Global Organic Pasta Market Size, Share and Report Analysis By Product Type (Spaghetti, Linguine And Fettuccine, Penne, Shells, Fusilli/Rotini, Ravioli, Others), By Source (Wheat, Rice, Legumes, Buckwheat, Oats, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175988

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

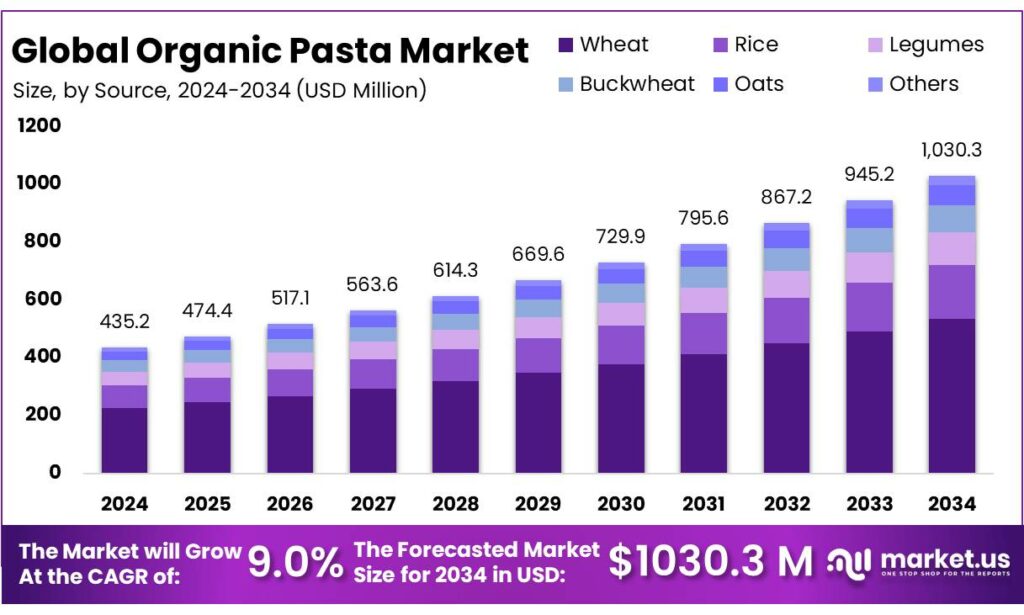

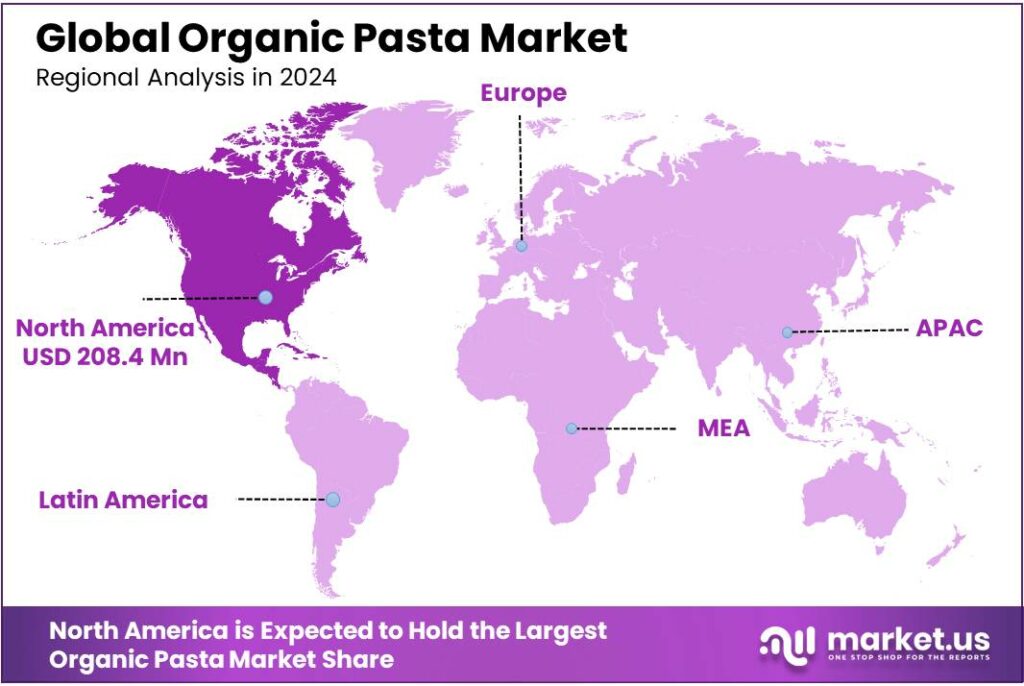

Global Organic Pasta Market size is expected to be worth around USD 1030.3 Million by 2034, from USD 435.2 Million in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 47.9% share, holding USD 208.4 Million in revenue.

Organic pasta sits at the intersection of two large, mature food industries—pasta and certified organic—so its “industrial” story is less about inventing a new category and more about upgrading ingredients, traceability, and compliance. On the pasta side, production scale is already massive: the International Pasta Organisation reports 17 million tonnes of pasta produced in 2023 across 52 countries, which keeps pasta firmly in the global staple-food basket.

- At the regional level, the EU’s pasta industry produced about 5,773,000 tonnes in 2024 and consumed around 3,801,000 tonnes, showing a strong home market that supports continuous manufacturing throughput.

