Global Music Similarity Search AI Market Size, Share, Industry Analysis Report By Component (Software/Platforms, Services), By Deployment (Cloud-based, On-Premises), By Technology (Deep Learning (Neural Networks), Audio Embedding Models, Self-Supervised Learning, Others), By Application (Streaming Service Recommendation, Music Creation & Production, A&R (Artists & Repertoire), DJ & Music Curation, Copyright & Royalty Analysis, Music Education & Research, Others), By End-User (Music Streaming Platforms, Record Labels, Broadcasters, Independent Artists, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 168046

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics

- Role of Generative AI

- Investment and Business Benefits

- North America Market Size

- Component Analysis

- Deployment Analysis

- Technology Analysis

- Application Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

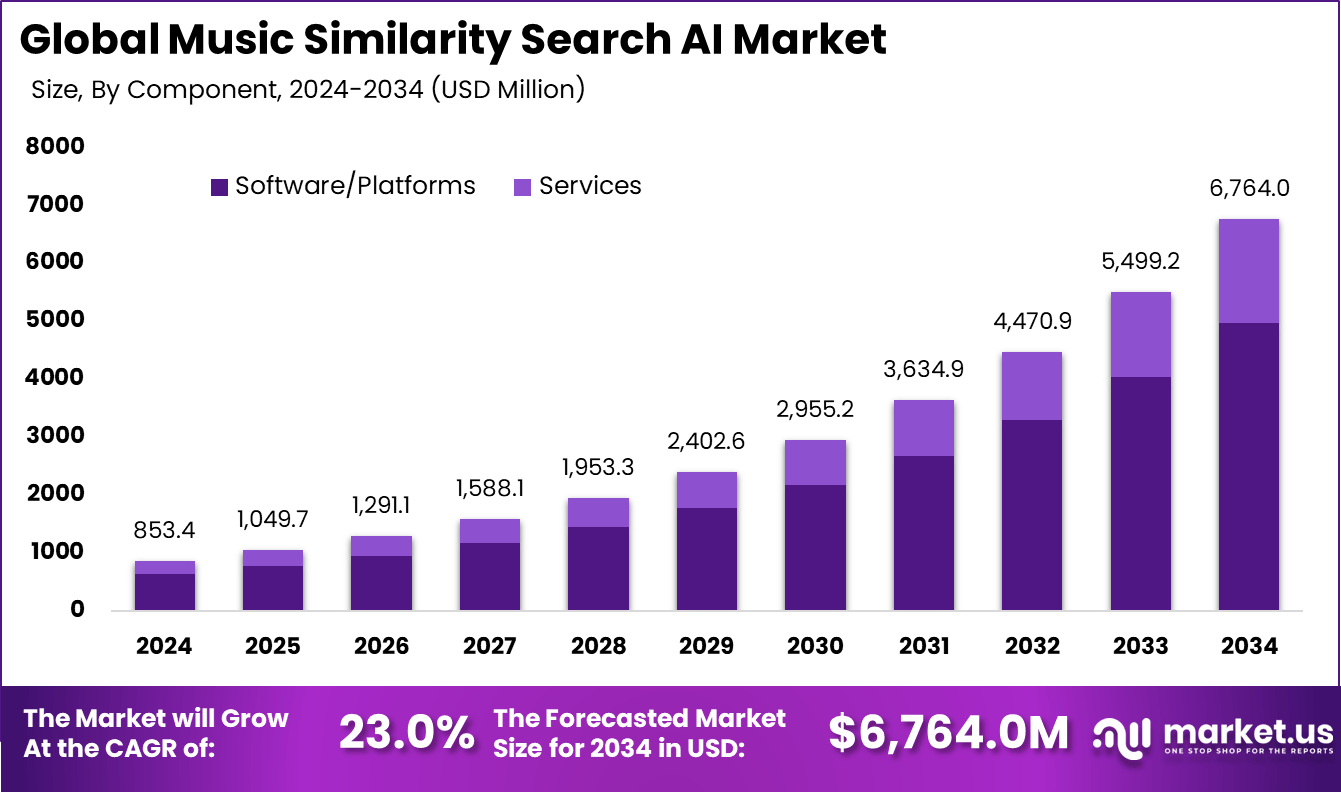

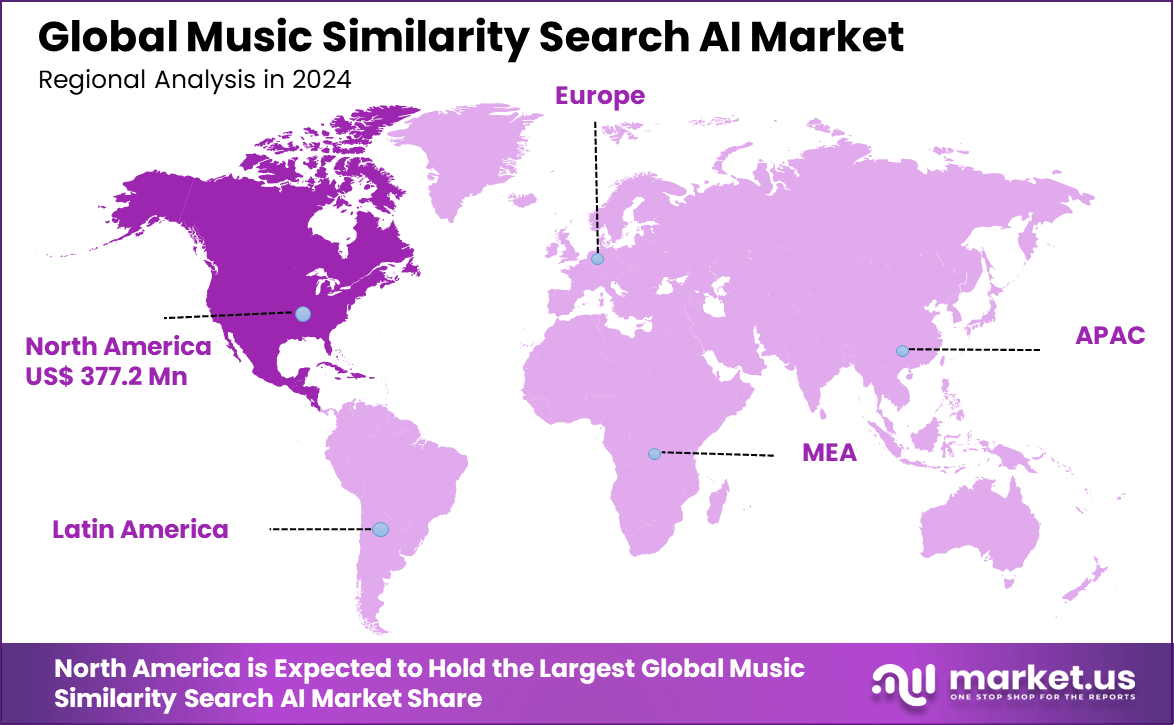

The Global Music Similarity Search AI Market size is expected to be worth around USD 6,764.0 million by 2034, from USD 853.4 million in 2024, growing at a CAGR of 23% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 44.2% share, holding USD 377.2 million in revenue.

The music similarity search AI market has expanded as streaming platforms, music labels and independent creators adopt intelligent systems to identify related tracks, detect patterns and understand musical relationships. Growth reflects rising volumes of digital music, increased need for accurate content discovery and the shift toward AI assisted curation. These systems now support playlist creation, rights management, recommendation engines and creative production workflows.

The growth of the market can be attributed to increasing demand for personalised listening experiences, rising competition among streaming services and the need for efficient catalog management. AI tools help identify rhythm, melody, harmony and timbre similarities across massive music libraries. Broader use of AI in creative industries and improved audio analysis techniques further accelerate adoption.

The rise in demand for faster, precise music discovery is a main driver. Content creators increasingly work on tight deadlines that require quick access to music fitting a particular sound or vibe. Additionally, legal complexities around music licensing encourage finding sound-alike alternatives that are easier to clear. Advances in machine learning models, such as convolutional neural networks and natural language processing for audio data, have dramatically improved the accuracy of similarity measures.

For instance, in October 2025, Musixmatch secured AI licensing deals with major music publishers, including Sony Music Publishing, Universal Music Publishing Group, and Warner Chappell Music, enabling the development of responsibly trained, AI-powered services based on authorized compositions, ensuring rights holder compensation.

Key Takeaway

- The Software and Platforms segment led the market with 73.5%, showing strong reliance on advanced tools that support accurate music discovery.

