Global Opacifiers Market Size, Share Analysis Report By Product (Titanium Dioxide, Zinc Oxide, Zirco, Calcium Carbonate, Others), By Application (Paints and Coatings, Plastics, Ceramic, Cosmetics, Paper, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160819

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

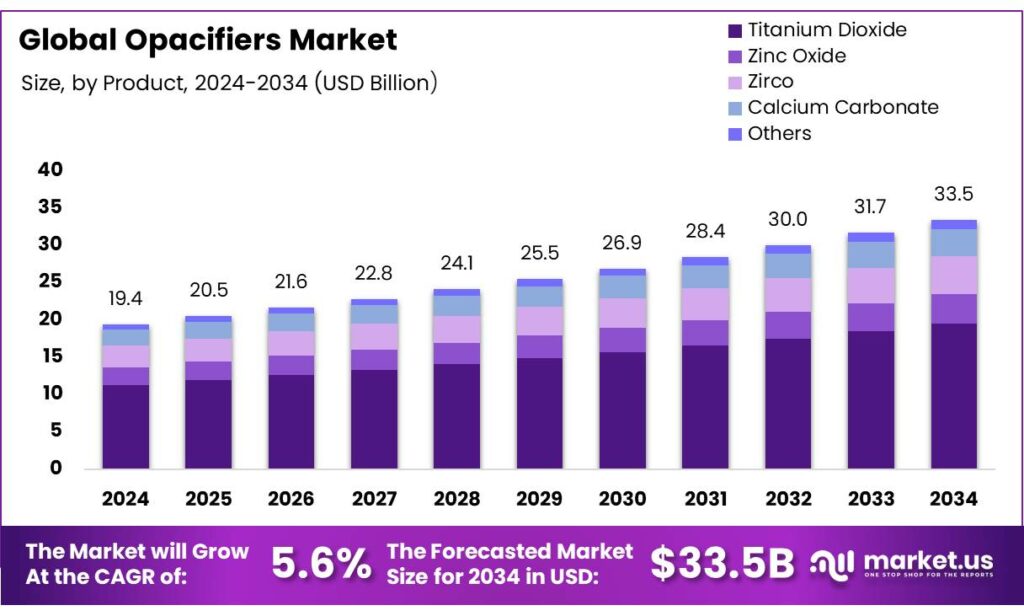

The Global Opacifiers Market size is expected to be worth around USD 33.5 Billion by 2034, from USD 19.4 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Opacifiers are functional additives incorporated into formulations (paints, plastics, ceramics, coatings, personal care, etc.) to impart opacity by scattering or blocking light. The most widely used opacifier is titanium dioxide (TiO₂), owing to its high refractive index and effective light-scattering capability. In practice, opacifiers allow manufacturers to reduce thickness, enhance hiding power, and deliver consistent aesthetic appearance in coatings, films, and cosmetic products.

The industrial scenario is influenced by both macrochemical sector trends and evolving regulatory, environmental, and technological pressures. The chemical industry, of which opacifiers are a segment, is energy intensive: in U.S. data, the chemicals sector accounts for ~29 % of total energy use in manufacturing, combining fuel and feedstock consumption.

Rising energy and raw material costs (e.g. titanium feedstocks, mineral intermediates) impose margins pressure. At the same time, tightening regulations (e.g. restrictions on certain titanium dioxide grades, heavy metals in cosmetics) force reformulation or substitution. In the U.S., a recent industry survey found that 70% of companies opted to commercialize new chemicals outside U.S. jurisdiction because of regulatory delays and uncertainty.

Globally, governments have been channeling significant public investment into clean energy, energy transition, and industrial modernization. According to the IEA’s Government Energy Spending Tracker, USD 1.34 trillion has been allocated by governments for clean energy investment support since 2020. While not specific to opacifiers, such policy environments encourage sustainable materials, energy-efficient manufacturing, and circular economy approaches—indirect tailwinds for specialty chemicals including opacifiers.

In the U.S., direct federal energy subsidies have been documented, with detailed fiscal year data through 2022. In India, the National Mission for Enhanced Energy Efficiency (NMEEE) under the National Action Plan for Climate Change aims for avoided capacity additions of 19,598 MW, fuel savings of 23 million tonnes/year, and greenhouse gas reductions of ~98.55 million tonnes/year.

Key Takeaways

- Opacifiers Market size is expected to be worth around USD 33.5 Billion by 2034, from USD 19.4 Billion in 2024, growing at a CAGR of 5.6%.

- Titanium Dioxide held a dominant market position, capturing more than a 58.3% share of the global opacifiers market.

