Global Oat Oil Market Size, Share Analysis Report By Type (Whole Oat Oil and Oat Bran Oil), By Extraction Method (Cold Pressed, Solvent Extracted, and Supercritical CO₂ Extracted), By Application (Personal Care And Cosmetics, Food and Beverage, Pharmaceuticals, Animal Health, and Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 173537

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

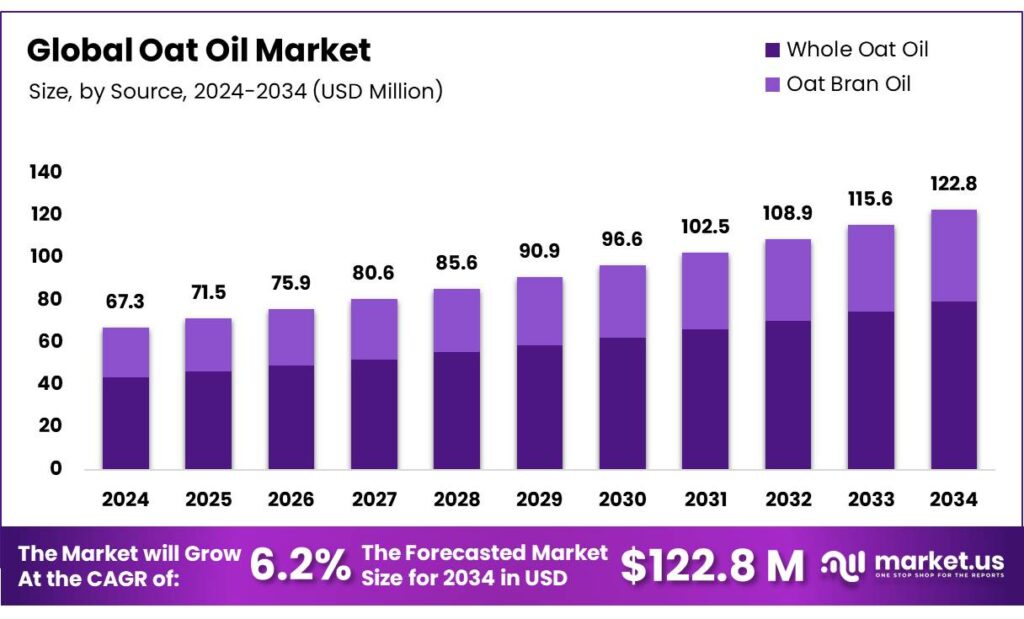

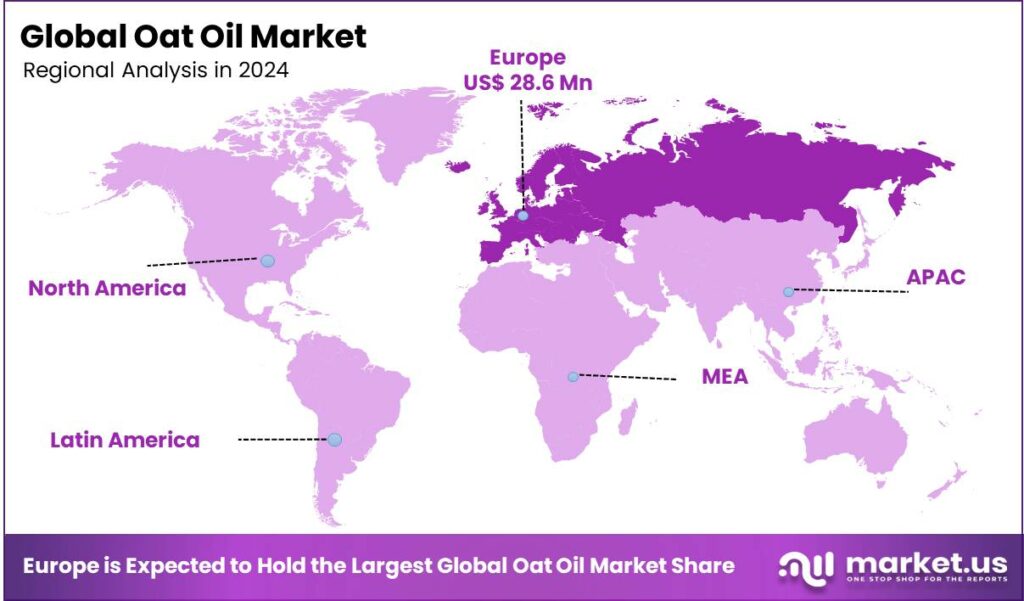

Global Oat Oil Market size is expected to be worth around USD 122.8 Million by 2034, from USD 67.3 Million in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 42.5% share, holding USD 28.6 Billion in revenue.

Oat oil, or Avena sativa kernel oil, is a nourishing, fast-absorbing oil extracted from oat kernels, rich in essential fatty acids, antioxidants such as Vitamin E, ceramides, and beta-glucans, making it a preferred choice for moisturizing, soothing, and repairing the skin’s protective barrier. Its market is primarily driven by the cosmetics industry for its hydrating, anti-inflammatory, and skin-barrier-strengthening properties, suitable for sensitive skin, dry hair, and products such as lotions, creams, and soaps.

