Global Mineral Wool Insulation for Data Center Market Size, Share Analysis Report By Material Type (Stone Wool and Glass Wool), By Product Form (Boards / Panels, Blankets / Rolls, Loose Fill, Pipe Sections), By Insulation Type (Thermal Insulation and Acoustic Insulation), By Installation Method (New Construction and Retrofit / Renovation), By Installation Location (Walls And Partitions, Roofs And Ceilings, Pipe, Air Duct, Equipment, Raised Floors), By End-use (IT And Telecom, BFSI, Healthcare, Retail And E-commerce, Entertainment And Media, Manufacturing, Energy and Utilities, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172796

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

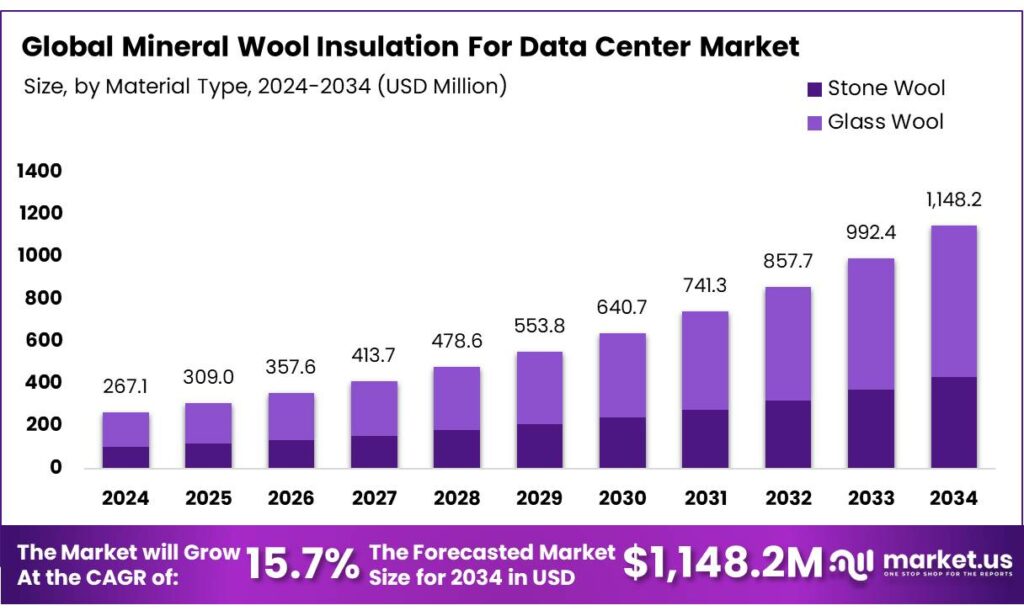

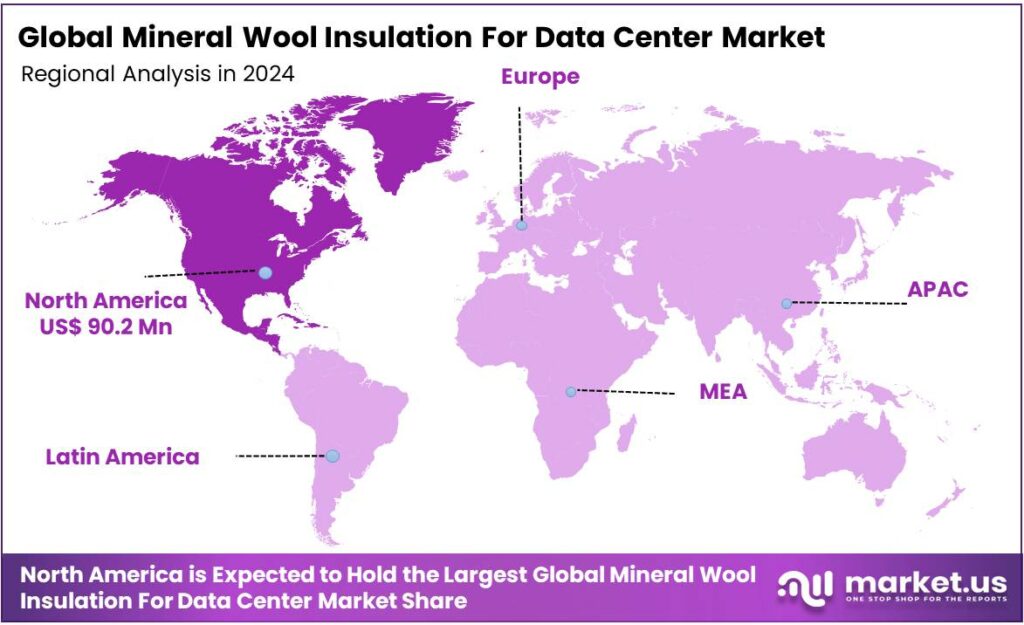

The Global Mineral Wool Insulation for Data Center Market size is expected to be worth around USD 1148.2 Million by 2034, from USD 267.1 Million in 2024, growing at a CAGR of 15.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 33.8% share, holding USD 10 Billion in revenue.

