Global Outbound Logistics Market Size, Share, Growth Analysis By Service Type (Transportation, Warehousing, Inventory Management, Packaging, Others), By Transportation Mode (Roadways, Railways, Airways, Waterways), By Organization Size (Large Enterprises, Small Enterprises, Medium Enterprises), By End-use (Retail, Manufacturing, Automotive, Healthcare, Food and Beverage, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177135

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

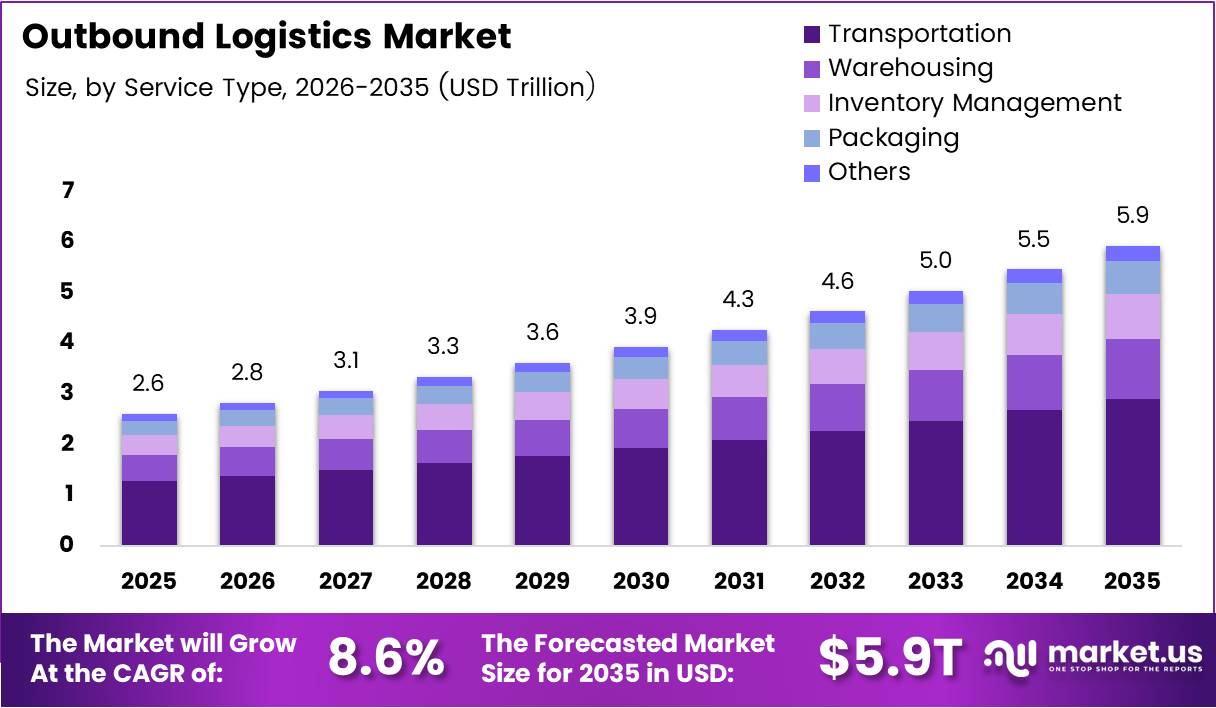

Global Outbound Logistics Market size is expected to be worth around USD 5.9 Trillion by 2035 from USD 2.6 Trillion in 2025, growing at a CAGR of 8.6% during the forecast period 2026 to 2035.

Outbound logistics encompasses the movement of finished goods from distribution centers to end customers. This process includes transportation management, order fulfillment, inventory control, and last-mile delivery operations. Consequently, it represents the final stage of supply chain execution.

Companies prioritize outbound logistics to ensure timely product delivery and customer satisfaction. Modern systems integrate warehousing, packaging, and freight management into unified platforms. Therefore, businesses gain operational efficiency and competitive advantages through optimized distribution networks.

E-commerce expansion drives substantial demand for advanced outbound logistics infrastructure worldwide. Retailers require flexible fulfillment capabilities to support omnichannel distribution strategies. Additionally, manufacturers seek integrated solutions to coordinate complex global shipping operations across multiple markets.

