Global Nylon 6 Filament Yarn Market Size, Share, And Business Benefit By Yarn Type (Partially Oriented Yarn (POY), Fully Drawn Yarn (FDY), High-Tenacity Industrial Yarn, Textured Yarn), By Application (Fabric, Sports Apparel, Sports and Adventure Equipment, Travel Accessories, Fishing Nets), By End-user (Apparel and Fashion, Industrial and Technical Textiles, Automotive Components, Consumer Goods, Others), By Distribution Channel (Textile Traders / Distributors, Direct Sales (Spinners), E-commerce Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165244

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

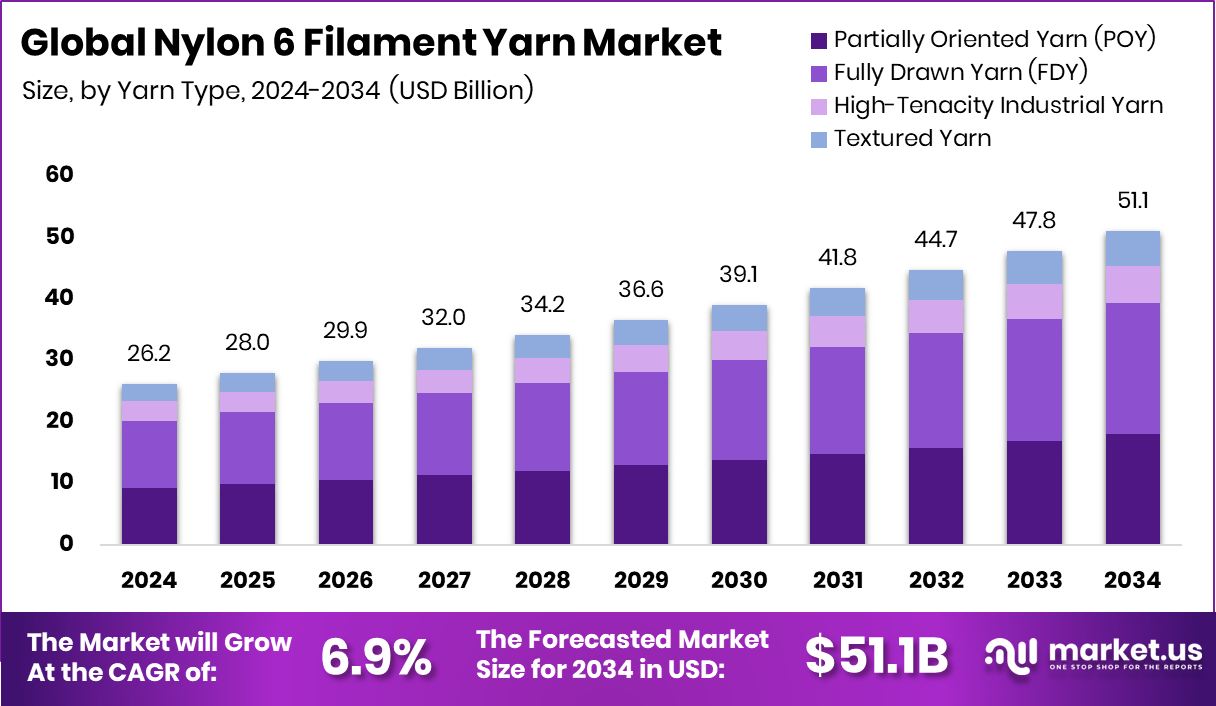

The Global Nylon 6 Filament Yarn Market is expected to be worth around USD 51.1 billion by 2034, up from USD 26.2 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. Asia Pacific’s 48.90% expanding apparel and industrial sectors continue driving demand for Nylon 6 filament yarn.

Nylon 6 filament yarn is a synthetic fiber made by polymerizing caprolactam and spinning it into continuous filaments. It has high tensile strength, elasticity, and abrasion resistance, making it ideal for apparel, upholstery, and industrial uses. Its smooth texture, excellent dyeability, and moisture management also make it popular in sportswear and activewear fabrics that demand flexibility and durability.

The Nylon 6 filament yarn market includes the global production and consumption of these fibers across apparel, automotive, and industrial segments. It is influenced by growth in textile innovation, rising sportswear demand, and new material technologies. The shift toward high-performance fabrics and the expansion of textile manufacturing in Asia are shaping the competitive landscape and supply chains for Nylon 6 yarn.