- According to the US Department of Agriculture, for the year 2024-25, the global production of oats, which is the main raw material for oat oil, reached 22.6 million metric tons, compared to 19.5 million metric tons in the year 2023-24.

Additionally, the market is propelled due to its growing applications in the personal care and food industries, fueled by the increasing consumer demand for natural and sustainable ingredients. While its use in the food and beverage sectors is expanding due to its health benefits, particularly for heart health and cholesterol management, oat oil faces competition from other oils in these categories. Furthermore, the trend toward plant-based nutrition and functional foods has increased the demand for oat oil in products such as protein bars and smoothies.

Key Takeaways

- The global oat oil market was valued at USD 67.3 million in 2024.

- The global oat oil market is projected to grow at a CAGR of 6.2% and is estimated to reach USD 122.8 million by 2034.

- Based on the types, whole oat oil dominated the market, with a market share of around 64.7%.

- On the basis of the extraction method, the cold-pressed method led the oat oil market, comprising 54.1% share of the total market.

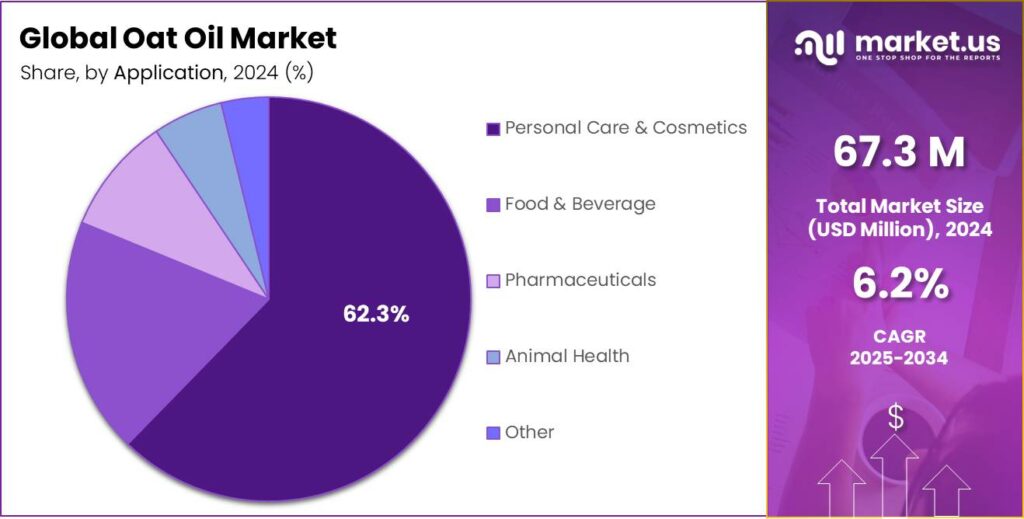

- Among the applications of oat oil, the personal care & cosmetics sector held a major share in the market, 62.3% of the market share.

