Global Online Education/E-Learning Market By Type (Custom e-Learning, Responsive e-Learning, Micro e-Learning, Translation & Localization, Game-Based Learning, Rapid e-Learning), By Course (Primary and Secondary Education, Higher Education, Online Certification and Professional Course, Test Preparation), By Course Pace (Self-paced Courses, Instructor-led Fixed Pace Virtual Courses), By End User (Academic, Corporate, Government), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 119582

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

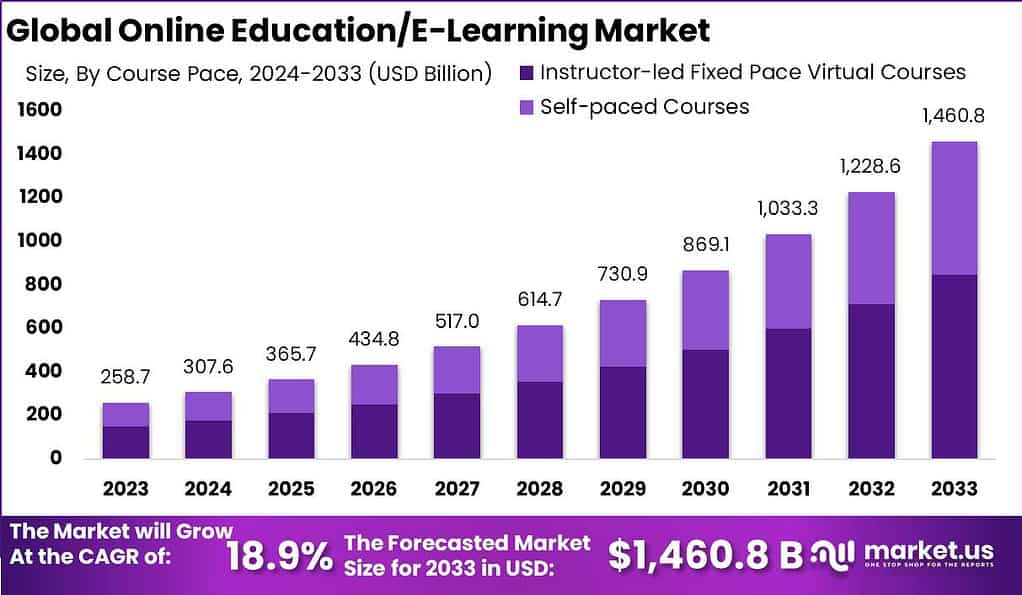

The Global Online Education/E-Learning Market size is expected to be worth around USD 1,460.8 Billion By 2033, from USD 258.7 Billion in 2023, growing at a CAGR of 18.9% during the forecast period from 2024 to 2033.

Online education, also known as e-learning, has gained immense popularity in recent years. It refers to the process of acquiring knowledge and skills through digital platforms and the internet. With the advancement of technology and widespread internet access, online education has become a convenient and flexible alternative to traditional classroom learning.

The Online Education or E-Learning market has experienced significant growth due to the increasing use of the internet and digital technology in education. This market encompasses various forms of learning conducted via the internet, including courses offered by universities and private institutions that can be accessed remotely. The flexibility and accessibility of online education have made it a popular choice for students around the world, allowing people to learn at their own pace and on their own schedule.

The market includes a wide range of products, such as software, courses, and platforms that cater to diverse educational needs, from elementary education to professional training. The shift towards digital learning platforms was further accelerated by the global pandemic, which forced many educational institutions to adopt online teaching methods. As technology continues to evolve, the E-Learning market is expected to grow, driven by innovations in educational technology and increasing internet penetration.

The Global Generative AI in Edtech Market is projected to witness substantial growth, with its value poised to increase from USD 268 million in 2023 to USD 8,324 million by 2033. This represents a CAGR of 41% during the forecast period from 2024 to 2033. This growth underscores the significant impact of AI technologies in the educational sector, driven by the increasing adoption of advanced learning solutions.

Simultaneously, the Global EdTech and Smart Classroom Market is also expected to experience robust expansion. Estimated at USD 146.8 billion in 2023, the market is forecasted to reach USD 498.5 billion by 2032, growing at a steady CAGR of 15% from 2023 to 2032. This growth is fueled by the integration of smart technologies in educational environments and the rising demand for personalized learning experiences.