Market growth is strongly supported by the rising popularity of performance-oriented apparel and activewear. Start-ups and sports platforms are attracting large investments, fueling innovation in fabric technology. Outdoor Voices raised $34 million, Fanatics reached a $27 billion valuation, Fanchest secured $4 million, Fanatics later hit $31 billion after a $700 million investment, and Ghost raised $40 million, all reflecting growing market confidence and increasing fabric consumption.

Opportunities lie in the growing move toward sustainable and high-performance fibers. Innovations in recycled and bio-based Nylon 6, coupled with investments from the athletic and e-commerce sectors, can accelerate adoption. As global brands expand and premium apparel segments grow, Nylon 6 filament yarn manufacturers have the scope to develop eco-friendly, advanced yarns that meet evolving quality and environmental standards.

Key Takeaways

- The Global Nylon 6 Filament Yarn Market is expected to be worth around USD 51.1 billion by 2034, up from USD 26.2 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In the Nylon 6 Filament Yarn Market, Fully Drawn Yarn (FDY) holds a 34.8% share.

- The fabric segment leads the Nylon 6 Filament Yarn Market by application, accounting for 34.2%.

- By end-user, the apparel and fashion sector dominates the Nylon 6 Filament Yarn Market with 38.3%.

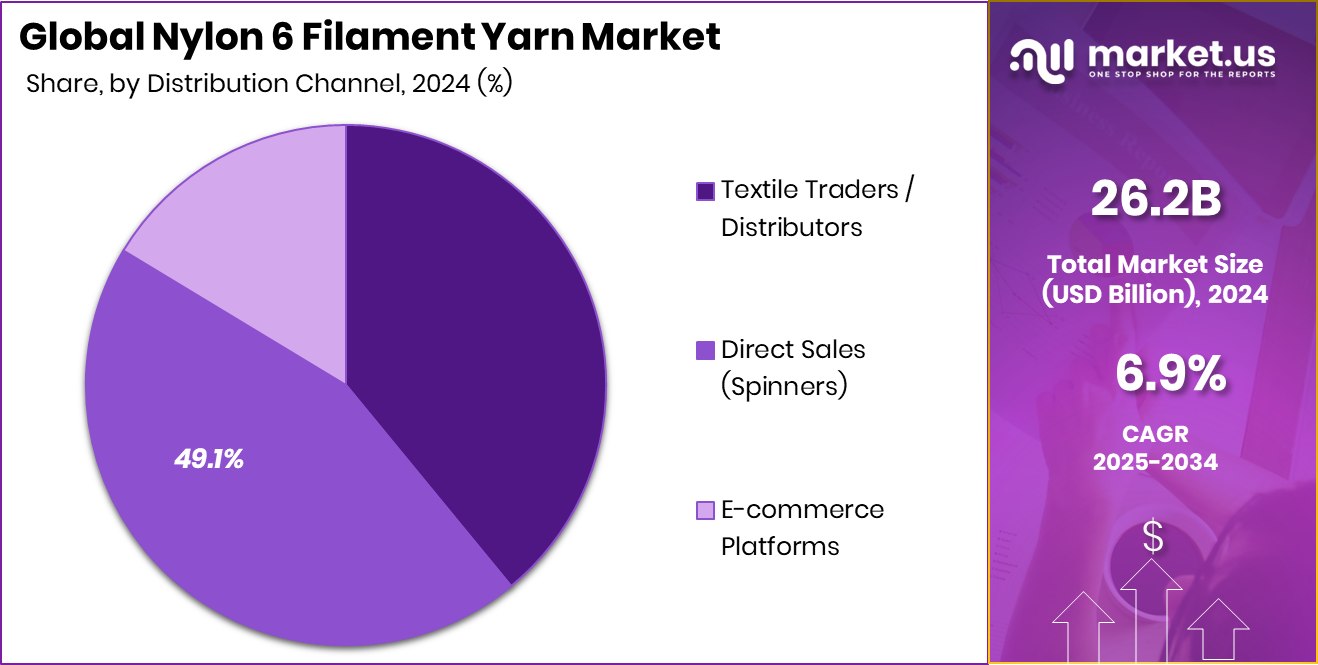

- Direct Sales through Spinners represent the largest distribution channel in the nylon 6 Filament Yarn Market at 49.1%.

