Global Neopentyl Glycol Market Size, Share and Future Trends Analysis Report By Form (Flake, Molten, Slurry), By Grade (Pharmaceutical Grade, Technical Grade), By Production Method (Hydrogenation of HPA, Disproportionation), By Application (Paints And Coatings, Adhesives And Sealants, Lubricants, Plasticizers, Insulation Materials, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149812

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

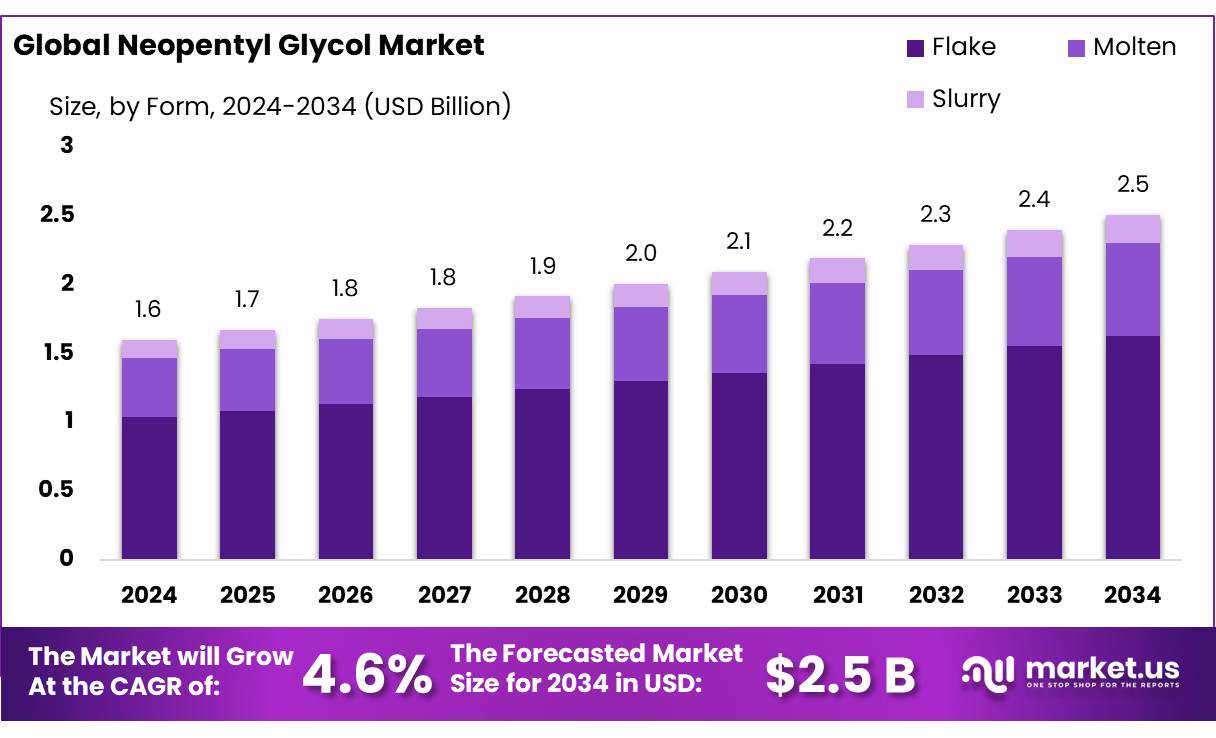

The Global Neopentyl Glycol Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Neopentyl Glycol (NPG), a diol compound with the chemical formula C₅H₁₂O₂, plays a crucial role as an intermediate in the synthesis of high-performance polyesters, coatings, and resins. Due to its branched molecular structure, NPG offers excellent thermal stability, resistance to hydrolysis, and low volatility, making it an essential ingredient in applications such as automotive finishes, construction materials, and electronic components. These performance advantages have driven consistent demand across both industrial and consumer segments.

In India, the domestic production of NPG is expected to grow significantly, supported by policy-level initiatives such as the Production Linked Incentive (PLI) Scheme. With a total budget of INR 1.97 lakh crore (approximately USD 26 billion), the scheme targets enhanced manufacturing capabilities across 14 strategic sectors, including chemicals. This move aims to reduce import dependency while strengthening India’s position in the global chemicals value chain, including NPG production.

