Global Microbial Seed Treatment Market Size, Share Analysis Report By Microbial Type (Bacteria, Fungi), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables), By Formulation (Liquid Suspension, Dry Powder, Encapsulated, Granule, Others), By Treatment (Fungicides, Insecticides, Non-chemical Treatments, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174041

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

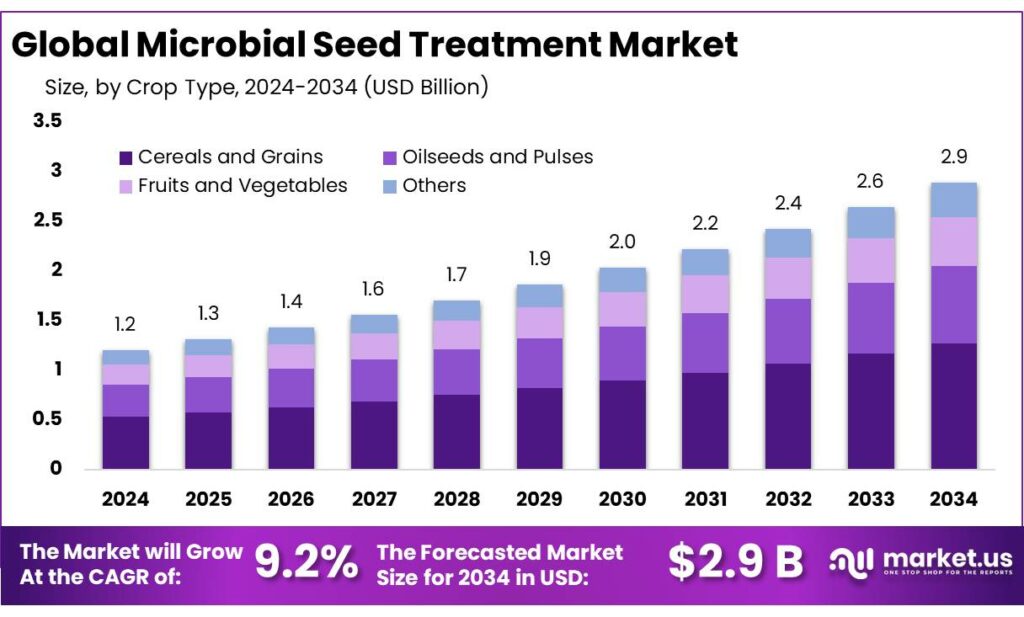

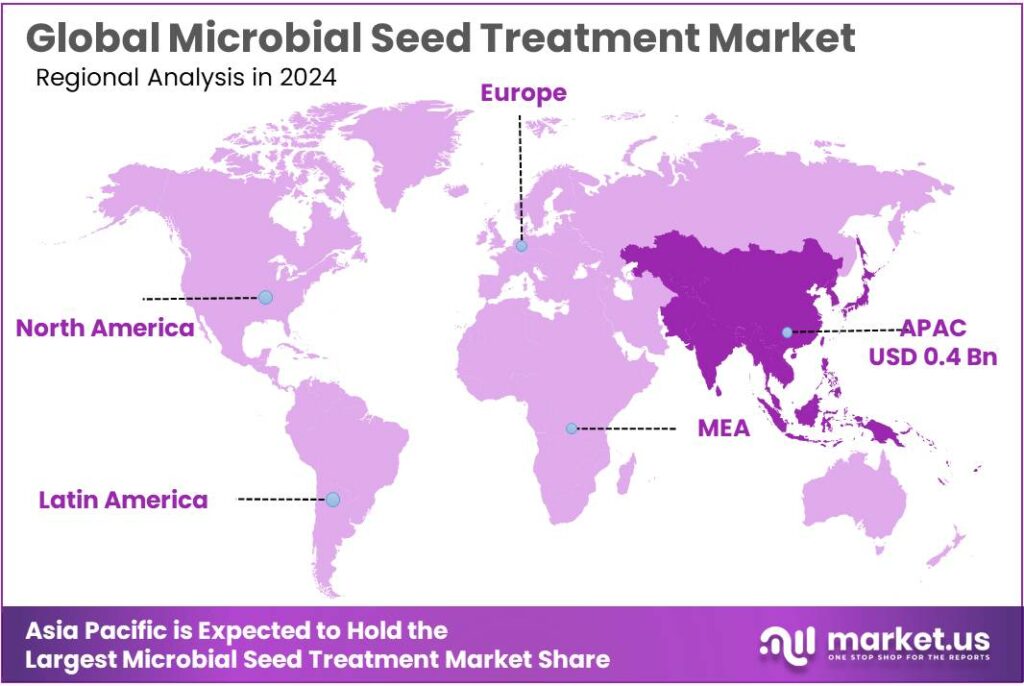

Global Microbial Seed Treatment Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 37.4% share, holding USD 0.4 Billion in revenue.

