Global Mobile Surveillance Tower Market By Component (Hardware (Sensors & Cameras, Power System, Others), Software (Video Management Software, Others), Services(Rental/Leasing Services, Installation & Deployment Services, Maintenance & Support Services)), By Power Source (Solar-Powered/Hybrid, Generator/Diesel-Powered ), By Application (Perimeter Security & Intrusion Detection, Traffic Monitoring & Incident Detection, Others), By End-User (Government, Commercial, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 169081

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

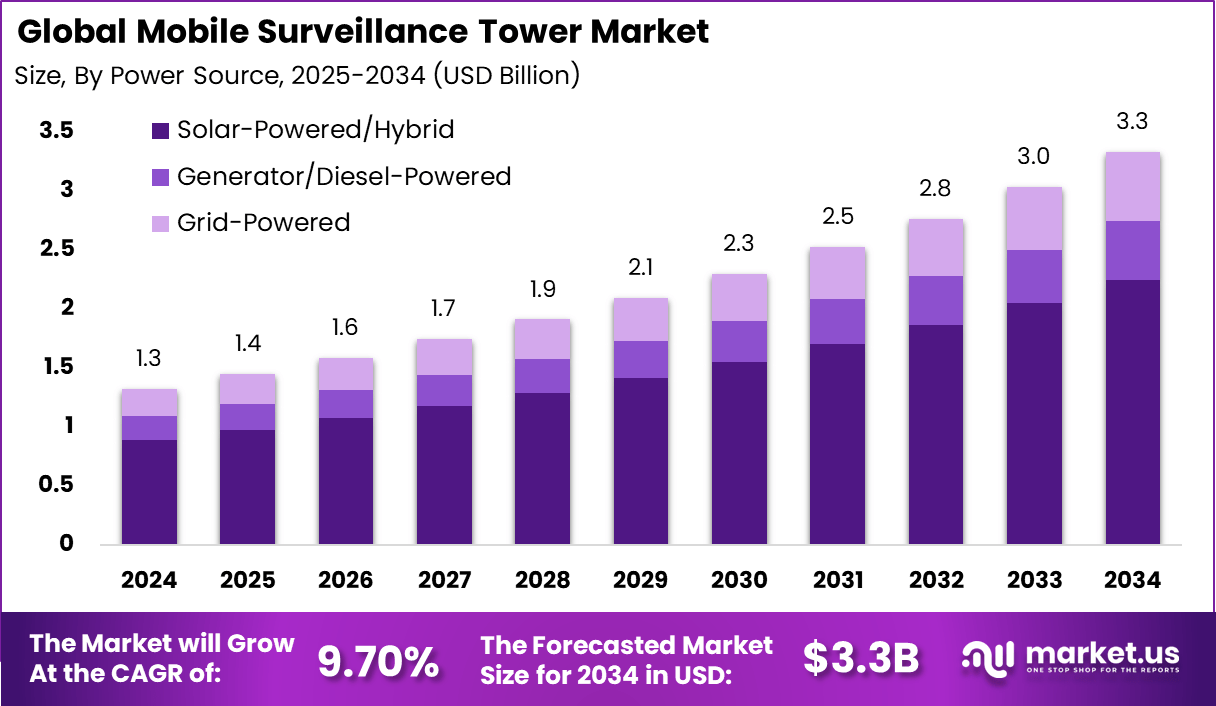

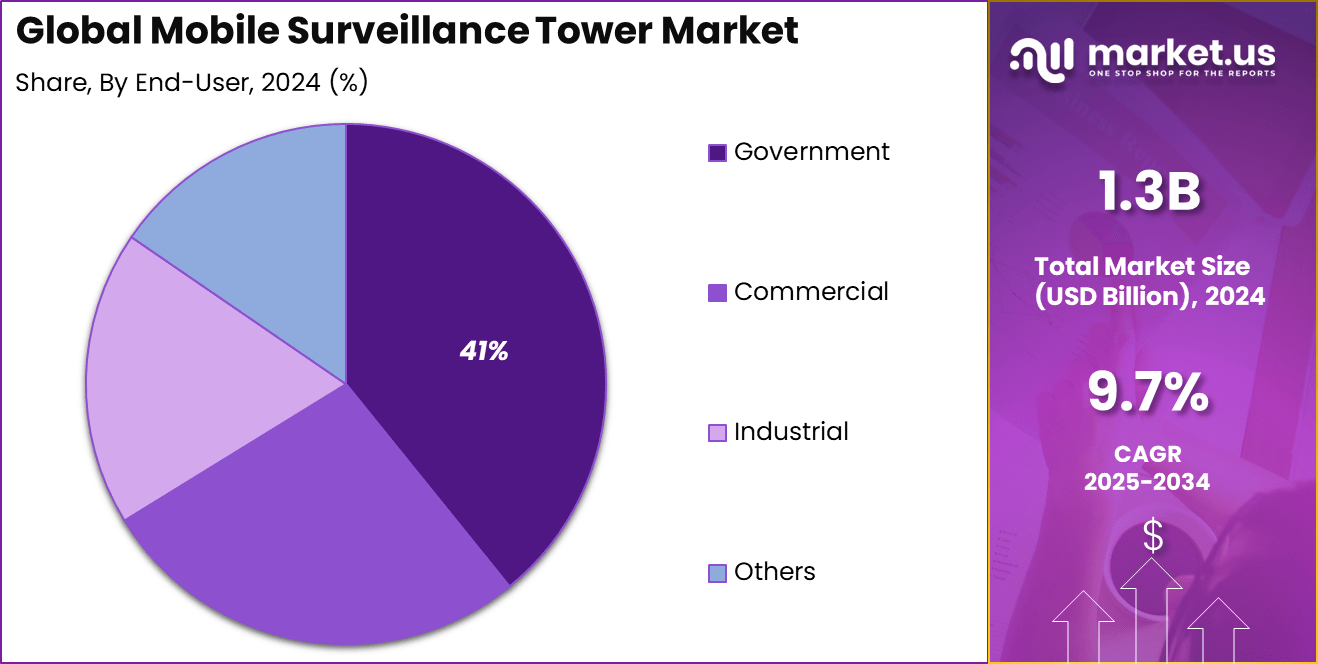

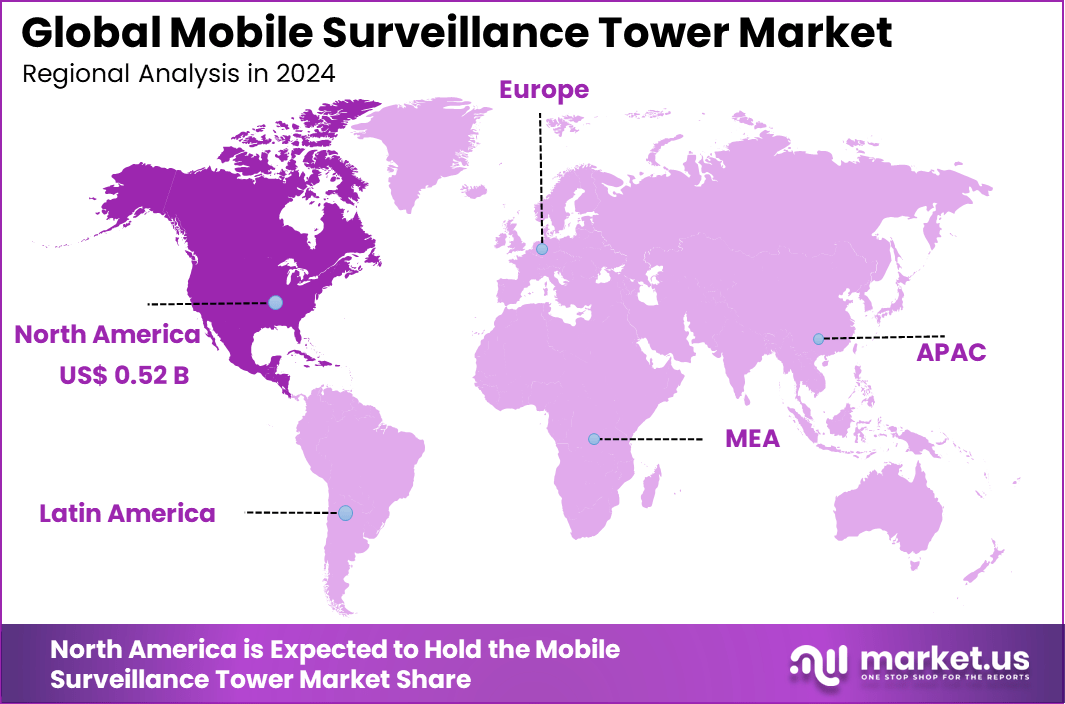

The Global Mobile Surveillance Tower Market generated USD 1.3 billion in 2024 and is predicted to register growth from USD 1.4 billion in 2025 to about USD 3.3 billion by 2034, recording a CAGR of 9.70% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.4% share, holding USD 0.52 Billion revenue.

