Global Metrology Equipment Market Size, Share and Report Analysis By Equipment Type (Coordinate Measuring Machines (CMM), Optical Inspection Systems, Image-Based Measurement Systems, Universal And Manual Measuring Instruments, and Others), By Technology (Contact-Based Metrology and Non-Contact Metrology), By Portability (Stationary Metrology Equipment and Portable Metrology Equipment), By End Use Industry (Automotive, Aerospace And Defense, Electronics And Semiconductors, Industrial Manufacturing, Medical Devices, Energy And Power, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178816

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

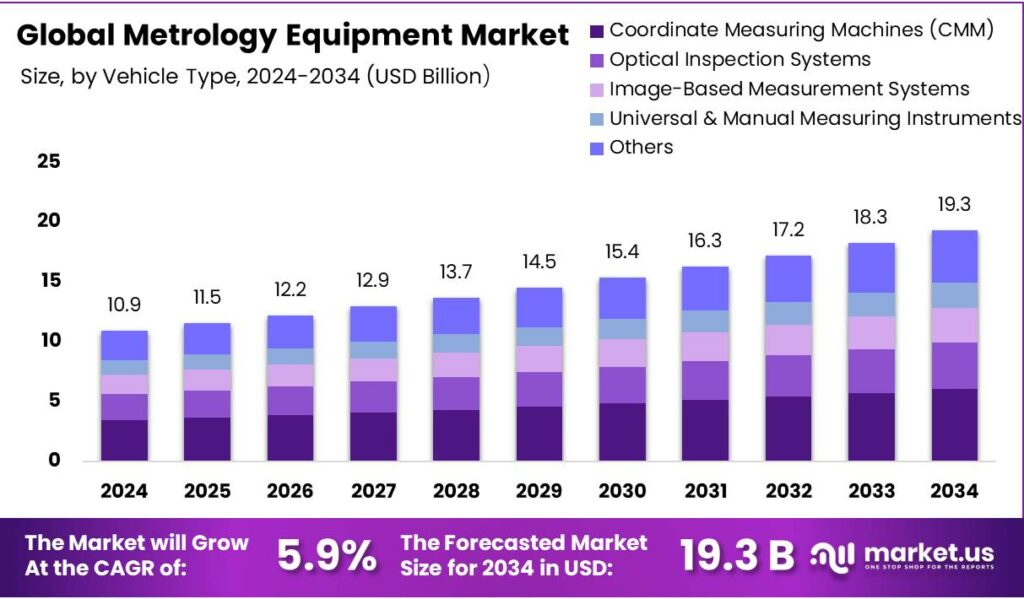

The Global Metrology Equipment Market is expected to be worth around USD 19.3 Billion by 2034, up from USD 10.9 Billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. The Asia Pacific segment maintained 37.5%, supporting a Metrology Equipment value of USD 4.1 Bn.

Metrology equipment refers to precise tools and instruments used to measure physical quantities such as dimensions, surface properties, temperature, or pressure to ensure products meet exact specifications, guaranteeing quality, safety, and performance in various industries. The global market is driven by the increasing demand for precision, quality control, and compliance across various industries, with the automotive sector being the largest adopter due to its mass production needs and stringent dimensional standards.

- According to the United Nations Industrial Development Organization, the manufacturing value added (MVA) share in the total GDP in 2024 was 22.7%, while the MVA growth rate was 4.4%. As the manufacturing sector grows and evolves, there is a consistent demand for metrology equipment.

Furthermore, the stationary metrology equipment, such as coordinate measuring machines (CMMs), remains more widely used than portable systems due to its superior accuracy and stability in controlled environments. While contact-based metrology systems are favored for their high precision and versatility, non-contact systems provide advantages in speed and delicacy for certain applications.

The market is further influenced by geopolitical tensions, which disrupt supply chains and increase the cost of components, and by high R&D costs, which pose a financial burden on manufacturers. Despite these challenges, ongoing advancements in automation, AI, and smart manufacturing continue to fuel demand, particularly in the automotive and aerospace industries. The metrology equipment plays a critical role in ensuring product reliability and regulatory compliance across industries.

Key Takeaways:

- The global metrology equipment market was valued at USD 10.9 billion in 2024.

- The global metrology equipment market is projected to grow at a CAGR of 5.9% and is estimated to reach USD 19.3 billion by 2034.

- On the basis of types of equipment, coordinate measuring machines (CMMs) dominated the metrology equipment market, constituting 31.4% of the total market share.

- Based on the technology, non-contact metrology dominated the metrology equipment market, with a substantial market share of around 54.7%.

