Global Mobile Wallet Tokenization Market By Tokenization Type (Payment Tokenization,Credential Tokenization) By Deployment (Cloud-based,On-Premises) By Application (In-Store Payments,In-App & E-Commerce Payments,Peer-to-Peer Transfers) By End-User (BFSI,Retail & E-Commerce,Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 169147

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Statistics

- By Tokenization Type

- By Deployment

- By Application

- By End-User

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

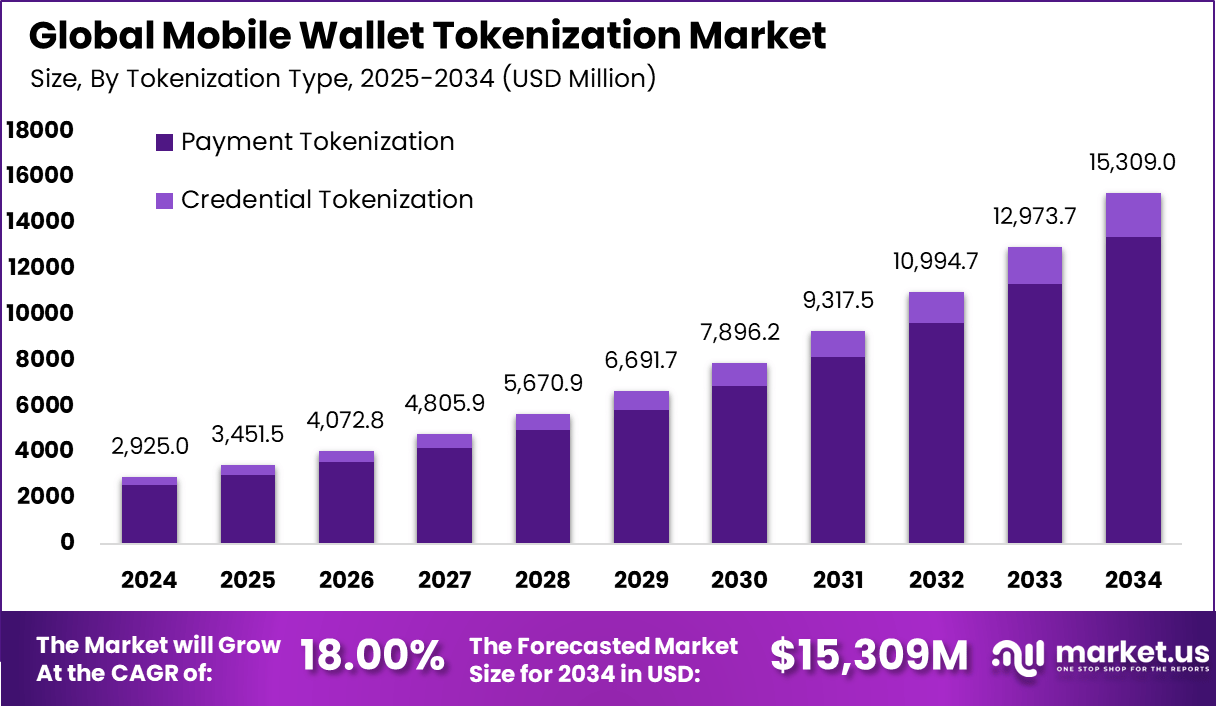

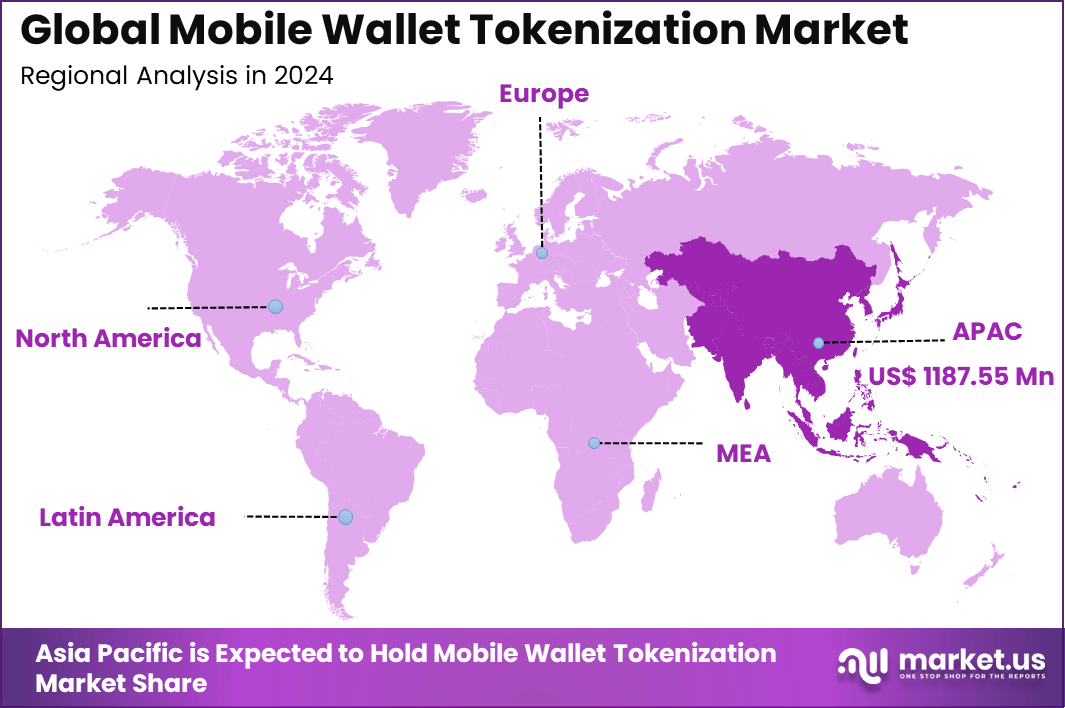

The Global Mobile Wallet Tokenization Market generated USD 2,925.0 million in 2024 and is predicted to register growth from USD 3,451.5 million in 2025 to about USD 15,309.0 million by 2034, recording a CAGR of 18% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 38.7% share, holding USD 1,187.55 Million revenue.

The mobile wallet tokenization market has expanded as consumers increasingly use smartphones for payments, transfers and digital commerce. Growth reflects rising adoption of mobile wallets, greater demand for secure transactions and stronger expectations for privacy protection. Tokenization replaces sensitive card numbers with unique digital tokens, allowing mobile wallets to process payments without exposing actual financial data.

The growth of the market can be attributed to increasing mobile payment activity, rising fraud attempts and wider regulatory pressure for stronger security controls. Merchants and financial institutions adopt tokenization to reduce data breach risk, while consumers seek safer ways to transact across apps and contactless channels. Expansion of digital ecosystems and embedded payments further boosts tokenization demand.

Demand is rising across e commerce platforms, retail stores, transport networks, digital banking apps and peer to peer payment services. Consumers use mobile wallets for everyday spending, subscriptions and online checkouts. Businesses adopt tokenization to secure stored payment credentials and improve conversion during checkout. Markets with high smartphone penetration and strong digital payment culture show particularly strong uptake.

Top Market Takeaways

- By tokenization type, payment tokenization dominates with 87.6% share, replacing sensitive card data with secure tokens to protect transactions in mobile wallets and digital payment platforms.