Furthermore, the broader Global EdTech Market size is anticipated to ascend from USD 146.0 billion in 2023 to USD 549.6 billion by 2033, reflecting a CAGR of 14.2% during the forecast period. This increase is largely attributed to the expanding requirement for digital learning solutions and technological enhancements in education.

In the realm of corporate and professional development, approximately 90% of organizations now provide digital learning opportunities to their employees. This trend is mirrored by a 20% annual revenue growth in the Asian online learning market, signaling robust consumer engagement in the region.

Additionally, about 49% of students globally have participated in online learning, with 63% of students in the US engaging in online educational activities daily. Businesses have also embraced this shift; 80% now offer online learning or training solutions.

The efficacy of online learning is evident in its ability to increase retention rates among students and employees, potentially up to 50%, and to reduce the time required to learn by 40% to 60%. Moreover, 68% of employees express a preference for workplace learning, training, and development activities.

For many prospective students, the affordability of online education programs is crucial, with 60% of undergraduates citing it as a key decision factor. However, 39% believe that the reputation of the program or school is the most significant. In the U.S., 75% of institutions plan to conduct their courses entirely online, a strategy that has been shown to increase student retention by 25% to 60%.

Key Takeaways

- Online Education/E-Learning Market size is expected to be worth around USD 1,460.8 Billion By 2033, growing at a CAGR of 18.9% during the forecast period from 2024 to 2033.

- In 2023, the custom e-learning segment held a dominant market position, capturing more than a 31% share of the online education/e-learning market.

- In 2023, the Primary and Secondary Education segment held a dominant market position within the online education/e-learning market, capturing more than a 29% share.

- In 2023, the Instructor-Led Virtual Courses segment held a dominant market position within the online education/e-learning market, capturing more than a 58% share.

- In 2023, the Academic segment held a dominant market position within the online education/e-learning market, capturing more than a 46% share.

Type Analysis

In 2023, the custom e-learning segment held a dominant market position, capturing more than a 31% share of the online education/e-learning market. This segment’s leading position can be attributed to its ability to meet specific learner needs and organizational goals.

Custom e-learning solutions are tailored to the precise requirements of an organization, allowing for the integration of brand-specific scenarios, policies, and workflows. This personalization enhances learner engagement and improves retention rates by delivering content that is directly relevant to the learners’ roles and responsibilities within their organization.

Moreover, custom e-learning modules can be designed to fit various learning paths, making them highly effective for comprehensive training programs. They support a range of multimedia elements like videos, interactive content, and simulations, which are crucial for training in complex skills. This level of customization is particularly beneficial in industries requiring specialized knowledge or compliance training, where generic content cannot address specific learning objectives or regulatory requirements.

The demand for custom e-learning solutions is also driven by their scalability and flexibility. Organizations can update and expand these programs as needed without significant disruptions or additional costs. This adaptability is essential in today’s fast-paced business environments, where continuous learning and development are key to maintaining competitive advantage. As businesses increasingly recognize the ROI of tailored training solutions, the custom e-learning segment is expected to maintain its lead in the market.

Course Analysis

In 2023, the Primary and Secondary Education segment held a dominant market position within the online education/e-learning market, capturing more than a 29% share. This segment’s prominence is primarily due to the global shift towards digital learning platforms, influenced heavily by the need for remote schooling options during health crises like the COVID-19 pandemic.

Schools and educational institutions rapidly adopted online systems to ensure uninterrupted learning, which significantly increased the demand for online resources tailored to primary and secondary education. Additionally, this segment benefits from governmental and non-governmental educational initiatives aiming to expand access to quality education.

Many governments have launched programs to integrate technology in classrooms and provide online resources, boosting the segment’s growth. These efforts are complemented by an increase in parental investment in online courses, which enhance traditional education and offer supplementary learning opportunities to help children excel academically.

The ongoing development of interactive and engaging content, such as gamified learning and video-based lessons, also plays a crucial role in attracting younger students and retaining their interest in online education platforms. As the digital native generation continues to grow, their familiarity with and preference for digital learning environments are expected to sustain the growth of the primary and secondary education segment in the online education market.

Course Pace Analysis

In 2023, the Instructor-Led Virtual Courses segment held a dominant market position within the online education/e-learning market, capturing more than a 58% share. This segment’s leadership can be primarily attributed to the structured learning environment it provides, closely mirroring traditional classroom settings.