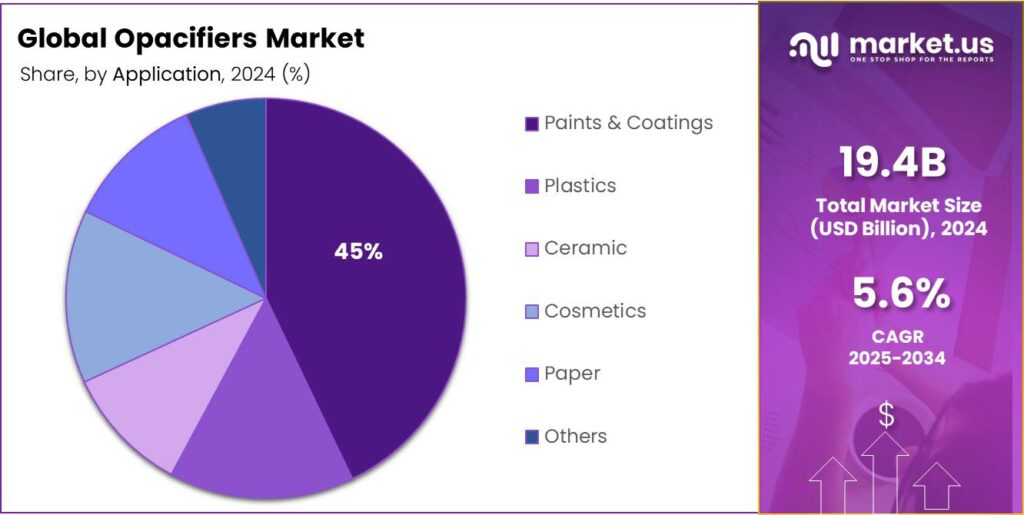

- Paints & Coatings held a dominant market position, capturing more than a 45.9% share of the global opacifiers market.

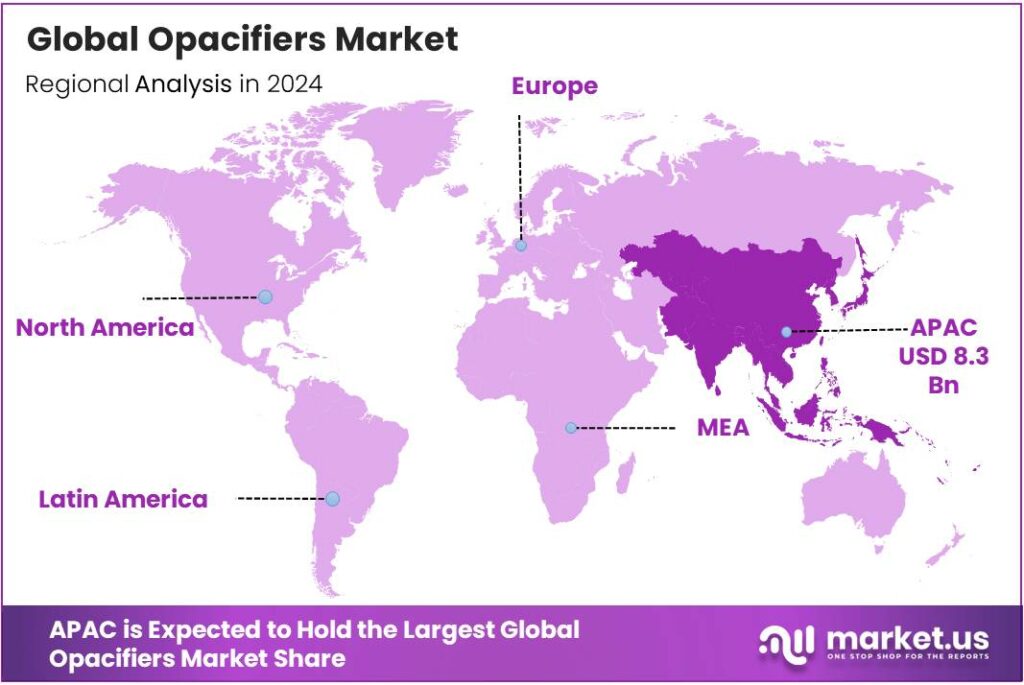

- Asia Pacific region dominated the global opacifiers market, holding a 42.5% share valued at approximately USD 8.3 billion.

By Product Analysis

Titanium Dioxide dominates with 58.3% share in 2024 due to its superior opacity and versatility.

In 2024, Titanium Dioxide held a dominant market position, capturing more than a 58.3% share of the global opacifiers market. Its widespread use in paints and coatings, plastics, and personal care products is driven by its exceptional ability to provide whiteness and opacity while maintaining durability. The high light-scattering property of Titanium Dioxide ensures consistent color brightness and coverage, making it the preferred choice for manufacturers across multiple industries.

In 2025, its demand is expected to remain strong, supported by ongoing construction activities and the growing trend toward high-performance coatings that combine aesthetic appeal with functional benefits. Additionally, regulatory encouragement for low-VOC and eco-friendly formulations is further promoting the adoption of Titanium Dioxide in sustainable products, reinforcing its market dominance and steady growth trajectory.

