Global Non-alcoholic Wine Market Size, Share Analysis Report By Product (Sparkling, Still), By ABV (ABV (0.0%), ABV (Up to 0.5%), ABV (Up to 1.2%)), By Packaging (Bottles, Cans), By Distribution Channel (Hypermarkets And Supermarkets, Online, Specialty Stores And Tasting Rooms, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173592

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

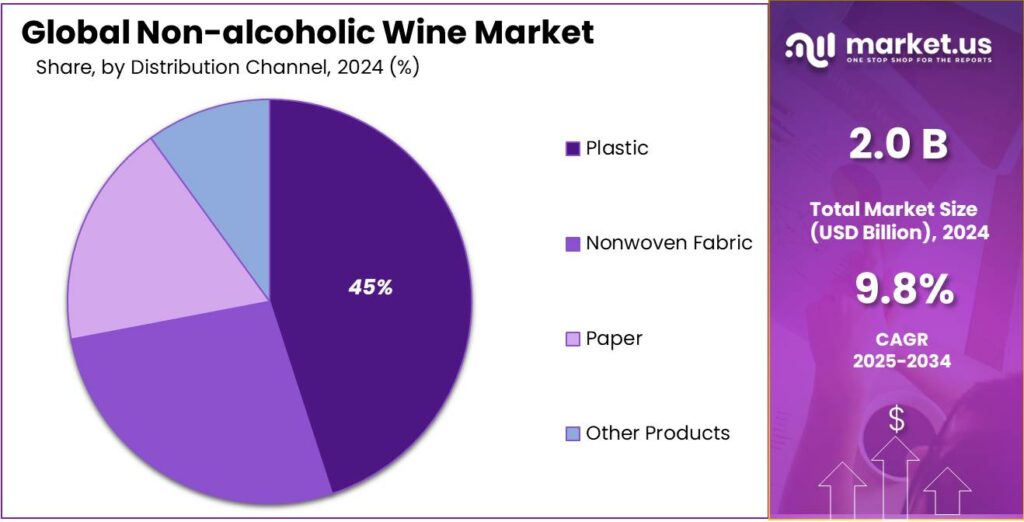

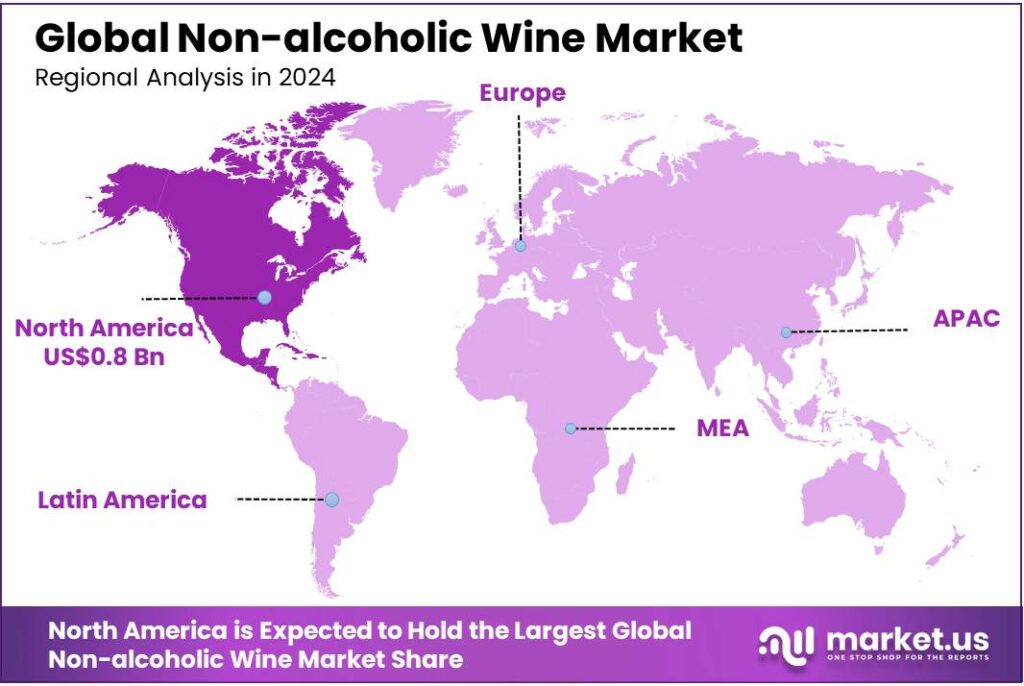

Global Non-alcoholic Wine Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 2.0 Billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.9% share, holding USD 0.8 Billion in revenue.

