Global Nylon Market By Product(Nylon 6, Nylon 66, Others), By End-Use(Automotive, Textiles, Packaging, Electrical and Electronics, Industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 112257

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

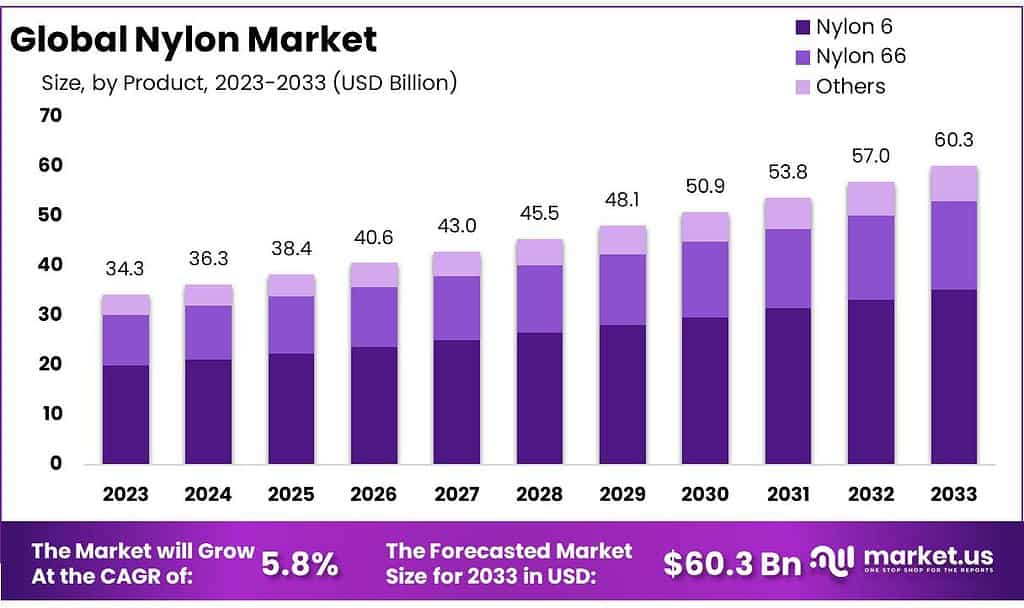

The global Nylon Market size is expected to be worth around USD 60.3 billion by 2033, from USD 34.3 billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

The term “Nylon Market” refers to the economic sphere or industry involved in the production, distribution, and trade of nylon-based products. This market encompasses the buying and selling of nylon materials, including raw materials used for manufacturing nylon (such as adipic acid and hexamethylenediamine), as well as the finished nylon products themselves.

Factors influencing the Nylon Market include technological advancements in nylon production, shifts in consumer preferences, changes in raw material prices, advancements in manufacturing processes, environmental regulations, and global economic conditions.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Nylon Market Growth: The global Nylon Market is expected to surge to around USD 60.3 billion by 2033, exhibiting a substantial growth trajectory from USD 34.3 billion in 2023, with a notable CAGR of 5.8%.

- Nylon Types and Their Dominance: Nylon 6 emerged as a dominant force in 2023, holding over 58.4% market share due to its versatility, strength, and affordability. It found extensive use in textiles, packaging, and automotive components.

- End-Use Applications in Animal Feed Nylon: Animal Feed Nylon might indirectly benefit from the Nylon Market, especially in industries like textiles and packaging, wrenylon’s strength, durability, and moisture resistance play a crucial role.

- Regional Influence: The Asia-Pacific region dominates the Nylon Market, indicating potential growth in regions where animal feed nylon might find application due to industrialization and rising disposable incomes.

By Product

In 2023, Nylon 6 emerged as the frontrunner in the nylon market, seizing a commanding market share of over 58.4%. Its dominance was driven by its versatility and widespread use across various industries. Nylon 6’s properties, including strength, durability, and affordability, made it a preferred choice in applications such as textiles, packaging, and automotive components.

