Global Nail Lamp Market Size, Share, Growth Analysis By Product Type (UV Nail Lamps, LED Nail Lamps, Hybrid Nail Lamps), By Installation (Tabletop, Handheld), By Operation (Electric Operated, Battery Operated), By Power (Upto 10 watts, 20-30 watts, 30-40 watts, 40-50 watts, Above 50 watts), By End Use (Commercial - Nail Salons, Spa Centres, Beauty Salons, Others; Residential), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174337

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

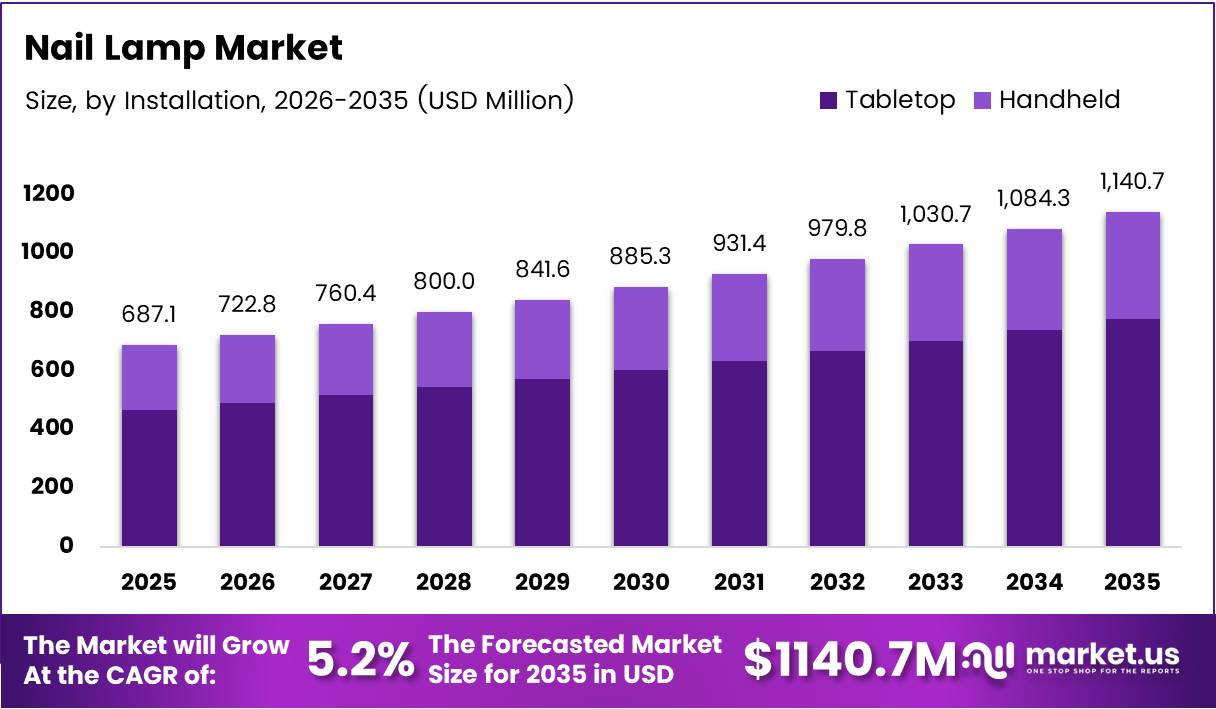

The Global Nail Lamp Market size is expected to be worth around USD 1140.7 Million by 2035 from USD 687.1 Million in 2025, growing at a CAGR of 5.2% during the forecast period 2026 to 2035.

The nail lamp market represents a specialized segment within the beauty and personal care industry. These devices utilize UV or LED technology to cure gel nail polish, providing durable and long-lasting manicures. Moreover, they serve both professional salons and home users seeking salon-quality results.

Market growth is primarily driven by increasing consumer preference for gel-based nail treatments. Additionally, the rapid expansion of professional nail salons and home-based nail studios across urban markets significantly contributes to demand. Social media influence further accelerates at-home nail art adoption among younger demographics.

