Global Next-Generation Intrusion Prevention System Market By Component (Hardware, Software, Services), By Deployment Mode (Cloud-based, On-premise), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End-use Industry (BFSI (Banking, Financial Services, and Insurance), Healthcare, IT and Telecom, Manufacturing, Government and Defense, Others) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Region Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 104960

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

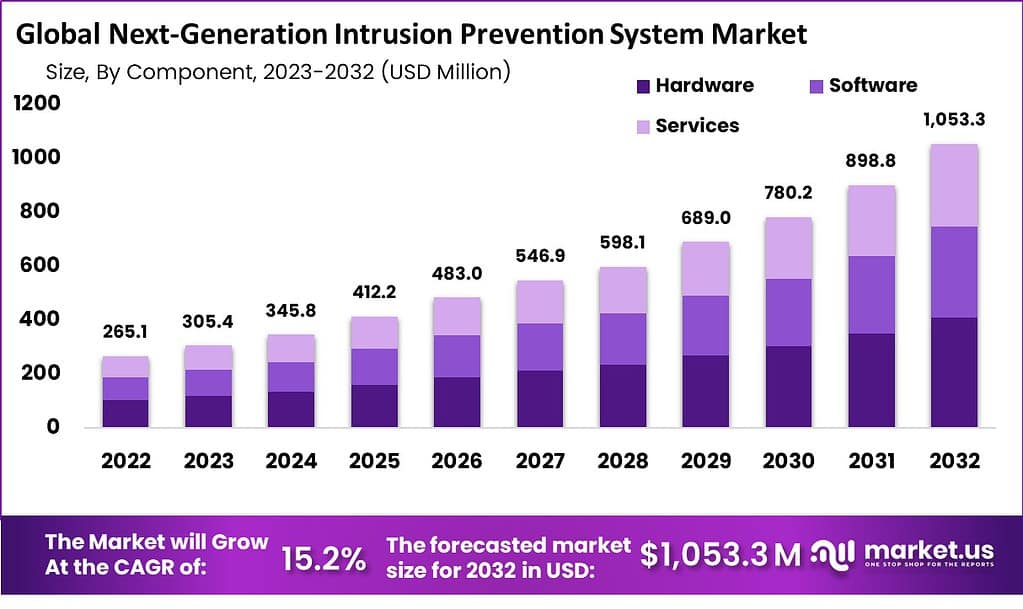

The global next-generation intrusion prevention system market size is expected to be USD 1053.32 Mn in 2032 from USD 305.4 Mn in 2023, registering a revenue CAGR of 15.2% during the forecast period (2023 to 2032).

Next-Generation Intrusion Prevention System (NGIPS) is a cutting-edge cybersecurity solution designed to proactively detect and prevent advanced threats within computer networks. Its primary function is to provide real-time threat detection, analysis, and immediate response mechanisms, detecting, alerting, and deterring unauthorized access, data breaches, and malware attacks.

NGIPS plays a crucial role in safeguarding sensitive information, critical infrastructure, and digital assets from evolving cyber threats. NGIPS is of paramount importance due to the increasing sophistication of cyber-attacks that enable exploiting vulnerabilities in networks and systems. Its ability to analyze network traffic, detect anomalies, and block malicious activities in real time helps organizations prevent breaches, minimize data loss, and maintain operational continuity.

Note: The figures presented here are subject to change in the final report.

NGIPS is utilized across various industries, including finance, healthcare, manufacturing, and government sectors, where data protection and network integrity are imperative. Factors driving demand for NGIPS include the rising frequency of cyber-attacks, stricter compliance regulations, and the shift to remote work, which increases the attack surface. Additionally, the preference for proactive threat prevention and the need to bolster overall cybersecurity posture contribute to the growing adoption of NGIPS as a critical defense mechanism against advanced cyber threats.

The global Next-Generation Intrusion Prevention System (NGIPS) market is currently registering substantial revenue growth as an increasing number of organizations worldwide prioritize advanced cybersecurity measures. Market expansion is also supported majorly by the escalating frequency and sophistication of cyber threats targeting critical data and systems.

As cyber-attacks have become more complex and intense, the demand for NGIPS solutions has surged, driven by the ability to proactively identify and thwart unauthorized access, malware, and other malicious activities within networks. Consumption of NGIPS solutions is prevalent across diverse sectors, including finance, healthcare, government, and manufacturing, where safeguarding sensitive information is paramount. Organizations increasingly opt for NGIPS services to enhance their threat detection and response capabilities, bolstering their overall cybersecurity posture.

