Global Mobile Wage Access Apps Market Size, Share, Industry Analysis Report By Type of Access (On-Demand Access, Scheduled Access), By Deployment Mode (Cloud-Based Solutions, On-Premise Solutions), By Enterprise Size ( Small & Medium Enterprises (SMEs), Large Enterprises), By Industry (Retail & E-commerce, Healthcare, Hospitality, Logistics & Transportation, Manufacturing, IT & Services / Technology, Others (e.g., Financial Services), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166336

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- User and Adoption Statistics

- Key Benefits and Impacts

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Type of Access Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- Industry Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

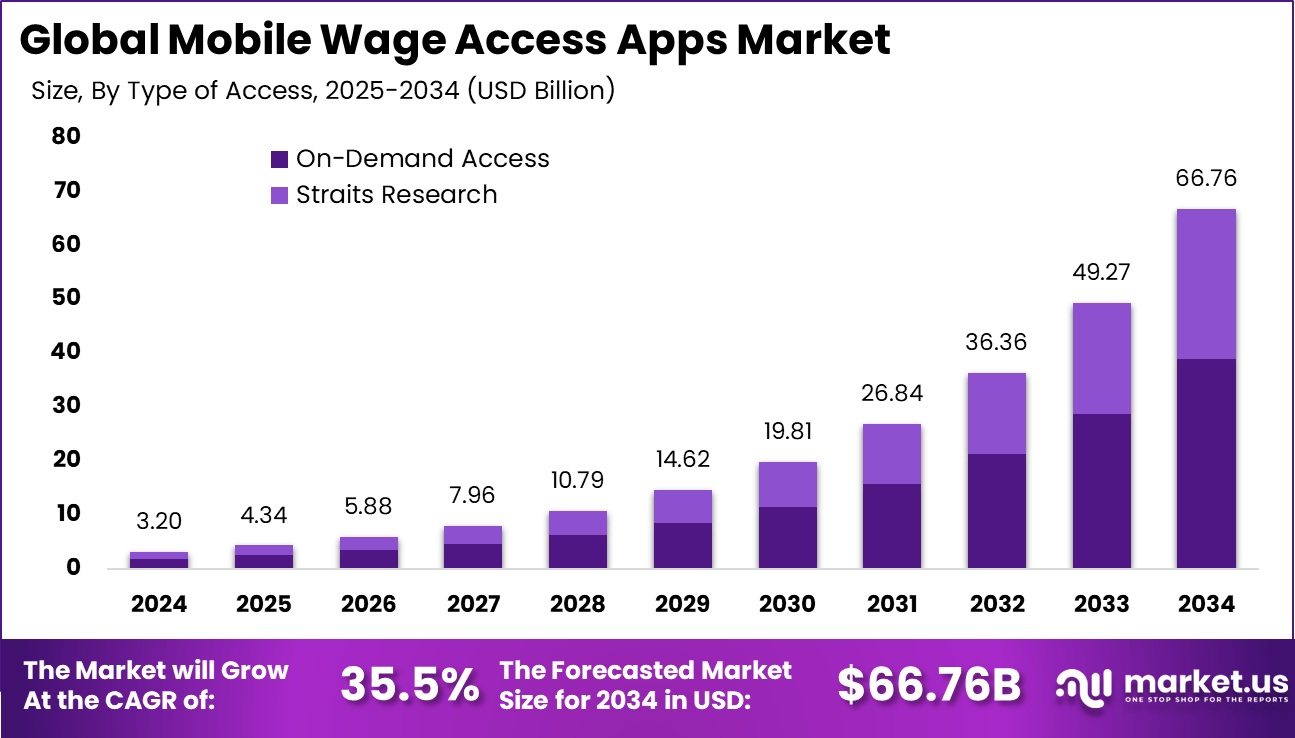

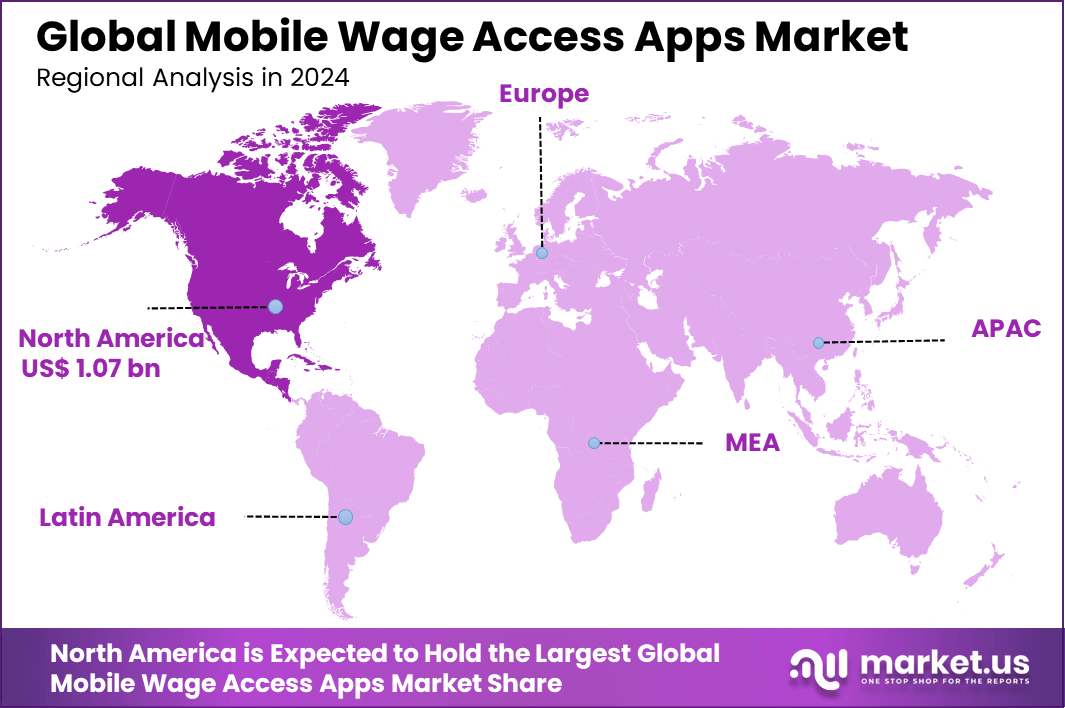

The Global Mobile Wage Access Apps Market size is expected to be worth around USD 66.76 billion by 2034, from USD 3.20 billion in 2024, growing at a CAGR of 35.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33.6% share, holding USD 1.07 billion in revenue.

The mobile wage access apps market has expanded as workers increasingly rely on smartphone based tools to view and access earned wages before payday. The market has grown into a key part of the digital financial wellness landscape, reflecting a preference for self service, real time wage visibility and on demand payouts. Adoption has widened across hourly, shift based and gig economy workers who prioritise simple and immediate access to earnings.

Top driving factors for this market include rising financial stress among employees, which is reported to affect over 60% of workers globally, pushing demand for early wage access solutions. Additionally, the gig and hourly work economy fuels this need, with many workers juggling variable income and expenses. Technology advances, such as app-based access and cloud payroll integration, simplify seamless wage delivery.

The market for mobile wage access apps is driven by rising financial stress among workers and their growing demand for on-demand access to earned wages. The increasing number of hourly and gig workers, who often face irregular income flows, fuels the need for flexible, real-time payment solutions. Widespread smartphone use and digital payroll systems make these apps accessible and easy to integrate for employers.

The increasing adoption of technologies such as mobile integration, API-based payroll connectivity, and analytics tools boosts the market’s growth. Mobile wage access apps leverage smartphones to provide instant wage access and additional features like financial education and savings tools. These technologies help employers and employees track earnings and manage finances more efficiently.

For instance, in June 2025, Madrid-based Payflow raised €10 million to expand its earned wage access platform across Europe and Latin America, supporting the growing adoption of mobile wage access apps that enable employees to withdraw part of their earned salaries before payday.

Key Takeaway

- The On-Demand Access segment led the market with a 58.4% share, indicating strong employee preference for instant access to earned wages through mobile apps.

- On-Premise solutions accounted for 62.7%, reflecting employers’ focus on data security, compliance, and tighter control over payroll-related integrations.

- Large Enterprises dominated adoption with a 70.3% share, as organizations with sizable workforces increasingly use mobile wage access to support retention and financial wellness.