In January 2026, CEVA Logistics confirmed the Fagioli acquisition would strengthen its ability to manage the full project logistics value chain from engineering to final delivery. This strategic move reflects industry consolidation trends toward comprehensive service portfolios. Moreover, companies invest heavily in automation and digital tracking technologies.

According to Riverhorse Logistics, order accuracy industry benchmark typically reaches 96–98%, while top performers achieve approximately 99.9%. This performance gap demonstrates significant optimization opportunities across distribution operations. Furthermore, precision impacts customer retention and operational costs substantially.

According to Riverhorse Logistics, on-time delivery industry benchmark typically ranges 94–96%, while top performers reach 98–99%. Meeting these standards requires sophisticated route planning and real-time shipment visibility. Therefore, logistics providers increasingly deploy AI-powered systems to enhance delivery performance and reduce transit delays.

Government regulations promote sustainable transportation practices and infrastructure modernization initiatives globally. Investment flows toward green logistics solutions and emission reduction technologies. Additionally, public-private partnerships accelerate development of smart warehousing facilities and multimodal freight corridors across emerging economies.

Key Takeaways

- Global Outbound Logistics Market is projected to reach USD 5.9 Trillion by 2035, expanding at a CAGR of 8.6% from 2025 to 2035

- Transportation services segment dominates with 53.8% market share, driven by cross-border freight demand and e-commerce growth

- Roadways transportation mode leads with 49.3% share due to last-mile delivery flexibility and infrastructure availability

- Large enterprises account for 61.9% of market demand, leveraging advanced logistics technology and global distribution networks

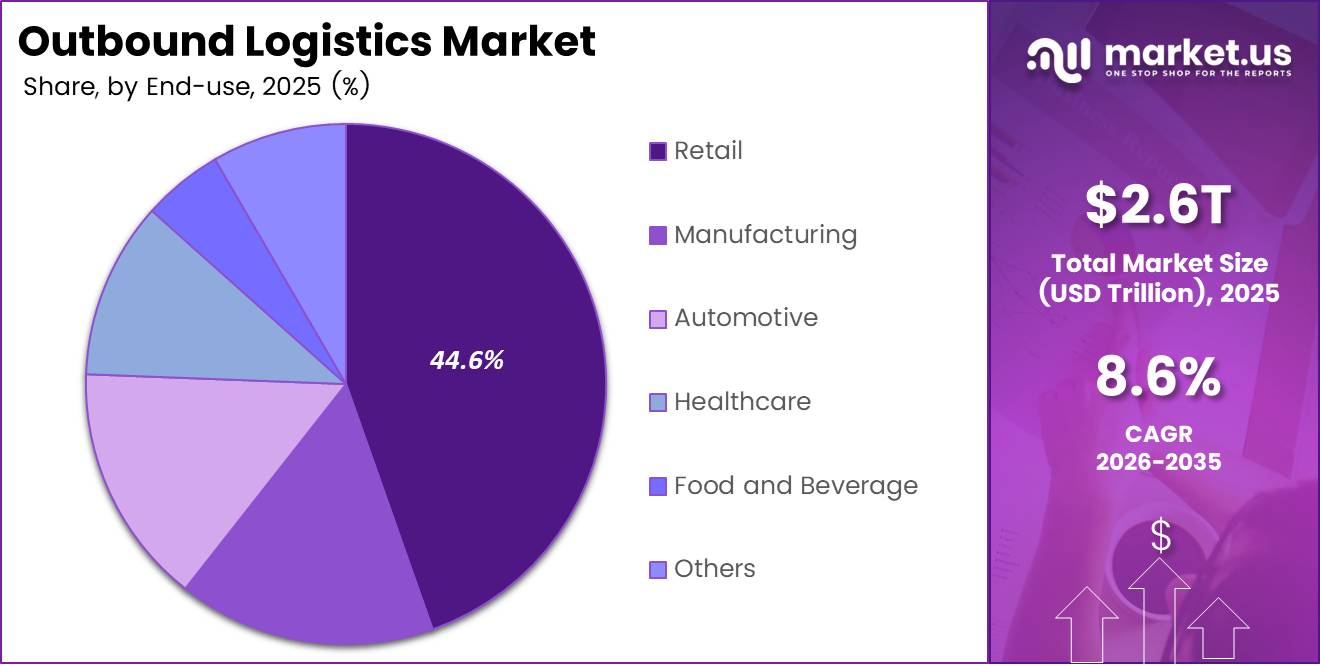

- Retail sector represents 44.6% of end-use applications, fueled by omnichannel fulfillment requirements and customer delivery expectations