Microbial seed treatment refers to applying living, beneficial microorganisms directly onto seed surfaces so the crop starts life with a protective and growth-supporting “biological partner.” This approach matters because global crop health risks are large: FAO estimates 20–40% of global crop production is lost each year to pests and diseases, costing about USD 220 billion, with invasive insects adding at least USD 70 billion in annual impacts.

Industrially, microbial seed treatment is gaining relevance because global farming systems are under twin pressure: raising output while managing input intensity. FAO has long projected that feeding a 9.1 billion global population in 2050 would require increasing overall food production by about 70% versus 2005/07 levels. At the same time, input dependence remains high. FAO estimates total pesticide use in agriculture reached 3.73 million tonnes of active ingredients in 2023, and pesticide use intensity averaged 2.40 kg per hectare of cropland.

Policy and regulation are also pulling the market forward. In Europe, the Farm to Fork Strategy set a target to reduce the overall use and risk of chemical pesticides by 50% by 2030, and to cut the use of more hazardous pesticides by 50% as well—creating strong incentives to scale integrated pest management and alternative tools.In the United States, the depth of the biological toolbox is expanding through regulation: EPA stated there were 390 registered biopesticide active ingredients (as of August 31, 2020) and continues to maintain updated registries and actions.

Demand fundamentals also reinforce long-term growth. The United Nations projects the world population to reach 9.7 billion in 2050, raising the pressure to protect yield and stabilize production under climate variability. In parallel, public investment is increasingly oriented toward climate-smart and lower-impact practices.

For example, USDA’s Partnerships for Climate-Smart Commodities committed more than $3.1 billion across 141 projects to expand climate-smart production and associated market opportunities. Separately, USDA launched a $300 million Organic Transition Initiative to support producers transitioning to organic systems, where biological approaches and preventive strategies typically play a larger role.

Key Takeaways

- Microbial Seed Treatment Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 9.2%.

- Bacteria held a dominant market position, capturing more than a 61.8% share in the microbial seed treatment market.

- Cereals and Grains held a dominant market position, capturing more than a 44.9% share in the microbial seed treatment market.

- Liquid Suspension held a dominant market position, capturing more than a 39.6% share in the microbial seed treatment market.

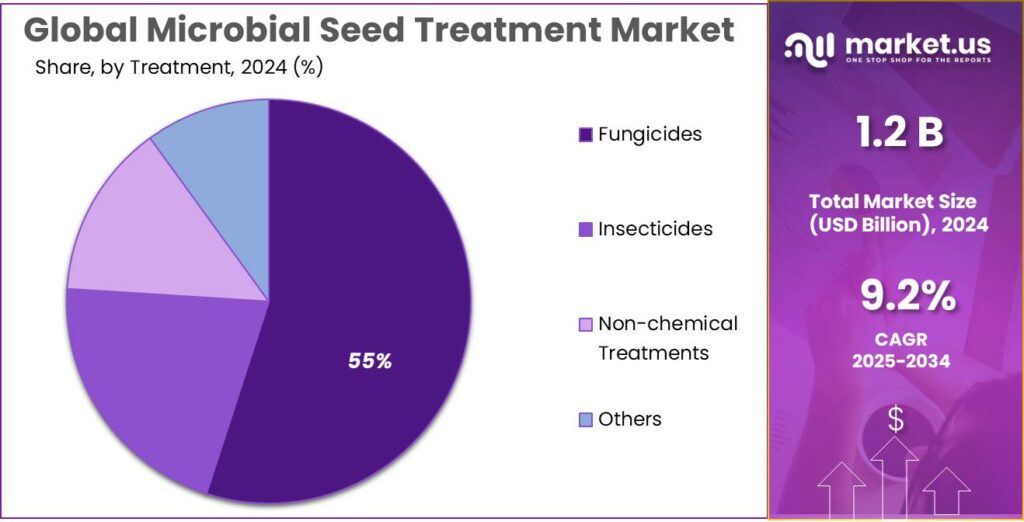

- Fungicides held a dominant market position, capturing more than a 55.3% share in the microbial seed treatment market.

