Pay TV Market By Technology (Cable TV, Satellite TV, Internet Protocol Television (IPTV)), By Application (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 124214

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

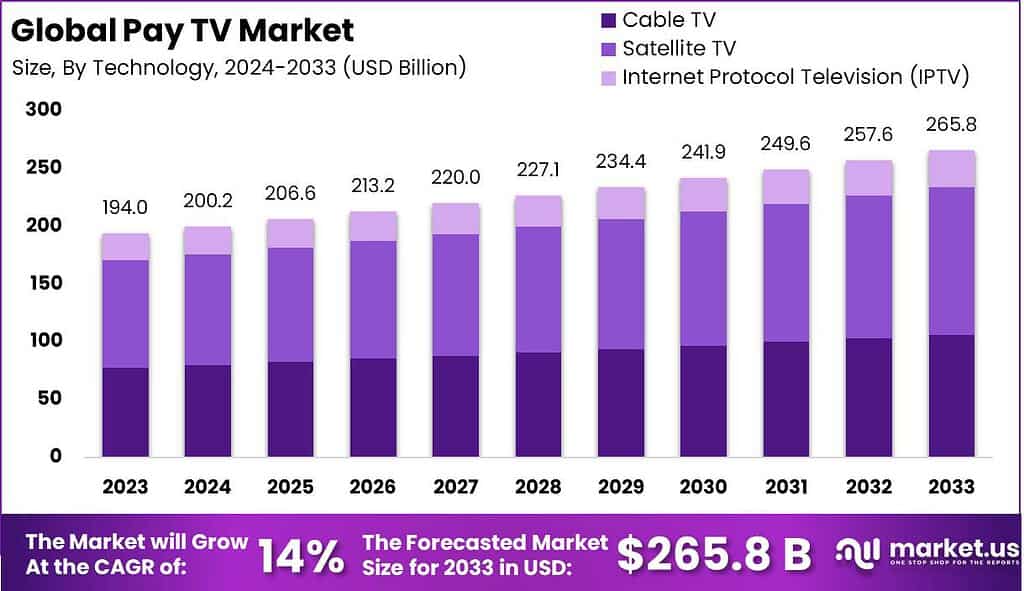

The Global Pay TV Market size is expected to be worth around USD 265.8 Billion By 2033, from USD 194.0 Billion in 2023, growing at a CAGR of 14% during the forecast period from 2024 to 2033.

Pay TV, also known as subscription television, refers to a service where viewers pay a fee to access a variety of television channels and programming. This payment model allows users to enjoy a wide range of entertainment options, including movies, TV shows, sports events, news, and specialized content. The Pay TV market encompasses the industry and businesses involved in providing these subscription-based television services.

The Pay TV market has grown significantly in recent years, driven by several factors. One of the main reasons for its growth is the increasing demand for diverse and high-quality entertainment content. People enjoy having access to a wide array of television channels and programs, tailored to their specific interests and preferences. Pay TV providers fulfill this demand by offering comprehensive packages that include numerous channels, including those dedicated to movies, sports, documentaries, and more.

Another factor contributing to the growth of the Pay TV market is technological advancements. The advent of digital technology and high-speed internet has revolutionized the way television is consumed. Pay TV operators have embraced these advancements, offering services such as video-on-demand, digital recording, and interactive features that enhance the viewing experience.

However, the Pay TV market faces significant challenges. One of the main issues is the increasing competition from over-the-top (OTT) streaming services like Netflix, Amazon Prime, and Disney+. These platforms offer flexible subscription models and a vast content library, making them attractive alternatives to traditional Pay TV.

Additionally, the high subscription costs associated with Pay TV services are a deterrent for price-sensitive customers, further fueling the shift towards more affordable streaming options. Despite these challenges, there are considerable opportunities within the Pay TV market. Innovations in content delivery, such as ultra-high-definition (UHD) and interactive TV, provide new avenues for market expansion.

Pay TV providers can also capitalize on the growing interest in local and niche content, catering to specific audience segments. Moreover, partnerships with OTT platforms to offer integrated viewing experiences can help Pay TV operators retain and attract subscribers. By adapting to changing consumer needs and leveraging technological advancements, the Pay TV market can continue to thrive in the evolving entertainment landscape.

According to study, the number of pay TV subscribers across 138 countries is projected to reach 1.03 billion by 2027, showing a slight increase from the figures recorded in 2021. This growth is primarily driven by the expanding pay TV market in developing countries. However, the percentage of pay TV subscribers as a portion of total TV households is expected to decline slightly from its peak of 61% in 2018 to 57% by 2027.