The mobile surveillance tower market has expanded as organisations adopt portable, rapidly deployable monitoring systems to secure outdoor locations and temporary sites. Growth reflects rising demand for real time surveillance in construction zones, remote facilities, public events and critical infrastructure areas. Mobile towers combine cameras, sensors and communication modules to deliver continuous visibility without permanent installation.

The growth of the market can be attributed to increasing security concerns, rising infrastructure development and greater emphasis on protecting high value assets in open environments. Mobile surveillance towers provide rapid response capability and can be positioned quickly in areas lacking fixed power or network infrastructure. Their flexibility and fast deployment appeal to both private and public sector users.

Top Market Takeaways

- By component, hardware leads with 54.2% share, including advanced camera systems, sensors, communication modules, and power systems vital for mobile surveillance solutions deployed in diverse environments.

- By power source, solar-powered and hybrid solutions dominate with 67.5% share, driven by sustainability initiatives, regulatory pressures, and the need for reliable off-grid power in remote or temporary deployments.

- By application, perimeter security and intrusion detection hold 45.8% share, with towers deployed extensively for border security, critical infrastructure protection, construction sites, and event security to deter unauthorized access and monitor perimeters proactively.

- By end-user, government entities represent 40.6%, spearheading investments in public safety, homeland security, and infrastructure protection, supported by multi-year contracts and stringent safety mandates.

- Regionally, North America commands approximately 39.4% market share.

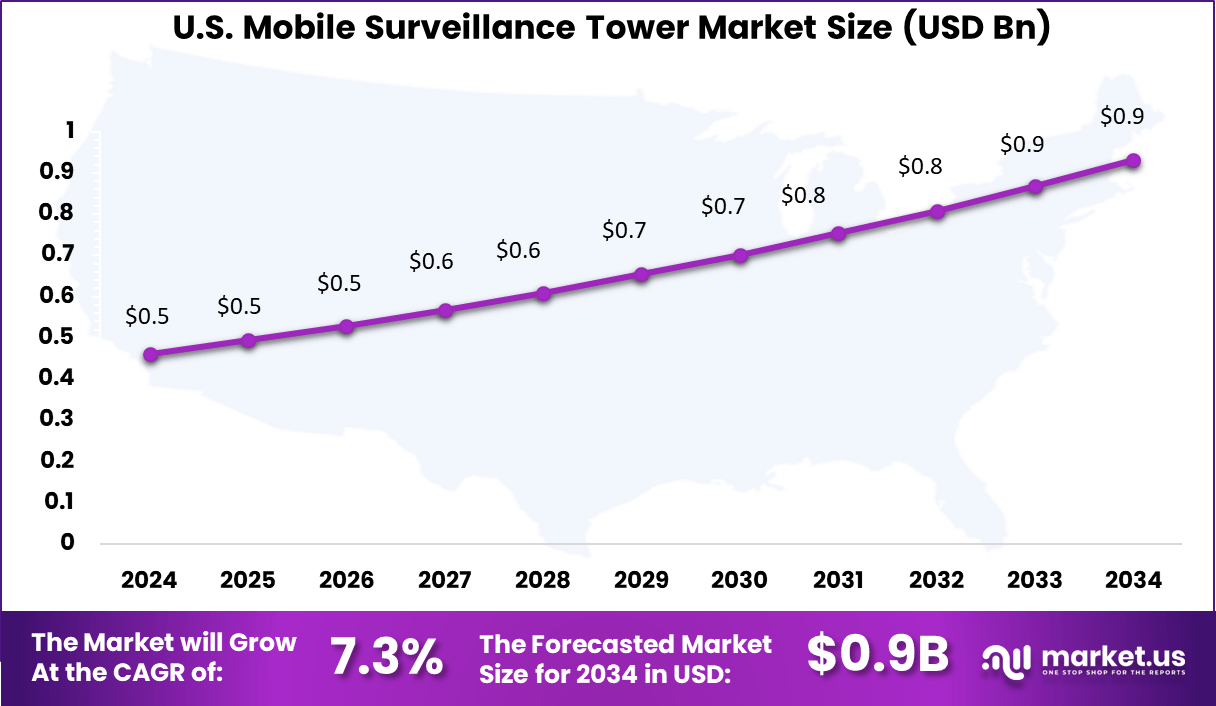

- The U.S. market is valued at around USD 0.46 billion in 2025.

