Global Mushroom Farm Insurance Market By Coverage Type (Property Insurance, Liability Insurance, Crop Insurance, Equipment Insurance, Business Interruption Insurance, Others), By Provider (Private Insurance Companies, Government Agencies, Others), By Distribution Channel (Direct Sales, Brokers/Agents, Online Platforms, Others), By End-User (Commercial Farms, Small & Medium Farms, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176468

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Premium Statistics

- By Coverage Type

- By Provider

- By Distribution Channel

- By End User

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Regional Analysis

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investment Opportunities

- Key Challenges

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

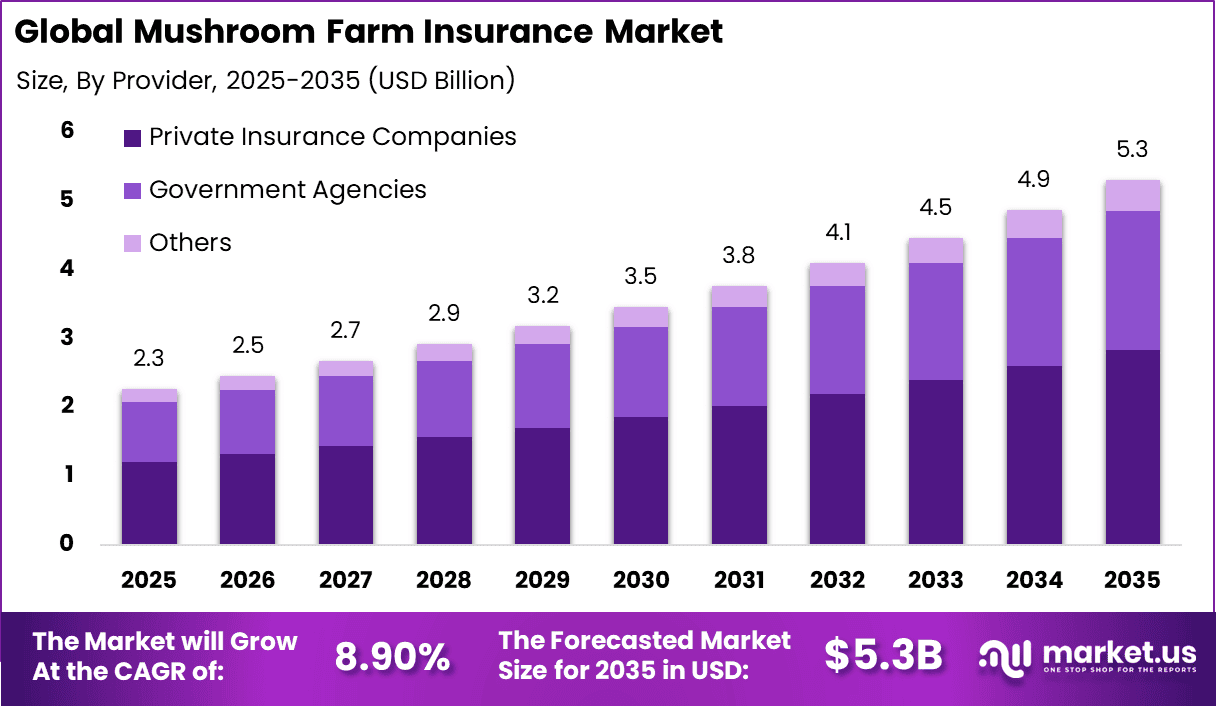

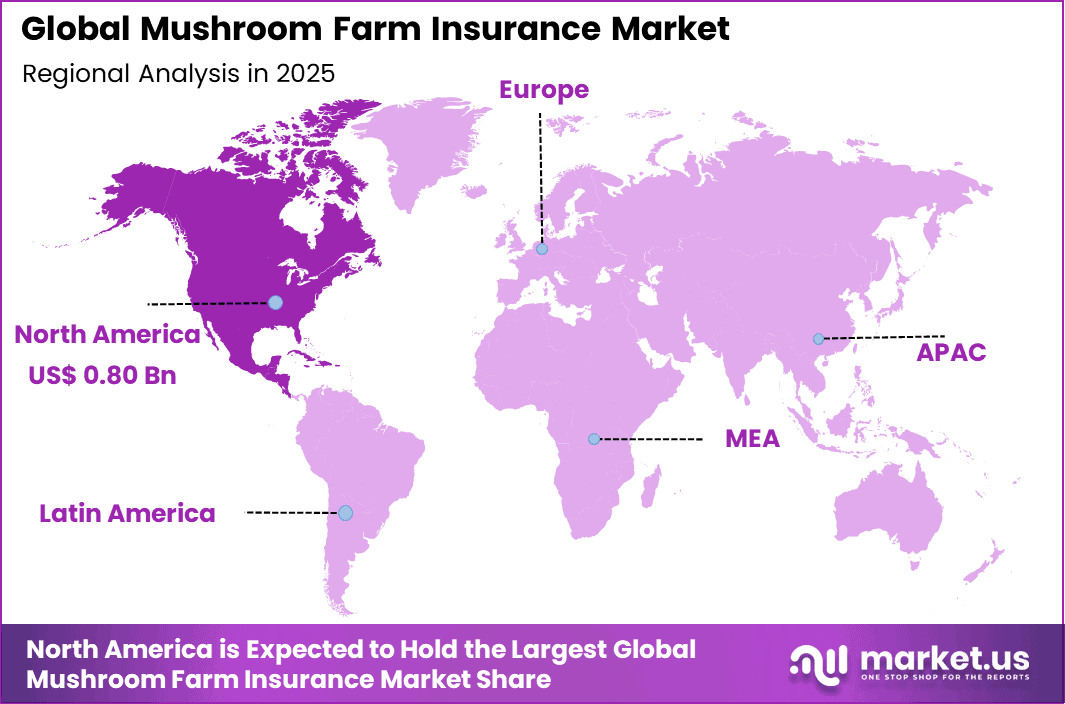

The Global Mushroom Farm Insurance Market generated USD 2.3 billion in 2025 and is predicted to register growth from USD 2.5 billion in 2026 to about USD 5.3 billion by 2035, recording a CAGR of 8.90% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 35.6% share, holding USD 0.80 Billion revenue.

The Mushroom Farm Insurance Market covers insurance solutions designed to protect mushroom cultivation operations against production, property, and income-related risks. Mushroom farming involves controlled indoor environments, specialized infrastructure, and biological inputs that are sensitive to environmental changes. Insurance policies are structured to address risks such as crop loss, equipment failure, contamination, and business interruption.

The market plays an important role in supporting farm stability and financial resilience. Mushroom farms operate with short production cycles and tight margin control, which increases sensitivity to operational disruptions. Even minor failures in climate control or hygiene can lead to total crop loss. Insurance provides a mechanism to manage these uncertainties and protect working capital.

One major driving factor is the increasing commercialization of mushroom farming. Farms are expanding in scale to meet growing demand from food processors, retailers, and export markets. Larger operations involve higher capital investment and greater financial exposure. This drives the need for structured risk protection through insurance.

Demand for mushroom farm insurance is driven by medium and large-scale growers operating climate-controlled facilities. These farms rely on uninterrupted production to meet supply contracts. Insurance helps manage revenue volatility caused by crop failure or equipment breakdown. This makes coverage a key component of farm risk management.

Top Market Takeaways

- By coverage type, property insurance accounts for 37.8% of the market, protecting grow houses, climate systems, and harvesting gear against fire, flooding, or structural failures.

- By provider, private insurance companies represent 53.5% share, offering customizable policies with expertise in agricultural hazards specific to mushroom cultivation.

- By distribution channel, direct sales hold 40.2%, allowing farm operators to secure coverage quickly via insurer portals without brokers, ideal for seasonal needs.