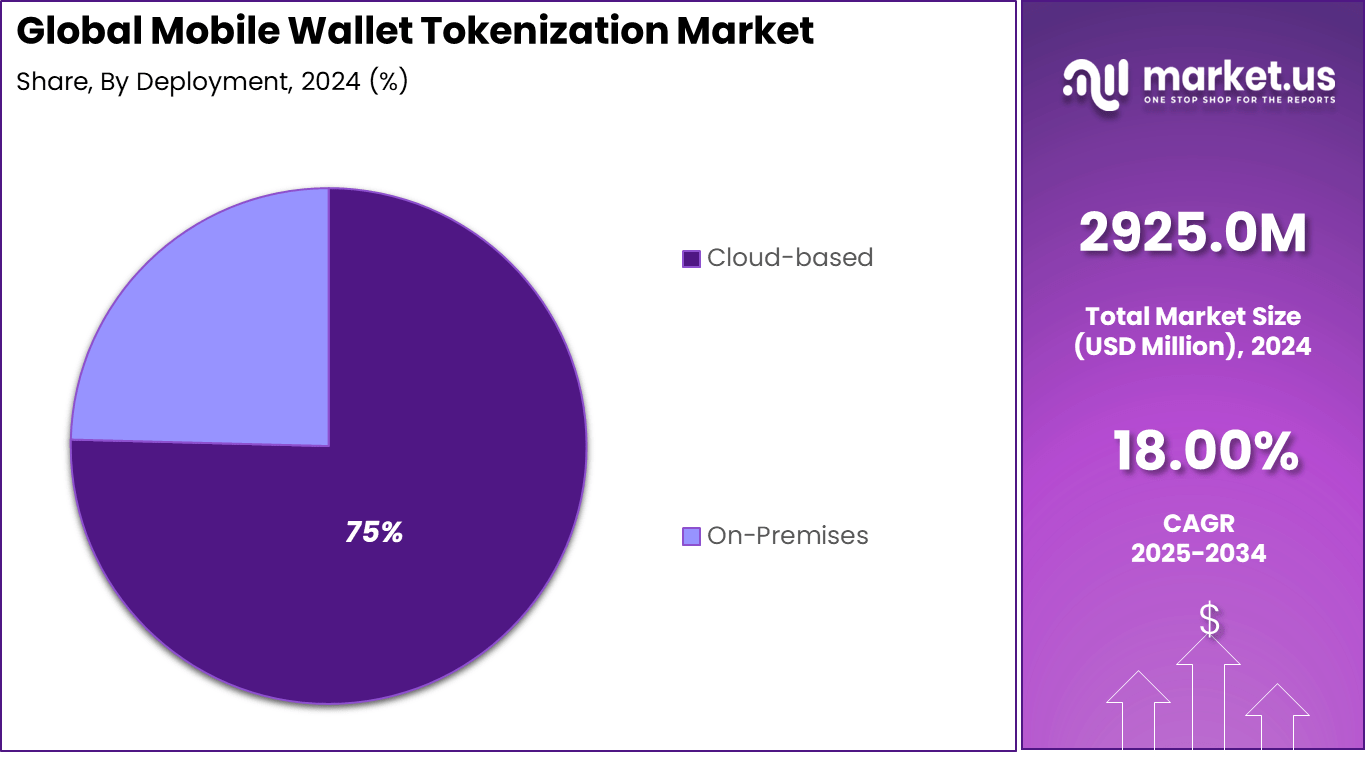

- By deployment, cloud-based solutions hold 75.4% share, favored for scalability, cost-efficiency, and centralized management, making them ideal for high-volume transaction environments.

- By application, in-app and e-commerce payments lead with 53.8% share, driven by the surge in mobile commerce, seamless checkout experiences, and demand for secure digital transactions.

- By end-user, BFSI accounts for 61.5% share, as banks and financial institutions leverage tokenization to secure card-on-file transactions, reduce fraud, and comply with data protection regulations.

- Regionally, Asia Pacific commands about 40.6% market share.

