Global Neobanking Market By Account Type (Business Account, Savings Account), Service Type (Mobile Banking, Payments and Money Transfer, Checking/Savings Account, Loans, Other Service Types), Application (Enterprises, Personal, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 110565

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The global Neobanking Market is anticipated to be USD 5,382.6 billion by 2033. It is estimated to record a steady CAGR of 49% in the Forecast period 2024 to 2033. It is likely to total USD 148.7 billion in 2023.

Neobanks, also known as digital banks, are fintech companies that offer banking services entirely online and through mobile apps. Unlike traditional banks with physical branches, neobanks operate with a purely digital presence, leveraging technology to provide a seamless and convenient banking experience. They aim to offer customers a seamless and user-friendly banking experience, often accompanied by modern features, personalized services, and enhanced convenience.

Neobanking has seen significant expansion and disruption in recent years. Many factors have influenced the growth of Neobanks. First, advances in technology including mobile connectivity, as well as online platforms have opened the way for the development of these new digital banking options. Neobanks use mobile applications and platforms online to provide financial services that allow clients to control their finances at any time and at any time.

Note: Actual Numbers Might Vary In Final Report

Secondly, neobanks differentiate themselves by focusing on customer-centricity and personalized experiences. They often provide intuitive interfaces, real-time financial insights, budgeting tools, and personalized recommendations to enhance the user experience. By leveraging data analytics and artificial intelligence, neobanks can offer tailored financial solutions to customers, addressing their specific needs and preferences.

The neobanking market presents significant growth opportunities. As consumers become more comfortable with digital banking and mobile-first experiences, the demand for neobank services continues to rise. Neobanks are expanding their product offerings beyond basic banking services, including features such as savings accounts, payment solutions, investment options, and even loans. Moreover, neobanks are targeting niche markets and specific customer segments, such as freelancers, small businesses, and the younger generation, who value convenience, flexibility, and personalized financial experiences.

Key Takeaways

- Market Growth and Forecast: The Neobanking Market is set to witness substantial growth, reaching a staggering USD 5,382.6 billion by 2033, at a CAGR of 49% during the forecast period.

- Definition of Neobanks: Neobanks, also known as digital banks, are fintech companies that offer banking services entirely online and through mobile apps.

- Factors Driving Neobank Growth: Advances in technology, including mobile connectivity and online platforms, have paved the way for the development of neobanks.

- Account Type Analysis: In 2023, the Business Account segment dominated the Neobanking market, capturing over 66% market share.

- Service Types in Neobanking: Payments and Money Transfer stood out in 2023, holding over 41% market share, driven by demand for efficient payment solutions.

- Applications of Neobanking: Enterprises led in 2023, securing more than 53% of the market, attracted by efficient cash management and expense tracking.

