Global Paper Box Market Size, Share, Growth Analysis By Product (Slotted Box, Folder Box, Telescope Box, Die Cut Box), By Material (Recycled, Virgin), By Board Type (Single Wall Board, Single Face Board, Double Wall Board, Triple Wall Board), By Grade Type (Liner, Fluting Medium), By End Use (Food & Beverages, Electrical & Electronics, Healthcare, Textiles & Apparels, Building & Construction, Homecare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167963

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

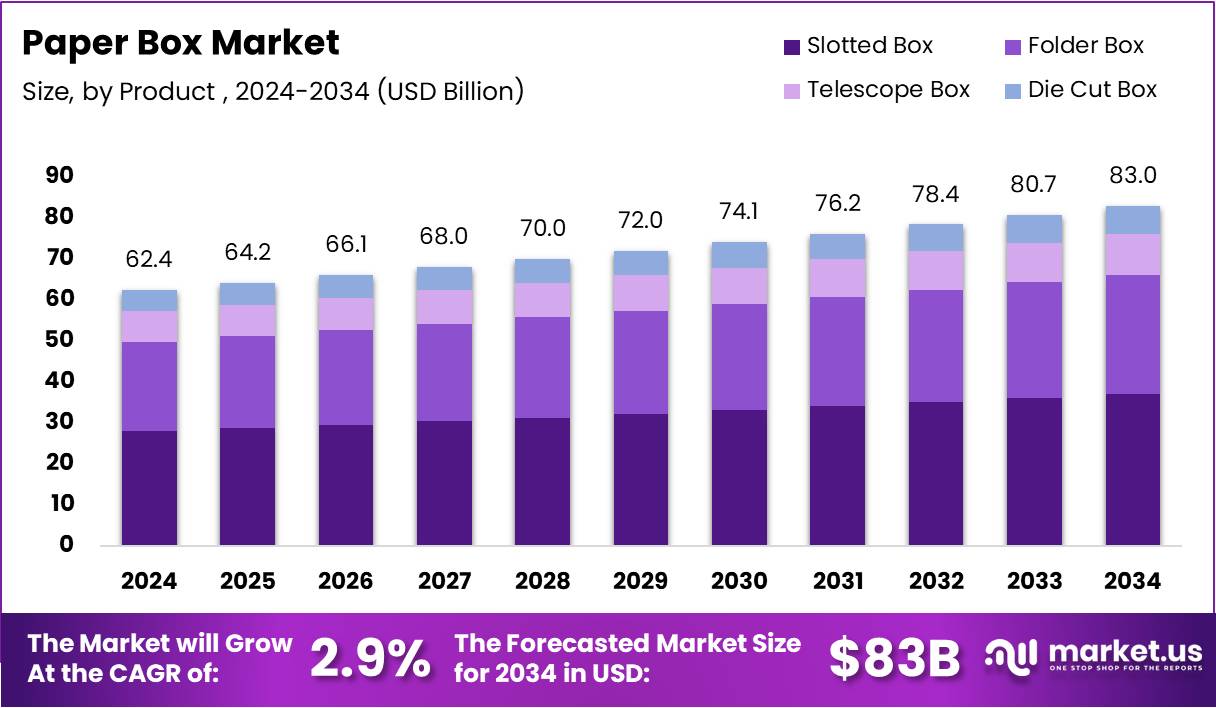

The Global Paper Box Market size is expected to be worth around USD 83.0 Billion by 2034, from USD 62.4 Billion in 2024, growing at a CAGR of 2.9% during the forecast period from 2025 to 2034.

The Paper Box Market represents a crucial segment of global sustainable packaging, covering folding cartons, corrugated boxes, and die-cut boxes used across retail, Fast Moving Consumer Goods, and industrial shipping. Demand strengthens as businesses shift toward recyclable, lightweight, and cost-efficient packaging that supports product safety, visual appeal, and responsible material use.