- In 2024, Europe was the most dominant region in the oat oil market, accounting for around 42.5% of the total global consumption.

Type Analysis

Whole Oat Oil Held the Largest Share in the Market.

The market is segmented based on types into whole oat oil and oat bran oil. The whole oat oil dominated the market, comprising around 64.7% of the market share, primarily due to its superior nutrient profile and broader versatility in applications. Whole oat oil, extracted from the entire grain, contains a higher concentration of beneficial compounds such as antioxidants, essential fatty acids, and vitamin E, making it ideal for use in food and cosmetic products.

In contrast, oat bran oil, which is derived from the outer husk or bran of the oat, is more limited in its nutritional benefits and often requires additional processing to enhance its stability. Additionally, whole oat oil has a milder flavor and smoother texture, making it more appealing for a wider range of formulations, including functional foods and skincare products. Furthermore, the greater availability and ease of extraction of whole oat oil contribute to its more widespread use compared to oat bran oil.

Extraction Method Analysis

The Pressed Extraction Method Dominated the Oat Oil Market.

The market is segmented based on extraction methods into cold-pressed, solvent-extracted, and supercritical CO₂-extracted. Among the extraction methods, the cold-pressed method led the market, comprising around 54.1% of the market share, due to its simplicity, cost-effectiveness, and ability to preserve the oil’s natural properties. Cold pressing involves mechanically squeezing the oil from the oat kernels without the use of heat, which helps retain the full spectrum of beneficial compounds such as antioxidants, essential fatty acids, and vitamins.

Moreover, the method is considered more natural and aligns with the growing consumer preference for clean, minimally processed products. In contrast, solvent extraction and supercritical CO₂ methods, while efficient, can be expensive and may result in the loss of some delicate nutrients or require the use of chemical solvents, which are less desirable in health-conscious and eco-friendly markets.

Application Analysis

The Oat Oil Was Mostly Utilized for the Personal Care & Cosmetics Sector.

Based on the applications of oat oil, the market is divided into personal care & cosmetics, food and beverage, pharmaceuticals, animal health, and other. The personal care & cosmetics sector dominated the market, with a market share of 62.3%, due to its exceptional skin-nourishing properties and suitability for topical applications. Oat oil, which is rich in antioxidants, essential fatty acids, and vitamin E, is observed to be effective in moisturizing, soothing, and protecting the skin, making it a popular choice for skincare products such as creams, lotions, and serums.

Furthermore, its anti-inflammatory and anti-irritant properties make it ideal for sensitive skin formulations. While oat oil has potential applications in food, pharmaceuticals, and animal health, these sectors often demand more specialized ingredients for specific functions. In contrast, the cosmetics industry benefits from oat oil’s versatility and alignment with the growing trend for natural, clean beauty products, which has led to its wider adoption in this sector.

Key Market Segments

By Type

- Whole Oat Oil

- Oat Bran Oil

By Extraction Method

- Cold Pressed

- Solvent Extracted

- Supercritical CO₂ Extracted

By Application

- Personal Care & Cosmetics

- Skin Care

- Hair Care

- Others

- Food and Beverage

- Bakery & Confectionery

- Functional Foods

- Others

- Pharmaceuticals

- Animal Health

- Other

Drivers

Expanding Clean Beauty Products Industry Drives the Demand for Oat Oil.

The rapid expansion of the clean beauty products industry is significantly driving the demand for oat oil due to its natural, skin-nourishing properties. Oat oil, which is rich in antioxidants and essential fatty acids, has become a preferred ingredient in skincare formulations aimed at consumers seeking non-toxic, sustainable alternatives.

