide real-time analytics and seamless integration with other software tools, which is essential for handling the complexities of modern payment ecosystems.

Moreover, cloud deployment ensures better accessibility across global teams and enhances data security protocols. As companies prioritize agility and remote accessibility, cloud-based payment analytics software becomes the preferred choice, allowing faster response to market changes and improved operational efficiency.

By Enterprise Size Analysis

In 2024, Large enterprises represent a majority share of 58% in the payment analytics software market. These organizations tend to have more complex payment environments, with multiple channels and high transaction volumes requiring sophisticated analytics capabilities. Payment analytics software helps these enterprises optimize cash flow, detect fraud, and improve customer payment experiences at scale.

Furthermore, large enterprises are more likely to invest in advanced analytics tools to meet regulatory compliance and automate payment processes. Their ability to absorb the costs of implementing comprehensive software solutions also accelerates adoption in this segment.

By End-User Industry

In 2024, the retail sector accounts for 35% of the demand for payment analytics software. In retail, understanding consumer payment behavior is vital as it directly influences sales strategies and inventory management. Payment analytics enables retailers to identify trends, assess payment method preferences, and optimize checkout flows for enhanced customer experience.

Retailers are increasingly using payment analytics to personalize offers and loyalty programs, helping to improve customer retention. The ability to merge payment data with other customer data sets also creates a more holistic view of purchasing patterns, further driving informed business decisions in the retail industry.

Emerging Trends

The payment analytics field in 2025 is shaped by personalization, real-time payments, and integrated finance solutions. More than 70% of consumers will abandon purchases if their preferred payment method is unavailable, putting pressure on providers to support diverse options. Account-to-account (A2A) payments continue to grow rapidly, particularly in emerging markets, driven by instant payment rails and open banking.

The shifts toward seamless payment experiences and hyper-personalized customer journeys reflect growing consumer demands, especially among Millennials and Gen Z. Cross-border payment innovations like central bank digital currencies and distributed ledger technology are also contributing to this evolution, moving payments toward faster, safer, and more transparent systems.

Growth Factors

Several clear factors support solid growth in the payment analytics software market. Increasing smartphone penetration combined with expanding 4G and 5G networks enhances user accessibility globally, particularly in developing economies.

The rise in digital transactions due to e-commerce and subscription services fuels the demand for better payment tracking and analysis. Additionally, enterprises prioritize cost reduction and operational efficiency, motivating adoption of AI and analytics solutions that reduce days sales outstanding and optimize cash flow forecasting.

Large enterprises are the primary growth engines, as they seek to simplify billing and offer advanced payment options tailored to customer expectations. Regions like Asia-Pacific are experiencing the fastest expansion thanks to economic growth, internet infrastructure, and digital adoption.

Key Market Segments

By Deployment

- Cloud-based

- On-premise

By Enterprise Size

- Large Enterprises

- SMEs (Small & Medium Enterprises)

By End-User Industry

- Retail

- BFSI

- Healthcare

- Government

- Others (Transportation, Hospitality, etc.)

Driver Analysis

Rising Adoption of Digital Payments

A major driver of the Payment Analytics Software Market is the rapid increase in digital payment transactions worldwide. As more businesses and consumers shift from cash to digital methods like mobile wallets, credit cards, and online platforms, there is a growing need for tools that can analyze vast amounts of payment data efficiently.

Companies use payment analytics software to track revenue flows, identify payment trends, and enhance customer experience by understanding purchasing behavior. This digital transformation of payments boosts demand for analytics software that can provide actionable insights, helping businesses optimize their payment processes and increase profitability.

For instance, retail and e-commerce sectors heavily use payment analytics software to monitor transaction performance and prevent fraud. This software combines data from multiple payment channels, centralizing information to give a clear picture of financial flows. Companies can visualize sales success or challenges in real-time and adjust strategies to capture missed revenue opportunities.

Restraint Analysis

High Initial Investment and Complexity

One of the main restraints restricting the faster adoption of payment analytics software is the high initial investment cost associated with integrating these advanced systems. Implementing sophisticated software solutions requires significant capital expenditure, especially for small and medium-sized businesses that may lack the budget or resources.

Additionally, the complexity of setting up, customizing, and training staff to effectively use payment analytics platforms can be a barrier. These systems often require specialized skills to manage and interpret the large volumes of payment data, which can be scarce or expensive to acquire.