Non-alcoholic wine is a fast-evolving slice of the wider wine industry, created either by fully fermenting wine first and then removing alcohol or by formulating “wine-style” drinks to deliver similar taste cues. It is positioned for consumers who want the rituals of wine—pairing, social occasions, gifting—while reducing alcohol intake. The category is also benefiting from a broader reset in global wine demand: in 2024, worldwide wine consumption was estimated at 214.2 million hectolitres, down 3.3% year over year, while global wine production fell to 225.8 million hectolitres, tightening competition for value growth and innovation.

Industrially, non-alcoholic wine is moving from “niche alternative” to a more formalized, regulated product class. In the European Union, reforms explicitly brought fully de-alcoholised wines—including those at 0.5% ABV or less—into the wine sector framework, reinforcing standards around identity, labeling, and market placement.

In the United States, regulation is more segmented: wines under 7% ABV fall under FDA food labeling rules rather than the traditional alcohol labeling regime, which changes how ingredients, nutrition, and allergens are handled across portfolios.

Key demand drivers are health risk awareness, moderation trends, and “occasion expansion”. Global public-health framing is influential here: the World Health Organization reports alcohol use caused about 2.6 million deaths in 2019, including 1.6 million from noncommunicable diseases.

Regulation and labelling are also shaping industrial strategy. In the EU, policy changes ensure de-alcoholised wines—including those at 0.5% ABV or less—are covered under wine-sector rules, supporting clearer category designations and more consistent market access.

Public-health framing is also intensifying: the U.S. Surgeon General’s advisory links alcohol to cancer risk and cites nearly 100,000 alcohol-related cancer cases and 20,000 deaths annually in the United States, encouraging consumers to reassess intake and making “lower-alcohol” propositions easier to justify in-store and on menus.

Key Takeaways

- Non-alcoholic Wine Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 2.0 Billion in 2024, growing at a CAGR of 9.8%.

- Sparkling held a dominant market position, capturing more than a 59.2% share.

- ABV (0.0%) held a dominant market position, capturing more than a 67.8% share.

- Bottles held a dominant market position, capturing more than a 87.3% share.

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 44.7% share.

- North America emerged as the dominating region in the non-alcoholic wine market, accounting for 44.9% of the global share and generating a market value of USD 0.8 Bn.

By Product Analysis

Sparkling leads the non-alcoholic wine segment with a 59.2% share, driven by its premium appeal and celebratory use

In 2024, Sparkling held a dominant market position, capturing more than a 59.2% share, as demand was supported by its close taste profile to traditional sparkling wine and its strong association with social and festive occasions. The segment was widely preferred by consumers seeking alcohol-free alternatives that still deliver a refined and celebratory experience, especially during events, dining occasions, and gifting. In 2025, growth in sparkling non-alcoholic wine continued to be supported by rising health awareness, lower alcohol consumption trends, and increasing acceptance of sober lifestyles across urban populations.

The product benefited from improved production methods that enhanced carbonation balance, aroma retention, and mouthfeel, making it more appealing to regular wine consumers. Retail visibility and on-trade adoption also played a role, as sparkling variants were increasingly positioned as premium non-alcoholic options. Overall, the segment maintained its leading position due to strong consumer perception, consistent quality improvements, and its suitability for both everyday consumption and special occasions.

By ABV Analysis

ABV (0.0%) dominates the non-alcoholic wine market with a 67.8% share, supported by strong health-focused demand

In 2024, ABV (0.0%) held a dominant market position, capturing more than a 67.8% share, as consumers increasingly preferred products that offer a complete alcohol-free experience without compromise. This segment was widely adopted by health-conscious buyers, pregnant consumers, and individuals avoiding alcohol for cultural or lifestyle reasons. The absence of alcohol made these wines suitable for everyday consumption and social settings where alcohol intake is restricted.