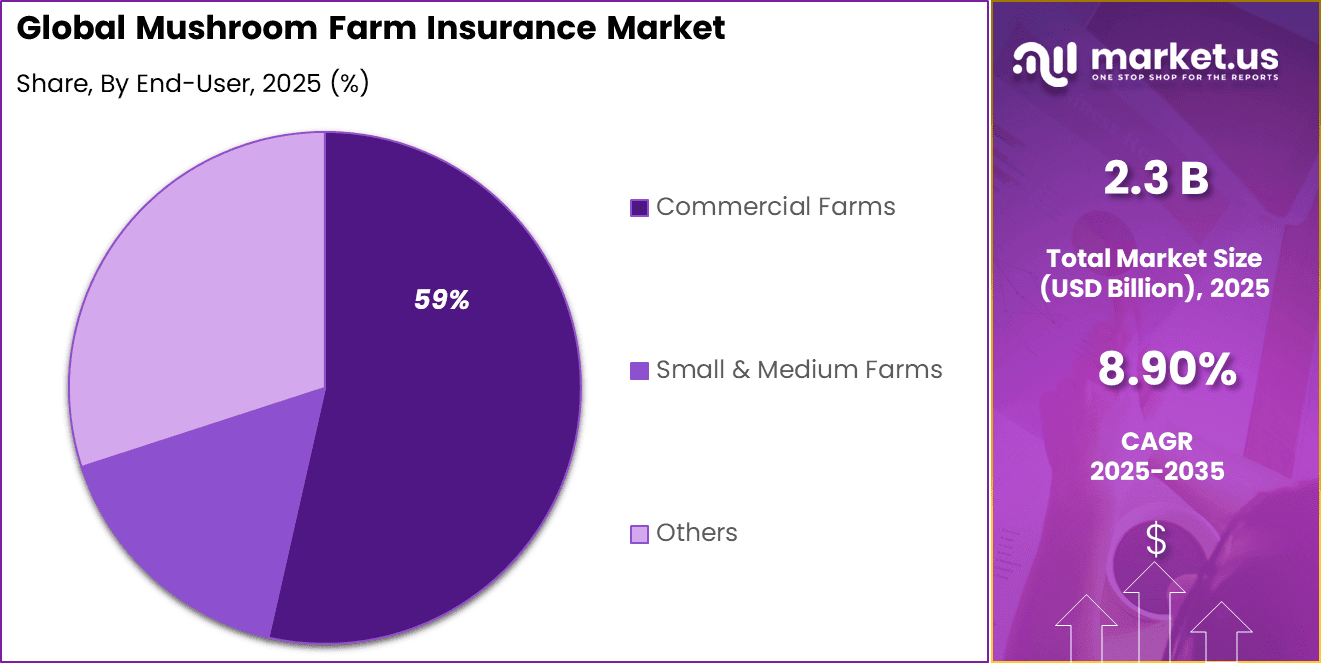

- By end-user, commercial farms capture 58.9% of the market, driven by large-scale operations requiring protection for high-value yields and supply chain disruptions.