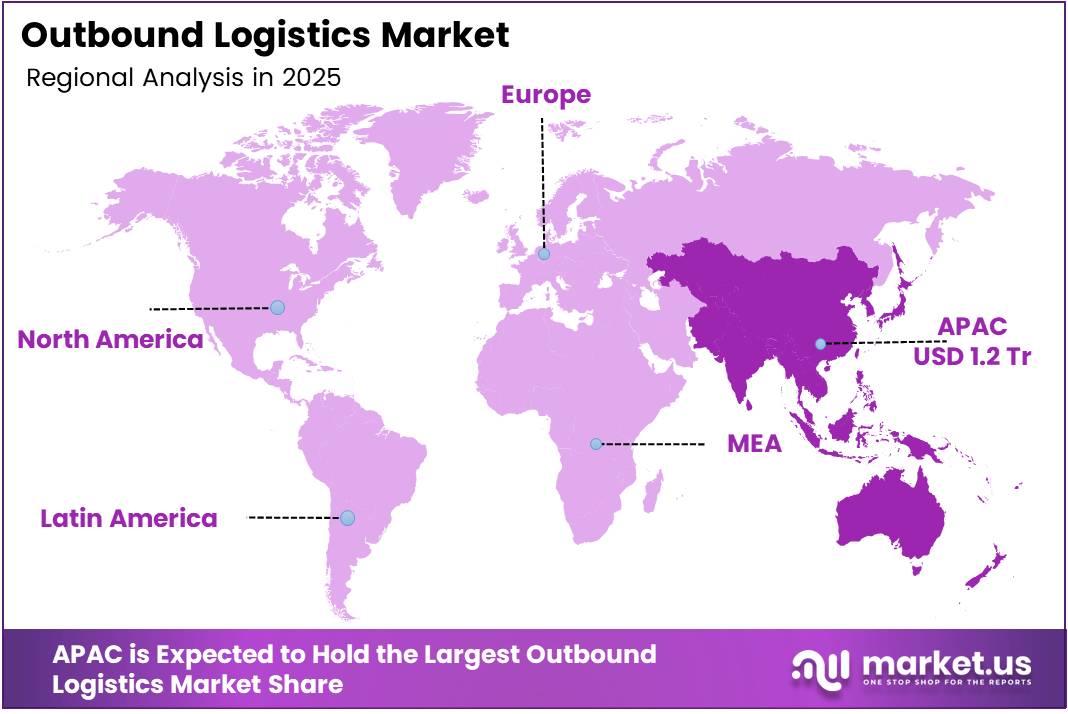

- Asia Pacific region dominates with 47.80% market share valued at USD 1.2 Trillion, supported by manufacturing hubs and e-commerce expansion

Service Type Analysis

Transportation dominates with 53.8% due to critical role in finished goods movement and cross-border freight operations.

In 2025, Transportation held a dominant market position in the By Service Type segment of Outbound Logistics Market, with a 53.8% share. Companies prioritize transportation services to ensure timely product delivery across domestic and international markets. Moreover, rising e-commerce volumes require scalable freight solutions for last-mile distribution networks.

Warehousing services provide essential storage and order fulfillment capabilities for retailers and manufacturers. Distribution centers consolidate inventory and enable efficient order processing workflows. Additionally, automated warehousing technologies reduce labor costs while improving picking accuracy and shipment speed across fulfillment operations.

Inventory Management solutions optimize stock levels and reduce carrying costs through demand forecasting systems. Real-time visibility platforms help businesses balance supply availability with customer demand fluctuations. Consequently, companies minimize stockouts and excess inventory through data-driven replenishment strategies and predictive analytics tools.

Packaging services ensure product protection during transportation and enhance brand presentation at delivery points. Custom packaging solutions accommodate fragile items and temperature-sensitive goods across various industries. Furthermore, sustainable packaging materials gain adoption as companies address environmental concerns and regulatory requirements for waste reduction.

Transportation Mode Analysis

Roadways dominates with 49.3% due to last-mile delivery flexibility and extensive infrastructure networks.

In 2025, Roadways held a dominant market position in the By Transportation Mode segment of Outbound Logistics Market, with a 49.3% share. Trucks provide door-to-door delivery capabilities that other modes cannot match for final customer shipments. Therefore, road freight remains essential for e-commerce fulfillment and retail distribution across urban and rural areas.