IPTV (Internet Protocol Television) is anticipated to experience significant growth, adding 79 million subscribers between 2021 and 2027, reaching a total of 440 million subscribers. This rise in IPTV adoption will position it as the leading pay TV platform in 2022, surpassing other forms of pay TV services.

On the other hand, pay satellite TV is predicted to lose 12 million subscribers during the same period as households switch to platforms that offer high-speed broadband. This shift indicates a preference for alternative methods of accessing content.

Cable TV subscriptions are also expected to decline, with estimates suggesting a decrease of 56 million subscribers between 2021 and 2027. The total number of cable TV subscribers in 2021, including analog cable TV subscribers, stood at 422 million. However, analog cable TV subscriptions are projected to reach zero by 2027, reflecting the industry’s transition towards digital cable services.

Key Takeaways

- The Global Pay TV Market is projected to reach approximately USD 265.8 billion by 2033, growing from USD 194.0 billion in 2023, with a compound annual growth rate (CAGR) of 14% during the forecast period from 2024 to 2033.

- In 2023, the Satellite TV segment dominated the Pay TV industry, capturing over 48% of the market share.

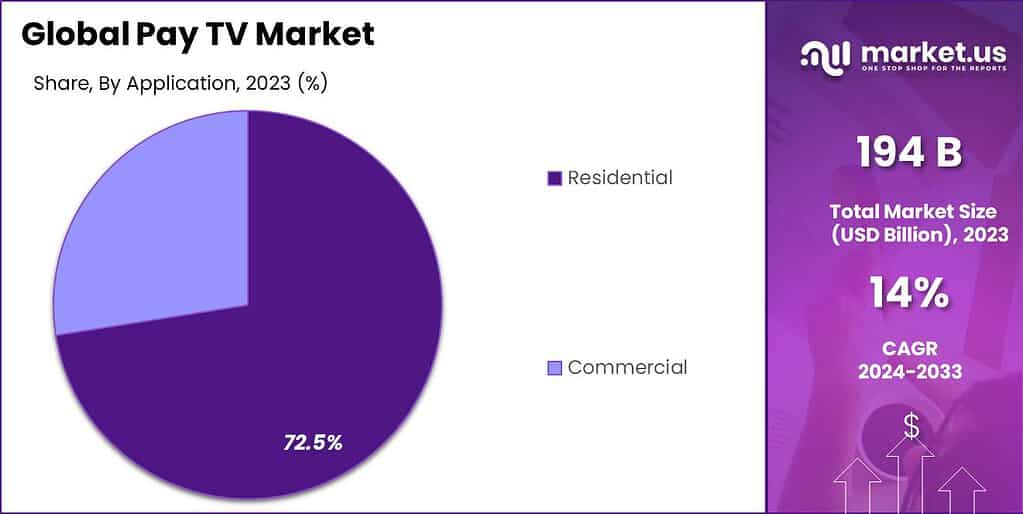

- Similarly, the Residential segment held a leading position in the industry, accounting for more than 72.5% of the market share.