Instructor-led virtual courses facilitate real-time interaction between educators and students, offering immediate feedback and fostering a collaborative learning atmosphere that many learners find beneficial. This format is particularly effective for complex subjects where students may require direct support from instructors to understand the material fully.

Furthermore, the demand for instructor-led virtual courses has been driven by their ability to adapt to various learning needs and styles. These courses often include live discussions, Q&A sessions, and group projects, which are crucial for subjects that benefit from dynamic interaction and dialogue. They also cater to professional training and development sectors, where real-time engagement and networking are key components of the learning process.

The ongoing advancements in technology, such as virtual reality (VR) and augmented reality (AR), are enhancing the interactivity and engagement of these courses, making them even more attractive. As businesses and educational institutions continue to value the structure and interactive capabilities of instructor-led formats, this segment is likely to maintain its leading position in the online education market.

End User Analysis

In 2023, the Academic segment held a dominant market position within the online education/e-learning market, capturing more than a 46% share. This leading position is largely due to the increasing integration of digital platforms in primary, secondary, and higher education institutions.

Schools and universities have been at the forefront of adopting online resources to supplement and extend traditional classroom experiences. This trend has been driven by the growing need to provide flexible learning options that can reach students regardless of geographical constraints and varying physical attendance capacities.

The Academic segment’s growth is further bolstered by the rising demand for accessible and diverse educational content that caters to a range of learning preferences and needs. Online platforms have enabled institutions to offer a broader curriculum, including international courses and specialized programs, without the need for physical expansion. The scalability of digital solutions allows educational institutions to serve a larger number of students more efficiently, making education more inclusive and accessible.

Moreover, the adoption of advanced technologies like AI and machine learning in educational platforms has enhanced the learning experience by providing personalized learning paths and adaptive learning technologies. These innovations help in identifying student weaknesses and adapting the content accordingly, thereby improving learning outcomes.

As the digital transformation in education continues to evolve, the Academic segment is expected to maintain its prominence in the online education market, driven by ongoing technological advancements and an increasing emphasis on accessible education.

Key Market Segments

By Type

- Custom e-Learning

- Responsive e-Learning

- Micro e-Learning

- Translation & Localization

- Game-Based Learning

- Rapid e-Learning

By Course

- Primary and Secondary Education

- Higher Education

- Online Certification and Professional Course

- Test Preparation

By Course Pace

- Self-paced Courses

- Instructor-led Fixed Pace Virtual Courses

By End User

- Academic

- Corporate

- Government

Driver

Technological Advancements in Education Technologies

Technological advancements, such as artificial intelligence (AI), virtual reality (VR), and augmented reality (AR), are major drivers in the growth of the online education/e-learning market. These technologies enhance the learning experience by making it more interactive and engaging, thereby attracting more learners.

AI facilitates personalized learning by adapting content to meet individual student needs, while VR and AR offer immersive experiences that can simulate real-world environments for practical learning. These innovations help in bridging the gap between traditional and digital education methods, making online learning more effective and appealing. As these technologies become more sophisticated and accessible, they drive the expansion and acceptance of online education across various sectors globally.

Restraint

Digital Divide and Access Issues

One of the primary restraints facing the online education/e-learning market is the digital divide, which refers to the gap between individuals who have access to modern information and communication technology and those who do not. In many regions, especially in developing countries, limited access to reliable internet services and lack of digital devices hinder the adoption of online education.

This digital divide is exacerbated in rural and underprivileged urban areas where the infrastructure is not robust enough to support high-speed internet and advanced digital platforms. Consequently, while online education offers potential cost savings and greater accessibility in theory, in practice, it remains out of reach for a significant portion of the global population, limiting market growth.

Opportunity

Expansion into Emerging Markets

Emerging markets present significant opportunities for the expansion of the online education/e-learning sector. Countries in Asia, Africa, and Latin America are witnessing rapid digitalization and a growing middle class with an increasing appetite for education. Moreover, governments in these regions are investing in digital infrastructure and educational reforms to enhance learning outcomes and increase the reach of education.

Online education providers can capitalize on this trend by offering localized content that meets the cultural and educational needs of these diverse markets. Tailoring content and learning solutions for emerging markets not only helps in scaling operations but also in building a more inclusive educational ecosystem globally.

