Middle East Billiards And Accessories Market Size, Share, Growth Analysis By Billiards Table (Pool, Snooker, Carom, Others), By Accessories (Racks/Triangles/Diamonds, Chalk & Chalk Holders, Cue Cases & Cue Stands, Cue Tip Tools, Others), By Material (Slate, Wooden, Acrylic), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168348

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

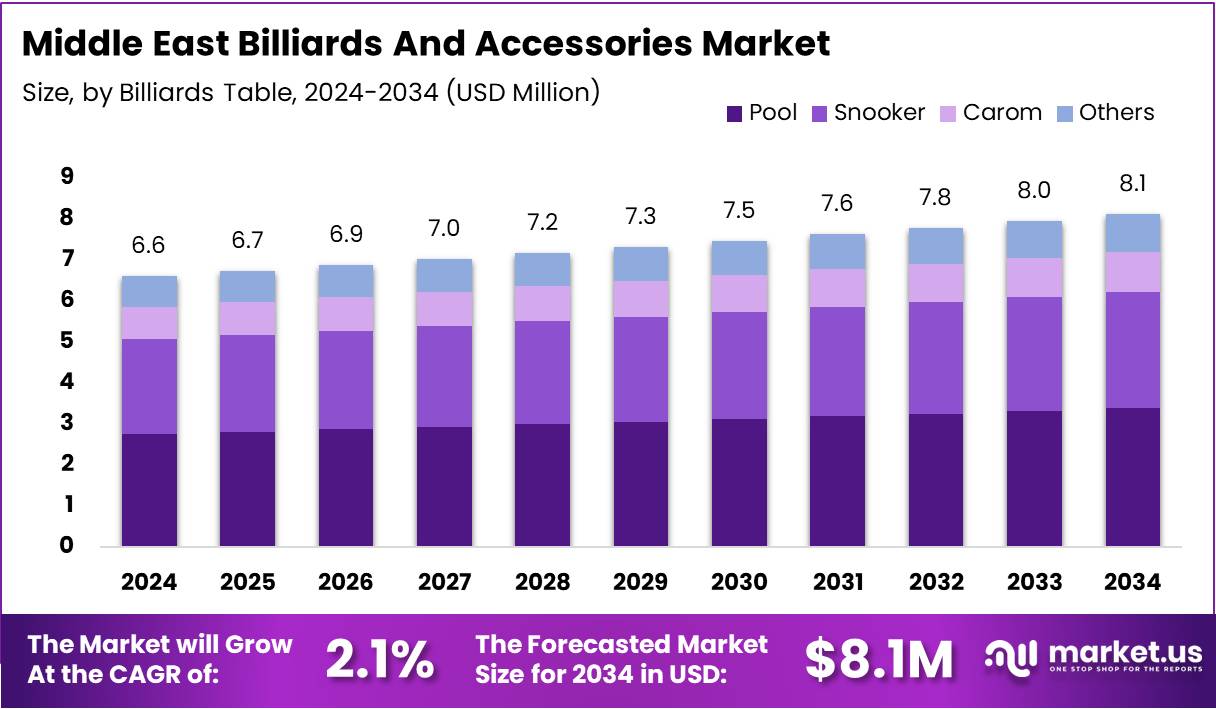

The Middle East Billiards And Accessories Market size is expected to be worth around USD 8.1 Million by 2034, from USD 6.6 Million in 2024, growing at a CAGR of 2.1% during the forecast period from 2025 to 2034.

The Middle East Billiards and Accessories Market is experiencing steady expansion as consumers increasingly adopt indoor leisure activities. Moreover, rising disposable income and the growth of entertainment venues support consistent demand for tables, cues, chalks, and related accessories. This creates a favorable environment for long-term market development across urban and semi-urban regions.

Furthermore, lifestyle shifts among younger audiences are encouraging greater participation in cue-sports. As gaming lounges, malls, and residential complexes integrate billiards areas, equipment usage continues to rise. This transition strengthens commercial demand for durable tables and stylish accessories, helping suppliers capture expanding opportunities within the Middle East Billiards and Accessories Market.

