North America Open RAN Market Analysis, Decision-Making Report By Component (Hardware, Software, Services), By Network Type (2G/3G Networks, 4G Networks, 5G Networks), By Unit (Radio Unit, Centralized Unit, Distributed Unit), By Frequency (Sub-6 GHz, Millimeter Wave), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144338

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

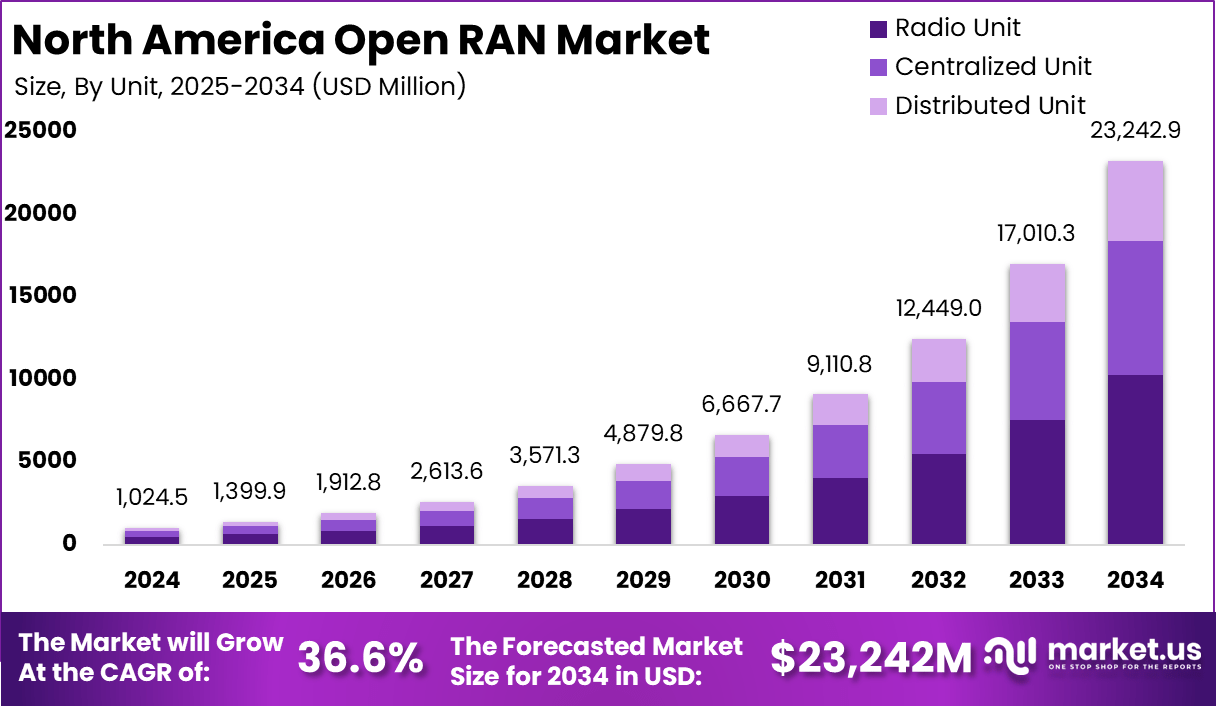

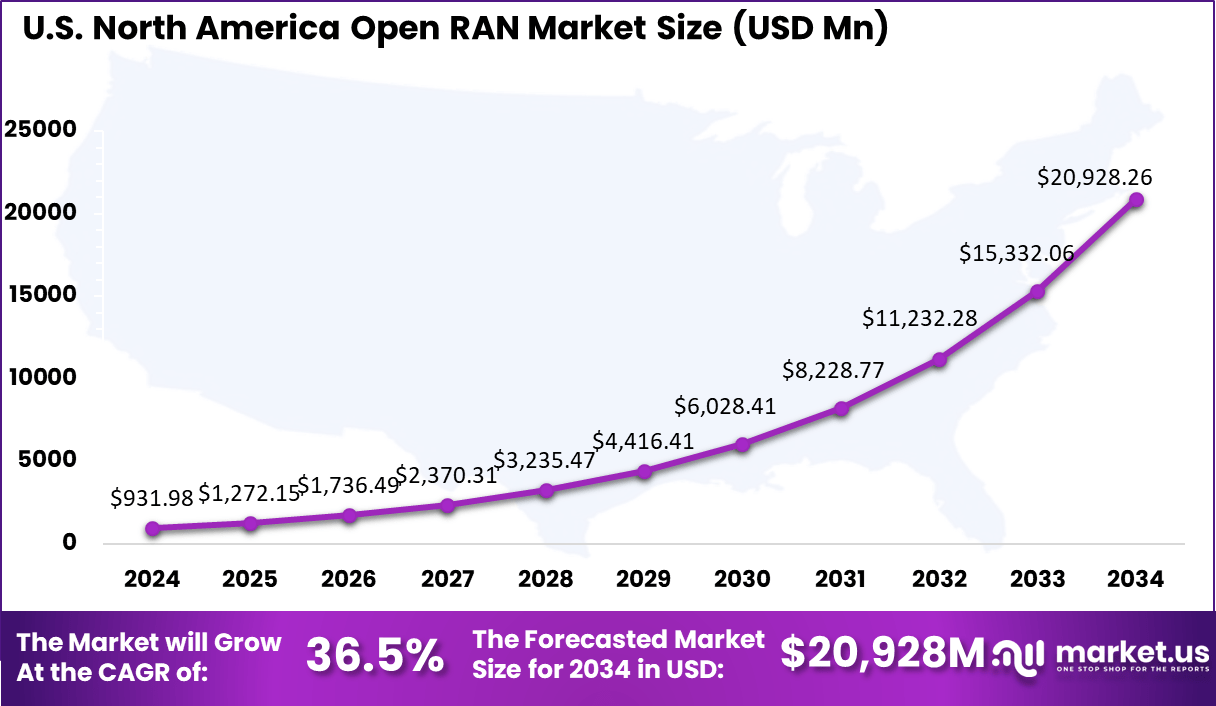

The North America Open RAN Market size is expected to be worth around USD 23,242.9 Million By 2034, from USD 1,024.5 Million in 2024, growing at a CAGR of 36.6% during the forecast period from 2025 to 2034. The U.S. Open RAN market was estimated at USD 931.98 Million in 2024 and is expected to grow at a CAGR of 36.5% from 2025 to 2034.

The North American Open RAN market is strongly influenced by several critical drivers, including regulatory support for open networking standards, technological advancements, and shifting market demands. Regulatory changes are playing a pivotal role, as increasing endorsements from global telecommunications standards organizations and government bodies are fostering innovation and competition.

Open RAN technology adoption is primarily driven by its promise of enhanced network functionality through virtualization and software-centric approaches, which reduce dependency on physical hardware and allow for more straightforward updates and maintenance. Additionally, the integration of AI and Machine Learning optimizes network traffic and predictive maintenance, which improves overall efficiency and performance.

The primary reasons for adopting Open RAN technology in North America include its ability to promote interoperability and standardization across different vendor equipment, which is vital for seamless integration of new technologies into existing infrastructures.

According to Market.us, The Global Open RAN Market size is expected to be worth around USD 79,379 Million By 2034, from USD 2,957 Million in 2024, growing at a CAGR of 38.9% during the forecast period from 2025 to 2034. North America dominated a 34.6% market share in 2024 and held USD 1,024.3 Million in revenue from the Open Ran Market.

This approach reduces supply chain and operational risks by diversifying sources and limiting the impact of specific vendor issues. Furthermore, the move towards cloud-native network functions within the Open RAN ecosystem is becoming increasingly critical, allowing for greater scalability and flexibility in network management and operations.

