Neurology Digital Therapeutics Market By Product Type (Devices, and Software), By Application (Diabetes, Cardiovascular Disease (CVD), Obesity, Respiratory Disease, Central Nervous System (CNS) Disease, and Others), By End-user (Hospitals, Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159928

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

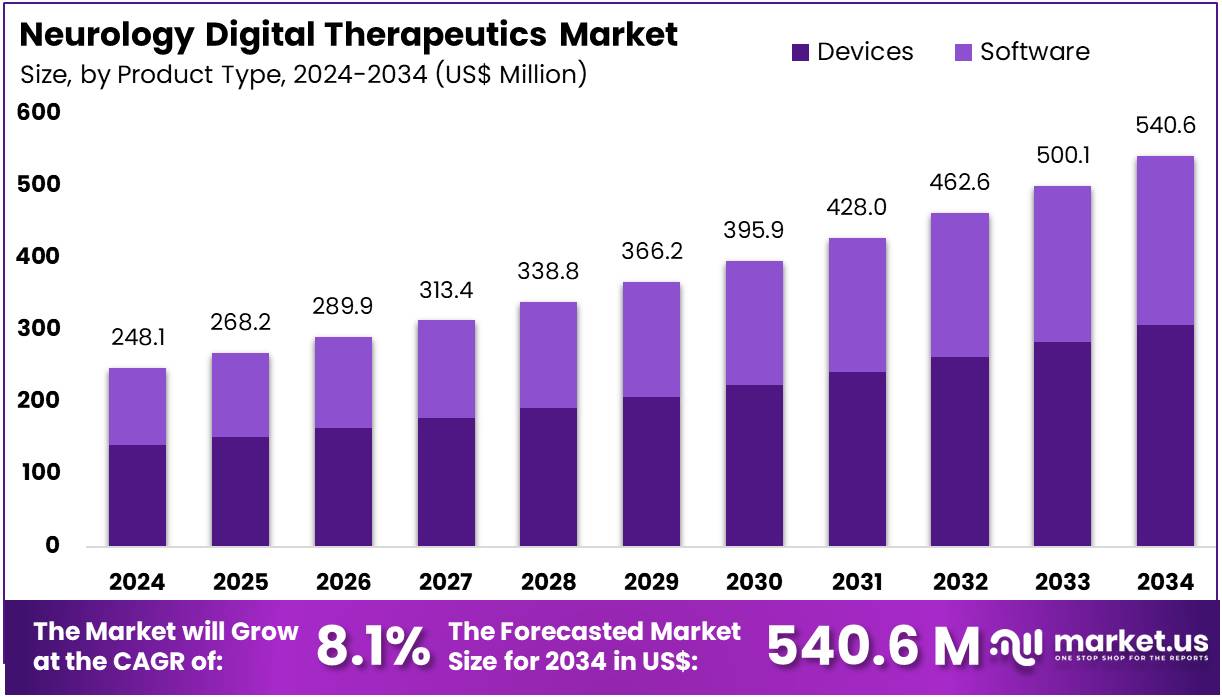

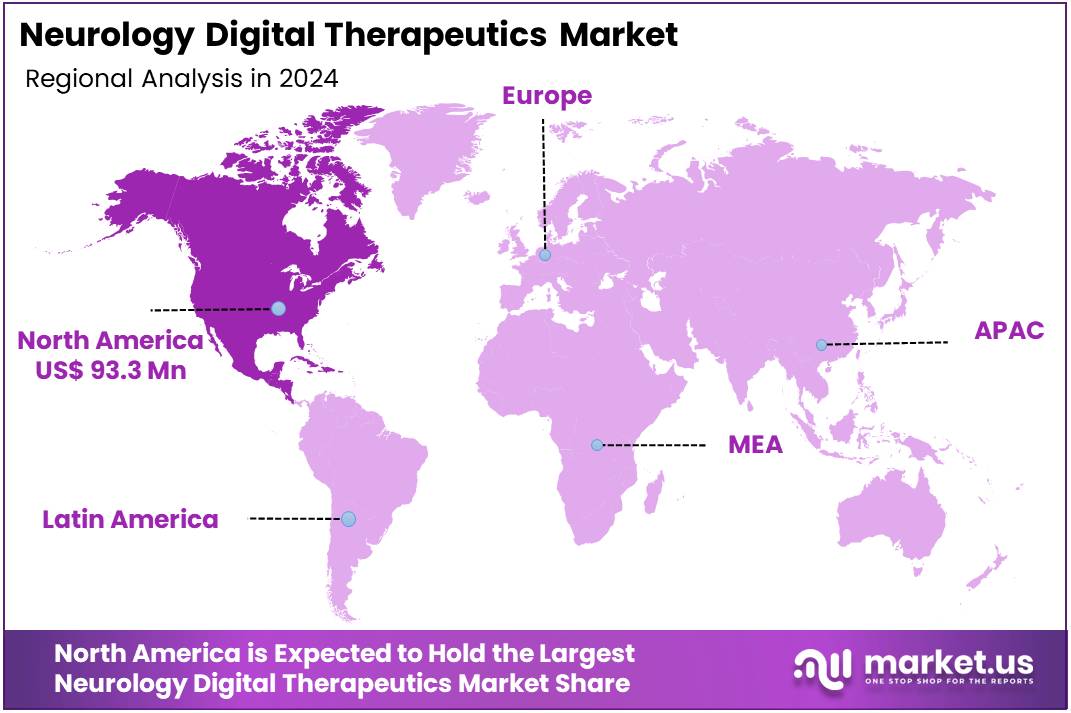

The Neurology Digital Therapeutics Market Size is expected to be worth around US$ 540.6 million by 2034 from US$ 248.1 million in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.6% share and holds US$ 93.3 Million market value for the year.

Increasing global burden of neurological disorders is a primary driver for the neurology digital therapeutics (DTx) market. The World Health Organization (WHO) estimates that neurological disorders affect up to 1 billion people worldwide, highlighting a significant unmet need for effective and scalable treatment options. Traditional therapies, which often include medication and in-person behavioral therapy, can be costly and have limited accessibility.

Neurology DTx solutions offer a compelling alternative by providing evidence-based, software-driven interventions for conditions such as ADHD, multiple sclerosis, and Alzheimer’s disease. These applications, delivered via smartphones or tablets, offer engaging and personalized treatment plans that improve patient engagement and health outcomes.

Growing opportunities are emerging from the integration of clinical validation and a clear pathway for regulatory approval. As the January 2023 announcement from Akili Interactive regarding the positive results for its digital therapeutic, EndeavorRx, shows, robust clinical trials are fundamental for demonstrating efficacy and gaining credibility with healthcare providers. This rigorous data is essential for securing regulatory approvals, which in turn unlocks broader market access and patient adoption.