The commercial segment, particularly nail salons and beauty centers, dominates market revenue streams. However, residential adoption is rising steadily due to growing disposable income and consumer willingness to invest in personal grooming devices. Consequently, manufacturers are developing more affordable and user-friendly models for home applications.

LED nail lamps are gaining preference over traditional UV models due to faster curing times and perceived safety benefits. Furthermore, hybrid nail lamps combining both UV and LED technology are emerging as premium alternatives. Therefore, innovation in product design and functionality remains crucial for market competitiveness.

Government regulations regarding UV exposure and product safety standards influence market dynamics. Manufacturers must comply with health guidelines while addressing consumer concerns about skin sensitivity. Nevertheless, the market continues to expand as technological advancements introduce safer and more efficient solutions.

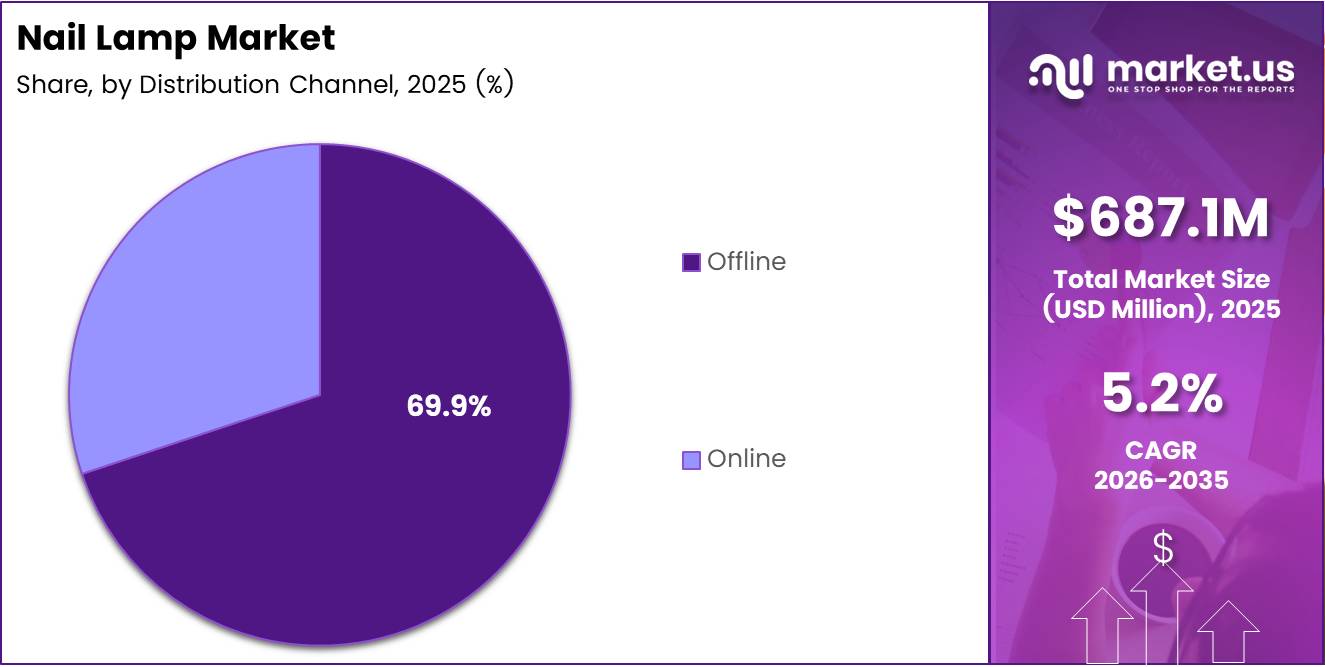

Distribution channels are evolving with increasing e-commerce penetration in the beauty appliances sector. Online platforms offer wider product variety and competitive pricing, attracting cost-conscious consumers. However, offline retail maintains significance for customers preferring hands-on product evaluation before purchase.