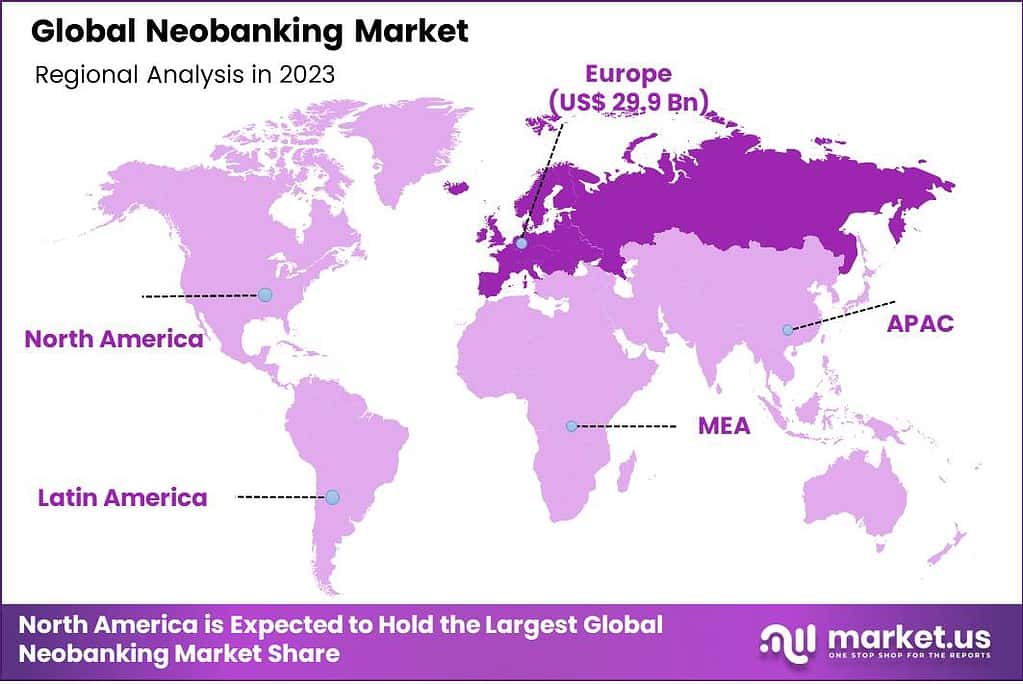

- Regional Analysis: Europe emerged as a dominant region, capturing over 30% of the Neobanking market share.

- Key Players: Top Key Players in the Neobanking market include Monzo Bank Limited, N26 AG, Revolut Ltd., and others.

Account Type Analysis

In 2023, the Neobanking market exhibited distinct segmental trends, with the Business Account segment emerging as the dominant force, capturing more than a commanding 66% share of the market. This significant market share can be attributed to the growing adoption of neobanking solutions by businesses of all sizes.

Neobanks have gained favor among businesses due to their agility and tailored financial services, such as seamless payment processing, real-time transaction monitoring, and simplified expense management. Moreover, the integration of advanced digital tools and analytics has further empowered businesses to optimize their financial operations, ultimately enhancing their competitiveness in the market.

On the other hand, the Savings Account segment, while holding a substantial portion of the Neobanking market, faced a somewhat slower growth trajectory compared to its business-oriented counterpart. The adoption of neobanking solutions for personal savings accounts has been driven by factors like user-friendly interfaces, higher interest rates, and convenient access to financial services through mobile apps. However, competition from traditional banks and the need for neobanks to build trust in handling personal finances have presented challenges to the growth of the Savings Account segment.

Service Type Analysis

In 2023, the Neobanking market displayed a dynamic landscape, with distinct segmental trends, and notably, the Payments and Money Transfer segment stood out by securing a dominant market position, capturing more than a substantial 41% share. This segment’s significant market share can be attributed to the ever-increasing demand for convenient and efficient payment solutions in the digital era.

Neobanks have excelled in providing users with seamless and cost-effective payment and money transfer services, enabling quick and secure transactions domestically and internationally. Additionally, the integration of advanced technologies such as blockchain and real-time transaction tracking has further bolstered the appeal of neobanks in this segment, attracting both individual users and businesses seeking streamlined financial operations.

In the same way, it is also there was a significant increase in the Mobile Banking part, though making up a large portion in the Neobanking market by 2023. Neobanks Mobile banking services have gained popularity due to their simple mobile applications. The apps offer customers convenient accessibility to accounts and quick financial updates, as well as the ability to manage their finances when they are on the go. These services offer competitive interest rates and low fees, making them an attractive option for both personal and business users.

Furthermore, the Loans segment, though a smaller component of the Neobanking market, has been gaining traction as neobanks explore opportunities to expand their service offerings. Numerical data suggests that Payments and Money Transfer is poised to maintain its dominant position in the coming years, driven by the continued digitalization of financial transactions. However, the market is expected to witness ongoing innovation and competition among neobanks across all service types, further reshaping the segmental landscape and enhancing the overall value proposition for customers.

Note: Actual Numbers Might Vary In Final Report

Application Analysis

In 2023, the Neobanking market exhibited distinctive segmental trends, with the Enterprises segment establishing its dominance by securing more than a commanding 53% share of the market. This substantial market share is primarily attributed to the increasing adoption of neobanking solutions by businesses of varying sizes.

Enterprises have been drawn to neobanks for their agility and tailored financial services, offering efficient cash management, customizable expense tracking, and streamlined payment processing. Furthermore, the integration of advanced digital tools and analytics has empowered enterprises to optimize their financial operations, fostering efficiency and competitiveness in a rapidly evolving market landscape.

In contrast, the Personal segment, while holding a significant portion of the Neobanking market in 2023. Personal users have embraced neobanking due to the convenience of user-friendly mobile applications, competitive interest rates on savings accounts, and access to real-time financial insights. However, intense competition from traditional banks and the need for neobanks to continually build trust in handling personal finances have posed challenges to the growth of this segment.