- Asia Pacific held the dominant position in the Microbial Seed Treatment Market, accounting for more than 37.4% and reaching about USD 0.4 Bn.

By Microbial Type Analysis

Bacteria dominates with 61.8% share due to reliable field performance

In 2024, Bacteria held a dominant market position, capturing more than a 61.8% share in the microbial seed treatment market. This leadership comes from bacteria’s proven ability to improve early plant growth in simple and practical ways. Bacterial strains help seeds absorb nutrients better, support strong root development, and protect young plants from soil stress during the critical germination stage. Farmers prefer bacterial treatments because they work well across many crops and soil types, making results more predictable in real farm conditions.

By Crop Type Analysis

Cereals and Grains dominate with 44.9% share due to large cultivation base

In 2024, Cereals and Grains held a dominant market position, capturing more than a 44.9% share in the microbial seed treatment market. This strong position is mainly linked to the large area under cereal and grain cultivation and their importance in global food supply. Farmers growing crops such as wheat, rice, maize, and barley increasingly use microbial seed treatments to support uniform germination and early crop strength. These crops are often planted on a large scale, so growers prefer seed solutions that improve plant establishment without adding complexity to farm operations.

By Formulation Analysis

Liquid Suspension dominates with 39.6% share due to easy application

In 2024, Liquid Suspension held a dominant market position, capturing more than a 39.6% share in the microbial seed treatment market. This formulation is widely preferred because it is simple to apply and fits smoothly into modern seed treatment systems. Liquid suspensions allow even coating of seeds, helping beneficial microbes stay in close contact with the seed surface during planting. Farmers value this consistency, especially when treating large seed volumes, as it supports uniform germination and early crop development.

By Treatment Analysis

Fungicides dominate with 55.3% share due to strong disease protection

In 2024, Fungicides held a dominant market position, capturing more than a 55.3% share in the microbial seed treatment market. This leadership reflects the critical role fungicidal treatments play in protecting seeds from soil-borne and early-stage diseases. Farmers rely on fungicide-based microbial treatments to safeguard germination and reduce crop losses during the most vulnerable growth phase. These treatments help ensure healthy seed emergence, which is especially important for crops planted under variable moisture and temperature conditions.

Key Market Segments

By Microbial Type

- Bacteria

- Bacillus spp.

- Rhizobium spp.

- Pseudomonas spp.

- Paenibacillus spp.

- Streptomyces spp.

- Fungi

- Trichoderma spp

- Penicillium spp.

- Aspergillus spp.

- Others

By Crop Type

- Cereals and Grains

- Wheat

- Corn

- Rice

- Oilseeds and Pulses

- Soybean

- Canola

- Fruits and Vegetables

- Tomatoes

- Potatoes

- Others

By Formulation

- Liquid Suspension

- Dry Powder

- Encapsulated

- Granule

- Others

By Treatment

- Fungicides

- Insecticides

- Non-chemical Treatments

- Others

Emerging Trends

Multi-Microbe “Consortium” Seed Coatings Move Into Focus

A clear latest trend in microbial seed treatment is the move from single-strain inoculants toward multi-microbe “consortia” and engineered communities that are designed to work together on the seed. The logic is practical: farms are not sterile labs, and one microbe often struggles to stay dominant in a living soil system. By combining compatible strains, suppliers aim to improve root-zone establishment, widen the range of benefits, and reduce the “hit or miss” feeling that some growers report.

This shift is being pushed by the size of the problem the industry is trying to solve. FAO points out that every year up to 40% of crops are lost due to plant pests and diseases, which keeps demand high for preventive, early-stage protection. At the same time, chemical inputs remain a large part of global farming, creating pressure to find alternatives that protect yield without adding to pesticide load. FAO’s statistics show total pesticide use in agriculture was 3.73 million tonnes of active ingredients in 2023, and pesticide use intensity averaged 2.40 kg per hectare of cropland.

Research is also getting more specific about how “consortium” approaches can be built and delivered. For example, a 2024 study on seed coating with a synthetic consortium of beneficial microbes reported that coating a consortium was effective in helping plants resist pathogenic infection and support growth, strengthening the case for multi-strain formulations rather than one-microbe products. In parallel, seedling “SynCom” work is advancing quickly; a 2024 paper in FEMS Microbiology Ecology describes a practical method for seedling microbiota engineering using synthetic communities applied on seeds—an approach that aligns closely with where commercial microbial seed treatments are heading.

