Global Methyl N-Amyl Ketone Market Size, Share Analysis Report By Type (98% Puriy, 99% Purity), By Application (Paints And Coatings, Process Solvents, Automotive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164174

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

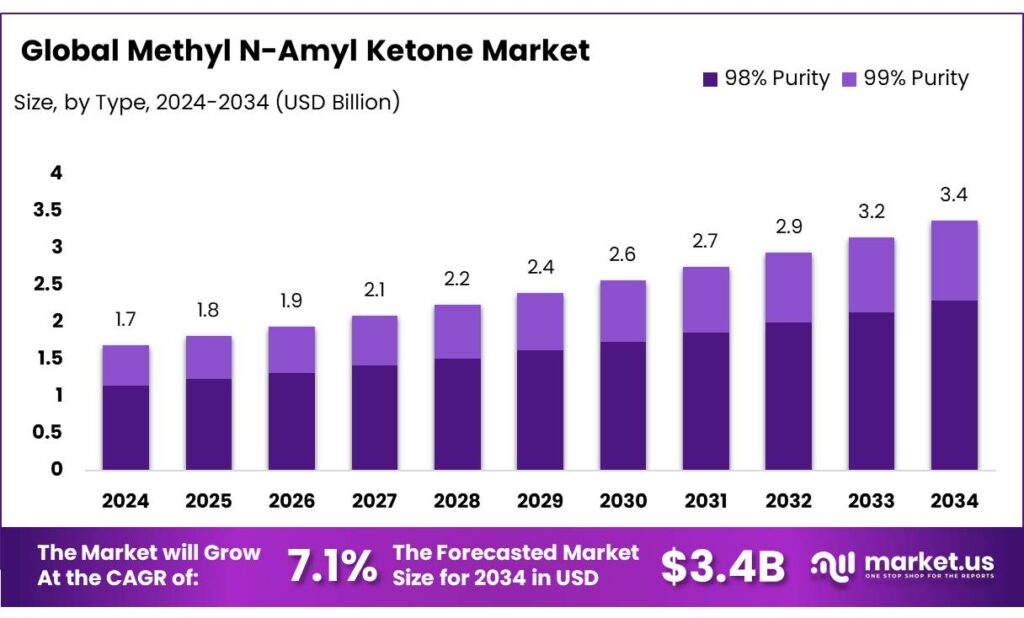

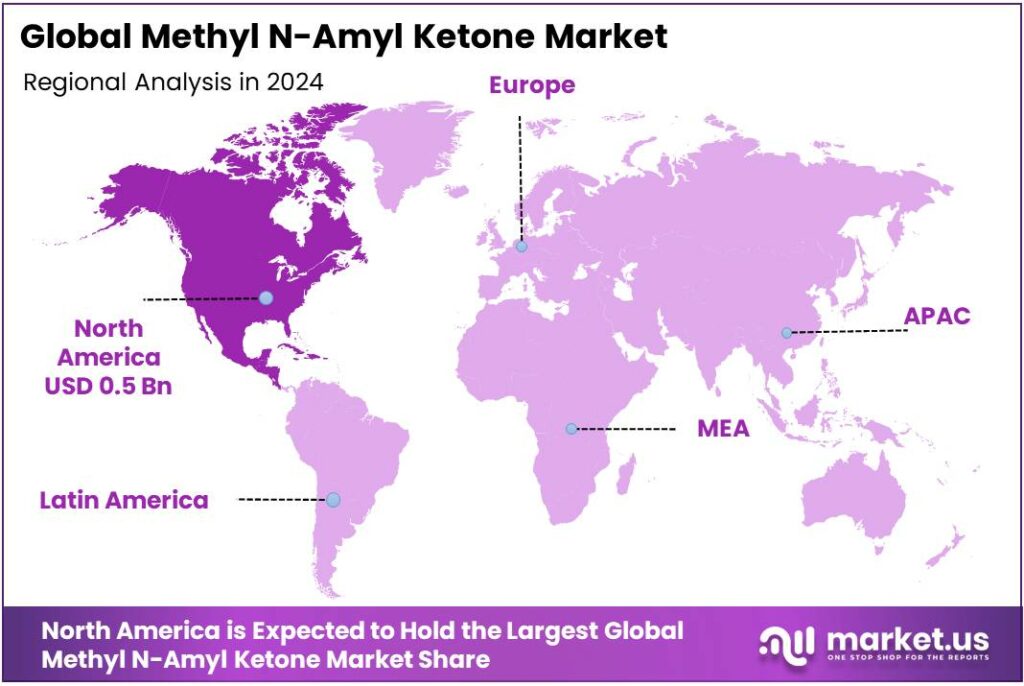

The Global Methyl N-Amyl Ketone Market size is expected to be worth around USD 3.4 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 34.9% share, holding USD 0.5 Billion in revenue.