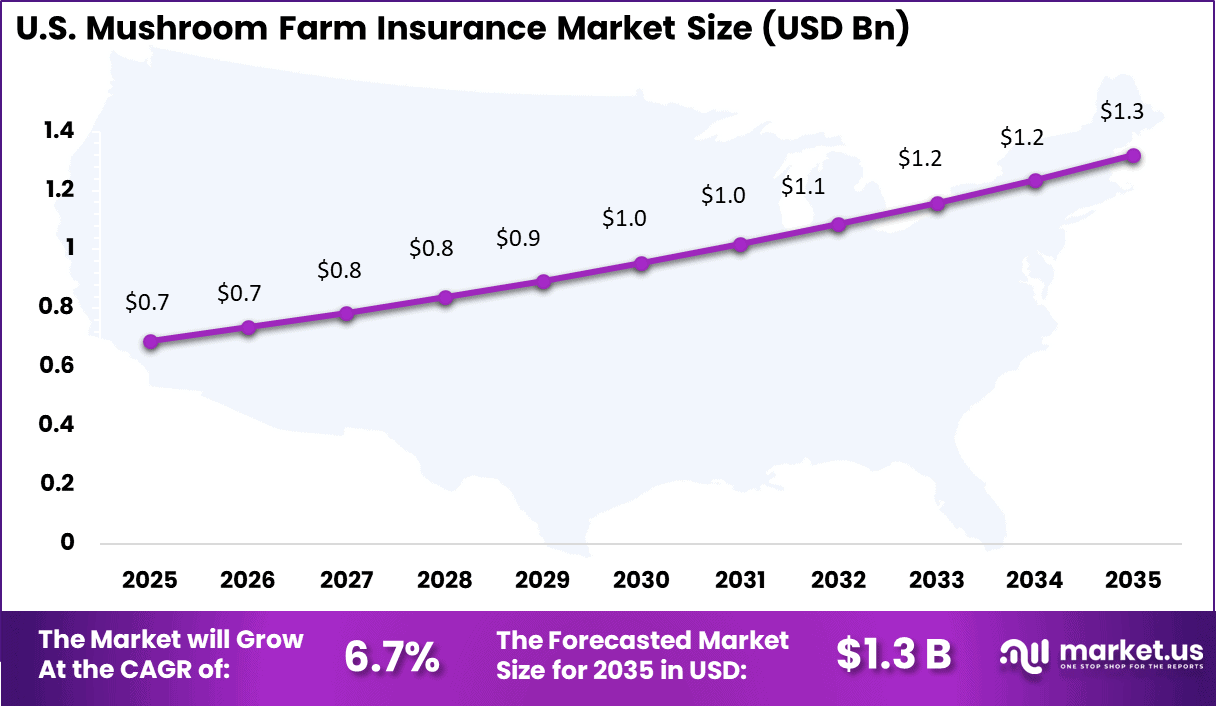

- By region, North America leads with 35.6% of the global market, where the U.S. is valued at USD 0.69 billion with a projected CAGR of 6.7%, fueled by expanding gourmet mushroom demand and climate vulnerability concerns.

Premium Statistics

- According to industry survey, Commercial mushroom farmers report annual savings of USD 300 to USD 800 on insurance premiums by using multiple quote comparison services.

- Insurance and taxes account for around 8.82% of the annual fixed costs of a mushroom processing unit.

- Post harvest losses average 25% due to gaps in cold storage, increasing the importance of spoilage and equipment failure coverage for large commercial operations.

- About 67% of specialty mushroom growers operate diversified farms, enabling mushroom coverage to be bundled under whole farm or multi peril insurance policies.

- Farms with formal scientific training show up to 80% adoption of advanced practices such as sanitation and process control, which lowers operational risk and contributes to reduced insurance premiums.

By Coverage Type

Property insurance accounts for 37.8% of coverage adoption in the mushroom farm insurance market, as physical assets are central to farm operations. Mushroom cultivation depends on climate controlled growing rooms, specialized shelving, and automated humidity systems that are highly sensitive to damage. Protection against fire, water intrusion, and equipment failure is therefore considered essential.

The controlled environment required for mushroom farming increases exposure to localized risks. Even minor disruptions in temperature or moisture can lead to crop loss and facility damage. This risk profile supports steady demand for property focused insurance coverage among operators.

By Provider

Private insurance companies represent 53.5% of provider participation due to their ability to offer customized agricultural policies. These providers often design coverage structures that reflect the unique production cycles and asset intensity of mushroom farms. Flexibility in policy terms is a key factor influencing adoption.

Private insurers also respond faster to emerging risks such as power outages or contamination events. Their underwriting models are better aligned with modern indoor farming practices. This has strengthened their position across both small and large scale mushroom producers.

By Distribution Channel

Direct sales channels hold a 40.2% share, supported by the preference for direct engagement between insurers and farm owners. Mushroom farm operators often seek clear explanations of coverage terms and risk exclusions. Direct sales models allow for detailed risk assessment and tailored policy structuring.

This channel also reduces dependency on intermediaries, which helps control premium costs. Insurers use direct interactions to better understand farm layout, production volume, and technology usage. This improves underwriting accuracy and strengthens long term client relationships.

By End User

Commercial farms account for 58.9% of end user demand, reflecting their larger asset base and higher operational exposure. These farms operate year round and supply retailers, food processors, and export markets. Insurance coverage is therefore treated as a core operational safeguard.

Commercial operators also face stricter compliance and contract requirements. Buyers and partners increasingly expect proof of insurance to manage supply chain risk. This expectation continues to reinforce insurance adoption among commercial mushroom farms.

Emerging Trends Analysis

An emerging trend in the mushroom farm insurance market is the increasing use of predictive analytics and environmental monitoring to inform risk assessment. Data from sensors and climate control systems can provide real time insights into conditions that may lead to crop stress or loss. Insurers are increasingly exploring how these technologies enhance underwriting precision and support loss prevention strategies.