The September 2024 inclusion of Cognoa’s Canvas Dx as a covered benefit under Wyoming Medicaid further demonstrates a critical step for the market, as it establishes a precedent for reimbursement from government payers. This is vital for ensuring the commercial viability of these treatments and expanding patient access.

The market is also witnessing a strong trend toward partnerships between DTx companies and traditional pharmaceutical firms, as well as the strategic focus on reimbursement. These collaborations allow DTx firms to leverage the established commercial channels and clinical expertise of pharmaceutical companies.

A 2024 survey conducted by The Pew Charitable Trusts found that 75% of physicians believe that digital tools can significantly improve health outcomes, showcasing a growing acceptance of these solutions within the clinical community. This favorable environment is leading to a shift in business models, where the focus is on achieving favorable reimbursement from both private and public payers. This trend is crucial for ensuring that these innovative, non-pharmacological therapies can be integrated seamlessly into standard clinical practice.

Key Takeaways

- In 2024, the market generated a revenue of US$ 248.1 million, with a CAGR of 8.1%, and is expected to reach US$ 540.6 million by the year 2034.

- The product type segment is divided into devices and software, with devices taking the lead in 2023 with a market share of 56.7%.

- Considering application, the market is divided into diabetes, cardiovascular disease (CVD), obesity, respiratory disease, central nervous system (CNS) disease, and others. Among these, diabetes held a significant share of 38.5%.

