Global Panel Saw Market Size, Share, Growth Analysis By Type (Electronic Panel Saw, Reciprocating Panel Saw, Sliding Table Saw), By Application (Panel Furniture, Wood Based Panel, Wooden Door & Floor Board, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160225

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

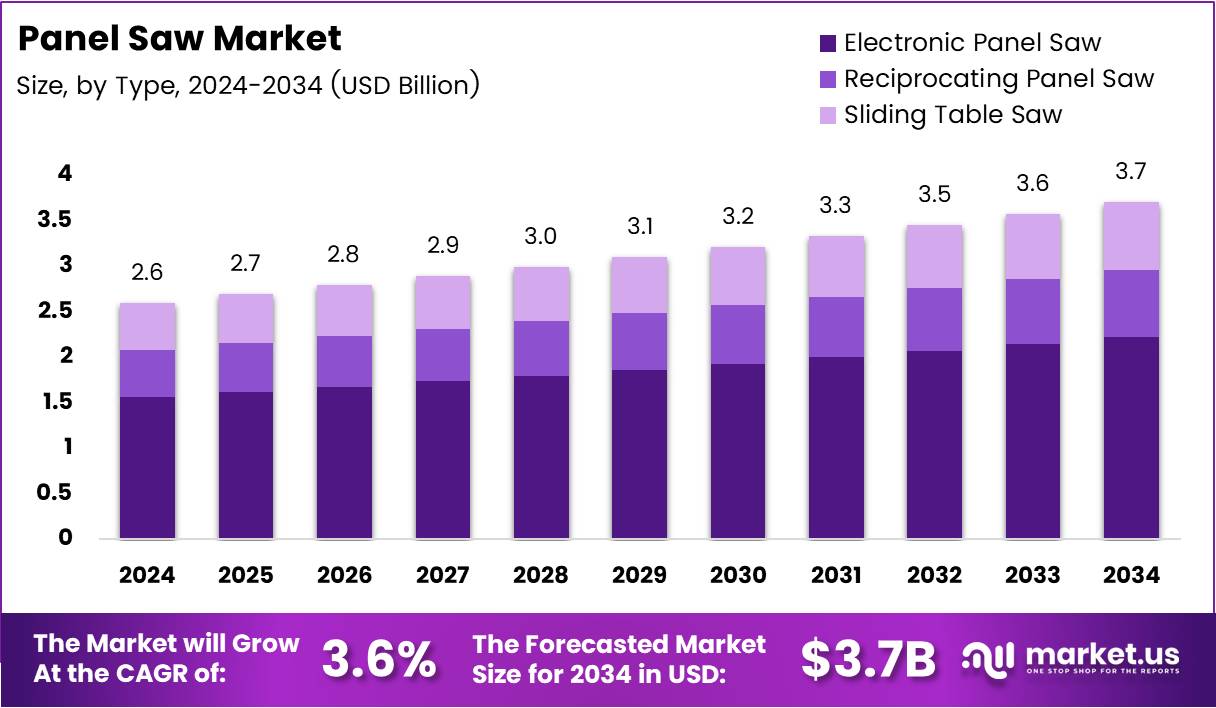

The Global Panel Saw Market size is expected to be worth around USD 3.7 Billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034.

The Panel Saw Market refers to the industry involved in manufacturing and distributing equipment designed to cut large sheets of wood, plastic, and metal into smaller panels. These machines are vital in furniture manufacturing, cabinetry, and construction sectors, offering precision, speed, and efficiency in material processing across industrial and commercial settings.

Driven by rapid industrialization, the Panel Saw Market is witnessing steady growth due to increasing demand for automation and advanced cutting technologies. Rising furniture production, coupled with expanding woodworking industries, supports this trajectory. Moreover, manufacturers are adopting digital controls and CNC integration to improve accuracy, enhance productivity, and reduce operational costs significantly.

