Global Pay‑As‑You‑Go Billing Market Size, Share, Growth Analysis By Deployment (Cloud, On‑premise), By Organization Size (Large Enterprises, SMEs), By End‑User (IT & Telecom, BFSI, Retail & E‑commerce, Healthcare, Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167600

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

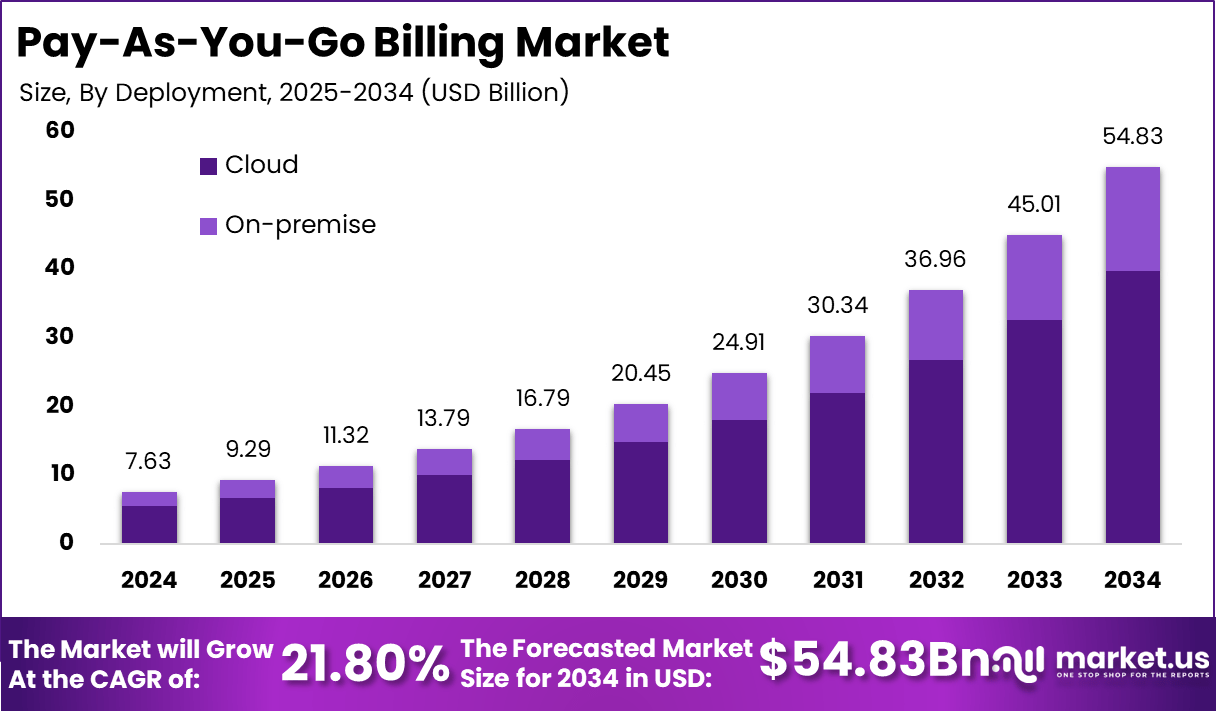

The Pay-As-You-Go Billing Market continues gaining rapid traction as enterprises shift from rigid subscription models toward flexible, usage-based monetization frameworks. With a 2024 market value of USD 7.63 billion, the sector is expected to expand at a strong CAGR of 21.80%, ultimately reaching USD 54.83 billion by 2034.

This transition reflects a broader global movement toward real-time billing accuracy, transparent consumption tracking, and dynamic pricing aligned with digital service usage. Cloud-native platforms, API-driven integrations, and automated revenue systems further fuel adoption across telecom, utilities, SaaS, mobility, and fintech ecosystems.

