Global Military Personal Protective Equipment Market Size, Share, Growth Analysis By Product (Tactical Clothing, Body Armor, Tactical Vest, Eye Protection, Combat Helmet, Life Safety Jacket, Backpack, Pelvic Protection, Respiratory Protection, Others), By End Use (Army, Navy, Air Force), By Distribution Channel (Government & Defense Tenders, Direct Institutional Procurement, Authorized Distributors, Defense Contractors), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173351

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

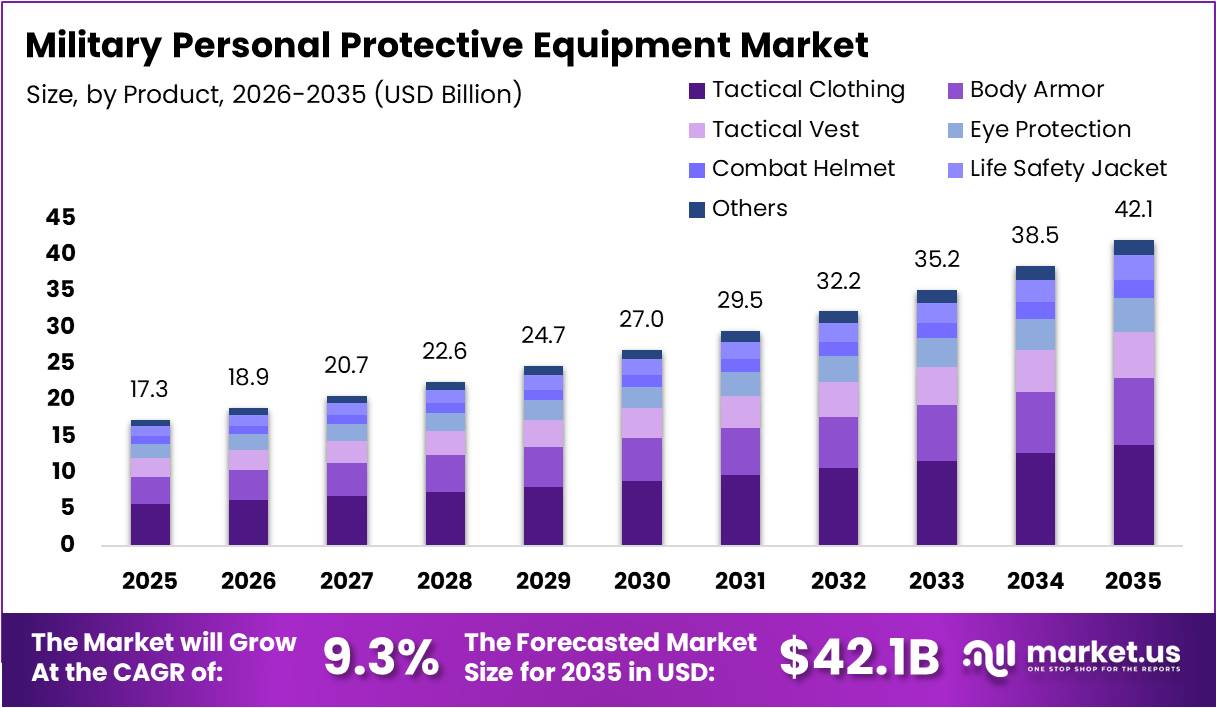

The Global Military Personal Protective Equipment Market size is expected to be worth around USD 42.1 Billion by 2035, from USD 17.3 Billion in 2025, growing at a CAGR of 9.3% during the forecast period from 2026 to 2035.

Military Personal Protective Equipment (PPE) includes body armor, combat helmets, tactical vests, protective eyewear, and ballistic plates designed to protect armed forces from ballistic, fragmentation, and combat-related threats. Modern PPE leverages advanced materials such as Kevlar and ceramic composites to enhance protection while maintaining operational mobility across diverse combat environments.