Methyl n-amyl ketone (MAK, 2-heptanone; CAS 110-43-0) is a medium-evaporation, strong-solvency ketone used in high-solids and polyurethane coatings, industrial adhesives, metal-cleaning, and resin processing. As manufacturers optimize solvent packages for film build and flow under tighter air-quality rules, MAK competes with MIBK and MEK while offering a useful balance of solvency and evaporation for automotive, general industrial, and wood coatings.

Worker safety remains central: NIOSH recommends a time-weighted average exposure limit of 100 ppm and identifies 800 ppm as immediately dangerous to life or health (IDLH), parameters that shape plant ventilation and PPE specifications.

The industrial backdrop for MAK is increasingly tied to petrochemical energy trends. The IEA finds petrochemicals will account for over one-third of global oil-demand growth by 2030 and nearly half by 2050, underscoring robust feedstock availability and long-cycle demand for solvents used across coatings and adhesives.

The IEA also estimates the chemical sector will add ~56 billion m³ of natural-gas demand by 2030, framing energy-cost sensitivity for ketone producers. In the United States, total primary energy production reached ~102.83 quads in 2023 versus 93.59 quads consumed, with ~84% of production from fossil sources—factors that influence domestic petrochemical competitiveness and MAK cost curves.

Regulation is a structural driver. The U.S. EPA’s national architectural-coatings rule is credited with reducing VOC emissions by ~103,000 megagrams per year via VOC-content limits, steering formulators toward higher-solids systems where MAK often appears in balanced solvent blends. In the EU, the Industrial Emissions Directive and its Annex VII set emission-limit values and solvent-management requirements for installations using organic solvents, pushing continuous improvements in capture/abatement and solvent selection across paints, printing, and cleaning lines that are relevant to MAK consuming sites.

These regulatory vectors influence how MAK is deployed: as a strong solvency, low-aromatic option to aid flow/leveling and film formation in higher-solids systems that still need workable viscosity and open time. Historically, EPA estimated U.S. solvent consumption at ~8,400 Gg/year (≈19 billion lb/year), with coatings and industrial uses as major outlets—useful context for the scale of emissions-management and substitution underway in mature markets.

Key Takeaways

- Methyl N-Amyl Ketone Market size is expected to be worth around USD 3.4 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 7.1%.

- 98% Purity held a dominant market position, capturing more than a 67.9% share of the global Methyl N-Amyl Ketone market.

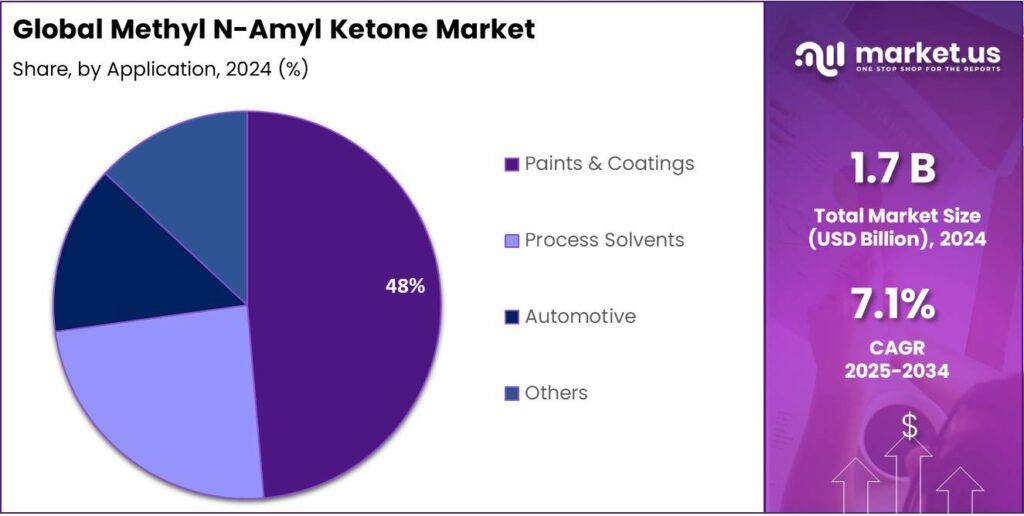

- Paints & Coatings held a dominant market position, capturing more than a 48.3% share of the global Methyl N-Amyl Ketone market.