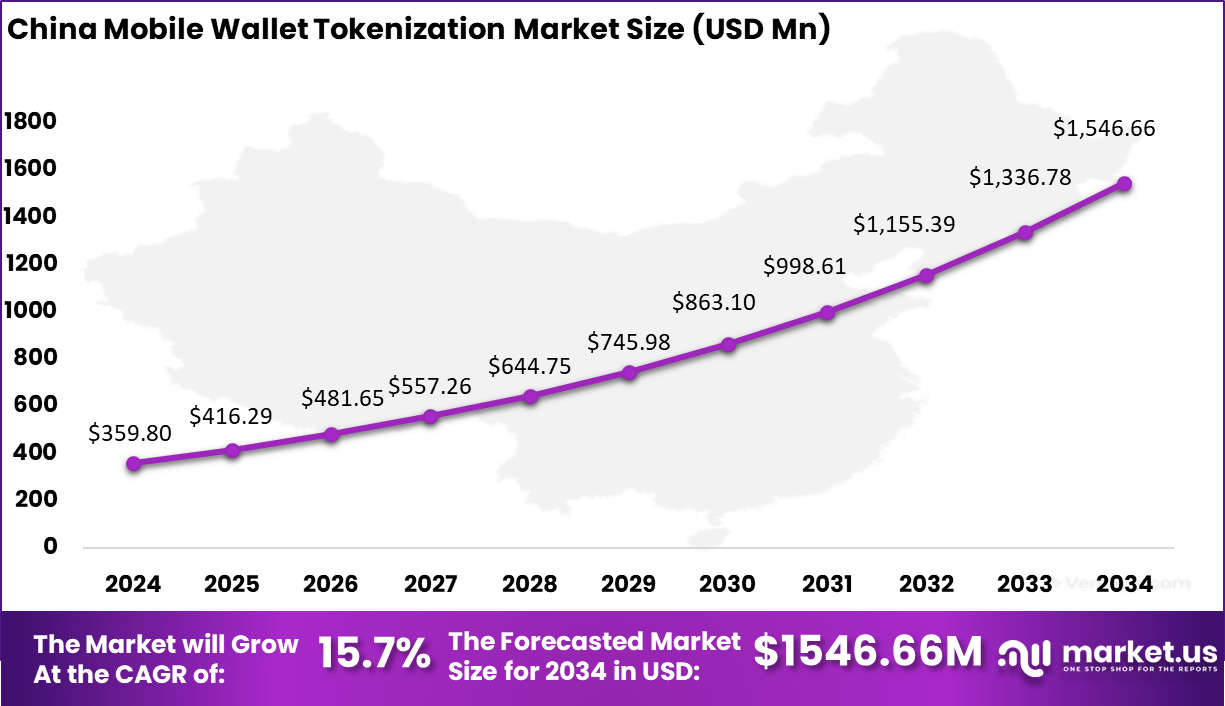

- The China market is valued at approximately USD 359.8 million in 2025.

- The market grows at a CAGR of 15.7%, fueled by rapid mobile wallet adoption, regulatory support, and increasing digital payment volumes in the region.

Key Statistics

- 93% of top mobile wallets have adopted tokenization to protect sensitive user data.

- Revenue from tokenization provisioning and management is expected to exceed USD 53 billion in 2025, rising sharply from USD 18 billion in 2020.

- Tokenization supports major mobile payment methods, including contactless transactions and persistent tokens for remote digital payments.

- Businesses using tokenization report a 34% drop in payment fraud.

- Mobile wallet providers using tokenization recorded a 48% reduction in data breaches over the past two years.

- Apple Pay and Google Pay account for 60% of all mobile tokenized payments.

- The Asia Pacific region leads global mobile wallet adoption, with tokenization acting as a key driver in countries such as China and India.

- NFC remains the dominant mobile wallet technology, supporting most contactless payments due to wide device and merchant compatibility.

- 72% of mobile wallet users rank security as their top priority, favoring tokenization and biometric authentication for safer payments.

By Tokenization Type

Payment tokenization dominates the mobile wallet tokenization market with a commanding 87.6% share. This method replaces sensitive payment data, such as card numbers, with unique tokens that are useless to hackers if intercepted.

Payment tokenization is the backbone of secure mobile wallet transactions, enabling users to make purchases without exposing their financial details. Its widespread adoption is driven by the need for fraud prevention, compliance with payment security standards, and consumer trust in digital payment platforms.

