Global Mobile Devices User Authentication Services Market Size, Share and Analysis Report By Component (Software, Hardware), By Authentication Method (Biometric Authentication, Multi-Factor Authentication (MFA), Single Sign-On (SSO), Passwordless Authentication, Others), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), IT & Telecommunications, Healthcare, Government & Defense, Retail & E-commerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175734

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

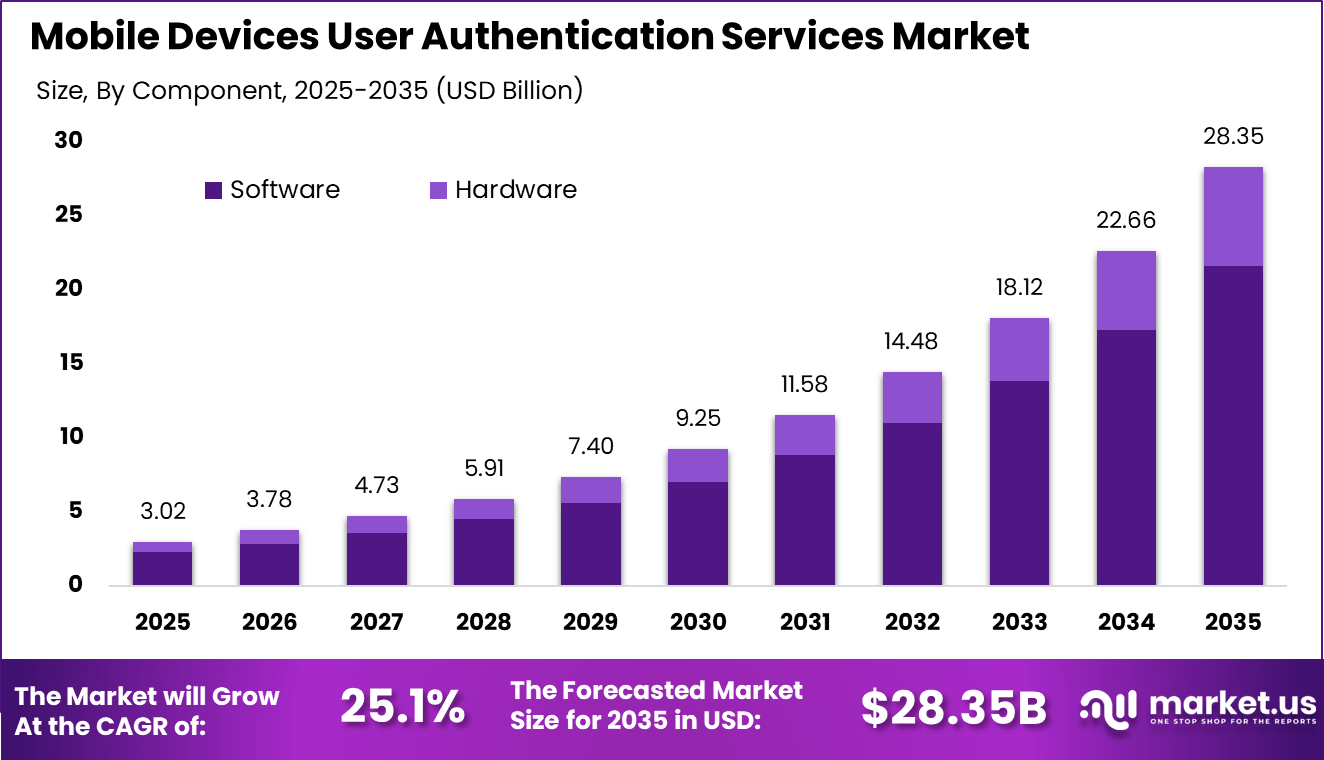

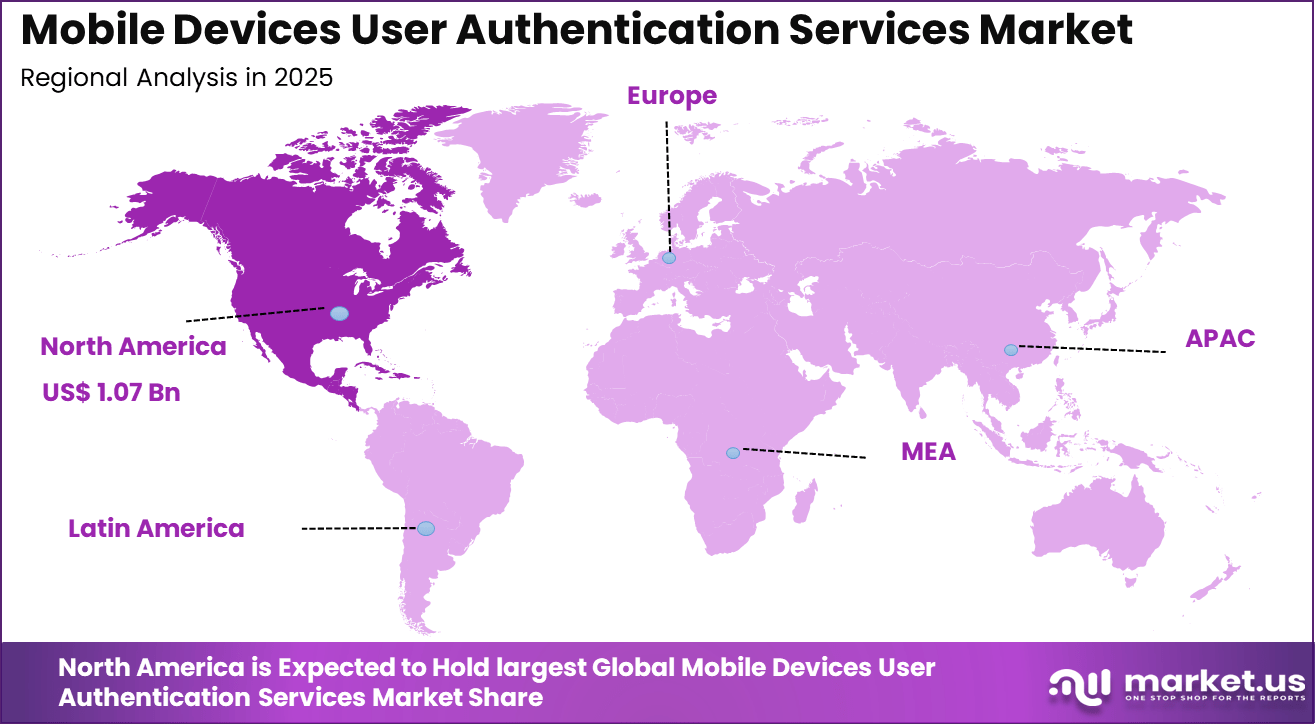

The Global Mobile Devices User Authentication Services Market was valued at USD 3.02 billion in 2025 and is projected to surge to approximately USD 28.35 billion by 2035, registering a strong CAGR of 25.1% over the forecast period. North America dominated the market in 2025, capturing more than 35.6% share and generating USD 1.07 billion in revenue, reflecting rapid adoption of advanced mobile security solutions and compelling long-term upside for investors.

The Mobile Devices User Authentication Services Market focuses on technologies and services that verify user identity on smartphones, tablets, and other mobile devices. These services ensure that only authorized users can access devices, applications, and sensitive data. Authentication methods include biometrics, passwords, PINs, and behavioral verification, often combined to improve security. As mobile devices become central to daily personal and business activities, authentication services play a critical role in digital trust.

These services are commonly delivered through software platforms integrated into operating systems, applications, and enterprise security frameworks. They support secure access for mobile banking, digital payments, corporate systems, and personal data. Authentication services are designed to balance security with user convenience, reducing friction during access.

Rising cyber threats push companies to use stronger authentication on mobile devices. Attacks on Android smartphones jumped 29% in the first half of 2025 compared to the year before. With more people handling sensitive info on phones daily, secure access turns into a real need. Government rules also force businesses to fight data leaks harder.

One of the main driving factors for this market is the rising concern over mobile security and data protection. Mobile devices store sensitive personal, financial, and enterprise information, making them attractive targets for unauthorized access. Strong authentication services help reduce risks related to device theft, data breaches, and identity misuse.

For instance, in January 2026, Duo Security Secured Cisco’s 125,000 users across 285,000 devices with seamless MFA deployment, cutting weekly authentications by 3.5 million and saving $3.4 million in productivity. Ann Arbor’s solution proves U.S. excellence in scalable, risk-based mobile protection.