Moving forward, the Paper Box industry expands due to rising sustainability goals and the declining use of plastics. Companies increasingly choose paper-based packaging to improve environmental scores and meet customer expectations. This transition encourages manufacturers to increase capacity, optimize board grades, and introduce designs that enhance both durability and product presentation.

Furthermore, supportive government policies accelerate market growth. Incentives promoting recycling, restrictions on single-use plastics, and improvements in waste-management systems encourage adoption of paper-based solutions. As regulations strengthen, producers gain opportunities to upgrade equipment, enhance printing technologies, and extend their reach into high-demand commercial and industrial applications.

Additionally, rapid e-commerce growth continues to create strong demand for corrugated and shipment-ready packaging. As online orders rise, businesses prioritize sturdy, lightweight, and customizable paper boxes to reduce transportation costs and protect goods. These trends strengthen long-term prospects for innovative fluting mediums, liners, and multi-wall board solutions.

Moreover, premium packaging demand offers additional opportunities. Brands increasingly focus on custom die-cut structures, minimalist designs, and sustainable materials that elevate consumer experience. This transition supports value-added production, enabling manufacturers to capture niche opportunities in specialty foods, cosmetics, electronics, and personalized gifting segments.

In addition, sustainability performance indicators reinforce overall market confidence. In 2024, the paper recycling rate reached 60–64%, and the cardboard recycling rate stood at 69–74%, highlighting strong recovery levels for raw materials. This consistent recycling flow supports stable supply for recycled paperboard and helps maintain competitive production costs.

Finally, the industry benefits from strong resource efficiency improvements. Nearly 60% of energy used in the U.S. paper sector comes from renewable biofuels, supporting lower emissions and operational resilience. Paper and board consumption also increased by 7.5% in 2024, reflecting rising demand across commercial, retail, and industrial users and strengthening long-term market outlook.

Key Takeaways

- Global Paper Box Market expected to reach USD 83 Billion by 2034, growing from USD 62.4 Billion in 2024 at a CAGR of 2.9%.

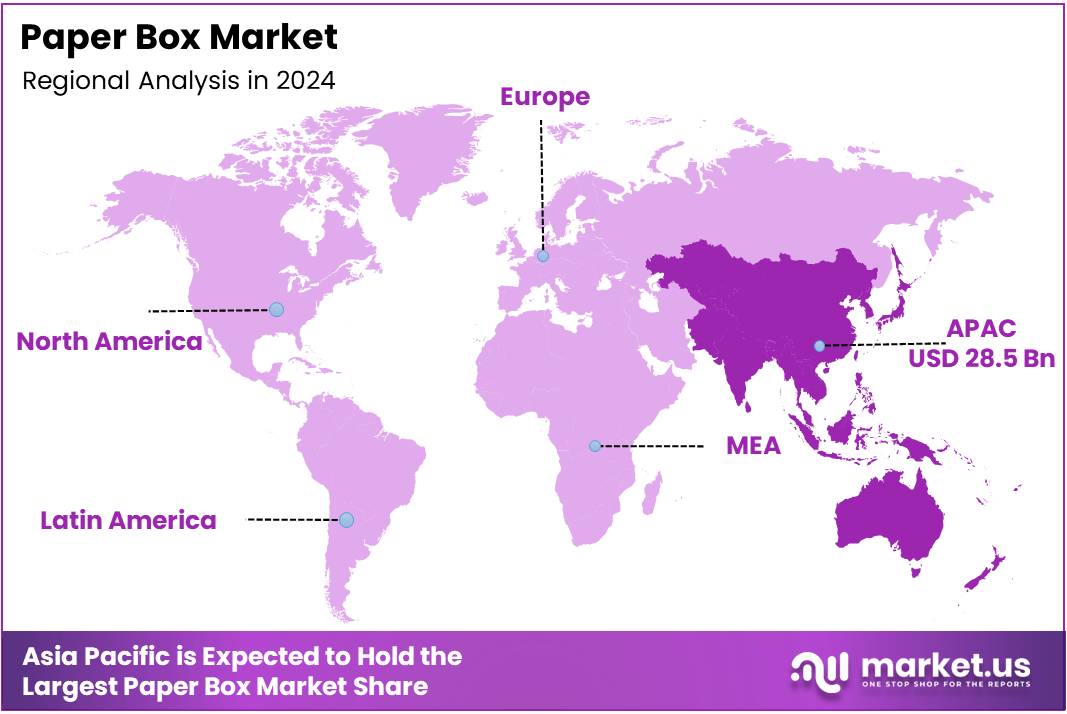

- Asia Pacific leads the market with a dominant share of 45.8%, valued at USD 28.5 Billion.

