Global Paraphenylenediamine Market By Product(PPD AD, PPD AD Molten, PPD AD Ultra-Pure, Others), By Type(Purified, Industrial), By Application(Rubber Chemicals, Hair Dyes, Textile Dyes and Pigments, Synthetic Fibers, Polyurethane, Photographic Developing, Printing Inks, Oils and Gasoline, Others), By End-use Industry(Personal Care and Cosmetics, Textile Industry, Oil and Gas, Rubber and Plastic Industry, Chemical and Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132655

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

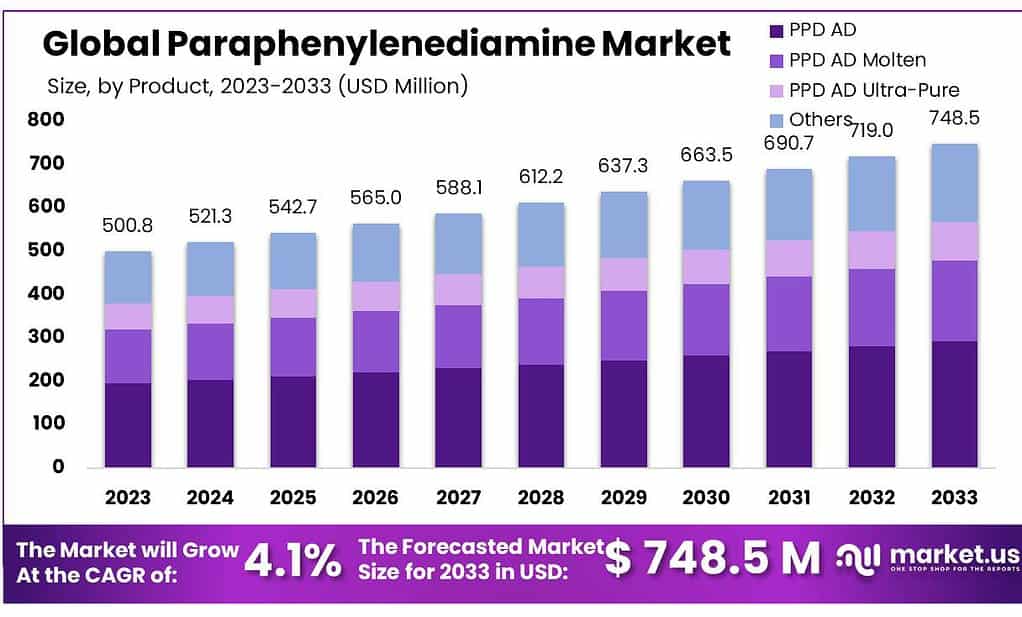

The Global Paraphenylenediamine Market size is expected to be worth around USD 748.5 Mn by 2033, from USD 500.8 Mn in 2023, growing at a CAGR of 4.1% during the forecast period from 2024 to 2033.

Paraphenylenediamine (PPD) is an organic compound derived from benzene, commonly used in various dye formulations such as hair dyes, textile dyes, and inks, as well as in the rubber industry as a polymerization agent. PPD’s ability to produce vibrant, long-lasting colors that resist fading makes it a valuable ingredient across these industries.

However, its use comes with notable health concerns, as it can trigger allergic reactions in some individuals. This has led to regulatory actions, particularly in cosmetic applications, to safeguard consumer health while maintaining its industrial utility.

Regulatory bodies, such as the U.S. Food and Drug Administration (FDA), have set strict guidelines on PPD usage in cosmetics. For instance, the FDA mandates that PPD concentrations in hair dyes should not exceed 2% post-mixing with hydrogen peroxide.

Similarly, Health Canada’s oversight ensures that hair dyes on the market comply with safety standards, confirming through tests that PPD concentrations do not surpass 3% after dilution. These regulations are critical for preventing adverse health effects among consumers.

Internationally, PPD also faces stringent regulations, particularly in the European Union (EU). The European Commission’s Scientific Committee on Consumer Safety (SCCS) has deemed PPD safe for use in hair dye products at concentrations ranging from 2% to 4%, depending on the formulation. Such regulatory endorsements are pivotal for maintaining market stability and consumer trust, especially given the health sensitivities associated with the chemical.