Nylon 66, while holding a smaller market share than Nylon 6, also played a significant role. Known for its exceptional strength and heat resistance, Nylon 66 found its niche in demanding applications like engineering plastics for automotive parts, electrical components, and industrial machinery.

The competition between Nylon 6 and Nylon 66 was largely influenced by their distinct characteristics and targeted industry applications. Nylon 6’s cost-effectiveness and adaptability made it a staple choice in a broader range of products, while Nylon 66’s specific properties catered to industries requiring higher performance and durability.

In 2023, Nylon 6 retained its stronghold in the market. Still, Nylon 66 continued to maintain its relevance, catering to specialized industries that prioritize its unique properties, contributing to the overall diversity and growth of the nylon market.

By End-Use

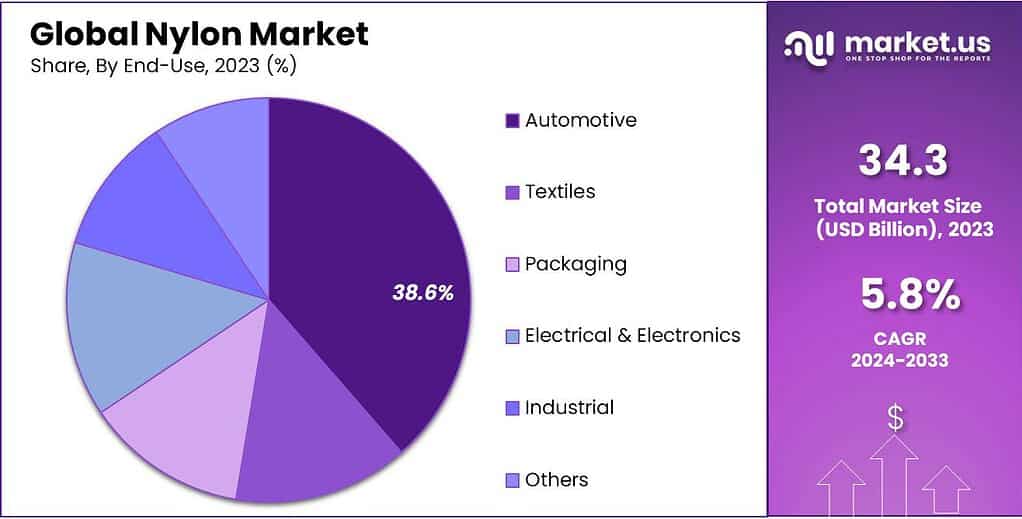

In 2023, the Automotive sector took the lead in the nylon market, securing over 38.6% of the market share. Its prominence stemmed from nylon’s extensive use in manufacturing various automotive components. Nylon’s durability, lightweight nature, and resistance to heat and chemicals made it an ideal choice for parts like engine covers, fuel systems, and interior components.

The Textiles segment also held a significant market share. Nylon’s use in textiles offered benefits such as strength, elasticity, and abrasion resistance, making it a preferred material for clothing, carpets, and other fabric applications.

Packaging emerged as another key segment, leveraging nylon’s properties to create durable and flexible packaging materials. Its moisture resistance and strength made it suitable for a wide range of packaging solutions.

Electrical & Electronics constituted a notable market share, utilizing nylon for insulating materials, connectors, and housings due to its electrical insulation properties and ability to withstand high temperatures.

The Industrial sector also embraced nylon for various purposes, including machinery parts, gears, and bearings, capitalizing on its strength and wear resistance to enhance operational efficiency.

Additionally, other sectors contributed to the market with miscellaneous applications, showcasing nylon’s versatility across diverse industries.

Note: Actual Numbers Might Vary In The Final Report

Маrkеt Ѕеgmеntѕ

By Product

- Nylon 6

- Nylon 66

- Others

By End-Use

- Automotive

- Textiles

- Packaging

- Electrical & Electronics

- Industrial

- Others

Drivers

- Growing Demand in Automotive Industries: The increasing demand for lightweight yet durable materials in automotive manufacturing is a significant driver for the nylon market. Nylon’s properties, such as strength, heat resistance, and flexibility, make it an ideal choice for producing various automotive components, contributing to fuel efficiency and reducing overall vehicle weight.