Key Takeaways

- Market Size and Growth: The NGIPS market is anticipated to reach USD 2 billion by 2032, with a projected revenue compound annual growth rate (CAGR) of 1.2%.

- Driving Factors: Increased cybersecurity threats, cloud adoption, and regulatory compliance requirements are propelling the demand for NGIPS solutions. The integration of machine learning and AI is enhancing threat detection capabilities.

- Challenges: Complex deployment and management, false positives, integration difficulties, and cost constraints are some of the challenges faced by the NGIPS market. Additionally, the impact on network performance and evolving evasion techniques pose significant hurdles.

- Opportunities: Rising cybersecurity concerns, the need for cloud security solutions, IoT security, and managed security services present lucrative opportunities for NGIPS vendors. Integration with security ecosystems and compliance solutions tailored to specific industry requirements are also areas for potential growth.

- Segment Analysis: The software segment is expected to hold a significant revenue share, while large enterprises, particularly in the BFSI sector, are likely to contribute significantly to the market. The APAC region, driven by increasing digitalization and cybersecurity risks, is experiencing notable market growth.

- Key Players and Recent Developments: Leading companies such as Cisco Systems, Palo Alto Networks, and Trend Micro are actively competing in the NGIPS market. Recent developments include the introduction of new NGIPS solutions by companies like IBM, McAfee, and Sophos, emphasizing automation and advanced threat detection capabilities.

Driving Factors

Escalating Cyber Threat Landscape & Rising Adoption of Cloud Services

The increase in risks of cyber threats, including advanced malware, ransomware, and zero-day attacks, has compelled organizations to invest in robust NGIPS solutions. This heightened threat landscape is driving the demand for sophisticated intrusion prevention systems capable of detecting and mitigating evolving risks.

As businesses migrate to cloud environments, the need for NGIPS solutions that can protect both on-premises and cloud-based assets has surged. This trend has opened new avenues for NGIPS vendors to provide comprehensive security solutions for hybrid and multi-cloud infrastructures.

Regulatory Compliance Requirements & IoT Proliferation and Vulnerabilities

Stricter data protection regulations and compliance mandates, such as GDPR and HIPAA, have mandated enhanced cybersecurity measures. NGIPS solutions offer the proactive defense needed to align with these regulations, driving adoption across industries to avoid hefty penalties and data breaches.

The rapid growth of the Internet of Things (IoT) has introduced a multitude of endpoints vulnerable to cyber-attacks. NGIPS plays a pivotal role in securing IoT devices, networks, and data, leading to increased adoption in sectors such as healthcare, manufacturing, and smart cities.

Machine Learning and AI Integration & Strategic Partnerships and Collaborations:

NGIPS solutions are incorporating Machine Learning (ML) and Artificial Intelligence (AI) to provide real-time threat detection and automated responses. This trend enhances accuracy and reduces false positives, making NGIPS more effective in identifying and mitigating threats, thereby boosting demand in the market.

NGIPS vendors are forming strategic partnerships with cybersecurity providers, cloud platforms, and technology integrators to deliver comprehensive solutions. These collaborations enhance NGIPS functionality and compatibility, appealing to a wider customer base and positively impacting market revenue growth

Restraining Factors

Complex Deployment and Management & False Positive:

NGIPS solutions often require skilled personnel for deployment, configuration, and ongoing management. The complexity of these systems can deter organizations with limited resources from adopting them, leading to slower market growth.

Despite advancements in machine learning and AI, NGIPS solutions can still generate false positives, flagging benign activities as threats. High false positive rates can lead to alert fatigue among security teams, decreasing the efficiency of the system and hampering its credibility.

Integration Challenges & Costs and Budget Constraints:

Integrating NGIPS with existing security infrastructure can be challenging due to compatibility issues and differing data formats. These integration complexities can hinder seamless operations and deter potential buyers seeking to avoid disruptions.

Implementing NGIPS involves significant upfront costs, including hardware, software, licensing, and personnel training expenses. Organizations with limited cybersecurity budgets might find it difficult to allocate resources, resulting in sluggish adoption rates.

Performance Impact & Evasion Techniques:

Some NGIPS solutions, particularly those with advanced inspection capabilities, can impact network performance. Organizations may be hesitant to deploy systems that could potentially slow down network operations and hamper user experience.

Sophisticated attackers employ evasion techniques to bypass NGIPS detection, exploiting vulnerabilities in the system’s rule-based detection mechanisms. As attackers develop more advanced evasion tactics, NGIPS solutions may face challenges to keep up, leading to a negative impact on the effectiveness of the solutions.