The technology is integral to contactless payments, mobile wallets, and e-commerce, providing a seamless and secure checkout experience. As digital payments continue to grow, payment tokenization remains the primary safeguard against data breaches and unauthorized transactions.

By Deployment

Cloud-based deployment holds a significant 75% share, reflecting the industry’s shift toward scalable and flexible solutions. Cloud platforms enable mobile wallet providers to implement tokenization services without heavy investment in physical infrastructure. They support rapid deployment, easy management, and efficient handling of high transaction volumes.

Centralized cloud management also facilitates faster updates and automated compliance checks, enhancing security and operational efficiency. Businesses favor cloud deployment for its cost-effectiveness and ability to scale with demand. The model supports continuous innovation in tokenization technologies, ensuring robust protection for mobile wallet users and seamless integration with evolving payment ecosystems.

By Application

In-app and e-commerce payments account for 53.8% of the mobile wallet tokenization market. This segment benefits from the growing popularity of mobile shopping and digital wallets, which require secure and frictionless payment experiences.

Tokenization enables safe transactions within apps and online stores by protecting sensitive payment information and minimizing fraud risks. Its integration into mobile payment platforms supports seamless user experiences, encouraging wider adoption of digital commerce.

The rise of smartphone usage and mobile-first consumers drives demand for secure in-app payment options. Tokenization ensures that every transaction is protected, supporting the expansion of mobile commerce and digital payment services.

By End-User

The BFSI sector represents 61.5% of the mobile wallet tokenization market. Banks, financial institutions, and payment processors are the primary users, leveraging tokenization to secure high-volume transactions and protect sensitive financial data. The sector’s stringent regulatory requirements and high exposure to cyber threats make tokenization essential for compliance and fraud prevention.

BFSI institutions drive innovation in tokenization technologies to enhance security and customer trust. Their large-scale adoption sets industry standards and encourages broader use of tokenization across other sectors, reinforcing its role as a cornerstone of digital payment security.

Key Reasons for Adoption

- Growing smartphone penetration and improved internet connectivity are making mobile wallet solutions more accessible to consumers worldwide.

- Consumers increasingly prefer contactless, fast, and secure payment options, driving demand for mobile wallet tokenization.

- Rising concerns about data breaches and fraud have led businesses and financial institutions to adopt tokenization for better payment security.

- Regulatory requirements for secure payment processing, such as PCI DSS, are pushing merchants to implement tokenization to reduce compliance risks.

- The expansion of e-commerce and digital transactions globally is accelerating the adoption of mobile wallet tokenization for seamless and safe online payments.

Benefits

Key Benefit Details Enhanced security Tokenization replaces sensitive card data with unique tokens, minimizing fraud risk. Faster, contactless payments Payments are quicker and more convenient, improving customer experience. Lower fraud and chargebacks Fraud rates and chargebacks drop significantly with tokenized transactions. Easier PCI DSS compliance Reduces the burden of compliance for merchants handling payment data. Improved approval rates Issuers trust tokenized transactions more, leading to higher approval rates. Better customer trust Secure transactions increase user confidence in digital wallets. Usage

Key Usage Details Online shopping Tokenized wallets enable secure, fast e-commerce payments. In-store contactless payments NFC-based tokenized wallets are widely used for tap-and-go transactions. Peer-to-peer transfers Secure, instant transfers between users. Subscription and recurring payments Tokenization simplifies recurring billing and subscription management. Cross-border payments Facilitates secure international transactions. Loyalty and rewards programs Tokenization supports secure integration of loyalty points and rewards. Emerging Trends

- Integration of AI and Machine Learning for enhanced fraud detection and transaction security.

- Adoption of biometric authentication methods like facial recognition and fingerprint scans.

- Increased use of blockchain technology for secure and transparent tokenization processes.

- Shift towards multi-channel and omni-channel mobile wallet solutions for seamless user experience.

- Growing focus on multi-factor authentication (MFA) and multi-layer security protocols.

Growth Factors

- Rising adoption of mobile payments and digital wallets across global markets.

- Increasing e-commerce and contactless transaction popularity during and post-pandemic.