Mineral wool is a fibrous insulation made from melted rock, such as basalt or slag, a steel byproduct, spun into fine fibers, and formed into dense mats, batts, or loose fill for excellent thermal, acoustic, and fire resistance in buildings, working by trapping air to prevent heat transfer. The mineral wool insulation market for data centers is primarily driven by the increasing demand for energy efficiency, fire safety, and thermal management in high-performance environments.

Data centers, particularly within the IT and telecom sector, require reliable solutions to control temperature fluctuations and reduce cooling costs, making mineral wool insulation a preferred choice due to its thermal resistance and fire-resistant properties. Despite the advantages, the materials face fierce competition from cost-effective alternatives, such as polyurethane foam insulation for data centers. However, as the laws regarding energy efficiency become more resilient, there would be a consistent demand for high-performance materials, such as mineral wool insulation.

- In the European Union, legal regulations such as the Energy Performance of Buildings Directive (EPBD) regulate energy savings around new and existing buildings, including insulation of the building. Similarly, the US codes, such as the International Energy Conservation Code (IECC), which set mandatory R-value (heat resistance) and continuous insulation requirements based on U.S. climate zones, create opportunities for insulation materials, such as mineral wool.

Key Takeaways

- The global mineral wool insulation for data center market was valued at USD 267.1 million in 2024.

- The global mineral wool insulation for data center market is projected to grow at a CAGR of 15.7% and is estimated to reach USD 1148.2 Million by 2034.

- On the basis of materials of mineral wool insulation for data centers, glass wool dominated the market, constituting 62.4% of the total market share.

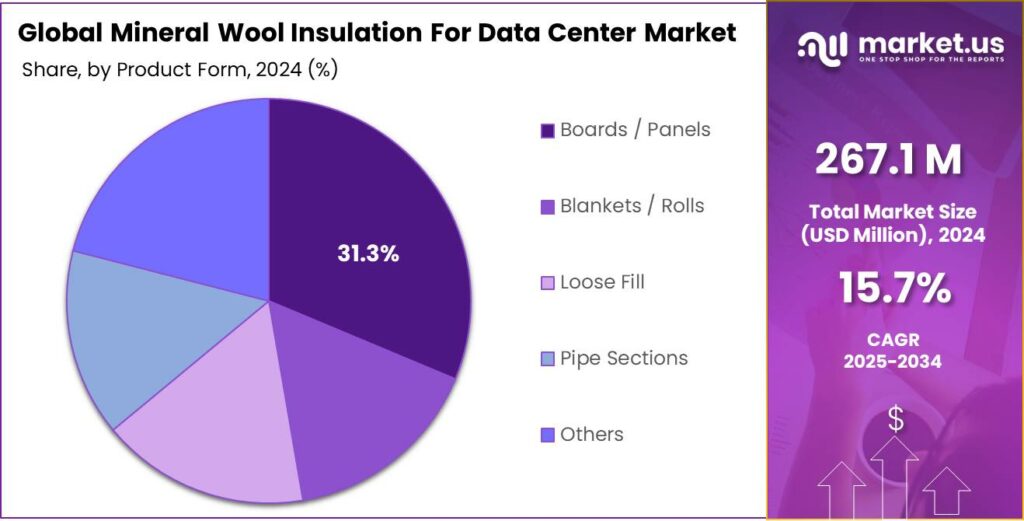

- On the basis of the form of mineral wool insulation for data centers, boards/panels dominated the market, comprising 31.3% of the total market share.

- Based on the insulation type of mineral wool insulation for data centers, thermal insulation dominated the market, with a substantial market share of around 71.1%.

- On the basis of installation methods, new constructions held a dominant position in the market, with 73.6% of the market share.

- Based on the installation location, walls & partitions led the market, comprising 33.2% of the total market.

- Among the end-uses, the IT & telecom sector held a major share in the mineral wool insulation for the data center market, 43.0% of the market share.

- In 2024, North America was the most dominant region in the mineral wool insulation for the data center market, accounting for 33.8% of the total global consumption.

Material Type Analysis

Glass Wool is a Prominent Segment in the Mineral Wool Insulation for the Data Center Market.