The military PPE market demonstrates robust growth potential driven by escalating geopolitical tensions and modernization initiatives across defense sectors globally. Emerging opportunities arise from technological advancements in lightweight armor systems and multi-threat protection capabilities. Defense forces increasingly prioritize soldier survivability, consequently amplifying demand for next-generation protective solutions that balance weight reduction with superior ballistic resistance across various threat levels.

Government investments significantly influence market expansion as nations allocate substantial budgets toward soldier modernization programs. Regulatory frameworks and military procurement standards shape product development trajectories, ensuring equipment meets stringent ballistic performance certifications. These compliance requirements drive continuous innovation in protective technologies, compelling manufacturers to develop solutions that satisfy evolving military specifications while addressing operational effectiveness concerns in contemporary warfare scenarios.

Technological integration transforms traditional protective equipment into smart systems incorporating sensors, communication modules, and health monitoring capabilities. This convergence creates opportunities for advanced soldier systems that enhance situational awareness alongside physical protection. Furthermore, asymmetric warfare patterns and unconventional threats necessitate adaptable equipment designs, spurring development of modular protective solutions suitable for varied mission profiles and operational theaters worldwide.

According to military equipment assessments, U.S. ground troops currently carry approximately 27 pounds of personal protective equipment comprising body armor and helmets during operations. Research conducted on law enforcement applications demonstrates that officers shot in the torso while wearing body armor were 76% less likely to be killed compared to those without protective equipment.

Key Takeaways

- The global Military Personal Protective Equipment market is projected to grow from USD 17.3 Billion in 2025 to USD 42.1 Billion by 2035, at a 9.3% CAGR.

- By product, Tactical Clothing leads the market with a 27.8% share in 2025, driven by its widespread use across combat environments.

