Global Micro Mobile Data Centers Market Size, Share, Industry Analysis Report By Offering (Solutions, Services), By Application (Edge Computing & IOT Deployment, Disaster Recovery & Emergency Response, Temporary & Remote Operations, Other Applications), By Rack Unit (Up to 20 RU, 21 to 40 RU, Above 40 RU), By Organization Size (Small & Medium Enterprises, Large Enterprises), By Form Factor (Rack-Mounted, Containerized, Wall-Mounted), By Type (Indoor, Outdoor), By Industry Vertical (IT & Telecom, Government & Defense, Media & Entertainment, Healthcare, Retail, Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Oct. 2025

- Report ID: 19884

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- Government-led Investments

- Investment and Business Benefits

- US Market Size

- By Offering

- By Application

- By Rack Unit

- By Organization Size

- By Form Factor

- By Type

- By Industry Vertical

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

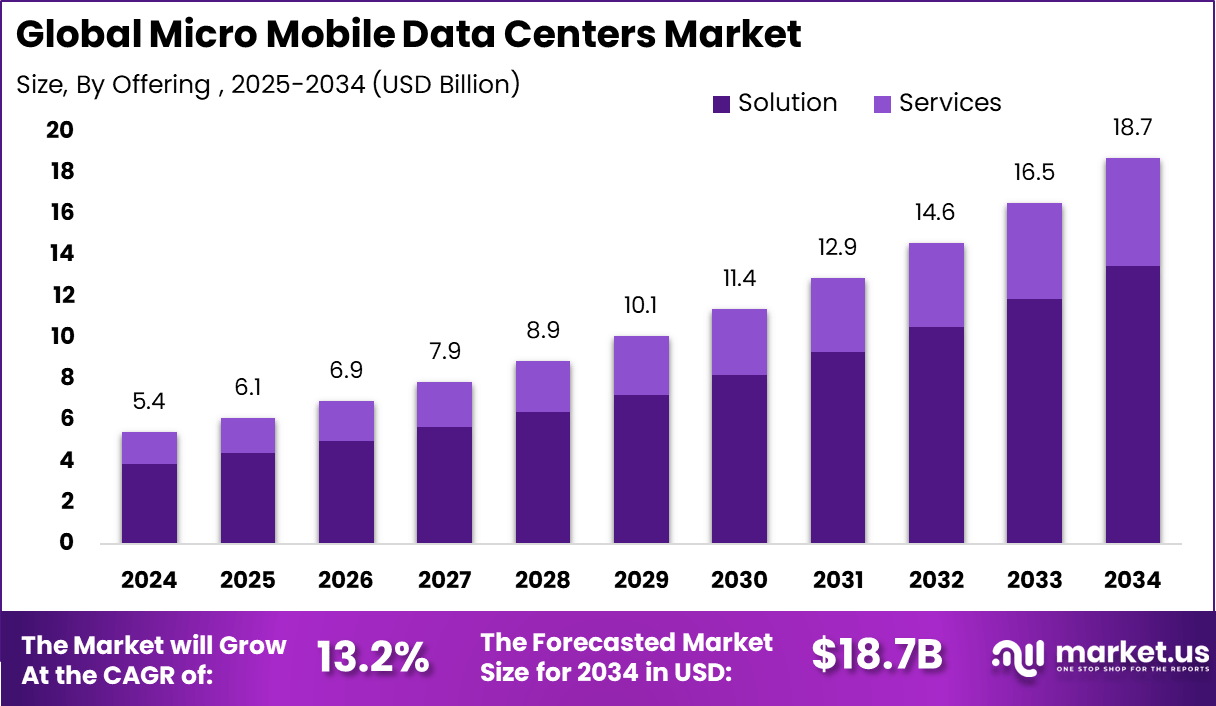

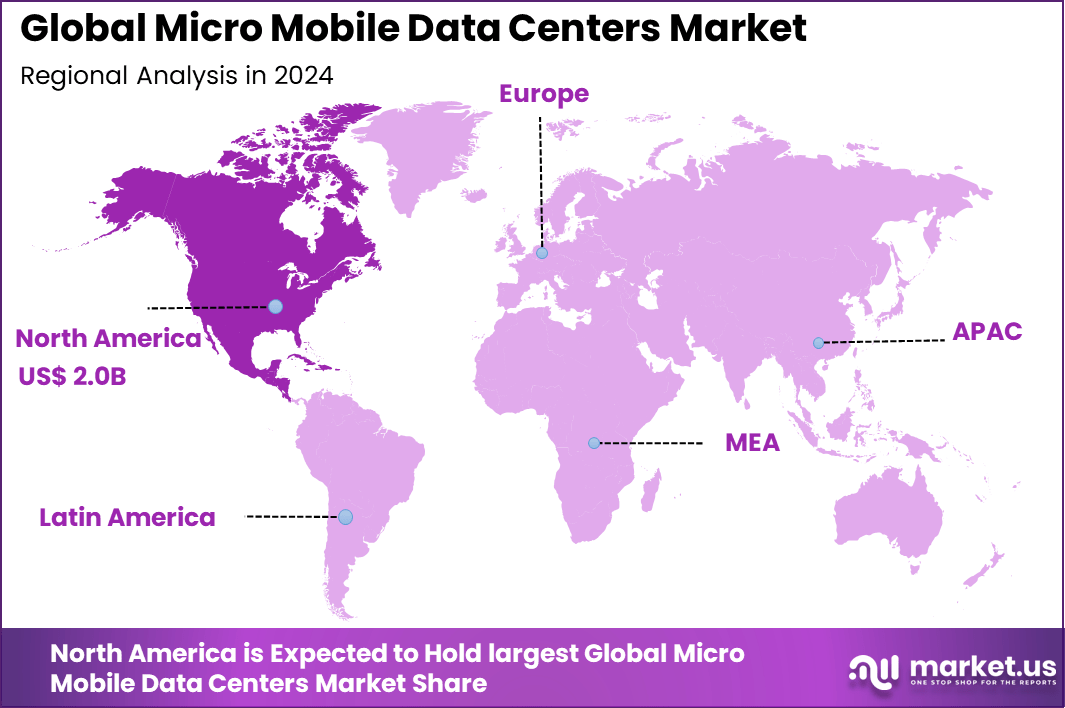

The Global Micro Mobile Data Centers Market size is expected to be worth around USD 18.7 Billion By 2034, from USD 5.4 billion in 2024, growing at a CAGR of 13.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.5% share, holding USD 2.0 Billion revenue.

Micro mobile data centers are compact, modular computing units that combine power, networking, cooling, and IT infrastructure in a portable or quickly deployable enclosure. They bring compute and storage closer to where data is generated, rather than relying solely on centralized data centers. They may be mounted in trucks, containers, or small prefabricated units.

Top driving factors behind the growth of this market include the surge in edge computing applications, IoT device proliferation, and the need for real-time data processing capabilities. Enterprises face increasing pressure to reduce latency and enhance responsiveness in applications such as autonomous vehicles, augmented reality, and industrial automation. Sustainability is also driving adoption, as micro mobile data centers use 20% to 40% less energy than traditional facilities and help companies meet environmental goals.

Key Insight Summary

- Solutions segment leads with 72%, reflecting demand for fully integrated and ready-to-deploy data center units.

- Edge computing & IoT deployment applications account for 44%, driven by the rise of connected devices and low-latency needs.

- Up to 20 RU configurations hold 40%, favored for compact and space-efficient deployments.