Policy signals reinforce this trend, because consortia products are often positioned as tools for integrated pest management and pesticide reduction strategies. The European Commission has described two pesticide-reduction targets announced in 2020: a 50% reduction in the “use and risk” of chemical pesticides and a 50% reduction in the use of more hazardous pesticides. Progress tracking published by the Commission indicates that from 2018 to 2023, use of more hazardous pesticides decreased by 27% relative to the baseline period (2015–2017).

Drivers

Pressure to Cut Chemical Pesticides While Protecting Yield

One major driver for microbial seed treatment is the growing need to protect crops early, while steadily reducing dependence on chemical pesticides. Crop loss is not a small issue; FAO notes that up to 40% of global crop production is lost each year due to plant pests and diseases. When a farmer loses stand density in the first few weeks, the season often cannot fully recover.

This yield-protection need is happening alongside a high baseline of pesticide use, which is increasingly questioned by regulators, buyers, and growers themselves. FAO reports that total pesticide use in agriculture reached 3.73 million tonnes of active ingredients in 2023, and pesticide use intensity was 2.40 kg per hectare of cropland.These numbers signal two things at once: first, farms still rely heavily on chemical tools; second, there is meaningful room for alternatives that reduce chemical load without sacrificing performance.

Government targets and policy direction strengthen this shift. In Europe, the European Commission tracks progress toward Farm to Fork pesticide reduction targets, including a 50% reduction in the “use and risk” of chemical pesticides and a 50% reduction in the use of more hazardous pesticides.

Public investment is also nudging adoption by backing climate-smart and soil-health practices, where biological inputs often fit naturally. USDA’s Partnerships for Climate-Smart Commodities describes investments of more than $3.1 billion across 141 projects, designed to expand markets and encourage practices with measurable climate benefits.

Restraints

Inconsistent Field Results and Shelf-Life Limits Slow Adoption

A major restraint for microbial seed treatment is simple to explain, yet hard to solve: performance can vary from field to field, even when the product is applied correctly. In real farms, the seed enters soils that differ in moisture, temperature, pH, organic matter, and native microbial competition. Scientific reviews of microbial tools in agriculture repeatedly flag “inconsistent field performance” as a core limitation, linked to plant genotype effects, interactions with the existing microbiome, and environmental conditions that decide whether the introduced microbe can establish and keep working.

That inconsistency is made worse by a second practical issue: living biology must survive logistics. Microbial seed treatments depend on viable cells or spores reaching the field in good condition, then staying alive on the seed long enough to colonize the root zone after planting. Studies on inoculated seed show viability can drop during storage; for example, a university research report observed surviving cells around 2.23 × 10^6 per seed in a most recent assay, and also tracked viability decline after 48 h of storage at 25°C under controlled humidity conditions.

Quality variation in the wider bioinoculant ecosystem also influences confidence. Independent assessments have reported variable counts and contamination concerns in some inoculant products, which can erode trust and slow repeat purchases. In plain business terms, if growers fear a “good batch / bad batch” problem—or if they cannot easily verify potency at the point of sale—they will treat microbial seed treatment as a trial product instead of a dependable input. That slows scale-up, even when the technology can work well under the right conditions.

Regulation, while important for safety, can add another layer of friction that buyers feel indirectly through time-to-market and label limitations. In the European Union, microbial active substances used in plant protection products must go through risk assessment, and the European Commission notes that more than 60 micro-organisms are approved in the EU. The EU also publishes detailed explanatory notes on data requirements for micro-organisms under the plant protection framework, reflecting how specific and evidence-heavy the process can be.

Opportunity

Climate-Smart and Organic Programs Create New Pull

In the United States, USDA’s Partnerships for Climate-Smart Commodities is a clear signal of where public and private agriculture are moving together. USDA states it is investing more than $3.1 billion across 141 projects to expand markets for commodities produced with climate-smart practices. These projects are not only about production; they are also about market access and measurement.

Organic transition support adds another strong lane of demand. USDA launched the Organic Transition Initiative as a $300 million effort to help producers move into organic and strengthen organic markets. The same USDA guidance explains that before crops can be certified organic, land must be managed without prohibited synthetic inputs for 36 months.