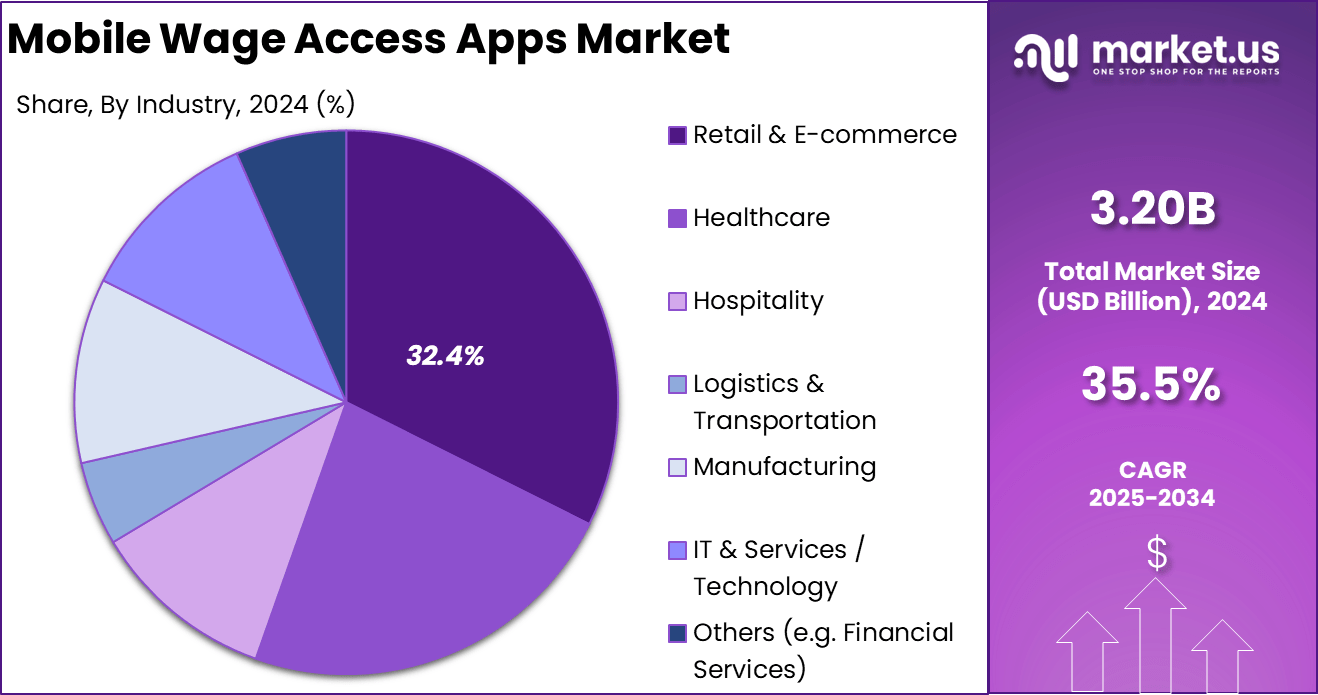

- The Retail and E-commerce segment held 32.4%, driven by high concentrations of hourly and shift-based workers who benefit most from flexible pay options.