- The Cloud-based segment reached 90.2%, indicating broad adoption of scalable infrastructures for similarity search functions.

- Deep Learning models held 51.4%, reflecting their central role in improving audio pattern detection and matching.

- The Streaming Service Recommendation category captured 70.6%, driven by the need for precise personalization and user behavior insights.

- Music Streaming Platforms accounted for 80.3%, confirming that intelligent search engines strengthened user engagement and catalog usefulness.

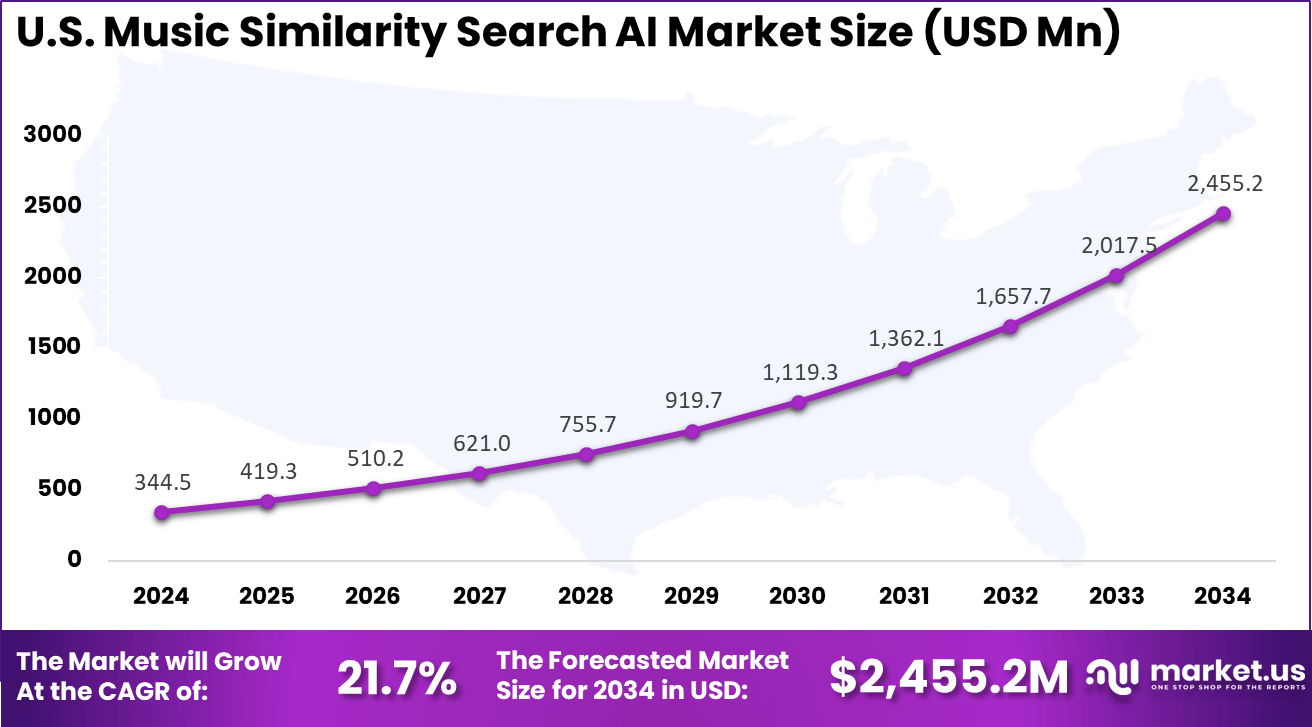

- The market in United States showed strong traction supported by rising adoption of AI-driven music discovery tools.

- North America held more than 44.2%, indicating early technology integration and a mature digital ecosystem across major markets.

Key Statistics

Performance and Accuracy Statistics

- Improved model accuracy: AIMS API reports that its latest AI music search model achieves up to 20% higher accuracy across multiple benchmark tests compared with earlier releases.

- Human evaluation alignment: A 2024 study of more than 1,000 respondents found a strong correlation between tracks rated highly by listeners and higher scores in AI evaluation metrics. Music that humans rated highly was less likely to be identified as AI-generated, confirming the model’s ability to predict human preference.