Railways offer cost-effective bulk transportation for heavy goods over long distances across continental markets. Rail freight reduces carbon emissions compared to road transport for high-volume shipments. Additionally, intermodal solutions combine rail efficiency with road flexibility to optimize transit times and freight costs.

Airways enable rapid delivery of high-value and time-sensitive products across international markets. Air cargo services support industries requiring express shipment capabilities, including electronics and pharmaceuticals. Moreover, expanding airport infrastructure and cargo handling facilities enhance global air freight capacity and connectivity.

Waterways facilitate economical intercontinental freight movement for bulk commodities and containerized goods. Maritime shipping dominates global trade volumes despite longer transit times compared to other modes. Furthermore, port modernization initiatives improve cargo handling efficiency and reduce vessel turnaround times significantly.

Organization Size Analysis

Large Enterprises dominates with 61.9% due to complex global distribution requirements and technology investment capacity.

In 2025, Large Enterprises held a dominant market position in the By Organization Size segment of Outbound Logistics Market, with a 61.9% share. Multinational corporations operate extensive supply chains spanning multiple regions and distribution channels. Consequently, they require sophisticated logistics platforms integrating warehouse management, transportation execution, and real-time tracking capabilities.

Small Enterprises increasingly adopt third-party logistics providers to access advanced fulfillment capabilities without capital investment. Outsourcing enables smaller businesses to compete with larger competitors through professional distribution services. Additionally, flexible pricing models allow small companies to scale logistics operations aligned with business growth trajectories.

Medium Enterprises balance in-house logistics capabilities with selective outsourcing for specialized distribution requirements. These companies invest in technology platforms to optimize order processing and inventory management workflows. Moreover, medium-sized businesses expand market reach through strategic partnerships with regional logistics providers and freight forwarders.

End-use Analysis

Retail dominates with 44.6% due to omnichannel distribution demands and consumer delivery expectations.

In 2025, Retail held a dominant market position in the By End-use segment of Outbound Logistics Market, with a 44.6% share. E-commerce growth drives massive demand for fast, accurate order fulfillment across diverse product categories. Therefore, retailers invest heavily in distribution center networks and last-mile delivery infrastructure to meet customer expectations.

Manufacturing companies require reliable outbound logistics to deliver finished products to distributors and business customers globally. Production facilities coordinate shipment schedules with inventory levels to optimize warehouse utilization and transportation costs. Additionally, just-in-time delivery models minimize working capital requirements while ensuring consistent product availability downstream.

Automotive sector demands specialized logistics for vehicle distribution and aftermarket parts delivery networks. Finished automobiles require dedicated carriers and port facilities for domestic and export shipments. Moreover, parts distribution supports dealership networks and repair facilities through centralized warehousing and rapid replenishment systems.

Healthcare industry requires temperature-controlled logistics for pharmaceuticals, biologics, and medical devices. Compliance regulations mandate strict handling protocols and chain-of-custody documentation throughout distribution processes. Furthermore, hospitals and pharmacies depend on reliable delivery services to maintain critical inventory levels for patient care.

Food and Beverage sector relies on cold chain logistics to preserve product quality and safety during transportation. Perishable goods require refrigerated warehousing and temperature-monitored vehicles across distribution networks. Additionally, food safety regulations drive investment in traceability systems and quality control throughout outbound supply chains.

Key Market Segments

By Service Type

- Transportation

- Warehousing

- Inventory Management

- Packaging

- Others

By Transportation Mode

- Roadways

- Railways

- Airways

- Waterways

By Organization Size

- Large Enterprises

- Small Enterprises

- Medium Enterprises

By End-use

- Retail

- Manufacturing

- Automotive

- Healthcare

- Food and Beverage

- Others

Drivers

Rapid Expansion of Cross-Border E-commerce and Omnichannel Retail Distribution Networks Drives Market Growth

E-commerce platforms expand internationally, creating unprecedented demand for cross-border fulfillment infrastructure and customs clearance expertise. Retailers implement omnichannel strategies requiring unified inventory visibility across physical stores and digital channels. According to Sparkmoor, global average on-time delivery rate across logistics networks reaches approximately 89%, highlighting performance improvement opportunities in expanding distribution operations.

