Global NPK Fertilizers Market By Form Type (Dry, Liquid), By Type (Nitrogen, Phosphorus, Potassium, Others), By Crop Type (Cereals And Grains, Oilseeds And Pulses, Fruits And Vegetables, Others), By Application (Bakery Products, Meat And Meat Products, Dairy Products, Beverages, Others)

- Published date: Jan 2026

- Report ID: 174862

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

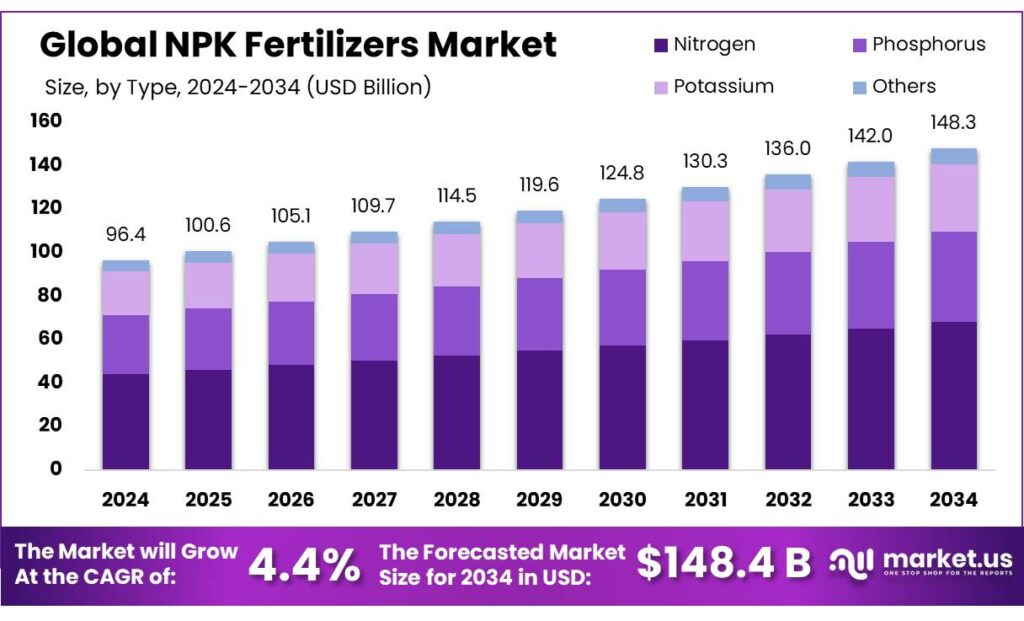

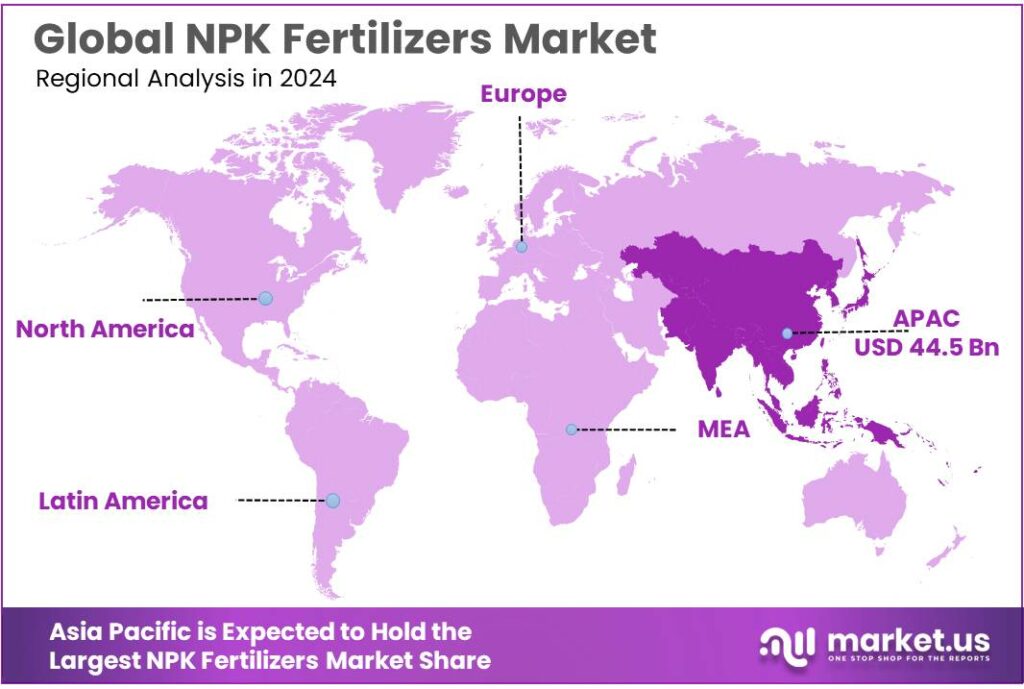

Global NPK Fertilizers Market size is expected to be worth around USD 148.3 Billion by 2034, from USD 96.4 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 46.2% share, holding USD 44.5 Billion in revenue.