Key Takeaways

- The global nail lamp market is projected to reach USD 1140.7 Million by 2035 from USD 687.1 Million in 2025, at a CAGR of 5.2%

- UV Nail Lamps dominate the product type segment with 56.4% market share in 2025

- Tabletop installation holds 71.2% of the market due to stability and professional use

- Electric operated nail lamps account for 78.1% market share

- 30-40 watts power segment leads with 33.6% share

- Commercial end use dominates with 64.8% market share

- Offline distribution channel holds 69.9% market share

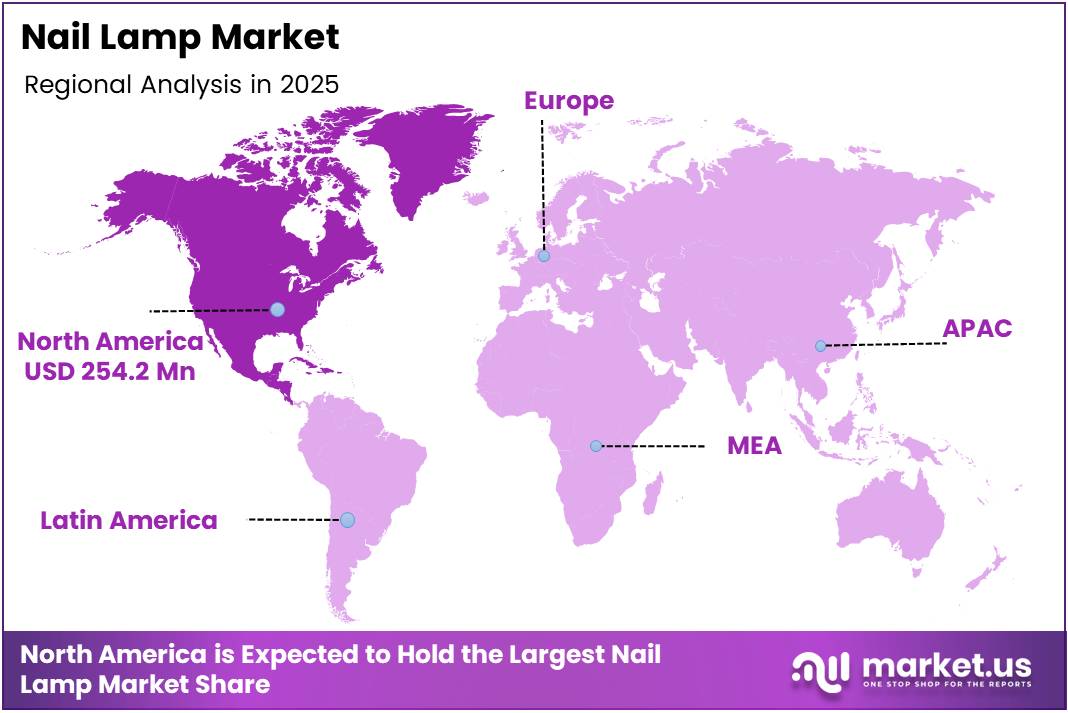

- North America leads the regional market with 37.3% share, valued at USD 254.2 Million

Product Type Analysis

UV Nail Lamps dominate with 56.4% due to their widespread adoption in professional salons and proven effectiveness.

In 2025, UV Nail Lamps held a dominant market position in the Product Type Analysis segment of Nail Lamp Market, with a 56.4% share. These lamps utilize ultraviolet light technology to cure gel nail polish efficiently. Professional nail salons prefer UV lamps for their reliability and compatibility with various gel formulations. However, consumer concerns about UV exposure are driving manufacturers to develop safer alternatives with protective features.

LED Nail Lamps represent the fastest-growing segment within the product type category. These devices offer significantly faster curing times, typically requiring only 30-60 seconds compared to UV lamps. Moreover, LED technology consumes less energy and generates minimal heat during operation. Consequently, home users increasingly prefer LED lamps for their convenience and perceived safety advantages over traditional UV models.