- The market grows at a CAGR of 7.3%, driven by technological advancements in AI-enabled surveillance, IoT integration, and growing security concerns at local, state, and federal levels.

By Component

Hardware accounts for a leading 54.2% share in the mobile surveillance tower market. This segment includes cameras, sensors, communication modules, and control panels that form the backbone of surveillance operations. Hardware reliability is crucial for continuous monitoring in challenging environments, especially in remote or harsh conditions.

The demand for rugged, high-performance devices is particularly strong in government, defense, and infrastructure projects where uninterrupted surveillance is essential for safety and security. Manufacturers continue to innovate with advanced imaging technologies, improved weather resistance, and modular designs that allow for rapid deployment and easy upgrades.

By Power Source

Solar-powered and hybrid systems hold a dominant 67.5% share, reflecting the industry’s shift toward sustainable and reliable energy sources. These solutions offer the flexibility to operate in off-grid or remote locations, where access to conventional power is limited.

Solar and hybrid towers combine solar panels with battery storage and, in some cases, backup generators, ensuring continuous operation even during extended periods of low sunlight. The adoption of solar and hybrid power is driven by both environmental regulations and operational needs.

These systems reduce ongoing fuel costs, lower carbon emissions, and minimize logistical challenges associated with diesel-powered units. Their scalability and ease of deployment make them ideal for temporary or rapidly changing security requirements.

By Application

Perimeter security and intrusion detection account for 45.8% of the mobile surveillance tower market, highlighting their critical role in safeguarding critical infrastructure, construction sites, and high-security facilities. These applications leverage mobile towers for real-time monitoring, rapid response, and deterrence against unauthorized access. The ability to quickly deploy and reposition towers provides flexibility in addressing evolving security threats and site-specific risks.

The integration of advanced analytics, motion detection, and remote alert systems enhances the effectiveness of perimeter security solutions. Mobile towers equipped with these features provide comprehensive situational awareness, enabling proactive threat management and improved incident response times.

By End-User

Government entities form the largest end-user segment with a 40% share. Government agencies deploy mobile surveillance towers for a wide range of applications, including border security, public safety, infrastructure protection, and emergency response. These deployments are often large-scale and require high reliability, durability, and compliance with stringent regulatory standards.

The government’s focus on public safety and critical infrastructure protection drives sustained investment in mobile surveillance technologies. Procurement cycles are typically long-term, providing stability for market participants and encouraging continuous innovation in surveillance solutions.

Key Reasons for Adoption

- Growing security concerns in public places like airports, railway stations, and parks.

- Need for flexible and rapid-deployment security solutions in temporary sites such as construction zones and events.

- Integration into smart city initiatives for improved law enforcement and city safety.

- Advancements in sensor technology, AI analytics, and connectivity (5G, cloud) make towers more effective and affordable.

- Rising demand for remote monitoring, especially in remote or underserved locations where permanent installations are impractical.

- Enhanced perimeter protection for critical infrastructure such as data centers, military sites, and industrial facilities.

Benefits

Key Benefits Details Visual deterrent Reduces theft, vandalism, and unauthorized access. Quick setup and scalability Easy to deploy and scale as security needs change. Real-time monitoring and alerts Enables rapid response to incidents. 360-degree surveillance Covers large areas with clear visibility. Reduced operating costs Solar-powered options lower expenses. Integration with security equipment Works with PTZ, thermal cameras, and alarm systems. Usage Trends

Usage Details Public safety in cities Used in parks, streets, and transit hubs. Temporary event security Deployed at festivals, sports events, and pop-up retail. Construction site monitoring Monitors sites for theft and safety compliance. Critical infrastructure protection Secures data centers, military, and industrial facilities. Remote and rural area surveillance Provides coverage in areas without permanent security. Integration with smart city systems Supports broader city safety and law enforcement initiatives. Emerging Trends

- Integration of AI and machine learning for real-time threat detection and activity analysis.

- Increased adoption of wireless and IoT-enabled sensors for flexible, scalable deployment.