Additionally, government investment in sports infrastructure is boosting access to indoor recreational spaces. New multipurpose facilities increasingly include billiards sections, which indirectly supports demand for equipment and accessories. Such initiatives enhance visibility for cue-sports and encourage long-term adoption across both commercial and home-based environments.

At the same time, supportive regulations for recreational centers contribute to organized play formats and casual tournaments. These measures encourage consistent purchase of cues, tables, racks, and maintenance tools. As regulatory clarity improves, suppliers gain better entry pathways, strengthening product adoption and overall market stability.

Consequently, premium accessories and modern table designs are gaining traction as consumers seek quality, aesthetics, and better gameplay experiences. Residential installations also continue rising, driven by the desire for compact and visually appealing tables. These trends reinforce strong sales potential in the Middle East Billiards and Accessories Market.

In addition, common gameplay formats shape product preferences across the region. English billiards uses 3 balls, snooker uses 21 balls plus a cue ball, and pool table uses 15 balls plus a cue ball. These game structures influence cue specifications, table layouts, and accessory requirements demanded by recreational players.

Moreover, table dimensions remain an important factor in regional purchasing. The Middle East primarily uses 7-foot, 8-foot, and 9-foot tables, which align well with residential room sizes and commercial floor plans. These preferred sizes continue driving consistent demand for standardized accessories, reinforcing stable growth for the Middle East Billiards and Accessories Market.

Key Takeaways

- The Middle East Billiards and Accessories Market is projected to reach USD 8.1 Million by 2034, up from USD 6.6 Million in 2024.

- The market is expected to grow at a 2.1% CAGR during 2025–2034.

- In the Billiards Table segment, Pool leads with a 59.4% share across Middle Eastern markets.

- In the Accessories category, Racks/Triangles/Diamonds dominate with 31.5% usage across all game formats.

- Slate remains the top material choice with a 56.8% market share due to its durability.