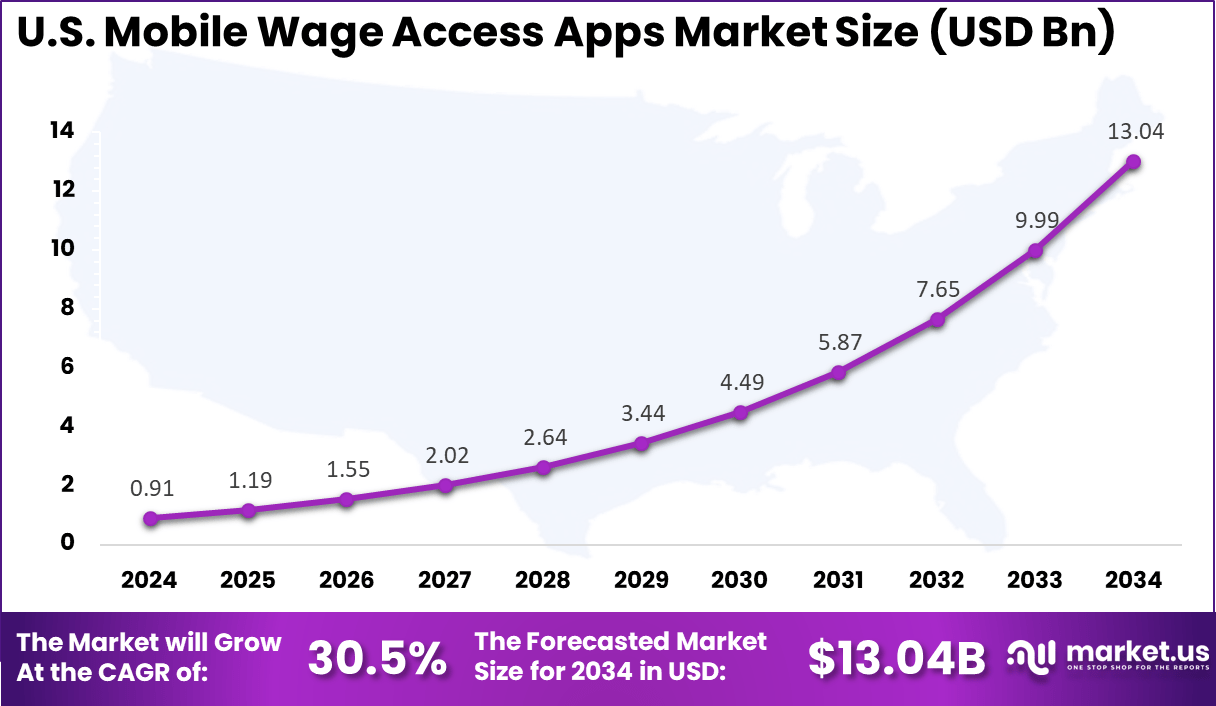

- The U.S. Mobile Wage Access Apps Market was valued at USD 0.91 Billion in 2024, expanding at a robust 30.5% CAGR, supported by rapid fintech growth and strong worker demand.

- North America maintained a leading position with over 33.6% of global share, backed by mature digital payment infrastructure and increasing employer-led financial wellness initiatives.

User and Adoption Statistics

- User preference: Nearly 90% of Earned Wage Access users prefer mobile apps for accessing funds because of convenience and immediate availability.

- User growth: More than 7 million U.S. workers used EWA services in 2022, and transaction volume increased by 93.2% from 2021 to 2022.

- Employer adoption: Only about 10% of employers currently offer EWA, showing significant room for expansion.

- Demographics: Interest is particularly strong among younger workers. About 84% of Millennials and 87% of Gen Z say they would apply for jobs offering same-day pay options.

Key Benefits and Impacts

- Reduced financial stress: Around 77% of users report lower financial stress, and 82% feel less anxious about money after using EWA services.

- Improved retention: Employers offering EWA fill open roles 52% faster and can see retention improvements of up to 49% after six months on certain platforms.

- Industry adoption: Retail and hospitality account for a large share of EWA usage because of high turnover and reliance on hourly wage workers.

Role of Generative AI

The role of generative AI in mobile wage access apps is transforming how workers manage their earnings. AI automates the calculation of earned wages in real time, reducing errors and speeding up access to funds. It assists in predicting payroll needs and personalizing the wage access experience for employees, which helps reduce financial stress by providing timely support.

Studies have shown that generative AI can increase productivity by approximately 15%, allowing workers, especially new or less experienced ones, to better utilize wage access tools to cover urgent expenses without waiting for regular pay cycles. Nearly 90% of companies experimenting with generative AI emphasize its ability to enhance payroll efficiency and user experience.

The technology helps in authenticating transactions, ensuring secure and seamless wage disbursements, and providing real-time support through chatbots or AI-driven customer service. This improvement in operational flow benefits both employers and employees by making earned wage access more transparent and easier to use, leading to increased trust in the system.

Investment and Business Benefits

The segment is seen as a promising area for investment due to its rapid growth and adoption, especially in industries with lower wages. Investment is driven by the demand for innovative financial technology solutions that meet the needs of hourly and gig workers.

The integration of EWA into existing HR and payroll platforms creates scalable opportunities, while API-driven infrastructure allows wider deployment and customization of wage access services. Businesses benefit from improved employee productivity, reduced absenteeism, and enhanced workforce engagement when they offer early wage access.