Key Takeaways

- The North America Open RAN Market is projected to experience unprecedented growth over the next decade. Valued at approximately USD 1,024.5 million in 2024, the market is expected to soar to around USD 23,242.9 million by 2034, reflecting a robust Compound Annual Growth Rate (CAGR) of 36.6%

- In 2024, the U.S. Open RAN market was valued at around USD 931.98 million and is projected to reach approximately USD 1,272.15 million in 2025. With continued investments and technological advancements, the market size is expected to surge to nearly USD 20,928 million by 2034, registering an impressive CAGR of 36.5% during the forecast period.

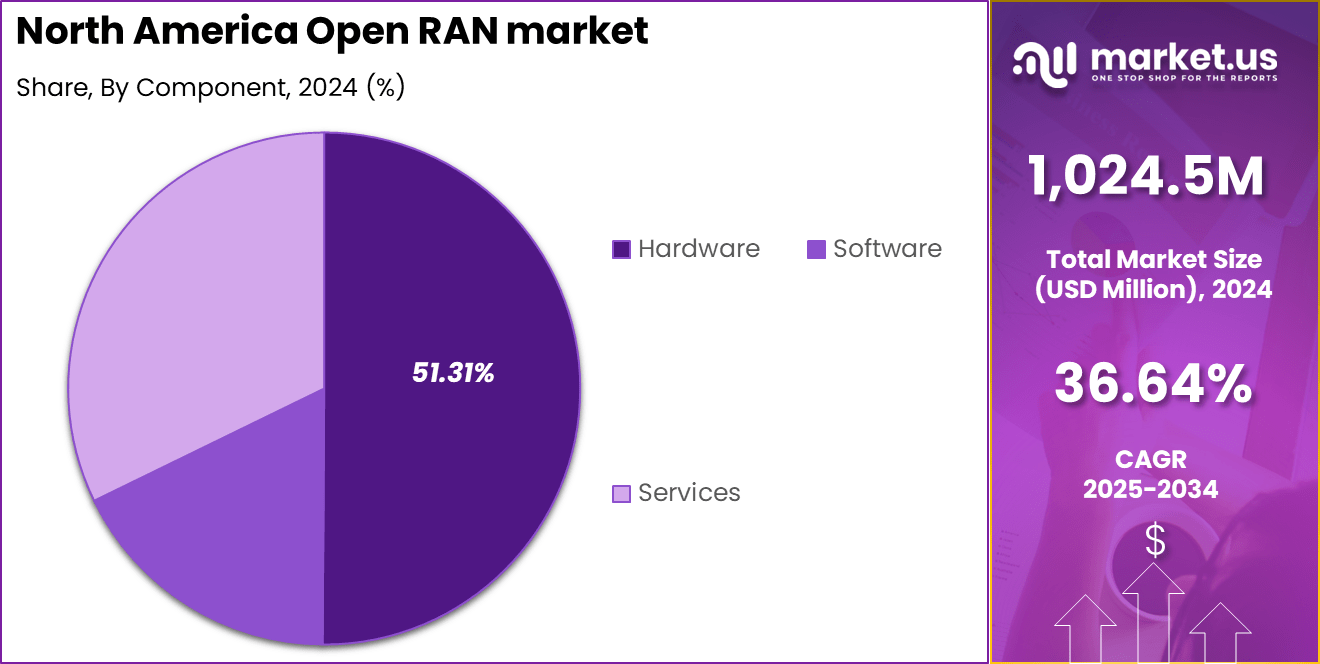

- The hardware segment emerged as a key contributor to market revenue, holding more than a 51.31% share in 2024.

- With the rapid deployment of next-generation networks, the 5G Networks segment captured over a 52.51% share of the market in 2024.

- Within the hardware category, the Radio Unit (RU) segment held a significant share of approximately 44.33% in 2024.

- Among the frequency segments, Sub-6 GHz emerged as the dominant band, holding more than an 84.38% share in 2024.

Analysts’ Viewpoint

The North American Open RAN market presents significant investment opportunities, especially in areas like RAN component manufacturing, network integration services, and software development for network management and automation solutions. The projected growth rate of 38.9% through 2034 signifies a robust expansion, underscoring a fertile ground for both investors and innovators keen on the forefront of Open RAN technology.

