Global Movies and Entertainment Market By Type (Movies, Music & Videos), By Mode of Watching (Theaters, OTT Platforms), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 58530

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

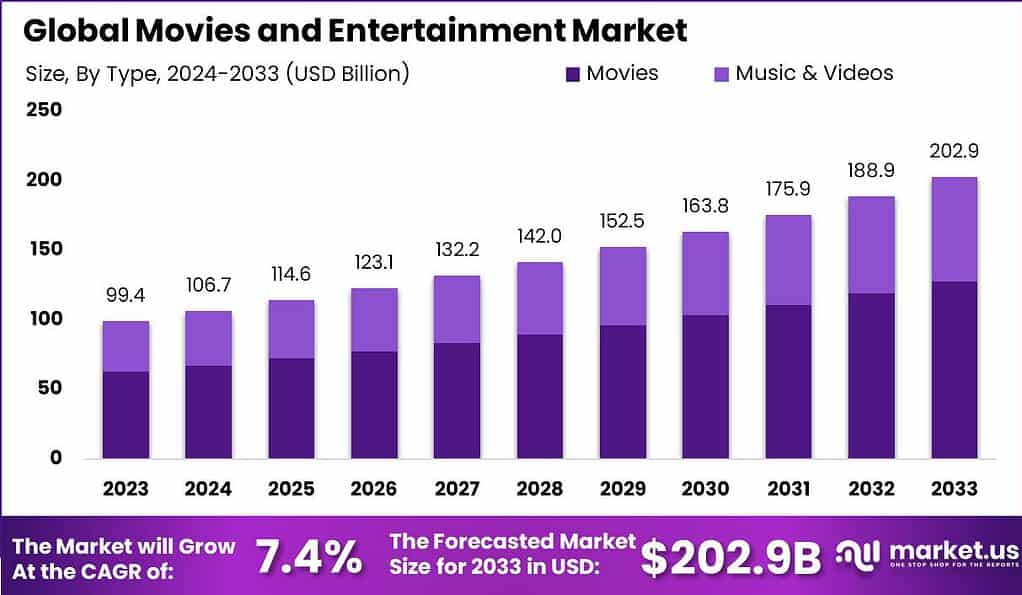

The Global Movies and Entertainment Market size is expected to be worth around USD 202.9 Billion By 2033, from USD 99.4 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

Movies and entertainment encompass a broad spectrum of activities that include film production, television shows, live performances, and online streaming content. This sector is pivotal in shaping cultural narratives and providing leisure activities worldwide. It not only offers escapism and entertainment but also serves as a platform for storytelling, cultural expression, and innovation. The industry employs millions globally, ranging from actors and directors to behind-the-scenes technicians, reflecting its extensive influence and economic significance.

The movies and entertainment market is a dynamic segment within the broader media and entertainment industry, characterized by rapid technological advancements and shifting consumer behaviors. It is heavily influenced by digital transformation, which has led to the emergence of streaming platforms that compete with traditional media like cinema and television. The market’s growth is fueled by global investments in content creation, distribution strategies, and technological enhancements that aim to improve accessibility and viewer engagement.

Several key factors contribute to the growth of the movies and entertainment sector. The advent of high-speed internet and the widespread adoption of smart devices have made digital streaming a predominant form of media consumption. Moreover, the integration of advanced technologies like artificial intelligence for personalized recommendations and virtual reality for immersive experiences is enhancing user engagement. Additionally, strategic partnerships between content creators and distribution platforms are expanding market reach and accessibility, further stimulating sector expansion.

There is a growing demand for high-quality, culturally diverse, and niche content, providing opportunities for both mainstream and independent filmmakers. Emerging markets, particularly in Asia and Africa, present vast potential due to their expanding middle classes and increasing digital penetration. Furthermore, the industry is exploring innovative revenue models, such as hybrid release strategies, which involve simultaneous releases in theaters and on digital platforms, catering to varied consumer preferences and maximizing revenue streams.

For instance, In 2024, the global box office is anticipated to generate approximately $528 million in gross revenue, with prominent releases such as “Wonka” contributing significantly, having already amassed around $64 million. Within the Indian context, the Media & Entertainment (M&E) sector is poised for significant expansion, with growth projected at 10.2%, escalating the sector’s valuation to Rs. 2.55 trillion (US$ 30.8 billion) by 2024, and continuing at a 10% compound annual growth rate (CAGR) to reach Rs. 3.08 trillion (US$ 37.2 billion) by 2026, according to IBEF.