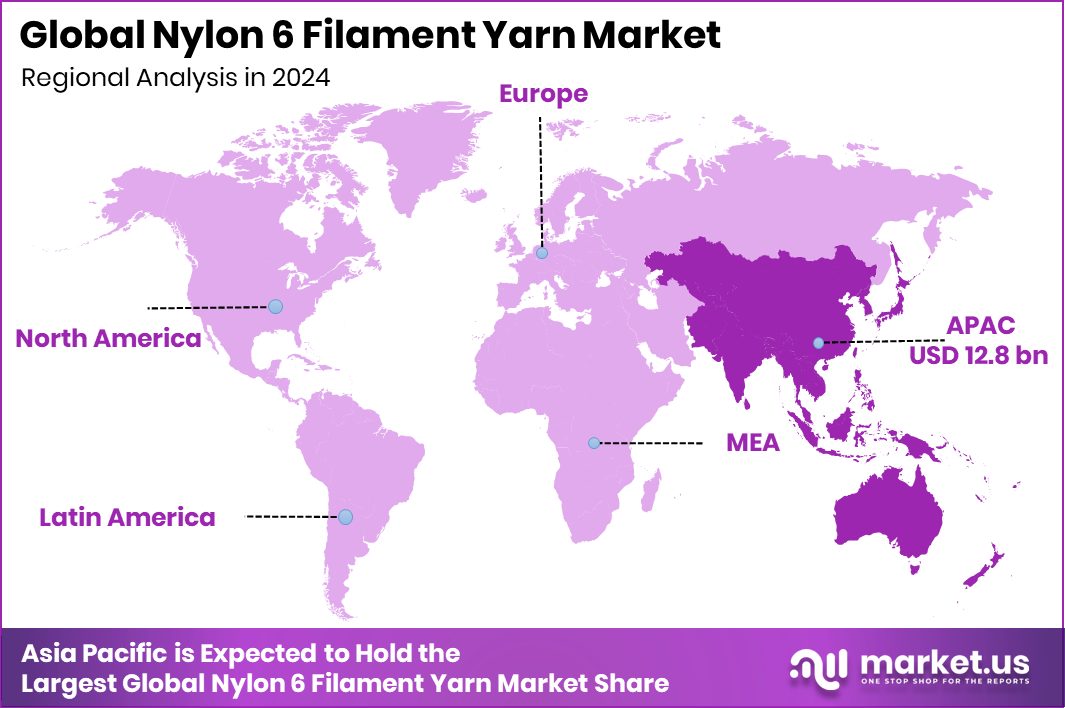

- The Asia Pacific market value reached approximately USD 12.8 billion, highlighting strong textile manufacturing growth.

By Yarn Type Analysis

The Nylon 6 Filament Yarn Market sees Fully Drawn Yarn (FDY) leading with 34.8% share.

In 2024, Fully Drawn Yarn (FDY) held a dominant market position in the By Yarn Type segment of the Nylon 6 Filament Yarn Market, accounting for a 34.8% share. This dominance is attributed to its superior tensile strength, uniformity, and excellent dyeing characteristics, which make it highly suitable for apparel, home textiles, and industrial fabrics. FDY’s consistent texture and ability to deliver smooth finishes support its extensive use in premium fashion and technical textile applications.

The growing demand for high-performance materials in sportswear and functional fabrics further strengthens FDY’s market leadership. Its versatility, durability, and cost-effectiveness continue to position it as a preferred choice among textile manufacturers and end-use industries.

By Application Analysis

Fabric applications dominate the Nylon 6 Filament Yarn Market, accounting for 34.2% overall utilization globally.

In 2024, Fabric held a dominant market position in the By Application segment of the Nylon 6 Filament Yarn Market, accounting for a 34.2% share. This leadership is mainly driven by the growing use of Nylon 6 yarns in apparel, home textiles, and upholstery, where strength, elasticity, and a smooth finish are essential.

Nylon 6 filament yarn offers excellent color fastness and durability, making it a preferred material for woven and knitted fabrics. Its ability to retain shape and withstand frequent use enhances its value in both fashion and industrial textile production.

Continuous innovation in fabric design and demand for high-performance textiles further reinforce the strong position of the fabric application segment in the market.

By End-user Analysis

The Apparel and Fashion segment drives the Nylon 6 Filament Yarn Market with 38.3% consumption share.

In 2024, Apparel and Fashion held a dominant market position in the end-user segment of the Nylon 6 Filament Yarn Market, accounting for a 38.3% share. This strong presence is attributed to the rising consumer preference for comfortable, lightweight, and durable clothing materials.

Nylon 6 filament yarn’s superior elasticity, softness, and abrasion resistance make it ideal for sportswear, casual wear, and high-performance fashion garments. The fiber’s ability to hold vibrant colors and maintain fabric integrity after repeated use further enhances its demand in the apparel sector.