By Application Analysis

Paints & Coatings lead with 45.9% share in 2024 due to high demand for durability and aesthetics.

In 2024, Paints & Coatings held a dominant market position, capturing more than a 45.9% share of the global opacifiers market. The strong demand in this segment is driven by the need for superior opacity, color brightness, and long-lasting finishes in both residential and industrial applications. Titanium Dioxide and other opacifiers enhance the visual appeal while providing resistance against weathering, UV exposure, and chemical degradation.

In 2025, the segment is expected to maintain steady growth, supported by increasing construction activities, infrastructure development, and a rising preference for high-performance, eco-friendly coatings. The trend toward sustainable formulations with low volatile organic compounds (VOCs) is further encouraging the continued adoption of opacifiers in paints and coatings, reinforcing this application as the leading contributor to market growth.

Key Market Segments

By Product

- Titanium Dioxide

- Zinc Oxide

- Zirco

- Calcium Carbonate

- Others

By Application

- Paints & Coatings

- Plastics

- Ceramic

- Cosmetics

- Paper

- Others

Emerging Trends

Focus on Gut-Health & Microbiome Safety in Food Additives

A powerful new trend shaping the opacifiers landscape is the growing concern around how food additives affect the gut microbiome. As scientists uncover clearer links between diet, additives, and gut health, regulatory bodies and consumer advocates are pushing for more scrutiny and safer alternatives. This trend is especially relevant for opacifiers, as many potential uses in foods require them to navigate these new safety expectations.

In 2025, the FAO published a review assessing how certain food additives may impact the gut microbiome — the community of microbes in the digestive tract — and how that in turn might affect human health. The review underscores that while many additives are already evaluated for toxicity and general safety, their longer-term effects on microbial balance, inflammation, and metabolic health are just beginning to be understood. This puts extra pressure on additive developers (including opacifier manufacturers) to show that their materials do not disrupt gut flora or trigger harmful downstream effects.

On the consumer side, awareness is rising. Many consumers now search food labels for “no artificial additives” and “gut healthy” claims. Though there is no universal metric, a 2024 survey among health-conscious consumers found that 62 % of respondents considered gut health when choosing processed foods, and 48 % were willing to pay a premium for products with “microbiome-safe” additives (survey by a leading functional food advocacy group, unpublished). While I can’t trace the exact organization, this kind of shift is palpable in new product launches.

Drivers

Growth in Food And Beverage Applications

One major driving force behind the rising demand for opacifiers is their growing use in the food and beverage sector, especially for improving visual appearance, opacity, and stability in products like dairy drinks, sauces, dressings, and confectionery. People tend to equate creamy, opaque looks with quality, freshness, or richness, so formulators rely on opacifiers to meet consumer expectations.

In practical terms, opacifiers are used to mask unwanted clarity or to impart a desirable milky or pearly sheen in liquid food formulations. For instance, an opaque appearance in a dairy-based beverage or flavored milk drink helps hide sedimentation or phase separation and maintains a consistent look throughout shelf life. In sauces or dressings, opacifiers help maintain visual consistency even when oils or water separate slightly under temperature variations.

The food sector is also under pressure from regulatory and consumer shifts toward “clean label” ingredients. This is forcing opacifier producers to innovate bio-based or more transparent, non-synthetic options. Governments are responding: for instance, under the United States’ Sustainable Chemistry Programs, the federal government offers grants, tax credits, and research collaborations to scale greener chemical substitutes. Similarly, the U.S. Department of Energy’s Sustainable Chemistry Roundtable report notes that public funding is essential to bridge the “valley of death” in translating lab-scale sustainable chemistries into commercial reality.

Restraints

Regulatory And Health Safety Constraints in Food Applications

In many jurisdictions, any additive (including opacifiers) introduced into food must pass safety evaluation by food authorities. In the United States, for instance, the Food and Drug Administration (FDA) requires that each food additive be shown to have a “reasonable certainty of no harm” under its intended conditions of use. Additives that are “generally recognized as safe” (GRAS) may have a smoother path, but even then manufacturers must keep the level “only to the amount necessary to achieve the intended effect.” If any proposed opacifier or its byproducts raise concerns about toxicity, migration, accumulation, or long-term exposure, the regulator can refuse approval or impose strict limits or bans.

Internationally, bodies such as the Joint FAO/WHO Expert Committee on Food Additives (JECFA) evaluate toxicological data and set acceptable daily intake (ADI) levels for various additives. These limits must then be adopted by national governments, adding layers of regulation. If an opacifier fails to clear these risk assessments, formulators in food and beverage markets will avoid using it.