India’s fast-paced infrastructure growth has also fueled demand for robust and weather-resistant construction materials. NPG is a key input in producing coatings that meet the durability requirements of modern infrastructure. The government’s Smart Cities Mission, which targets the development of 100 smart urban hubs, is expected to further push the consumption of high-performance materials, directly contributing to NPG market growth.

Furthermore, the expansion of India’s pharmaceutical industry, valued at approximately USD 50 billion in FY 2023–24 and projected to reach USD 130 billion by 2030, presents additional growth avenues. NPG is utilized in the formulation of certain pharmaceutical intermediates and excipients. Technological progress, particularly the integration of Industry 4.0 in manufacturing operations, is enhancing production efficiencies and product quality. These developments are expected to make Indian NPG products more competitive on the global stage, supporting sustained market growth.

Key Takeaways

- Neopentyl Glycol Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 4.6%.

- Flake held a dominant market position, capturing more than a 64.8% share in the global Neopentyl Glycol (NPG) market.

- Technical Grade held a dominant market position, capturing more than an 85.7% share in the global Neopentyl Glycol (NPG) market.

- Hydrogenation of Hydroxy Pivalic Aldehyde (HPA) held a dominant market position, capturing more than a 78.2% share in the global Neopentyl Glycol (NPG) market.

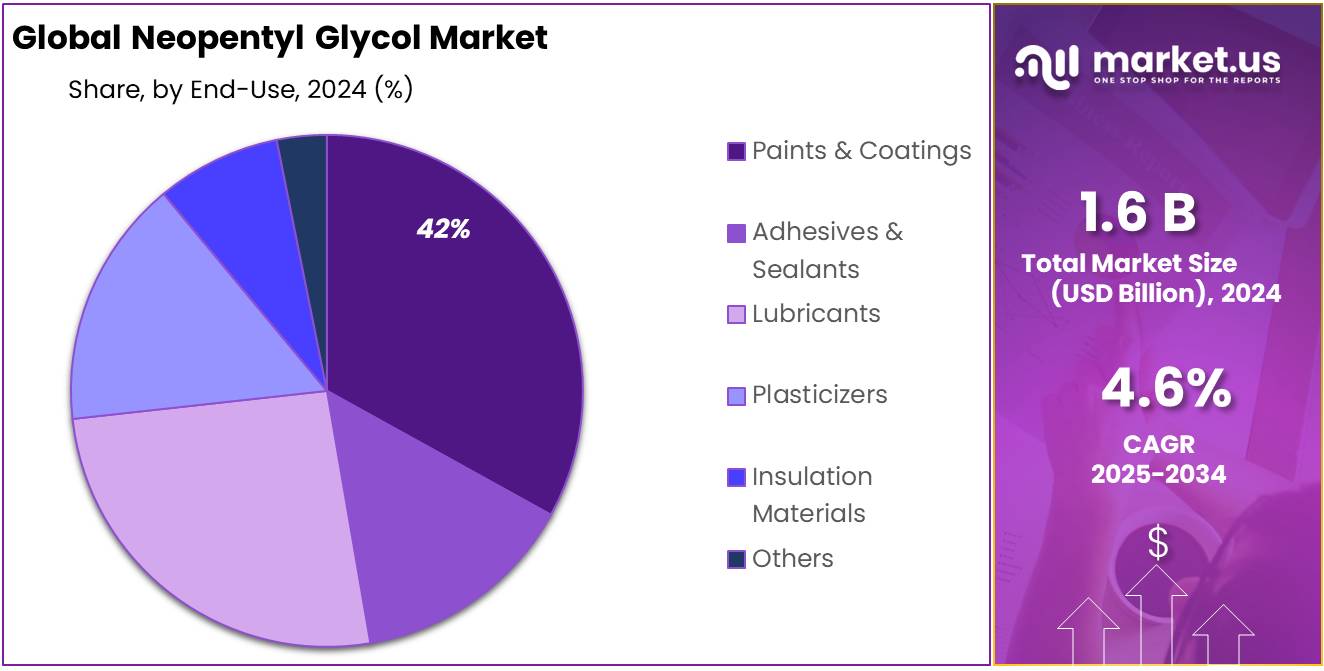

- Paints & Coatings held a dominant market position, capturing more than a 42.9% share of the global Neopentyl Glycol (NPG) market.