Additionally, the Other Applications segment, which encompasses diverse niche use cases, constituted the remaining share of the market. Numerical data suggests that the dominance of the Enterprises segment is likely to persist in the years ahead, albeit with increasing competition among neobanks vying for business clientele. The Neobanking market is expected to continue evolving, with the potential for innovative solutions and tailored services to further shape the segmental landscape, meeting the evolving needs of both enterprises and personal users.

Driving Factors

- Digital Transformation: The global shift towards digitalization in financial services is a significant driver for the neobanking market. Neobanks offer seamless, online account management and transactions, aligning with the growing preference for digital banking among consumers.

- Cost-Effective Solutions: Neobanks typically have lower overhead costs than traditional banks, enabling them to offer competitive interest rates on savings accounts and reduced fees on transactions. This cost-effectiveness attracts customers seeking more affordable banking options.

- Accessibility and Convenience: Neobanks provide 24/7 access to banking services through mobile apps, making it convenient for users to manage their finances anytime, anywhere. This accessibility appeals to individuals and businesses looking for flexibility.

- Innovative Features: Neobanks often introduce innovative features, such as real-time spending insights, budgeting tools, and automated savings, enhancing the overall banking experience and attracting tech-savvy customers.

Restraining Factors

- Regulatory Challenges: The regulatory environment for neobanks varies by region and can be complex. Meeting compliance requirements and obtaining necessary licenses can pose challenges and slow market entry.

- Limited Physical Presence: Neobanks usually lack physical branches and ATMs, which can be a drawback for customers who prefer in-person banking services or need access to cash.

- Cybersecurity Concerns: The digital nature of neobanking makes it susceptible to cybersecurity threats. Protecting customer data and ensuring secure transactions are ongoing challenges for neobanks.

- Customer Trust: Building trust in digital-only banking services, especially for personal finance management, remains a challenge. Many consumers still harbor reservations about the security and reliability of neobanks.

Growth Opportunities

- Global Expansion: Neobanks have the potential to expand their reach internationally, targeting markets with underdeveloped banking infrastructure or a growing appetite for digital financial services.

- Partnerships and Collaborations: Collaborations with fintech companies, traditional banks, or e-commerce platforms can open new avenues for neobanks to offer complementary services and reach a broader customer base.

- Niche Segmentation: Identifying and catering to specific niches, such as small businesses, freelancers, or underserved communities, presents growth opportunities for neobanks to tailor their offerings effectively.

- Advanced Technology Adoption: Embracing emerging technologies like blockchain, AI-driven chatbots, and biometric authentication can enhance security and improve the overall user experience, attracting more customers.

Challenges

- Competition from Traditional Banks: Established banks are also investing in digital banking solutions, intensifying competition and making it challenging for neobanks to differentiate themselves.

- Monetization Strategies: Finding sustainable revenue streams beyond low-cost accounts and transaction fees can be a challenge for neobanks, especially in the absence of traditional banking products.

- Customer Acquisition Costs: Acquiring new customers in a crowded marketplace can be expensive, requiring significant marketing and promotional efforts.

- Scalability: As neobanks grow, maintaining scalability and ensuring that service quality doesn’t diminish can be a challenge that affects customer satisfaction.

Key Market Trend

- Embedded Finance: A prominent trend is the integration of neobanking services into other industries, such as e-commerce, where financial services are embedded seamlessly into the customer experience.

- Eco-Friendly Banking: Neobanks are increasingly focusing on environmentally sustainable practices, including digital-only operations that reduce carbon footprints and offering green banking products.

- Open Banking Initiatives: Neobanks are leveraging open banking APIs to provide customers with access to a broader range of financial products and services, enhancing their value proposition.

- Customer-Centric Design: The market trend is shifting towards highly user-centric neobanking apps, focusing on personalization, ease of use, and a frictionless customer journey.

Key Market Segments

Account Type

- Business Account

- Savings Account

Service Type

- Mobile Banking

- Payments and Money Transfer

- Checking/Savings Account

- Loans

- Other Service Types

Application

- Enterprises

- Personal

- Other Applications

Regional Analysis

In 2023, Europe asserted its dominance in the Neobanking market, capturing more than a 30% share, making it the leading region in the global neobanking landscape. This commanding position can be attributed to Europe’s early adoption of digital banking solutions and a favorable regulatory environment that encourages innovation in financial services. The demand for Neobanking in europe was valued at USD 29.9 billion in 2023 and is anticipated to grow significantly in the forecast period.

Countries in the European Union have been leading the way in promoting open banking, helping neobanks grow. Europe’s strong fintech system, including both neobanks and traditional banks, has created a competitive and lively market. This has led to a variety of neobanking choices for both consumers and businesses.