Key Takeaway

- In 2025, the software segment led the global mobile devices user authentication services market with a 76.4% share, driven by wide adoption of app based and platform integrated authentication solutions.

- The multi factor authentication (MFA) segment held a dominant 58.3% share in 2025, reflecting strong demand for layered security to protect mobile users and sensitive data.

- Cloud based deployment accounted for 81.7% of the market, supported by scalability, ease of integration, and centralized identity management.

- Large enterprises represented 68.9% of total adoption, as these organizations manage large mobile workforces and require advanced access control systems.

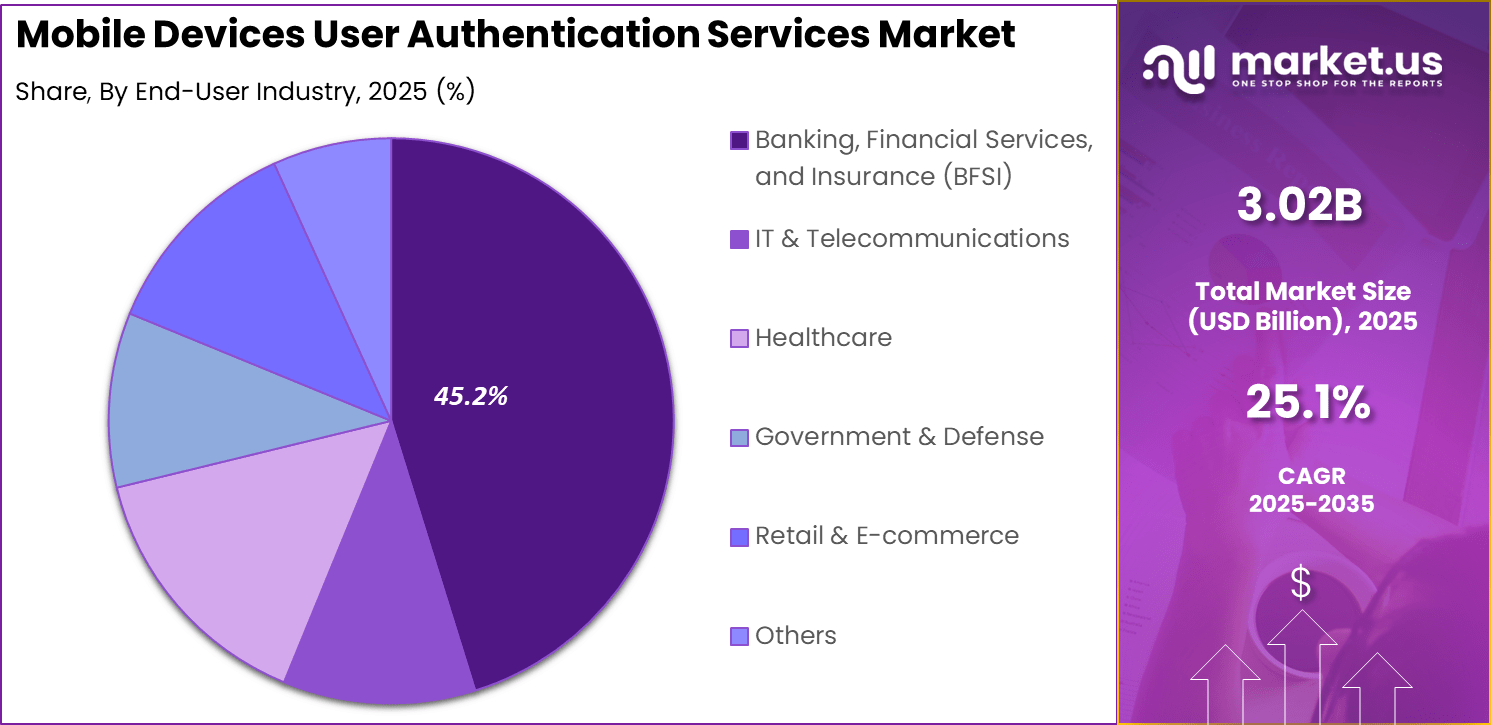

- The BFSI sector captured 45.2% share, driven by strict security requirements, regulatory compliance needs, and high mobile banking usage.