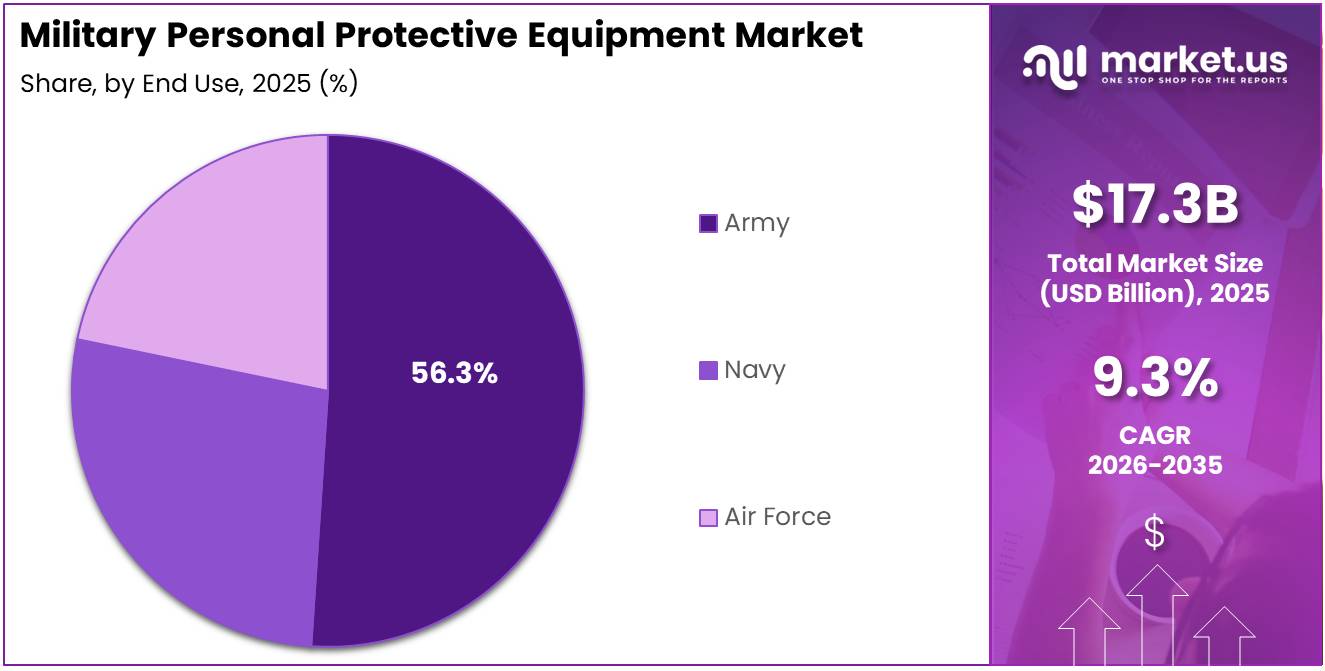

- By end use, the Army segment dominates with a 56.3% market share in 2025, reflecting the largest deployment of ground forces.

- By distribution channel, Government & Defense Tenders account for the largest share at 49.2% in 2025, supported by large-scale procurement contracts.

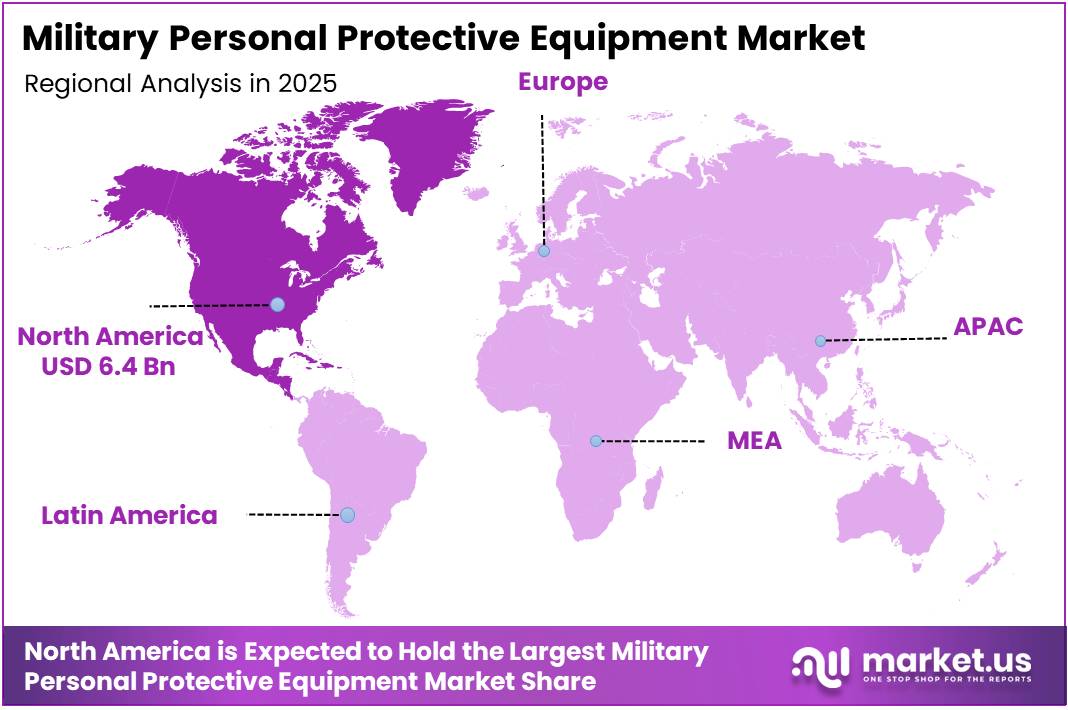

- North America holds the leading regional position with a 37.4% market share, valued at USD 6.4 Billion.

By Product Analysis

Tactical Clothing dominates with 27.8% due to its essential role as the foundation layer of military protection and versatility across diverse combat environments.