The financial wellness provided by these apps reduces employee stress, which translates into better job performance and lower turnover rates. Additionally, automating wage access through mobile apps streamlines payroll operations and reduces administrative burden, especially for companies with large or distributed hourly workforces.

U.S. Market Size

The market for Mobile Wage Access Apps within the U.S. is growing tremendously and is currently valued at USD 0.91 billion, the market has a projected CAGR of 30.5%. This strong growth is driven primarily by increasing financial stress among workers, many of whom live paycheck to paycheck and seek flexible access to their earned wages. On-demand payment options help employees manage unexpected expenses and avoid costly payday loans.

Additionally, the rise of the gig and hourly economy fuels demand as more workers require real-time pay access. Employers increasingly recognize earned wage access as a valuable tool for improving employee satisfaction, reducing turnover, and boosting workforce productivity. Advances in mobile technology and integration with payroll systems also support market expansion and ease of deployment.

For instance, in October 2025, Refyne announced the integration of AI-driven financial insights into its mobile wage access app, enhancing users’ ability to manage earned wages with personalized budgeting and saving recommendations, further solidifying its position in the U.S. market.

In 2024, North America held a dominant market position in the Global Mobile Wage Access Apps Market, capturing more than a 33.6% share, holding USD 1.07 billion in revenue. This dominance is due to the region’s early adoption of digital payroll systems and robust fintech infrastructure that supports real-time wage disbursements.

Advanced payment technologies like FedNow and RTP enable seamless and instant wage transfers, enhancing user convenience and trust. The presence of leading providers such as DailyPay and Payactiv, alongside employee demand for financial wellness tools, further propels market growth. Additionally, the growing gig and hourly workforce, combined with regulatory support for flexible pay, contributes significantly to North America’s dominance in the market.

For instance, in September 2025, DailyPay expanded its partnerships with major U.S. employers to offer instant wage access combined with financial wellness tools, increasing its footprint across diverse industries and reinforcing North American leadership in earned wage access technology.

Type of Access Analysis

In 2024, The On-Demand Access segment held a dominant market position, capturing a 58.4% share of the Global Mobile Wage Access Apps Market. This shows a clear preference for solutions where employees can access their earned wages anytime they need before the scheduled payday. It offers workers practical financial freedom and supports cash flow management, especially helpful for hourly or gig workers who often face irregular income patterns.

Such flexibility reduces dependency on high-interest loans and enables better day-to-day budgeting. This type of access aligns with the increasing demand for real-time financial wellness solutions among workers. Employers find on-demand access useful for enhancing job satisfaction by offering immediate wage access, which helps in reducing financial stress and improving employee retention rates. The ease of use and instant availability make it especially popular in sectors with fluctuating work hours.

For Instance, in June 2025, Refyne secured INR 35 Cr (around $4 million) in debt funding to expand its on-demand salary access services across multiple cities, reflecting growth in flexible wage access solutions. The firm is focused on broadening its reach to serve millions of workers with instant salary access.

Deployment Mode Analysis

In 2024, the On-Premise Solutions segment held a dominant market position, capturing a 62.7% share of the Global Mobile Wage Access Apps Market. Companies using these solutions prefer keeping wage access software inside their own IT environments to meet compliance and data privacy demands. This model is more common in large enterprises that handle substantial payroll volumes and operate in regulated industries.

Even though on-premise deployments require higher investment and maintenance, organizations value the ability to closely manage and secure employee wage information internally. This setup assures companies of data ownership and regulatory adherence, factors vital in industries like finance, healthcare, and manufacturing.

For instance, in September 2025, Payactiv launched “Access-as-a-Service,” an API infrastructure to embed Earned Wage Access and financial wellness features within large enterprise systems. This development supports on-premise deployment by allowing seamless integration into existing payroll and HR platforms.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 70.3% share of the Global Mobile Wage Access Apps Market. These organizations benefit from integrating wage access into their payroll systems to support their large hourly or shift workforce. The solution helps improve employee financial wellness, which in turn reduces turnover and enhances productivity.

Large companies have the resources to manage the complexities of compliance and integration across diverse geographies. Their scale also allows them to leverage vendor partnerships effectively, making wage access a strategic tool for employee engagement and satisfaction.