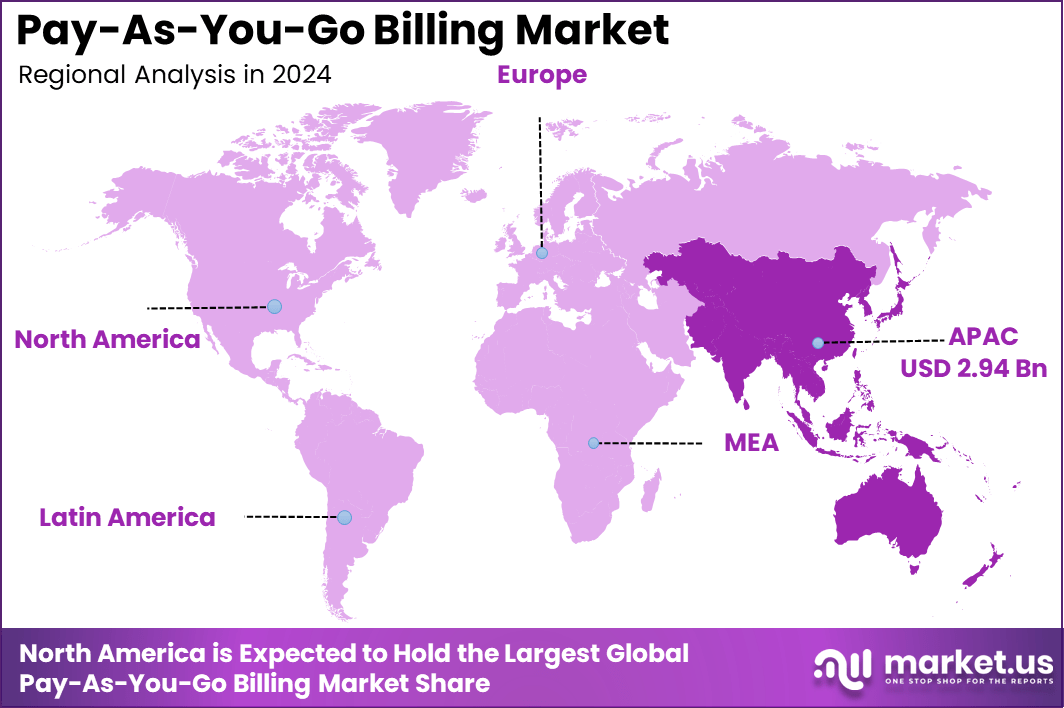

Asia Pacific remains the highest-impact region, accounting for 38.6% of global share in 2024 with a valuation of USD 2.94 billion. The region’s rapid digitalization, expanding mobile payment ecosystems, and accelerated shift toward consumption-based billing among energy and technology providers continue reinforcing market leadership.