Hybrid Nail Lamps combine both UV and LED technologies in a single device. These versatile products accommodate all types of gel polish formulations, providing maximum flexibility for users. Additionally, hybrid lamps eliminate the need for multiple devices in professional settings. Therefore, they appeal to salon owners seeking cost-effective solutions while maintaining service quality.

Installation Analysis

Tabletop installation dominates with 71.2% due to stability requirements in professional salon environments.

In 2025, Tabletop held a dominant market position in the Installation Analysis segment of Nail Lamp Market, with a 71.2% share. These stationary units provide stable platforms for precise nail curing procedures. Professional salons require tabletop models for consistent client service and efficient workflow management. Furthermore, tabletop lamps typically feature larger curing chambers and higher wattage for faster processing times.

Handheld nail lamps cater to the portable and travel-friendly segment of the market. These compact devices appeal to mobile nail technicians and consumers seeking convenience during travel. Additionally, handheld models are more affordable and require less storage space than tabletop units. However, their smaller size and lower power output limit their application in high-volume professional settings.

Operation Analysis

Electric Operated dominates with 78.1% due to consistent power delivery and reliability in professional applications.

In 2025, Electric Operated held a dominant market position in the Operation Analysis segment of Nail Lamp Market, with a 78.1% share. These mains-powered devices ensure uninterrupted operation during extended salon hours. Professional establishments prefer electric models for their consistent performance and higher power output capabilities. Moreover, electric operation eliminates concerns about battery depletion during critical service periods.

Battery Operated nail lamps address the growing demand for portable grooming solutions. These rechargeable devices enable users to perform nail treatments without access to electrical outlets. Consequently, battery-operated models are popular among mobile technicians and frequent travelers. However, limited battery life and lower power output compared to electric models constrain their usage in professional environments.

Power Analysis

30-40 watts dominates with 33.6% as it balances curing efficiency with energy consumption.

Upto 10 watts nail lamps target entry-level consumers and budget-conscious buyers. These low-power devices are suitable for occasional home use and basic gel polish applications. However, their limited wattage results in longer curing times and reduced efficiency. Therefore, professional salons rarely adopt this power category for commercial operations.

20-30 watts nail lamps serve the mid-range market segment effectively. These devices offer improved curing speed compared to lower-wattage models while maintaining affordability. Additionally, they consume moderate energy, making them cost-effective for regular home users. Consequently, this power range appeals to semi-professional nail enthusiasts seeking quality without premium pricing.

In 2025, 30-40 watts held a dominant market position in the Power Analysis segment of Nail Lamp Market, with a 33.6% share. This power range delivers optimal curing performance for most gel polish formulations. Professional salons favor this wattage for balancing speed and energy efficiency. Moreover, 30-40 watt lamps accommodate both UV and LED technologies effectively.

40-50 watts nail lamps cater to high-volume professional salons requiring maximum efficiency. These powerful devices significantly reduce curing times, enabling faster client turnover rates. However, higher energy consumption and increased heat generation require careful operation. Therefore, they are primarily used in busy commercial establishments prioritizing speed.

Above 50 watts represents the premium professional segment of nail lamp market. These high-performance devices offer fastest curing times available in the industry. Additionally, they feature advanced cooling systems and multiple light sources for uniform curing. Consequently, high-end salons and nail art studios invest in this power category for superior service delivery.

End Use Analysis

Commercial dominates with 64.8% driven by professional salon demand and repeat usage patterns.

In 2025, Commercial held a dominant market position in the End Use Analysis segment of Nail Lamp Market, with a 64.8% share. This segment encompasses nail salons, spa centers, beauty salons, and other professional establishments. Professional facilities require durable, high-capacity nail lamps for continuous daily operations. Moreover, commercial users prioritize reliability and warranty support to minimize service disruptions.

Nail Salons represent the largest sub-segment within commercial end use category. These specialized establishments depend entirely on nail lamp technology for service delivery. Additionally, nail salons frequently upgrade equipment to maintain competitive advantage and client satisfaction. Therefore, they contribute significantly to recurring market demand.