In 2025, Tactical Clothing held a dominant market position in the By Product Analysis segment of Military Personal Protective Equipment Market, with a 27.8% share. This segment provides fundamental protective layers that soldiers depend on across operational theaters. Modern tactical clothing integrates advanced fabric technologies including moisture-wicking systems, flame-resistant materials, and infrared signature reduction capabilities for enhanced performance during extended missions.

Body Armor represents a critical life-saving component protecting personnel against ballistic threats and fragmentation injuries. Contemporary armor systems utilize lightweight ceramic and composite materials that reduce fatigue while maintaining multi-hit capability. Modular designs allow customization based on mission requirements, with continuous innovations improving protection-to-weight ratios for enhanced soldier mobility.

Tactical Vests function as integrated load-bearing platforms distributing equipment weight efficiently across soldiers’ torsos. These systems feature MOLLE webbing for customizable configuration of pouches and communication devices. Quick-release mechanisms enable rapid equipment removal during emergencies, while designs incorporate drag handles for casualty evacuation and body armor compatibility.

Eye Protection safeguards vision while defending against ballistic impacts and environmental debris. Military-grade eyewear meets stringent standards using shatter-resistant polycarbonate lenses with anti-scratch and anti-fog coatings. Interchangeable lens systems accommodate varying light conditions, while modern designs integrate seamlessly with helmets and night vision devices.

Combat Helmets deliver critical cranial protection using advanced composite shells defeating ballistic projectiles and blunt impacts. Modern designs incorporate integrated rail systems for mounting night vision devices and communication equipment. Improved suspension systems with adjustable padding distribute impact forces, while weight reduction initiatives using carbon fiber improve neck strain reduction.

Life Safety Jackets ensure personnel survival during maritime operations with reliable buoyancy and visibility features. These jackets feature automatic inflation mechanisms, reflective markers, and integrated emergency beacons for rescue coordination. Military specifications require compatibility with body armor for amphibious operations, with quick-donning capabilities and reinforced construction for harsh marine environments.

Backpacks provide essential carrying capacity for sustainment supplies and mission-specific gear during extended operations. Military-grade packs utilize reinforced construction with water-resistant materials and ergonomic harness systems for efficient weight distribution. Internal frame designs maintain load stability while external attachment points accommodate additional equipment for diverse operational needs.

Pelvic Protection shields vulnerable lower torso regions from blast overpressure and fragmentation injuries. These components attach seamlessly to body armor carriers, providing coverage for femoral arteries and pelvic organs. Increased adoption follows documented effectiveness in reducing life-threatening injuries from improvised explosive devices, with designs balancing protection and mobility.

Respiratory Protection defends personnel against chemical, biological, radiological, and nuclear threats in contaminated environments. Advanced filter cartridges provide multi-threat protection while minimizing breathing resistance. Modern masks integrate voice amplification systems and hydration ports, with designs ensuring compatibility with helmets and communication equipment for complete protection.

Others encompasses specialized protective equipment including hearing protection devices, knee and elbow pads, and groin guards. These supplementary items address specific operational hazards and reduce cumulative trauma injuries. Hearing protection systems balance auditory awareness with protection against damaging noise, while joint protection pads prevent injuries during combat scenarios.

By End Use Analysis

Army dominates with 56.3% due to substantial troop strength and diverse ground combat requirements across varied operational theaters worldwide.

In 2025, Army held a dominant market position in the By End Use Analysis segment of Military Personal Protective Equipment Market, with a 56.3% share. Land forces face multifaceted threats including direct fire engagements, improvised explosive devices, and chemical agents, necessitating comprehensive protective equipment suites. Large-scale procurement programs ensure standardized equipment across infantry, armor, and artillery units for operational cohesion.

Navy requires maritime-specific protective equipment designed for shipboard operations, amphibious warfare, and submarine service. Naval gear emphasizes corrosion resistance, flame retardant properties, and buoyancy features. Damage control teams utilize specialized firefighting ensembles, while special warfare units require tactical equipment comparable to ground forces for boarding operations.