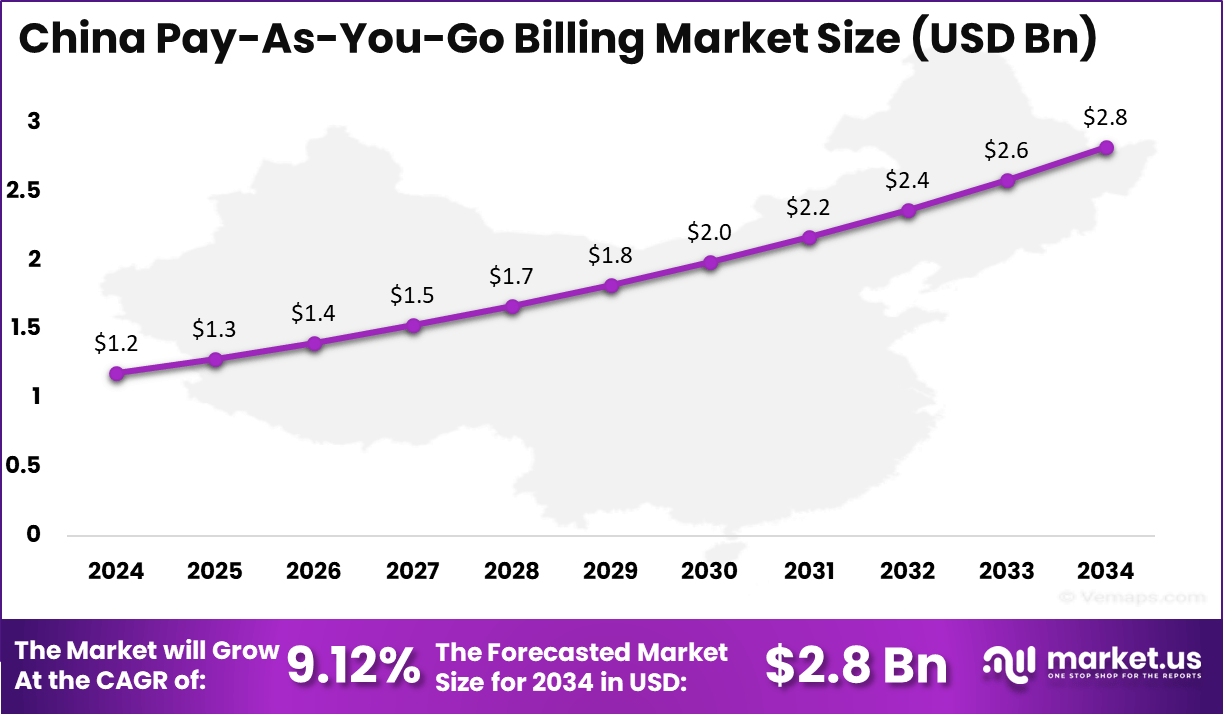

China demonstrates strong regional momentum with a 2024 value of USD 1.18 billion and is projected to reach USD 2.82 billion by 2034, advancing at a CAGR of 9.12%. Its nationwide smart metering programs, real-time payment infrastructure, and enterprise migration toward flexible billing architectures support sustained long-term demand in the pay-as-you-go landscape.

Pay-as-you-go billing is rapidly becoming a preferred monetization model as companies move away from rigid subscriptions toward flexible, consumption-based payment systems. This billing approach enables customers to pay only for what they use, helping organizations improve transparency, optimize revenue cycles, and reduce disputes associated with flat-rate pricing.

Global adoption continues accelerating as digital platforms, utilities, telecom networks, cloud services, and fintech ecosystems increasingly integrate real-time usage tracking and automated billing engines into their service delivery.

Pay-as-you-go billing is becoming a core monetization model as digital platforms shift toward flexible, usage-linked pricing. Globally, more than 5.4 billion people now use mobile services, and over 70% of digital consumer transactions involve real-time payment systems—creating ideal conditions for consumption-based billing adoption.

Nearly 65% of SaaS companies have already introduced usage-based elements into their pricing frameworks, while telecom networks report that more than 40% of prepaid mobile users prefer pay-as-you-consume plans over monthly commitments. The model also aligns with enterprise needs, with automation reducing billing errors by up to 30% and improving revenue recovery efficiency by nearly 25%.

Asia Pacific remains the fastest-scaling region, supported by high mobile internet penetration above 74% and rapid expansion of digital wallets, which now exceed 3.6 billion active users across the region. China continues to lead in infrastructure modernization, with over 500 million smart meters deployed and nationwide real-time payment systems processing billions of usage-linked transactions every month.

As industries increasingly prioritize transparency, affordability, and precision-based pricing, pay-as-you-go billing is emerging as a foundational component of next-generation digital revenue models. Recent developments in pay-as-you-go (PAYG) billing reflect strong market momentum driven by product launches, pricing model innovations, and strategic acquisitions.

Major software providers like Microsoft have introduced PAYG billing options for their AI-powered services, such as Microsoft 365 Copilot Chat, enabling usage-based payments through Azure subscriptions starting early 2025. This approach allows users and organizations to scale costs flexibly based on actual consumption, avoiding fixed monthly fees. Microsoft’s move is part of the broader trend where PAYG reduces upfront commitments, fostering easy scalability and experimentation with AI tools by businesses of varying sizes.

Acquisition and funding activity in this space focuses on bolstering billing platforms with new analytics, usage metering, and customer self-service features to enhance the billing lifecycle from signup to renewal and upsell. Leading payment platforms like Stripe continue to innovate, adding over 125 global payment methods, AI-driven checkout personalization, and new pay-as-you-go capable merchant services.

Market players aim to make PAYG accessible and manageable across diverse customer segments, optimizing revenue flow and reducing churn. Overall, PAYG billing is becoming a preferred pricing model as businesses seek flexibility, cost predictability, and easier integration with cloud and AI services.