- Slotted Box dominates the product segment with a share of 44.8% in 2024.

- Recycled material accounts for the largest material share at 67.2% in 2024.

- Single Wall Board leads the board type segment with a share of 47.3% in 2024.

- Liner grade holds the dominant grade type share of 61.1% in 2024.

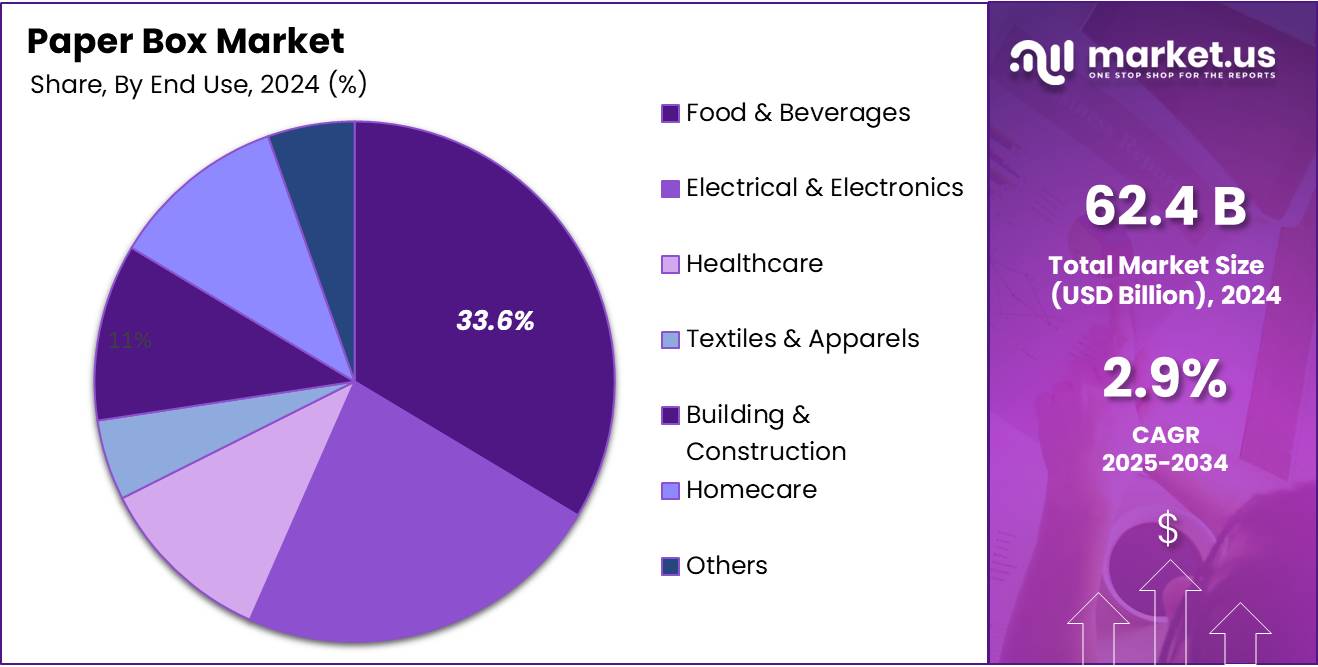

- Food & Beverages is the leading end-use segment with a share of 33.6% in 2024.

By Product Analysis

Slotted Box dominates with 44.8% due to its versatility and large-scale adoption across packaging operations.