- Recommendation precision: In a content similarity study, the system identified a track from the same album as the closest match for 46.7% of jazz queries. For classical music, 86% of recommended tracks were considered highly satisfactory in terms of style and period.

- Emotion detection accuracy: AI emotion-classification models reached 70% to 80% accuracy when categorizing music into emotional groups such as cheerful or depressing, and relaxing or exciting.

- Genre classification performance: A recommendation approach using a GS-RNN model achieved 80% accuracy and an 88% F1-score for genre classification tasks.

Technical and Implementation Metrics

- Embedding representation: Audio inputs are transformed into numerical embeddings. Models such as VGGish produce 128-dimensional embeddings for each 0.96-second audio segment.

- Processing efficiency: Large-scale processing is intensive. Generating embeddings for more than 20,000 songs can require one hour or more without optimization.

- Search acceleration: Tools such as FAISS use GPU acceleration to enable fast similarity searches across millions of embeddings, improving system responsiveness.

- User behavior insights: Research by the University of Utrecht shows that 75% of music searches occur when users are in a hurry, emphasizing the need for fast, accurate retrieval systems.

Role of Generative AI

Generative AI has become central to improving music similarity search by analyzing and producing detailed descriptions of songs. It converts musical elements like rhythm, tone, and instrumentation into numerical forms called embeddings. This allows AI to compare tracks based on their actual sound and feel, rather than relying just on tags or user behavior.

Approximately 74% of internet users now depend on AI-powered systems to find new music, highlighting the growing trust and adoption of these technologies in everyday listening experiences. This method improves the accuracy and consistency of music matching, making it easier for users to find songs with similar vibes or moods. Generative AI also supports music creation and personalization on streaming platforms.

It helps recommend songs that fit individual tastes by continuously learning from listener habits. This enhances user engagement and satisfaction, enabling smoother music discovery. Investments in generative AI have surged significantly, with billions being funneled into developing tools for enhanced music production and smarter search capabilities, reflecting widespread confidence in generative AI’s role within the music industry.

Investment and Business Benefits

Investment interest is growing around platforms that enable independent artists and labels to monetize their music directly through AI-powered discovery and licensing tools. Marketplaces integrating similarity search help sync writers’ price and license tracks efficiently across commercial sectors.

Additionally, AI-driven royalty forecasting and music asset valuation models create new fintech opportunities supporting music creators financially. Funds targeting AI in music tech focus on startups that combine music similarity with metadata, licensing automation, and user-friendly search interfaces.

Business benefits include increased catalog revenue from faster and wider music usage licensing. Improved user experience boosts client satisfaction in sync and media production sectors. AI tools help reduce dependence on manual metadata curation, lowering operational costs.

Greater transparency and data-driven insights into music usage patterns assist companies with strategic decision-making and rights management. The ability to handle large, diverse catalogs without compromising search quality opens markets to more niche and independent content providers.

North America Market Size

In 2024, North America held a dominant market position in the Global Music Similarity Search AI Market, capturing more than a 44.2% share, holding USD 377.2 million in revenue. This dominance is due to its advanced technological infrastructure and a large presence of leading AI innovators. The United States acts as a key hub for AI research and development, fostering continuous innovation in music AI technologies.

This region also benefits from strong regulatory support and government initiatives promoting AI adoption in media and entertainment. Further boosting North America’s leadership is the high digital music consumption rate and the concentration of major music streaming platforms and technology firms, which actively invest in AI to improve music discovery and personalization.

For instance, in August 2025, LANDR launched advanced AI-powered mastering and distribution tools that help musicians produce professional-quality tracks and distribute them to over 150 streaming platforms efficiently, enhancing creative workflows with machine learning.

The market for Music Similarity Search AI within the U.S. is growing tremendously and is currently valued at USD 344.5 million, the market has a projected CAGR of 21.7%. The market is growing due to increasing demand for personalized music experiences and enhanced streaming service recommendations.

The growth is fueled by the adoption of advanced AI technologies, particularly deep learning, which enables more accurate and nuanced music matching and discovery. The widespread use of cloud-based platforms supports scalability and efficiency in handling large music catalogs.

For instance, in December 2024, Audible Magic partnered with Music AI to combine advanced stem separation and music identification technologies, improving rights management and content licensing through AI. This collaboration streamlines music identification and usage in media production.