- Based on the portability, stationary metrology equipment led the metrology equipment market, comprising 67.8% of the total market.

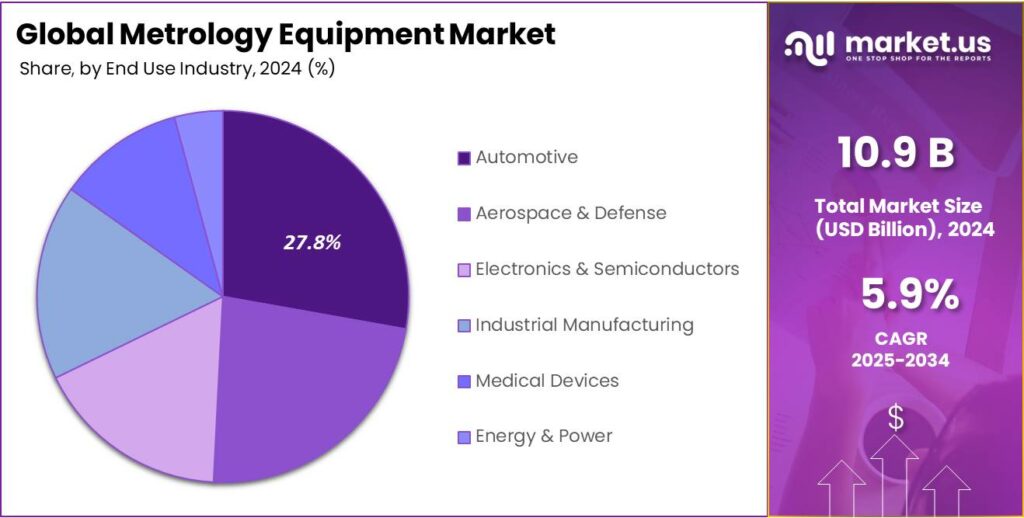

- Among the end-user industries, the automotive industry held a major share in the metrology equipment market, 27.8% of the market share.

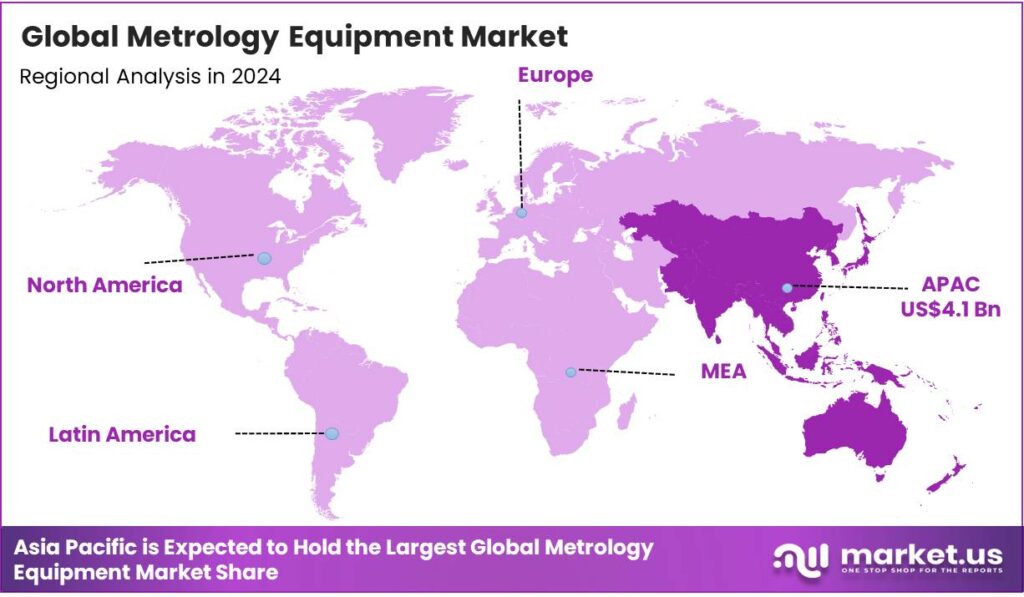

- In 2024, the Asia Pacific was the most dominant region in the metrology equipment market, accounting for 37.5% of the total global consumption.

Equipment Type Analysis

Coordinate Measuring Machines (CMMs) are a Prominent Segment in the Metrology Equipment Market.

The metrology equipment market is segmented based on types of equipment into coordinate measuring machines (CMM), optical inspection systems, image-based measurement systems, universal & manual measuring instruments, and others. The coordinate measuring machines (CMMs) led the metrology equipment market, comprising 31.4% of the market share, due to their versatility, precision, and automation capabilities. CMMs offer highly accurate 3D measurements, making them suitable for a broad range of industries, including automotive, aerospace, and medical devices.