In 2024, Slotted Box held a dominant market position in the By Product segment of the Paper Box Market, with a 44.8% share. This format supports efficient stacking and offers cost-friendly production, driving consistent use across supply chains. Its adaptability further promotes enhanced demand among diverse end-use industries.

The Folder Box category continues to gain steady traction as brands seek packaging that offers better product protection and quick assembly. Its lightweight nature helps reduce logistics costs, while improved customization options enhance branding potential. These advantages sustain its relevance in premium and specialty packaging requirements.

The Telescope Box segment benefits from rising demand for high-strength and multi-layered packaging solutions. Its dual-cover structure enhances durability during shipping, making it suitable for fragile or oversized items. As e-commerce expands, businesses increasingly adopt telescope formats to ensure improved handling and secure product delivery.

The Die Cut Box segment progresses as companies prefer customized shapes and fit-to-product packaging. Its precision cutting supports enhanced aesthetics and optimized material usage. Growing interest in branded and promotional packaging strengthens adoption, particularly in consumer goods and retail industries where visual appeal matters.

By Material Analysis

Recycled material dominates with 67.2% due to rising sustainability commitments and cost benefits.

In 2024, Recycled material held a dominant market position in the By Material segment of the Paper Box Market, with a 67.2% share. Increasing focus on circular packaging drives its usage, while lower production costs and regulatory support accelerate widespread adoption across industrial applications and consumer goods sectors.

The Virgin material segment remains relevant for applications requiring stronger structural integrity and food-grade compatibility. Its consistent fiber quality ensures better printability and performance, making it suitable for premium packaging formats. As brands prioritize product safety and visual impact, virgin-grade boxes maintain stable demand in targeted niche categories.

By Board Type Analysis

Single Wall Board dominates with 47.3% due to balanced strength, cost, and broad usage across industries.

In 2024, Single Wall Board held a dominant market position in the By Board Type segment of the Paper Box Market, with a 47.3% share. Its lightweight structure paired with adequate load-bearing capacity supports large-scale use. Businesses prefer this board for everyday packaging owing to cost-efficiency and versatility.

The Single Face Board segment grows gradually as industries utilize it for inner cushioning and lightweight wraps. Its flexibility helps protect delicate items during transit. As manufacturers explore eco-friendly protective packaging, single face boards continue gaining attention for their material savings and functional simplicity.

The Double Wall Board segment strengthens its presence due to higher durability requirements in industrial distribution. Its dual-layer structure offers superior resistance, making it appropriate for heavier loads. With expanding logistics networks, more companies adopt double wall configurations to ensure safer long-distance transportation.

The Triple Wall Board segment caters to heavy-duty packaging needs where maximum compression strength is essential. Industries dealing with bulk chemicals, machinery, or export shipments use this board type to minimize product damage. As global trade intensifies, triple-wall options remain vital for secure containerized transport.

By Grade Type Analysis

Liner grade dominates with 61.1% due to its strength, printing quality, and wide application.

In 2024, Liner grade held a dominant market position in the By Grade Type segment of the Paper Box Market, with a 61.1% share. Its superior surface strength and print performance support branding needs. As companies prioritize appealing packaging, liner grades remain essential for producing visually consistent and durable box exteriors.

The Fluting Medium segment supports core structural strength within corrugated boxes. It provides cushioning and rigidity, ensuring protection across supply chains. With rising shipments of fragile goods, fluting mediums remain a key component in reinforcing packaging, allowing manufacturers to maintain cost-effective internal support across various box formats.

By End Use Analysis

Food & Beverages dominates with 33.6% due to high packaging turnover and regulatory-driven adoption.

In 2024, Food & Beverages held a dominant market position in the By End Use segment of the Paper Box Market, with a 33.6% share. Its strong consumption rate stems from frequent product rotations and growing preference for safe, recyclable packaging. Sustainability concerns further reinforce paper-based solutions in this sector.