Advertising revenue within India is also expected to surge, reaching Rs. 330 billion (US$ 3.98 billion) by 2024. In 2023, traditional media maintained a 57% share of the total media and entertainment sector revenues. In the United States, the Media and Entertainment industry significantly contributes 6.9% to the total U.S. GDP, employing 1.4 million Americans as of 2022.

The sector’s market size stands at $717 billion, with an anticipated CAGR of 8.9% through 2030. Meanwhile, the Indian print media industry is forecasted by ICRA to experience a revenue growth of 8-10% in FY24, while the broader entertainment and media industry is expected to grow annually by 9.7%, reaching US$ 73.6 billion by 2027.

Regarding digital streaming, the revenue from subscriptions for over-the-top (OTT) video platforms in India was approximately US$ 0.88 billion in 2023, with projections to rise to over US$ 1.2 billion by 2026. Further, according to Media Partners Asia’s report, India’s video market, encompassing TV and digital, is estimated to grow from $13 billion in 2023 to $17 billion by 2028, highlighting the increasing consumer demand and technological integration within the sector.

Key Takeaways

- The global movies and entertainment market is projected to attain a value of approximately USD 202.9 billion by 2033, up from USD 99.4 billion in 2023, reflecting a compound annual growth rate (CAGR) of 7.4% over the forecast period from 2024 to 2033.

- In 2023, the Movies segment occupied a prominent position within the market, securing over 63.1% of the total market share in the movies and entertainment sector.

- Similarly, the OTT Platforms segment commanded a significant market share, accounting for over 69.5% of the industry in 2023.

- In the regional context, North America maintained a leading stance in the movies and entertainment market, holding more than 34.7% of the market with revenues approximating USD 34.4 billion in 2023.

Type Analysis

In 2023, the Movies segment held a dominant market position, capturing more than a 63.1% share of the overall Movies and Entertainment market. This segment’s leadership can be primarily attributed to the increasing global demand for cinematic entertainment, driven by a resurgence in movie theater attendances and the expansion of streaming platforms.

As digital technology continues to evolve, the quality and accessibility of movie productions have significantly improved, appealing to a broader audience worldwide. Moreover, the rise of diverse storytelling and international cinema has contributed to a more engaged global audience, further solidifying the position of movies as a leading entertainment choice.

The robust growth of the Movies segment is also bolstered by significant investments in original content by major streaming services, coupled with strategic partnerships with production houses to secure exclusive rights. These platforms are expanding their libraries with a mix of genres, languages, and culturally specific content, making movies more accessible to viewers at home, thereby increasing consumption rates.

The convenience of on-demand movie viewing has effectively captured the interests of a wide demographic, from young adults to older generations, ensuring a steady revenue stream through subscriptions and pay-per-view services. Furthermore, the global film industry’s adaptability in response to consumer preferences has been pivotal in maintaining the Movies segment’s market supremacy.

Innovations such as enhanced CGI technologies and the introduction of immersive viewing experiences in theaters, like IMAX and 4DX, have revitalized the traditional movie-going experience. Additionally, film festivals and awards continue to play a critical role in the promotion and recognition of films, influencing viewer choices and driving higher box office revenues. Collectively, these factors ensure that the Movies segment remains at the forefront of the entertainment industry.

Mode of Watching Analysis

In 2023, the OTT Platforms segment held a dominant market position, capturing more than a 69.5% share of the overall Movies and Entertainment market. This substantial market share is largely due to the convenience and flexibility offered by OTT services, which allow consumers to access a vast array of content anytime and anywhere.

The global shift towards digital consumption has been accelerated by improvements in internet infrastructure and the proliferation of smart devices, making it easier for users to stream their favorite shows and movies on their preferred devices. Additionally, the pandemic significantly altered viewing habits, with more people opting for home entertainment, a trend that has continued to favor the growth of OTT platforms.

Another critical factor contributing to the dominance of OTT platforms is their aggressive content strategy. These platforms invest heavily in original content, catering to diverse tastes and preferences, which helps attract a broad spectrum of audiences. Exclusive releases, original series, and films that cater to niche interests or regional tastes have particularly strengthened viewer loyalty and platform subscriptions.