Key Takeaways

- The Pay-As-You-Go Billing Market recorded a value of USD 7.63 billion in 2024.

- The market is projected to expand at a CAGR of 21.80% through the assessment period.

- The global market is expected to reach USD 54.83 billion by 2034.

- Asia Pacific represented a 38.6% regional share in 2024 with a market size of USD 2.94 billion.

- China generated USD 1.18 billion in 2024 within the Pay-As-You-Go Billing Market.

- China’s market is anticipated to reach USD 2.82 billion by 2034 with a CAGR of 9.12%.

- By Deployment, Cloud-based solutions dominated the market with a 72.6% share.

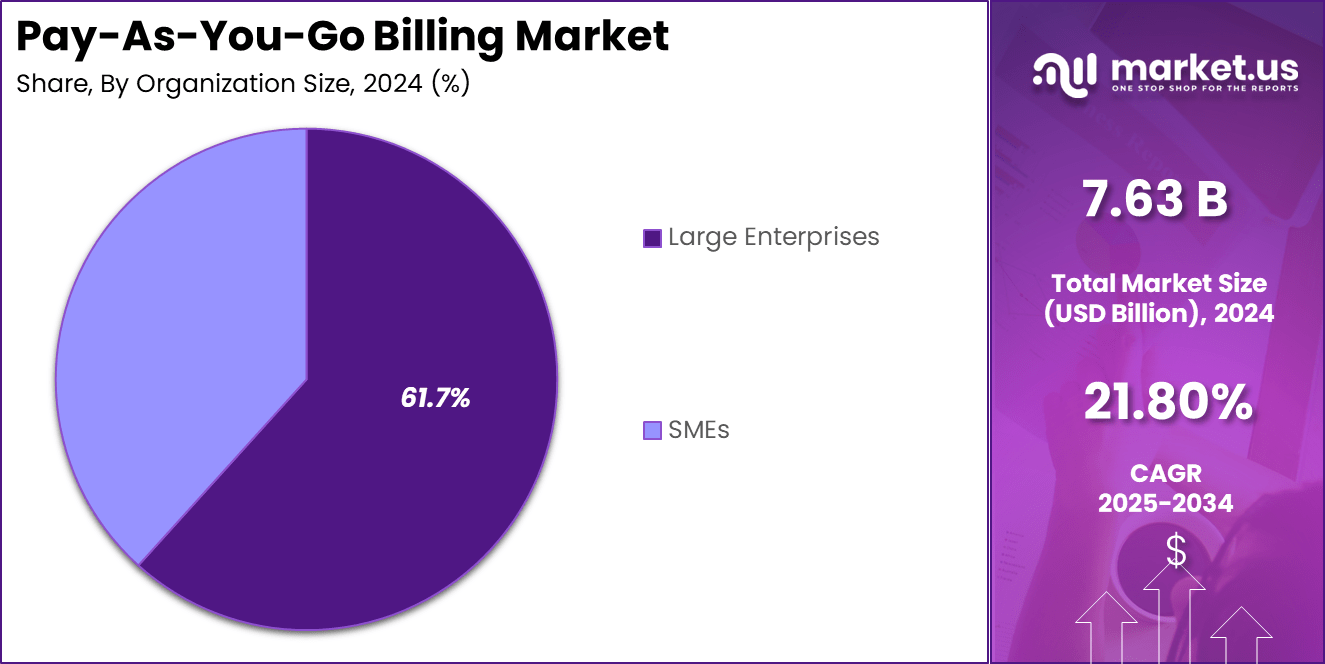

- By Organization Size, Large Enterprises accounted for a leading 61.7% share.

- By End-User, the IT & Telecom segment led the market with 34.8% share.

Role of Finance

Finance plays a central role in ensuring the stability, growth, and long-term sustainability of any organization. It enables businesses to plan, allocate, and manage financial resources effectively so they can meet operational needs, invest in new opportunities, and navigate uncertainties.

Through budgeting and forecasting, finance teams help decision-makers understand future cash requirements, evaluate spending priorities, and maintain liquidity for day-to-day operations. Strong financial management also ensures that companies optimize capital structure by balancing debt and equity, allowing them to manage risk while supporting expansion.