On the other hand, North America, especially the United States, has also seen substantial growth, holding a significant share of the neobanking market. The region’s large population of tech-savvy consumers and a robust fintech industry have driven neobanking adoption. However, in terms of market share, it closely follows Europe.

The Asia-Pacific (APAC) region, with its vast and diverse market, is witnessing rapid neobanking expansion. The adoption of digital financial services in emerging economies like India and Southeast Asian nations has contributed to the region’s growth. APAC is poised to become a key battleground for neobanks as they compete for market share.

Latin America, the Middle East, and Africa are emerging as promising regions for neobanking, albeit at a slower pace. These regions are characterized by varying levels of digital infrastructure and regulatory frameworks, which present both opportunities and challenges for neobank expansion. While they hold smaller market shares compared to Europe, North America, and APAC, their potential for growth remains substantial as neobanks seek to tap into underserved markets and address the unique financial needs of these regions.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key Players Analysis involves identifying and evaluating the most important players or businesses who play a major role in a certain market or industry. This analysis aids in understanding the market dynamics, and strategies used by the key players to get an edge. By studying the strengths and weaknesses, as well as the opportunities and threats from these competitors, companies can make informed choices and devise successful strategies to compete on the market.

Top Key Players

- Monzo Bank Limited

- Movencorp Inc.

- WeBank

- PRETA S.A.S.

- N26 AG

- Revolut Ltd.

- Ubank

- Pockit LTD

- Starling Bank Limited

- Atom Bank PLC

- Other Key Players

Recent Developments

- Rajasthan’s Kitzone Neo Bank is set to launch India’s inaugural Assured Cashback Debit Cards in October 2022, alongside the provision of Mini ATMs and POS Terminals.

- In September 2022, N26 became the first neo-bank to join Bizum. Users with a Spanish IBAN (1) can now seamlessly engage in sending, receiving, and requesting money through the popular mobile payments service, as per a recent announcement by the online bank.

Report Scope

Report Features Description Market Value (2023) US$ 148.7 Bn Forecast Revenue (2033) US$ 5,382.6 Bn CAGR (2024-2033) 49% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Account Type (Business Account, Savings Account), Service Type (Mobile Banking, Payments and Money Transfer, Checking/Savings Account, Loans, Other Service Types), Application (Enterprises, Personal, Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Monzo Bank Limited, Movencorp Inc., WeBank, PRETA S.A.S., N26 AG, Revolut Ltd., Ubank, Pockit LTD, Starling Bank Limited, Atom Bank PLC, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Neobanking?Neobanking refers to a new-age digital banking model that operates exclusively online, often without physical branches. It leverages technology to provide efficient, user-friendly, and innovative financial services.

What is the size of neobanking market?The global Neobanking Market is anticipated to be USD 5,382.6 billion by 2033. It is estimated to record a steady CAGR of 49% in the Forecast period 2024 to 2033. It is likely to total USD 148.7 billion in 2023.

How do Neobanks differ from Traditional Banks?Neobanks differ from traditional banks in that they operate solely online, have minimal physical infrastructure, and often focus on providing a seamless digital experience with features such as mobile apps and real-time transaction tracking.

What is an example of a neobank?An example of a neobank is "Revolut." Revolut is a UK-based neobank that provides a range of financial services, including currency exchange, cryptocurrency trading, and international money transfers through its mobile app.

What are some challenges facing Neobanks?Some of the challenges facing neobanks include:

- Building brand awareness and trust: As relatively new players in the market, neobanks need to work hard to build brand awareness and trust with consumers.

- Regulation and compliance: Neobanks need to comply with a complex and evolving regulatory landscape.

- Competition: The neobanking market is becoming increasingly crowded, making it difficult to stand out from the competition.

- Profitability: Neobanks often operate at low margins and need to find sustainable ways to grow their businesses.

What is the future of Neobanking?The future of neobanking is bright. The market is likely to grow rapidly over the years ahead, driven by factors like the increase in use of mobile phones, increasing consumers' need for digital banking as well as the growth of new technology. Neobanks will keep innovating and offering customers more customized and efficient banking services.

-

-

- Monzo Bank Limited

- Movencorp Inc.

- WeBank

- PRETA S.A.S.

- N26 AG

- Revolut Ltd.

- Ubank

- Pockit LTD

- Starling Bank Limited

- Atom Bank PLC

- Other Key Players