- Use of mobile surveillance towers in temporary or remote security setups for events, construction, and disaster response.

- Incorporation of advanced camera technologies such as thermal imaging and 4K/5G connectivity for improved monitoring.

- Growing emphasis on solar-powered and energy-efficient mobile towers to support sustainability and off-grid operations.

Growth Factors

- Rising demand for flexible, rapid-deployment security solutions across industries.

- Expansion of smart city initiatives and government-led urban surveillance projects.

- Heightened security concerns in public places, critical infrastructure, and border regions.

- Technological advancements reducing costs and improving reliability of mobile surveillance equipment.

- Increasing investment in defense, law enforcement, and industrial safety sectors.

Key Market Segments

By Component

- Hardware

- Sensors & Cameras

- Power System

- Communication Module

- Others

- Software

- Video Management Software

- Command & Control (C2) Software

- Others

- Services

- Rental/Leasing Services

- Installation & Deployment Services

- Managed Services (VSaaS)

- Maintenance & Support Services

By Power Source

- Solar-Powered/Hybrid

- Generator/Diesel-Powered

- Grid-Powered

By Application

- Perimeter Security & Intrusion Detection

- Traffic Monitoring & Incident Detection

- Crowd & Event Management

- Temporary Critical Infrastructure Monitoring

- Public Safety & Emergency Response

- Others

By End-User

- Government

- Commercial

- Industrial

- Others

Regional Analysis

North America captured a 39.4% share of the mobile surveillance tower market in 2024, driven by rising demand for flexible, rapid-deployment security solutions across public safety, defense, and critical infrastructure sectors.

The region’s growth is supported by increased investments in border security, event monitoring, and disaster response, as well as the adoption of advanced wireless and AI-powered surveillance technologies. Mobile towers offer scalable, temporary coverage for urban and remote areas, making them a preferred choice for law enforcement and private security agencies seeking adaptable surveillance capabilities.

The U.S. leads within North America, valued at approximately USD 0.46 billion in 2024 and growing at a CAGR of 7.3%. The country’s large-scale security needs, including border patrol, major public events, and infrastructure protection, drive robust demand for mobile surveillance towers.

Continuous innovation in tower design, integration with real-time analytics, and remote monitoring solutions further strengthens the U.S. market’s position as the primary growth engine in North America, setting industry standards for mobile surveillance deployment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Flexible Security Solutions

The mobile surveillance tower market grows from the need for flexible, temporary security solutions in sectors like construction, events, and disaster response. These towers can be quickly deployed to monitor remote or high-risk sites without permanent infrastructure, making them ideal for short-term projects or emergency situations.

Their ability to cover large areas and deter criminal activity drives adoption by both public and private organizations. Advances in solar power and wireless connectivity also boost demand, allowing towers to operate independently in off-grid locations. This mobility and adaptability make them a preferred choice for organizations needing scalable and efficient security coverage.

Restraint

High Costs and Regulatory Barriers

High initial investment and ongoing maintenance costs limit adoption, especially for small and medium enterprises. Setting up mobile surveillance towers requires expensive equipment, skilled labor, and regular upkeep, making it less accessible for budget-conscious users.

Regulatory hurdles and privacy concerns also pose challenges, as governments impose strict rules on surveillance activities. Compliance with data protection laws and public scrutiny can slow deployment and expansion in sensitive regions.

Opportunity

Integration of AI and IoT Technologies

There is strong opportunity in integrating AI and IoT into mobile surveillance towers. AI-driven analytics can automate threat detection and reduce false alarms, while IoT enables real-time data sharing and remote monitoring. These features improve operational efficiency and response times, attracting more users across industries.

Growing government support for smart city projects and public safety initiatives further fuels market expansion. As technology advances, mobile towers will offer smarter, more connected solutions for diverse security needs.

Challenge

Rapid Technological Change and Cybersecurity Risks

The fast pace of technological change requires continuous innovation to keep up with evolving threats and user demands. Companies must invest in R&D to maintain competitive offerings, which can strain resources.

Cybersecurity is another major challenge, as interconnected towers are vulnerable to hacking and data breaches. Ensuring robust protection for sensitive surveillance data adds complexity and cost to system deployment and management.