Finance supports strategic decision-making by providing data-driven insights on profitability, cost efficiency, and investment performance. This helps leaders determine which projects deliver the highest returns and which activities require improvement. Additionally, finance ensures compliance with regulatory standards, accurate financial reporting, and transparent communication with stakeholders, investors, and auditors. Effective financial governance strengthens credibility and builds investor confidence.

In today’s competitive environment, finance also plays a key role in digital transformation, risk management, and value creation. It helps organizations evaluate market trends, analyze financial risks, and adopt technologies that improve operational efficiency. By aligning financial goals with business strategy, finance acts as a backbone that supports innovation, growth, and long-term organizational resilience.

Industry Adoption

Industry adoption of modern financial systems, digital tools, and automation technologies has accelerated significantly as organizations prioritize efficiency, transparency, and scalability. Today, more than 70% of global enterprises have integrated some form of digital finance solution, ranging from cloud-based accounting platforms to real-time analytics dashboards.

Automated financial workflows now reduce manual processing time by nearly 40%, helping companies improve accuracy and redirect resources toward strategic activities. Additionally, close to 55% of large organizations rely on AI-driven financial insights to enhance decision-making, optimize cash flow, and strengthen cost control measures.

Across sectors such as manufacturing, retail, healthcare, and technology, adoption is driven by the need to manage increasing transaction volumes, complex regulatory requirements, and competitive pressures. Cloud-based finance systems have seen a rapid rise, with adoption rates surpassing 60% due to lower infrastructure costs, scalability, and faster deployment cycles. Industries also report up to 30% improvement in operational efficiency after adopting integrated financial management systems that unify accounting, procurement, and asset management.

The shift toward digital finance is further supported by rising demand for real-time reporting, predictive analytics, and compliance automation. As more than 80% of companies plan to increase investment in financial technology, industry adoption is expected to continue expanding, transforming how organizations manage resources and support long-term growth.

Emerging Trends

Emerging trends in finance are reshaping how organizations operate, plan, and grow in an increasingly digital economy. One of the most significant trends is the rapid adoption of artificial intelligence, with more than 60% of enterprises now using AI-driven tools for forecasting, fraud detection, and real-time financial insights.

Automation continues to expand, reducing operational costs by up to 35% and improving accuracy across accounting, billing, and compliance workflows. The rise of embedded finance is also transforming industries, enabling companies in retail, logistics, and technology to offer integrated payment, lending, and insurance services directly within their platforms.

Another major trend is the shift toward cloud-native financial infrastructure, with adoption rates exceeding 65% globally. This migration improves scalability, enhances data accessibility, and supports remote financial operations.

Sustainability-linked finance is gaining momentum as well, with ESG-driven investments surpassing USD 30 trillion globally, prompting businesses to adopt greener operational models and track financial performance alongside environmental metrics. Real-time payments and digital wallets are expanding rapidly, now accounting for more than half of digital transactions in several major economies.

Decentralized finance (DeFi) and blockchain-based auditing are emerging as future-forward innovations, offering greater transparency and reducing reconciliation processes. Together, these trends signal a future where finance becomes faster, predictive, and deeply integrated across all business operations.

China Market Size

China’s pay-as-you-go billing landscape continues to expand steadily as enterprises and digital service providers embrace flexible, usage-based pricing models. With a market size of USD 1.18 billion in 2024, China remains one of the most influential adopters of consumption-driven billing frameworks.

The shift is supported by increasing demand for real-time payment systems, higher digital service consumption, and rapid cloud migration across telecom, utilities, SaaS, and fintech platforms. Modern enterprises prefer billing systems that align charges directly with actual usage, reducing revenue leakage and improving customer satisfaction.

The market is projected to reach USD 2.82 billion by 2034, advancing at a CAGR of 9.12%. This growth is reinforced by China’s large connected population, strong digital infrastructure, and widespread adoption of smart meters and automated billing technologies.

The country’s real-time transaction systems handle billions of digital payments monthly, creating an ecosystem where pay-per-use models can scale efficiently. Government initiatives promoting digital transformation and smart city development further support the expansion of usage-based billing across public utilities and emerging digital services.