NPK fertilizers (blended or compound grades supplying nitrogen, phosphorus and potassium) sit at the core of modern crop nutrition because they let growers correct multiple nutrient gaps in a single application, which matters as farms push for higher yields while protecting soil health. At the global level, inorganic fertilizer use has steadily expanded alongside food production: FAO reports agricultural use of inorganic fertilizers rose from 142 million tonnes (Mt) in 2002 to 190 Mt in 2023 (a 34% increase).

From an industrial scenario perspective, NPK is tightly linked to upstream ammonia/urea (nitrogen), processed phosphate rock (phosphates), and potash mining (potassium). The sector is also highly exposed to trade flows and energy costs, which drive both production economics and final pricing. FAO’s 2022 breakdown shows how demand is distributed across nutrients: 108 Mt nitrogen, nearly 42 Mt phosphorus, and 35 Mt potassium used in agriculture in 2022.

Key demand drivers are agronomic and economic. Farmers adopt NPK to correct nutrient imbalances, improve crop response consistency, and simplify application logistics—particularly for cereals, oilseeds, fruits/vegetables, and plantation crops. Pricing dynamics also shape usage. The World Bank reported the fertilizer price index was up 15% since the start of 2025, with phosphate products showing sharp moves: TSP up 43% and DAP up 23% over that period, driven by demand strength, trade restrictions, and production shortfalls.

- Government policy is another major lever because affordability determines adoption at scale. In India, the government approved Nutrient-Based Subsidy (NBS) support for Rabi 2025–26 (Oct 1, 2025–Mar 31, 2026) with a tentative budgetary requirement of ~₹37,952 crore, and cited over ₹2.04 lakh crore allocated between 2022–23 and 2024–25 toward NBS subsidies. The same note lists per-kg nutrient subsidies for Rabi 2025–26—₹43.02/kg (N), ₹47.96/kg (P), ₹2.38/kg (K), ₹2.87/kg (S)—and shows product support such as DAP subsidy ₹29,805/MT.

Key Takeaways

- NPK Fertilizers Market size is expected to be worth around USD 148.3 Billion by 2034, from USD 96.4 Billion in 2024, growing at a CAGR of 4.4%.

- Dry NPK fertilizers held a dominant market position, capturing more than a 69.3% share.

- Nitrogen held a dominant market position, capturing more than a 45.9% share.

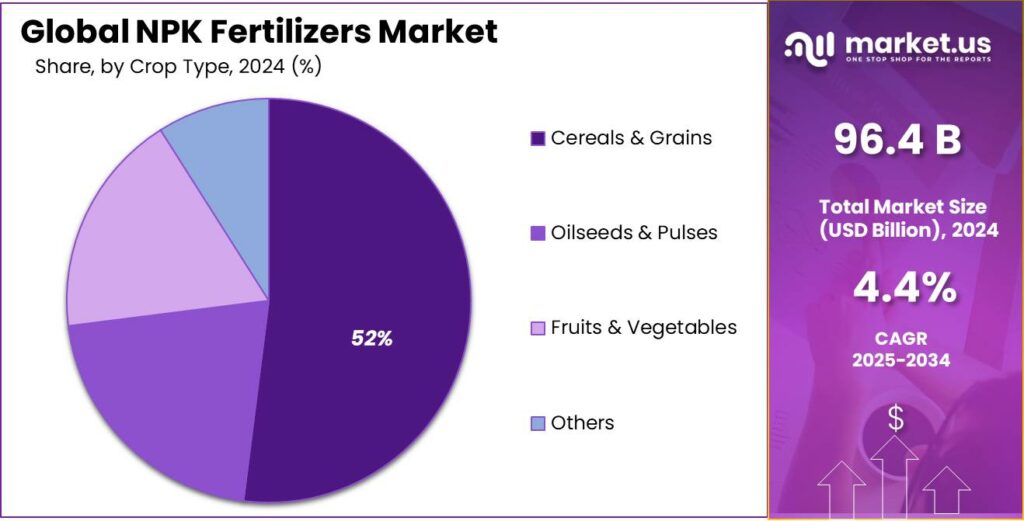

- Cereals & Grains held a dominant market position, capturing more than a 52.1% share.