The mineral wool insulation for the data center market is segmented based on material type into stone wool and glass wool. The glass wool led the mineral wool insulation for the data center market, comprising 62.4% of the market share, due to its cost-effectiveness, lightweight properties, and thermal performance. Glass wool provides high thermal resistance, helping to minimize energy loss and reduce the requirement for extensive cooling, which is critical in data center environments.

Additionally, it is easier to handle and install due to its lighter weight, which reduces labor costs and time during construction. While stone wool offers better fire resistance and higher durability in extreme conditions, glass wool strikes a balance between performance and affordability, making it the preferred choice for most data center projects. Its effectiveness in controlling temperature and sound while meeting regulatory requirements further solidifies its widespread use in the industry.

Product Form Analysis

Boards / Panels Are a Prominent Segment in the Mineral Wool Insulation for the Data Center Market.

The mineral wool insulation for the data center market is segmented based on boards/panels, blankets/rolls, loose fill, pipe sections, and others. The boards/panels led the mineral wool insulation for the data center market, comprising 31.3% of the market share, due to their structural rigidity, ease of installation, and space efficiency. These pre-formed panels offer a high level of thermal performance and are well-suited for the flat, consistent surfaces commonly found in data center walls and ceilings.

Their rigid nature ensures they stay in place without additional support, reducing installation time and labor costs. Furthermore, panels provide better soundproofing and are easier to cut to specific dimensions, allowing for precise fitment in tight spaces. Unlike blankets, rolls, or loose fill, which may shift or compress over time, boards maintain their integrity and insulation properties, making them ideal for long-term, high-performance use in the temperature-sensitive environment of a data center.

Insulation Type Analysis

Thermal Insulation Dominated the Mineral Wool Insulation for the Data Center Market.

On the basis of insulation type, the market is segmented into thermal insulation and acoustic insulation. The thermal insulation dominated the mineral wool insulation for the data center market, comprising 71.1% of the market share, primarily due to the critical need to manage heat generated by servers and other electronic equipment. Data centers consume large amounts of energy, and maintaining an optimal temperature is essential to ensure the performance and longevity of the equipment.

While acoustic insulation is important for controlling noise in certain environments, the priority in data centers is minimizing heat buildup. Thermal insulation plays a far more significant role in reducing operational costs and ensuring that equipment operates within safe temperature ranges, making it the preferred choice for these high-performance facilities.

Installation Location Analysis

Most Mineral Wool Insulation in Data Centers is Utilized for Walls & Partitions.

Based on the installation location, the market is divided into walls & partitions, roofs & ceilings, pipes, air ducts, equipment, raised floors, and others. The market witnessed substantial dominance from the walls & partitions segment, with a notable market share of 33.2%, as these areas are critical for maintaining temperature control and structural integrity. Walls and partitions are directly exposed to external temperature fluctuations and internal heat generated by the equipment, making effective insulation essential for energy efficiency and thermal regulation.

Additionally, walls and partitions are larger and more rigid than other surfaces, such as air ducts or raised floors, allowing for easier installation of solid panels, which provide consistent performance over time. While insulation for other areas, such as air ducts or floors, is necessary, the walls and partitions are the primary focus for managing overall temperature and energy consumption in data centers.

End-Use Analysis

The IT & Telecom Sector Held a Major Share of the Mineral Wool Insulation for the Data Center Market.

Among the end-uses, 43.0% of the total global consumption of mineral wool insulation for data centers is for the IT & telecom sector. The IT and telecom sector is the largest user of mineral wool insulation in data centers due to the industry’s high demand for reliable, energy-efficient, and secure data storage and processing facilities. Data centers in this sector house critical infrastructure, including servers, networking equipment, and telecommunications hardware, which generate substantial heat and require precise temperature control.

The IT and telecom sector’s rapid growth, driven by increasing digitalization, cloud computing, and telecommunications expansion, places a significant emphasis on building energy-efficient and resilient data centers, making mineral wool insulation an ideal choice for these high-performance environments. Other sectors, while requiring data storage, do not have the same scale or intensity of infrastructure needs as IT and telecom.

Key Market Segments

By Material Type

- Stone Wool

- Glass Wool

By Product Form

- Boards / Panels

- Blankets / Rolls

- Loose Fill

- Pipe Sections

- Others

By Insulation Type

- Thermal Insulation

- Acoustic Insulation

By Installation Method

- New Construction

- Retrofit / Renovation

By Installation Location

- Walls & Partitions

- Roofs & Ceilings

- Pipe

- Air Duct

- Equipment

- Raised Floors

- Others

By End-Use

- IT & Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Entertainment & Media

- Manufacturing

- Energy and Utilities

- Others

Drivers

Consumer Demand for Energy Efficiency Drives the Mineral Wool Insulation for the Data Center Market.