Air Force personnel utilize protective equipment tailored for aviation operations and airbase security functions. Aircrew members depend on specialized flight suits with flame-resistant materials, survival vests, and helmets with integrated oxygen systems. Security forces protecting air installations require ground-oriented protective gear including body armor for base defense missions.

By Distribution Channel Analysis

Government & Defense Tenders dominate with 49.2% due to mandated competitive procurement processes ensuring transparency and fiscal accountability in military acquisitions.

In 2025, Government & Defense Tenders held a dominant market position in the By Distribution Channel Analysis segment of Military Personal Protective Equipment Market, with a 49.2% share. Formal tender systems allow multiple manufacturers to compete on technical specifications and pricing, optimizing value for defense budgets. This channel accommodates large-volume contracts supplying entire military branches with standardized equipment.

Direct Institutional Procurement enables expedited acquisitions for urgent operational requirements and specialized unit needs bypassing lengthy tender processes. This channel allows military organizations to engage manufacturers directly when timelines demand rapid equipment deployment. Direct procurement facilitates prototype testing and urgent replacements with streamlined approval processes.

Authorized Distributors maintain regional supply networks providing accessibility for routine replenishment orders and maintenance supplies across dispersed installations. These intermediaries stock commonly required items reducing lead times significantly. Distributors offer logistics support, warranty administration, and technical assistance with local presence enabling rapid response.

Defense Contractors deliver integrated protective equipment solutions through comprehensive prime contract arrangements coordinating multiple subcontractors and suppliers. These contractors provide complete system packages including training, maintenance support, and lifecycle upgrades. Their program management expertise ensures interoperability and regulatory compliance for large-scale military transformation programs.

Key Market Segments

By Product

- Tactical Clothing

- Body Armor

- Tactical Vest

- Eye Protection

- Combat Helmet

- Life Safety Jacket

- Backpack

- Pelvic Protection

- Respiratory Protection

- Others

By End Use

- Army

- Navy

- Air Force

By Distribution Channel

- Government & Defense Tenders

- Direct Institutional Procurement

- Authorized Distributors

- Defense Contractors

Drivers

Rising Defense Budgets Prioritizing Soldier Survivability Drive Market Expansion

Governments worldwide are increasing their defense spending with a clear focus on protecting soldiers in the field. This shift reflects a growing understanding that investing in personnel safety directly improves combat readiness and operational effectiveness. Military forces recognize that well-protected soldiers can perform better under pressure and return home safely.

Modern warfare involves unpredictable threats that require advanced protection systems. Asymmetric warfare and close-quarter combat situations have become more common, exposing soldiers to immediate danger. These scenarios demand reliable protective equipment that can withstand diverse threats including bullets, shrapnel, and improvised explosive devices.

Outdated protective gear no longer meets the challenges of contemporary battlefields. Military organizations are mandating upgrades to legacy equipment to ensure soldiers have access to modern protection standards. This requirement stems from lessons learned in recent conflicts where inadequate gear resulted in preventable casualties. Defense forces are systematically replacing old body armor, helmets, and tactical gear with advanced solutions that offer superior protection.

Restraints

Lengthy Military Testing Requirements Restrain Market Growth Pace

Military protective equipment must undergo extensive testing before deployment, creating significant delays in market adoption. These certification processes are designed to ensure absolute reliability under extreme conditions, but they also extend product development timelines considerably. Manufacturers must demonstrate that their equipment meets strict performance standards across multiple threat scenarios and environmental conditions.

The testing phase involves rigorous ballistic evaluations, durability assessments, and field trials that can take years to complete. Each piece of equipment must prove its effectiveness against specified threats while maintaining functionality in harsh climates. This thorough approach, while necessary for soldier safety, slows the introduction of innovative products to the market.