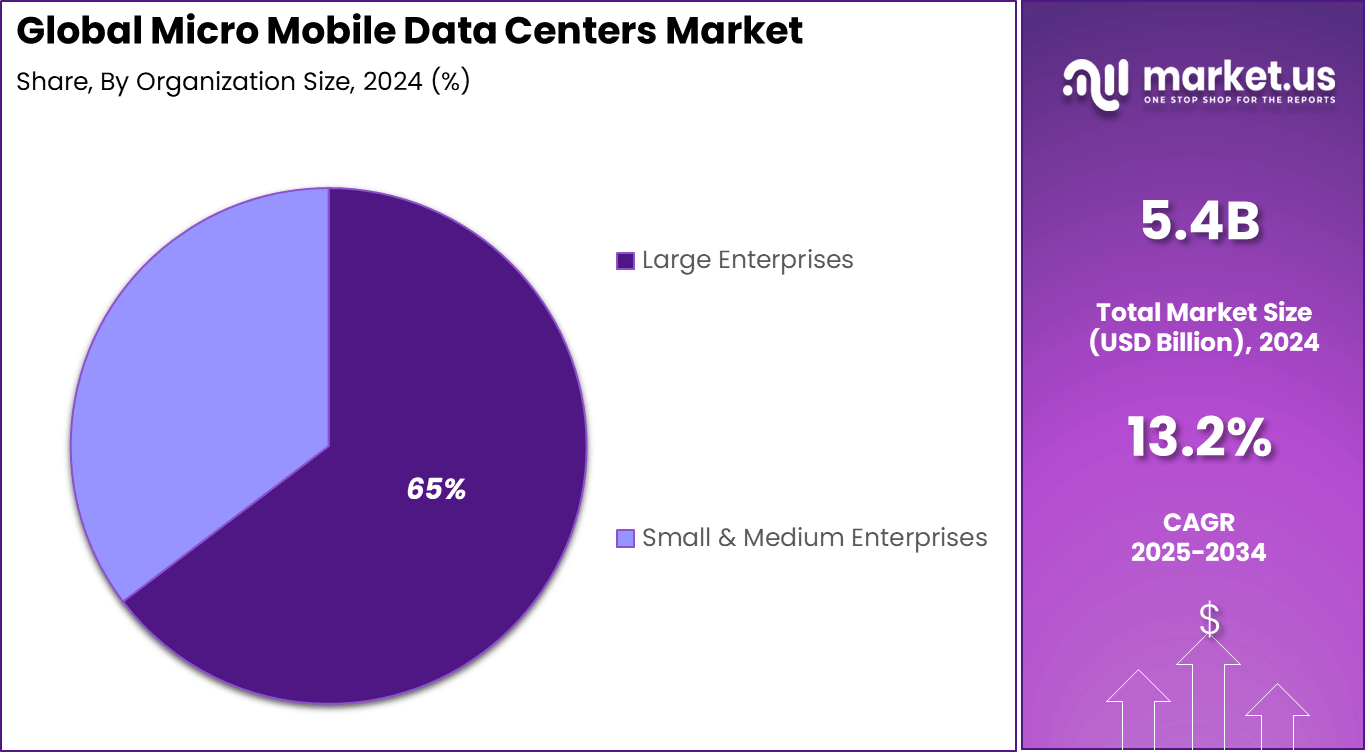

- Large enterprises dominate with 65%, investing in micro data centers to support distributed IT infrastructure.

- Rack-mounted form factor leads at 51%, offering compatibility and ease of integration.

- Indoor type holds 65%, as organizations prioritize secure and controlled environments for data handling.

- IT & Telecom vertical captures 28%, leveraging micro data centers for network optimization and edge services.

- North America contributes 38.5%, supported by advanced telecom infrastructure and rapid adoption of edge technologies.