Competitive Analysis

Dahua Technology, Hikvision, Axis Communications, Bosch Security Systems, and FLIR Systems lead the mobile surveillance tower market with advanced imaging technologies, ruggedized hardware, and integrated analytics. Their towers support temporary or remote security operations with high-resolution video, thermal imaging, and automated threat detection. These companies focus on reliability, low-light performance, and seamless integration with command centers.

MSS, WCCTV, Vanguard Wireless, 3xLOGIC, Senstar, Honeywell, Avigilon, and MOBOTIX strengthen the competitive landscape with flexible, modular tower solutions tailored for construction sites, critical infrastructure, and event security. Their platforms offer wireless connectivity, cloud monitoring, and AI-based motion detection. These providers emphasize ease of deployment, robust environmental protection, and scalable upgrade options.

Pro-Vigil, LiveView Technologies, Solar Surveillance, Total Security Solutions, Mobile Pro Systems, SentryPODS, Rapid Deployment CCTV, and others broaden the market with cost-effective, energy-efficient, and autonomous surveillance towers. Their offerings include solar power integration, remote management tools, and rapid setup for temporary deployments. These companies target users seeking affordable, flexible alternatives to fixed surveillance systems.

Top Key Players in the Market

- Dahua Technology

- Hikvision

- Axis Communications

- Bosch Security Systems

- FLIR Systems

- MSS (Mobile Surveillance Systems)

- WCCTV (Wireless CCTV Ltd)

- Vanguard Wireless

- 3xLOGIC

- Senstar Corporation

- Honeywell International

- Avigilon (Motorola Solutions)

- MOBOTIX AG

- Pro-Vigil

- LiveView Technologies

- Solar Surveillance

- Total Security Solutions

- Mobile Pro Systems

- SentryPODS

- Rapid Deployment CCTV

- Others

Future Outlook

The mobile surveillance tower market is poised for strong growth as demand rises for rapid-deployment, flexible security solutions across industries like defense, law enforcement, infrastructure, and public safety. Advancements in camera technology, AI-powered analytics, and integration with IoT platforms are enabling smarter, real-time threat detection and remote monitoring.

Opportunities lie in

- Expansion in emerging markets where infrastructure development and urbanization drive demand for agile surveillance solutions.

- Integration of AI, thermal imaging, and radar for enhanced threat detection and autonomous operation.

- Growing adoption in non-traditional sectors such as environmental monitoring, border security, and event management.

Recent Developments

- December, 2025, Axis Communications signed the U.S. CISA Secure by Design pledge, committing to higher cybersecurity standards for its video surveillance products and services, and showcased new integrated access control panels, intercoms, and audio devices at Security Canada Central.

- November, 2025, Dahua Technology unveiled its next-generation smart city solutions powered by Xinghan Large-Scale AI Models at the Smart City Expo World Congress, highlighting real-time urban safety and traffic management with integrated cameras, radars, and IoT sensors.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 3.3 Bn CAGR(2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component(Hardware (Sensors & Cameras,Power System,Communication Module,Others), Software (Video Management Software,Command & Control (C2) Software, Others), Services (Rental/Leasing Services, Installation & Deployment Services,Managed Services(VSaaS), Maintenance & Support Services)), By Power Source (Solar-Powered/Hybrid, Generator/Diesel-Powered,Grid-Powered), By Application(Perimeter Security & Intrusion Detection, Traffic Monitoring & Incident Detection, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dahua Technology, Hikvision, Axis Communications, Bosch Security Systems, FLIR Systems, MSS (Mobile Surveillance Systems), WCCTV (Wireless CCTV Ltd), Vanguard Wireless, 3xLOGIC, Senstar Corporation, Honeywell International, Avigilon (Motorola Solutions), MOBOTIX AG, Pro-Vigil, LiveView Technologies, Solar Surveillance, Total Security Solutions, Mobile Pro Systems, SentryPODS, Rapid Deployment CCTV, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Surveillance Tower MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Surveillance Tower MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dahua Technology

- Hikvision

- Axis Communications

- Bosch Security Systems

- FLIR Systems

- MSS (Mobile Surveillance Systems)

- WCCTV (Wireless CCTV Ltd)

- Vanguard Wireless

- 3xLOGIC

- Senstar Corporation

- Honeywell International

- Avigilon (Motorola Solutions)

- MOBOTIX AG

- Pro-Vigil

- LiveView Technologies

- Solar Surveillance

- Total Security Solutions

- Mobile Pro Systems

- SentryPODS

- Rapid Deployment CCTV

- Others