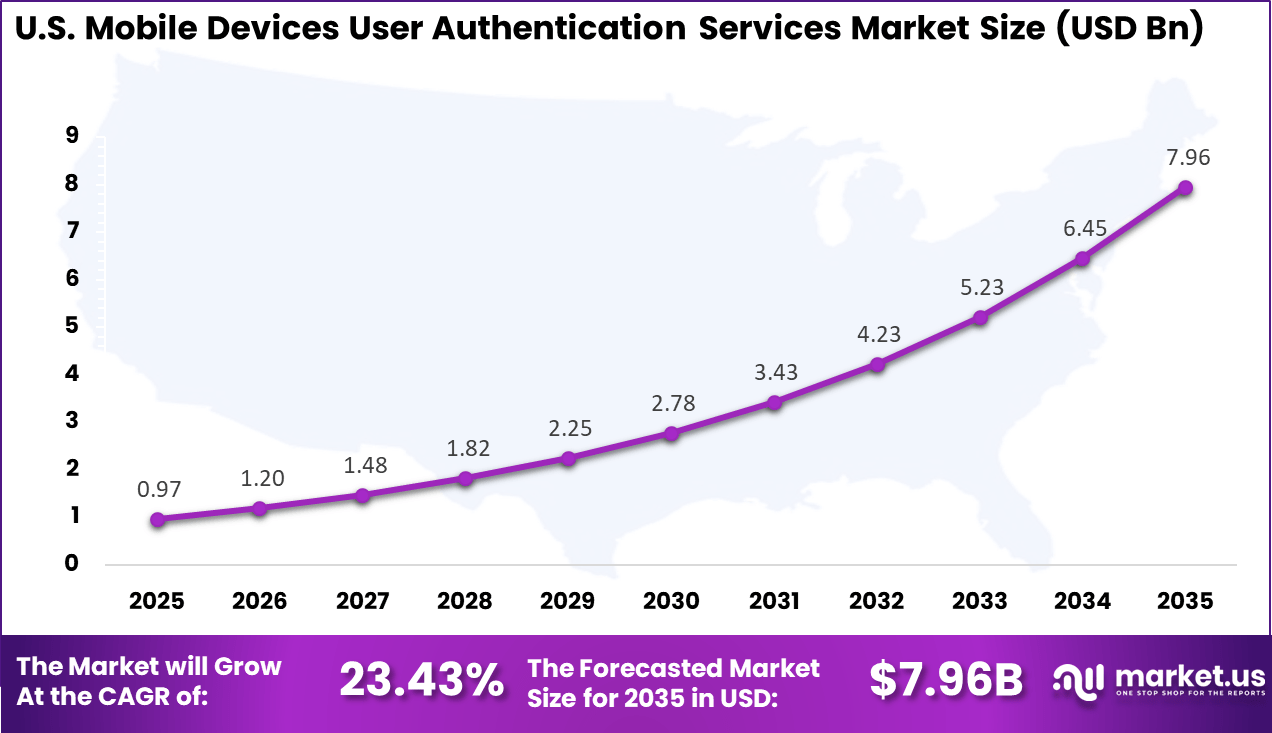

- The US mobile devices user authentication services market was valued at USD 0.97 billion in 2025 and is growing at a 23.43% CAGR, reflecting rapid adoption of mobile security solutions.

- North America held a leading position in 2025, capturing more than 35.6% of the global market, supported by strong digital infrastructure and high cybersecurity awareness.

Key Insights Summary

Usage and Behavior Trends

- Millennial adoption: About 75% of millennials are comfortable using biometric authentication, and 28% are more likely to enable multi factor authentication after experiencing a security breach.

- Banking and finance leadership: The BFSI sector leads adoption, holding over 32% of market share, supported by high security requirements and strong digital usage.

- Behavioral biometrics: Continuous authentication methods that combine behavioral and keystroke dynamics can achieve error rates as low as 3.3%, improving accuracy and fraud detection.

Adoption by Authentication Type

- Multi factor authentication (MFA): Remained the dominant method, capturing around 56% to 57% of total market share.

- Biometrics: Account for nearly 50% of deployments, with facial and fingerprint recognition favored for speed and user convenience.