The Electrical & Electronics segment relies on sturdy packaging to protect sensitive items. Paper boxes offer shock resistance when combined with inserts, supporting safer transportation. As electronics shipments rise globally, demand for well-engineered corrugated solutions remains steady and increasingly aligned with eco-friendly packaging requirements.

The Healthcare segment adopts paper boxes to ensure compliance, hygiene, and ease of disposal. Pharmaceutical and medical-device packaging demand continues increasing due to expanding healthcare access. Paper-based formats support clear labeling and secure containment, making them suitable for regulated supply chains and sterile product transport.

The Textiles & Apparels segment benefits from lightweight, brand-friendly packaging options. Retailers leverage paper boxes for improved presentation and sustainable delivery solutions. With rising apparel e-commerce shipments, demand for custom-sized and visually appealing packaging formats strengthens across domestic and international markets.

The Building & Construction segment uses paper boxes for tools, components, and fittings. These boxes simplify handling while protecting items from dust and damage. As small hardware sales rise, corrugated packaging remains essential for managing varied product dimensions across retail and wholesale distribution channels.

The Homecare segment relies on paper boxes to package detergents, cleaners, and household supplies. Their printability enhances product visibility, while recyclability supports green positioning. Growing demand for organized storage and subscription-based home products boosts continued use across homecare brands.

The Others category includes miscellaneous consumer goods adopting paper boxes for versatility and cost control. Small businesses continue shifting to paper-based packaging to meet regulatory guidelines and enhance sustainability messaging. These trends keep the segment relevant across fragmented markets with evolving packaging needs.

Key Market Segments

By Product

- Slotted Box

- Folder Box

- Telescope Box

- Die Cut Box

By Material

- Recycled

- Virgin

By Board Type

- Single Wall Board

- Single Face Board

- Double Wall Board

- Triple Wall Board

By Grade Type

- Liner

- Fluting Medium

By End Use

- Food & Beverages

- Electrical & Electronics

- Healthcare

- Textiles & Apparels

- Building & Construction

- Homecare

- Others

Drivers

Strong Push Toward Circular Packaging Models Drives Market Growth

Global Fast Moving Consumer Goods brands are increasingly shifting toward circular packaging models, and this transition is giving strong momentum to the paper box market. Companies are replacing single-use plastics with recyclable and compostable paper formats to meet sustainability goals. This trend is pushing large-scale demand across retail, personal care, and household product categories.

Alongside this, the rapid expansion of food delivery services is creating significant opportunities. As more consumers order meals online, restaurants and delivery platforms prefer eco-friendly packaging to meet regulatory expectations and improve brand image. Paper boxes offer a safer, greener, and cost-efficient alternative, making them the preferred choice for hot and cold food items.

Moreover, subscription boxes and gift packaging brands are increasingly adopting paper boxes to enhance product presentation and consumer experience. These formats offer better customization, printing flexibility, and premium appeal without harming the environment. As more brands launch curated monthly boxes, demand for lightweight and visually appealing paper boxes continues to rise.

Restraints

Rising Competition From Flexible Packaging Alternatives Reducing Paper Box Preference

The paper box market is facing growing pressure as flexible packaging formats gain wider acceptance. Many brands are shifting toward pouches and lightweight films because they offer lower transport costs. This shift reduces the preference for traditional paper boxes, making it difficult for producers to maintain consistent demand levels across different industries.

Additionally, flexible packaging provides better barrier protection for moisture-sensitive products, which further limits paper box usage. As more companies adopt cost-efficient materials, paper box manufacturers struggle to differentiate their offerings. This trend creates a competitive disadvantage and slows market expansion, especially in fast-moving consumer goods and e-commerce packaging segments.

Moreover, rising investments in flexible packaging technologies are strengthening this competition. New designs allow these alternatives to be more durable and visually appealing. As a result, paper box makers must continuously innovate to stay relevant. This pressure often increases production costs, reducing overall profitability and impacting long-term planning for many manufacturers.