In 2025, demand for ABV (0.0%) non-alcoholic wine remained strong, supported by improved dealcoholization techniques that preserved flavor, aroma, and mouthfeel. The segment also benefited from clearer labeling and growing consumer trust in certified zero-alcohol products. Overall, ABV (0.0%) continued to lead the market due to its broad consumer acceptance, regulatory clarity, and alignment with long-term wellness and moderation trends.

By Packaging Analysis

Bottles dominate non-alcoholic wine packaging with an 87.3% share, driven by familiarity and premium shelf presence

In 2024, Bottles held a dominant market position, capturing more than a 87.3% share, as they remained the most trusted and widely accepted packaging format for non-alcoholic wine. Consumers continued to associate bottled packaging with quality, authenticity, and a traditional wine-drinking experience, making it the preferred choice across retail and on-trade channels. Bottles also supported better product stability and flavor protection, which strengthened consumer confidence at the point of purchase.

In 2025, the dominance of bottles was sustained by premium positioning, improved lightweight glass designs, and increased use of recyclable materials to meet sustainability expectations. The format also benefited from ease of storage, gifting appeal, and compatibility with existing wine distribution systems. Overall, bottles maintained their leadership due to strong consumer familiarity, perceived value, and consistent performance across different consumption occasions.

By Distribution Channel Analysis

Hypermarkets & supermarkets lead non-alcoholic wine sales with a 44.7% share due to strong visibility and consumer trust

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 44.7% share, as these stores remained the primary shopping destination for non-alcoholic wine purchases. Wide product availability, clear shelf placement, and the ability to compare brands and formats in one location supported higher consumer confidence and repeat buying. These outlets also benefited from regular promotions and in-store tastings, which helped educate consumers about alcohol-free wine options.

In 2025, the segment continued to perform well, supported by growing shelf space dedicated to non-alcoholic beverages and increasing footfall from health-focused shoppers. The convenience of one-stop shopping and established retail trust further strengthened sales through this channel. Overall, hypermarkets and supermarkets maintained their lead due to scale, accessibility, and their strong role in shaping consumer purchase decisions.

Key Market Segments

By Product

- Sparkling

- Still

By ABV

- ABV (0.0%)

- ABV (Up to 0.5%)

- ABV (Up to 1.2%)

By Packaging

- Bottles

- Cans

By Distribution Channel

- Hypermarkets & Supermarkets

- Online

- Specialty Stores & Tasting Rooms

- Others

Emerging Trends

Clearer labels and “0.0%” definitions are reshaping alcohol-free wine

A noticeable latest trend in non-alcoholic wine is how quickly the category is becoming more standardised and easier to understand at the shelf. For years, people had to guess what “alcohol-free” really meant, or they had to trust tiny print on the back label. Now, regulators are tightening definitions and pushing clearer information, which helps consumers compare products with more confidence. This matters because non-alcoholic wine is often a first-time purchase—if the label feels simple and transparent, the buyer is more likely to try it again.

In the European Union, a big shift started when new labelling rules entered into application on 8 December 2023. These rules require wines and aromatised wine products placed on the EU market to provide ingredients and nutritional values, with the option to present some details digitally. This is more than “extra compliance.” It pushes wine—traditionally a category with limited label detail—closer to the transparency people already expect from packaged foods. For non-alcoholic wine, that transparency is even more valuable, because buyers often want to check calories, sugars, and ingredients before they commit.

At the same time, the EU is tightening what different alcohol levels should be called, and that is directly boosting consumer clarity. On 4 December 2025, the Council of the EU announced a provisional agreement with the European Parliament to modernise wine-sector rules. Under the agreed approach, the term “alcohol-free” applies to wines below 0.5% alcohol, and “0.0%” can be used for wines below 0.05%. The same agreement also introduced a clearer naming route for reduced-alcohol wines: products above 0.5% but at least 30% lower than standard strength can use the designation “reduced-alcohol.”