Component Analysis

In 2024, The Software/Platforms segment held a dominant market position, capturing a 73.5% share of the Global Music Similarity Search AI Market. This segment leads because software platforms provide the essential tools needed to analyze extensive audio libraries and extract key musical features.

Innovations within these platforms allow them to deliver fast and accurate similarity search results, making them indispensable for music streaming providers, music supervisors, and playlist curators. The ease with which software solutions can integrate AI-driven music analysis functions is a key advantage in this segment.

These software tools empower music platforms to offer personalized experiences by enabling dynamic playlist creation and providing recommendations tailored to individual listener preferences. Their continuous evolution, supported by advancements in AI algorithms and computing power, ensures they remain the preferred solution for managing and exploring ever-growing music collections.

For Instance, in November 2025, Spotify continued to innovate its software platforms, recently launching new features to enhance personalized music and podcast experiences. These updates improve content discovery and recommendations driven by AI algorithms analyzing music similarity, helping Spotify retain its competitive edge in software solutions for streaming.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 90.2% share of the Global Music Similarity Search AI Market. Cloud services allow music similarity search systems to operate efficiently without the need for expensive hardware investments, facilitating seamless handling of large-scale music data.

The cloud infrastructure supports real-time processing and on-demand access, which is crucial for streaming platforms aiming to provide instant search and recommendation capabilities. Additionally, cloud deployment fosters easy collaboration and integration with other services, benefiting music producers, artists, and data analysts alike.

For instance, In December 2024, Audible Magic partnered with Music AI to improve music recognition and rights management through cloud-based AI tools. The collaboration supports faster content identification and smoother licensing for producers and rights holders. This move reflects the wider use of cloud deployment among major players, as cloud systems offer scalability, easy integration, and more reliable service delivery.

Technology Analysis

In 2024, The Deep Learning (Neural Networks) segment held a dominant market position, capturing a 51.4% share of the Global Music Similarity Search AI Market. These models are prized for their ability to learn complex audio patterns and subtle sonic nuances that traditional methods might miss. Neural networks analyze audio samples to create distinctive musical fingerprints, essential for comparing tracks and making accurate similarity assessments.

This technology advances continuously, adapting to new genres and musical trends and more effectively personalizing music discovery. Its dominance is a testament to how well deep learning handles the complexity and diversity of digital music libraries in producing reliable similarity matches.

For Instance, in October 2025, Musixmatch’s AI innovation agreements emphasize the use of advanced machine learning, including deep learning, to analyze lyrical and musical content comprehensively. Their AI models power metadata enrichment, which is crucial for understanding and matching music similarity at scale. These examples highlight how neural network technology forms the core of music similarity search advances.

Application Analysis

In 2024, The Streaming Service Recommendation segment held a dominant market position, capturing a 70.6% share of the Global Music Similarity Search AI Market. Music streaming platforms rely on these AI systems to recommend songs that fit listeners’ unique tastes, thereby enhancing the user experience and increasing engagement.

Recommendations are based on analyzing similarities in musical features, enabling platforms to suggest tracks that users are likely to enjoy. This application supports deeper personalization, helping listeners uncover new music seamlessly and boosting overall satisfaction. By making discovery more relevant and efficient, the recommendation function also helps streaming platforms attract and retain subscribers.

For Instance, in September 2025, Spotify continues to refine its streaming service recommendation features, improving user engagement through deeper personalization. The platform now relies more on AI similarity algorithms that study listening behavior and audio characteristics to deliver better music discovery experiences.

End-User Analysis

In 2024, The Music Streaming Platforms (DSPs) segment held a dominant market position, capturing an 80.3% share of the Global Music Similarity Search AI Market. These platforms use such AI technology to improve user interfaces with smarter search, discovery, and playlist creation tools. Custom recommendations produced by AI similarity models increase user retention and differentiate streaming services in a crowded market.

The platforms invest heavily in AI to optimize content delivery and personalize music exploration. By integrating sophisticated similarity search tools, DSPs meet growing consumer demands for personalized, efficient, and engaging music experiences.

For Instance, In September 2025, platforms like Spotify expanded their use of music similarity search AI to improve discovery and manage content responsibly. The company emphasized ethical use, artist protection, and transparent algorithms, while new AI monitoring tools were used to flag unauthorized content and strengthen rights management.