Furthermore, growing investments in smart manufacturing create notable opportunities for market players. As industries embrace Industry 4.0, automated panel saw systems are being preferred for better throughput and safety. Emerging economies are showing higher adoption rates, supported by rising construction activities and demand for modular furniture across both residential and commercial projects.

Government initiatives promoting industrial modernization are also strengthening the Panel Saw Market outlook. Investments in small and medium-sized enterprises (SMEs) and incentives for technological upgrades encourage businesses to adopt advanced saw systems. Additionally, favorable trade policies and import–export regulations help manufacturers expand their global footprint, driving new growth avenues.

Environmental regulations and sustainable production practices are reshaping the market dynamics. Companies are increasingly investing in energy-efficient and dust-free cutting technologies to meet compliance standards. As a result, green manufacturing initiatives are fostering innovation, pushing the development of eco-friendly saw machines that reduce waste and improve material utilization effectively.

The integration of IoT and AI in panel saws presents lucrative opportunities for innovation. Smart saw systems equipped with data analytics and predictive maintenance enhance operational uptime and process reliability. Hence, the growing emphasis on automation, precision, and sustainability is expected to fuel market expansion in upcoming years.

Key Takeaways

- The Global Panel Saw Market is projected to reach USD 3.7 Billion by 2034, growing from USD 2.6 Billion in 2024 at a CAGR of 3.6% (2025–2034).

- In 2024, Electronic Panel Saw dominated the By Type segment with a 48.5% market share, driven by demand for automation, precision, and minimal wastage.