Drivers

Health-led moderation is pushing non-alcoholic wine forward

One major driving factor for non-alcoholic wine is the steady shift toward health-first drinking, where people want the social and food-pairing experience of wine but with far less alcohol. This change is not just a “trend” from marketing; it is being reinforced by public-health evidence and government guidance that keeps getting clearer: less alcohol generally means lower health risk. When everyday choices start to follow that message, non-alcoholic wine becomes an easy swap that still feels familiar at dinner, at celebrations, and in restaurants.

- The scale of alcohol harm is one reason this category keeps gaining attention. The World Health Organization reports that 2.6 million deaths worldwide were attributable to alcohol consumption in 2019. In a WHO news release about the same data, alcohol-attributable deaths are described as 4.7% of all deaths in 2019, and the release again states 2.6 million deaths per year were attributable to alcohol.

Government-backed guidelines translate that health message into simple limits that people can remember, and those limits naturally create space for alcohol-free alternatives. In the United Kingdom, the Chief Medical Officers’ guideline for both men and women says it is safest not to regularly drink more than 14 units a week.

In the United States, the Dietary Guidelines for Americans 2020–2025 state that adults of legal drinking age can choose not to drink or drink in moderation by limiting intake to 2 drinks or less per day for men and 1 drink or less per day for women, and it adds a plain line that “drinking less is better for health than drinking more.”

Restraints

Taste and “real wine” mouthfeel are hard to keep

A major restraining factor for non-alcoholic wine is simple: it is genuinely difficult to make it taste and feel like wine once most of the alcohol is removed. Alcohol is not just “a number on the label.” It helps carry aromas, adds warmth, and gives the liquid a fuller body. When that structure is taken out, the product can end up smelling flatter, tasting thinner, or finishing with a slightly “cooked” or sweet-and-sour edge that some consumers notice right away.

The size of the technical challenge becomes clear when the starting point is considered. In the OIV’s definition, wine’s actual alcohol content “shall not be less than 8.5% vol”. Many non-alcoholic wines, meanwhile, aim to sit at or below 0.5% vol in markets that recognise that threshold for de-alcoholised products. That means producers often need to remove roughly 8.0 percentage points of alcohol just to reach the basic “de-alcoholised” zone. The physical chemistry explains why quality can slip. Ethanol has a normal boiling point around 78.5°C, lower than water’s normal boiling point around 373.15 K.

Regulation can add friction on top of the sensory challenge, especially for brands selling across borders. In the EU, official guidance and classification references cover de-alcoholised wines with an alcoholic strength by volume not exceeding 0.5% vol. In the U.S., wine products with less than 7% alcohol by volume fall under FDA food-labelling rules rather than the Federal Alcohol Administration Act framework, which can change labelling expectations.

Opportunity

Restaurants and wine tourism can make alcohol-free wine feel normal

One of the biggest growth opportunities for non-alcoholic wine is its fit with hospitality—restaurants, hotels, tasting rooms, and wine tourism—where people want the ritual of ordering wine, but not always the alcohol. This matters because wine is already under pressure in many markets, and producers are actively looking for fresh ways to stay relevant without losing their identity. The International Organisation of Vine and Wine (OIV) estimates global wine consumption fell to 214.2 million hectolitres in 2024, down 3.3% from 2023.

The same OIV report shows why the industry is motivated to diversify. Global wine production dropped to 225.8 million hectolitres in 2024, while the global vineyard surface area declined to 7.1 million hectares. In plain terms: climate pressure, cost pressure, and changing habits are squeezing the traditional model. Non-alcoholic wine gives wineries a second door into the same dining moment—especially in places where a group includes drivers, pregnant guests, people training for sport, or anyone simply cutting back.

In Europe, policy direction is becoming more supportive of adaptation and innovation in the wine sector, which can strengthen this opportunity. The European Commission notes a yearly budget of €1,061 million of EU funds is dedicated to supporting the wine sector to invest, innovate, promote products, restructure, and insure harvests, with a minimum of 5% of expenditure dedicated to sustainability objectives.