Another trend is collaboration between agricultural extension services, growers’ associations, and insurance providers to build risk awareness. Joint initiatives focused on farm safety practices, contamination control, and quality assurance help create a risk conscious farming community. These collaborations support better risk management behaviour and can lead to higher insurance uptake.

Growth Factors Analysis

One of the key growth factors for the mushroom farm insurance market is the rising global demand for mushrooms as part of plant forward diets. Consumer interest in healthy, sustainable food sources has increased commercial mushroom production, expanding the number of growers and production scale. This expansion creates a broader customer base for insurance solutions.

Another growth factor is increased investment in controlled environment agriculture technologies. As growers adopt advanced climate control systems and automation, the value of insured assets rises. Protecting these higher value operations becomes more important, driving demand for tailored insurance that reflects technological and financial exposures.

Key Market Segments

By Coverage Type

- Property Insurance

- Liability Insurance

- Crop Insurance

- Equipment Insurance

- Business Interruption Insurance

- Others

By Provider

- Private Insurance Companies

- Government Agencies

- Others

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Online Platforms

- Others

By End-User

- Commercial Farms

- Small & Medium Farms

- Others

Regional Analysis

North America accounts for 35.6% of the mushroom farm insurance market, supported by the region’s high concentration of commercial mushroom producers and controlled-environment farming operations. Insurance demand is driven by exposure to crop loss from contamination, humidity and temperature control failures, and facility-related risks within indoor growing units. Coverage adoption is also influenced by lender requirements and the need to protect climate-controlled infrastructure, composting systems, and perishable inventory.

The United States market is valued at USD 0.69 Bn and is growing at a CAGR of 6.7%, reflecting steady expansion in specialty crop farming and food supply chains. Insurance purchasing is shaped by risks linked to disease outbreaks, yield variability, and rising input costs for energy and substrates used in mushroom cultivation. Growth is further supported by increased focus on business continuity, contract farming arrangements, and the need for liability coverage related to food safety and distribution.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising commercial mushroom production and indoor farming +2.7% North America, Europe Medium term Increasing risk exposure to crop contamination and disease +2.1% Global Short to medium term Higher capital investment in climate-controlled grow facilities +1.9% North America, Europe Medium term Growing demand for specialty and organic mushrooms +1.4% North America, Asia Pacific Medium to long term Regulatory and buyer requirements for farm risk coverage +0.8% North America, Europe Long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High premium sensitivity among small and mid-sized farms – 1.9% Global Short to medium term Limited insurance awareness among independent growers – 1.6% Asia Pacific, Latin America Medium term Difficulty in standardizing risk profiles across farm types – 1.3% Global Medium term Informal operations with limited regulatory enforcement – 1.1% Emerging Markets Medium to long term Dependence on manual farming practices in some regions – 0.9% Emerging Markets Long term Investment Opportunities

Investment opportunities in the mushroom farm insurance market are developing as controlled environment farming and specialty crop cultivation continue to expand. Mushroom farms face unique risks related to humidity control, crop contamination, power outages, and short harvest cycles, which increases demand for tailored insurance coverage.

Investors can focus on supporting flexible policies that combine crop protection, equipment coverage, and business interruption support for small and mid scale growers. Digital policy access and advisory services on risk prevention also offer scope for long term engagement as growers seek stable and predictable farm operations.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Agricultural insurance providers High Medium North America, Europe Stable premium growth Large commercial insurers Medium Low to Medium Global Portfolio diversification Cooperative and mutual insurers Medium Medium North America, Europe Strong alignment with growers Private equity firms Medium Medium North America, Europe Niche agri-insurance consolidation Venture capital investors Low High North America Limited to agri-insurtech models Key Challenges

- Limited availability of insurance products designed specifically for indoor and controlled environment mushroom farming

- Difficulty in accurately assessing crop loss risk due to sensitivity to humidity, temperature, and contamination

- High premium concerns among small and family owned mushroom farms

- Limited awareness of risk management practices related to disease control and environmental monitoring

- Variability in local regulations and farm structures, increasing underwriting and compliance complexity

Competitive Analysis

Large commercial and agricultural insurers such as Nationwide Mutual Insurance Company, Zurich Insurance Group, and American International Group play a major role in the mushroom farm insurance market. Their policies typically cover crop loss, property damage, equipment breakdown, and business interruption. These insurers apply risk models suited to controlled-environment agriculture. Strong underwriting experience supports medium and large-scale farms.