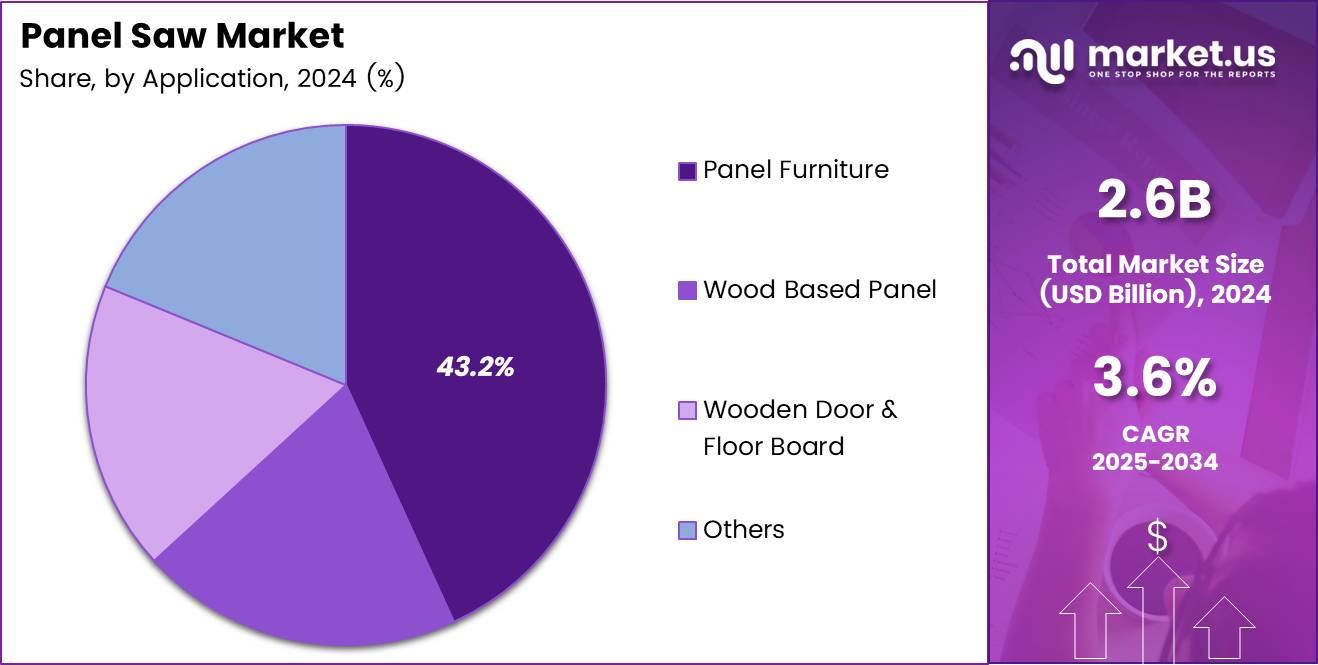

- In 2024, Panel Furniture led the By Application segment with a 43.2% share, fueled by urbanization and compact housing trends.

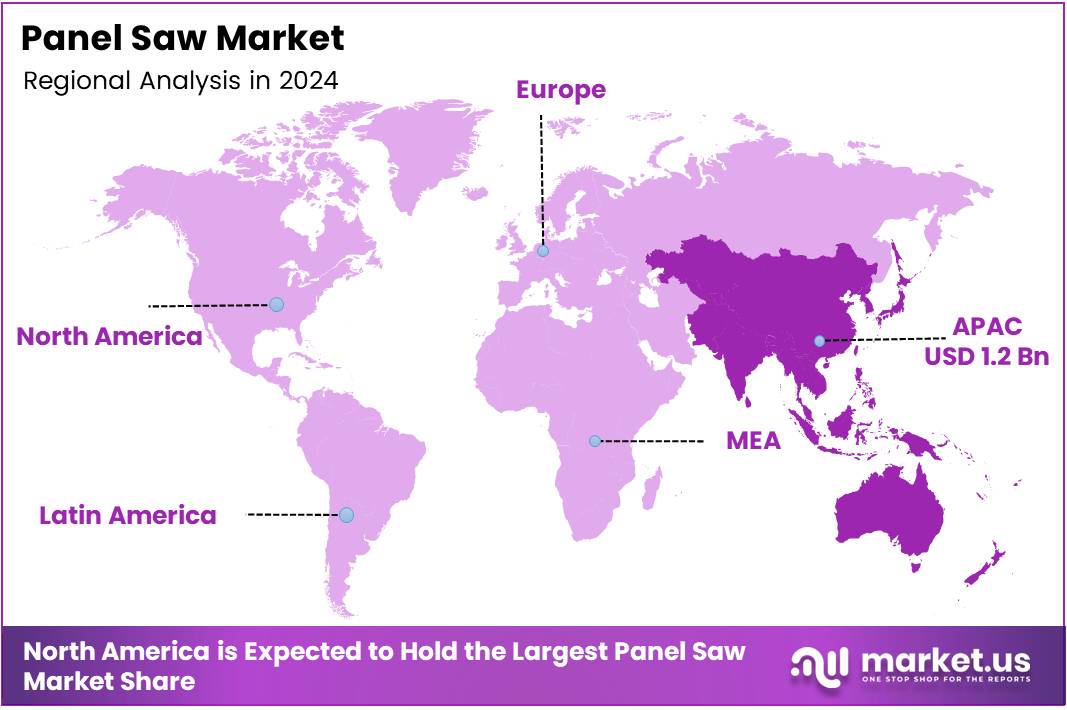

- North America leads the global market with a 46.9% share, valued at USD 1.2 Billion, supported by advanced manufacturing and automation adoption.

By Type Analysis

Electronic Panel Saw dominates with 48.5% due to its automation efficiency, precision cutting, and reduced labor cost.

In 2024, Electronic Panel Saw held a dominant market position in the By Type Analysis segment of the Panel Saw Market, with a 48.5% share. This dominance is driven by rising demand for automated solutions that enhance productivity and precision. These saws integrate advanced digital controls, enabling faster setup and minimal material wastage. Growing adoption across furniture and wood manufacturing units further fuels their popularity.