Opportunities

Rising Cybersecurity Concerns & Cloud Security Solutions:

The increasing frequency and complexity of cyber threats present a significant opportunity for NGIPS vendors. As organizations prioritize cybersecurity, the demand for advanced intrusion prevention systems that can effectively detect and mitigate these threats is on the rise.

With the growing adoption of cloud services, there is a need for NGIPS solutions tailored to cloud environments. Providing robust security for cloud-based assets and applications opens a new revenue stream for NGIPS vendors.

IoT Security & Managed Security Services:

The proliferation of Internet of Things (IoT) devices introduces vulnerabilities in networks. NGIPS solutions that offer specialized protection for IoT endpoints and data streams can tap into a niche market, catering to industries like healthcare, manufacturing, and smart cities.

Many organizations prefer to outsource their cybersecurity needs. Offering managed NGIPS services where vendors provide continuous monitoring, threat detection, and response can create a recurring revenue stream.

Integration with Security Ecosystems & Compliance and Regulatory Solutions

Seamless integration with existing security infrastructure, including Security Information and Event Management (SIEM) platforms, offers an opportunity for NGIPS vendors. Providing compatibility with established security tools enhances the value proposition and attracts a broader customer base.

NGIPS solutions that cater to specific industry compliance requirements, such as healthcare (HIPAA) and financial services (PCI DSS), can address a niche market. Organizations seeking to align with regulatory mandates are likely to invest in solutions tailored to their needs

By Component

Among the component segments, the software segment is expected to account for a major revenue share during the forecast period. The increasing complexity of cyber threats demands software-based solutions that offer real-time detection, analysis, and automated response mechanisms. As organizations prioritize advanced threat prevention, the demand for software-based intrusion prevention systems grows, making this segment a significant contributor to the overall revenue share.

By Organization Size

Among the organization size segments, the large enterprises segment is expected to account for a major revenue share during the forecast period. Large enterprises often have more extensive and complex IT environments, which require robust intrusion prevention systems to safeguard their sensitive data and operations. Their greater resources and higher security budgets contribute to higher investments in advanced cybersecurity solutions, making the large enterprises segment a significant contributor to the overall revenue share in the market.

By End-use Industry

Among the end-use industry segments, the Banking, Financial Services, and Insurance (BFSI) segment is expected to account for a major revenue share during the forecast period. The BFSI sector handles highly sensitive financial data and transactions, making it a prime target for cyber threats. To ensure regulatory compliance and protect against data breaches, the BFSI industry heavily invests in robust intrusion prevention systems. This sector’s critical need for cybersecurity solutions and its substantial resources contribute to it being a significant contributor to the overall revenue share of the market.

Market Segmentation

By Component

- Hardware

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premise

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End-use Industry

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- IT and Telecom

- Manufacturing

- Government and Defense

- Others

Regional Analysis

North America

In North America, the demand for next-generation intrusion prevention systems remains robust. The region commands a significant market share due to its advanced cybersecurity landscape and increasing cyber threats. The steady revenue growth is driven by the expanding adoption of NGIPS across industries like finance, healthcare, and technology. Technological advancements and collaborations foster industry growth. Government initiatives to enhance cybersecurity, such as the U.S. National Cyber Strategy, support revenue expansion.

Europe

Europe demonstrates substantial demand for NGIPS solutions, owing to stringent data protection regulations and rising cyber threats. The market share is significant as industries emphasize compliance and security. Revenue growth stems from the adoption in sectors like finance and manufacturing. Ongoing technological advancements and research initiatives contribute to industry expansion. Government support for cybersecurity measures, such as the EU Cybersecurity Act, bolsters revenue streams.

Asia Pacific

Asia Pacific exhibits a growing demand for NGIPS due to the expanding digital landscape and increasing cyber risks. The market share is expanding as industries embrace technology. Revenue growth is notable, driven by sectors like e-commerce and telecommunications. Technological advancements in AI and machine learning are transforming the industry. Government initiatives promoting digital security, such as China’s Cybersecurity Law and India’s National Cyber Security Policy, play a pivotal role in driving revenue expansion.

Latin America

Latin America’s demand for NGIPS is on the rise, influenced by the growing digital transformation and cybersecurity awareness. The region’s market share is increasing as industries adopt advanced security measures. Revenue growth is notable in sectors like banking and energy. Technological advancements and collaborations foster industry development. Government initiatives, such as Brazil’s National Cybersecurity Strategy, aim to bolster cybersecurity measures and support revenue expansion.