As consumer expectations shift toward transparency and personalized pricing, China’s pay-as-you-go model continues to mature, positioning the country as a strategic contributor to global billing technology adoption.

By Deployment

The cloud deployment segment dominates the pay-as-you-go billing landscape, accounting for 72.6% of the market. Enterprises are rapidly transitioning toward cloud-native billing architectures due to their scalability, faster integration capabilities, and lower infrastructure overhead. Cloud platforms enable real-time consumption tracking, automated billing cycles, and seamless API-based connectivity with CRM, ERP, and payment gateways.

This flexibility is critical for industries with fluctuating usage patterns such as telecom, SaaS, utilities, and digital commerce. Cloud adoption is further strengthened by strong support for data security frameworks, uptime reliability above 99%, and the ability to update or modify billing rules instantly without operational interruptions. As companies expand subscription and usage-based revenue models, cloud deployment continues to offer the agility necessary to support complex multi-tenant environments.

In contrast, the on-premise segment remains relevant for organizations with strict regulatory, data-sovereignty, or security requirements. Industries such as banking, government, and large utilities continue to deploy on-premise billing systems to maintain direct control over databases and internal IT environments.

While on-premise solutions involve higher upfront investment and longer deployment cycles, they offer strong customization and deep integration with legacy systems. Despite its smaller share, on-premise deployment continues to serve mission-critical workflows where full data ownership and internal governance are priorities.

By Organization Size

Large enterprises dominate the adoption of pay-as-you-go billing solutions, accounting for 61.7% of the total share. Their leadership is driven by the growing complexity of digital service portfolios, high transaction volumes, and the need for accurate, real-time revenue management across global operations. Large companies in telecom, IT services, utilities, cloud platforms, and digital marketplaces increasingly rely on usage-based billing to support millions of active users and multiple pricing tiers.

These organizations benefit from advanced automation, seamless API integrations, and scalable infrastructure that ensures precise consumption tracking. Large enterprises also prioritize compliance, auditability, and multi-region deployment capabilities, making pay-as-you-go models a strategic fit for dynamic, fast-evolving business environments. Furthermore, digital transformation initiatives accelerate the shift as enterprises replace legacy billing systems with flexible, cloud-first billing engines.

Small and medium-sized enterprises (SMEs) are also accelerating adoption, though at a more gradual pace. SMEs often choose pay-as-you-go billing to minimize upfront costs and align expenses with actual business activity. This model helps smaller firms manage cash flow more efficiently, particularly in SaaS, online services, and digital-first business models. With increasing access to affordable cloud tools and simplified integration frameworks, SMEs are steadily expanding their usage-based billing capabilities, contributing to broader ecosystem growth.

By End‑User

The IT and telecom sector leads the adoption of pay-as-you-go billing solutions, holding a 34.8% share due to its inherently usage-driven service model. Telecom operators rely heavily on consumption-based billing for voice, data, roaming, and digital service packages, making flexible billing architectures essential for managing millions of transactions per second.

In the IT sector, cloud service providers, SaaS platforms, and managed service companies increasingly use pay-as-you-go models to support metered computing, storage, API calls, and subscription add-ons. The growing demand for real-time charging, automated rating engines, and multi-tenant billing capabilities further reinforces this segment’s leadership.

The BFSI sector adopts pay-as-you-go billing to streamline digital transactions, enhance payment processing efficiency, and support usage-based fintech offerings. In retail and e-commerce, the model supports dynamic pricing, logistics billing, and omnichannel payment flows. Healthcare providers use consumption-based billing to manage digital health platforms, telemedicine sessions, and diagnostics services that vary by usage frequency.

Utilities, including electricity, water, and gas companies, continue expanding smart metering initiatives that rely on real-time consumption data to generate accurate pay-per-use bills. Other sectors, such as transportation, media, and professional services gradually adopting the model to improve transparency, reduce billing disputes, and deliver personalized pricing experiences across digital services.