Open RAN technology is evolving rapidly with advancements like virtualization and software-centric networks that reduce reliance on physical hardware, thus facilitating easier updates and maintenance. The integration of AI and ML optimizes network traffic management and enables predictive maintenance, improving overall efficiency and performance.

The regulatory landscape for Open RAN is also progressing, with an increasing number of global and regional policy frameworks that support the technology. This includes initiatives aimed at fostering innovation, ensuring competition, and securing networks. Such governmental and regulatory involvement not only promotes the adoption of Open RAN technologies but also ensures that the ecosystem evolves in a secure and standardized manner.

U.S. Open RAN Market Size

The U.S. Open RAN (Radio Access Network) market has been valued at approximately USD 931.98 million in 2024, and it is projected to grow significantly – reaching around USD 1,272.15 million in 2025 and expanding further to nearly USD 20,928 million by 2034. This remarkable growth reflects a strong compound annual growth rate (CAGR) of 36.5% during the forecast period from 2025 to 2034.

The United States is currently at the forefront of this market, driven by a combination of technological leadership, early adoption of open architecture in telecom networks, and active support from both government and private sectors.

The increasing demand for vendor interoperability, the rising need to reduce network costs, and ongoing investments in 5G infrastructure have positioned the U.S. as a key innovator and adopter of Open RAN technologies.

North America Open RAN Market Share, By Coutrywise Analysis, 2019-2024 (%)

Country 2019 2020 2021 2022 2023 2024 The US 91.47% 91.37% 91.28% 91.19% 91.09% 91.00% Canada 8.53% 8.63% 8.72% 8.81% 8.91% 9.00% Additionally, strategic collaborations between cloud providers, telecom operators, and system integrators in the U.S. have further strengthened its role in shaping the future of open and flexible mobile networks. This market momentum is not only reshaping the way mobile networks are deployed but also offering greater competition, innovation, and scalability for operators nationwide.

Component Analysis

In 2024, the Hardware segment held a dominant market position within the North American Open RAN market, capturing more than a 51.31% share. This prominence is primarily attributed to the critical role that hardware components play in the deployment and operational success of Open RAN systems.

The hardware segment includes essential elements like radio units, antennas, and base stations, which are integral for establishing robust and reliable network infrastructure. The substantial share of the hardware segment is also fueled by the accelerated deployment of 5G networks across North America, which demands advanced and scalable hardware solutions to support high-speed data transmission and enhanced connectivity.

North America Open RAN market Share, By Component, 2019-2024 (%)

Component 2019 2020 2021 2022 2023 2024 Hardware 52.24% 52.05% 51.86% 51.67% 51.45% 51.31% Software 33.52% 33.56% 33.61% 33.65% 33.70% 33.75% Services 14.24% 14.39% 14.53% 14.67% 14.85% 14.94% As telecommunications operators push for more extensive 5G coverage, the demand for compatible and high-performance hardware that can support 5G technologies intensifies, thereby bolstering the growth of the hardware segment in the Open RAN market. Moreover, the shift towards Open RAN architectures is driven by the need for more flexible and cost-effective network solutions.

This shift encourages the adoption of hardware that can support open standards and interoperability among different network components from various vendors. By enabling a multi-vendor environment, Open RAN hardware reduces vendor lock-in and promotes innovation, leading to more competitive pricing and improved network capabilities.

Additionally, the strategic focus on enhancing network capacities to handle increasing volumes of data and to provide better network coverage, including in underserved areas, further amplifies the importance of the hardware segment. The ongoing investments in telecommunication infrastructure, coupled with regulatory support for innovative network technologies, are expected to sustain the growth momentum of the hardware segment in the Open RAN market.

Network Type Analysis

In 2024, the 5G Networks segment held a dominant market position within the North American Open RAN market, capturing more than a 52.51% share. This leading position can be attributed primarily to the rapid expansion and deployment of 5G networks across the region, driven by the escalating demand for higher bandwidth and lower latency communications.