- Passwordless authentication: The fastest growing segment, projected to grow at a 26% CAGR, with about 50% of the workforce expected to adopt passwordless access methods.

- SMS one time passwords: Represent 45% of authentication channels but are declining due to security risks such as SIM swapping, which is linked to 95% of certain account takeover incidents.

U.S. Market Size

The market for Mobile Devices User Authentication Services within the U.S. is growing tremendously and is currently valued at USD 0.97 billion, the market has a projected CAGR of 23.43%. Themarket is growing due to high smartphone use for banking and work apps. Strict laws like data privacy rules force companies to add strong logins on phones.

Cyber attacks hit headlines often, pushing firms to adopt multi-factor checks and biometrics quickly. Remote work keeps rising, so businesses need secure access anywhere. Tech giants roll out easy tools that fit daily habits, speeding up demand across sectors.

For instance, in August 2025, Microsoft Corporation mandated multi-factor authentication (MFA) rollout for all Microsoft 365 users, emphasizing mobile-based 2FA to combat cyberattacks. This initiative drives the adoption of phishing-resistant mobile authentication, solidifying U.S. dominance in enterprise security services.

In 2025, North America held a dominant market position in the Global Mobile Devices User Authentication Services Market, capturing more than a 35.6% share, holding USD 1.07 billion in revenue. This lead comes from tough cybersecurity rules that push companies to lock down mobile apps tightly.

Tech hubs in the US and Canada roll out new tools like biometrics first, setting trends worldwide. High smartphone use for payments and work adds fuel, while big cloud shifts make secure logins easy to scale. Agencies promote multi-factor checks hard, keeping the region ahead.

For instance, in November 2025, Okta, Inc. advanced mobile authentication leadership with Identity Engine updates, including Android passkey support and network zone restrictions for OIDC tokens. These features expand passwordless options and enhance security for native mobile apps, reinforcing North American companies’ position in secure AI-driven identity management.

Component Analysis

In 2025, The Software segment held a dominant market position, capturing a 76.4% share of the Global Mobile Devices User Authentication Services Market. Businesses turn to it because it fits right into apps and devices without extra hardware costs. As phones handle more sensitive tasks like banking, software keeps checks simple yet strong. Growth comes from easy updates that fix new threats fast. Teams find it reliable for daily use across millions of users.

This segment grows as companies want quick setups for security on mobiles. Software handles fingerprints, codes, and patterns smoothly. With more remote work, firms need tools that scale without big investments. It beats hardware by working on any phone model. Developers push updates often, so users stay safe from hackers trying new tricks.

For Instance, in January 2026, Ping Identity completed its acquisition of Keyless, adding zero-knowledge biometrics to its software platform for mobile authentication. This boosts privacy-focused software tools that verify users without storing sensitive data. Enterprises gain stronger defenses against AI-driven attacks while keeping logins smooth on phones.

Authentication Method Analysis

In 2025, the Multi-Factor Authentication (MFA) segment held a dominant market position, capturing a 58.3% share of the market. Users add steps like fingerprints or codes, making breaches much harder. This method grows as phones pack better sensors and apps support it out of the box. Banks push it hard to guard money transfers, and folks feel safer with extra checks. Daily mobile use for sensitive tasks drives this segment up steadily.

Growth speeds up since rules now force companies to use multi-factor for compliance. People adopt it willingly after seeing news of data leaks. From my reports, it thrives because it balances security with speed, unlike clunky old systems. Apps make it seamless, so users stick with it. As cyber risks rise, this layer becomes a must-have everywhere.

For instance, in August 2025, Duo Security highlighted phishing-resistant MFA with proximity checks and biometrics in its mobile app updates. Deployments take days, easing IT burdens while verifying users on phones securely. This keeps teams productive without slowing access, solidifying MFA as the go-to method against modern threats.

Deployment Mode Analysis

In 2025, The Cloud-based segment held a dominant market position, capturing a 81.7% share of the Global Mobile Devices User Authentication Services Market. Businesses skip heavy hardware costs and scale security as their teams grow. Phones connect to the cloud naturally, so updates roll out fast without user hassle. This setup grows because it lets small firms compete with big ones on protection. Remote work boosts it even more.