- North America held a leading position in the global Methyl N-Amyl Ketone (MAK) market, accounting for 34.9% of the total market share, valued at approximately USD 0.5 billion.

By Type Analysis

98% Purity dominates with 67.9% share due to its high industrial suitability and cost efficiency

In 2024, 98% Purity held a dominant market position, capturing more than a 67.9% share of the global Methyl N-Amyl Ketone market. This grade is widely preferred across coatings, adhesives, and chemical synthesis applications due to its consistent quality, low impurity level, and excellent solvency power. The high-purity level ensures stable performance in formulations that demand precise evaporation rates and reduced contamination, particularly in automotive and industrial coatings. Industries have increasingly favored 98% purity MAK because it meets regulatory safety and environmental standards while maintaining production cost efficiency.

The demand for 98% purity Methyl N-Amyl Ketone is expected to continue growing steadily, supported by rising consumption in paints, printing inks, and surface treatment sectors across Asia-Pacific and North America. Manufacturers have prioritized this grade for large-scale production owing to its compatibility with a wide range of resins and polymers. The segment’s growth is also linked to increasing industrial coatings output and expanding construction activities that drive solvent-based coating applications. As industries shift toward refined chemical intermediates, the 98% purity segment is anticipated to remain the key contributor to the overall MAK market volume in the near term.

By Application Analysis

Paints & Coatings dominates with 48.3% share driven by strong demand from construction and automotive industries

In 2024, Paints & Coatings held a dominant market position, capturing more than a 48.3% share of the global Methyl N-Amyl Ketone market. This segment’s leadership is attributed to the solvent’s excellent balance of evaporation rate, solvency, and compatibility with various resins, making it ideal for high-performance coatings and industrial finishes. The compound’s ability to enhance film formation, improve gloss, and reduce viscosity has led to its extensive use in automotive refinishes, architectural paints, and industrial coatings.

Demand from the paints and coatings sector is expected to rise further due to the rapid growth of construction projects and automotive manufacturing across emerging economies. Increasing infrastructure development, particularly in Asia-Pacific, and the rebound in industrial production are anticipated to boost the consumption of Methyl N-Amyl Ketone in solvent-borne coating systems. Additionally, the shift toward premium coatings with improved drying and surface protection properties continues to favor MAK-based formulations. With steady industrial output and rising demand for durable coatings, the paints and coatings application is projected to maintain its dominant position in the market through the next few years.

Key Market Segments

By Type

- 98% Puriy

- 99% Purity

By Application

- Paints & Coatings

- Process Solvents

- Automotive

- Others

Emerging Trends

Food-safety alignment and low-VOC coatings favor MAK

A clear trend for methyl n-amyl ketone (MAK, 2-heptanone) is its “dual-compliance” pull: formulators want solvents that can live comfortably under tightening paint/coating VOC caps while also fitting alongside food-sector expectations where 2-heptanone is an established flavoring substance. On the food side, U.S. FDA lists 2-heptanone (CAS 110-43-0) as a flavoring agent or adjuvant and references 21 CFR 172.515, with FEMA No. 2544 and JECFA No. 283—a regulatory signal that the molecule isn’t exotic in foods.

Europe adds momentum through continuous scientific gatekeeping. In 2022, EFSA’s Panel on Food Additives and Flavourings evaluated 55 flavoring substances in one group review—part of its rolling program to keep the flavor inventory current. That steady cadence matters: as more flavorings are reassessed and confirmed, labs and developers feel safer standardizing extraction and formulation around known inputs like 2-heptanone.