Spa Centres incorporate nail care services as part of comprehensive beauty and wellness packages. These facilities typically invest in premium nail lamp models with aesthetic designs. Furthermore, spa centers prioritize quiet operation and low-heat technology for enhanced client comfort. Consequently, they drive demand for advanced hybrid and LED nail lamps.

Beauty Salons offer nail services alongside hair and skincare treatments. These multi-service establishments require versatile nail lamp solutions accommodating various service types. Additionally, beauty salons seek space-efficient tabletop models that integrate seamlessly into existing workstations. Therefore, compact yet powerful designs appeal to this sub-segment.

Others in the commercial category include nail art studios, mobile nail services, and beauty training academies. These diverse business models have unique requirements regarding portability, power options, and feature sets. However, they collectively contribute to overall commercial segment growth through specialized product demand.

Residential end use is expanding rapidly due to increasing at-home nail care adoption. Consumers invest in personal nail lamps for convenience and long-term cost savings. Additionally, social media tutorials and DIY nail art trends encourage residential purchases. Consequently, manufacturers are developing user-friendly models specifically designed for home environments.

Distribution Channel Analysis

Offline dominates with 69.9% as consumers prefer hands-on evaluation before purchasing beauty appliances.

In 2025, Offline held a dominant market position in the Distribution Channel Analysis segment of Nail Lamp Market, with a 69.9% share. Physical retail stores including beauty supply shops and department stores facilitate direct product examination. Professional buyers particularly prefer offline channels for evaluating build quality and testing operational features. Moreover, offline retailers provide immediate product availability and after-sales service access.

Online distribution channels are experiencing rapid growth in the nail lamp market. E-commerce platforms offer extensive product variety, competitive pricing, and convenient home delivery options. Additionally, online customer reviews and demonstration videos assist purchase decisions effectively. Therefore, online channels increasingly attract tech-savvy consumers and residential buyers seeking cost-effective solutions.

Key Market Segments

By Product Type

- UV Nail Lamps

- LED Nail Lamps

- Hybrid Nail Lamps

By Installation

- Tabletop

- Handheld

By Operation

- Electric Operated

- Battery Operated

By Power

- Upto 10 watts

- 20-30 watts

- 30-40 watts

- 40-50 watts

- Above 50 watts

By End Use

- Commercial

- Nail Salons

- Spa Centres

- Beauty Salons

- Others

- Residential

By Distribution Channel

- Offline

- Online

Drivers

Rapid Expansion of Professional Nail Salons Drives Market Growth

The proliferation of professional nail salons and home-based nail studios across urban markets significantly propels demand. Consequently, these establishments require multiple nail lamps to serve growing client bases efficiently. Moreover, the trend toward specialized nail art services necessitates advanced curing equipment with superior performance capabilities.

Rising consumer preference for long-lasting gel and shellac nail treatments fundamentally transforms market dynamics. These professional-grade treatments require specialized nail lamps for proper curing and durability. Additionally, consumers appreciate the extended wear time compared to traditional polish, driving repeat salon visits.

Social media platforms substantially influence at-home nail art adoption among younger demographics. Beauty influencers and tutorial content inspire consumers to invest in personal nail care equipment. Furthermore, platforms like Instagram and TikTok showcase nail art possibilities, encouraging equipment purchases for home experimentation.

Growing disposable income levels boost consumer spending on personal grooming devices globally. Middle-class expansion in developing economies creates new market opportunities for nail lamp manufacturers. Therefore, consumers increasingly prioritize self-care investments, including professional-quality nail care equipment for home use.

Restraints

Health Concerns Related to UV Exposure Limit Market Expansion

Persistent health concerns regarding UV exposure and potential skin sensitivity issues restrain market growth. Consumers worry about prolonged ultraviolet radiation effects on skin health and aging. Consequently, some potential buyers hesitate to purchase UV-based nail lamps despite their effectiveness. Moreover, dermatological warnings about UV exposure create negative perception among health-conscious demographics.