As industries and consumers increasingly rely on advanced applications such as real-time streaming, augmented reality, and the Internet of Things (IoT), the infrastructure provided by 5G networks becomes indispensable. The dominance of the 5G Networks segment is also bolstered by significant investments from both private and governmental sectors in 5G technology.

These investments are aimed at harnessing the potential for transformative changes across various sectors, including healthcare, automotive, and manufacturing, which rely heavily on 5G for innovative solutions such as telemedicine, autonomous vehicles, and smart factories.

Network Market Share by Type (2019-2024) (%)

Network Type 2019 2020 2021 2022 2023 2024 2G/3G Networks 4.58% 4.45% 4.33% 4.20% 4.09% 3.97% 4G Networks 43.52% 43.52% 43.51% 43.50% 43.43% 43.52% 5G Networks 51.90% 52.03% 52.16% 52.30% 52.48% 52.51% Furthermore, the push towards digital transformation and the adoption of cloud-based solutions across businesses have necessitated robust 5G networks that can support extensive data transfer and connectivity demands. The agility and scalability offered by Open RAN architectures in 5G networks enable operators to deploy and upgrade their services more efficiently, thereby reducing operational costs and enhancing service delivery.

Additionally, the regulatory environment in North America has been supportive, with policies that encourage the development and deployment of 5G infrastructure. This regulatory backing helps in addressing the increasing consumer and business demands for better and faster connectivity, further propelling the growth of the 5G Networks segment in the Open RAN market.

Unit Analysis

In 2024, the Radio Unit segment held a dominant market position within the North American Open RAN market, capturing more than a 44.33% share. This segment’s leadership is largely due to its fundamental role in the Open RAN architecture, where Radio Units are essential for managing radio frequency signals and facilitating the connection between mobile devices and the core network.

As network operators accelerate the deployment of Open RAN to enhance network flexibility and efficiency, the demand for advanced Radio Units that support a wide range of frequencies and can efficiently handle increased data traffic has surged.

Unit Share by Type (2019-2024) (%)

Unit 2019 2020 2021 2022 2023 2024 Radio Unit 45.15% 44.98% 44.81% 44.65% 44.45% 44.33% Centralized Unit 35.22% 35.26% 35.30% 35.34% 35.35% 35.43% Distributed Unit 19.63% 19.76% 19.89% 20.02% 20.20% 20.25% The prominence of the Radio Unit segment is also driven by the ongoing upgrades from 4G to 5G technologies, where enhanced Radio Units are critical for supporting the dense network architectures required for 5G’s high-speed data capabilities. These units are pivotal in enabling the high throughput and low-latency communications that 5G networks promise, making them indispensable in today’s rapidly evolving telecommunications landscape.

Moreover, the push towards more sustainable and cost-effective network solutions has led to innovations in Radio Unit technology, including developments in energy efficiency and the ability to operate over broader geographic areas with fewer physical installations. This not only supports the expansion of network coverage, particularly in rural and underserved regions but also aligns with global initiatives towards reducing the environmental impact of network infrastructures.

Frequency Analysis

In 2024, the Sub-6 GHz segment held a dominant market position within the North American Open RAN market, capturing more than an 84.38% share. This significant market share is primarily due to the Sub-6 GHz spectrum’s ability to offer a balanced combination of coverage and capacity, making it ideal for widespread network deployment.

The dominance of the Sub-6 GHz segment is further supported by its compatibility with existing mobile devices and infrastructure, facilitating easier and more cost-effective network upgrades compared to deploying new millimeter-wave technology.

As network operators strive to extend their coverage and enhance network reliability, the Sub-6 GHz spectrum remains a preferred choice due to its established technology and extensive support from a broad ecosystem of devices and equipment.