- According to a study by the National Institutes of Health, approximately 90% of individuals worldwide use some form of personal care product daily. However, around 78% of consumers raised concerns about the potential risks due to added chemicals in these products. Additionally, approximately 74% of consumers consider organic ingredients important in personal care products. This shift towards natural and organic ingredients in beauty products propels the demand for natural products, such as oat oil.

The growing consumer preference for clean beauty has highlighted the demand for ingredients that are free from synthetic chemicals and harsh preservatives, boosting the appeal of oat-based formulations. The versatility of oat oil, along with its compatibility with other natural ingredients, positions it as a key player in the evolving clean beauty market, aligning with the broader shift toward more eco-conscious and health-oriented consumer choices.

Restraints

Processing Hurdles Might Hamper the Growth of the Oat Oil Market.

The production of oat oil faces significant challenges due to its high oil content, which can clog mill processing equipment and reduce the shelf life of the product. This inherent issue arises from the natural oils in oats, which are prone to oxidation, further complicating efforts to stabilize and preserve the oil for broader use in nutraceutical, cosmetic, and pharmaceutical applications.

In addition, conventional extraction methods, such as supercritical CO₂, are both expensive and energy-intensive, adding to the overall cost of production. Furthermore, the oil’s tendency to oxidize quickly limits its effectiveness in formulations that require long-term stability.

However, recent advancements in Pickering microencapsulation, particularly through the use of cellulose nanocrystals (CNCs), have been observed to overcome the hurdles. For instance, CNC-stabilized emulsions have demonstrated stability, with yields reaching up to 82%. Though the scalability of these processes and their integration into existing production lines remains a barrier for large-scale adoption, making it difficult to fully capitalize on the potential of oat oil in industrial applications.

Opportunity

Plant-Based Nutrition Creates Opportunities in the Oat Oil Market.

The growing shift toward plant-based nutrition is opening up new opportunities for oat oil, particularly within the food and beverage sectors. As more consumers adopt plant-based diets, there is a rising demand for plant-derived oils that can provide nutritional benefits without relying on animal-based ingredients. Oat oil, with its high concentration of unsaturated fats, vitamins, and antioxidants, is increasingly being incorporated into plant-based food products as a healthier alternative to traditional oils.

- According to the Vegan Society, approximately 25.8 million individuals globally tried veganism in January 2025. Additionally, in 2023, Germany was the leading source of searches about veganism according to Google Trends, followed by Austria and the UK.

For instance, oat oil is being used in dairy alternatives, salad dressings, and protein bars, offering a rich source of omega-3 and omega-6 fatty acids, which support heart health. Its mild flavor and versatility make it an attractive option for formulations aiming to cater to a health-conscious, plant-based consumer base. As plant-based diets continue to gain mainstream popularity, oat oil is well-positioned to become a key ingredient in plant-based nutrition products, capitalizing on its functional and health-promoting qualities.

Trends

Application of Oat Oil in Functional Foods.

The application of oat oil in functional foods has become a prominent trend, driven by its potential health benefits and ability to enhance the nutritional profile of everyday foods. Oat oil is increasingly being used to fortify products such as smoothies, snack bars, and fortified beverages. For instance, its high content of beta-glucan, a soluble fiber, contributes to lowering cholesterol levels and improving heart health, making it an appealing addition to functional foods targeting cardiovascular wellness.

Additionally, oat oil’s anti-inflammatory properties have led to its inclusion in foods designed to support joint health and overall immune function. With consumers becoming more health-conscious and seeking foods that provide functional benefits beyond basic nutrition, oat oil offers an excellent option for product developers looking to cater to the demand. As the focus on functional foods continues to grow, oat oil’s versatility and health-promoting qualities position it as a key ingredient in future food formulations.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Oat Oil Market by Shifting Trade Flows.