Reciprocating Panel Saw is gaining steady traction due to its versatility in handling various materials. These machines are preferred by small and medium-scale manufacturers for their cost-effectiveness and ease of maintenance. Moreover, their adaptability in cutting both wood and composite panels makes them a viable choice for diverse production environments. Continuous improvements in blade technology also enhance their performance and reliability.

Sliding Table Saw continues to serve as a vital tool for precision woodworking applications. These saws are widely used in carpentry workshops and custom furniture manufacturing units. Their ability to deliver accurate, straight cuts with adjustable angles makes them indispensable in fine woodworking. Increasing preference for flexible, high-quality panel cutting drives steady growth for this sub-segment.

By Application Analysis

Panel Furniture dominates with 43.2% due to growing modular furniture demand and widespread use in residential and commercial interiors.

In 2024, Panel Furniture held a dominant market position in the By Application Analysis segment of the Panel Saw Market, with a 43.2% share. Rising urbanization and compact housing trends have boosted demand for ready-to-assemble and modular furniture. Electronic and sliding table saws are increasingly used for cutting high-density boards, laminates, and MDF panels to meet design precision needs.

Wood Based Panel applications are expanding steadily due to increasing usage in decorative laminates, veneered panels, and engineered wood products. Manufacturers rely on high-performance saws for precise sizing and reduced edge chipping. The sub-segment benefits from the ongoing shift toward eco-friendly, engineered wood alternatives in furniture and building applications.

Wooden Door & Floor Board applications are witnessing consistent growth, supported by rising construction and renovation activities. Panel saws help achieve smooth finishes and accurate dimensions essential for premium flooring and door manufacturing. The increasing demand for durable hardwood and veneer-based designs is enhancing adoption of precision cutting equipment in this segment.

Others category includes custom cabinetry, interior fittings, and shop fitting solutions. These applications demand flexible saws capable of handling diverse panel materials and thicknesses. Small-scale manufacturers and bespoke furniture makers favor compact, efficient models. This sub-segment continues to benefit from niche customization trends and growing DIY woodworking culture.

Key Market Segments

By Type

- Electronic Panel Saw

- Reciprocating Panel Saw

- Sliding Table Saw

By Application

- Panel Furniture

- Wood Based Panel

- Wooden Door & Floor Board

- Others

Drivers

Rising Adoption of CNC-Integrated Panel Saw Systems for Precision Cutting

The growing use of CNC-integrated panel saws is transforming the woodworking industry. These machines provide high accuracy, faster setup, and consistent output. As manufacturers seek precision and repeatability, CNC systems enable better optimization of materials, reducing waste and boosting productivity in large-scale woodworking and furniture manufacturing facilities.

Moreover, demand from furniture and modular kitchen manufacturers continues to rise. These sectors prefer panel saws for their ability to deliver smooth, precise, and uniform cuts. With growing urbanization and lifestyle changes, modular furniture production is expanding, fueling the need for efficient, automated panel cutting solutions across global markets.

Additionally, smart woodworking facilities are increasingly adopting IoT-enabled machinery. Through connected systems, operators can track performance, schedule maintenance, and improve efficiency. This shift toward digital and data-driven operations helps reduce downtime, enhance quality, and support smart factory initiatives within the woodworking and panel cutting industry.

Furthermore, energy-efficient and automated cutting systems are gaining attention. Manufacturers are investing in eco-friendly machines that minimize power consumption and improve safety. These advanced models reduce operational costs while maintaining high performance, making them attractive choices for companies seeking sustainability and long-term cost efficiency in woodworking processes.

Restraints

Limited Availability of Skilled Operators for Digital Control Systems

One major restraint in the panel saw market is the shortage of skilled operators. As panel saws become more digital and CNC-controlled, many workshops struggle to find trained professionals. This skill gap affects operational efficiency and limits the adoption of advanced cutting technologies across smaller woodworking facilities.