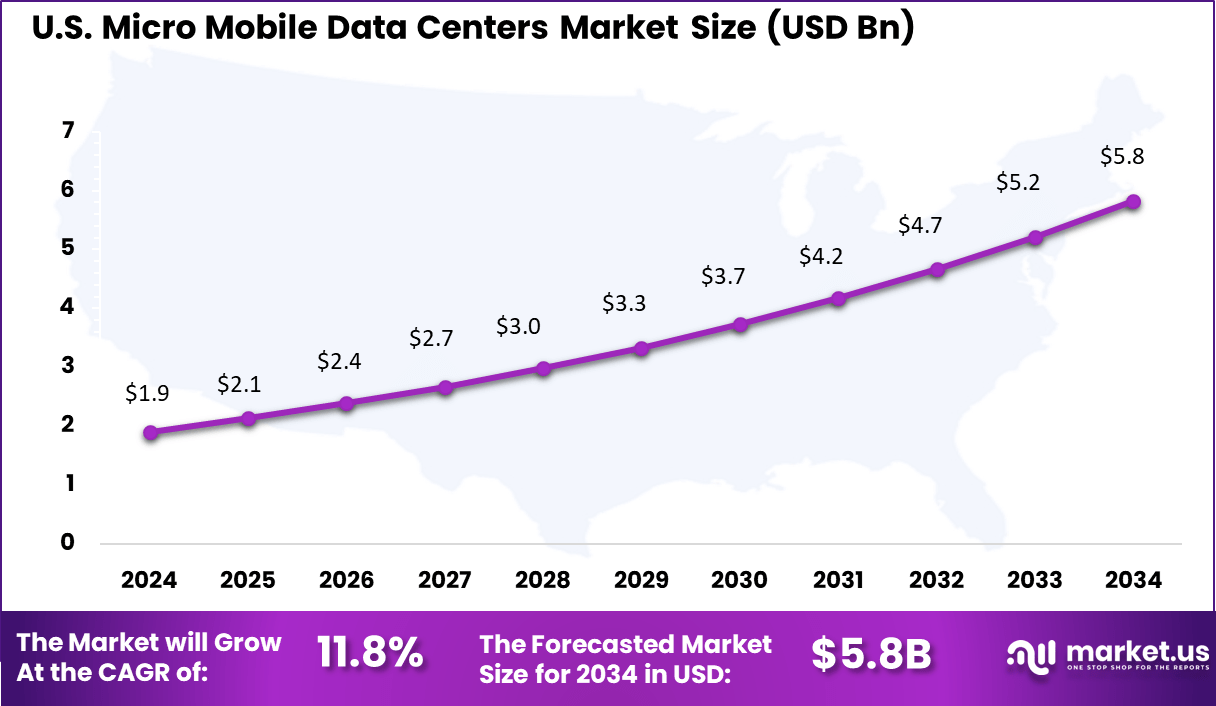

- The US market reached USD 1.91 billion and is growing at a steady CAGR of 11.8%, underlining its strong role in driving global demand.

Analysts’ Viewpoint

Demand analysis reveals that micro mobile data centers are favored by both large enterprises and SMEs. Large organizations prioritize these solutions for scalability, disaster recovery, and latency reduction, while SMEs appreciate their affordability and flexibility. Nearly 40% of enterprises now adapt micro mobile data centers especially to support edge computing needs.

The healthcare, retail, and manufacturing sectors are notable adopters due to their need for low-latency, localized data processing and real-time analytics. Increasing adoption technologies include edge computing, 5G networks, and IoT integrations. The deployment of 5G alone has accelerated demand, with about 45% of installations focusing on low-latency applications enabled by these data centers.

IoT devices generate vast streams of data that must be processed locally to avoid network bottlenecks, which micro mobile data centers facilitate. These technologies enable enhanced operational efficiency and support emerging applications in smart cities, autonomous systems, and digital healthcare monitoring. Key reasons for adopting micro mobile data centers are multifaceted. Businesses benefit from cost efficiency as these systems reduce upfront infrastructure investment and operational costs due to lower power and cooling demands.

Flexibility and rapid deployment allow organizations to scale infrastructure according to evolving needs without long lead times. Security gains from localized data handling and built-in protections mitigate risks associated with transmitting sensitive information to centralized locations. Furthermore, disaster recovery solutions driven by micro data centers offer quicker recovery and continuity compared to traditional methods.

Role of Generative AI

The role of Generative AI in micro mobile data centers is becoming increasingly significant. These data centers support AI workloads by providing localized computing power, which is essential for processing large AI models with low latency. Generative AI not only requires advanced hardware but also sophisticated data center network infrastructure to facilitate distributed AI model training and real-time inference.

About 39% of data center operators have reported serious outages mainly due to human error, where generative AI tools are starting to help by assisting with standard operating procedures and staff training to reduce such mishaps. This makes generative AI a valuable productivity and administrative support tool in data center management, improving operational efficiency while requiring human oversight for accuracy.

Government-led Investments

Government-led investments are playing a crucial role in accelerating market growth, particularly in Asia-Pacific. For instance, Thailand committed approximately USD 2.7 billion in 2024 to enhance digital infrastructure involving micro mobile data centers.

India plans over USD 1 billion investment in the next five years to develop hyperscale and edge data center ecosystems to support its expanding digital economy. These investments are critical in supporting cloud adoption, AI deployment, and 5G infrastructure, thereby reinforcing the foundational technology for future-ready data centers.

Investment and Business Benefits

Investment opportunities in this market are substantial. Organizations recognize the potential for modular, scalable, and energy-efficient infrastructure to support expanding digital transformation initiatives. The need for disaster recovery platforms, especially in light of rising cyber threats and natural disasters, opens doors for innovative product development.