The market dynamics of PPD reflect its critical role in manufacturing, underscored by a robust trade environment. Recent figures indicate a total export value of paraphenylenediamine at approximately $22.9 million, with an average price of $4.45 per kilogram. These figures highlight the ongoing demand for PPD despite regulatory challenges and health concerns, driven by its indispensable role in producing durable and aesthetically pleasing products across multiple sectors.

Key Takeaways

- Paraphenylenediamine Market size is expected to be worth around USD 748.5 Mn by 2033, from USD 500.8 Mn in 2023, growing at a CAGR of 4.1%.

- PPD AD held a dominant market position, capturing more than a 39.2% share.

- Purified Paraphenylenediamine held a dominant market position, capturing more than a 62.1% share.

- Rubber Chemicals held a dominant market position in the Paraphenylenediamine (PPD) sector, capturing more than a 29.1% share.

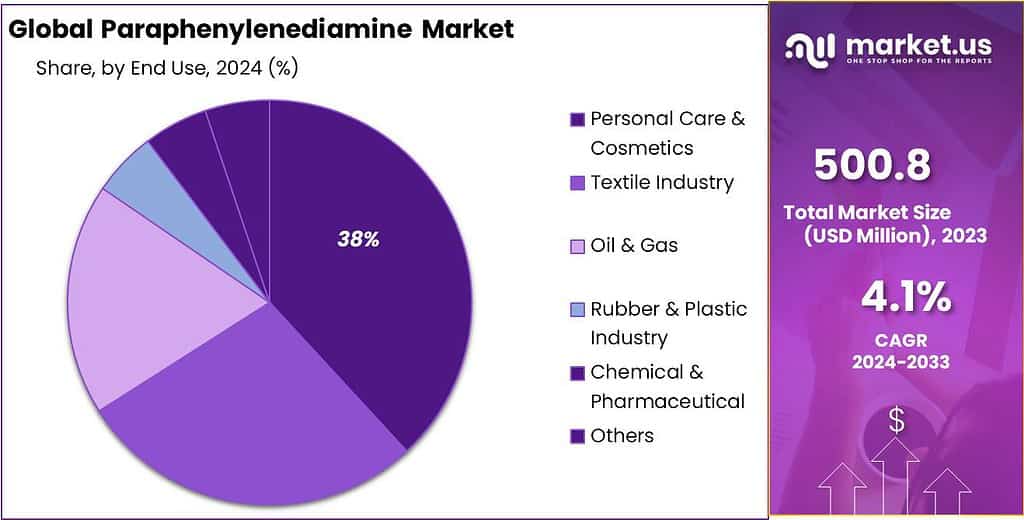

- Personal Care & Cosmetics sector held a dominant market position in the Paraphenylenediamine (PPD) market, capturing more than a 37.3% share.