Additionally, space limitations in small and medium workshops pose challenges. Panel saws require significant floor area for installation and safe operation. Due to restricted space, many businesses hesitate to invest in large cutting machines, slowing overall market expansion in regions dominated by compact manufacturing setups.

Fluctuations in raw material prices also impact production costs. Rising prices of steel, aluminum, and electronic components increase manufacturing expenses for panel saw producers. This volatility reduces profit margins and discourages investment in new product development, especially among small and medium-sized enterprises competing in price-sensitive markets.

Growth Factors

Integration of AI and Predictive Maintenance in Cutting Operations

The integration of artificial intelligence (AI) and predictive maintenance offers significant opportunities. By using sensors and real-time data, AI-enabled panel saws can predict breakdowns and optimize performance. This proactive approach helps minimize downtime, enhance productivity, and extend equipment life, providing manufacturers with a competitive technological edge.

Moreover, expanding custom panel cutting services is creating new revenue streams. Commercial woodshops offering tailored solutions attract customers seeking unique furniture and design projects. As demand for customization grows, these specialized services are driving investment in versatile and high-precision panel saw systems across industrial and commercial applications.

Additionally, there’s rising interest in compact and portable panel saws. These models are ideal for on-site construction and renovation projects. With growing demand for flexible and mobile solutions, manufacturers are developing lightweight, space-saving machines that combine convenience with accuracy, especially suited for small contractors and interior fit-out firms.

Furthermore, the push toward sustainability is inspiring innovation in eco-friendly blades and components. Manufacturers are developing recyclable materials and energy-efficient saw parts. These sustainable initiatives not only reduce environmental impact but also align with green building practices, enhancing the market appeal among environmentally conscious consumers and businesses.

Emerging Trends

Shift Toward Automated and Robotic Wood-Cutting Equipment

The panel saw market is witnessing a strong shift toward automation and robotics. Robotic cutting systems offer precision, consistency, and safety, helping reduce manual errors. As labor costs rise, automated machines improve throughput and reliability, making them essential in modern woodworking and industrial manufacturing setups.

Additionally, cloud-based monitoring tools are becoming more popular. These platforms allow real-time performance tracking, data storage, and process optimization from remote locations. By leveraging cloud technology, manufacturers can improve decision-making, schedule maintenance efficiently, and enhance production planning across multiple woodworking facilities.

Furthermore, hybrid saws designed for multi-purpose use are gaining traction. These versatile machines can handle various materials and cutting styles, making them suitable for workshops handling diverse projects. Their adaptability and cost-effectiveness attract both small-scale and large-scale manufacturers aiming to optimize operations.

Lastly, technological advancements in dust extraction and noise reduction are improving workplace safety. Modern panel saws now feature quieter motors and efficient filtration systems. These enhancements reduce health risks and ensure compliance with environmental regulations, creating safer, cleaner, and more comfortable working environments for operators.

Regional Analysis

North America Dominates the Panel Saw Market with a Market Share of 46.9%, Valued at USD 1.2 Billion

North America holds the leading position in the global panel saw market, accounting for a significant 46.9% share, valued at approximately USD 1.2 Billion. The region’s dominance is attributed to advanced manufacturing capabilities, robust woodworking industries, and growing adoption of automation technologies. Additionally, the presence of modern infrastructure and a strong focus on precision cutting tools continue to drive steady demand across industrial and commercial sectors.

Europe Panel Saw Market Trends

Europe represents a mature market characterized by strong technological innovation and strict safety standards. The region’s growth is supported by increasing investments in industrial automation and the rising demand for customized furniture production. Moreover, sustainability initiatives and the focus on energy-efficient cutting equipment have further accelerated the adoption of modern panel saw systems across European countries.

Asia Pacific Panel Saw Market Trends

Asia Pacific is witnessing rapid market expansion, driven by a surge in construction activities and the flourishing furniture manufacturing industry. Growing urbanization and industrialization, particularly in countries like China, India, and Japan, have amplified the need for efficient and cost-effective woodworking machinery. The region also benefits from government support for manufacturing modernization and the growing popularity of smart factory solutions.