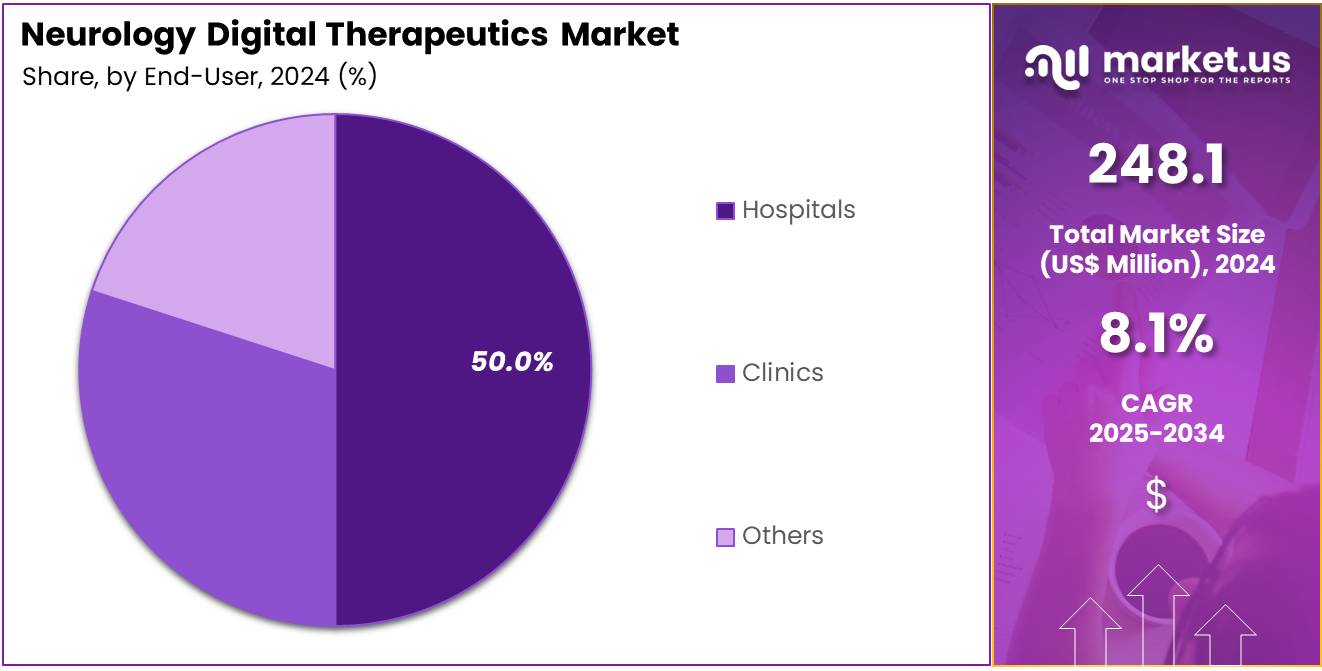

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 50.0% in the market.

- North America led the market by securing a market share of 37.6% in 2023.

Product Type Analysis

In 2024, the Devices Section held a dominant market position in the Product types Segment of Neurology Digital Therapeutics Market, and captured more than a 56.7% share. This growth is primarily driven by the increasing demand for innovative, interactive, and wearable digital therapeutics in neurology.

The adoption of digital health technologies, particularly devices that monitor and manage neurological conditions such as epilepsy, Parkinson’s disease, and migraines, is anticipated to increase. These devices enable real-time data collection, offer personalized therapeutic options, and help patients maintain adherence to treatment plans.

As the healthcare industry continues to embrace digital solutions, devices will remain at the forefront of neurological care. The ability of these devices to integrate with patient management systems further strengthens their market growth, as healthcare providers demand more efficient and scalable solutions to treat neurological conditions.

Application Analysis

In 2024, the Diabetes held a dominant market position in the application segment of Neurology Digital Therapeutics Market, and captured more than a 38.5% share.

This segment is expected to grow due to the increasing prevalence of diabetes worldwide, especially Type 2 diabetes. Digital therapeutics tailored to diabetes management, including glucose monitoring devices, insulin management systems, and mobile health applications, are expected to see increased demand. These solutions help patients monitor their blood sugar levels, adhere to prescribed treatments, and reduce the risk of complications associated with the disease.

As healthcare systems shift towards more remote and personalized care models, the market for digital therapeutics in diabetes management will continue to grow. Moreover, the rise in health-conscious behavior and the demand for personalized treatment plans are expected to fuel growth in this segment.