The availability of low-quality counterfeit nail lamps in online marketplaces undermines consumer confidence significantly. These substandard products often lack safety certifications and proper quality control measures. Additionally, poor performance from counterfeit devices damages overall market reputation and brand trust. Therefore, legitimate manufacturers face challenges differentiating authentic products from inferior imitations in crowded e-commerce environments.

Regulatory scrutiny regarding UV device safety standards adds compliance costs for manufacturers. Different regions impose varying requirements for product certification and testing procedures. Furthermore, evolving regulations necessitate continuous product modifications and documentation updates. Consequently, smaller manufacturers struggle to maintain compliance while remaining price-competitive in the market.

Growth Factors

Rising Demand for Smart Nail Lamps Accelerates Market Development

Increasing demand for smart nail lamps with timer, sensor, and heat control functions expands market opportunities. These advanced features enhance user experience through automated operation and safety mechanisms. Moreover, smart technology integration appeals to tech-savvy consumers seeking convenient grooming solutions. Consequently, manufacturers prioritize innovation in sensor technology and programmable settings.

Expansion of men’s grooming and nail care segments opens new market avenues previously untapped. Male consumers increasingly embrace personal care routines including professional nail maintenance and manicures. Additionally, changing social attitudes toward male grooming normalize nail care product purchases among men. Therefore, manufacturers develop gender-neutral designs and marketing strategies targeting this emerging demographic.

Increasing e-commerce platform penetration for beauty appliances facilitates wider market reach globally. Online marketplaces enable small manufacturers to access international customers without physical distribution networks. Furthermore, digital marketing and social media advertising reduce customer acquisition costs significantly. Consequently, new brands enter the market more easily, intensifying competition and innovation.

Growing adoption of portable and rechargeable nail lamps addresses travel and mobility requirements effectively. Consumers seek compact solutions for maintaining nail care routines during business trips and vacations. Additionally, mobile nail technicians require lightweight equipment for on-location services. Therefore, battery technology improvements enable longer operational times in portable configurations.

Emerging Trends

Shift Toward LED Nail Lamps Transforms Market Landscape

The accelerating shift toward LED nail lamps with faster curing technology reshapes consumer preferences significantly. LED devices reduce treatment time from minutes to seconds, improving efficiency dramatically. Moreover, LED technology consumes less electricity and generates minimal heat during operation. Consequently, both professional salons and home users increasingly prefer LED over traditional UV lamps.

Growing demand for dual light source UV-LED hybrid nail lamps reflects consumer desire for versatility. These hybrid devices accommodate all gel polish formulations without requiring multiple separate units. Additionally, hybrid lamps provide backup functionality if one light source malfunctions during operation. Therefore, professional salons particularly value hybrid technology for service continuity assurance.

Rising popularity of compact foldable nail lamps addresses space constraints in home environments effectively. These innovative designs feature collapsible structures that minimize storage requirements when not in use. Furthermore, foldable models maintain full functionality despite reduced footprint compared to traditional designs. Consequently, urban apartment dwellers represent a growing target market for portable solutions.

Increasing launch of nail lamps with skin-safe low-heat mode addresses consumer safety concerns proactively. These temperature-controlled devices prevent discomfort during extended curing sessions while maintaining effectiveness. Moreover, low-heat technology particularly appeals to users with sensitive skin or circulation issues. Therefore, manufacturers emphasize thermal management features in product development and marketing communications.

Regional Analysis

North America Dominates the Nail Lamp Market with a Market Share of 37.3%, Valued at USD 254.2 Million

North America holds the dominant position in the global nail lamp market with a 37.3% share, valued at USD 254.2 Million in 2025. The region benefits from high consumer spending on personal grooming and well-established beauty salon infrastructure. Moreover, strong e-commerce adoption facilitates widespread product availability across urban and suburban markets. Additionally, growing awareness about nail health and aesthetics drives consistent demand for professional-grade equipment.