The growing consumer demand for energy efficiency has significantly contributed to the increasing adoption of mineral wool insulation in data centers. As data centers account for a substantial portion of global energy consumption, businesses are increasingly prioritizing sustainability in their infrastructure.

- According to a report by the International Energy Agency (IEA), electricity consumption from data centers is estimated to amount to around 415 terawatt hours (TWh), or about 1.5% of global electricity consumption in 2024, which has grown at 12% per year over the last five years. Similarly, in the European Union, wholesale electricity prices averaged around USD 90/MWh in the first half of 2025, about 30% higher compared to the same period in 2024.

As these numbers increase, there is a consumer demand for energy-efficient solutions, driving the demand for mineral wool insulation. Mineral wool insulation, known for its thermal and acoustic properties, helps reduce energy loss by maintaining optimal temperatures and minimizing heat transfer. This directly contributes to reducing the overall cooling requirements and energy consumption of data centers. Moreover, as the world shifts toward stricter energy efficiency regulations and climate-conscious initiatives, data centers are becoming more committed to adopting materials that help lower their carbon footprints.

Restraints

Availability of the Effective Alternatives Might Delay the Growth of the Mineral Wool Insulation for the Data Centers Market.

The availability of effective alternatives to mineral wool insulation could potentially slow the growth of the mineral wool insulation market for data centers. While mineral wool is highly regarded for its thermal and acoustic properties, other insulation materials, such as polyurethane foam and spray foam, offer comparable performance and may be preferred due to their lower weight and ease of installation.

In addition, these alternatives are gaining popularity due to their cost-effectiveness and ability to provide superior insulation with thinner profiles, which is crucial in space-constrained data center environments. For instance, polyurethane foam can provide similar thermal resistance values with a thinner layer, potentially reducing both installation and operational costs.

Additionally, as energy-efficient and sustainable building practices evolve, new materials such as aerogels or sustainable plant-based insulations are being developed, offering more eco-friendly solutions. The growing range of alternative insulation options may challenge the widespread adoption of mineral wool insulation in data center construction.

Opportunity

Rapid Increase in the Number of Data Centers Creates Opportunities in Mineral Wool Insulation for the Data Center Market.

The rapid increase in the number of data centers worldwide presents significant opportunities for the mineral wool insulation market. As businesses and industries shift toward digitalization and cloud computing, the demand for data storage and processing capacity has surged, leading to the establishment of more data centers. In particular, North America and the Asia Pacific region have seen a sharp rise in data center infrastructure, with countries such as the United States, China, and Japan leading the expansion. This growth directly translates to increased requirements for energy-efficient building materials, such as mineral wool insulation, which offers superior thermal resistance, fire safety, and soundproofing.

- Globally, there are over 12,000 operational data centers, with the U.S. accounting for 45% of all facilities worldwide.

Data centers, known for their high energy consumption due to constant cooling needs, benefit from mineral wool’s ability to maintain temperature control, reducing the reliance on energy-intensive cooling systems. For instance, mineral wool insulation can lower operational costs by enhancing building envelope performance, thus creating a clear opportunity for the material’s widespread adoption in new data center projects.

Trends

Adoption of Stone Wool Insulation for Data Centers.

The adoption of stone wool insulation in data centers is an ongoing trend, driven by its numerous advantages in terms of fire resistance, thermal performance, and sustainability. Stone wool, a type of mineral wool, is gaining popularity in data center construction due to its non-combustibility and ability to withstand high temperatures, making it an ideal choice for enhancing fire safety in environments with heavy electrical equipment. Stone wool insulation provides high thermal resistance, which helps reduce energy consumption by improving temperature control within data centers.

Additionally, the material is moisture-resistant, preventing mold growth and maintaining insulation efficiency over time. This makes it particularly valuable in areas with high humidity or fluctuating temperatures. Leveraging the trend, many manufacturers are expanding their manufacturing facilities to cater to the rising demand for stone wool insulation. For instance, in May 2025, Saint-Gobain announced the launch of a low-carbon stone wool insulation plant in the UK, to produce 50,000 tons per year of high-performance stone wool insulation with the potential to double its output to 100,000 tons per year.

Geopolitical Impact Analysis

Geopolitical Tensions Have Affected the Mineral Wool Insulation for Data Centers Market by Disrupting Major Supply Chains.

The geopolitical tensions have had a significant impact on the mineral wool insulation market for data centers, influencing supply chains and demand patterns. Following events such as the Russia-Ukraine conflict and trade war between the US and China, several industries, including construction and infrastructure, faced disruptions in the availability of raw materials. Mineral wool, primarily produced from basalt and dolomite, relies on a steady supply of natural resources, several of which are sourced from regions affected by these tensions.