Furthermore, OTT platforms frequently update their content libraries, ensuring they offer something new and engaging to keep their audience interested and subscribed. Moreover, the competitive pricing and customizable subscription models of OTT platforms greatly enhance their appeal compared to traditional movie theaters. Many consumers find the subscription fees for OTT services more economical, especially when considering the rising costs of theater tickets and concessions.

Additionally, the ability to share accounts among multiple users and access multiple screens simultaneously provides added value that theaters cannot match. These pricing strategies, combined with the enhanced comfort and privacy of watching from home, have positioned OTT platforms as the leading segment in the Movies and Entertainment market.

Key Market Segments

By Type

- Movies

- Music & Videos

By Mode of Watching

- OTT Platforms

- Theaters

Driver

Increasing Global Demand and Technological Advancements

The Movies and Entertainment market is experiencing substantial growth, largely driven by increased global demand for various forms of movies and entertainment shows. Technological advancements have made movies and programs more accessible than ever before.

With the widespread adoption of smart devices, audiences can enjoy content on-the-go, which has expanded viewership beyond traditional settings like theaters. This digital shift is propelled by a growing consumer segment eager for diverse and continuous content, highlighting the evolving dynamics in how media is consumed.

Restraint

High Competition and Consumer Fragmentation

One of the major restraints in the Movies and Entertainment market is the intense competition within the industry. This sector is not only vast but also highly subjective, making it challenging for producers to meet the varied tastes of the global audience simultaneously. Economic and social dynamics within different regions further influence the performance and reception of entertainment offerings, posing significant challenges in consistently capturing audience interest across diverse demographics.

Opportunity

Surge in Demand for Original Content

There’s a significant opportunity in the creation and promotion of original content. As the market becomes increasingly saturated, consumers show a strong preference for unique and authentic content, which is evident from the success of programs like “Squid Games” on platforms like Netflix. This trend towards originality offers a lucrative avenue for creators to engage with audiences seeking fresh and innovative content, potentially leading to higher revenue streams and strengthened viewer loyalty.

Challenge

Rapidly Changing Consumer Preferences

The Movies and Entertainment sector faces the challenge of rapidly changing consumer preferences, particularly in a digital age where access to a vast array of content has empowered viewers to be more selective. This shift demands that producers and distributors continuously adapt and innovate to capture and maintain audience interest. The industry must balance between trend-following and trend-setting to navigate this dynamic landscape effectively, making it crucial for market players to remain agile and responsive to consumer demands.

Growth Factors

The Movies and Entertainment market is poised for robust growth, fueled by several key factors. One significant driver is the global increase in disposable incomes, which allows more spending on leisure and entertainment, a trend particularly strong in emerging markets. The rise of digital and streaming platforms has also catalyzed this growth by making movies and music more accessible to a wider audience, thereby expanding the consumer base significantly.

Technological advancements, such as high-quality digital effects and 3D cinema, have revolutionized the viewing experience, attracting larger audiences and driving revenue growth. This trend is complemented by the growing global demand for diverse and engaging content across various genres and formats

Emerging Trends

Emerging trends in the Movies and Entertainment industry reflect the dynamic changes in how content is consumed and distributed. The integration of artificial intelligence and machine learning in content recommendation engines enhances viewer engagement by providing personalized content suggestions, which increases platform stickiness and viewer retention rates.

Moreover, the rise of original content production by streaming services, like Netflix and Amazon Prime, is reshaping the competitive landscape, as these platforms not only distribute but also produce content that caters to a global audience.

Another notable trend is the increasing popularity of immersive viewing experiences through virtual reality (VR), which offers new ways for audiences to experience content, promising a new growth avenue for the industry. Additionally, the adoption of dynamic pricing models in movie theaters and on digital platforms is becoming more common, providing flexibility and maximizing revenue opportunities.

Regional Analysis

In 2023, North America held a dominant market position in the movies and entertainment sector, capturing more than a 34.7% share with revenues reaching approximately USD 34.4 billion. This substantial market share can be attributed to several pivotal factors including advanced technological infrastructure, high consumer spending on entertainment, and the presence of major Hollywood studios, which continue to dominate global cinema.

The region’s robust digital infrastructure supports widespread distribution platforms, from streaming services to traditional cinema, enhancing accessibility and consumption of entertainment content. The growth in North America is also bolstered by the rapid adoption of various formats of entertainment ranging from digital streaming to live experiences, which attract a diverse audience.