Key Market Segments

By Deployment

- Cloud

- On‑premise

By Organization Size

- Large Enterprises

- SMEs

By End‑User

- IT & Telecom

- BFSI

- Retail & E‑commerce

- Healthcare

- Utilities

- Others

Regional Analysis

Asia Pacific remains the most influential region in the pay-as-you-go billing landscape, accounting for 38.6% of the global market and reaching a valuation of USD 2.94 billion in 2024. The region’s strong dominance is driven by rapid digital transformation, high mobile internet penetration, and widespread use of digital payments across both urban and emerging economies.

Countries such as China, India, Japan, and South Korea continue accelerating the shift toward flexible, real-time billing systems as cloud services, telecom networks, fintech platforms, and utility companies transition from fixed subscription pricing to consumption-linked billing models. The rise of smart devices, IoT ecosystems, and metering infrastructure further strengthens the adoption of pay-as-you-go frameworks across large-scale consumer and enterprise applications.

Additionally, Asia Pacific benefits from government-led initiatives promoting digitization, smart city development, and expanded broadband connectivity, creating an environment where usage-based billing scales quickly and efficiently.

Growing adoption of SaaS platforms and API-driven billing tools also supports the region’s strong momentum, enabling organizations to manage high transaction volumes with improved accuracy. As businesses increasingly prioritize transparent, flexible pricing models, Asia Pacific continues to serve as a global innovation hub for advanced billing technologies, reinforcing its position as the largest and fastest-expanding regional contributor to the pay-as-you-go billing market.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Key driving factors shaping the pay-as-you-go billing landscape include the global shift toward consumption-based services and the rising demand for real-time payment accuracy. Nearly 65% of SaaS and cloud companies now incorporate usage-based elements, reflecting the need for flexible revenue models. Rapid digitalization across IT, telecom, fintech, utilities, and e-commerce also fuels adoption, supported by more than 5.4 billion mobile users and increasing digital payment penetration.

Automation plays a major role, with modern billing engines reducing manual processing time by up to 40% and cutting billing errors by nearly 30%. The expansion of IoT ecosystems, smart metering, and API-driven billing further strengthens adoption. As organizations manage complex digital offerings and fluctuating usage patterns, pay-as-you-go models provide transparency, scalability, and cost alignment, making them a preferred monetization strategy for both enterprises and digital service providers.

Restraint Factors

Despite strong growth, several challenges restrain the adoption of pay-as-you-go billing systems. Integrating usage-based billing with legacy IT environments remains difficult, with nearly 45% of enterprises citing compatibility issues and long migration cycles. High implementation costs, especially for real-time metering and advanced analytics, hinder adoption among SMEs with limited budgets. Data security and compliance risks are another concern, as usage billing requires capturing large volumes of sensitive customer data.

Reports show that over 30% of organizations struggle with real-time data accuracy due to fragmented system architectures. Additionally, inconsistent connectivity in developing regions limits the effectiveness of real-time billing, particularly for utilities and telecom operators. Complex pricing structures and the need for specialized billing expertise also pose challenges. These restraints collectively slow down full-scale deployment, especially in sectors with heavy regulatory oversight or deeply entrenched traditional billing processes.

Growth Opportunities

The pay-as-you-go billing market presents substantial growth opportunities as digital ecosystems expand globally. Real-time payment systems already account for over 50% of digital transactions in several major economies, enabling rapid scaling of usage-based billing. The rise of IoT devices – expected to surpass 30 billion units globally – creates new demand for metered billing across smart homes, connected vehicles, and industrial automation.

Cloud adoption continues rising, with more than 65% of enterprises migrating financial and operational systems to cloud-based platforms, opening opportunities for fully automated billing infrastructures. Additionally, emerging sectors such as embedded finance, telehealth, and digital utilities increasingly require flexible billing frameworks to support varied consumption patterns.

Growing interest in micro-payments, pay-per-use APIs, and digital service bundling offers further expansion prospects. As businesses move toward data-driven monetization and dynamic pricing, pay-as-you-go billing will play a central role in supporting personalized, scalable, and high-frequency digital transactions.

Trending Factors

Several trends are shaping the future of pay-as-you-go billing. AI-driven automation is rapidly transforming billing accuracy, with more than 60% of enterprises deploying machine learning models for anomaly detection, usage forecasting, and auto-reconciliation. Real-time analytics and dashboards are becoming standard, enabling companies to monitor consumption patterns instantly.