Growing adoption in developing regions and sectors like BFSI (banking, financial services, and insurance) and healthcare create lucrative markets. Capital injections focus on advanced cooling, power management, and AI-driven monitoring technologies to improve system resilience and management. Business benefits include improved latency, enhanced user experience, and resilience in IT operations.

Micro mobile data centers enable companies to support remote sites, temporary locations, and edge devices with seamless connectivity and computing power. Scalability supports growth without the risk of under-or over-provisioning IT resources. These data centers also bolster cybersecurity postures by offering controlled environments closer to data sources, reducing vulnerabilities associated with centralized data transit. They contribute to sustainability goals by lowering energy consumption considerably.

US Market Size

The United States represents the largest market within North America, valued at 1.91 billion. Its strong adoption is driven by demand from industries such as telecom, cloud services, and manufacturing, where decentralized data centers play a vital role in real-time processing. U.S. enterprises are leading in IoT and AI adoption, which reinforces the need for robust edge computing solutions.

Government emphasis on digital infrastructure and the rapid pace of 5G rollout also contribute to the country’s leadership in the market. The micro mobile data centers market is projected to grow at a CAGR of 11.8%. This steady growth reflects the ongoing shift towards distributed computing models, fueled by the surge in smart devices, connected applications, and latency-sensitive workloads.

In 2024, North America holds 38.5% share of the micro mobile data centers market. The region’s strong uptake is supported by rapid advancements in 5G, IoT, and edge computing applications. Enterprises across industries are moving away from centralized data processing and investing in localized infrastructure to achieve lower latency and improved security. The mature IT ecosystem in North America, along with an early focus on digital transformation, continues to make it a front-runner in adopting micro mobile data centers.

By Offering

In 2024, Solutions dominate the micro mobile data centers market with 72% share. Companies prefer complete packaged solutions over standalone services because these systems provide integrated infrastructure, power management, and cooling technologies. Businesses deploying micro data centers often need a ready-to-use system that can be quickly installed at remote or edge sites.

The demand for solutions is also fueled by the need for scalability and reduced setup time. Instead of building traditional data centers, organizations adopt micro data center solutions that bundle hardware, software, and security in one unit. This not only shortens deployment cycles but also helps maintain performance in tough environments like industrial and remote locations.

By Application

In 2024, Edge computing and IoT deployment hold 44% share in this market. The expansion of connected devices, sensors, and smart applications requires processing near the data source. Micro mobile data centers provide the local computing power needed to reduce latency and deliver faster insights for real-time decision-making.

This demand is rising in sectors such as manufacturing, smart cities, and autonomous systems that generate high volumes of data at the edge. By deploying micro mobile data centers close to devices, businesses ensure secure, localized processing and avoid over-reliance on central data centers.

By Rack Unit

In 2024, Units up to 20 RU represent 40% of adoption. These compact racks are widely deployed because they are easier to install in constrained spaces, including office sites, branch locations, and retail outlets. Their small size makes them attractive for edge computing as they balance performance with portability.

Moreover, enterprises choose these systems for their energy efficiency and affordability. Smaller configurations provide sufficient power for specific workloads such as video processing, IoT applications, and AI inference tasks, making them a popular choice for organizations scaling digital operations at the edge.

By Organization Size

In 2024, Large enterprises account for 65% share of the market. Their need for distributed infrastructure to support global operations fuels investment in micro data centers. For large organizations, micro facilities provide flexibility while supporting compliance, security, and workload-specific demands.

These enterprises are also early adopters of advanced IT strategies such as hybrid and multi-cloud environments. Micro data centers help them extend computational power close to their operations without the limitations of centralized infrastructure, which makes them critical in long-term digital transformation initiatives.

By Form Factor

In 2024, Rack-mounted systems dominate with 51% market share. Their popularity comes from efficient use of space and compatibility with existing IT equipment. Many enterprises prefer rack-mounted formats because they can easily integrate with existing workflows, simplifying deployment at edge sites.

In addition, rack-mounted units improve scalability as organizations can add or remove racks based on capacity needs. This makes them well-suited for sectors that experience fluctuating data requirements, including IT, telecom, and financial services.