- Expanding Applications in Textiles: Nylon’s versatility and adaptability in the textile industry continue to drive market growth. Its use in clothing, carpets, and sportswear owing to properties like durability, moisture-wicking, and ease of dyeing bolster its demand. Additionally, the rising trend of athleisure wear and sustainable fashion contributes to the increased adoption of nylon-based textiles.

Restraints

- Fluctuating Raw Material Prices: The nylon market is susceptible to fluctuations in raw material prices, particularly those of adipic acid and hexamethylenediamine. Volatility in oil prices, which impacts the production of these key nylon components, often leads to uncertain manufacturing costs, affecting market stability and profit margins for manufacturers.

- Environmental Concerns and Regulations: Environmental regulations and growing awareness of the ecological impact of traditional nylon production pose challenges to the market. Issues related to carbon footprint, plastic waste, and emissions during production have prompted stricter regulations, compelling manufacturers to invest in sustainable practices, and impacting initial production costs.

Opportunities

- Expanding Applications in Emerging Economies: Growing industrialization and urbanization in emerging economies present substantial opportunities for nylon market expansion. Increased infrastructure development, coupled with rising consumer spending, creates a fertile ground for the adoption of nylon-based products across various industries.

- Innovative Product Development: There exists immense potential for innovation and product diversification within the nylon market. Advancements in research and development can lead to the creation of novel nylon formulations with enhanced properties, opening doors to new applications and untapped market segments. Opportunities lie in catering to niche industries and fulfilling specific demands for advanced nylon products.

Trends

- Shift Towards Sustainable Solutions: A noticeable trend in the nylon market is the growing focus on sustainability. Companies are investing in research and development to create bio-based or recycled nylon, addressing environmental concerns. This trend aligns with consumer preferences for eco-friendly materials, fostering innovation and creating opportunities for sustainable nylon products.

- Rising Technological Advancements: Ongoing technological advancements in nylon production processes are driving market trends. Innovations in manufacturing techniques, such as improved polymerization methods and enhanced product formulations, are resulting in higher-quality nylon with superior properties. These advancements cater to evolving industry needs, broadening the scope of applications for nylon.

Geopolitical and Recession Impact Analysis

Geopolitical Impact

Trade Import and Tariff Restrictions: Geopolitical tensions and trade disputes among nations may trigger the imposition of tariffs and import restrictions on nylon materials. Such actions can disrupt the nylon supply chain, escalating production costs and subsequently increasing prices for end consumers.

Supply Chain Disruptions: Political instability or conflicts in major nylon-producing regions can severely disrupt the supply chain. Any disturbances in the flow of raw materials or manufacturing processes in these regions could result in delays in production and supply, affecting the availability of nylon products in the market.

Market Access Challenges: Geopolitical tensions often create barriers for nylon manufacturers attempting to enter new markets. Restrictions on market access or unfavorable trade policies might impede their expansion efforts into specific regions, limiting growth opportunities for the nylon market.

Currency Exchange Rate Fluctuations: Geopolitical events have the potential to cause fluctuations in currency exchange rates, impacting the cost of nylon raw materials. These fluctuations can influence the competitiveness of nylon exports in the global market, affecting both domestic sales and international trade.

Recession Impact

Reduced Construction Activity: Economic downturns often lead to a slowdown in construction activities across residential, commercial, and infrastructure sectors. This decline in construction demand directly affects the need for nylon-based materials in various applications like structural components, piping, and insulation, consequently reducing sales and production.

Consumer Spending Constraints: During recessions, consumers tend to cut back on discretionary spending, impacting sectors like home improvement. This reduction in spending may cause homeowners to postpone or downscale projects involving nylon-based materials, affecting the demand for items like nylon textiles, carpets, and furniture.

Cost-Cutting Measures: Nylon manufacturers may resort to cost-cutting measures during economic downturns, potentially impacting production levels and product availability. Streamlining operations through reduced workforce or scaled-down production might influence the variety and quantity of nylon products offered in the market.