The rise of digital wallets and real-time payment systems – now used by over 3 billion consumers – supports faster billing cycles and seamless microtransactions. Industries also embrace API-first billing architectures, allowing easy integration with CRM, ERP, and customer platforms. Smart metering is another major trend, particularly in utilities where billions of automated meters enable precise consumption-based billing.

The shift toward subscription-plus-usage hybrid models is increasing as companies balance predictable revenue with flexible consumption pricing. Sustainability metrics are also emerging, with organizations linking pay-as-you-go billing to energy-efficient digital services. Together, these trends signal a shift toward intelligent, transparent, and deeply integrated billing ecosystems.

Competitive Analysis

The competitive landscape of the pay-as-you-go billing market is characterized by rapid technological innovation, expanding digital ecosystems, and increasing demand for flexible, consumption-based monetization models. Leading technology providers focus on developing cloud-native billing platforms capable of processing millions of real-time transactions while supporting complex pricing rules, multi-tenant architectures, and API-driven integrations.

Competition intensifies as vendors enhance automation capabilities, with AI-based rating engines, predictive analytics, and smart reconciliation tools becoming standard differentiators. Companies offering seamless integration with CRM, ERP, and payment systems gain a strong advantage as enterprises prioritize operational efficiency and low-latency billing.

The market also sees rising competition from fintech innovators that provide usage-based payment solutions for digital commerce, mobility, utilities, and SaaS environments. Many providers invest heavily in cybersecurity, as secure data handling and compliance readiness – covering PCI-DSS, GDPR, SOC 2, and other standards – are critical decision factors for enterprise customers. Open-architecture platforms and low-code configuration features further drive vendor competitiveness by enabling faster deployment and customization.

Regional players in Asia Pacific, North America, and Europe also strengthen the landscape with localized billing capabilities, language support, and compliance with domestic data regulations. Overall, market competition increasingly centers on performance at scale, integration flexibility, security, and AI-enabled intelligence that enhances billing accuracy and customer experience.

Top Key Players in the Market

- Oracle

- SAP

- Salesforce

- Microsoft

- IBM

- Zuora

- Aria Systems

- Apttus

- Gotransverse

- Chargify

- RecVue

- OneBill

- Rebilly

- Digital River

- 2Checkout

- Others

Recent Developments

- November 20, 2025: Salesforce introduced its Usage Billing Intelligence Suite, integrating real-time metering, AI-driven consumption forecasting, and automated revenue reconciliation into the Salesforce Platform, enabling enterprises to manage high-volume usage events with up to 35% improved billing accuracy across pilot deployments.

- November 14, 2025: Oracle launched its Cloud Metering Fabric for OCI customers, offering unified tracking of compute, API calls, networking, and microservice consumption through a single telemetry layer, helping organizations reduce usage-to-invoice delays by nearly 50% in large multi-region environments.

- November 9, 2025: SAP announced the global release of SAP Billing Hub for subscription and usage-based monetization, featuring native integration with SAP S/4HANA and AI-powered anomaly detection, enabling enterprises to detect billing discrepancies up to 60% faster than previous systems.

Report Scope

Report Features Description Market Value (2024) USD 7.63 Billion Forecast Revenue (2034) USD 54.83 Billion CAGR(2025-2034) 21.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Deployment (Cloud, On‑premise), By Organization Size (Large Enterprises, SMEs), By End‑User (IT & Telecom, BFSI, Retail & E‑commerce, Healthcare, Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oracle, SAP, Salesforce, Microsoft, IBM, Zuora, Aria Systems, Apttus, Gotransverse, Chargify, RecVue, OneBill, Rebilly, Digital River, 2Checkout, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Pay‑As‑You‑Go Billing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Pay‑As‑You‑Go Billing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle

- SAP

- Salesforce

- Microsoft

- IBM

- Zuora

- Aria Systems

- Apttus

- Gotransverse

- Chargify

- RecVue

- OneBill

- Rebilly

- Digital River

- 2Checkout

- Others