Demand climbs as cloud providers add strong encryption tailored for mobiles. I notice in trends that outages drop with their backups, building trust. Growth happens since companies handle more devices without worry. It saves time on installation. Everyone wins with quick fixes for new threats right from the server side.

For Instance, in July 2025, Auth0 rolled out native Web SSO in early access for cloud deployments, enabling seamless sessions between mobile apps and browsers. Secure tokens with device binding support SAML and actions, simplifying cloud management. Developers build frictionless cloud auth faster, boosting its top share.

Organization Size Analysis

In 2025, The Large Enterprises segment held a dominant market position, capturing a 68.9% share of the Global Mobile Devices User Authentication Services Market. They invest big in authentication to meet strict laws and avoid fines. This segment grows as these firms expand globally, needing uniform security across borders. Their scale tests tools hard, pushing better features for all. Complex needs drive a steady rise here.

Big players lead growth by setting examples others follow. They afford custom setups that smaller ones copy later. In my analysis, their budgets fund innovations like AI checks that trickle down. As they go digital, authentication becomes core. This pulls the market up with reliable, proven systems.

For Instance, in February 2025, HID Global’s report showed large enterprises shifting to cloud mobile credentials and AI for access control. Over 1,800 surveyed leaders prioritize unified platforms for thousands of devices. This trend helps big firms manage scale securely, driving enterprise segment growth.

End-User Industry Analysis

In 2025, The BFSI segment held a dominant market position, capturing a 45.2% share of the Global Mobile Devices User Authentication Services Market. Banks roll out strong authentication to protect transfers on phones. Customers expect it for peace of mind during daily use. Regulations force quick upgrades here, fueling growth. High stakes mean no skimping on mobile locks.

For Instance, in April 2025, Thales Group released its 2025 Cyber Trends Report, stressing hardware-rooted MFA for mobile banking with biometrics and eSIMs. Real-time risk checks protect BFSI apps from device exploits. This layered approach builds trust for high-value transactions on phones.

Key Market Segments

By Component

- Software

- Hardware

By Authentication Method

- Biometric Authentication

- Multi-Factor Authentication (MFA)

- Single Sign-On (SSO)

- Passwordless Authentication

- Others

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecommunications

- Healthcare

- Government & Defense

- Retail & E-commerce

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in January 2026, Ping Identity marked a digital trust milestone by integrating Zero-Knowledge Biometrics through its acquisition of Keyless. This Denver-based innovation delivers device-independent, privacy-focused biometric authentication for mobile users, countering AI-driven fraud and bolstering continuous verification in enterprise environments.

Top Key Players in the Market

- Microsoft Corporation

- Okta, Inc.

- Ping Identity Holding Corp.

- Broadcom, Inc.

- ForgeRock, Inc.

- OneLogin, Inc.

- RSA Security LLC

- Duo Security

- Google LLC

- IBM Security

- HID Global Corporation

- Thales Group

- Entrust, Inc.

- Auth0

- Yubico AB

- Others

Recent Developments

- In January 2026, OneSpan Announced acquisition of Build38, expanding SDK-based mobile app protection with RASP technology for 250 million endpoints. This enhances authentication and fraud detection for financial apps, advancing innovation in embedded security.

Report Scope

Report Features Description Market Value (2025) USD 3.0 Bn Forecast Revenue (2035) USD 28.3 Bn CAGR(2026-2035) 25.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware), By Authentication Method (Biometric Authentication, Multi-Factor Authentication (MFA), Single Sign-On (SSO), Passwordless Authentication, Others), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), IT & Telecommunications, Healthcare, Government & Defense, Retail & E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Okta, Inc., Ping Identity Holding Corp., Broadcom, Inc., ForgeRock, Inc., OneLogin, Inc., RSA Security LLC, Duo Security, Google LLC, IBM Security, HID Global Corporation, Thales Group, Entrust, Inc., Auth0, Yubico AB, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Devices User Authentication Services MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Mobile Devices User Authentication Services MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Okta, Inc.

- Ping Identity Holding Corp.

- Broadcom, Inc.

- ForgeRock, Inc.

- OneLogin, Inc.

- RSA Security LLC

- Duo Security

- Google LLC

- IBM Security

- HID Global Corporation

- Thales Group

- Entrust, Inc.

- Auth0

- Yubico AB

- Others