- Dairy Products held a dominant market position, capturing more than a 37.7% share.

- Asia Pacific region stood out as the largest and most influential market for NPK fertilizers, accounting for approximately 46.2% of global consumption and generating around USD 44.5 billion.

By Form Type Analysis

Dry NPK fertilizers lead the market with a strong 69.3% share in 2024

In 2024, Dry NPK fertilizers held a dominant market position, capturing more than a 69.3% share, reflecting their long-established role in large-scale farming and cost-efficient nutrient delivery. Farmers continue to prefer dry formulations because they are easier to store, transport, and blend into custom nutrient ratios. These products also fit well within traditional broadcasting, top-dressing, and mechanized field application practices, making them a natural choice for growers managing extensive acreage. Their granular structure offers slow and even nutrient release, which supports crops over longer growth cycles while keeping application costs manageable.

By Type Analysis

Nitrogen dominates with 45.9% share as farmers prioritize quick nutrient response

In 2024, Nitrogen held a dominant market position, capturing more than a 45.9% share, highlighting its central role in crop growth and yield improvement. Farmers rely heavily on nitrogen-rich NPK blends because nitrogen drives chlorophyll formation, boosts vegetative growth, and helps crops achieve higher biomass. Its fast-acting nature makes it especially important for cereals such as wheat, rice, and maize, which account for a large share of global fertilizer use. The strong presence of nitrogen-based NPK blends in 2024 also reflects their affordability and availability through both public distribution systems and private retailers, ensuring consistent access during peak farming seasons.

By Crop Type Analysis

Cereals & Grains lead the market with a 52.1% share in 2024 due to high nutrient demand

In 2024, Cereals & Grains held a dominant market position, capturing more than a 52.1% share, reflecting the heavy nutrient requirement of crops such as wheat, rice, maize, and barley. These crops are grown across vast acreage worldwide and depend strongly on NPK fertilizers to maintain yield stability, especially in regions where soil nutrients continue to decline due to repeated cultivation. Farmers prefer tailored NPK blends for cereals and grains because they support strong root development, balanced vegetative growth, and improved grain filling—factors crucial for securing high output in both irrigated and rain-fed systems.

By Application Analysis

Dairy Products lead the application segment with a strong 37.7% share in 2024

In 2024, Dairy Products held a dominant market position, capturing more than a 37.7% share, reflecting the crucial link between fodder quality and milk productivity. Dairy farmers rely heavily on nutrient-rich forage crops such as maize silage, sorghum, alfalfa, and pasture grasses, all of which respond strongly to balanced NPK fertilization. These fertilizers help improve biomass yield, enhance protein content, and support consistent fodder supply throughout the year—factors that directly influence animal health and daily milk output. With dairy sectors in many countries expanding rapidly, the demand for nutrient-managed fodder crops has grown proportionally, pushing the dairy application segment to a leading position in 2024.

Key Market Segments

By Form Type

- Dry

- Liquid

By Type

- Nitrogen

- Phosphorus

- Potassium

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Application

- Bakery Products

- Meat & Meat Products

- Dairy Products

- Beverages

- Others

Emerging Trends

Precision and efficiency technologies drive the latest NPK fertilizer trend

A major latest trend in the NPK fertilizer sector is the growing use of precision and enhanced-efficiency technologies that help farmers apply nutrients more effectively and protect the environment while improving yields. This trend is emerging because farmers, governments, and food bodies increasingly recognize that traditional blanket fertilizer use is not always efficient and can lead to nutrient runoff, wasted inputs, and environmental damage.

Precision nutrient management systems, digital soil mapping, and controlled-release formulations are beginning to reshape how NPK fertilizers are made and applied. This shift is not driven by marketing hype—there are real signals in global fertilizer data showing a move toward smarter, more sustainable nutrient practices. According to fertilizer use records, global agricultural consumption of inorganic fertilizers rose from 142 million tonnes in 2002 to 190 million tonnes in 2023, reflecting both increased demand and the opportunity to make use more efficient and targeted.

Farmers have realized that simply increasing total fertilizer volume does not always translate to better yields if nutrients are not taken up by the crop. Precision techniques—such as variable-rate application, soil testing before planting, and use of enhanced-efficiency NPK formulas with slow-release or controlled-release coatings—help match nutrient supply to actual crop needs at the right time and place.