Continuous innovation in fabric design and the growing trend of functional and stylish clothing reinforce the leading role of the apparel and fashion segment in this market.

By Distribution Channel Analysis

Direct Sales (Spinners) channel holds the highest Nylon 6 Filament Yarn Market share at 49.1%.

In 2024, Direct Sales (Spinners) held a dominant market position in the By Distribution Channel segment of the Nylon 6 Filament Yarn Market, accounting for a 49.1% share. This strong lead is driven by the preference of manufacturers to engage directly with spinners, ensuring better quality control, customized supply, and cost efficiency.

Direct sales enable faster response to changing yarn specifications and market needs, which is crucial for textile producers. The approach also enhances transparency and builds stronger supplier–buyer relationships.

As textile production continues to expand and demand for consistent-quality yarn grows, the direct sales model remains the most reliable and preferred channel for Nylon 6 filament yarn distribution.

Key Market Segments

By Yarn Type

- Partially Oriented Yarn (POY)

- Fully Drawn Yarn (FDY)

- High-Tenacity Industrial Yarn

- Textured Yarn

By Application

- Fabric

- Sports Apparel

- Sports and Adventure Equipment

- Travel Accessories

- Fishing Nets

By End-user

- Apparel and Fashion

- Industrial and Technical Textiles

- Automotive Components

- Consumer Goods

- Others

By Distribution Channel

- Textile Traders / Distributors

- Direct Sales (Spinners)

- E-commerce Platforms

Driving Factors

Surge in High-Performance Sportswear Demand

The rapid rise in high-performance sportswear is a major driving force behind the demand for nylon 6 filament yarn. Brands and startups backed by significant funding are pushing aggressive volumes of technical apparel, creating strong downstream demand for yarns that boast strength, elasticity, and durability.

For example, one athletic apparel start-up raised £8,815 in funding to support new product lines. As sportswear grows in popularity worldwide, manufacturers are turning to nylon 6 filament yarn to meet fabric requirements for stretch, resilience, and comfort. This surge in activewear production directly translates into increased yarn consumption and a broader market opportunity for textile fibre suppliers.

Restraining Factors

Rising Raw Material Price Volatility

One major restraining factor for the Nylon 6 Filament Yarn Market is the continuous fluctuation in raw material prices. The production of Nylon 6 relies heavily on caprolactam, a petrochemical derivative whose cost depends on crude oil prices. Any increase in oil prices directly raises production costs, making yarn manufacturing less profitable. These unpredictable price movements affect long-term contracts and discourage small manufacturers from scaling operations.

Additionally, transportation and energy costs add further pressure to margins, leading to unstable supply chains. Such volatility makes it difficult for textile producers to plan budgets efficiently, forcing many to seek alternative synthetic fibers or blends to maintain product affordability and competitiveness in both domestic and export markets.

Growth Opportunity

Expanding Use in the Performance Apparel Industry

A key growth opportunity for the Nylon 6 Filament Yarn Market lies in its expanding role within the performance and sports apparel industry. Nylon 6 yarn’s durability, flexibility, and moisture resistance make it ideal for high-performance clothing used in active lifestyles. As consumer interest in sportswear and athleisure continues to grow, manufacturers are seeking strong, lightweight, and comfortable materials.

This trend is reinforced by major funding activities in the sports sector, such as Fanatics reaching a $31 billion valuation after a $700 million investment round, highlighting the booming demand for sports-related products. This surge in investment and innovation offers significant opportunities for Nylon 6 yarn producers to supply advanced materials tailored to next-generation apparel and textile applications

Latest Trends

Growing Sustainable and Recycled Nylon Filament Usage

In the Nylon 6 filament yarn market, one of the most visible recent trends is the heavier adoption of sustainable and recycled versions of the yarn. Manufacturers are increasingly embracing yarns made from recycled raw materials or bio-based feedstocks that reduce waste and lower environmental impact. These eco-friendly variants appeal to textile brands and end-users who prioritise greener supply chains and want to meet consumer demand for more responsible fashion.

At the same time, advancements in recycling technologies are making such yarns more cost-competitive and technically viable, which helps expand their application in both apparel and industrial uses. As sustainability becomes a core buying criterion, this trend is gaining momentum and shaping the direction of product innovation in the Nylon 6 filament yarn sector.

Regional Analysis

In 2024, the Asia Pacific dominated the Nylon 6 Filament Yarn Market with a 48.90% share.