- Growing regulatory emphasis on security standards for financial transactions.

- Expansion of contactless payment infrastructure in retail, healthcare, and transport sectors.

- Rising smartphone penetration and internet access, especially in emerging markets

Key Market Segments

By Tokenization Type

- Payment Tokenization

- Credential Tokenization

By Deployment

- Cloud-based

- On-Premises

By Application

- In-Store Payments

- In-App & E-Commerce Payments

- Peer-to-Peer Transfers

By End-User

- BFSI

- Retail & E-Commerce

- Hospitality & Travel

- Healthcare

- Others

Regional Analysis

Asia Pacific held a dominant 40.6% share of the mobile wallet tokenization market in 2024, driven by rapid digital payment adoption and strong government support for financial technology in countries like China, India, and Japan.

The region’s growth is fueled by increasing smartphone penetration, expanding e-commerce, and rising demand for secure payment solutions. Regulatory initiatives promoting cashless transactions and digital financial inclusion further accelerate the deployment of tokenization technologies, making Asia Pacific a global leader in mobile wallet security innovation.

China leads within Asia Pacific, valued at approximately USD 359.8 million in 2024 and growing at a robust CAGR of 15.7%. The country’s advanced fintech ecosystem, widespread use of mobile wallets like Alipay and WeChat Pay, and strong focus on data security drive market expansion.

Chinese providers continuously innovate in tokenization to combat fraud and ensure compliance with evolving regulatory standards, positioning China as the primary growth engine for mobile wallet tokenization in Asia Pacific .

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Surge in Mobile Wallet Adoption

The mobile wallet tokenization market is driven by the rapid adoption of mobile wallets worldwide, as consumers shift to digital payments for convenience and security. Tokenization replaces sensitive card details with unique digital tokens, reducing fraud risk and making transactions safer. This is especially important as more people use smartphones for shopping, banking, and peer-to-peer payments.

Banks and payment providers are integrating tokenization to comply with strict data protection standards and meet customer demand for seamless, secure experiences. The rise in contactless payments and digital commerce further accelerates this trend.

Restraint

Regulatory Uncertainty and Integration Issues

Regulatory uncertainty in many regions slows the adoption of tokenization, as laws on digital assets and data privacy differ widely. Businesses hesitate to invest without clear guidance, especially for cross-border transactions and new digital asset classes.

Integrating tokenization into legacy payment systems also proves complex and costly. Many organizations struggle to update their infrastructure, which limits how quickly they can roll out secure tokenized payments

Opportunity

Expansion into New Payment Ecosystems

Tokenization opens doors for mobile wallets to enter new sectors like transit, retail, and subscription services. Governments and regulators are encouraging digital payment adoption for transparency and efficiency, creating fertile ground for innovation.

The growth of digital identity and blockchain-based solutions also presents opportunities. Tokenization can support secure, instant settlements for assets ranging from loyalty points to real estate, expanding its role beyond simple payments.

Challenge

Security Risks and Consumer Education

Security remains a key challenge, as vulnerabilities in wallet apps, smart contracts, or supporting infrastructure can expose users to fraud. Ensuring end-to-end protection requires constant vigilance and investment in cybersecurity.

Consumer education is another hurdle, as many users do not fully understand how tokenization works or why it matters. Overcoming this knowledge gap is essential for building trust and driving broader adoption of secure mobile payment solutions.

Competitive Analysis

The mobile wallet tokenization market is highly competitive, with major players such as Apple, Google, Samsung, Visa, Mastercard, PayPal, American Express, Alibaba (Alipay), Tencent (WeChat Pay), Amazon, Square (Block), FIS, Fiserv, NXP Semiconductors, Thales Group, Gemalto, and IDEMIA leading the space.

These companies focus on providing secure, seamless payment experiences by replacing sensitive card data with unique digital tokens, reducing fraud risks and ensuring compliance with global security standards.