Separately, the Council of the EU said a 4 December 2025 provisional agreement on updated wine measures aims to better balance supply and demand, encourage innovation, harmonise labelling, and stimulate rural economies through wine tourism, while responding to evolving consumer preferences.

Regional Insights

North America dominates the non-alcoholic wine market with a 44.9% share, reaching a value of USD 0.8 Bn

North America emerged as the dominating region in the non-alcoholic wine market, accounting for 44.9% of the global share and generating a market value of USD 0.8 Bn. This strong position was primarily supported by shifting consumer attitudes toward alcohol consumption, with a growing preference for healthier and low-risk beverage options. In 2024, demand across the United States and Canada was driven by rising wellness awareness, increasing participation in “dry” and moderation-focused lifestyles, and a broader acceptance of alcohol-free products in social settings. Non-alcoholic wine benefited from its ability to replicate traditional wine experiences while aligning with health and lifestyle goals.

Retail penetration remained high across supermarkets, hypermarkets, and specialty beverage stores, supporting consistent product visibility and consumer access. The region also showed strong uptake in on-trade channels, where restaurants and bars increasingly offered non-alcoholic wine as part of inclusive beverage menus. In 2025, market momentum in North America continued, supported by product innovation focused on taste improvement, premium positioning, and clean-label offerings. Consumers in urban areas showed higher repeat purchases, reflecting growing trust in product quality and brand consistency.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Schloss Wachenheim AG is a Germany-based beverages company known for its extensive portfolio of sparkling, semi-sparkling, and dealcoholised wines including non-alcoholic variants, distributed in more than 80 countries. The company operates production facilities across Germany, France, Poland, and Romania and maintains a workforce of approximately 1,742 employees while producing about 224 million bottles annually in 2024/25.

Australian Vintage Limited, founded in 1991 and listed on the Australian Securities Exchange, produces and markets a range of wines under brands such as McGuigan and Tempus Two across Europe, Australia, Asia, and North America. The company employs around 430 staff and generates most of its revenue from wine processing and packaging, with export markets contributing significantly to its total sales.

Miguel Torres S.A is a family-owned Spanish winery with operations extending to Chile and presence in over 100 countries. The company is recognised for quality wines and has expanded its portfolio to include non-alcoholic and low-alcohol options while maintaining a strong reputation in traditional wine production and sustainable practices.

Top Key Players Outlook

- Schloss Wachenheim AG

- Australian Vintage Limited

- Sutter Home Wine Estate

- Miguel Torres S.A

- DGB (Pty) Ltd.

- Bodega La Tautila

- Grüvi

- Chateau Diana Winery

- Hill Street Beverage Company Inc.

- Ariel Vineyards

Recent Industry Developments

June 30, 2024, Australian Vintage reported total revenue of approximately AUD 260.6 million, with underlying earnings showing resilience and the no-and-low alcohol wine category achieving an estimated 20 % growth compared to the prior year, reflecting rising consumer interest in alcohol-free beverages.

In the 2023/24 Schloss Wachenheim AG, the group recorded revenue of approximately EUR 441.5 million, with total sales volumes around 221.5 million bottles, reflecting an established footprint in both traditional and non-alcoholic wine segments.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Bn Forecast Revenue (2034) USD 5.1 Bn CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sparkling, Still), By ABV (ABV (0.0%), ABV (Up to 0.5%), ABV (Up to 1.2%)), By Packaging (Bottles, Cans), By Distribution Channel (Hypermarkets And Supermarkets, Online, Specialty Stores And Tasting Rooms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Schloss Wachenheim AG, Australian Vintage Limited, Sutter Home Wine Estate, Miguel Torres S.A, DGB (Pty) Ltd., Bodega La Tautila, Grüvi, Chateau Diana Winery, Hill Street Beverage Company Inc., Ariel Vineyards Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schloss Wachenheim AG

- Australian Vintage Limited

- Sutter Home Wine Estate

- Miguel Torres S.A

- DGB (Pty) Ltd.

- Bodega La Tautila

- Grüvi

- Chateau Diana Winery

- Hill Street Beverage Company Inc.

- Ariel Vineyards