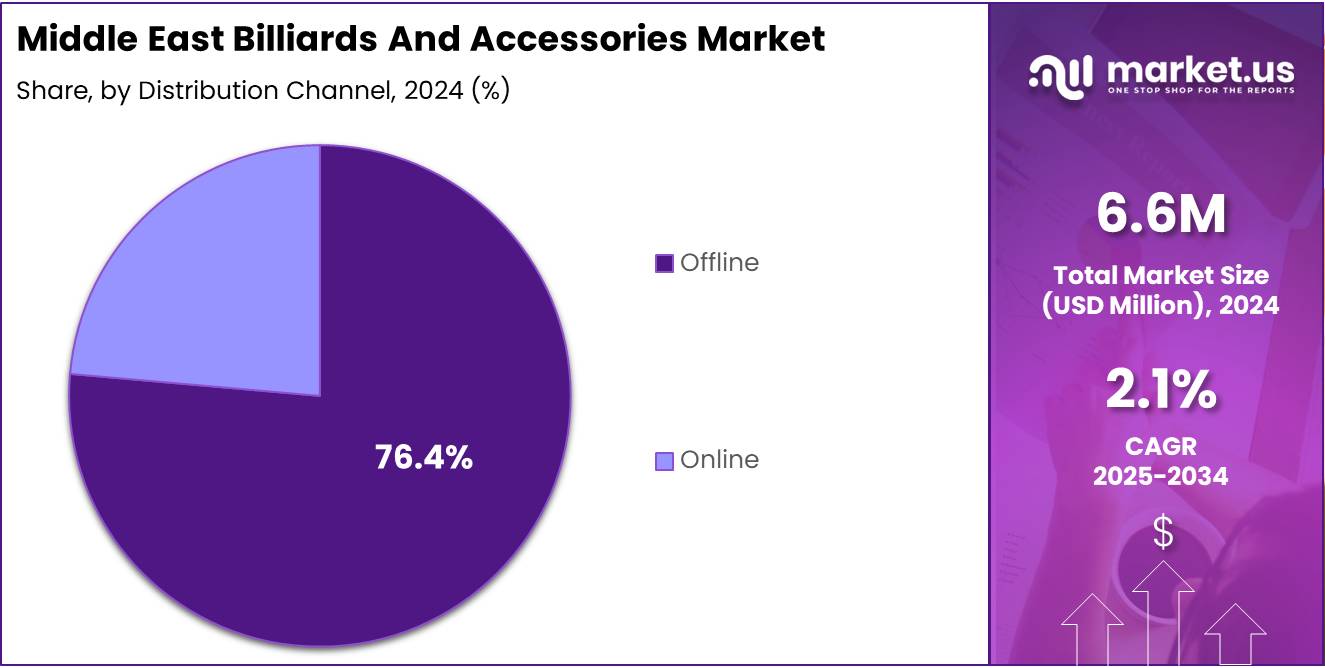

- Offline distribution channels hold a strong lead with 76.4%, reflecting preference for in-store product inspection.

By Billiards Table Analysis

Pool dominates with 59.4% due to its wider reach and higher table adoption across commercial and recreational spaces.

In 2024, Pool held a dominant market position in the By Billiards Table segment of the Middle East Billiards And Accessories Market, with a 59.4% share. It benefits from strong demand in clubs and hospitality venues. Moreover, rising youth participation continues to accelerate installations across premium entertainment settings.

Snooker maintained steady traction due to its established follower base and expanding presence in professional training environments. Additionally, the format attracts serious players seeking precision-based gameplay. As clubs upgrade their offerings, snooker tables increasingly find space in competitive and semi-professional locations across major urban markets.

Carom observed gradual adoption across selective regions where traditional cue sports maintain cultural relevance. Furthermore, its compact table structure appeals to consumers seeking space-efficient options. With growing recreational setups in residential communities, carom continues to gain moderate but consistent visibility across indoor entertainment hubs.

Others, including hybrid and specialty tables, contributed niche demand supported by custom entertainment zones. Moreover, consumers seeking diversified gaming experiences helped sustain this category. As premium leisure destinations expand, these formats increasingly complement broader gaming portfolios, offering added variety to modern entertainment-driven spaces.

By Accessories Analysis

Racks/Triangles/Diamonds dominate with 31.5% owing to essential usage across all billiards formats.

In 2024, Racks/Triangles/Diamonds held a dominant market position in the By Accessories segment of the Middle East Billiards And Accessories Market, with a 31.5% share. These accessories remain mandatory for gameplay setup. Additionally, rising table installations across clubs and homes steadily push demand for durable rack solutions.

Chalk & Chalk Holders sustained notable demand due to their high-frequency replacement cycle and essential role in cue performance. Moreover, growing awareness of shot accuracy and cue maintenance supports consistent consumption. As players actively focus on improved control, this category continues to experience stable market engagement.

Cue Cases & Cue Stands experienced reliable adoption as players increasingly value equipment protection and organized storage. Furthermore, premium cue owners drive higher spending toward structured protective solutions. With more clubs offering dedicated cue storage areas, this segment benefits from both personal and commercial usage growth.

Cue Tip Tools advanced gradually as users prioritized cue longevity and precision play. Additionally, rising amateur participation encourages regular tool usage for tip shaping and maintenance. As the region’s recreational gaming culture expands, this category supports players seeking consistent performance without frequent cue replacement. Others maintained marginal yet steady traction.

By Material Analysis

Slate dominates with 56.8% for its superior durability and professional-grade playability.

In 2024, Slate held a dominant market position in the By Material segment of the Middle East Billiards And Accessories Market, with a 56.8% share. It remains the preferred choice for premium and competition-level tables. Additionally, slate’s stability and smoothness continue to attract clubs and upscale recreational centers.

Wooden tables maintained noticeable adoption in residential and small recreational setups due to their affordability and aesthetic appeal. Moreover, wooden structures complement home interiors, enabling broader household penetration. As casual entertainment grows across villas and modern apartments, wooden table installations continue to widen steadily in lifestyle-focused markets.

Acrylic tables witnessed rising interest among users seeking lightweight and modern alternatives. Additionally, acrylic’s design flexibility appeals to contemporary entertainment venues. With increasing demand for visually distinctive gaming equipment, acrylic formats gradually carve space within trendy hospitality zones and compact lifestyle entertainment spaces.