Geopolitical tensions, particularly between the U.S., Canada, and China, are significantly impacting the oat oil market in 2025. The United States is the largest oat market for Canada; however, tariffs imposed on Canadian commodities by the US, including oats, are creating uncertainty. The U.S. has implemented 25% tariffs on Canadian imports, which may lead to increased costs for U.S. food companies, such as millers. Consequently, the price of oats could rise for U.S. consumers.

The American Bakers Association had estimated that tariffs would raise ingredient and other costs by half a billion dollars. In addition, these tariffs may push U.S. companies to explore alternative sources of oats, such as those from Europe or South America. In the meantime, the oat stocks of Canada are perilously low, with ending stocks forecasted at 376,000 tons for 2024-25, which is the lowest in about a decade. This tight supply situation, coupled with the tariff uncertainty, could further exacerbate price volatility in the U.S. and in the global market.

Additionally, the ongoing trade tensions between Canada and China, particularly around canola products, could create ripple effects for the oat market, with potential shifts in trade dynamics. While the global demand for oats is increasing, geopolitical issues and low production are leading to an unpredictable and strained market, making the future of oat oil supply uncertain.

Regional Analysis

Europe Held the Largest Share of the Global Oat Oil Market.

In 2024, Europe dominated the global oat oil market, holding about 38.1% of the total global consumption, driven by its well-established demand for natural, sustainable, and health-oriented ingredients in various sectors, particularly in cosmetics, nutraceuticals, and food products. In 2023, 23% of consumers looked for natural and organic ingredients in skincare products.

In addition, the region’s growing preference for plant-based, clean-label ingredients has significantly contributed to the adoption of oat oil, as it is seen as a versatile and eco-friendly alternative to synthetic oils and animal-derived fats. In 2023, 2.6 million individuals in Europe converted to veganism, representing 3.2% of the European population. Countries such as Germany, France, and the UK are leading the way in incorporating oat oil into a variety of applications, including skincare products, dietary supplements, and functional foods. This demand for oat oil in consumer goods and industrial applications is expected to maintain Europe’s dominant position in the global market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the oat oil market focus on product innovation, where companies develop new oat oil-based formulations for use in food, cosmetics, and nutraceuticals, aligning with consumer demand for natural and sustainable ingredients. Additionally, they emphasize partnerships with brands in the clean beauty and plant-based food sectors to expand their market reach. Furthermore, these players focus on improving production efficiency through technology, such as optimizing extraction and encapsulation methods, to offer competitive pricing and better yields, driving volume and profitability.

The Major Players in The Industry

- Givaudan S.A.

- Oy Karl Fazer Ab

- COSCIENS BIOPHARMA

- ConnOils

- Oat Cosmetics

- O&3 Limited

- Jedwards International, Inc.

- Other Key Players

Key Development

- In April 2023, Fazer expanded into the global personal care market by supplying plant-based ingredients derived from Nordic oats. Through Fazer Foodtech, the company offers xylitol and oat oil for cosmetic use, combining sustainable sourcing with advanced technology.

- In April 2025, Oat Cosmetics launched EcoPep, a natural peptide designed for cosmetic formulations, which is derived from avena sativa (oat oil) using a patent-pending biotechnology process.

Report Scope

Report Features Description Market Value (2024) US$67.3 Mn Forecast Revenue (2034) US$122.8 Mn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Whole Oat Oil and Oat Bran Oil), By Extraction Method (Cold Pressed, Solvent Extracted, and Supercritical CO₂ Extracted), By Application (Personal Care & Cosmetics, Food and Beverage, Pharmaceuticals, Animal Health, and Other) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Givaudan S.A., Oy Karl Fazer Ab, COSCIENS BIOPHARMA, ConnOils, Oat Cosmetics, O&3 Limited, Jedwards International, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Givaudan S.A.

- Oy Karl Fazer Ab

- COSCIENS BIOPHARMA

- ConnOils

- Oat Cosmetics

- O&3 Limited

- Jedwards International, Inc.

- Other Key Players