Unlike optical systems, CMMs can measure surface and internal dimensions with greater consistency in complex geometries. In addition, they handle a variety of materials, such as metals and plastics, without requiring significant adjustments. Furthermore, the ability to integrate CMMs into automated production lines enhances efficiency, reducing human error and operational downtime. These attributes, combined with their scalability and adaptability, make CMMs the preferred choice in industries where precision and repeatability are critical.

Technology Analysis

Non-Contact Metrology Dominated the Metrology Equipment Market.

On the basis of the technology, the metrology equipment market is segmented into contact-based metrology and non-contact metrology. The non-contact metrology dominated the metrology equipment market, comprising 54.7% of the market share, primarily due to its higher accuracy, reliability, and ability to handle a broad range of materials and surface finishes.

Contact methods, such as those used in coordinate measuring machines (CMMs), involve direct interaction with the object being measured, allowing for precise dimensional measurements on complex geometries and rough surfaces. Additionally, these systems can achieve micron-level precision, making them ideal for critical applications in industries such as automotive and aerospace. While non-contact systems offer speed and are suitable for delicate or small parts, they may struggle with transparency or reflectivity issues on certain surfaces. Moreover, contact-based metrology is often more cost-effective, offering a proven solution for many industrial quality control processes.

Portability Analysis

Stationary Metrology Equipment is Mostly Utilized Due to Its Stability.

Based on the portability, the metrology equipment market is divided into stationary metrology equipment and portable metrology equipment. The portable metrology equipment dominated the metrology equipment market, with a prominent market share of 67.8%, due to its superior precision, stability, and repeatability. Stationary systems, such as fixed coordinate measuring machines (CMMs) and optical inspection systems, are designed for high-accuracy measurements in controlled environments, which are critical for industries such as aerospace and automotive. Their stable setup minimizes measurement errors caused by movement or vibrations, ensuring highly consistent results.

Additionally, these systems can handle larger, more complex components that require precise measurement and are often integrated into automated production lines for continuous quality control. While portable equipment offers flexibility, it often cannot match the accuracy and repeatability of stationary systems, especially for high-precision or high-volume applications.

End Use Industry Analysis

The Automotive Industry Held a Major Share of the Metrology Equipment Market.

Among the end-user industries, 27.8% of the total global consumption of metrology equipment products is for the automotive industry. The automotive industry uses the most metrology equipment due to its large-scale production processes, need for high-volume precision, and focus on quality control. The automotive sector involves the mass manufacturing of parts with stringent dimensional requirements for safety, performance, and regulatory compliance. Metrology tools ensure that components meet these standards across various stages of production.

Furthermore, the industry’s continuous push for cost efficiency and automation drives the adoption of advanced measurement technologies to streamline quality control and reduce defects. While aerospace, electronics, medical devices, and other sectors rely on metrology, the automotive industry’s scale, production speed, and focus on standardized mass production make it a primary driver of metrology equipment use.

Key Market Segments:

By Equipment Type

- Coordinate Measuring Machines (CMM)

- Bridge CMM

- Cantilever CMM

- Gantry CMM

- Others

- Optical Inspection Systems

- Image-Based Measurement Systems

- Universal & Manual Measuring Instruments

- Calipers

- Micrometers

- Height Gauges

- Dial Indicators

- Others

- Others

By Technology

- Contact-Based Metrology

- Non-Contact Metrology

By Portability

- Household

- Foodservice

By End Use Industry

- Automotive

- Aerospace & Defense

- Electronics & Semiconductors

- Industrial Manufacturing

- Medical Devices

- Energy & Power

- Others

Drivers

Expanding Manufacturing Industry Drives the Metrology Equipment Market.

The expanding manufacturing industry plays a crucial role in driving demand for metrology equipment, as companies increasingly rely on precision measurement tools to meet higher quality standards and comply with regulatory requirements. The growing complexity in production processes is intensifying the demand for advanced metrology systems to ensure product quality and process efficiency. As industries such as aerospace, electric vehicles (EVs), and medical devices adopt more complex designs, the demand for precision measurement has shifted from the laboratory to the factories.

- According to the National Association of Manufacturers, manufacturing value-added output increased from US$ 2.813 trillion at an annual rate in Q1 2025 to US$ 2.859 trillion in Q2 2025 in the US alone.