The industrial scenario is increasingly shaped by how fast organic farming can supply consistent, certified durum wheat and specialty grains. IFOAM notes global organic farmland reached nearly 99 million hectares in 2023, alongside organic food sales of nearly €136 billion in 2023—signals that upstream acreage and downstream demand are expanding together. In the U.S., the Organic Trade Association reports certified organic sales of $71.6 billion in 2024 (up 5.2%), which encourages brands and retailers to widen organic shelf space, including pantry staples such as pasta.

Key driving factors are mostly practical. First, shoppers are paying for “clean-label reassurance” in everyday foods, and organic certification is one of the clearest labels available. In the United States alone, the Organic Trade Association reports $63.8 billion in organic food sales in 2023, illustrating how organic has moved from niche to mainstream grocery behavior.

In parallel, governments are funding or scaling organic production systems that indirectly support organic wheat and grain availability. In India, the PKVY program reported ₹2,265.86 crore released from 2015–25, with around 15 lakh hectares under organic farming and 52,289 clusters formed, helping broaden certified supply pools relevant to organic cereals used in pasta.

Key Takeaways

- Organic Pasta Market size is expected to be worth around USD 1030.3 Million by 2034, from USD 435.2 Million in 2024, growing at a CAGR of 9.0%.

- Spaghetti held a dominant market position, capturing more than a 47.5% share in the Organic Pasta Market.

- Wheat held a dominant market position, capturing more than a 52.1% share in the Organic Pasta Market.