The integration of virtual reality (VR) and augmented reality (AR) in entertainment is also more pronounced in this region, offering immersive experiences that are drawing more users. For instance, the proliferation of VR theme parks and AR games in the United States and Canada presents novel entertainment avenues that contribute significantly to the revenue streams in this sector.

Furthermore, North America benefits from substantial investments in content creation, characterized by high-budget films, exclusive streaming content, and extensive marketing campaigns. This investment is driven by intense competition among giants like Netflix, Disney, and Amazon, pushing the boundaries of content and distribution strategies. Additionally, the U.S. box office often sets global trends, influencing movie production and consumption worldwide, which in turn perpetuates the region’s leading position in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The movies and entertainment market is intensely competitive, with major players continuously strategizing through acquisitions, product launches, and mergers to enhance their market presence. Key players include industry giants such as Walt Disney Company, Warner Bros. Discovery, Inc., and Netflix, Inc., among others such as Amazon Prime Video, Comcast Corporation, and Sony Pictures Entertainment.

Walt Disney Company has consistently expanded its footprint through strategic acquisitions, notably its purchase of 21st Century Fox, which significantly broadened its library of content and distribution capabilities. This move has allowed Disney to leverage vast new content across its multiple streaming platforms, including Disney+.

Warner Bros. Discovery, Inc., formed by the merger of WarnerMedia and Discovery, Inc., represents a landmark fusion that combines extensive networks, production assets, and a rich portfolio of streaming services. This merger aims to enhance direct-to-consumer offerings and is poised to reshape the competitive dynamics of the global entertainment industry.

Netflix, Inc., remains a leader in innovation within the market, constantly launching new products and features. Recent initiatives include exploring gaming as a new content category, reflecting its commitment to diversify entertainment offerings and increase subscriber engagement through interactive experiences.

Top Key Players in the Market

- Walt Disney Company

- Warner Bros. Discovery, Inc.

- Netflix, Inc.

- Amazon Prime Video

- Comcast Corporation

- Sony Pictures Entertainment

- Paramount Global

- Apple Inc.

- Alibaba Pictures Group

- Vivendi

- Other Key Players

Recent Developments

- November 2023: Disney acquired Comcast’s remaining stake in Hulu for approximately $8.6 billion. This move gave Disney full ownership of Hulu, solidifying its position in the streaming market as it continues to integrate Hulu’s content with Disney+.

- June 2023: Warner Bros. Discovery launched “Max,” a rebranded and enhanced streaming service that combined content from HBO Max and Discovery+. This was part of their strategy to consolidate their streaming offerings under one roof to better compete with rivals like Netflix and Disney.

Report Scope

Report Features Description Market Value (2023) USD 99.4 Bn Forecast Revenue (2033) USD 202.9 Bn CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Movies, Music & Videos), By Mode of Watching (Theaters, OTT Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Walt Disney Company, Warner Bros. Discovery Inc., Netflix Inc., Amazon Prime Video, Comcast Corporation, Sony Pictures Entertainment, Paramount Global, Apple Inc., Alibaba Pictures Group, Vivendi, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Movies and Entertainment Market?The Movies and Entertainment Market encompasses the production, distribution, and exhibition of films, television shows, and related content. It includes various forms of entertainment, such as cinema, streaming services, music, and digital media.

How big is Movies and Entertainment Market?The Global Movies and Entertainment Market size is expected to be worth around USD 202.9 Billion By 2033, from USD 99.4 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

What are the major trends in the Movies and Entertainment Market?Key trends include the rise of streaming services, the growing importance of global box office revenues, increased investment in original content, the integration of AI and data analytics for content recommendation, and the expansion of virtual and augmented reality experiences in entertainment.

What are the challenges faced by the Movies and Entertainment Market?Key challenges include piracy, increasing production costs, the need to constantly innovate in content creation, competition among streaming platforms, and the balancing act between theatrical releases and digital distribution.

What are the key factors driving the growth of the Movies and Entertainment Market?Key factors include the increasing demand for digital content, the growth of streaming platforms, the rising popularity of global and regional content, advancements in technology (e.g., AR/VR in entertainment), and the impact of social media on content consumption and marketing.

Movies and Entertainment MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample

Movies and Entertainment MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Walt Disney Company

- Warner Bros. Discovery, Inc.

- Netflix, Inc.

- Amazon Prime Video

- Comcast Corporation

- Sony Pictures Entertainment

- Paramount Global

- Apple Inc.

- Alibaba Pictures Group

- Vivendi

- Other Key Players