For example, smaller retailers or emerging enterprises may hesitate to invest in these technologies due to the upfront costs and the challenge of acquiring data analytics expertise. The learning curve and requirement for ongoing technical support can also slow down adoption. High costs and operational issues may restrict adoption in smaller firms or less developed markets.

An important opportunity for the payment analytics software market is the increasing integration of artificial intelligence (AI) and machine learning (ML) capabilities. These technologies can significantly enhance the predictive and prescriptive power of payment analytics by identifying patterns that human analysts might miss.

AI-driven analytics can improve fraud detection, risk management, and customer segmentation by processing large datasets in real-time with high accuracy. This ability attracts financial institutions, retailers, and other sectors that demand smarter, faster decision-making tools.

For instance, companies integrating AI in payment analytics can offer more personalized services to customers while reducing fraudulent transactions and optimizing payment workflows. The opportunity for vendors lies in innovating with AI-enhanced features that differentiate their solutions in a competitive market.

Challenge Analysis

Data Privacy and Regulatory Compliance

A significant challenge faced by the payment analytics software market is navigating data privacy concerns and regulatory compliance. Payment data is highly sensitive, involving personal and financial information that must be protected under various national and international laws.

Companies must ensure that their analytics practices comply with regulations such as GDPR in Europe or PCI DSS standards for payment security. Meeting these requirements involves continuous updates to software, strong security protocols, and transparent data handling processes. For example, failure to comply with data privacy regulations can lead to severe fines and reputational damage. This challenge requires vendors to invest heavily in security measures and compliance frameworks.

Business users also face challenges in managing data governance as regulations evolve, complicating their analytics efforts. The need for secure and compliant analytics solutions can slow adoption and increase operational costs, presenting a hurdle for market growth despite the expanding demand for payment insights.

Key Players Analysis

In the payment analytic software market, ACI Payment Systems, BNY Mellon NEXEN, and BlueSnap are recognized as major players. Their platforms offer advanced tools for tracking transactions, analyzing customer behavior, and detecting payment anomalies. These companies serve global enterprises and financial institutions by focusing on security, compliance, and scalability.

Specialized firms such as HiPay Intelligence, IXOPAY, Yapstone, and Amaryllis strengthen the market with solutions tailored for e-commerce, subscription billing, and cross-border payments. Their analytics help businesses improve payment success rates, optimize gateways, and manage fraud risks.

Smaller and niche players including Profitable, CashNotify, Databox, MRR.io, Payfirma, PaySketch, RJMetrics, Revealytics, and Putler contribute by providing cost-effective and user-friendly platforms. Their tools are especially suited for start-ups, SMEs, and digital merchants seeking actionable insights without complex integrations.

Top Key Players in the Market

- Profitable

- BlueSnap

- CashNotify

- Databox

- HiPay Intelligence

- IXOPAY

- MRR.io

- Payfirma

- PaySketch

- RJMetrics

- Yapstone

- Putler

- ACI Payment Systems

- BNY Mellon NEXEN

- Revealytics

- Amaryllis

- Other Key Players

Recent Developments

- In September 2025, IXOPAY integrated J.P. Morgan Payments’ Commerce Platform, allowing merchants to connect through IXOPAY’s orchestration platform via a single API. This enables improved approval rates, reduced costs, and simplified global expansion.

- In July 2025, BlueSnap expanded its Channel Partner Program by adding 11 new system integrators since its launch in September 2024, growing the program by 137% to 41 partners globally. This reflects strong demand for scalable, cross-border payment orchestration solutions

Report Scope

Report Features Description Market Value (2024) USD 3.7 Bn Forecast Revenue (2034) USD 5.8 Bn CAGR(2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered by Deployment (Cloud-based, On-premise), by Enterprise Size (Large Enterprises, SMEs (Small & Medium Enterprises)), by End-User Industry (BFSI, Healthcare, Government, Others (Transportation, Hospitality, etc.)), Region Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Profitable, BlueSnap, CashNotify, Databox, HiPay Intelligence, IXOPAY, MRR.io, Payfirma, PaySketch, RJMetrics, Yapstone, Putler, ACI Payment Systems, BNY Mellon NEXEN, Revealytics, Amaryllis, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Payment Analytic Software MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Payment Analytic Software MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Profitable

- BlueSnap

- CashNotify

- Databox

- HiPay Intelligence

- IXOPAY

- MRR.io

- Payfirma

- PaySketch

- RJMetrics

- Yapstone

- Putler

- ACI Payment Systems

- BNY Mellon NEXEN

- Revealytics

- Amaryllis

- Other Key Players