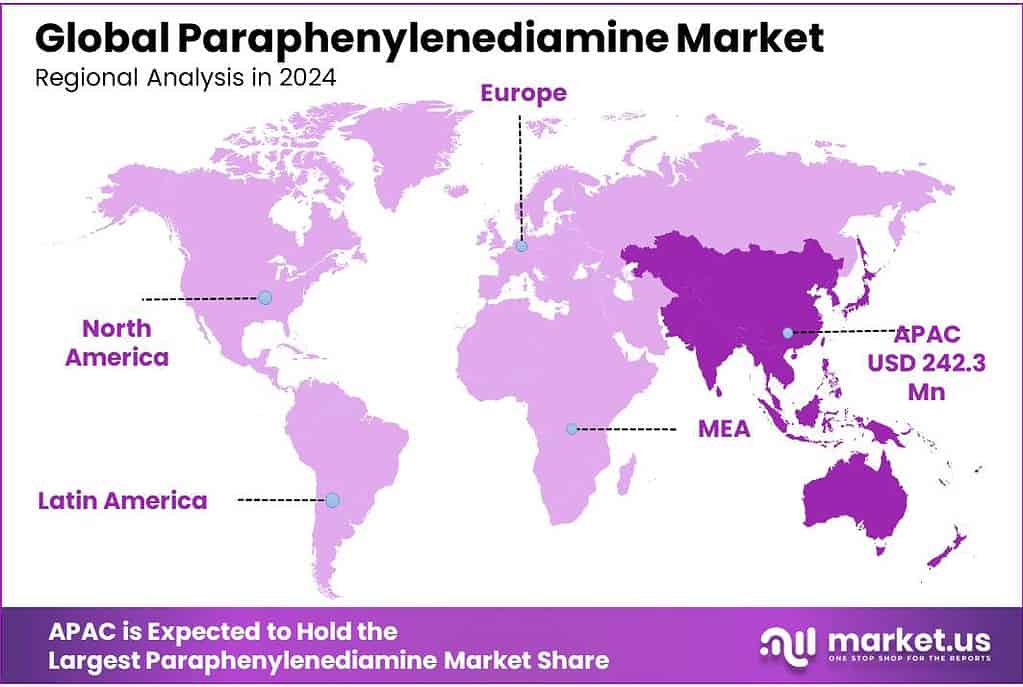

- Asia Pacific (APAC) leading the charge, holding a dominating market share of 48.4% and a value of USD 242.3 million.

By Product

In 2023, PPD AD held a dominant market position, capturing more than a 39.2% share of the Paraphenylenediamine (PPD) market. This product is favored for its standard quality and reliability in various industrial applications, including hair dyes and textile manufacturing. Its widespread use across multiple industries underlines its importance and market preference.

PPD AD Molten, a more fluid form of the chemical, also plays a significant role in the market. It offers ease of handling and use in industrial processes where liquid integration is essential, contributing to efficient production flows. This variant is particularly valued in sectors that require precise chemical processing.

PPD AD Ultra-Pure represents a high-purity version of PPD, designed for sensitive applications where impurities could affect product quality, such as in cosmetics and pharmaceuticals. Its enhanced purity supports industries where the highest standards of chemical composition are necessary.

By Type

In 2023, Purified Paraphenylenediamine held a dominant market position, capturing more than a 62.1% share. This type is highly valued for its superior quality and consistency, making it a preferred choice in sensitive applications such as cosmetics and pharmaceuticals, where impurity levels must be strictly controlled to meet regulatory standards and ensure consumer safety.

Industrial Paraphenylenediamine serves as a more cost-effective option for various commercial uses that do not require high purity levels. This type is commonly utilized in the rubber manufacturing and dyeing industries, where its effectiveness in enhancing the properties of end products is well recognized, despite the less stringent requirements on purity compared to the Purified type.

By Application

In 2023, Rubber Chemicals held a dominant market position in the Paraphenylenediamine (PPD) sector, capturing more than a 29.1% share. This segment benefits significantly from the demand for enhanced rubber compounds in various industrial and automotive applications, where PPD is utilized to improve the elasticity and durability of rubber products.

Hair Dyes are another significant application, leveraging PPD’s ability to provide long-lasting and deep coloring effects. This application remains strong due to the continuous demand in both consumer and professional markets for hair coloring products.

In the Textile Dyes and Pigments sector, PPD is valued for its vivid and resistant color properties, making it essential in fabric manufacturing processes that require durable and vibrant colors.

Synthetic Fibers also utilize PPD to achieve specific qualities in fibers, such as resistance to chemicals and heat, enhancing their application in more demanding industrial environments.

Polyurethane applications benefit from PPD mainly in the production of flexible foams, where its properties contribute to the material’s performance in automotive, furniture, and insulation sectors.

Photographic Developing uses PPD due to its ability to act as a stabilizer and protectant, improving the quality and longevity of photographic images.

Printing Inks sector utilizes PPD to enhance the quality of inks used in commercial and artistic printing, capitalizing on its stable pigment properties.

In Oils and Gasoline, PPD is used as an additive to improve the performance and efficiency of fuels and lubricants in various engine types.