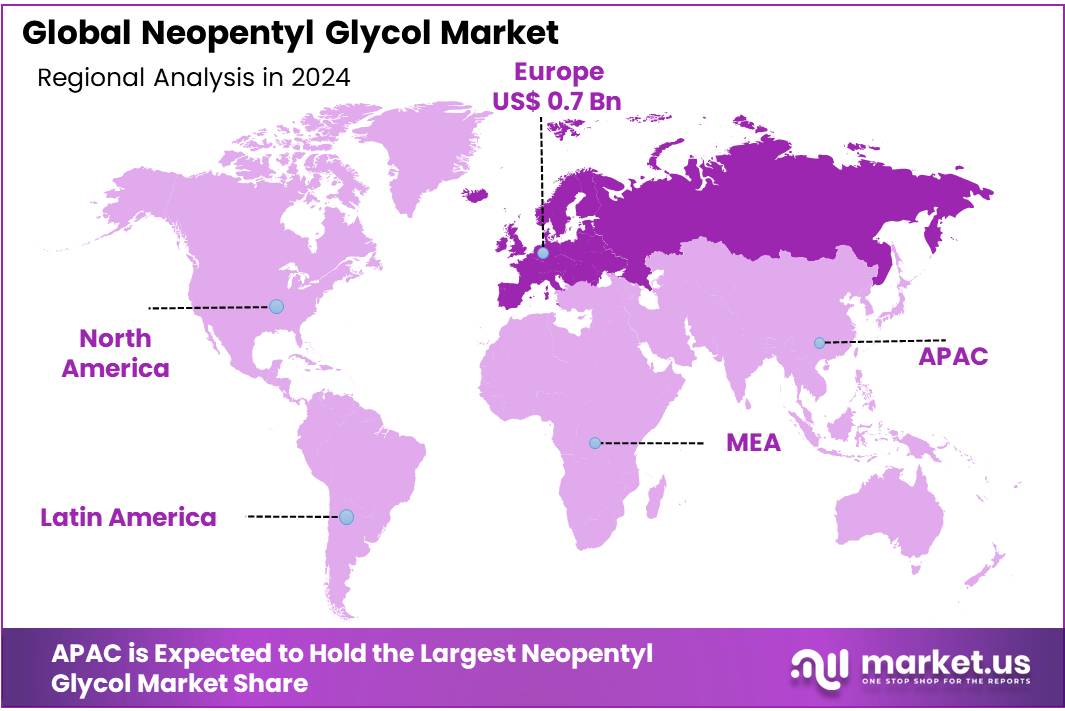

- Europe holds a significant position in the global Neopentyl Glycol (NPG) market, accounting for approximately 43.9% of the market share, which translates to a valuation of around USD 0.7 billion.

By Form

Flake form of Neopentyl Glycol leads the market with 64.8% share in 2024 due to its ease of storage and wide use in resins and coatings.

In 2024, Flake held a dominant market position, capturing more than a 64.8% share in the global Neopentyl Glycol (NPG) market. This form is favored due to its solid-state stability, ease of handling, and efficient storage, which make it suitable for large-scale industrial applications. Flake NPG is commonly used in the production of polyester resins, powder coatings, and lubricants.

The rising demand from the automotive and construction sectors—especially for coatings that offer high durability and chemical resistance—has significantly contributed to the segment’s growth. Industries also prefer flake NPG for its high purity and consistent melting behavior during processing. As infrastructure projects expand globally and demand for weather-resistant materials continues, the use of flake NPG is expected to maintain its lead through 2025.

By Grade

Technical Grade dominates the Neopentyl Glycol market with 85.7% share in 2024, thanks to its high demand in industrial coatings and resins.