In addition, the integration of robotics in manufacturing requires sensors and laser scanners that can provide immediate feedback to machines. Companies are using tools such as the Hexagon Absolute Scanner to ensure robotic arms remain calibrated during high-speed assembly. Similarly, the shift toward EVs requires extreme precision in battery cell manufacturing and drivetrain alignment. Automated optical inspection (AOI) systems are now essential to detect microscopic flaws in battery foils that could lead to thermal runaway.

Restraints

High R&D Costs Pose a Challenge to the Metrology Equipment Market.

High research and development (R&D) costs present a significant challenge to the metrology equipment market, as companies must invest heavily in innovation to meet increasingly stringent quality standards and customer demands for precision. For instance, in its 2022 annual report, Hexagon AB disclosed a 13% year-over-year increase in R&D expenditures, reaching Eur252 million, driven by efforts to enhance product capabilities, integrate AI and automation, and develop next-generation metrology solutions. The challenge of high R&D costs is further compounded by regulatory pressures, which necessitate continuous product improvements to ensure compliance.

Consequently, companies have reported an increase in R&D spending, allocating a significant portion of their annual budget to advancing their metrology offerings. For instance, ZEISS Group recorded a peak R&D expenditure of EUR 1.731 billion in fiscal year 2024-25, representing 15% of total revenue.

However, while these investments are necessary for technological advancement, they place a financial burden on firms, particularly smaller players with limited resources. The ongoing demand for R&D to meet regulatory and market demands can lead to slower product cycles and higher costs for customers, potentially limiting access to cutting-edge metrology tools in cost-sensitive sectors.

Opportunity

Strict Quality Control Demands Create Opportunities in the Metrology Equipment Market.

Strict quality control (QC) demands are driving significant opportunities in the metrology equipment market as industries increasingly focus on enhancing precision in manufacturing, particularly in the semiconductor and automotive sectors. For instance, the European Commission’s 2022 communication on digital transformation in manufacturing emphasizes the importance of precision engineering to ensure product safety and reliability, further increasing reliance on advanced metrology tools.

The regulatory pressures, alongside rising customer expectations for high-quality products, have led to greater adoption of metrology solutions that ensure compliance with these standards. In a study on 1,136 manufacturers in the US by the Zeiss Group in 2025, it was revealed that 93% of U.S. manufacturers viewed quality assurance as mission-critical. Additionally, the group launched Zeiss Inspect 2026, featuring advanced GD&T (Geometric Dimensioning and Tolerancing) to ensure compliance with the latest global standards.

Trends

Adoption of Laser Tracker Systems.

The adoption of laser tracker systems is a notable trend in the global metrology equipment market, driven by increasing demands for high precision in large-scale industrial applications. The adoption of laser tracker systems is characterized by a transition toward high-portability, automated, and AI-integrated solutions for large-scale dimensional metrology.

Laser trackers, which offer 3D measurement capabilities and real-time data collection, are increasingly used in sectors such as aerospace, automotive, and heavy manufacturing, where large parts require accurate alignment and measurement. Regulatory frameworks, such as the U.S. Federal Aviation Administration (FAA) regulations on aircraft manufacturing and maintenance, are reinforcing the need for high-precision measurement tools such as laser trackers to ensure safety and compliance with stringent quality standards. Despite the barriers in terms of cost and the complexity of integrating laser trackers into existing workflows, the ability to increase measurement accuracy and reduce production time positions laser tracker systems as an essential tool for modern metrology.

Leveraging the trend, several companies have launched the product to cater to the larger market. For instance, API Metrology launched the 6th generation integrated laser tracker (iLT) in November 2025, which reduces weight by 50% (to 4.9kg) compared to its previous models.

Geopolitical Impact Analysis

Unstable Supply Chains Amid Geopolitical Tensions in the Metrology Equipment Market.

Geopolitical tensions, characterized by intensifying trade barriers and regional conflicts, increasingly function as a restrictive driver in the global metrology equipment market, impacting both investment willingness and supply chain stability. For instance, throughout 2025, the U.S. and China implemented reciprocal trade measures, including broad-based tariffs aimed at reshoring and export controls on critical materials.

According to a report by Hexagon AB, the company employed a NOK 200 million cost reduction program and a 15% workforce reduction in specific segments to navigate a challenging market environment. The prevailing geopolitical climate has shifted the sector’s focus from linear efficiency to resilience and diversification.

Global defense budgets are surging in response to conflicts in Europe and the Middle East, with the U.S. proposing a US$1.5 trillion budget for 2027. This drives massive demand for industrial metrology equipment, as aerospace and defense systems require extreme precision for safety and performance.