By End-use Industry

In 2023, the Personal Care & Cosmetics sector held a dominant market position in the Paraphenylenediamine (PPD) market, capturing more than a 37.3% share. This industry relies heavily on PPD, particularly in hair dye products, due to its effectiveness in providing long-lasting and deep coloration, which is a critical attribute for consumer satisfaction in hair care solutions.

The Textile Industry also utilizes PPD extensively, applying it in the synthesis of textiles dyes that require durability and vibrant color properties to meet the demands of fashion and functional fabrics.

In the Oil & Gas sector, PPD is used as a corrosion inhibitor and an antioxidant in fuels and lubricants, helping to enhance the efficiency and longevity of engine oils and gasoline.

The Rubber & Plastic Industry benefits from PPD’s properties that improve the resistance of materials to fatigue, abrasion, and heat, making it essential in the manufacture of various rubber and plastic products that require enhanced performance characteristics.

Chemical & Pharmaceutical industries use PPD in a variety of synthesis processes and formulations. In pharmaceuticals, it plays a role in manufacturing drugs that require specific chemical properties that PPD can provide.

Key Market Segments

By Product

- PPD AD

- PPD AD Molten

- PPD AD Ultra-Pure

- Others

By Type

- Purified

- Industrial

By Application

- Rubber Chemicals

- Hair Dyes

- Textile Dyes and Pigments

- Synthetic Fibers

- Polyurethane

- Photographic Developing

- Printing Inks

- Oils and Gasoline

- Others

By End-use Industry

- Personal Care & Cosmetics

- Textile Industry

- Oil & Gas

- Rubber & Plastic Industry

- Chemical & Pharmaceutical

- Others

Driving Factors

Rising Demand from the Chemical Industry

The chemical industry’s expansion, especially in regions like India and the European Union, is a significant driver. India’s chemical sector is projected to reach a market size of $300 billion by 2025, reflecting a broader trend of increasing chemical production and consumption that relies on paraphenylenediamine as a critical component. In Europe, the chemical output is expected to grow by 2.5% in 2022, following a substantial 6% growth in 2021. This expansion underscores the rising demand for PPD in various chemical applications, boosting the overall market growth.

Growth in the Textile Industry

Similarly, the textile industry’s growth substantially contributes to the demand for PPD, particularly in dyeing processes where its properties are essential for producing long-lasting and vibrant colors. The global textile and apparel market is expected to grow significantly, from $103.4 billion in 2020-21 to $190 billion by 2025-26. This growth is driven by increasing consumer demand for varied and high-quality textile products, where PPD’s role in dye manufacturing becomes crucial.

Strategic Industry Developments

Key market players are actively expanding their product lines and exploring new applications of PPD to capitalize on these growing industries. This includes investments in research and development aimed at enhancing PPD formulations and ensuring their adaptability to various industrial needs. Strategic mergers, acquisitions, and partnerships are also prevalent as companies aim to strengthen their market positions and expand their operational capabilities globally.

Restraining Factors

Health and Safety Concerns

The toxicity of PPD can lead to allergic reactions and dermatitis, which poses a significant barrier to its use in personal care products. Concerns over the safety of PPD have led to regulatory scrutiny and restrictions, which can impact the market size and growth. In some instances, adverse health impacts have prompted manufacturers to reformulate products to reduce PPD content or replace it entirely with safer alternatives.

Regulatory Impact

Regulations aimed at reducing exposure to harmful chemicals directly affect the PPD market. In regions with stringent safety regulations, such as the European Union and North America, the demand for PPD is impacted by legal limits on its use in consumer products. These regulations not only restrict the use of PPD in high-concentration applications but also encourage the development of alternative substances that are less harmful.

Market Shifts Toward Safer Alternatives

The market is seeing a shift towards products that are marketed as “PPD-free”, especially in the hair dye sector, where consumer awareness about the risks associated with chemical dyes is growing. This shift is influencing market dynamics, pushing companies to innovate with safer ingredients that can provide similar results without the associated health risks.

Industry Response and Innovation

Despite these challenges, the PPD market continues to find support through applications in industries less impacted by direct consumer use, such as in the manufacture of rubber and polymers, where its properties are still valued. Additionally, ongoing research and development activities aim to mitigate the negative effects of PPD by enhancing the safety profile of PPD-containing products.