Consumers expect seamless shopping experiences with flexible delivery options including click-and-collect and same-day services. Companies invest in distributed warehouse networks positioned closer to urban population centers. Therefore, outbound logistics providers develop specialized capabilities for handling returns management and reverse logistics workflows efficiently.

Globalization intensifies as manufacturers source materials internationally and distribute finished products across multiple continents. Supply chains become more complex, requiring integrated freight management and customs compliance solutions. Additionally, businesses seek logistics partners offering comprehensive services spanning transportation, warehousing, and value-added activities throughout distribution processes.

Restraints

High Transportation and Fuel Cost Volatility Impacting Outbound Freight Margins Limits Market Growth

Fuel price fluctuations create unpredictable cost structures for transportation-dependent logistics operations across all modes. Companies struggle to maintain profitability when sudden energy price spikes cannot be immediately passed to customers. Moreover, long-term contracts with fixed pricing expose logistics providers to significant margin compression during inflationary periods.

Operating expenses increase substantially when diesel and aviation fuel costs rise sharply over short timeframes. Logistics firms implement fuel surcharges and dynamic pricing mechanisms to offset volatility impacts. However, competitive pressures limit pricing power, particularly in commoditized freight segments serving price-sensitive customer industries.

Labor shortages across warehousing, fleet operations, and last-mile delivery workforce constrain capacity expansion plans. Logistics companies face recruitment challenges and elevated wage costs to attract and retain qualified personnel. Consequently, operational efficiency suffers when experienced drivers, warehouse workers, and logistics coordinators remain in short supply across regional markets.

Growth Factors

Expansion of Third-Party Logistics and Fourth-Party Logistics Outsourcing Models Accelerates Market Development

Companies increasingly outsource non-core logistics functions to specialized providers offering advanced technology and operational expertise. Third-party logistics firms deliver cost savings through economies of scale and network optimization capabilities. According to Freightamigo, perfect order rate target in modern shipping operations typically reaches 92%+ in 2025 benchmarks, demonstrating performance standards driving outsourcing decisions.

Fourth-party logistics providers offer comprehensive supply chain orchestration across multiple service providers and transportation modes. Businesses gain end-to-end visibility and simplified vendor management through single-point coordination platforms. According to Freightamigo, fill rate targets in modern logistics operations typically reach 96%+ to avoid backorders, emphasizing precision requirements driving sophisticated fulfillment partnerships.

In December 2025, CEVA Logistics signed a share purchase agreement to acquire 100% of project logistics specialist Fagioli Group to expand end-to-end heavy-lift and project logistics capabilities. Strategic acquisitions enable providers to offer integrated solutions spanning conventional freight and specialized industrial logistics. Therefore, market consolidation creates comprehensive service portfolios addressing diverse customer requirements across industries.

Emerging Trends

Rapid Adoption of Warehouse Automation, Robotics, and Smart Sorting Technologies Reshapes Market Operations

Distribution centers deploy autonomous mobile robots, automated storage and retrieval systems, and AI-powered sorting equipment. These technologies dramatically increase throughput while reducing labor dependency and operational costs. According to FanRuan, world-class order picking accuracy ranges between approximately 98.5% and 99.8%, establishing performance benchmarks driving automation investments across fulfillment operations.

IoT-based real-time shipment visibility and tracking systems become standard across outbound logistics networks globally. Sensors monitor location, temperature, humidity, and handling conditions throughout transportation journeys. According to FanRuan, perfect order rate world-class benchmark ranges between approximately 95% and 98%, highlighting quality standards enabled by comprehensive tracking capabilities.

Artificial intelligence and advanced analytics optimize last-mile delivery through dynamic route planning and predictive demand forecasting. Machine learning algorithms analyze historical delivery data, traffic patterns, and customer preferences to improve efficiency. Additionally, sustainable transportation models gain traction as companies adopt electric vehicles, alternative fuels, and carbon-neutral shipping programs addressing environmental regulations and corporate sustainability commitments.

Regional Analysis

Asia Pacific Dominates the Outbound Logistics Market with a Market Share of 47.80%, Valued at USD 1.2 Trillion

Asia Pacific commands the global outbound logistics landscape with 47.80% market share, valued at USD 1.2 Trillion, driven by massive manufacturing output and explosive e-commerce growth. China, Japan, and India operate extensive production facilities exporting goods worldwide through sophisticated distribution networks. Moreover, rising middle-class consumer spending fuels domestic retail logistics expansion across Southeast Asian markets rapidly.