Alongside this, volatility in recycled paper supply adds another challenge. Frequent supply fluctuations affect production flow and raise material costs. Many producers find it difficult to secure stable raw material sources. This inconsistency disrupts output schedules and increases operational risks, ultimately limiting the market’s ability to scale efficiently and serve expanding packaging needs.

Growth Factors

Growing Demand for Custom-Printed Paper Boxes Creates New Market Opportunities

The paper box market is witnessing strong growth opportunities as industries shift toward lightweight and efficient packaging. E-commerce sellers are increasingly using light paper box formats to reduce shipping costs and improve handling. This trend is encouraging manufacturers to design new, industry-specific box types that offer better strength without adding weight. As online retail grows, these specialized formats will continue gaining traction.

At the same time, small and mid-size businesses are adopting custom-printed paper boxes to stand out in a crowded market. This rising demand for branding-focused packaging is opening space for short-run, cost-effective printing solutions. Manufacturers that offer flexible customization and quick delivery are well-positioned to capture this expanding customer base. This shift is helping the market evolve toward more value-added services.

Additionally, the push toward better product protection is creating opportunities for new water-resistant and moisture-shielded paper box variants. These advanced boxes are increasingly used in food, cosmetics, and cold-chain packaging where durability is essential. As brands seek eco-friendly yet protective materials, moisture-resistant solutions are becoming a key investment area. This innovation trend is expected to accelerate as sustainability requirements become more strict.

Emerging Trends

Rising Adoption of Minimalist and Mono-Material Paper Box Designs Drives Market Trends

The paper box market is witnessing a strong shift toward minimalist and mono-material designs as brands aim for cleaner aesthetics and easier recyclability. This trend is becoming popular across beauty, electronics, and lifestyle products, as companies seek packaging that reduces waste while maintaining visual appeal. It also helps streamline manufacturing and lowers material usage.

At the same time, plastic-free packaging is gaining momentum, especially in direct-to-consumer retail. As online-first brands focus on sustainability, they increasingly choose paper-only boxes for shipping and product displays. This trend is supported by consumers who prefer eco-friendly packaging and often associate it with responsible brand practices, improving overall customer loyalty.

Additionally, luxury finishing techniques are becoming a key trend in paper box branding. More brands are adopting foil stamping, embossing, matte lamination, and textured coatings to stand out in competitive retail shelves and online marketplaces. These premium finishes elevate product perception and help companies enhance their storytelling through packaging, especially in categories like cosmetics, gourmet foods, and gift items.

Regional Analysis

Asia Pacific Leads the Paper Box Market with a Dominant Share of 45.8%, Valued at USD 28.5 Billion

Asia Pacific holds the leading position in the global paper box market, driven by strong manufacturing activity and large-scale consumption across e-commerce and FMCG sectors. The region’s dominant 45.8% market share and value of USD 28.5 Billion reflect rising demand for recyclable and lightweight packaging. Additionally, ongoing investments in sustainable materials and advanced printing technologies further support regional expansion.

North America Paper Box Market Trends

North America demonstrates consistent growth supported by strict sustainability regulations and rising consumer demand for eco-friendly packaging. The region benefits from high adoption of custom-printed and premium paper box formats across food delivery, cosmetics, and subscription services. Growing focus on recyclable packaging continues to enhance market performance.

Europe Paper Box Market Trends

Europe remains a strong market driven by its advanced circular economy policies and rapid transition toward plastic-free packaging. Increased demand from luxury goods, bakery, and personal care sectors fuels the adoption of high-quality paper box formats. Regulatory pressure to reduce single-use plastics continues to accelerate market expansion across major European countries.

Middle East & Africa Paper Box Market Trends

The Middle East & Africa region is gradually strengthening its market presence due to rising retail expansion, urbanization, and growing e-commerce penetration. Governments are encouraging sustainable packaging adoption, leading to increased demand for paper-based solutions. Investments in local production capabilities are further enhancing regional market development.