Europe Nail Lamp Market Trends

Europe represents a mature market characterized by premium product preferences and strict safety regulations. Consumers prioritize quality certifications and eco-friendly features when selecting nail care equipment. Furthermore, the region’s fashion-conscious population drives demand for innovative nail art technologies. Consequently, European manufacturers focus on sustainable materials and energy-efficient designs.

Asia Pacific Nail Lamp Market Trends

Asia Pacific demonstrates the fastest growth potential driven by rising disposable incomes and urbanization. Expanding middle-class populations in China, India, and Southeast Asian countries create substantial market opportunities. Moreover, increasing Western beauty trend adoption accelerates nail salon establishment across metropolitan areas. Therefore, both international and local brands compete aggressively for market share.

Latin America Nail Lamp Market Trends

Latin America shows steady growth supported by strong beauty culture and social grooming traditions. Brazilian and Mexican markets lead regional demand due to large urban populations and beauty industry development. Additionally, increasing online retail penetration improves product accessibility in remote areas. However, economic volatility occasionally impacts consumer spending on discretionary beauty products.

Middle East & Africa Nail Lamp Market Trends

Middle East and Africa exhibit emerging market characteristics with concentrated demand in urban centers. GCC countries demonstrate high per-capita spending on luxury beauty services and premium equipment. Furthermore, growing expatriate populations introduce diverse nail care preferences and service expectations. Consequently, market development follows broader beauty industry expansion patterns.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Nail Lamp Company Insights

SunUV maintains a leading position in the professional nail lamp market through continuous innovation. The company specializes in high-wattage LED and UV-LED hybrid lamps designed for salon environments. Moreover, SunUV’s products feature advanced sensor technology and timer functions that enhance operational efficiency. Their extensive distribution network across North America and Asia Pacific ensures strong market presence.

MelodySusie focuses on the residential and semi-professional market segment with user-friendly designs. The company offers competitively priced nail lamps that balance affordability with essential functionality. Additionally, MelodySusie leverages strong e-commerce partnerships to reach home users effectively. Their product portfolio includes portable and rechargeable models that appeal to mobile technicians and travel enthusiasts.

Gelish operates as a premium brand combining professional gel polish systems with compatible curing equipment. The company’s integrated approach ensures optimal performance when using their gel formulations with proprietary lamps. Furthermore, Gelish maintains strong relationships with professional salons through training programs and exclusive product offerings. Their emphasis on product quality and brand reputation supports premium pricing strategies.

Sun5 specializes in compact and affordable LED nail lamps targeting budget-conscious consumers and entry-level professionals. The company’s streamlined product designs prioritize essential features while minimizing manufacturing costs. Additionally, Sun5 benefits from efficient supply chain management in Asian manufacturing hubs. Their competitive pricing strategy enables rapid market penetration in price-sensitive emerging markets.

Key Companies

- SunUV

- MelodySusie

- Gelish

- Sun5

- Beurer

- LKE

- Kiss

- Kiara Sky

- S&L Beauty

- SUNone

Recent Developments

- In May 2024, Glitter Planet announced the Nail Mate Pro+ LED Nail Lamp scheduled for a summer launch. The new model features enhanced sensor technology and faster curing capabilities designed for professional salon applications.

Report Scope

Report Features Description Market Value (2025) USD 687.1 Million Forecast Revenue (2035) USD 1140.7 Million CAGR (2026-2035) 5.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (UV Nail Lamps, LED Nail Lamps, Hybrid Nail Lamps), By Installation (Tabletop, Handheld), By Operation (Electric Operated, Battery Operated), By Power (Upto 10 watts, 20-30 watts, 30-40 watts, 40-50 watts, Above 50 watts), By End Use (Commercial, Residential), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape SunUV, MelodySusie, Gelish, Sun5, Beurer, LKE, Kiss, Kiara Sky, S&L Beauty, SUNone Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SunUV

- MelodySusie

- Gelish

- Sun5

- Beurer

- LKE

- Kiss

- Kiara Sky

- S&L Beauty

- SUNone