For instance, China is a major exporter of dolomite and one of the major producers of basalt, and the restrictions on trade with the country have driven up the prices of the raw materials. Additionally, the uncertainty surrounding global trade agreements prompted a shift toward localized production, with regions increasing investment in domestic manufacturing of mineral wool to mitigate dependence on volatile international markets. Furthermore, the geopolitical instability led to cautious investment in large-scale infrastructure projects, including data centers.

Regional Analysis

North America Held the Largest Share of the Global Mineral Wool Insulation for the Data Center Market.

In 2024, North America dominated the global mineral wool insulation for the data center market, holding about 33.8% of the total global consumption. The region holds the largest share of the global mineral wool insulation market for data centers, driven by the region’s robust demand for energy-efficient building materials and rapid increase in the number of data centers. In particular, the United States leads the adoption of advanced data center technologies, with major hubs such as Northern Virginia and Silicon Valley housing some of the world’s largest data centers.

For instance, as of November 2025, the United States had 5,427 data centers, making it the world’s largest data center market by a significant margin. In addition, the annual energy usage by data centers in the United States in 2023, not accounting for cryptocurrency, was approximately 176 terawatt-hours (TWh), approximately 4.4% of U.S. annual electricity consumption that year. Similarly, it is estimated that AI consumes 10% to 20% of data center energy.

As these facilities consume a large amount of energy, they require efficient thermal management solutions to address their significant energy consumption, making mineral wool insulation an essential choice. Furthermore, the data centers in the region are subject to stringent building codes and environmental regulations, which further boost the demand for fireproof and sustainable materials, such as mineral wool.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies invest heavily in product innovation to enhance the thermal, fire-resistant, and acoustic properties of their insulation solutions. In addition, the players prioritize expanding their manufacturing capabilities, particularly in regions with high demand, to shorten supply chains and reduce dependency on volatile international markets. Similarly, these companies focus on mergers and acquisitions of local players in several regions to expand their geographic reach and sometimes diversify their product portfolio.

The Major Players in The Industry

- Saint-Gobain

- Sika AG

- Ventac

- Johns Manville

- Armacell International S.A

- Owens Corning

- IAC Acoustics UK Ltd

- Huamei Energy-Saving Technology Group Co., Ltd.

- InsulTech, LLC

- Kingspan Group

- Knauf Group

- Rockwool A/S

- Supreme Industries

- L’ISOLANTE K-FLEX S.p.A.

- Thermaflex

- Other Key Players

Key Development

- In February 2025, Rockwool, a leading manufacturer of stone wool insulation, announced its investment of around US$100 million to expand its footprint in north Mississippi.

- In October 2024, Knauf Group and Texnopark announced a joint agreement for Knauf to acquire Texnopark’s Rock Mineral Wool insulation business, which included a plant in Tashkent, Uzbekistan, equipped with advanced electric melting technology, which enables low CO2 emissions in production.

Report Scope

Report Features Description Market Value (2024) USD 267.1 Mn Forecast Revenue (2034) USD 1148.2 Mn CAGR (2025-2034) 15.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Stone Wool and Glass Wool), By Product Form (Boards / Panels, Blankets / Rolls, Loose Fill, Pipe Sections, and Others), By Insulation Type (Thermal Insulation and Acoustic Insulation), By Installation Method (New Construction and Retrofit / Renovation), By Installation Location (Walls & Partitions, Roofs & Ceilings, Pipe, Air Duct, Equipment, Raised Floors, and Others), By End-use (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Entertainment & Media, Manufacturing, Energy and Utilities, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Saint-Gobain, Sika AG, Ventac, Johns Manville, Armacell International S.A., Owens Corning, IAC Acoustics UK Ltd, Huamei Energy-Saving Technology Group Co., Ltd., InsulTech, LLC, Kingspan Group, Knauf Group, Rockwool A/S, Supreme Industries, L’ISOLANTE K-FLEX S.p.A., Thermaflex, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Mineral Wool Insulation for Data Center MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Mineral Wool Insulation for Data Center MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Saint-Gobain

- Sika AG

- Ventac

- Johns Manville

- Armacell International S.A

- Owens Corning

- IAC Acoustics UK Ltd

- Huamei Energy-Saving Technology Group Co., Ltd.

- InsulTech, LLC

- Kingspan Group

- Knauf Group

- Rockwool A/S

- Supreme Industries

- L’ISOLANTE K-FLEX S.p.A.

- Thermaflex

- Other Key Players