Defense procurement adds another layer of complexity to market growth. Military purchasing involves multiple approval levels, budget allocations, and contractual negotiations that create bureaucratic obstacles. The procurement framework requires extensive documentation, competitive bidding processes, and compliance with national security regulations. These multi-level approval systems are essential for accountability but significantly extend the time between product development and deployment.

Growth Factors

Expanding Use of Lightweight Multi-Threat Protection Creates Market Opportunities

The military sector is actively seeking protective equipment that defends against multiple threats without adding excessive weight. Soldiers need gear that protects them from bullets, explosives, and chemical agents while allowing them to move quickly and efficiently. This demand creates substantial opportunities for manufacturers developing advanced materials that combine superior protection with reduced bulk.

Modular protection systems represent a significant growth avenue in the military equipment market. Armed forces want gear that adapts to different mission requirements rather than one-size-fits-all solutions. Mission-adaptive systems allow soldiers to add or remove protective components based on specific operational needs, improving both safety and efficiency during diverse combat scenarios.

Ergonomic design has emerged as a critical factor in military equipment development. Traditional protective gear often restricts movement and causes fatigue during extended operations. Modern soldiers require equipment that supports natural body mechanics and distributes weight evenly. Manufacturers focusing on ergonomic improvements help soldiers maintain endurance during long missions while reducing physical strain and enhancing overall operational performance in challenging environments.

Emerging Trends

Integration of Smart Wearable Technologies Shapes Market Trends

Military protective equipment is evolving beyond passive defense to include smart technologies that enhance soldier capabilities. Wearable sensors embedded in protective gear now monitor vital signs, environmental threats, and equipment status in real-time. This integration allows commanders to track soldier health and location while providing troops with enhanced situational awareness during missions.

The military industry shows a strong preference for mobility-focused equipment designs that minimize weight without sacrificing protection. Soldiers operating in challenging terrain need gear that doesn’t slow them down or exhaust them quickly. Manufacturers are redesigning traditional heavy armor into streamlined systems that preserve defensive capabilities while dramatically reducing physical burden on personnel.

Advanced materials are revolutionizing how protective equipment performs in combat situations. Next-generation composites and specialized armor materials offer better threat protection than conventional options while weighing significantly less. These materials include high-performance polymers, ceramic composites, and engineered fabrics that stop projectiles more efficiently. The adoption of these innovative materials represents a fundamental shift in military equipment design toward smarter solutions.

Regional Analysis

North America Dominates the Military Personal Protective Equipment Market with a Market Share of 37.4%, Valued at USD 6.4 Billion

North America leads the military personal protective equipment market with a commanding share of 37.4%, valued at USD 6.4 billion. The region’s dominance stems from substantial defense spending, advanced technology integration, and stringent safety standards. Continuous modernization programs and focus on soldier protection drive sustained demand for body armor, helmets, and combat gear across military branches.

Europe Military Personal Protective Equipment Market Trends

Europe maintains a strong position in the military personal protective equipment market, driven by NATO collaborations and increased defense budgets across member nations. The region emphasizes lightweight, multi-threat protection systems and standardization initiatives to enhance interoperability among allied forces. Growing focus on survivability against emerging threats and joint procurement programs contribute to steady market expansion.

Asia Pacific Military Personal Protective Equipment Market Trends

Asia Pacific exhibits rapid growth in military personal protective equipment adoption, fueled by territorial disputes, modernization efforts, and expanding defense capabilities. Countries are investing heavily in indigenous manufacturing and acquiring advanced protective systems to equip their growing military personnel. Rising defense expenditures and focus on self-reliance in defense production further accelerate market development in the region.

Middle East and Africa Military Personal Protective Equipment Market Trends

The Middle East and Africa region demonstrates consistent demand for military personal protective equipment due to ongoing conflicts and counter-terrorism operations. Nations are procuring combat-proven gear and investing in upgrading their forces’ protective capabilities amid evolving security challenges. Strategic partnerships with global suppliers and emphasis on quick-deployment forces sustain steady procurement activities.