Middle East and Africa Panel Saw Market Trends

The Middle East and Africa market is gradually gaining traction due to expanding infrastructure projects and increasing investments in the construction sector. With a growing emphasis on modern woodworking facilities, the region is adopting advanced machinery to meet rising production demands. Additionally, the shift toward diversifying economies beyond oil-based industries is encouraging the development of local manufacturing capabilities.

Latin America Panel Saw Market Trends

Latin America’s panel saw market is experiencing moderate growth, supported by the region’s evolving furniture and construction sectors. Countries such as Brazil and Mexico are witnessing increased demand for high-performance machinery to improve productivity and precision. Ongoing industrial development and modernization efforts are expected to create favorable opportunities for market expansion in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Panel Saw Company Insights

In 2024, the Panel Saw Market showcased strong competition among global players focusing on automation, precision, and efficiency. Key manufacturers are investing in smart technologies and expanding global reach to cater to rising demand from furniture and modular kitchen industries.

Wilhelm Altendorf GmbH & Co. KG maintained its leadership through advanced sliding table saw solutions and innovative digital integration. The company’s focus on CNC-controlled systems and operator-friendly interfaces enhanced cutting precision and safety, driving adoption across industrial woodworking units and furniture manufacturing setups.

SCM Group S.p.A strengthened its position with a wide range of automated panel saws tailored for both small workshops and large-scale production. Its emphasis on energy efficiency, software connectivity, and Industry 4.0 integration helped it attract customers seeking sustainable and high-performance solutions across global markets.

FELDER GROUP continued to grow by offering versatile machines combining compact design with intelligent control systems. Its commitment to supporting small and medium woodworking businesses with space-efficient and affordable saw systems positioned it as a reliable choice for emerging markets and regional manufacturers.

Otto Martin Maschinenbau GmbH & Co. KG enhanced its market share by providing precision-engineered saws built for durability and consistent performance. The company’s robust German engineering and focus on long-term reliability resonated with industrial users aiming for high-quality panel cutting and minimal downtime in production.

Top Key Players in the Market

- Wilhelm Altendorf GmbH & Co. KG

- SCM Group S.p.A

- FELDER GROUP

- Otto Martin Maschinenbau GmbH & Co. KG

- Griggio s.r.l.

- Casadei Busellato

- Robland NV

- Baileigh Industrial, Inc

- SAWSTOP

- OAV Equipment and Tools, Inc.

Recent Developments

- In December 2024, Burton Mill Solutions acquired Menominee Saw & Supply to strengthen its market presence and expand its product portfolio in saw manufacturing and industrial tooling services. This acquisition enhances Burton’s regional reach and supports its strategic growth in precision cutting solutions.

- In March 2024, NuVescor advised Control Dynamics in its acquisition by Verona Industrial Controls, enabling Verona to broaden its automation capabilities and industrial control system offerings. The deal underscores growing consolidation trends in the industrial automation sector for improved operational efficiency and market competitiveness.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 3.7 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electronic Panel Saw, Reciprocating Panel Saw, Sliding Table Saw), By Application (Panel Furniture, Wood Based Panel, Wooden Door & Floor Board, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Wilhelm Altendorf GmbH & Co. KG, SCM Group S.p.A, FELDER GROUP, Otto Martin Maschinenbau GmbH & Co. KG, Griggio s.r.l., Casadei Busellato, Robland NV, Baileigh Industrial, Inc, SAWSTOP, OAV Equipment and Tools, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wilhelm Altendorf GmbH & Co. KG

- SCM Group S.p.A

- FELDER GROUP

- Otto Martin Maschinenbau GmbH & Co. KG

- Griggio s.r.l.

- Casadei Busellato

- Robland NV

- Baileigh Industrial, Inc

- SAWSTOP

- OAV Equipment and Tools, Inc.