Growth Opportunity

Expanding Consumer Base in Emerging Markets

Urbanization and rising disposable incomes, especially in Asia-Pacific, are key factors contributing to the growth of the PPD market. As cities grow and economies develop, more people are investing in personal grooming products, including hair dyes that use PPD. This demographic shift is pushing the demand for PPD as consumers seek more varied and high-quality cosmetic products.

Innovation in Hair Dye Formulations

Manufacturers are continuously innovating to create PPD-based hair dyes that are not only vibrant and durable but also safer and less likely to cause allergic reactions. This innovation helps to maintain consumer trust and loyalty, thereby driving market growth. Efforts to improve the formulation could also mitigate some of the health concerns associated with PPD, potentially opening up more markets.

Marketing and Influence in Beauty Trends

The role of influencers and digital marketing cannot be underestimated in the hair dye market. As fashion trends evolve, influencers and celebrities promote the use of various hair dye colors, which in turn fuels consumer demand for PPD-based products. This is particularly influential in regions like North America and Europe, where there is a high engagement with online beauty platforms.

Latest Trends

Consumer Preferences and Lifestyle Changes

The hair dye market is seeing a shift with consumers seeking a wide variety of colors, from natural shades to bold and unusual hues. This trend is particularly strong in urban areas where changing lifestyles and increased disposable incomes allow consumers to experiment more with their appearance. As such, the need for PPD, which is known for its ability to provide permanent and vibrant colors, is on the rise.

Innovation and Product Development

Manufacturers are continuously innovating to improve the formulations of PPD-based dyes to enhance their safety and effectiveness, reducing the risk of allergies and increasing color durability. This innovation is crucial in maintaining market growth as it addresses both the aesthetic desires and health concerns of consumers.

Influence of Digital Marketing

Marketing strategies, especially those involving influencers and social media, play a significant role in shaping consumer preferences. Influencers promoting various hair colors can significantly impact market trends, driving the demand for PPD-based products as consumers seek to replicate the looks admired online.

Regional Analysis

The Paraphenylenediamine (PPD) market exhibits diverse regional dynamics, with Asia Pacific (APAC) leading the charge, holding a dominating market share of 48.4% and a value of USD 242.3 million. This region’s robust position is driven by significant industrial growth, rising fashion and personal care industries, and increasing urbanization, particularly in countries like China, India, and Japan.

The demand in APAC is bolstered by both the expansion of domestic manufacturing capacities and the escalating consumption of consumer goods that incorporate PPD in their production processes.

In North America, the market is characterized by advanced technological integration and stringent regulatory standards, which govern the use of chemicals like PPD. The region’s focus on safety and innovative hair dye solutions, coupled with high consumer awareness about organic and safer product alternatives, supports steady market growth.

Europe follows a similar pattern to North America, with a strong emphasis on safety regulations and high-quality standards in chemical usage. The market here benefits from a well-established personal care industry and ongoing research into safer and more sustainable chemical formulations.

The Middle East & Africa (MEA) and Latin America regions, while smaller in market size compared to APAC, North America, and Europe, are experiencing gradual growth. In MEA, the increase is driven by urban development and an expanding consumer base, whereas in Latin America, growth is spurred by industrial advancements and increasing local manufacturing capabilities. Both regions show potential for significant market expansion as they continue to develop industrially and economically.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Paraphenylenediamine (PPD) market features a robust landscape with key players spread across various regions, contributing to its dynamic growth and innovation. Prominent companies like DuPont de Nemours Inc., Lanxess AG, and Aarti Industries Ltd. are notable for their significant roles in technological advancements and global supply chain enhancements in the PPD sector. These companies are recognized for their commitment to sustainability and environmental safety, which are critical due to the stringent regulatory standards governing chemical use globally.

Additionally, specialized firms such as Chizhou Fangda Science and Technology Co., Ltd. and Anhui Xianglong Chemical Co. Ltd. focus on niche aspects of the PPD market, like high-purity PPD production for sensitive applications, including cosmetics and pharmaceuticals. Their targeted approach helps in meeting the precise needs of these industries, ensuring compliance with international safety standards.