Similarly, governments are weaponizing trade through export controls on advanced manufacturing equipment, such as extreme ultraviolet (EUV) lithography. In the US, to secure national security, over US$30 billion is projected to be spent on these critical technologies in 2026 to bypass supply chain chokepoints. Governments are utilizing industrial policy and trade controls as strategic tools. For instance, the NIST CHIPS Metrology Program in the US emphasizes domestic measurement leadership as a national security imperative, specifically addressing unbroken chains of provenance in semiconductor manufacturing. However, the ongoing geopolitical uncertainties create a complex operating environment, potentially leading to longer lead times, increased costs, and limited market access in certain regions.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Metrology Equipment Market.

In 2024, the Asia Pacific dominated the global metrology equipment market, holding about 37.5% of the total global consumption, driven by the region’s dominant manufacturing base and increasing industrial automation. According to the United Nations Industrial Development Organization, since 2015, the Asia Pacific has accounted for over 50% of the world’s manufacturing value added (MVA), a share that reached 56.7% in 2023, reflecting a growth rate consistently above the global average.

In addition, manufacturing exports from the region stood at 46.2% of the global total during the same year. Additionally, the region’s robust automotive, electronics, and semiconductor sectors are particularly reliant on metrology systems to meet rising product quality and precision standards.

Similarly, government policies in countries such as China and Japan emphasize technological advancement and industrial upgrading. In 2025, the Chinese Ministry of Industry and Information Technology (MIIT) outlined plans for 2026 to promote smart and digitalized manufacturing, which includes increased investments in precision measurement technologies.

The region’s large manufacturing footprint and technological advancements continue to make Asia Pacific a dominant player in the metrology equipment market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of metrology equipment adopt several strategies to gain a competitive edge. Key approaches include investing heavily in research and development (R&D) to innovate and improve product performance, such as enhancing measurement precision and integrating advanced technologies like AI and automation. For instance, companies such as Hexagon AB focus on developing smart metrology systems that offer greater speed and accuracy.

Additionally, the company’s focus on expanding geographic reach is evidenced by Mitutoyo’s increased production and service capacity in key regions like North America and the Asia Pacific. Similarly, the companies emphasize strategic partnerships and acquisitions that allow them to broaden their product portfolios and access new markets.

The Major Players in The Industry

- Hexagon AB

- Carl Zeiss AG

- Nikon Corporation

- Mitutoyo Corporation

- Renishaw Plc

- KLA Corporation

- Applied Materials Inc.

- Keyence Corporation

- Creaform

- Automated Precision Inc.

- Wenzel Group

- Ametek Inc.

- Zygo Corporation

- TRIMOS SA

- Optical Gaging Products (OGP)

- Other Key Players

Key Development:

- In July 2025, AMETEK, Inc. completed its US$920 million cash acquisition of FARO Technologies at US$44 per share following shareholder and regulatory approvals. FARO is to be delisted from Nasdaq and integrated into AMETEK’s Ultra Precision Technologies Division, adding leading 3D measurement, imaging, and digital reality solutions.

- In June 2025, Hexagon’s Manufacturing Intelligence division unveiled the Autonomous Metrology Suite on its cloud-based Nexus platform. The software simplifies CMM workflows by eliminating coding, enabling faster quality control, accelerating R&D and production, and helping manufacturers address the growing shortage of skilled metrologists worldwide.

Report Scope:

Report Features Description Market Value (2024) US$10.9 Bn Forecast Revenue (2034) US$19.3 Bn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Coordinate Measuring Machines (CMM), Optical Inspection Systems, Image-Based Measurement Systems, Universal & Manual Measuring Instruments, and Others), By Technology (Contact-Based Metrology and Non-Contact Metrology), By Portability (Stationary Metrology Equipment and Portable Metrology Equipment), By End Use Industry (Automotive, Aerospace & Defence, Electronics & Semiconductors, Industrial Manufacturing, Medical Devices, Energy & Power, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Hexagon AB, Carl Zeiss AG, Nikon Corporation, Mitutoyo Corporation, Renishaw Plc, KLA Corporation, Applied Materials Inc., Keyence Corporation, Creaform, Automated Precision Inc., Wenzel Group, Ametek Inc., Zygo Corporation, TRIMOS SA, Optical Gaging Products (OGP), and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Hexagon AB

- Carl Zeiss AG

- Nikon Corporation

- Mitutoyo Corporation

- Renishaw Plc

- KLA Corporation

- Applied Materials Inc.

- Keyence Corporation

- Creaform

- Automated Precision Inc.

- Wenzel Group

- Ametek Inc.

- Zygo Corporation

- TRIMOS SA

- Optical Gaging Products (OGP)

- Other Key Players