By Type

In 2024, Indoor deployments lead with 65% share. Most businesses prefer installing micro mobile data centers inside controlled environments to ensure stable performance and easy maintenance. Indoor use is common in industries where secure and continuous operations are critical.

Another advantage of indoor systems is reduced exposure to external risk factors such as weather or temperature variations. These deployments are tailored for enterprises focusing on efficiency, longevity, and minimal downtime.

By Industry Vertical

In 2024, the IT and telecom sector holds 28% share, making it the leading vertical for micro mobile data centers. This industry’s reliance on real-time data transmission, high availability, and network expansion makes micro infrastructure vital. Telecom operators particularly need micro facilities to support 5G rollout and low-latency services.

IT companies also leverage micro mobile data centers for cloud services, edge computing, and AI-related workloads. Their ability to process data close to users enhances performance, which is critical for customer-facing platforms and digital services.

Emerging Trends

Emerging trends in micro mobile data centers revolve around edge computing integration, 5G, modular designs, and energy efficiency. More than 60% increase in deployments is being driven by the need for faster real-time data processing at the edge, especially in sectors like manufacturing and smart cities where IoT devices generate massive data volumes.

Advances such as containerized micro data centers with liquid cooling and AI-driven predictive maintenance are shaping the sector’s future, enabling resilience and sustainability in harsh environments. Additionally, around 65% of new units are designed with renewable energy sources, aligning with global sustainability goals.

Growth Factors

Growth factors for this market include rising adoption of cloud services, explosion of IoT devices, and the necessity for low latency computing. The demand for micro mobile data centers is growing significantly due to their portability, scalability, and cost efficiency compared to traditional data centers.

The arrival of 5G is a major catalyst, enabling ultra-low latency networks that these centers leverage for diverse applications across IT, defense, healthcare, and BFSI sectors. In 2025, North America led the market with over 40% share due to its robust IT infrastructure, while Asia-Pacific shows the fastest growth because of rapid digitalization and internet penetration.

Key Market Segments

By Offering

- Solutions

- IT Modules

- Servers

- Storage

- Network Infrastructure

- Power Modules

- Uninterruptible Power Supplies (UPSs)

- Power Distribution Units (PDUs)

- Battery Backup Systems

- Power Management & Monitoring Tools (PMMTs)

- Cooling Modules

- Direct Expansion (DX) Cooling Systems

- Air-Cooled Cooling Units

- Chilled Water-Cooling Systems

- Liquid Cooling Systems

- In-Row Cooling Units

- Smart Cooling Management Systems

- IT Modules

- Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

By Application

- Edge Computing & IOT Deployment

- Disaster Recovery & Emergency Response

- Temporary & Remote Operations

- Other Applications

By Rack Unit

- Up to 20 RU

- 21 to 40 RU

- Above 40 RU

By Organization Size

- Small & Medium Enterprises

- Large Enterprises

By Form Factor

- Rack-Mounted

- Containerized

- Wall-Mounted

By Type

- Indoor

- Outdoor

By Industry Vertical

- IT & Telecom

- Government & Defense

- Media & Entertainment

- Healthcare

- Retail

- Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Edge Computing

Micro mobile data centers are gaining momentum due to the rising demand for edge computing, which requires data processing closer to data sources for faster response times. With the expansion of IoT devices, 5G networks, and real-time applications like autonomous vehicles and smart factories, traditional centralized data centers struggle to meet low latency needs.

Micro mobile data centers offer compact, portable solutions that enable organizations to deploy computing resources near the end users, reducing data transmission delays and improving performance. This drive for enhanced real-time processing is a key factor fueling market growth worldwide.

Restraint

High Initial Investment Costs

Despite their benefits, micro mobile data centers face the noteworthy restraint of significant upfront investment requirements. Building these modular units involves costs for advanced cooling systems, integrated power backup, and heightened security features.

Small and medium-sized enterprises, which could benefit the most from these scalable solutions, often find the initial capital expenditure a barrier. Additionally, ongoing maintenance and operational costs add to the financial challenges. This high investment hurdle slows broader adoption, especially in budget-sensitive sectors.