The European policy direction strengthens the opportunity globally because it influences multinational food buyers and seed companies. EU Farm to Fork ambitions include reducing the “use and risk” of chemical pesticides by 50% by 2030, reducing use of more hazardous pesticides by 50%, and scaling organic farming toward 25% of agricultural land by 2030. Even outside Europe, these targets shape supplier expectations and corporate sustainability roadmaps. When retailers and processors start asking for lower pesticide footprints, seed-applied biologicals become an attractive, traceable lever.

There is also a simple demand-side reason this opportunity keeps widening: food production has to grow reliably. The UN expects the world population to reach 9.7 billion in 2050. At the same time, FAO notes that plant pests and diseases can cause up to 40% losses in global crop production each year. That combination—more mouths to feed and persistent biological pressure—pushes the industry toward tools that protect yield without adding heavy environmental trade-offs.

Regional Insights

Asia Pacific leads with 37.4% share, valued at USD 0.4 Bn

In 2024, Asia Pacific held the dominant position in the Microbial Seed Treatment Market, accounting for more than 37.4% and reaching about USD 0.4 Bn. The region’s strength is closely tied to its huge base of cereal, rice, and maize cultivation and the constant need to protect seeds during early growth, when weather swings and soil-borne pressure can quickly cut plant stands. Growers and distributors across key markets increasingly view microbial seed treatments as a practical “first step” at planting—one that can be layered into existing seed-coating and farm routines without changing field operations.

Supportive regional indicators also point to why biological inputs are gaining attention. FAO reports global pesticide use in agriculture reached 3.73 million tonnes of active ingredients in 2023, highlighting the scale of crop-protection reliance and the growing push for safer, smarter input strategies. In India—one of Asia Pacific’s largest seed markets—APEDA reports total area under organic cultivation at about 7.3 million hectares in FY24, showing how residue awareness and organic/natural farming programs are expanding the addressable base for biologicals.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Indigo Ag, Inc. is a leading biological agriculture company focused on microbial seed innovations. By 2024, Indigo had worked with over 1 million acres globally and raised more than USD 1.6 billion in funding since inception. Its microbial seed treatments target stress tolerance and productivity across major row crops.

Koppert is a global specialist in biological crop protection and seed solutions. In 2024, the company was active in more than 100 countries with approximately 2,800 employees. Koppert’s microbial seed treatments focus on improving soil biology and supporting healthy root development in conventional and organic farming systems.

BioConsortia focuses on advanced microbial consortia for crop productivity. By 2024, the company had raised over USD 65 million in funding and built a microbial library exceeding 6 million strains. Its seed treatment solutions aim to enhance nutrient efficiency and support consistent early-stage crop establishment.

Top Key Players Outlook

- Bayer AG

- Indigo Ag, Inc.

- Koppert

- Microbial Solutions

- BioConsortia

- Certis USA L.L.C.

- VensoGrow

- Syngenta Group

- Heliae Development, LLC

- Valent Biosciences

Recent Industry Developments

In 2024, BioConsortia pushed deeper into microbial seed treatment by moving its nitrogen-fixing technology closer to farm use and scaling field validation. On April 1, 2024, the company reported raising $15 million to expand field trials and support its microbial R&D platform in Davis, California, which matters because seed treatments need repeatable performance across locations before wide rollout.

In 2024, Microbial Solutions LLC (based at 2501 Lakeview Rd, Mexico, MO 65265, phone (573) 582-1188) positioned its work around microbial inputs that can be used at the seed stage and in the root zone to help crops start stronger. Public product-registration records show its branded products listed with 2024 registration status, including HUMIC-AG 2024 and NLAg 2024, which signals active market participation during that year.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Microbial Type (Bacteria, Fungi), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables), By Formulation (Liquid Suspension, Dry Powder, Encapsulated, Granule, Others), By Treatment (Fungicides, Insecticides, Non-chemical Treatments, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer AG, Indigo Ag, Inc., Koppert, Microbial Solutions, BioConsortia, Certis USA L.L.C., VensoGrow, Syngenta Group, Heliae Development, LLC, Valent Biosciences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Microbial Seed Treatment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Microbial Seed Treatment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bayer AG

- Indigo Ag, Inc.

- Koppert

- Microbial Solutions

- BioConsortia

- Certis USA L.L.C.

- VensoGrow

- Syngenta Group

- Heliae Development, LLC

- Valent Biosciences