Others within material selections observed minimal yet continued usage across customized design categories. Furthermore, consumers exploring unique table modifications and artistic finishes support this niche. As boutique leisure establishments emphasize thematic décor, these materials enhance aesthetic versatility and specialized gaming ambiance within premium entertainment environments.

By Distribution Channel Analysis

Offline dominates with 76.4% due to preference for physical inspection and guided purchase decisions.

In 2024, Offline channels held a dominant market position in the By Distribution Channel segment of the Middle East Billiards And Accessories Market, with a 76.4% share. Buyers prefer in-store evaluation of tables and accessories. Moreover, offline stores provide tailored guidance, installation support, and better assurance for premium billiards purchases.

Online channels continued gaining traction as digital adoption accelerated across the region. Additionally, expanding e-commerce platforms offer broader product variety and competitive pricing. With rising comfort toward doorstep delivery and online comparison, more consumers explore accessories and mid-range equipment through online stores, supporting steady segment expansion.

Key Market Segments

By Billiards Table

- Pool

- Snooker

- Carom

- Others

By Accessories

- Racks/Triangles/Diamonds

- Chalk & Chalk Holders

- Cue Cases & Cue Stands

- Cue Tip Tools

- Others

By Material

- Slate

- Wooden

- Acrylic

By Distribution Channel

- Offline

- Online

Drivers

Growing Interest in Skill-Based Indoor Recreational Activities Drives Market Growth

The Middle East billiards and accessories market is gaining momentum as more consumers shift toward skill-based indoor activities. This trend is supported by rising demand for leisure options that combine entertainment with mental focus. Billiards is increasingly viewed as a social and skill-oriented pastime, encouraging new players to engage and existing players to upgrade their equipment.

The region’s expanding middle-class population is another strong growth driver. As disposable incomes rise, consumers are more willing to invest in premium billiards tables, cues, and accessories. This spending behavior reflects a broader lifestyle shift, where families and young adults prioritize high-quality recreational products for both home and commercial use.

Additionally, the growth of entertainment hubs, gaming lounges, and recreational centers across major Middle Eastern cities is strengthening market expansion. These venues increasingly feature billiards zones to attract visitors seeking interactive experiences. Their rising presence not only boosts equipment demand but also encourages repeat participation among consumers.

Together, these drivers create a supportive ecosystem for sustained market growth. Increasing interest in skill-based games, higher spending power, and the expansion of modern recreational spaces are collectively positioning billiards as a mainstream entertainment choice across the region.

Restraints

Limited Availability of Standardized Training Facilities Restrains Market Growth

The Middle East billiards and accessories market faces restraints due to the limited availability of well-equipped training facilities across several countries in the region. Many cities lack standardized coaching centers that help beginners learn the game professionally. This gap reduces interest among new players and slows the development of structured talent pipelines.

Moreover, the absence of certified trainers and consistent training programs limits opportunities for enthusiasts to improve their skills. As a result, casual players do not progress to advanced levels, which affects long-term engagement and reduces demand for premium accessories. This challenge also prevents the formation of strong local leagues that could drive wider participation.

Another key restraint is the declining interest in indoor recreational activities among younger demographics. Younger consumers increasingly prefer digital entertainment, fitness-based activities, and social-media-driven experiences. This shift reduces the frequency of billiards participation, especially in urban areas where lifestyle choices are rapidly evolving.

Additionally, the rising popularity of e-gaming and virtual competitions diverts attention from traditional indoor sports. As young users spend more time on mobile gaming platforms, billiards halls experience lower footfall. This trend limits market expansion and affects sales of tables, cues, and accessories across the region.

Growth Factors

Rising Popularity of Home Gaming Rooms Creates New Market Growth

The growing interest in home gaming rooms is opening strong opportunities for the Middle East billiards market. More families are investing in indoor entertainment setups, which increases demand for compact billiard tables and stylish accessories. This shift supports manufacturers offering customizable and space-saving designs.

Additionally, the steady expansion of online retail channels is reshaping how consumers purchase billiards products. Digital platforms provide wider product visibility, easier price comparison, and faster delivery options. As more buyers prefer online shopping, brands can reach new customer segments across different Middle Eastern countries.