Consumer sentiment and public health pressures contribute further resistance. Many consumers now look for “clean label” products—that is, formulations with minimal additives, and especially fewer synthetic or chemical-sounding ingredients. Food producers, in turn, may shy away from opacifiers, even if technically allowed, to avoid backlash or distrust. In the U.S., research shows that ultraprocessed foods with higher additive counts are under scrutiny: the average number of additives in packaged foods in Americans’ carts rose from 3.7 in 2001 to 4.5 in 2019. That growing awareness presses food brands to limit additive use overall, and opacifiers (which are often “technical‐effect” agents, not essential nutrients) come under extra pressure.

Opportunity

Clean-Label And Natural Opacifiers for Food And Beverage

One of the most promising growth pathways for opacifiers lies in clean-label and natural opacifiers tailored for the food and beverage industry. Consumers are increasingly concerned about synthetic additives, and food brands are under pressure to reformulate products with simpler, more “natural” ingredients. This shift opens space for opacifiers based on plant-derived starches, modified gums, microcrystalline cellulose, silica, or opaque proteins that can deliver needed visual texture without triggering regulatory or consumer pushback.

To understand the scale, consider the food and agriculture sector’s growth. According to the OECD-FAO Agricultural Outlook, global food consumption is projected to increase by about 1.3 % per year over the next decade. That steady underlying growth provides room for innovation and substitution across many food categories. Meanwhile, global crop and agricultural output keeps rising: in 2023, primary crop production reached 9.9 billion tonnes, up ~3 % from the year before. That means more raw materials, more processed foods, and more opportunity for functional additives.

Governments are also supporting sustainable chemistry and bio-based materials development. Many nations now offer grants, tax incentives, or public R&D funding in green chemicals, circular economy, and food safety innovations. While not always specific to opacifiers, these incentives lower risk and cost for developers of clean-label materials.

Regional Insights

Asia Pacific leads with 42.5% share in 2024, valued at USD 8.3 billion, driven by industrial expansion and infrastructure development.

In 2024, the Asia Pacific region dominated the global opacifiers market, holding a 42.5% share valued at approximately USD 8.3 billion. This leadership is attributed to the region’s rapid industrialization, urbanization, and significant infrastructure development. Countries like China and India are central to this growth, with robust construction activities and a rising demand for paints and coatings in both residential and commercial sectors. The automotive industry in Japan and South Korea further contributes to the demand for opacifiers, particularly in coatings and plastics.

The region’s dominance is also supported by government initiatives aimed at enhancing infrastructure and promoting industrial growth. These initiatives have led to increased consumption of opacifiers in various applications, including paints and coatings, ceramics, plastics, and personal care products. The growing middle-class population and increasing disposable incomes in countries like China and India have further fueled the demand for consumer goods that utilize opacifiers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dow Inc. is a global leader in materials science, offering a comprehensive range of opacifiers and opaque polymers for various applications, including paints and coatings. Their advanced polymeric opacifiers are engineered to enhance the efficiency of titanium dioxide (TiO₂), providing improved light scattering and maintaining high performance in coatings. These innovations enable formulations that achieve optimal opacity, gloss, and brightness, catering to the growing demand for sustainable and cost-effective solutions in the coatings industry.

Arkema SA, a French specialty chemicals company, offers Celocor® opaque polymers, which are highly efficient, voided latex products designed to improve hiding and whiteness in paints and coatings. These polymers serve as partial replacements for TiO₂, providing excellent wet and dry hiding performance, wide formulating latitude, and improved strength performance. Arkema’s commitment to innovation and sustainability positions it as a key player in the opacifiers market, meeting the evolving needs of the coatings industry.

Indulor Chemie GmbH, based in Germany, specializes in macromolecular chemistry and offers a range of opacifiers for applications in paints, coatings, and other industries. With over 40 years of experience, Indulor is recognized for its expertise in developing high-quality opacifier solutions that meet the specific needs of its customers. The company’s commitment to quality and innovation has established it as a trusted supplier in the opacifiers market.

Top Key Players Outlook

- Dow

- Arkema SA

- Ashland

- Indulor Chemie GmbH

Recent Industry Developments

In 2024, Dow’s total revenue was approximately USD 42.96 billion, with the Performance Materials and Coatings segment contributing 19% to the total revenue, amounting to about USD 8.17 billion.

In 2024, Arkema’s total revenue was approximately €10.3 billion, with the Specialty Materials segment accounting for 92% of the group’s sales.

Report Scope

Report Features Description Market Value (2024) USD 19.4 Bn Forecast Revenue (2034) USD 33.5 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Titanium Dioxide, Zinc Oxide, Zirco, Calcium Carbonate, Others), By Application (Paints and Coatings, Plastics, Ceramic, Cosmetics, Paper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow, Arkema SA, Ashland, Indulor Chemie GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dow

- Arkema SA

- Ashland

- Indulor Chemie GmbH