Frequency Band Market Share (2019-2024) (%)

Frequency 2019 2020 2021 2022 2023 2024 Sub-6 GHz 85.02% 84.89% 84.76% 84.63% 84.51% 84.38% Millimeter Wave 14.98% 15.11% 15.24% 15.37% 15.49% 15.62% Moreover, the regulatory environment in North America has facilitated the rapid allocation and use of Sub-6 GHz bands for commercial telecommunications services, including 5G. This regulatory support has accelerated the adoption and roll-out of Sub-6 GHz-based Open RAN solutions across the region, reinforcing its leadership position in the market.

Additionally, the Sub-6 GHz band supports a wide range of applications, from traditional voice and data services to newer IoT applications, which demand extensive and reliable coverage. The ability of Sub-6 GHz to meet these diverse requirements ensures its continued prominence in the Open RAN ecosystem, catering to a broad spectrum of consumer and business needs while driving network evolution.

Kay Market Segments

By Component

- Hardware

- Software

- Services

By Network Type

- 2G/3G Networks

- 4G Networks

- 5G Networks

By Unit

- Radio Unit

- Centralized Unit

- Distributed Unit

By Frequency

- Sub-6 GHz

- Millimeter Wave

Driver

Advancements in Network Flexibility and Cost Efficiency

One of the primary drivers of the Open RAN market in North America is the significant advancement in network flexibility and cost efficiency. As the telecommunications sector evolves, there is a rising demand for mobile data services coupled with a need for enhanced network capabilities. This has led to a shift towards cloud-based solutions that offer more scalable and adaptable network infrastructure.

Open RAN plays a crucial role by providing a platform that supports high-speed connectivity and facilitates the integration of innovative technologies. The growth in this market segment is primarily fueled by the continuous development of network functions that are vital for improving the performance and reliability of mobile networks.

Restraint

Integration Challenges with Legacy Infrastructure

Integration with legacy systems represents a significant restraint for the Open RAN market in North America. Many telecom operators still rely on traditional, proprietary radio access network solutions that are closely tied to specific vendors. Transitioning to Open RAN requires extensive modifications to both hardware and software, often leading to complex integration issues.

These challenges necessitate substantial network upgrades, which are both time-consuming and resource-intensive. Operators must also ensure compatibility between new Open RAN components and existing legacy systems, which adds further complexity to the adoption process.

Opportunity

Expansion of 5G Networks and Government Support

The rollout of 5G networks presents substantial opportunities for the Open RAN market in North America. Open RAN offers the flexibility and scalability needed to efficiently build out 5G infrastructures, accommodating the increasing demand for high-speed, low-latency services. This technology enables telecom operators to deploy multi-vendor solutions that are tailored to specific operational needs.

Additionally, government policies and initiatives promoting the adoption of open and interoperable telecom technologies further bolster the market. These efforts support the development of a competitive market landscape and encourage innovation by reducing dependence on traditional network vendors.

Challenge

Security and Standardization

A major challenge facing the Open RAN market is ensuring robust security and achieving industry-wide standardization. The disaggregated nature of Open RAN introduces potential vulnerabilities as each network component must be secured against cyber threats. Achieving standardization across the industry is crucial for ensuring interoperability and seamless deployment of Open RAN solutions.

The lack of universally accepted standards leads to interoperability issues, making it difficult for operators to manage network complexities effectively. These challenges can slow down the adoption of Open RAN, especially in regions where regulatory compliance and stringent security standards are essential.

Growth Factors

Enhancing Network Flexibility and Cost Efficiency

The North American Open RAN market is witnessing robust growth driven by several key factors. Primarily, the enhancement of network flexibility and the reduction of operational costs stand out as significant growth drivers. As telecommunications infrastructure evolves, network operators are increasingly adopting Open RAN to leverage its cost-effective and flexible network architecture.

This shift is particularly crucial in the context of the rapid rollout of 5G networks, where Open RAN facilitates the integration of various vendor technologies, enhancing the ability to scale and adapt to changing network demands. Furthermore, the push towards virtualized network functions emphasizes the need for architectures like Open RAN, which support dynamic resource allocation and improved network management.