In 2024, Technical Grade held a dominant market position, capturing more than an 85.7% share in the global Neopentyl Glycol (NPG) market. This grade is widely used in the manufacturing of alkyd resins, powder coatings, lubricants, and plasticizers due to its high chemical stability and consistent performance. Its suitability for industrial applications like automotive finishes and protective coatings makes it a preferred choice among manufacturers. The steady growth in infrastructure and automotive production, especially across Asia-Pacific and Europe, has further pushed demand for technical-grade NPG. As industrial sectors seek more durable and environmentally compliant coating solutions, this grade is expected to retain its dominance into 2025.

By Production Method

Hydrogenation of HPA leads the market with 78.2% share due to its efficiency and cost-effectiveness in producing Neopentyl Glycol.

In 2024, Hydrogenation of Hydroxy Pivalic Aldehyde (HPA) held a dominant market position, capturing more than a 78.2% share in the global Neopentyl Glycol (NPG) market. This method is favored for its high conversion rates and relatively lower production costs, making it ideal for large-scale industrial manufacturing. The process is also considered more environmentally sustainable compared to other routes, aligning well with growing regulatory emphasis on cleaner chemical production.

The dominance of this method is expected to persist through 2025, particularly driven by demand from end-use industries such as automotive coatings, construction materials, and plasticizers, which rely on bulk, high-purity NPG. The scalability and cost advantage of hydrogenation of HPA make it a preferred method among producers across North America, Europe, and Asia-Pacific.

By Application

Paints & Coatings lead the NPG market with 42.9% share, driven by rising demand for durable and weather-resistant finishes.

In 2024, Paints & Coatings held a dominant market position, capturing more than a 42.9% share of the global Neopentyl Glycol (NPG) market. This dominance is largely attributed to NPG’s strong chemical stability, low volatility, and excellent resistance to heat and weathering, making it a critical ingredient in high-performance coating formulations.

The construction and automotive sectors, especially in emerging economies like India and Southeast Asia, have significantly driven demand for these coatings, as infrastructure development and vehicle production continue to rise. By 2025, the segment is expected to maintain its lead due to the ongoing shift toward environmentally friendly and durable coating technologies, where NPG plays a vital role in achieving low VOC and high-performance outcomes.

Key Market Segments

By Form

- Flake

- Molten

- Slurry

By Grade

- Pharmaceutical Grade

- Technical Grade

By Production Method

- Hydrogenation of HPA

- Disproportionation

By Application

- Paints & Coatings

- Adhesives & Sealants

- Lubricants

- Plasticizers

- Insulation Materials

- Others

Drivers

Government Initiatives and Infrastructure Growth Fuel Neopentyl Glycol Market Expansion

In 2024, the Neopentyl Glycol (NPG) market experienced significant growth, primarily driven by increased demand from the paints and coatings industry. NPG is a key component in the production of high-performance resins, which are essential for durable and weather-resistant coatings used in construction and automotive sectors.

In India, the government’s Production Linked Incentive (PLI) Scheme has played a pivotal role in bolstering domestic manufacturing across various sectors, including chemicals. With an outlay of INR 1.97 lakh crore (over USD 26 billion), the PLI scheme aims to enhance production capabilities and reduce import dependence . This initiative is expected to positively impact the NPG market by encouraging local production and investment in the chemical sector.

Furthermore, India’s rapid urbanization and infrastructure development have led to increased demand for durable and weather-resistant coatings, where NPG is a critical component. The government’s ‘Smart Cities Mission’ aims to develop 100 smart cities, further propelling the need for high-performance construction materials. This surge in infrastructure projects is anticipated to drive the demand for NPG-based products in the coming years.

Additionally, the expansion of India’s pharmaceutical industry, valued at an estimated USD 50 billion in FY 2023-24 and projected to reach USD 130 billion by 2030, presents new avenues for NPG applications . NPG finds applications in the production of certain pharmaceutical intermediates and excipients, contributing to its market growth.

Restraints

Stringent Environmental Regulations and Compliance Costs

The Neopentyl Glycol (NPG) industry is currently facing significant challenges due to increasingly stringent environmental regulations. These regulations, aimed at reducing harmful emissions and promoting sustainable practices, have led to increased compliance costs for manufacturers.