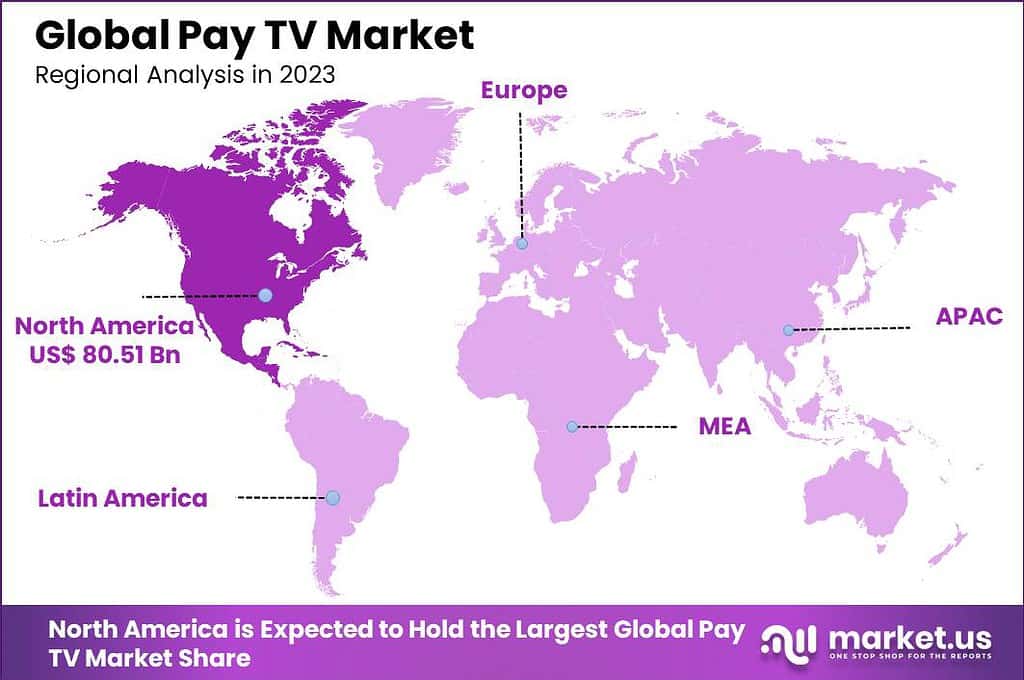

- North America emerged as a dominant region in the Pay TV industry in 2023, holding over 41.5% of the market share, with revenue reaching USD 80.51 billion.

Technology Analysis

In 2023, the Satellite TV segment held a dominant market position in the Pay TV industry, capturing more than a 48% share. This significant market share can be attributed to several key factors. Satellite TV’s widespread availability is a primary driver, as it can reach rural and remote areas where cable and IPTV services may not be accessible.

This broad coverage is particularly advantageous in regions with less developed telecommunications infrastructure, ensuring that satellite TV remains a preferred option for delivering diverse content to a wider audience. Another reason for the leading position of Satellite TV is its capacity to offer a wide array of international channels and premium content, which can be more difficult for cable and IPTV providers to match.

The technology behind Satellite TV allows for a more extensive selection of HD channels and superior broadcast quality, appealing to consumers desiring high-definition viewing experiences. Additionally, the one-time installation of satellite dishes with relatively low ongoing maintenance costs appeals to consumers looking for cost-effective long-term entertainment solutions.

Satellite TV providers have also been proactive in integrating advanced features such as DVR capabilities, on-demand content, and interactive TV services, which enhance user engagement and satisfaction. This adaptability has helped Satellite TV maintain its competitive edge over other technologies in the Pay TV market. As technology evolves and consumer preferences shift, Satellite TV providers continue to innovate, ensuring their offerings remain attractive and relevant in the dynamic entertainment landscape.

Application Analysis

In 2023, the Residential segment held a dominant market position in the Pay TV industry, capturing more than a 72.5% share. This leadership can primarily be attributed to the consistent demand for home entertainment solutions. As families and individuals continue to value in-home leisure and entertainment, Pay TV services remain a popular choice due to their diverse offerings, including a wide range of channels covering sports, movies, news, and lifestyle programming.

The desire for comprehensive entertainment packages that cater to the preferences of all family members underpins the sustained popularity of Pay TV in residential settings. Moreover, the introduction of bundled services by Pay TV providers, which include internet, phone, and television in a single package, has significantly contributed to the appeal of Pay TV for residential customers.

These bundles not only offer convenience but also provide cost savings compared to purchasing these services separately. This bundling strategy has been effective in retaining existing customers and attracting new subscribers who seek simplicity and value in their entertainment and communication needs. The residential segment’s growth is further bolstered by technological advancements such as high-definition (HD) and ultra-high-definition (UHD) broadcasting, which enhance the viewing experience.

As households increasingly invest in advanced television systems and home theater setups, the demand for high-quality broadcast content has risen, reinforcing the position of Pay TV as a preferred provider of premium entertainment content. Moving forward, as Pay TV operators continue to innovate and tailor their offerings to the evolving consumer preferences, the residential segment is expected to maintain its strong market presence.

Key Market Segments

By Technology

- Cable TV

- Satellite TV

- Internet Protocol Television (IPTV)

By Application

- Residential

- Commercial

Driver

Increasing Demand for Premium Content

The Pay TV market continues to be driven by a strong consumer appetite for premium content, including exclusive movies, sports events, and original programming. This desire for high-quality, diverse entertainment options is significant, as it attracts viewers who seek unique and engaging content not readily available on other platforms.

Technological advancements have significantly enhanced the viewing experience by offering higher picture quality, interactive features, and multi-screen capabilities, making pay TV services increasingly appealing. Additionally, as disposable incomes rise, consumers are more willing to allocate part of their budget to entertainment expenses, further bolstering the pay TV market.