End-User Analysis

In 2024, the Hospitals Section held a dominant market position in the End-User Segment of Neurology Digital Therapeutics Market, and captured more than a 50.0% share.

Hospitals are likely to continue leading the adoption of digital therapeutics for neurology due to the integration of advanced technologies in patient care and treatment management. Hospitals play a crucial role in providing comprehensive care for patients with neurological disorders, and the need for real-time monitoring and effective disease management drives the demand for digital therapeutics.

The growth of telemedicine, virtual care platforms, and the increasing focus on patient-centered care are projected to further boost the market for digital therapeutics in hospitals. These digital solutions not only help in improving patient outcomes but also enhance the overall efficiency of healthcare facilities, making them an essential part of modern healthcare infrastructure. As hospitals increasingly incorporate digital tools for diagnosis and monitoring, this segment is expected to experience significant growth.

Key Market Segments

By Product Type

- Devices

- Software

By Application

- Diabetes

- Cardiovascular Disease (CVD)

- Obesity

- Respiratory Disease

- Central Nervous System (CNS) Disease

- Others

By End-user

- Hospitals

- Clinics

- Others

Drivers

The rising prevalence of neurological disorders is driving the market

The growing global burden of neurological disorders is a primary driver for the neurology digital therapeutics (DTx) market. Conditions such as Alzheimer’s disease, Parkinson’s, and multiple sclerosis are on the rise, creating a substantial and growing need for new, effective, and scalable treatment options.

These conditions often require long-term management and support beyond what traditional, in-person clinical care can provide. Digital therapeutics offer a unique solution by delivering evidence-based, therapeutic interventions directly to patients through software, often as an adjunct to or a replacement for medication.

The Lancet Neurology journal reported in 2024 that nervous system conditions are the world’s leading cause of overall disease burden, with case numbers rising by 59% globally since 1990. This significant increase highlights the immense pressure on healthcare systems to find new ways to manage these chronic conditions. The ability of DTx to provide continuous, personalized support and monitoring for patients at home makes it an invaluable tool for managing complex neurological conditions, thereby driving strong demand and market expansion.

Restraints

The complex regulatory landscape is restraining the market

One of the most significant restraints on the neurology digital therapeutics market is the complex and evolving regulatory landscape. Unlike traditional software, DTx products are often classified as medical devices, which means they must undergo rigorous clinical trials and secure regulatory approvals from bodies like the U.S. Food and Drug Administration (FDA) before they can be marketed and prescribed. This process can be lengthy, costly, and uncertain, creating a major barrier for new entrants and small startups.

A study published in the journal Nature highlighted that a key challenge is the lack of standardized regulatory requirements for validating the efficacy and safety of these digital tools. Furthermore, the FDA’s Center for Drug Evaluation and Research (CDER) and Center for Biologics Evaluation and Research (CBER) approved 50 novel drugs in 2024, but the path for digital therapeutics remains distinct and less defined. This regulatory uncertainty, combined with the high cost of clinical trials to generate the necessary evidence for approval, can slow down the development and commercialization of new neurology DTx products.

Opportunities

Strategic partnerships with pharmaceutical companies are creating growth opportunities

The increasing number of strategic partnerships between digital therapeutics developers and large pharmaceutical companies represents a significant growth opportunity for the neurology DTx market. These collaborations are mutually beneficial: DTx companies gain access to the extensive clinical trial expertise, regulatory knowledge, and global commercialization networks of their pharmaceutical partners. In return, pharmaceutical companies can diversify their product portfolios, explore new therapeutic areas, and offer a more holistic treatment approach that combines a traditional drug with a complementary digital therapy.

In September 2025, Sanofi Ventures committed an additional US$625 million to its venture arm, specifically to accelerate investments in early-stage biotechnology and digital health companies, including those in the neurology space. This trend is driven by the recognition that digital therapeutics can enhance the effectiveness of a drug, improve patient adherence, and provide real-world evidence of a drug’s performance. These partnerships are a vital mechanism for overcoming the commercialization and distribution challenges that DTx startups often face on their own.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical forces shake up the neurological digital therapeutics market, pushing healthcare leaders to tackle tough financial challenges while tapping into exciting growth prospects. Soaring global inflation pinches clinic budgets, causing delays in launching app-based cognitive tools that help manage dementia or epilepsy. Economic dips in places like Europe and Asia-Pacific shrink funding for cutting-edge AI solutions that predict seizures or support stroke recovery. US-China trade spats and supply hiccups from Baltic unrest jack up prices for vital cloud servers and wearable sensors.