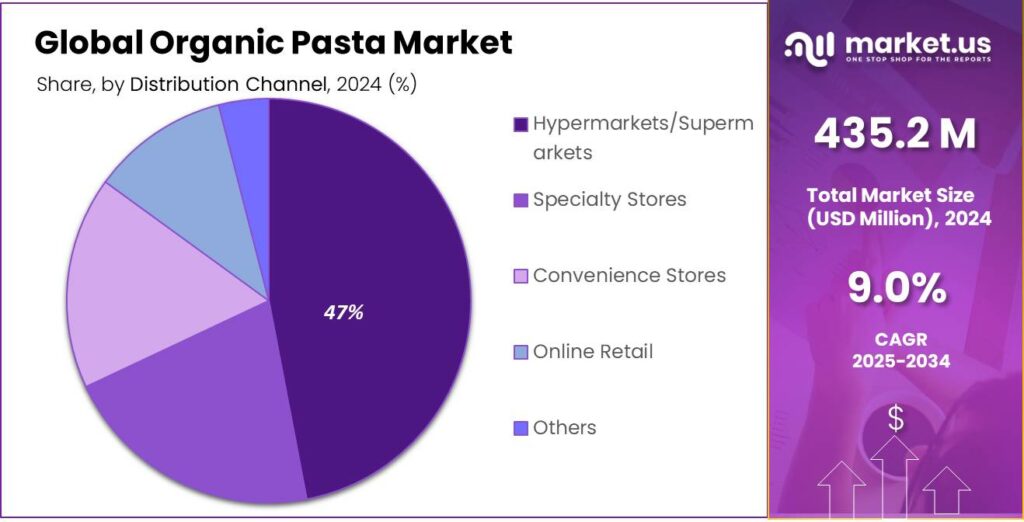

- Hypermarkets/Supermarkets Retail held a dominant market position, capturing more than a 47.4% share in the Organic Pasta Market.

- North America Leads the Organic Pasta Market with a Strong 47.9% Share Valued at USD 208.4 Million.

By Product Type Analysis

Spaghetti leads the Organic Pasta category with a strong 47.5% share, driven by everyday consumption and wide household acceptance.

In 2024, Spaghetti held a dominant market position, capturing more than a 47.5% share in the Organic Pasta Market. Its leadership is shaped by the product’s universal appeal, easy cooking format, and strong presence across both offline and online retail shelves. Consumers continue to prefer spaghetti because it fits into regular meal routines, from simple home cooking to restaurant menus, making organic versions a natural upgrade as people seek cleaner and pesticide-free ingredients. The category benefits further from the shift toward sustainable diets, where organic wheat and clean-label formulations add value without changing cooking habits.

By Source Analysis

Wheat dominates the organic pasta market with a strong 52.1% share, reflecting its reliability, taste familiarity, and wide cultivation base.

In 2024, Wheat held a dominant market position, capturing more than a 52.1% share in the Organic Pasta Market. Its leadership comes from the deep-rooted consumer preference for wheat-based pasta, especially durum wheat, which delivers the texture, flavor, and cooking quality people recognize. Organic wheat farming has expanded consistently across major producing regions, making certified wheat more accessible for pasta processors. This stable supply has helped manufacturers maintain product consistency, which is crucial for household staple items like pasta.

By Distribution Channel Analysis

Hypermarkets and supermarkets lead the organic pasta market with a strong 47.4% share, supported by wide product visibility and accessible pricing.

In 2024, Hypermarkets/Supermarkets Retail held a dominant market position, capturing more than a 47.4% share in the Organic Pasta Market. This leadership is driven by the trust consumers place in large retail chains, where they can compare brands, check certifications, and evaluate packaging before buying. These stores offer a wide variety of organic pasta options—from basic wheat spaghetti to emerging organic multigrain formats—making it easier for shoppers to shift from regular pasta to organic alternatives without hunting across multiple outlets.

Key Market Segments

By Product Type

- Spaghetti

- Linguine & Fettuccine

- Penne

- Shells

- Fusilli/Rotini

- Ravioli

- Others

By Source

- Wheat

- Rice

- Legumes

- Buckwheat

- Oats

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Emerging Trends

Rising health-first eating habits are reshaping organic pasta demand with real impact

One of the latest trends redefining the organic pasta market is the growing consumer focus on health and clean-label foods, which is driving people to rethink not just what they eat, but why they eat it. This trend goes beyond a passing fad—many families, young professionals, and older shoppers are choosing products with transparent ingredient lists and minimal processing. In practical terms, that means organic pasta is no longer seen as a specialty product; for many, it’s becoming part of everyday meals because it fits both nutritional concerns and familiar cooking routines.

Over the past few years, overall organic food sales have shown that this shift is not marginal. In the United States alone, certified organic food sales reached $71.6 billion in 2024, rising 5.2% year over year. What this reflects is a broadening of the organic customer base—more people are choosing organic across categories, from produce and dairy to pantry staples like pasta. They are driven by worries over pesticide residues, additives, and a desire for foods that feel closer to nature. Organic pasta, with its simple ingredients and clean production standards, is benefiting directly from this shift.