In 2024, the Asia Pacific region held a dominant position in the Nylon 6 Filament Yarn Market, accounting for 48.90% share, valued at USD 12.8 billion. This strong presence is supported by the region’s large-scale textile production hubs, particularly in China, India, and Japan, where expanding apparel, industrial fabric, and automotive sectors drive steady demand. The region’s growing middle-class population, rising fashion consumption, and government incentives for textile manufacturing further strengthen its leadership.

North America demonstrates stable growth due to demand for high-performance materials in sportswear and technical fabrics, supported by innovation in sustainable yarn production. Europe continues to benefit from advancements in textile engineering and eco-friendly material trends.

Meanwhile, the Middle East & Africa and Latin America show gradual adoption, driven by rising investments in textile infrastructure and regional apparel exports. Overall, Asia Pacific remains the dominant and fastest-growing market, driven by manufacturing capabilities, export-oriented policies, and expanding end-user industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, JCT Group continues to demonstrate strong expertise in synthetic fiber production, with Nylon 6 Filament Yarn as one of its key focus areas. The company’s integrated textile operations, supported by advanced spinning and polymerization units, enable it to maintain consistent product quality and meet the needs of diverse applications such as apparel, upholstery, and industrial fabrics. Its ongoing modernization initiatives have improved production efficiency and positioned it well in both domestic and export markets.

Century Enka Limited remains a prominent manufacturer of Nylon 6 Filament Yarn, emphasizing quality, consistency, and sustainable production practices. With its well-established manufacturing infrastructure and technical collaboration capabilities, the company supports India’s growing textile demand, especially in apparel and tire cord applications. Its balanced portfolio of synthetic fibers and commitment to process innovation help strengthen its market position.

Zhejiang Century ChenXing Fiber Technology Co., Ltd. has emerged as a dynamic producer in Asia, known for its high-performance Nylon 6 filament yarns tailored for fashion, home textile, and industrial applications. The company focuses on technological advancement, efficient polymerization, and eco-friendly production processes. Its adaptability to evolving textile trends and competitive cost structure contributes to its growing presence in the regional and global markets.

Top Key Players in the Market

- JCT Group

- Century Enka Limited

- Zhejiang Century ChenXing Fiber Technology Co., Ltd.

- Singhal Industries Pvt. Ltd.

- Salud Industry (Dongguan) Co., Ltd.

- Changzhou Yida Chemical Fiber Co., Ltd.

- Anand Rayons Ltd.

- Yiwu Huading Nylon Co., Ltd.

- TORAY INDUSTRIES, INC.

- Prutex Nylon Co., Ltd.

- EAST ASIA TEXTILE TECHNOLOGY LTD.

Recent Developments

- In June 2025, the company entered the Corporate Insolvency Resolution Process (CIRP) with effect from June 10, 2025, under the order of the National Company Law Tribunal (NCLT). The Board of Directors’ powers were suspended, and an Interim Resolution Professional was appointed to manage affairs.

Report Scope

Report Features Description Market Value (2024) USD 26.2 Billion Forecast Revenue (2034) USD 51.1 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Yarn Type (Partially Oriented Yarn (POY), Fully Drawn Yarn (FDY), High-Tenacity Industrial Yarn, Textured Yarn), By Application (Fabric, Sports Apparel, Sports and Adventure Equipment, Travel Accessories, Fishing Nets), By End-user (Apparel and Fashion, Industrial and Technical Textiles, Automotive Components, Consumer Goods, Others), By Distribution Channel (Textile Traders / Distributors, Direct Sales (Spinners), E-commerce Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape JCT Group, Century Enka Limited, Zhejiang Century ChenXing Fiber Technology Co., Ltd., Singhal Industries Pvt. Ltd., Salud Industry (Dongguan) Co., Ltd., Changzhou Yida Chemical Fiber Co., Ltd., Anand Rayons Ltd., Yiwu Huading Nylon Co., Ltd., TORAY INDUSTRIES, INC., Prutex Nylon Co., Ltd., EAST ASIA TEXTILE TECHNOLOGY LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nylon 6 Filament Yarn MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Nylon 6 Filament Yarn MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- JCT Group

- Century Enka Limited

- Zhejiang Century ChenXing Fiber Technology Co., Ltd.

- Singhal Industries Pvt. Ltd.

- Salud Industry (Dongguan) Co., Ltd.

- Changzhou Yida Chemical Fiber Co., Ltd.

- Anand Rayons Ltd.

- Yiwu Huading Nylon Co., Ltd.

- TORAY INDUSTRIES, INC.

- Prutex Nylon Co., Ltd.

- EAST ASIA TEXTILE TECHNOLOGY LTD.