Latin America Paper Box Market Trends

Latin America is experiencing steady market growth, driven by the expansion of food processing industries and increasing preference for affordable, lightweight packaging. E-commerce growth is contributing significantly to the demand for durable paper boxes. The region is also witnessing a gradual shift toward recyclable materials as sustainability awareness improves.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Paper Box Company Insights

DS Smith plc continues to lead through a strong focus on sustainable packaging solutions and operational scale. Its integrated recycling and fiber-based innovations strengthen cost efficiencies and appeal to eco-conscious brands. For 2024, DS Smith’s strategic investments in automation and regional capacity helped it maintain stable margins despite raw-material volatility. Market demand for circular solutions should further favor its model. It should sustain revenue growth.

Robinson Plc emphasizes customized folding-carton solutions for consumer goods and pharmaceuticals. Robinson’s agile supply chain and close customer partnerships enable rapid turnarounds and niche product differentiation. In a market shifting toward lightweight, mono-material designs, Robinson’s technical capabilities position it well for premium and regulated segments. Continued R&D in barrier coatings will be key to expansion. This will support market share gains.

McLaren Packaging Ltd has differentiated on specialty design and short-run printing services that attract SMEs and direct-to-consumer brands. McLaren’s flexible manufacturing and service orientation reduce lead times and support bespoke finishes. This focus allowed McLaren to capture growth where large converters deprioritize small volume, high-margin orders. Scaling digital print could accelerate its market reach. Digital capability investment will broaden reach.

Elite Marking Systems specializes in marking, labelling and end-to-end identification systems for corrugated and paper boxes. Their solutions improve traceability and regulatory compliance for food and pharmaceutical packaging. By bundling hardware with software analytics, Elite Marking helps customers reduce waste and improve supply-chain visibility, a growing priority in 2024. Increasing demand for traceability bodes well for further uptake. Adoption should rise as standards tighten.

Top Key Players in the Market

- DS Smith plc

- Robinson Plc

- McLaren Packaging Ltd

- Elite Marking Systems

- Huhtamäki Oyj

- Smurfit Kappa Group Plc

- Stora Enso Oyj

- WestRock Company

- Mayr-Melnhof Karton AG

- PakFactory

Recent Developments

- In April 2025, Mondi completed the acquisition of Schumacher Packaging’s Western Europe operations, strengthening its footprint across solid board packaging. The move also enhanced its capacity, enabling improved service capabilities and a broader product mix.

- In March 2025, Amcor introduced its AmFiber Performance Paper stand-up pouch for instant coffee and dry beverages. The launch expanded its paper-based packaging line, offering brands a recyclable alternative with improved barrier performance.

- In April 2024, DS Smith plc agreed to be acquired by International Paper Company under a £5.8 billion all-share transaction. This strategic deal aimed to create a global fiber-based packaging leader with integrated supply chain and production strengths.

- In July 2024, Smurfit Kappa Group finalized its $11.0 billion acquisition of WestRock, expanding its North American presence. The merger created one of the world’s largest paper-based packaging companies with strengthened innovation and distribution capabilities.

Report Scope

Report Features Description Market Value (2024) USD 62.4 Billion Forecast Revenue (2034) USD 83 Billion CAGR (2025-2034) 2.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Slotted Box, Folder Box, Telescope Box, Die Cut Box), By Material (Recycled, Virgin), By Board Type (Single Wall Board, Single Face Board, Double Wall Board, Triple Wall Board), By Grade Type (Liner, Fluting Medium), By End Use (Food & Beverages, Electrical & Electronics, Healthcare, Textiles & Apparels, Building & Construction, Homecare, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape DS Smith plc, Robinson Plc, McLaren Packaging Ltd, Elite Marking Systems, Huhtamäki Oyj, Smurfit Kappa Group Plc, Stora Enso Oyj, WestRock Company, Mayr-Melnhof Karton AG, PakFactory Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DS Smith plc

- Robinson Plc

- McLaren Packaging Ltd

- Elite Marking Systems

- Huhtamäki Oyj

- Smurfit Kappa Group Plc

- Stora Enso Oyj

- WestRock Company

- Mayr-Melnhof Karton AG

- PakFactory