These innovations reduce losses to the environment, improve nutrient uptake, and support long-term soil health. While global fertilizer markets are large, with overall fertilizer value projected to grow strongly—in the broader fertilizers category to around USD 281.56 billion by 2030 as demand for efficient nutrient use grows—the NPK segment itself stands to benefit from technologies that increase nutrient efficiency and reduce environmental impacts.

Drivers

Food security pressure is pushing balanced NPK use

One major driving factor for NPK fertilizers is the steady pressure to grow more food from the same land, while keeping soils productive year after year. Global food demand is rising, and the challenge is not only volume but also stability—farmers need reliable harvests despite weather swings, tighter water availability, and soils that are often tired from continuous cropping. FAO’s long-term outlook highlights the scale of this pull: feeding a projected 9.1 billion people by 2050 would require raising overall food production by about 70% compared with 2005/07 levels.

This demand-side push is visible in hard fertilizer-use data. FAO reports that global agricultural use of inorganic fertilizers rose from 142 million tonnes (Mt) in 2002 to 190 Mt in 2023, a 34% increase. In 2023 specifically, nitrogen use reached 112 Mt, phosphorus 41 Mt, and potassium 38 Mt, showing that all three nutrients are rising together—exactly the pattern that supports multi-nutrient, balanced products like NPK. On the industry outlook side, the International Fertilizer Association expects global fertilizer use (N + P₂O₅ + K₂O) to recover and set a new high, forecasting 205 Mt nutrients in FY 2025, above the prior record of 201.5 Mt in FY 2020.

Government actions also reinforce this driving factor by making balanced fertilization more reachable at the farm level. In India, for example, the fertilizer budget is explicitly tied to likely consumption and global input prices, and the official statement shows the Department of Fertilizers’ allocation moving from ₹1,68,130.81 crore to a final allocation of ₹1,91,836.29 crore through supplementary grants. Within that, the Nutrient Based Subsidy (NBS) system supports non-urea nutrients and helps keep P&K-containing products—including many NPK grades—affordable; the government’s NBS framework sets subsidy per kg of nutrients including N, P, K (and S).

Restraints

Environmental concerns and inefficient use restrain NPK fertilizer adoption

One of the major restraining factors for NPK fertilizers is the environmental harm and inefficiency associated with their use, which directly affects policies, farmer practices, and long-term soil health outcomes. While balanced NPK blends are crucial for crop nutrition, many regions struggle with the low nutrient use efficiency of these products. Research shows that only a fraction of applied nitrogen from fertilizers is actually taken up by crops, with the rest lost to the soil, air, or water. This inefficiency leads to environmental problems such as nutrient leaching into groundwater and surface water pollution, causing issues like eutrophication, harmful algal blooms, and broader ecosystem degradation.

These environmental concerns are not abstract—they are measurable and widespread. For example, in India 56% of districts have groundwater nitrate levels above safe limits, largely due to fertilizer runoff and overuse, highlighting how mismanaged nutrient application can harm water quality and human health. In China, the world’s largest consumer of nitrogen fertilizers, 30% of global nitrogen use is attributed to the country, with a significant share going into rice cultivation. However, because plants often absorb only a small portion of applied nutrients, the remainder contributes to soil degradation and pollution.

Governments recognize these issues and are increasingly tied to policies that balance nutrient supply with environmental protection. For example, initiatives aimed at reducing nitrate leaching and protecting water resources push agricultural extension services to promote nutrient management planning, soil testing, and more precise application methods. These policies are designed to minimize negative environmental impacts while still enabling productivity gains, but they also reshape market dynamics by placing greater emphasis on efficiency rather than simply volume of fertilizer consumption.

Opportunity

Precision nutrient management is opening a big runway for NPK

One major growth opportunity for NPK fertilizers is the shift toward precision nutrient management—using soil testing, better advisory, and smarter application to deliver the right N, P, and K in one product, instead of guessing or over-applying single nutrients. This matters because farmers are being asked to grow more food on the same land while keeping soils productive. At the same time, fertilizer budgets are tighter, and there is more pressure to show that nutrients are being used efficiently. In practical terms, the opportunity is not only “more fertilizer,” but better fertilizer decisions, and NPK fits naturally into that change because it is designed for balanced feeding.