For instance, in the European Union, the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation requires companies to register and evaluate the safety of their chemical substances, including NPG. Compliance with REACH can cost companies between €50,000 to €500,000 per substance, depending on the volume and complexity of data required. This financial burden can be particularly challenging for small and medium-sized enterprises (SMEs) operating in the NPG market.

In addition to REACH, the European Union’s Emissions Trading System (EU ETS) imposes costs on companies for their greenhouse gas emissions. Companies exceeding their emission allowances must purchase additional permits, which can be costly. As of 2025, the price for EU ETS allowances has reached approximately €80 per ton of CO₂ emitted. This adds a significant operational cost for NPG manufacturers, who often rely on energy-intensive processes that contribute to CO₂ emissions.

In the United States, the Environmental Protection Agency (EPA) has implemented the Toxic Substances Control Act (TSCA), which requires companies to report information on the manufacturing, processing, and use of chemical substances. Compliance with TSCA can involve substantial administrative and testing costs, particularly when new chemicals or significant new uses are introduced. These regulatory requirements can delay product development and market entry, affecting the competitiveness of NPG manufacturers.

Opportunity

Rising Demand for Bio-Based Neopentyl Glycol (NPG) in Sustainable Industries

The increasing global emphasis on sustainability and environmental responsibility is driving a significant shift towards bio-based chemicals, presenting a substantial growth opportunity for the Neopentyl Glycol (NPG) market. Bio-based NPG, derived from renewable resources, offers an eco-friendly alternative to its petrochemical counterpart, aligning with the growing demand for sustainable materials across various industries.

One of the primary growth factors for the bio-based NPG market is the rising environmental awareness among consumers and industries alike. The global push towards sustainability has led to an increased preference for bio-based chemicals over traditional petrochemical-derived alternatives.

Governments and regulatory bodies around the world are implementing stringent regulations aimed at reducing greenhouse gas emissions and promoting the use of renewable resources, further propelling the demand for bio-based NPG. Additionally, advancements in biotechnology and chemical engineering have made the production of bio-based NPG more efficient and cost-effective, making it a viable alternative for various industrial applications.

Another significant growth driver is the expanding application scope of bio-based NPG across different industries. Its usage in coatings, adhesives, sealants, and elastomers is on the rise due to its superior properties such as high thermal stability, resistance to oxidation, and low volatility. The automotive and construction industries, in particular, are witnessing increased adoption of bio-based NPG in their products and processes.

Trends

Shift Towards Sustainable Production Methods in Neopentyl Glycol Manufacturing

In recent years, the Neopentyl Glycol (NPG) industry has been witnessing a significant shift towards sustainable production methods. This trend is driven by increasing environmental concerns, stringent regulations, and the global push for greener industrial practices.

One of the primary drivers of this trend is the growing demand for eco-friendly products across various industries. NPG, known for its high thermal stability and resistance to oxidation, is extensively used in the production of resins, coatings, and plasticizers. However, traditional production methods of NPG involve the use of formaldehyde and isobutyraldehyde, which are associated with environmental and health concerns. To address these issues, manufacturers are increasingly adopting bio-based raw materials and green catalytic processes to produce NPG.

Furthermore, the automotive industry, a major consumer of NPG, is also shifting towards sustainable practices. NPG finds application in both OEM and refinishing paints to enhance resistance to UV light, chemicals, and physical abrasion. With the world’s car production recovering and electric vehicle manufacturing on the rise, the demand for tough, low-maintenance paints is driving the consumption of NPG.

Regional Analysis

Europe holds a significant position in the global Neopentyl Glycol (NPG) market, accounting for approximately 43.9% of the market share, which translates to a valuation of around USD 0.7 billion. This dominance is attributed to the region’s robust industrial base, stringent environmental regulations, and the presence of key market players.

The European market’s growth is driven by the increasing demand for NPG in the production of high-performance coatings, resins, and plasticizers. Industries such as automotive, construction, and electronics heavily rely on NPG-based products due to their superior thermal stability, resistance to oxidation, and low volatility. For instance, in the automotive sector, NPG is utilized in the manufacture of durable coatings that can withstand harsh environmental conditions, thereby enhancing vehicle longevity.