Moreover, companies like BOC Sciences and TBI CORPORATION LTD. contribute to the market through extensive R&D, driving innovations that reduce PPD’s potential health risks while maintaining its effectiveness as a dye.

Top Key Players in the Market

- Alfa Aesar

- BOCSCI Inc.

- CHEMOS GmbH and Co. KG

- Chizhou Fangda Science and Technology Co., Ltd.

- DuPont de Nemours Inc.

- EC Plaza Network, Inc.

- JAY ORGANICS PVT. Ltd.

- Lanxess AG

- Liaoning Xinyu Bio-tech Co., Ltd.

- Qingdao ECHEMI Digital Technology Co. Ltd.

- TBI CORPORATION LTD.

- Thinkbiotech LLC

- Zhejiang Longsheng Group Co. Ltd.

- Aarti Industries Ltd.

- Anhui Xianglong Chemical Co. Ltd.

- BOC Sciences

- Chizhou Fangda Technology Co. Ltd.

- DuPont

- Jay Organics Pvt. Ltd.

- Jayvir Dye Chem

- Jiangsu Xinyu Bio-Tech Co. Ltd.

- Quzhou Rui Chemical Co. Ltd.

- Suzhou Rosen Additives Co. Ltd.

Recent Developments

In 2023 Alfa Aesar, recognized for its significant contributions to the Paraphenylenediamine (PPD) market, continues to be a key player.

In 2023 BOCSCI Inc. plays a crucial role in addressing the increasing demand for these compounds.

Report Scope

Report Features Description Market Value (2023) USD 500.8 Mn Forecast Revenue (2033) USD 748.5 Mn CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(PPD AD, PPD AD Molten, PPD AD Ultra-Pure, Others), By Type(Purified, Industrial), By Application(Rubber Chemicals, Hair Dyes, Textile Dyes and Pigments, Synthetic Fibers, Polyurethane, Photographic Developing, Printing Inks, Oils and Gasoline, Others), By End-use Industry(Personal Care and Cosmetics, Textile Industry, Oil and Gas, Rubber and Plastic Industry, Chemical and Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alfa Aesar, BOCSCI Inc., CHEMOS GmbH and Co. KG, Chizhou Fangda Science and Technology Co., Ltd., DuPont de Nemours Inc., EC Plaza Network, Inc., JAY ORGANICS PVT. Ltd., Lanxess AG, Liaoning Xinyu Bio-tech Co., Ltd., Qingdao ECHEMI Digital Technology Co. Ltd., TBI CORPORATION LTD., Thinkbiotech LLC, Zhejiang Longsheng Group Co. Ltd., Aarti Industries Ltd., Anhui Xianglong Chemical Co. Ltd., BOC Sciences, Chizhou Fangda Technology Co. Ltd., DuPont, Jay Organics Pvt. Ltd., Jayvir Dye Chem, Jiangsu Xinyu Bio-Tech Co. Ltd., Quzhou Rui Chemical Co. Ltd., Suzhou Rosen Additives Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Paraphenylenediamine MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Paraphenylenediamine MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Aesar

- BOCSCI Inc.

- CHEMOS GmbH and Co. KG

- Chizhou Fangda Science and Technology Co., Ltd.

- DuPont de Nemours Inc.

- EC Plaza Network, Inc.

- JAY ORGANICS PVT. Ltd.

- Lanxess AG

- Liaoning Xinyu Bio-tech Co., Ltd.

- Qingdao ECHEMI Digital Technology Co. Ltd.

- TBI CORPORATION LTD.

- Thinkbiotech LLC

- Zhejiang Longsheng Group Co. Ltd.

- Aarti Industries Ltd.

- Anhui Xianglong Chemical Co. Ltd.

- BOC Sciences

- Chizhou Fangda Technology Co. Ltd.

- DuPont

- Jay Organics Pvt. Ltd.

- Jayvir Dye Chem

- Jiangsu Xinyu Bio-Tech Co. Ltd.

- Quzhou Rui Chemical Co. Ltd.

- Suzhou Rosen Additives Co. Ltd.