Developers wrestle with rising cyber threats from rogue actors, making global data sharing for migraine apps trickier. Varying rules, like the EU’s AI Act, slow down approvals for virtual reality therapies for Parkinson’s. Yet, with neurological disorders impacting over 15% of people worldwide per WHO, the need for user-friendly digital therapies skyrockets. Smart companies pivot to sourcing from stable spots like Canada and boost local tech designs, sparking innovations that make patient care more effective and engaging.

US tariffs stir the neurological digital therapeutics market by hiking costs but also igniting a wave of homegrown creativity. The September 2025 tariffs—slapping 15% on imported drugs and up to 25% on Asian tech gear—drive up prices for sensors and processors powering brain health apps, squeezing profits for companies like Propeller Health. Clinics hold off on rolling out remote therapy platforms, leaving gaps in care for stroke or multiple sclerosis patients.

EU and Canadian counter-tariffs mess with supplies for mobile diagnostics, hitting rural areas hardest. Budgets shift from fine-tuning algorithms to navigating tariff rules, stressing global supply chains for cloud-based tools. But these tariffs fire up US manufacturing, with firms tapping CHIPS Act funds to create jobs and build secure, tariff-free tech. Teaming up with local tech innovators speeds up flexible, protected platforms. By snagging exemptions for key components, the industry turns hurdles into opportunities, fueling growth with bold, patient-focused digital solutions.

Latest Trends

The rise of AI-powered digital biomarkers is a recent trend

A significant and recent trend in the neurology digital therapeutics market is the rise of AI-powered digital biomarkers. This trend involves the use of artificial intelligence and machine learning to analyze data collected from smartphones, wearable sensors, and other digital devices to provide objective and continuous measures of a patient’s neurological symptoms and cognitive function. Instead of relying solely on periodic clinical assessments, digital biomarkers can track subtle changes in a patient’s motor skills, speech patterns, or cognitive performance in their natural environment.

For example, a 2024 project by the University of Lancashire is developing a wireless, dry-electrode headset with a smartphone app to provide at-home EEG monitoring for seizures, which could transform the diagnosis and management of conditions like epilepsy. This integration of AI with remote monitoring is moving the field from reactive to proactive care, enabling earlier detection of disease progression and allowing for more timely interventions. This trend not only improves patient outcomes but also provides valuable, high-resolution data for clinical research and the development of more personalized and effective treatments.

Regional Analysis

North America is leading the Neurology Digital Therapeutics Market

In 2024, North America accounted for 37.6% of the global Neurology Digital Therapeutics market, experiencing notable expansion due to heightened integration of mobile applications and AI-driven interventions for managing conditions such as major depressive disorder and Parkinson’s disease, amid rising neurological disorder prevalence and clinician endorsements. Healthcare providers increasingly prescribed evidence-based digital tools for cognitive behavioral therapy delivery, enabling scalable, home-based symptom monitoring that complements traditional pharmacotherapy and reduces relapse risks in outpatient settings.

The FDA’s proactive clearance processes facilitated rapid market entry for software-as-a-medical-device platforms, enhancing clinician confidence in automated neurofeedback systems for tremor control. Collaborative trials between academic centers and developers refined machine learning algorithms for personalized stroke rehabilitation protocols, optimizing neuroplasticity outcomes through gamified exercises.

Post-pandemic telehealth synergies amplified demand, as virtual platforms incorporated real-time EEG feedback to support epilepsy seizure prediction and management. Economic analyses revealed cost efficiencies from averted hospitalizations, prompting integrated health systems to subsidize access for underserved populations.

Venture ecosystems bolstered innovation in wearable neurostimulation apps, aligning with federal priorities for mental health equity. These developments positioned the region at the forefront of non-pharmacological neurology care. The FDA issued 13 clearances for neurology devices in 2024, including software tools for brain image assessment in dementia and seizure monitoring. Additionally, the NIH BRAIN Initiative supported 180 new awards totaling US$315 million in 2024 for neurotechnology advancements, encompassing digital therapeutic prototypes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific Neurology Digital Therapeutics sector to advance substantially during the forecast period, as governments prioritize scalable interventions to address escalating neurological burdens in aging societies. National health ministries in Japan and China direct resources toward app-based cognitive training programs, equipping clinics with tools for early dementia detection and virtual reality simulations for balance restoration in Parkinson’s patients.