For Instance, in September 2025, DailyPay expanded its platform capabilities to improve frontline communications and productivity, a key need among large firms with extensive hourly workforces.

Industry Analysis

In 2024, The Retail & E-commerce segment held a dominant market position, capturing a 32.4% share of the Global Mobile Wage Access Apps Market. This dominance is due to the high number of hourly wage workers and frequent staff turnover. Wage access apps help retailers by offering staff timely access to earnings, which is crucial in supporting employee financial stability and retention.

Given the dynamic nature of retail work hours and the competitive labor market, providing immediate wage access is a strong incentive for workers. This industry sees wage access as a way to enhance operational flexibility and improve workforce morale.

For Instance, in June 2025, ZayZoon launched a Perks Marketplace to enhance financial benefits for frontline workers, many of whom are in retail and e-commerce sectors, demonstrating industry-specific wage access innovation.

Emerging trends

Emerging trends in mobile wage access apps highlight the shift toward fully mobile, cloud-based platforms that enable instant wage access across multiple industries. There is a growing preference for apps linked directly to digital wallets or bank accounts, allowing employees to access a portion of their earned wages immediately after completing shifts.

This trend is most pronounced in industries with hourly or gig workers, reflecting the widespread demand for financial flexibility. Mobile wage access platforms now also include features for budget management and financial education, helping users better handle their earnings. Another trend is the rise of integration with other financial services, such as prepaid cards and direct deposit options tailored to worker preferences.

The gig economy’s expansion continues to push demand for on-demand pay, with about 28% of workers living paycheck to paycheck and seeking reliable wage access solutions. As these apps become widely accepted, they are also evolving to include better user interfaces and more transparent fee structures to increase accessibility.

Growth Factors

Growth in mobile wage access is driven by the increasing number of workers in non-traditional employment arrangements such as part-time and gig work. These workers value the flexibility to receive pay as needed without waiting for fixed payroll cycles.

The ubiquity of smartphones globally supports this growth since workers can easily access earned wages via apps at any time. Around 20% of firms employing mostly hourly workers have adopted wage access tools to meet this demand and reduce employee financial stress. Financial insecurity remains a key factor driving the adoption of these apps.

Younger generations, especially Millennials and Gen Z, see early wage access as a necessary feature of their financial lives. About 88% of these workers say access to earned wages affects their choice of banking services. Employers offering wage access services benefit from improved worker retention and morale as employees feel more in control of their finances.

Key Market Segments

By Type of Access

- On-Demand Access

- Scheduled Access

By Deployment Mode

- Cloud-Based Solutions

- On-Premise Solutions

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry

- Retail & E-commerce

- Healthcare

- Hospitality

- Logistics & Transportation

- Manufacturing

- IT & Services / Technology

- Others (e.g., Financial Services)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Financial Flexibility

A main driver for mobile wage access apps is the growing demand from employees for more financial flexibility. Many workers face tight budgets and live paycheck to paycheck, so having instant access to earned wages between pay cycles helps them manage unexpected expenses without relying on costly payday loans or credit cards. This financial relief improves their cash flow and reduces stress, leading more employers to adopt these platforms as a valuable employee benefit.

Smartphone penetration and digital payroll adoption foster this demand further. The convenience of mobile apps, allowing real-time wage tracking and easy fund transfers, aligns perfectly with the preferences of hourly, gig, and part-time workers. Employers recognize that offering earned wage access can improve employee satisfaction and reduce absenteeism, making it a strong motivation behind the market’s rapid growth.

For instance, in June 2025, Refyne raised INR 35 Cr in debt from Stride Ventures to fuel expansion in its on-demand salary platform. This funding supports enhancing financial flexibility for employees in India by offering early access to earned wages, responding to growing worker demand for better cash flow management between pay cycles. Refyne’s strong employer partnerships show the rising acceptance of these solutions as sought-after benefits.

Restraint

Regulatory Uncertainty and Complexity

A significant restraint for mobile wage access apps is the unclear and evolving regulatory environment. Different regions have varying rules about whether accessing earned wages early is considered a loan, which subjects providers to complex lending and wage laws. This regulatory uncertainty creates compliance risks and can delay product launches or limit market expansion.

Further regulatory requirements around fee transparency, consumer protection, and data privacy add operational burdens. App providers must invest heavily to secure user data and ensure compliance with different legal frameworks while striving to maintain trust. These challenges may slow adoption by employers wary of legal complications.