Competition is fueled by continuous innovation in payment security, integration with contactless and mobile payment platforms, and expansion into new markets and use cases such as transit, retail, and online commerce. Key differentiators include the ability to support multiple payment networks, advanced encryption, biometric authentication, and interoperability across devices and platforms.

Market leaders invest heavily in partnerships with banks, merchants, and technology providers to enhance ecosystem reach and drive adoption, with North America and Asia-Pacific emerging as the most dynamic regions due to high smartphone penetration and digital payment growth.

Top Key Players in the Market

- Apple Inc.

- Google LLC

- Samsung Electronics Co. Ltd.

- Visa Inc.

- Mastercard Incorporated

- PayPal Holdings Inc.

- American Express Company

- Alibaba Group (Alipay)

- Tencent Holdings Ltd. (WeChat Pay)

- Amazon.com Inc.

- Square Inc. (Block, Inc.)

- FIS (Fidelity National Information Services, Inc.)

- Fiserv, Inc.

- NXP Semiconductors N.V.

- Thales Group

- Gemalto (now part of Thales Group)

- IDEMIA

- Others

Future Outlook

The mobile wallet tokenization market is expected to experience robust growth as increasing digital transactions and e-commerce activities demand higher security standards for online payments. Rising concerns over data breaches and fraud, combined with stricter regulatory frameworks, are accelerating adoption of tokenization technology to protect sensitive card and transaction data.

Innovations in EMV chip technology and digital identity verification are further driving the market, making secure, seamless payments more accessible for consumers worldwide, and supporting the broader shift toward cashless economies.

Opportunities lie in

- Expansion of tokenization solutions across emerging markets to facilitate digital payment adoption in developing economies.

- Integration of biometric authentication and AI for enhanced security and user experience.

- Development of multi-layered tokenization systems for complex, high-value enterprise transactions and supply chain payments.

Recent Developments

- December, 2025, Apple expanded Apple Pay’s tokenization capabilities with the introduction of recurring tokens for Merchant Initiated Transactions (MITs). These tokens remain valid even when users upgrade devices, improving payment continuity and security. Apple also began supporting the storage of digital government passports in Apple Wallet, advancing mobile identity.

- November, 2025, Google officially launched Google Wallet in the Philippines, offering secure mobile payments with enhanced tokenization and seamless integration with Android and Wear OS devices. Visa integrated Google Pay with its fleet payment solutions, enabling tokenization for vehicle-related expenses and push-to-wallet functionality for fleet operators.

Report Scope

Report Features Description Market Value (2024) USD 2,925.0 Mn Forecast Revenue (2034) USD 15,309.0 Mn CAGR(2025-2034) 18% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Tokenization Type (Payment Tokenization, Credential Tokenization)By Deployment (Cloud-based, On-Premises), By Application (In-Store Payments, In-App & E-Commerce Payments, Peer-to-Peer Transfers), By End-User(BFSI, Retail & E-Commerce, Hospitality & Travel, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Google LLC, Samsung Electronics Co. Ltd., Visa Inc., Mastercard Incorporated, PayPal Holdings Inc., American Express Company, Alibaba Group (Alipay), Tencent Holdings Ltd. (WeChat Pay), Amazon.com Inc., Square Inc. (Block, Inc.), FIS (Fidelity National Information Services, Inc.), Fiserv, Inc., NXP Semiconductors N.V., Thales Group, Gemalto (now part of Thales Group), IDEMIA, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Wallet Tokenization MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Wallet Tokenization MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Google LLC

- Samsung Electronics Co. Ltd.

- Visa Inc.

- Mastercard Incorporated

- PayPal Holdings Inc.

- American Express Company

- Alibaba Group (Alipay)

- Tencent Holdings Ltd. (WeChat Pay)

- Amazon.com Inc.

- Square Inc. (Block, Inc.)

- FIS (Fidelity National Information Services, Inc.)

- Fiserv, Inc.

- NXP Semiconductors N.V.

- Thales Group

- Gemalto (now part of Thales Group)

- IDEMIA

- Others