Restraint

Rise of Over-The-Top (OTT) Platforms

A major restraint facing the Pay TV industry is the growing popularity of OTT platforms, such as Netflix and Amazon Prime, which offer flexible, cost-effective alternatives to traditional pay TV subscriptions. This trend of “cord-cutting” is increasingly prevalent as consumers opt for streaming services that provide freedom from fixed schedules and long-term contracts. The rise of these platforms challenges Pay TV providers to innovate and adapt their offerings to retain customer interest and compete effectively in a rapidly evolving digital landscape.

Opportunity

Integration of Advanced Technologies

The integration of cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) presents a significant opportunity for the Pay TV sector. These technologies can analyze viewer preferences to offer personalized content recommendations, enhancing user experience and satisfaction.

Additionally, the deployment of high-definition and ultra-high-definition services, alongside interactive features like video on demand and enhanced user interfaces, provides Pay TV services with opportunities to differentiate themselves from competitors and attract a broader audience.

Challenge

Regulatory and Economic Pressures

Pay TV providers face challenges from regulatory environments and economic factors that can impact growth and operational efficiency. Stringent regulations and licensing requirements across different regions can limit the flexibility of Pay TV services to expand and innovate.

Furthermore, economic pressures such as rising content costs and the necessity to invest in new technologies strain profit margins. Pay TV operators must navigate these challenges while continuing to offer competitive and appealing services to their subscribers.

Growth Factors

- Rising Demand for High-Quality Content: The Pay TV market continues to expand, fueled by consumers’ growing appetite for high-quality, diverse entertainment options such as exclusive movies and sports events.

- Technological Advancements: Innovations in digital broadcasting, such as high-definition (HD) and ultra-high-definition (UHD) viewing, are enhancing the overall consumer experience, making Pay TV a more attractive option.

- Increased Internet Penetration: As more households worldwide gain access to high-speed internet, the reach and reliability of Internet Protocol Television (IPTV) services improve, supporting market growth particularly in regions like Asia-Pacific.

- Bundling of Services: Pay TV providers are increasingly offering bundled services that include internet, phone, and television, which not only provides convenience but also cost savings to consumers.

- Globalization of Content: The ability to offer a wide array of international programming allows Pay TV to meet the varied cultural and language preferences of a global audience, driving subscriber growth.

Emerging Trends

- Shift Towards OTT and Streaming Services: The integration of over-the-top (OTT) services with traditional Pay TV offerings allows providers to offer a more comprehensive package, catering to the shift in consumer preference towards on-demand content.

- Personalization Through AI and Machine Learning: Advanced technologies like AI and ML are being used to analyze viewer preferences and provide personalized content recommendations, enhancing user engagement and satisfaction.

- Expansion in Emerging Markets: The Pay TV market is expanding in emerging economies due to increasing digitalization and more affordable internet services, which enhance the accessibility of Pay TV services.

- Interactive and Multi-Screen Features: Innovations that allow multi-screen viewing and more interactive user interfaces are becoming common, catering to the needs of a technologically adept audience.

- Regulatory Changes and Market Adaptation: Changes in regulatory frameworks across different regions are prompting Pay TV providers to adapt their business models and offerings to comply with new standards and to capitalize on new market opportunities.

Regional Analysis

In 2023, North America held a dominant market position in the Pay TV industry, capturing more than a 41.5% share, with revenue amounting to USD 80.51 billion. This significant market presence is primarily driven by high consumer spending on entertainment and the widespread availability of advanced Pay TV services across the United States and Canada.

The region’s well-developed telecommunications infrastructure facilitates the widespread adoption of diverse Pay TV services, including cable, satellite, and IPTV, each tailored to suit the varied preferences of a technologically savvy population. The leadership of North America in the Pay TV market is also supported by the presence of major industry players and content producers in the region.

Hollywood and other local content industries provide a rich source of entertainment that bolsters the demand for Pay TV services. These services not only deliver mainstream entertainment but also cater to niche markets with specialized programming, such as regional sports, local news, and cultural content, which resonates well with the diverse demographic composition of the region.