Emerging trends

A notable trend in music similarity search is the shift to sound-based matching instead of just genre or popularity. AI looks directly at the audio features, such as tempo and instrumentation, allowing more precise music comparisons. This change has helped reduce music search times by large margins, sometimes over 80%, making it highly efficient for professionals needing quick, accurate matches for licensing or creative projects.

Another growing trend is linking similarity search with marketing and social media promotion. Using AI to find songs similar to popular tracks helps new artists connect with the right audience more effectively. Also, the rise of AI-generated virtual music artists adds a new layer to the music ecosystem. These artists use AI to create and perform music, offering fresh entertainment options while expanding the possibilities for music discovery and creation.

Growth Factors

Continuous improvements in AI technology, especially deep learning, have pushed growth by enabling better identification of music features and more accurate comparisons. Increased funding for AI research, rising about 13% in recent years, has also supported innovations targeted at creative industries. Collaboration between AI developers and musicians has helped develop practical tools that enhance accessibility and acceptance of AI in music production and discovery.

Wider adoption of AI in music streaming services is another significant growth factor. Many platforms integrate AI algorithms to improve user experience by personalizing song recommendations. This not only attracts more users but also keeps them engaged longer. Studies show that over 70% of music industry leaders believe AI will accelerate content creation and listener satisfaction, encouraging further integration and innovation in music similarity search technology.

Key Market Segments

By Component

- Software/Platforms

- Services

- Integration & Deployment Services

- Managed Services & Support

- Consulting Services

By Deployment

- Cloud-based

- On-Premises

By Technology

- Deep Learning (Neural Networks)

- Audio Embedding Models

- Self-Supervised Learning

- Others

By Application

- Streaming Service Recommendation

- Music Creation & Production

- A&R (Artists & Repertoire)

- DJ & Music Curation

- Copyright & Royalty Analysis

- Music Education & Research

- Others

By End-User

- Music Streaming Platforms

- Record Labels

- Broadcasters

- Independent Artists

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Digital Music Consumption

The market is supported by the steady rise in global digital music consumption, which increases the need for accurate and personalized recommendations. Similarity search AI helps platforms understand user preferences more precisely, improving discovery and keeping listeners engaged. This growing demand strengthens repeat usage and supports long term platform loyalty.

Innovation is also advancing through cooperation among AI developers, record labels, and music artists. These collaborations make advanced analytics more accessible, helping both large companies and independent creators optimize releases and understand audience behavior. This wider accessibility expands adoption of similarity search AI across the music ecosystem.

For instance, In September 2025, Spotify advanced its AI recommendation system by analyzing user behavior, cultural patterns, audio features, and lyrics for more precise suggestions. Its AI Playlist Generator feature allows users to create playlists from prompts, improving engagement and supporting higher digital music consumption. These tools strengthen the role of similarity search AI in modern music discovery.

Restraint

Copyright and Intellectual Property Concerns

Copyright and intellectual property concerns remain a major restraint for the Music Similarity Search AI market. Many AI models are trained on large music datasets without explicit consent, creating uncertainty about ownership of AI-derived outputs. This lack of clarity results in legal and ethical risks, slowing adoption as artists and companies remain cautious about royalty distribution and future disputes.

The absence of strong regulatory frameworks adds further hesitation. Artists worry their creations may be used without proper credit, while developers avoid building tools that might expose them to litigation. As a result, market growth progresses more slowly until clearer protections and guidelines are established.

For instance, In November 2025, Musixmatch announced its Music Lens AI agent for early 2026, built on licensed and permission-based datasets to ensure safe music analysis. This focus on ethical data use reflects the broader legal concerns in the industry, reinforcing how copyright uncertainties continue to restrain wider deployment of similarity search AI technologies.

Opportunities

Integration with Emerging Technologies

A strong opportunity for the Music Similarity Search AI market lies in its integration with technologies such as blockchain, augmented reality, and the Internet of Things. Blockchain can support transparent royalty payments by automating compensation based on verified AI analytics, improving fairness for creators. AR and IoT can create new interactive listening environments, allowing similarity search capabilities to power immersive and personalized music experiences across connected devices.

Growth is also supported by the expansion of similarity search AI into gaming, film, advertising, health, and education. These sectors rely on fast and precise music matching for licensing, creative production, and therapeutic or learning applications. Such diversification broadens the market reach and attracts new user groups seeking advanced music identification tools.