Behind the scenes, governments are helping to support this shift through policies that make organic farming more viable and visible. In the United States, the USDA Organic Certification Cost Share Program helps farmers and processors with certification costs by reimbursing up to 75%, capped at $750 per certification scope. While this doesn’t directly change demand, it strengthens the supply side by enabling more producers to enter or stay in the organic system. A broader pool of organic ingredients helps keep products like organic pasta accessible and varied, encouraging shoppers to try different shapes, grains, and brands.

Drivers

Rising organic food spending, backed by stronger certification support, is pushing organic pasta into everyday shopping baskets

One major driving factor for organic pasta is simple: more people are buying organic food more often, and pasta is an easy staple to “switch” without changing how a family cooks. In the United States, organic sales reached $71.6 billion in 2024, growing 5.2% year over year—showing that organic is still gaining ground even when shoppers are careful with budgets.

When consumers already trust organic labels for items like fruits, milk, or eggs, they are more willing to buy organic pantry basics too. Pasta fits that pattern because it is affordable, familiar, and used in weekly meals. The wider pasta category is also massive: global pasta production nearly reached 17 million tons in 2023, which means even a small shift toward organic formats can translate into meaningful volume.

This demand pull is getting stronger because supply conditions are improving, largely due to public policy and clearer standards that make certification less intimidating for farmers and food handlers. In the U.S., the USDA Organic Certification Cost Share Program (OCCSP) allows certified operations to receive up to 75% of certification costs back, capped at $750 per certification scope.

Europe shows the same story from a different angle: policy targets and consumer demand are working together to expand organic production capacity. The share of EU agricultural land under organic farming increased from 5.9% in 2012 to 10.8% in 2023, and the European Green Deal strategies set a target of 25% by 2030.

Restraints

Higher production costs and limited certified grain supply continue to restrain the steady expansion of organic pasta

One major restraining factor for the organic pasta market is the higher cost of producing and sourcing certified organic wheat, which creates a price gap that many consumers still hesitate to overcome. Unlike conventional farming, organic production cannot use synthetic fertilizers or pesticides, and yields tend to be lower. According to long-term agricultural observations compiled by the FAO, organic crop yields can fall 20–25% below conventional yields, depending on climate and crop type.

A second pressure point is the limited availability of certified organic farmland relative to total agricultural land. While organic farming is growing, it is still a small share of global agriculture. According to IFOAM’s global update, organic farmland reached around 96–98 million hectares in 2023, which is only a fraction of the total global agricultural area.

The price gap is further complicated by household spending behavior. Even though organic food sales are rising overall, not all consumers prioritize organic staples. For example, the U.S. organic market reached $71.6 billion in 2024, growing 5.2%, but reports still show that many shoppers selectively buy organic rather than fully switching their pantry staples.

Another factor restraining growth is the cost and complexity of certification. Although support programs exist, they do not eliminate all barriers. The USDA Organic Certification Cost Share Program reimburses up to 75% of certification costs (capped at $750 per scope), which helps but does not fully offset inspection fees, documentation work, or recurring compliance expenses.

Opportunity

Expansion of organic farmland and supportive policies open the door for big growth in organic pasta

One major growth opportunity for the organic pasta market lies in the expansion of organic farmland supported by strong government policies and rising consumer demand for certified organic food. As more land is converted to organic production and supportive frameworks reduce barriers for farmers, the availability of organic wheat and other core pasta ingredients is set to increase. This creates a more reliable supply base for pasta makers and helps bring down costs over time, encouraging wider adoption across retail and foodservice sectors.

Government support plays a key role in accelerating this transition. In the United States, programs such as the USDA Organic Certification Cost Share Program help reduce the financial burden of certification by reimbursing up to 75% of eligible costs, capped at $750 per certification scope. In Europe, policy signals reinforce this opportunity. The European Green Deal and Farm to Fork Strategy aim to increase the share of EU agricultural land under organic farming from 10.8% in 2023 toward 25% by 2030.