Furthermore, the trend of integrating Pay TV with other digital services like high-speed internet and home automation systems is particularly pronounced in North America. This convergence has led to the development of innovative bundled services that offer consumers convenience and enhanced value, further strengthening the market’s growth. With ongoing advancements in technology and service delivery, coupled with robust consumer demand for high-quality entertainment, North America is poised to maintain its leading position in the global Pay TV market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Airtel Digital TV and Dish TV India Limited have been active in launching new, region-specific subscription packages aimed at diversifying content and appealing to a broader demographic, which includes regional language options and value-added services like HD and 4K content. Similarly, DIRECTV has recently expanded its offering by integrating more streaming content into its satellite services, allowing traditional TV and streaming platforms to merge seamlessly.

Comcast Corporation, a significant player in the market, has enhanced its competitive edge through acquisitions that expand its content library and technological capabilities. The acquisition of smaller content providers and technology firms has allowed Comcast to offer more personalized content bundles and advanced smart home integrations.

DISH Network Corporation has similarly focused on technological enhancements, launching state-of-the-art receiver systems that improve user experience through voice recognition and internet integration, supporting a more connected home environment.

In the international arena, Rostelecom in Russia has been part of strategic mergers designed to consolidate its holdings and streamline operations, optimizing its service offerings across a vast geographic area. This strategy enhances their ability to provide tailored services across diverse regions.

Fetch TV Pty Limited in Australia and Foxtel have focused on expanding their digital footprint by launching mobile apps and enhanced user interfaces that cater to the growing demand for on-the-go content consumption.

Top Key Players in the Market

- Airtel Digital TV

- DIRECTV

- Carter Communications

- Foxtel

- Comcast Corporation.

- Dish TV India Limited

- DISH Network Corporation

- Rostelecom

- Fetch TV Pty Limited

Recent Developments

- April 2023: Airtel launched the fourth version of its Airtel Xstream Box with Android 10 pre-installed. This new model features upgraded software, a redesigned exterior, and supports various OTT apps like Netflix and Prime Video.

- October 2023: AT&T considered selling its remaining shares in DIRECTV or part of the company to other investors. This comes after the company spun off DIRECTV into an independent entity, with AT&T holding a 70% stake and TPG Capital holding 30%.

- July 2023: Comcast expanded the availability of its Xfinity Stream app to Apple TV devices. This allows Xfinity subscribers to access live TV, on-demand content, and DVR recordings directly through their Apple TV, enhancing the flexibility and accessibility of Comcast’s services.

Report Scope

Report Features Description Market Value (2023) US$ 194 Bn Forecast Revenue (2033) US$ 265.8 Bn CAGR (2024-2033) 14% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Cable TV, Satellite TV, Internet Protocol Television (IPTV)), By Application (Residential, Commercial) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Airtel Digital TV, DIRECTV, Carter Communications, Foxtel, Comcast Corporation., Dish TV India Limited, DISH Network Corporation, Rostelecom, Fetch TV Pty Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Pay TV market?The Pay TV market consists of subscription-based television services that offer a variety of channels and content, typically via cable, satellite, or internet protocol (IPTV) platforms. Customers pay a recurring fee to access this content.

How big is Pay TV Market?The Global Pay TV Market size is expected to be worth around USD 265.8 Billion By 2033, from USD 194.0 Billion in 2023, growing at a CAGR of 14% during the forecast period from 2024 to 2033.

What are the key factors driving the Pay TV market?Key factors include the demand for high-quality and diverse content, advancements in technology, increasing disposable incomes, and the growth of high-definition (HD) and ultra-high-definition (UHD) television sets.

What are the current trends and advancements in the Pay TV Market?Current trends include the shift towards internet-based streaming services, the incorporation of on-demand content, and the rise of hybrid models combining traditional TV and online streaming. There is also a trend towards personalized viewing experiences through advanced analytics and AI, as well as increased integration with smart home devices.

What are the major challenges and opportunities in the Pay TV Market?Major challenges include intense competition from over-the-top (OTT) streaming services, high subscription costs, and issues related to piracy. However, opportunities exist in offering innovative packages, expanding into emerging markets, and leveraging advanced technologies like AI for content recommendations and enhanced viewer engagement.

Who are the leading players in the Pay TV Market?Leading players in the Pay TV Market include companies like Airtel Digital TV, DIRECTV, Carter Communications, Foxtel, Comcast Corporation., Dish TV India Limited, DISH Network Corporation, Rostelecom, Fetch TV Pty Limited

-

-

- Airtel Digital TV

- DIRECTV

- Carter Communications

- Foxtel

- Comcast Corporation.

- Dish TV India Limited

- DISH Network Corporation

- Rostelecom

- Fetch TV Pty Limited