Middle East and Africa

The Middle East and Africa are witnessing a growing demand for NGIPS solutions due to increasing digitalization and emerging cyber threats. The region’s market share is expanding as industries invest in cybersecurity. Revenue growth is notable in sectors like finance and healthcare. Technological advancements and partnerships drive industry growth. Government initiatives, such as the UAE National Cybersecurity Strategy and South Africa’s National Cybersecurity Policy Framework, provide support for revenue expansion.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global next-generation intrusion prevention system market features a competitive landscape marked by prominent players such as Cisco Systems, Palo Alto Networks, and Trend Micro. These industry leaders offer comprehensive NGIPS solutions that integrate advanced threat detection, real-time analysis, and automated response mechanisms. Competition centers around technological innovation, scalability, and seamless integration with existing security infrastructure. Market entrants are also focusing on partnerships, mergers, and acquisitions to strengthen their offerings and expand their market presence. As the demand for robust cybersecurity solutions continues to surge, the competitive landscape remains dynamic, with companies striving to provide cutting-edge NGIPS solutions to meet evolving customer needs.

Company List:

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Trend Micro Incorporated

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- McAfee, LLC

- Symantec Corporation (NortonLifeLock Inc.)

- IBM Corporation

- FireEye, Inc.

- Juniper Networks, Inc.

- SonicWall Inc.

- WatchGuard Technologies, Inc.

- Darktrace Limited

- Forcepoint LLC

- F5 Networks, Inc.

Recent Development

- In 2023, IBM Security launched its Resilient Orchestrator, a platform for automating security operations.

- In 2023, McAfee introduced its MVISION Cloud NGIPS, which is designed for cloud-based environments.

- In 2023, Sophos launched its Intercept X NGIPS, which includes new features for detecting and preventing ransomware attacks.

- In 2023, Juniper Networks launched its SRX Series NGIPS, which is designed for high-performance networks.

- In 2023, Radware launched its DefensePro NGIPS, which is designed for small and medium businesses.

Report Scope

Report Features Description Market Value (2023) USD 305.4 Mn Forecast Revenue (2032) USD 1,053 Mn CAGR (2023-2032) 15.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Deployment Mode (Cloud-based, On-premise), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End-use Industry (BFSI (Banking, Financial Services, and Insurance), Healthcare, IT and Telecom, Manufacturing, Government and Defense, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Cisco Systems Inc., Palo Alto Networks Inc., Trend Micro Incorporated, Fortinet Inc., Check Point Software Technologies Ltd., McAfee LLC, Symantec Corporation (NortonLifeLock Inc.), IBM Corporation, FireEye Inc., Juniper Networks Inc., SonicWall Inc., WatchGuard Technologies Inc., Darktrace Limited, Forcepoint LLC, F5 Networks Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Next-Generation Intrusion Prevention System (NGIPS)?A Next-Generation Intrusion Prevention System (NGIPS) is a security technology designed to detect and prevent various types of cyber threats and attacks on computer networks and systems. It goes beyond traditional intrusion detection and prevention systems by incorporating advanced techniques such as behavioral analysis, machine learning, threat intelligence, and application awareness to identify and block both known and unknown threats in real-time.

What differentiates a Next-Generation IPS from traditional IPS?NGIPS offers several advancements over traditional IPS. It incorporates machine learning and behavioral analysis to detect anomalies, can identify encrypted threats through SSL decryption, and provides more context-aware insights by analyzing application-level traffic. Additionally, NGIPS can often integrate with threat intelligence feeds, cloud-based services, and sandboxing technology to enhance threat detection capabilities.

What types of threats can a NGIPS protect against?NGIPS is designed to protect against a wide range of threats, including but not limited to:

- Malware and ransomware attacks

- Intrusion attempts and exploits

- Zero-day vulnerabilities and attacks

- Distributed Denial of Service (DDoS) attacks

- Data exfiltration and unauthorized access

- Web application attacks

- Advanced persistent threats (APTs)

- Insider threats

How does a NGIPS use machine learning for threat detection?NGIPS leverages machine learning algorithms to analyze network traffic patterns and behaviors. It can learn what constitutes normal behavior within a network and then identify deviations that might indicate a potential threat. This approach allows NGIPS to detect unknown or previously unseen threats that might evade signature-based detection methods.

Next-Generation Intrusion Prevention System MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Next-Generation Intrusion Prevention System MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Trend Micro Incorporated

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- McAfee, LLC

- Symantec Corporation (NortonLifeLock Inc.)

- IBM Corporation

- FireEye, Inc.

- Juniper Networks, Inc.

- SonicWall Inc.

- WatchGuard Technologies, Inc.

- Darktrace Limited

- Forcepoint LLC

- F5 Networks, Inc.