North America Outbound Logistics Market Trends

North America maintains advanced logistics infrastructure supporting mature retail markets and cross-border trade with Mexico and Canada. E-commerce giants drive innovation in warehouse automation and last-mile delivery technologies. Additionally, nearshoring trends increase manufacturing logistics activity as companies relocate production closer to consumption markets.

Europe Outbound Logistics Market Trends

Europe emphasizes sustainable logistics practices through stringent environmental regulations and green transportation initiatives. Cross-border freight flows benefit from integrated road and rail networks spanning the European Union. Furthermore, automotive and pharmaceutical industries generate substantial demand for specialized outbound distribution services across the region.

Latin America Outbound Logistics Market Trends

Latin America experiences rapid e-commerce adoption driving investments in modern fulfillment infrastructure and last-mile capabilities. Brazil and Mexico lead regional logistics development through expanding middle-class populations and digital retail penetration. However, infrastructure gaps and regulatory complexity challenge distribution efficiency in certain markets.

Middle East & Africa Outbound Logistics Market Trends

Middle East and Africa benefit from strategic geographic positioning connecting Europe, Asia, and Africa through major shipping routes. Gulf Cooperation Council countries invest heavily in logistics infrastructure and free trade zones. Additionally, African e-commerce markets show strong growth potential despite infrastructure development requirements across distribution networks.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

C.H. Robinson operates as a leading third-party logistics provider specializing in freight brokerage and multimodal transportation management services globally. The company leverages advanced technology platforms connecting shippers with carriers across road, rail, air, and ocean modes. Moreover, their extensive network provides customers with flexible capacity and competitive pricing through market expertise and digital freight matching capabilities.

CEVA Logistics SA delivers comprehensive supply chain solutions spanning contract logistics, freight management, and specialized transportation services worldwide. The company serves diverse industries including automotive, healthcare, technology, and retail through integrated warehouse and distribution operations. Additionally, strategic acquisitions expand their end-to-end capabilities in project logistics and heavy-lift transportation for complex industrial applications.

DB Schenker provides global logistics services combining land transport, air and ocean freight, and contract logistics solutions. The company operates extensive warehouse networks and transportation assets across Europe, Americas, and Asia Pacific regions. Furthermore, digital transformation initiatives enhance customer visibility and operational efficiency through advanced tracking systems and data analytics platforms.

DHL Supply Chain specializes in warehousing, distribution, and value-added services supporting retail, automotive, technology, and life sciences industries globally. The company invests heavily in automation technologies and sustainable logistics solutions to improve operational performance. Consequently, their innovation centers develop robotics, AI-powered systems, and green transportation alternatives addressing evolving customer requirements and environmental regulations.

Key players

- C.H. Robinson

- CEVA Logistics SA

- DB Schenker

- DHL Supply Chain

- DSV Panalpina

- Expeditors International of Washington, Inc

- Fedex Corporation

- Kuehne + Nagel International AG

- Maersk

- Nippon Express Holdings, Inc

Recent Developments

- April 2025 – DSV completed the acquisition of DB Schenker from Deutsche Bahn, creating one of the world’s largest global transport and logistics companies with expanded capabilities across air, ocean, and road freight services.

Report Scope

Report Features Description Market Value (2025) USD 2.6 Trillion Forecast Revenue (2035) USD 5.9 Trillion CAGR (2026-2035) 8.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Transportation, Warehousing, Inventory Management, Packaging, Others), By Transportation Mode (Roadways, Railways, Airways, Waterways), By Organization Size (Large Enterprises, Small Enterprises, Medium Enterprises), By End-use (Retail, Manufacturing, Automotive, Healthcare, Food and Beverage, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape C.H. Robinson, CEVA Logistics SA, DB Schenker, DHL Supply Chain, DSV Panalpina, Expeditors International of Washington, Inc, Fedex Corporation, Kuehne + Nagel International AG, Maersk, Nippon Express Holdings, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- C.H. Robinson

- CEVA Logistics SA

- DB Schenker

- DHL Supply Chain

- DSV Panalpina

- Expeditors International of Washington, Inc

- Fedex Corporation

- Kuehne + Nagel International AG

- Maersk

- Nippon Express Holdings, Inc