Latin America Military Personal Protective Equipment Market Trends

Latin America shows moderate growth in the military personal protective equipment market, driven by border security concerns and internal stability operations. Budget constraints influence procurement decisions, with countries balancing between modernization needs and cost-effective solutions for their armed forces. Increasing collaboration with international manufacturers and gradual military modernization programs support measured market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Military Personal Protective Equipment Company Insights

3M continues to leverage its broad technological foundation and global scale to reinforce its position in the military PPE segment. The company’s ability to integrate advanced materials science especially in respiratory and hearing protection—helps it meet evolving threat profiles and compliance standards. Strategic engagement with defense procurement agencies and a diversified product portfolio underpin stable growth amid competitive pressures.

NFM Group maintains a strong niche presence through its focused investment in ballistic protection solutions and modular PPE systems. The company’s customer-centric approach, emphasizing customization and local support, distinguishes it in procurement cycles that prioritize mission-specific gear. Going into 2025, NFM’s robust R&D pipeline and responsiveness to emerging battlefield requirements position it well for incremental market share gains.

SnigelDesign AB has carved out a reputation for highly ergonomic and practical PPE tailored to end-user feedback from active military and special operations units. Its design philosophy, which balances durability with mobility, resonates in segments where operational agility is critical. Continued emphasis on lightweight materials and field-tested configurations strengthens its appeal among specialized forces and allied partners.

Varusteleka remains a differentiated player by combining functional military gear with direct-to-consumer accessibility and community engagement. While historically rooted in outdoor and tactical equipment distribution, the company’s curated selection of PPE enhances its relevance to defense and security professionals. Varusteleka’s agile supply chain and emphasis on cost-effective quality solutions support steady traction in both professional and enthusiast segments.

Top Key Players in the Market

- 3M

- NFM Group

- SnigelDesign AB

- Varusteleka

- SAVOTTA

- PGD

- Avon Protection

- Drägerwerk AG & Co. KGaA

- uvex group

- GENTEX CORPORATION

Recent Developments

- In November 2025, Gentex Corporation secured the third one-year option under its Advanced Combat Helmet Generation II contract, with the Defense Logistics Agency extending production support valued at $38.4 million, reinforcing continued U.S. military demand for next-generation head protection.

- In June 2025, Avon Technologies plc received a new procurement order from the UK Ministry of Defence worth approximately £10.2 million, supplying FM50 respirators to support the Armed Forces of Ukraine and strengthening allied CBRN readiness capabilities.

- In February 2024, Avon Protection expanded its CBRN portfolio with the launch of the EXOSKIN-S1 protective suit, designed to deliver enhanced mobility, comfort, and high-level chemical, biological, radiological, and nuclear protection for defense and emergency response personnel.

Report Scope

Report Features Description Market Value (2025) USD 17.3 Billion Forecast Revenue (2035) USD 42.1 Billion CAGR (2026-2035) 9.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Tactical Clothing, Body Armor, Tactical Vest, Eye Protection, Combat Helmet, Life Safety Jacket, Backpack, Pelvic Protection, Respiratory Protection, Others), By End Use (Army, Navy, Air Force), By Distribution Channel (Government & Defense Tenders, Direct Institutional Procurement, Authorized Distributors, Defense Contractors) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3M, NFM Group, SnigelDesign AB, Varusteleka, SAVOTTA, PGD, Avon Protection, Drägerwerk AG & Co. KGaA, uvex group, GENTEX CORPORATION Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Military Personal Protective Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Military Personal Protective Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- NFM Group

- SnigelDesign AB

- Varusteleka

- SAVOTTA

- PGD

- Avon Protection

- Drägerwerk AG & Co. KGaA

- uvex group

- GENTEX CORPORATION