Challenge

Ensuring Educational Quality and Accreditation

A major challenge in the online education/e-learning market is maintaining and ensuring the quality and accreditation of programs offered. With the proliferation of online courses and providers, there is a varied range of quality, and not all courses meet the required educational standards. This inconsistency can lead to issues with accreditation and recognition of qualifications obtained online, which in turn affects student and employer confidence in online education.

Ensuring consistent quality and securing accreditation from recognized bodies are crucial for the credibility and long-term success of e-learning programs. This requires ongoing evaluation and adaptation of courses to meet stringent educational standards.

Growth Factors

- Increased Demand for Flexible Learning Solutions: The need for flexible, scalable learning options that accommodate various lifestyles and work schedules drives the growth of online education. As people seek to balance education with other responsibilities, the demand for online courses that offer self-paced learning continues to rise.

- Technological Integration: The integration of cutting-edge technologies like AI, VR, and AR into online education platforms enhances the learning experience by making it more interactive and personalized. These technologies help in replicating a classroom experience online and providing hands-on training through simulations.

- Global Internet Penetration: As internet connectivity improves and becomes more widely available, more people can access online education. This is particularly impactful in emerging markets where traditional educational infrastructure may be lacking but cellular and broadband coverage is expanding.

- Government Initiatives and Support: Many governments worldwide are promoting digital education through initiatives and funding, recognizing online education as a solution to reach educational equity. Such support not only drives the adoption of online learning but also encourages the development of local content and technology.

- Corporate Training and Development: Businesses are increasingly adopting e-learning platforms for employee training and development due to cost efficiency and effectiveness. Online education allows companies to provide consistent training across multiple locations globally and keep their workforce up-to-date with industry changes and new technologies.

Emerging Trends

- Microlearning: This trend involves short, focused segments of learning designed to meet a specific learning outcome. These bite-sized learning modules are perfect for learners looking to develop specific skills quickly and efficiently, fitting learning into their busy schedules.

- Mobile Learning: The proliferation of smartphones and tablets has led to the rise of mobile learning, where education is accessible on mobile devices, making it possible for learners to access content anytime and anywhere, further enhancing the flexibility of online education.

- Gamification: Incorporating game elements into learning is becoming increasingly popular as it boosts engagement, motivation, and retention. Gamified learning environments make education fun and interactive, appealing to a diverse range of learners.

- Social Learning: Platforms are increasingly incorporating social features such as forums, shared virtual workspaces, and peer-to-peer recognition features that mimic social media interactions. This trend leverages the community aspect of learning, enhancing student engagement and information retention.

- Learning Analytics: The use of analytics tools to monitor learners’ progress and predict future learning outcomes is on the rise. These insights help educators tailor the learning experience to individual needs, thereby improving learning efficiencies and outcomes.

Regional Analysis

In 2023, North America held a dominant market position in the online education and e-learning sector, capturing more than a 37% share of the global market. This prominence can be attributed to several structural and technological factors. The demand for Online Education/E-Learning in North America was valued at USD 95.71 billion in 2023 and is anticipated to grow significantly in the forecast period.

The region boasts a highly developed technological infrastructure, which facilitates widespread access to high-speed internet and advanced digital devices. Such technological readiness has been integral in supporting the seamless delivery of online education across diverse platforms.

Furthermore, North America benefits from the presence of major technology firms and e-learning providers, which invest significantly in research and development. These companies are continually innovating and expanding their offerings, which enhances the quality and accessibility of online courses. The region also shows a strong preference for continuous professional development, driving demand among adults for upskilling and reskilling programs, which are readily served by online platforms.

Additionally, the educational policies and government support in countries like the United States and Canada encourage the adoption of digital learning tools in both academic and corporate settings. Initiatives to integrate technology into the curriculum and to promote lifelong learning have further bolstered the growth of the e-learning market in this region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The online education market has attracted numerous key players who are actively contributing to its growth and development. These companies and platforms have played a crucial role in shaping the online education landscape and providing learners with diverse and high-quality educational opportunities.

One of the prominent players in the online education market is Coursera. Coursera offers a vast array of courses from leading universities and institutions worldwide. It partners with prestigious universities to provide learners with access to high-quality educational content across various disciplines. Coursera’s platform features interactive learning materials, assessments, and certifications, making it a popular choice for both individual learners and institutions.