Moreover, the rising demand for eco-friendly billiard products is creating a promising niche. Consumers are becoming more conscious of sustainable materials such as responsibly sourced wood, recycled components, and non-toxic finishes. This trend encourages companies to innovate with greener product lines while strengthening their brand positioning.

Emerging Trends

Surge in Social Media Influencers Promoting Billiards as a Lifestyle Sport Drives Market Trends

The Middle East billiards and accessories market is experiencing strong momentum as social media influencers increasingly showcase billiards as a stylish and modern leisure activity. Their content attracts younger audiences, helping the sport gain visibility and reshaping it into a lifestyle trend rather than a traditional pastime.

This shift is encouraging more casual players to explore the game, boosting demand for cues, tables, and accessories across both home and commercial spaces. Brands in the region are leveraging influencer collaborations to create aspirational appeal and strengthen customer engagement.

Another major trend is the rise of virtual and augmented reality billiard gaming. These technologies offer immersive experiences, making the sport more interactive and accessible for digital-first consumers. As gaming culture expands in the region, VR and AR billiards are helping attract tech-savvy players and expanding the market’s reach.

Alongside this, consumers are increasingly choosing customized and designer cue sticks. Personalization options such as engravings, premium materials, and bespoke designs are gaining popularity among enthusiasts seeking unique and high-quality equipment. This trend supports premiumization in the market, encouraging manufacturers to expand their custom product lines and deliver more value-driven offerings.

Key Middle East Billiards And Accessories Company Insights

In 2024, Knight Shot maintained a steady position through focused product quality and targeted distribution in the Middle East. As an analyst, I see their emphasis on durable cues and localized marketing as a driver for steady retail performance, though growth may be constrained by limited premium assortment expansion.

The strategy of Interpool in 2024 showed strength in channel relationships and wholesale reach across the region. My view is that their broad portfolio and supply-chain reliability support consistent volume sales, but they face pressure to increase brand differentiation to capture higher-margin segments.

For CueCraft, 2024 was notable for product innovation and niche design offerings that appeal to serious players. From an analyst perspective, their focus on craftsmanship and modular cue options positions them well for premium demand, while scaling production to meet wider regional demand remains a key operational challenge.

Finally, Faris Group displayed diversification across accessories and leisure venue partnerships in 2024, which helped cushion market volatility. I assess their multi-channel approach as pragmatic for market share retention, but long-term value will depend on deeper investments in brand marketing and after-sales service to build stronger customer loyalty.

Top Key Players in the Market

- Knight Shot

- Interpool

- CueCraft

- Faris Group

- Xingpai Billiards

- Escalade Sports

- Mezz Cues

- Wiraka

- Exceed Cue

Recent Developments

- In August 2024, Predator Group and the European Pocket Billiard Federation (EPBF) announced a landmark multi-year partnership.This collaboration aims to enhance the global visibility of billiards and develop new competitive platforms across Europe.

- In September 2025, Predator Group and the World Pool-Billiard Association (WPA) announced the staging of the Predator WPA Men’s 10-Ball World Championship 2025.The event is expected to attract top professional players and promote high-level competitive play worldwide.

- In October 2025, Cuetec and the World Nineball Tour united for their first-ever cue collaboration.This partnership focuses on launching innovative cue designs to enhance player performance and fan engagement.

Report Scope

Report Features Description Market Value (2024) USD 6.6 Million Forecast Revenue (2034) USD 8.1 Million CAGR (2025-2034) 2.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Billiards Table (Pool, Snooker, Carom, Others), By Accessories (Racks/Triangles/Diamonds, Chalk & Chalk Holders, Cue Cases & Cue Stands, Cue Tip Tools, Others), By Material (Slate, Wooden, Acrylic), By Distribution Channel (Offline, Online) Competitive Landscape Knight Shot, Interpool, CueCraft, Faris Group, Xingpai Billiards, Escalade Sports, Mezz Cues, Wiraka, Exceed Cue Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Middle East Billiards And Accessories MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Middle East Billiards And Accessories MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Knight Shot

- Interpool

- CueCraft

- Faris Group

- Xingpai Billiards

- Escalade Sports

- Mezz Cues

- Wiraka

- Exceed Cue