Specialty and global insurers including AXA XL, Chubb Limited, and Allianz SE focus on customized coverage for intensive farming operations. Tokio Marine HCC and QBE Insurance Group support farms with higher operational and export exposure. These players emphasize risk prevention, loss control, and tailored policy limits. Adoption is supported by rising investment in commercial mushroom cultivation and food supply contracts.

Regional and agriculture-focused insurers such as Agricultural Insurance Company of India Limited, ICICI Lombard General Insurance, and China United Property Insurance address local farming needs. Farmers Mutual Hail Insurance Company of Iowa, Great American Insurance Group, MAPFRE S.A., and RSA Insurance Group expand regional coverage. Munich Re Group supports risk capacity. Other insurers enhance competition and customization.

Top Key Players in the Market

- Nationwide Mutual Insurance Company

- Zurich Insurance Group

- American International Group (AIG)

- AXA XL

- Chubb Limited

- Allianz SE

- Tokio Marine HCC

- QBE Insurance Group

- The Hartford Financial Services Group

- Liberty Mutual Insurance

- Aviva plc

- Sompo International

- Munich Re Group

- Agricultural Insurance Company of India Limited (AIC)

- ICICI Lombard General Insurance

- China United Property Insurance

- Farmers Mutual Hail Insurance Company of Iowa

- Great American Insurance Group

- MAPFRE S.A.

- RSA Insurance Group

- Others

Future Outlook

The Mushroom Farm Insurance Market indicates steady growth as commercial and small-scale mushroom farms increase globally. Demand for specialized insurance is expected to rise because producers need protection against crop loss, contamination, equipment damage, and business interruption risks. New product offerings tailored to biological risk factors and climate impacts are likely to enter the market.

As regulatory standards and quality certifications advance, farms will increasingly adopt insurance to support financial resilience. Overall, growth can be attributed to expanding production, higher risk awareness, and the need for comprehensive coverage in a competitive agricultural sector.

Recent Developments

- June, 2025: Nationwide Mutual wrapped up its $1.25 billion buy of Allstate’s Employer Stop Loss business, freeing resources to push deeper into ag claims amid rising storm costs hitting farms harder.

- October, 2025: Chubb posted strong Q3 growth in P&C premiums at 5.3%, with agribusiness lines like their rural property coverage gaining traction as mushroom ops scale up.

Report Scope

Report Features Description Market Value (2025) USD 2.3 Billion Forecast Revenue (2035) USD 5.3 Billion CAGR(2025-2035) 8.90% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Property Insurance, Liability Insurance, Crop Insurance, Equipment Insurance, Business Interruption Insurance, Others), By Provider (Private Insurance Companies, Government Agencies, Others), By Distribution Channel (Direct Sales, Brokers/Agents, Online Platforms, Others), By End-User (Commercial Farms, Small & Medium Farms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nationwide Mutual Insurance Company, Zurich Insurance Group, American International Group (AIG), AXA XL, Chubb Limited, Allianz SE, Tokio Marine HCC, QBE Insurance Group, The Hartford Financial Services Group, Liberty Mutual Insurance, Aviva plc, Sompo International, Munich Re Group, Agricultural Insurance Company of India Limited (AIC), ICICI Lombard General Insurance, China United Property Insurance, Farmers Mutual Hail Insurance Company of Iowa, Great American Insurance Group, MAPFRE S.A., RSA Insurance Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mushroom Farm Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Mushroom Farm Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Nationwide Mutual Insurance Company

- Zurich Insurance Group

- American International Group (AIG)

- AXA XL

- Chubb Limited

- Allianz SE

- Tokio Marine HCC

- QBE Insurance Group

- The Hartford Financial Services Group

- Liberty Mutual Insurance

- Aviva plc

- Sompo International

- Munich Re Group

- Agricultural Insurance Company of India Limited (AIC)

- ICICI Lombard General Insurance

- China United Property Insurance

- Farmers Mutual Hail Insurance Company of Iowa

- Great American Insurance Group

- MAPFRE S.A.

- RSA Insurance Group

- Others