Another significant player is Udemy, an online learning marketplace that offers a wide range of courses taught by experts in different fields. Udemy provides a platform for instructors to create and publish their courses, covering topics ranging from technology and business to arts and personal development. Its user-friendly interface and affordable pricing make it accessible to learners of all backgrounds

Top Key Players in the Market

- Adobe

- Aptara Inc.

- Articulate Global LLC

- CERTPOINT

- Oracle Corporation

- McGraw Hill

- SAP SE

- IBM Corporation

- upGrad Education Private Limited

- NIIT (USA) Inc.

- Adobe

- LinkedIn Corporation

- Docebo

- Coursera Inc.

- BYJU’S

- edX LLC

- Udemy Inc.

- Udacity Inc

- Other key players

Recent Developments

- In March 2024, Accenture announced its acquisition of Udacity, a leader in digital education. This move aims to enhance Accenture’s capabilities in training and upskilling, particularly in areas like cloud, data, and AI, through its Accenture LearnVantage platform. This strategic acquisition is expected to expand both companies’ reach and impact in the digital learning space.

- For McGraw Hill, recent developments in 2023 in the E-Learning sector have included several strategic expansions and product launches. In August 2023, McGraw Hill launched Sharpen, a mobile study app that delivers learning through a continuous content feed, bite-sized videos, swipeable study tools, and a personalized activity dashboard.

- In 2023, SAP SE launched several new initiatives within its E-Learning and professional certification landscape. A notable development is the enhancement of the SAP Certification program, scheduled to start in April 2024. This revamped program emphasizes continuous learning, requiring certified individuals to regularly update their skills and revalidate their certifications to align with evolving SAP products.

Report Scope

Report Features Description Market Value (2023) USD 258.7 Bn Forecast Revenue (2033) USD 1,460.8 Bn CAGR (2024-2033) 18.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Custom e-Learning, Responsive e-Learning, Micro e-Learning, Translation & Localization, Game-Based Learning, Rapid e-Learning), By Course (Primary and Secondary Education, Higher Education, Online Certification and Professional Course, Test Preparation), By Course Pace (Self-paced Courses, Instructor-led Fixed Pace Virtual Courses), By End User (Academic, Corporate, Government) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe, Aptara Inc., Articulate Global LLC, CERTPOINT, Oracle Corporation, McGraw Hill, SAP SE, IBM Corporation, upGrad Education Private Limited, NIIT (USA) Inc., Adobe, LinkedIn Corporation, Docebo, Coursera Inc., BYJU’S, edX LLC, Udemy Inc., Udacity Inc, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is online education/e-learning?Online education, also known as e-learning, refers to the process of learning using digital platforms, typically over the internet. It involves accessing educational materials, interacting with instructors, and participating in discussions and assessments through online mediums.

How big is Online Education/E-Learning Market?The Global Online Education/E-Learning Market size is expected to be worth around USD 1,460.8 Billion By 2033, from USD 258.7 Billion in 2023, growing at a CAGR of 18.9% during the forecast period from 2024 to 2033.

Which companies are leading in the development of Online Education/E-Learning?Adobe, Aptara Inc., Articulate Global LLC, CERTPOINT, Oracle Corporation, McGraw Hill, SAP SE, IBM Corporation, upGrad Education Private Limited, NIIT (USA) Inc., Adobe, LinkedIn Corporation, Docebo, Coursera Inc., BYJU’S, edX LLC, Udemy Inc., Udacity Inc, Other key players

Which region has the biggest share in Online Education/E-Learning Market?In 2023, North America held a dominant market position in the online education and e-learning sector, capturing more than a 37% share of the global market.

What are the factors driving the online education/e-learning market?Factors driving the online education/e-learning market include increased internet accessibility, demand for flexible learning options, technological advancements, remote work trends, and emphasis on lifelong learning for skill development.

Online Education/E-Learning MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Online Education/E-Learning MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe

- Aptara Inc.

- Articulate Global LLC

- CERTPOINT

- Oracle Corporation

- McGraw Hill

- SAP SE

- IBM Corporation

- upGrad Education Private Limited

- NIIT (USA) Inc.

- Adobe

- LinkedIn Corporation

- Docebo

- Coursera Inc.

- BYJU’S

- edX LLC

- Udemy Inc.

- Udacity Inc

- Other key players