For instance, in April 2022, FlexWage’s patented Earned Wage Access solution, recognized by California regulators for compliance without lender licensing, illustrates the regulatory challenges in this sector. Their careful navigation of labor and lending laws highlights how complex and varying regulations restrain some providers’ ability to scale quickly or enter new markets without intensive legal oversight.

Opportunities

Integration with Fintech Ecosystems

A key opportunity lies in integrating mobile wage access apps with broader financial technology ecosystems. Combining earned wage access with financial wellness tools, budgeting apps, and digital wallets increases value for users by helping them better manage overall finances beyond instant payments.

This integration also benefits employers who can offer holistic financial support, improving workforce stability. As employers and fintech platforms collaborate more closely, these integrated solutions can scale quickly, especially in sectors with many hourly and gig workers seeking flexible pay options. This synergy creates new revenue streams and market expansion possibilities.

For instance, in September 2025, Payactiv launched “Access-as-a-Service℠”, an API platform for earned wage access and financial wellness integration. This innovative move opens opportunities for embedding wage access within wider fintech services, allowing employers to provide a comprehensive financial well-being package that includes budgeting and bill management tools alongside instant wages.

Challenges

User Trust and System Reliability

A major challenge for mobile wage access apps is building and maintaining user trust through reliable service. Users must have confidence that wage transfers are accurate and timely, with clear information on any fees or withdrawal limits. Technical glitches or delays in payment access can quickly erode confidence and reduce app usage.

Providers face the ongoing task of ensuring system stability and security amid handling sensitive wage data and real-time transactions. Transparency around data privacy and fee structures is critical. Without robust infrastructure and clear communication, skepticism among users and employers could hinder long-term adoption and growth.

For instance, in September 2025, DailyPay enhanced its platform by adding a frontline communications feature aimed at improving employee engagement and ensuring users fully understand wage access options. This underlines the challenge of maintaining trust through transparency and smooth operation in real-time pay services, as employee confidence hinges on reliability and clear communication from providers.

Key Players Analysis

Refyne, DailyPay, and EarnIn lead the mobile wage access apps market with strong platforms designed for instant access to earned income. Their solutions focus on simple app-based withdrawals, transparent fee structures, and strong user experience. High adoption is driven by workers seeking fast liquidity without relying on traditional credit. These companies continue to enhance security, automation, and financial wellness features.

Payactiv, Stream Platforms, Flexwage Solutions, and Hastee Technologies strengthen the market through reliable payout frameworks and compliance-aligned design. Their apps offer budgeting tools, scheduled access, and repayment automation to promote responsible financial use. These providers support employers and workers by simplifying integration with attendance and payroll systems.

ZayZoon, Instant Financial, Branch, and other participants widen the market with cost-efficient, user-friendly mobile wage access options. Their apps prioritize quick setup, instant disbursements, and flexible earning visibility. These companies appeal to gig workers, retail staff, and service employees who require frequent access to wages.

Top Key Players in the Market

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others

Recent Developments

- In April 2025, Payactiv launched Visa+, a new service that enables real-time earned wage disbursements directly to Venmo and PayPal accounts. This innovation expands how users can access their wages without sharing bank or debit card information, improving convenience and security for employees.

- In June 2025, Refyne secured INR 35 crore (around $4 million) in debt funding from Stride Ventures to support its salary-on-demand services in India. Refyne’s platform continues to scale, allowing employees early access to earned wages with convenient and compliant digital tools.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 66.7 Bn CAGR(2025-2034) 35.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Access (On-Demand Access, Scheduled Access), By Deployment Mode (Cloud-Based Solutions, On-Premise Solutions), By Enterprise Size ( Small & Medium Enterprises (SMEs), Large Enterprises), By Industry (Retail & E-commerce, Healthcare, Hospitality, Logistics & Transportation, Manufacturing, IT & Services / Technology, Others (e.g., Financial Services), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034 Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Refyne, DailyPay, EarnIn, Payactiv, Inc., Stream Platforms Ltd., Flexwage Solutions, Hastee Technologies Ltd., ZayZoon, Instant Financial, Branch, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Wage Access Apps MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Wage Access Apps MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others