Pharmaceutical developers collaborate with regional tech firms to customize AI chatbots for anxiety management, anticipating improved adherence in diverse linguistic contexts. Innovation hubs in Singapore and India pioneer blockchain-secured data platforms, enabling secure sharing of patient progress metrics across borders for collaborative stroke recovery plans. Local authorities estimate deploying low-cost neurofeedback wearables in community centers, mitigating access barriers in rural provinces through subsidized subscriptions.

Regional consortia focus on machine learning models for migraine pattern recognition, integrating them with national registries to refine preventive strategies. These efforts establish the region as a leader in inclusive, tech-enabled neurological support. Japan’s Agency for Medical Research and Development allocated 16.2 billion JPY to psychiatric and neurological R&D in fiscal year 2023, supporting digital therapeutic developments for disorders like depression.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major companies in the neurology digital therapeutics sector fuel growth by launching AI-powered apps that offer tailored cognitive exercises and symptom tracking for disorders like ADHD and Parkinson’s. They form alliances with drug companies and clinics to create integrated treatments, speeding up regulatory approvals and market reach. Firms acquire startups with VR and wearable technologies to enhance platforms with real-time patient data insights.

Leaders invest heavily in R&D to refine algorithms for better user engagement and disease management. They expand into regions like Asia-Pacific and Europe, adapting solutions to local regulations and patient needs. Additionally, they provide subscription-based support and analytics to boost user retention and ensure steady income.

Akili Interactive Labs, founded in 2012 and based in Boston, Massachusetts, develops engaging video game-based therapies to address cognitive issues in neurological conditions. Its flagship product, EndeavorRx, targets pediatric ADHD with FDA approval, and recent partnerships expand its mental health focus. Akili invests in research to create accessible, non-invasive treatments for broader patient populations.

CEO Matt Franklin leads a team dedicated to innovative, evidence-based solutions for global clinicians. The company operates in the US and select international markets, prioritizing scalable digital care. Akili strengthens its market position by combining neuroscience with interactive technology to transform treatment approaches.

Top Key Players in the Neurology Digital Therapeutics Market

- WellDoc

- Proteus Digital Health

- Propeller Health

- Pear Therapeutics

- Omada Health

- Noom

- Mango Health

- Livongo Health

- Better Therapeutics

- Akili Interactive Labs

Recent Developments

- In September 2025: The launch of T.Rx Capital and its US$77.5 million fund, co-founded by former Pear Therapeutics CEO Dr. Corey McCann, demonstrates continued investor interest in digital health. This new capital source helps drive the market by funding early-stage companies and fostering innovation in neurology digital therapeutics.

- In August 2025: Cognoa’s publication in Nature Communications provided clinical validation for its AI-based autism diagnostic tool, Canvas Dx. This strengthens the market by building trust with healthcare providers and payers, proving the tool’s effectiveness in providing an earlier diagnosis.

- In July 2024: Akili Interactive was acquired by Virtual Therapeutics. This market consolidation drives growth by combining the companies’ expertise and resources to create more comprehensive and scalable solutions, which can help overcome commercialization challenges faced by smaller, individual firms.

Report Scope

Report Features Description Market Value (2024) US$ 248.1 million Forecast Revenue (2034) US$ 540.6 million CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Devices, and Software), By Application (Diabetes, Cardiovascular Disease (CVD), Obesity, Respiratory Disease, Central Nervous System (CNS) Disease, and Others), By End-user (Hospitals, Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WellDoc, Proteus Digital Health, Propeller Health, Pear Therapeutics, Omada Health, Noom, Mango Health, Livongo Health, Better Therapeutics, Akili Interactive Labs. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Neurology Digital Therapeutics MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Neurology Digital Therapeutics MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WellDoc

- Proteus Digital Health

- Propeller Health

- Pear Therapeutics

- Omada Health

- Noom

- Mango Health

- Livongo Health

- Better Therapeutics

- Akili Interactive Labs