The demand backdrop supports this move. FAO reports that global agricultural use of inorganic fertilizers (N, P₂O₅, K₂O) rose from 142 million tonnes in 2002 to 190 million tonnes in 2023. Within 2023, nitrogen use reached 112 Mt, phosphorus 41 Mt, and potassium 38 Mt, showing that farmers are still relying on all three nutrients and, in many areas, need them together rather than separately. Looking ahead, the International Fertilizer Association expects global fertilizer use to keep recovering, forecasting 205 Mt nutrients in FY 2025, which would be higher than the previous record of 201.5 Mt in FY 2020.

Government-led soil testing is a direct accelerator for this opportunity because it changes buying behavior from habit to need. In India, the government reports that over 25 crore Soil Health Cards had been distributed as of July 2025 to promote balanced fertiliser use, and by February 2025 it had provided ₹1,706.18 crore to States/UTs to support the Soil Health Card scheme. When farmers receive soil results, many discover that one nutrient is not the only issue—so blended and complex NPK grades become more relevant, and customized blends become easier to justify.

Regional Insights

Asia Pacific dominates with 46.2% share and USD 44.5 Billion value in NPK fertilizer demand

In 2024, the Asia Pacific region stood out as the largest and most influential market for NPK fertilizers, accounting for approximately 46.2% of global consumption and generating around USD 44.5 billion in revenue. This commanding market position reflects the region’s agricultural intensity and the central role of balanced nutrient inputs in sustaining staple crop production across economies such as China, India, Indonesia, and Vietnam.

Vast areas under cultivation for rice, wheat, maize, and other cereal crops create a strong baseline demand for NPK blends that deliver essential nitrogen, phosphorus, and potassium nutrients in a single application. Agricultural planners and farm communities in these countries have steadily increased the use of compound fertilizers to support higher yields per hectare, particularly as soil nutrient depletion becomes more pronounced with repeated cropping cycles.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Akzo Nobel maintains a notable presence in the NPK value chain through specialty chemicals supporting fertilizer production. With operations in over 150 countries and annual revenues exceeding €10 billion, the company supplies essential process chemicals used in granulation and nutrient stabilization. Its global manufacturing footprint and continued investment in efficiency solutions strengthen its position in the agricultural inputs ecosystem.

Yara is one of the world’s largest fertilizer producers, operating in more than 60 countries with revenues around USD 17–18 billion. The company manufactures a wide range of NPK blends and complex fertilizers, supported by 30+ production sites. Yara’s focus on digital farming tools and low-carbon ammonia strengthens its leadership in efficient and sustainable NPK nutrient solutions.

EuroChem is a major global fertilizer producer with revenues exceeding USD 10 billion and production assets in 6+ countries. It is one of the few companies with fully integrated capabilities in nitrogen, phosphate, and potash, enabling efficient, large-scale NPK manufacturing. EuroChem’s strategic expansion in Europe and Asia strengthens its competitiveness in diversified NPK formulations.

Top Key Players Outlook

- Akzo Nobel N.V.

- AGROFERT

- Yara International ASA

- The Mosaic Company

- Eurochem

- PotashCorp.

- K+S Akitengesellschaft

- Haifa Chemical Ltd

- Aditya Birla Chemicals

Recent Industry Developments

Akzo Nobel reported approximately USD 11.59 billion in revenue for 2024 and employed around 34,600 people across 150+ countries, underlining its global scale in the chemicals industry that supplies components to multiple end markets, including agricultural inputs.

In 2024, EuroChem continued to expand its capacity and reach, supporting farmers in 100+ countries and helping feed over 350 million people worldwide through its fertilizer solutions. A key milestone in 2024 was the ramp-up of the Serra do Salitre phosphate complex in Brazil, a US $1 billion project with an annual capacity of 1 million tonnes of advanced phosphate fertilizers, which supports local NPK formulation supply and reduces reliance on imports.

Report Scope

Report Features Description Market Value (2024) USD 96.4 Bn Forecast Revenue (2034) USD 148.3 Bn CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form Type (Dry, Liquid), By Type (Nitrogen, Phosphorus, Potassium, Others), By Crop Type (Cereals And Grains, Oilseeds And Pulses, Fruits And Vegetables, Others), By Application (Bakery Products, Meat And Meat Products, Dairy Products, Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel N.V., AGROFERT, Yara International ASA, The Mosaic Company, Eurochem, PotashCorp., K+S Akitengesellschaft, Haifa Chemical Ltd, Aditya Birla Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Akzo Nobel N.V.

- AGROFERT

- Yara International ASA

- The Mosaic Company

- Eurochem

- PotashCorp.

- K+S Akitengesellschaft

- Haifa Chemical Ltd

- Aditya Birla Chemicals