Consumer trends reinforce this growth opportunity. Organic foods are no longer niche; U.S. organic sales reached $71.6 billion in 2024, with a 5.2% increase from the previous year. This indicates that organic purchasing is broadening beyond produce and dairy into pantry staples. As shoppers become familiar with organic labels and certification, they are more willing to experiment with organic pasta—especially when it’s priced competitively and positioned near conventional pasta on store shelves.

Regional Insights

North America Leads the Organic Pasta Market with a Strong 47.9% Share Valued at USD 208.4 Million

North America is the dominating region in the Organic Pasta Market, supported by high household penetration of organic groceries and a strong pasta-eating culture. The region held a leading share of 47.9%, valued at USD 208.4 Mn, reflecting how organic pantry staples are moving from “specialty” to regular weekly purchases in the U.S. and Canada. In the U.S., certified organic product sales reached $71.6 billion in 2024, growing 5.2% year over year, which signals steady willingness to pay for trusted labels even in everyday categories like pasta.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Barilla remains the world’s largest pasta producer, operating in over 100 countries and managing 28 production sites globally. The company produces more than 1.9 million tons of food annually, a portion of which includes expanding organic pasta lines. Its investments in sustainable wheat sourcing and low-carbon production continue strengthening its position in premium and organic pasta categories.

Nestlé, the world’s largest food company with CHF 93 billion in annual sales, participates in the organic and wellness pasta space through its portfolio of health-oriented and plant-based brands. Its presence in 186 countries gives it unmatched distribution reach. The company’s reformulation strategy and investment in cleaner ingredient profiles continue supporting demand for organic and natural pasta formats.

Grupo Gallo, a leading Spanish pasta producer, operates six production plants and manufactures more than 200,000 tons of pasta annually. The company has expanded its organic pasta portfolio and strengthened wheat-sourcing programs within Spain. With over 75 years of heritage, Gallo’s brand trust and regional leadership position it strongly in the fast-growing Mediterranean organic pasta segment.

Top Key Players Outlook

- Barilla G. e R. Fratelli S.p.A

- Ebro Foods S.A.

- TreeHouse Foods, Inc.

- Nestlé S.A.

- Gallo

- F.lli De Cecco di Filippo S.p.A

- Rummo S.p.A.

- Pastificio Lucio Garofalo S.p.A.

- Newlat Food S.p.A

- Jovial Foods, Inc.

- DeLallo

Recent Industry Developments

In 2024, Ebro Foods reported consolidated sales of approximately €3.14 billion, up 1.8% from the prior year, while its pasta division—an important contributor to this portfolio—drove €347.1 million in revenue with an adjusted EBITDA of €51.8 million in the first half of 2025, showing resilience in a challenging market.

In 2024, Nestlé S.A reported total sales of approximately CHF 91.35 billion, with organic sales growth of around 2.2%, signaling a continued demand for products perceived as healthier and more transparent.

Report Scope

Report Features Description Market Value (2024) USD 435.2 Mn Forecast Revenue (2034) USD 1030.3 Mn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Spaghetti, Linguine And Fettuccine, Penne, Shells, Fusilli/Rotini, Ravioli, Others), By Source (Wheat, Rice, Legumes, Buckwheat, Oats, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Barilla G. e R. Fratelli S.p.A, Ebro Foods S.A., TreeHouse Foods, Inc., Nestlé S.A., Gallo, F.lli De Cecco di Filippo S.p.A, Rummo S.p.A., Pastificio Lucio Garofalo S.p.A., Newlat Food S.p.A, Jovial Foods, Inc., DeLallo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Barilla G. e R. Fratelli S.p.A

- Ebro Foods S.A.

- TreeHouse Foods, Inc.

- Nestlé S.A.

- Gallo

- F.lli De Cecco di Filippo S.p.A

- Rummo S.p.A.

- Pastificio Lucio Garofalo S.p.A.

- Newlat Food S.p.A

- Jovial Foods, Inc.

- DeLallo