Germany, being Europe’s largest economy, plays a pivotal role in the regional NPG market. The country’s well-established chemical industry and strong demand in sectors like automotive and construction contribute significantly to NPG consumption. In Q3 2024, the price of NPG in Germany was reported at USD 1,940 per metric ton, reflecting the material’s value in the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mitsubishi Gas Chemical Company (MGC) plays a strategic role in the Neopentyl Glycol (NPG) market with its focus on specialty chemicals and high-purity production. The company has expanded its NPG offerings to cater to industries like coatings and plastics, emphasizing low-VOC and sustainable formulations. MGC’s advanced R&D capabilities and commitment to innovation have supported strong growth across Asia and Europe. In FY2024, the company reported consolidated revenue of ¥731.8 billion.

OXEA GmbH, based in Germany, is a key producer of oxo intermediates and derivatives, including Neopentyl Glycol. The company leverages its integrated chemical infrastructure to deliver high-purity NPG for applications in powder coatings, resins, and synthetic lubricants. OXEA emphasizes eco-efficient production and compliance with REACH regulations. In 2024, the company’s production facilities in Oberhausen contributed significantly to NPG output in Europe, reinforcing its role as a regional supplier. OXEA operates under the OQ Chemicals group.

Hefei TNJ Chemical Industry is one of China’s recognized exporters of Neopentyl Glycol, offering both flakes and molten forms. The company targets coatings, lubricants, and adhesives markets, supplying globally at competitive rates. TNJ focuses on high-efficiency logistics and compliance with international standards such as ISO 9001 and SGS. In 2024, TNJ exported over 4,000 tons of NPG, with key clients in South America, Southeast Asia, and Eastern Europe.

Top Key Players in the Market

- Mitsubishi Gas Chemical Company

- OXEA GmbH

- Tokyo Chemical Industry Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Zouping Fenlian Biotech Co., Ltd.

- Shandong Dongchen Ind. Group. Corp.

- BASF SE

- LG Chem Ltd.

- Eastman Chemical Company

- Perstorp Holding AB

- Wanhua Chemical Group

- Mitsubishi Gas Chemical Company

- OXEA GmbH

- Tokyo Chemical Industry Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Zouping Fenlian Biotech Co., Ltd.

Recent Developments

In 2024, MGC reported consolidated net sales of ¥773.5 billion, a slight decline of 5.6% from the previous year, primarily due to currency fluctuations and increased R&D expenditures. Despite these challenges, the company’s operating profit stood at ¥50.8 billion, reflecting its resilience and efficient operations.

Shandong Dongchen New Technology Co., Ltd. has steadily emerged as a significant player in the global neopentyl glycol (NPG) market, contributing approximately 5% to the global market share as of 2024.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 2.5 Bn CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Flake, Molten, Slurry), By Grade (Pharmaceutical Grade, Technical Grade), By Production Method (Hydrogenation of HPA, Disproportionation), By Application (Paints And Coatings, Adhesives And Sealants, Lubricants, Plasticizers, Insulation Materials, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsubishi Gas Chemical Company, OXEA GmbH, Tokyo Chemical Industry Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., Zouping Fenlian Biotech Co., Ltd., Shandong Dongchen Ind. Group. Corp., BASF SE, LG Chem Ltd., Eastman Chemical Company, Perstorp Holding AB, Wanhua Chemical Group, Mitsubishi Gas Chemical Company, OXEA GmbH, Tokyo Chemical Industry Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., Zouping Fenlian Biotech Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mitsubishi Gas Chemical Company

- OXEA GmbH

- Tokyo Chemical Industry Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Zouping Fenlian Biotech Co., Ltd.

- Shandong Dongchen Ind. Group. Corp.

- BASF SE

- LG Chem Ltd.

- Eastman Chemical Company

- Perstorp Holding AB

- Wanhua Chemical Group

- Mitsubishi Gas Chemical Company

- OXEA GmbH

- Tokyo Chemical Industry Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Zouping Fenlian Biotech Co., Ltd.