For instance, In March 2024, Audible Magic expanded its AI technologies for digital fingerprinting and music cover recognition, including integration with NFT platforms for rights verification. This development demonstrates how blockchain-supported systems can strengthen ownership tracking and royalty transparency, creating new revenue opportunities for creators and platforms through Web 3.0 applications.

Challenges

Data Privacy and Algorithmic Bias

A core challenge in the Music Similarity Search AI market is ensuring data privacy and managing algorithmic bias. AI systems require large amounts of user and music data to function well, but collecting and using this data responsibly while respecting privacy regulations is complex. Mishandling data can lead to breaches of user trust and regulatory penalties.

Additionally, algorithms may unintentionally favor certain genres or artists, skewing results and limiting diversity in recommendations. This bias reduces fairness and can alienate users or creators whose styles are underrepresented. Developers must continuously work to improve algorithms for unbiased and inclusive similarity searches. These technical and ethical challenges must be overcome for sustained market success.

For instance, In September 2025, ACRCloud underscored the challenge of managing data privacy and algorithmic bias while operating one of the largest music fingerprint databases. Its recognition services connect directly to streaming platforms, yet the company must ensure secure data handling and unbiased results across varied music genres. This reflects the broader industry challenge of maintaining responsible data practices and algorithmic fairness in similarity search AI.

Key Players Analysis

One of the leading players in November 2025, SoundHound AI further announced an expanded partnership with Parkopedia to integrate voice-powered parking transactions and other voice commerce services into connected car platforms. This expansion highlights growing AI applications beyond music recognition into broader automated voice services, potentially enhancing the user experience by creating seamless, hands-free interfaces in multiple industries.

Top Key Players in the Market

- Spotify

- Shazam (Apple Inc.)

- SoundHound Inc.

- Musixmatch

- Audible Magic

- Gracenote (Nielsen)

- ACRCloud

- Mubert

- Musimap

- Cyanite

- LANDR

- Amper Music

- Endlesss

- Qloo

- Moodagent

- Sonic Visualiser

- Melodrive

- Audio Analytic

- Superpowered

- Sonible

- Others

Recent Developments

- In January 2025, Apple’s Shazam introduced “Shazam Fast Forward 2025,” a predictive AI feature aiming to forecast trending artists and tracks. The update reflects continued investment in digital fingerprinting and real-time music identification technology, ensuring Shazam remains a key player in music similarity search through advanced AI-driven trend prediction.

- In April 2025, Spotify expanded its AI-generated playlist feature in beta to premium users across 40 new markets, offering personalized playlists driven by AI to enhance music discovery and cater to individual tastes. This move reflects Spotify’s focus on refining music recommendations using AI to maintain user engagement and improve the listening experience consistently.

Report Scope

Report Features Description Market Value (2024) USD 853.4 Mn Forecast Revenue (2034) USD 6,764 Mn CAGR(2025-2034) 23.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platforms, Services), By Deployment (Cloud-based, On-Premises), By Technology (Deep Learning (Neural Networks), Audio Embedding Models, Self-Supervised Learning, Others), By Application (Streaming Service Recommendation, Music Creation & Production, A&R (Artists & Repertoire), DJ & Music Curation, Copyright & Royalty Analysis, Music Education & Research, Others), By End-User (Music Streaming Platforms, Record Labels, Broadcasters, Independent Artists, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Spotify, Shazam (Apple Inc.), SoundHound Inc., Musixmatch, Audible Magic, Gracenote (Nielsen), ACRCloud, Mubert, Musimap, Cyanite, LANDR, Amper Music, Endless, Qloo, Moodagent, Sonic Visualiser, Melodrive, Audio Analytic, Superpowered, Sonible, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Music Similarity Search AI MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Music Similarity Search AI MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Spotify

- Shazam (Apple Inc.)

- SoundHound Inc.

- Musixmatch

- Audible Magic

- Gracenote (Nielsen)

- ACRCloud

- Mubert

- Musimap

- Cyanite

- LANDR

- Amper Music

- Endlesss

- Qloo

- Moodagent

- Sonic Visualiser

- Melodrive

- Audio Analytic

- Superpowered

- Sonible

- Others