Opportunity

Growing Need for Disaster Recovery Solutions

There is a clear opportunity as organizations increasingly seek reliable, mobile disaster recovery systems to protect critical operations from cyberattacks, natural disasters, and system failures. Micro mobile data centers provide agile and rapid deployment options for disaster recovery, ensuring uninterrupted business continuity even in remote or challenging environments.

As digital infrastructures become more vital across industries, the demand for on-demand, scalable backup data centers grows. This trend opens significant market potential for providers delivering resilient and portable IT infrastructure.

Challenge

Deployment Complexity in Remote Locations

One major challenge for micro mobile data centers is the complexity of deploying them effectively in remote or harsh environments. These locations often lack reliable power, cooling infrastructure, and robust network connectivity, which are crucial for data center operation.

Additionally, logistics around transportation, installation, and ongoing maintenance in such areas can be cumbersome and costly. Overcoming these operational and environmental challenges requires extensive planning and investment in resilient infrastructure, which can delay deployment schedules and increase total costs.

Competitive Analysis

The Micro Mobile Data Centers Market is led by global IT and infrastructure providers such as Schneider Electric, HPE, Dell Inc., and Vertiv. These companies deliver prefabricated, modular, and edge-ready data center solutions designed for rapid deployment. Their offerings integrate power, cooling, IT racks, and security systems, making them suitable for remote locations, industrial environments, and edge computing applications.

Key technology and industrial players including Huawei, Eaton, IBM Corp., and Rittal GmbH & Co. KG strengthen the market with customizable enclosures, power management systems, and micro-edge infrastructure. These solutions support low-latency processing, IoT workloads, 5G rollouts, and enterprise disaster recovery setups.

Specialized and emerging companies such as Panduit Corp., Stulz, Delta Electronics, Zella DC, Scalematrix, Canovate, and Dataracks contribute with compact and energy-efficient micro data center systems. These firms offer edge rack solutions, cooling innovations, and containerized data center units tailored for SMEs and rugged deployments.

Top Key Players in the Market

- Schneider Electric

- HPE

- Dell Inc.

- Vertiv

- Huawei

- Eaton

- IBM Corp.

- Rittal Gmbh & Co. KG

- Panduit Corp.

- Stulz

- Delta Electronics

- Zella DC

- Scalematrix

- Canovate

- Dataracks

- Others

Recent Developments

- June 2025 – Schneider Electric launched next-generation EcoStruxure Pod Data Center solutions designed specifically to support high-density AI computing clusters. These prefabricated modular data centers combine liquid cooling, high-power busways, and high-density racks to meet extreme power density demands projected to reach 1MW and above.

- April 2025 – Vertiv unveiled four new solutions to address the growing challenges of AI data centers, including power density and thermal management. Highlights include a cloud-connected management platform, prefabricated modular infrastructure, and advanced cooling technologies. These innovations support faster deployment and scalable operations in AI and high-performance computing environments.

- March 2025 – Eaton announced a major $1.4 billion acquisition of Fibrebond Corporation, a leader in pre-integrated modular power enclosures for data centers. This move aims to accelerate Eaton’s capabilities in delivering faster deployment of AI-driven data center infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Bn Forecast Revenue (2034) USD 18.7 Bn CAGR(2025-2034) 13.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Solutions, Services), By Application (Edge Computing & IOT Deployment, Disaster Recovery & Emergency Response, Temporary & Remote Operations, Other Applications), By Rack Unit (Up to 20 RU, 21 to 40 RU, Above 40 RU), By Organization Size (Small & Medium Enterprises, Large Enterprises), By Form Factor (Rack-Mounted, Containerized, Wall-Mounted), By Type (Indoor, Outdoor), By Industry Vertical (IT & Telecom, Government & Defense, Media & Entertainment, Healthcare, Retail, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schneider Electric, HPE, Dell Inc., Vertiv, Huawei, Eaton, IBM Corp., Rittal Gmbh & Co. KG, Panduit Corp., Stulz, Delta Electronics, Zella DC, Scalematrix, Canovate, Dataracks, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Micro Mobile Data Center MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Micro Mobile Data Center MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schneider Electric

- HPE

- Dell Inc.

- Vertiv

- Huawei

- Eaton

- IBM Corp.

- Rittal Gmbh & Co. KG

- Panduit Corp.

- Stulz

- Delta Electronics

- Zella DC

- Scalematrix

- Canovate

- Dataracks

- Others