Emerging Trends

Shift Towards Cloud-Native and AI-Enabled Networks

Emerging trends within the Open RAN ecosystem include the shift towards cloud-native networks and the integration of AI-driven technologies. These trends are reshaping the telecommunications landscape by enabling greater scalability and more efficient network management.

Cloud-native Open RAN solutions offer telecom operators the flexibility to deploy and scale up or down based on real-time demands, which is essential for managing the data-intensive applications of 5G networks.

Moreover, the use of AI and machine learning within Open RAN architectures is becoming more prevalent, aiding in predictive maintenance, network optimization, and resource management, thus ensuring higher reliability and performance of mobile networks.

Business Benefits

Cost Reduction and Enhanced Service Delivery

The adoption of Open RAN offers substantial business benefits, primarily through cost reduction and enhanced service delivery. By facilitating a multi-vendor environment, Open RAN reduces dependency on single vendors, thereby lowering the risk of supply chain disruptions and enabling competitive pricing.

Additionally, Open RAN’s ability to support various frequencies and its compatibility with both existing and emerging network technologies ensures that operators can optimize their service offerings across diverse geographical and demographic markets.

Key Player Analysis

In North America, several companies are shaping the Open RAN market with strong innovation and long-term strategies. These key players are focusing on building flexible, software-driven networks that reduce dependency on traditional, closed telecom systems.

Ericsson has solidified its position in the North American Open RAN market through substantial contracts and technological advancements. In October 2024, Ericsson reported an 80% increase in sales within its North American networks unit, a growth largely attributed to a five-year agreement with AT&T valued at up to $14 billion.

Mavenir, a U.S.-based telecommunications software company, has been instrumental in advancing Open RAN technologies. In November 2024, Mavenir was in discussions with Saudi Aramco’s digital arm for a potential $1 billion investment, aiming to secure a significant minority stake in the company.

Airspan Networks has strategically expanded its Open RAN capabilities through targeted acquisitions. In March 2025, the company announced an agreement to acquire Jabil’s Open RAN radio portfolio, including associated intellectual property rights and the integration of Jabil’s radio research and development team

Top Key Players in the Market

- Rakuten Group, Inc.

- Samsung Electronics Co., Ltd.

- Nokia Corporation Finland

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limited Japan

- Mavenir

- Parallel Wireless

- Radisys

- NEC Corporation

- 1VIAVI Solutions Inc.

Recent Developments

- In March 2025, Airspan Networks announced an agreement to acquire Jabil’s Open RAN radio portfolio, including associated intellectual property rights and the integration of Jabil’s former radio research and development team. This acquisition aims to strengthen Airspan’s position in the Open RAN market.

- In March 2025, AT&T has initiated large-scale deployment of Open RAN technology across the United States, with plans to operate a fully Open RAN mobile network. The company is deploying assets that are Open RAN capable or ready, supporting open network management and integrating radios from various vendors.

- In January 2024, DISH Wireless received a $50 million grant from the U.S. Department of Commerce’s National Telecommunications and Information Administration (NTIA) to establish the Open RAN Center for Integration & Deployment (ORCID).

Report Scope

Report Features Description Market Value (2024) USD 1,024.5 Mn Forecast Revenue (2034) USD 23,242.9 Mn CAGR (2025-2034) 36.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Network Type (2G/3G Networks, 4G Networks, 5G Networks), By Unit (Radio Unit, Centralized Unit, Distributed Unit), By Frequency (Sub-6 GHz, Millimeter Wave) Competitive Landscape Rakuten Group, Inc., Samsung Electronics Co., Ltd., Nokia Corporation Finland, Telefonaktiebolaget LM Ericsson, Fujitsu Limited Japan, Mavenir, Parallel Wireless, Radisys, NEC Corporation, 1VIAVI Solutions Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Open RAN MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

North America Open RAN MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rakuten Group, Inc.

- Samsung Electronics Co., Ltd.

- Nokia Corporation Finland

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limited Japan

- Mavenir

- Parallel Wireless

- Radisys

- NEC Corporation

- 1VIAVI Solutions Inc.