Innovation and Product Development: Recessions can stimulate innovation within the nylon market. Manufacturers may focus on developing more cost-effective and sustainable nylon solutions to align with changing consumer preferences and budget constraints. This drive for innovation could lead to the introduction of new nylon formulations or applications to maintain competitiveness in a constrained market.

Regional Analysis

The Asia-Pacific (APAC) region stood out as the powerhouse in the Nylon market during 2023, showcasing its dominance with a remarkable market share exceeding 52.6%. This region exhibited a strong appetite for Nylon products, with the demand reaching a valuation of USD 18.04 billion in 2023, signaling substantial market growth.

Several factors contributed to the robust performance of the Nylon market in the APAC region. Rapid industrialization, burgeoning manufacturing activities, and the presence of key industries such as automotive, textiles, and electronics fueled the demand for Nylon-based materials. The region’s emphasis on infrastructure development, coupled with a rising population and increasing disposable incomes, further bolstered the use of Nylon across various applications.

The forecast for the Nylon market in the APAC region appears promising, with expectations of continued significant growth in the foreseeable future. The region’s pivotal role in driving global Nylon market trends underscores its influence and importance within the industry landscape. Factors such as ongoing industrial expansion, increasing urbanization, and further advancements in Nylon technology are poised to sustain the upward trajectory of the Nylon market in the Asia-Pacific region.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

These key players drive market innovation, set industry standards, and play a crucial role in meeting the diverse demands of consumers across various sectors, contributing to the overall growth and dynamism of the Nylon market. Their focus on sustainability, technological advancements, and customer-centric solutions shapes the direction of the industry.

Top Key Рlауеrѕ

- BASF SE

- Honeywell International Inc.

- Ascend Performance Materials

- Solvay S.A.

- DuPont de Nemours, Inc.

- RadiciGroup

- Asahi Kasei Corporation

- Lanxess AG

- DSM Engineering Plastics

- Formosa Plastics Corporation

- Evonik Industries AG

- UBE Industries, Ltd.

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- DOMO Chemicals

- Ashley Polymers, Inc.

Recent Developments

January 2022: BASF announced plans to expand its PA 6,6 production in Freiburg, Germany. BASF has also decided to build a new hexamethylene diamine (HMD) plant in Chalampé, France. HMD is a precursor used in producing PA 6,6 plastics and coating raw materials. This plant is expected to start production by 2024.

Report Scope

Report Features Description Market Value (2023) USD 34.3 Bn Forecast Revenue (2033) USD 60.3 Bn CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Nylon 6, Nylon 66, Others), By End-Use(Automotive, Textiles, Packaging, Electrical & Electronics, Industrial, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Honeywell International Inc., Ascend Performance Materials, Solvay S.A., DuPont de Nemours, Inc., RadiciGroup, Asahi Kasei Corporation, Lanxess AG, DSM Engineering Plastics, Formosa Plastics Corporation, Evonik Industries AG, UBE Industries, Ltd., Toray Industries, Inc., Mitsubishi Chemical Corporation, DOMO Chemicals, Ashley Polymers, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Nylon, and what are its primary uses?Nylon is a synthetic polymer known for its durability and versatility. It's used in various industries for applications like textiles (clothing, carpets), engineering plastics (automotive parts, electrical components), packaging materials, and more.

What are the different types of Nylon available in the market?Common types include Nylon 6, Nylon 6,6, and other variations. Each type has distinct properties suitable for different applications.

What factors influence the Nylon market’s growth?Factors include technological advancements in production, demand from industries like automotive and textiles, raw material prices, environmental considerations, and global economic conditions.

-

-

- BASF SE

- Honeywell International Inc.

- Ascend Performance Materials

- Solvay S.A.

- DuPont de Nemours, Inc.

- RadiciGroup

- Asahi Kasei Corporation

- Lanxess AG

- DSM Engineering Plastics

- Formosa Plastics Corporation

- Evonik Industries AG

- UBE Industries, Ltd.

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- DOMO Chemicals

- Ashley Polymers, Inc.