On the coatings side, government VOC rules create the other half of the trend. The U.S. EPA architectural coatings rule estimates an annual cut of 103,000 megagrams (113,500 tons) of VOCs by enforcing category limits; example ceilings in the federal table include 250 g/L for many flat/exterior architectural coatings, pushing formulators toward higher-solids blends and efficient, slower-evaporating solvents like MAK to keep film build and flow.

Similar caps, labeling, and eco-label programs across the EU (rooted in Directive 2004/42/EC) have reshaped solvent choices for more than a decade, requiring VOC content to be disclosed in g/L and encouraging migration from fast aromatics to oxygenated ketones/esters that can deliver solvency with fewer grams per liter. Together, these rules reward MAK’s balance of solvency and evaporation rate.

Drivers

Packaged-food growth fuels MAK demand via inks And coatings

One powerful, real-world driver for methyl n-amyl ketone (MAK) is the steady expansion of packaged food and beverage activity—because every incremental box, pouch, label, or can needs inks and coatings where MAK’s high solvency and medium evaporation help film formation and print quality.

The Food and Agriculture Organization (FAO) estimates the global food import bill reached nearly USD 2.1 trillion in 2024, up 3.6% year over year, signaling more traded, packaged foods moving through supply chains—and, by extension, more packaging conversions and print runs that consume solvent systems like MAK. This sits alongside a still-busy commodity backdrop: the FAO Food Price Index averaged 128.8 points in September 2025, 3.4% higher than September 2024, reflecting continued throughput across cereals, meats, oils, and other categories that are predominantly distributed in packaged formats.

On the manufacturing side, the United States—an anchor for global food processing and packaging technology—illustrates the scale that ultimately pulls MAK into formulations. The USDA Economic Research Service reports 1.7 million workers in U.S. food and beverage manufacturing (2021), equal to 15.4% of all manufacturing employment, underscoring a large base of plants that run printing, coating, laminating, and can-lining operations every shift.

Trade adds momentum: U.S. agricultural exports in 2024 rose by USD 1.8 billion (+1%) versus 2023 to the third-highest level on record, a proxy for robust packaged food flows to overseas markets that lean on packaging inks and overprint varnishes where MAK can be part of the solvent package.

Restraints

food-contact And VOC rules are squeezing solvent-borne MAK

Methyl n-amyl ketone (MAK) is a strong solvent for inks, coatings and cleaners used around food packaging—but the rules that protect air quality and food safety are steadily pushing converters toward water-based, UV/EB, and high-solids systems that use less (or no) solvent. In the United States, the South Coast Air Quality Management District’s Rule 1113 sets very low VOC caps for many coating categories—50 g/L for most architectural coatings—which has become a de-facto benchmark referenced by specifications nationally; when buyers lock in 50 g/L targets, solvent-borne options with MAK often fall out of scope.

The broader emissions backdrop reinforces this direction: EPA’s National Emissions Inventory shows national VOC emissions declining from 10.5 million tons (2017) to 10.0 million tons (2020), a trend consistent with ongoing substitution away from traditional solvent systems in surface coating and printing.

In Europe, the regulatory pressure is structural. The EU Solvent Emissions Directive sets stack emission limits for installations using organic solvents at 50 mg C/Nm³ and 150 mg C/Nm³. Plants that cannot economically meet these thresholds often pivot to lower-solvent chemistries, reducing room for MAK in recipes serving food packaging and related lines. National transpositions echo the same numbers—for example, Ireland’s rules specify 50 mg C/Nm³ and 150 mg C/Nm³, underscoring how these limits are enforced at plant level.

Opportunity

packaged-food expansion And export momentum lift MAK in inks and coatings

A clear, near-term growth lane for methyl n-amyl ketone (MAK) sits where food and packaging meet: more traded food means more printed films, cartons, and labels—and those lines rely on high-solvency, medium-evaporation solvents like MAK to keep inks, overprint varnishes, and certain can/coil coatings running fast and glossy.

The Food and Agriculture Organization (FAO) reports the global food import bill reached nearly USD 2.1 trillion in 2024, up 3.6% year over year, with sharp cost rises across categories such as coffee, tea, cocoa, fruits, vegetables, and meat. That single number signals bigger volumes of packaged foods crossing borders and a sustained need for high-quality printing and protective finishes—prime use cases where MAK helps with flow, leveling, and film formation in high-solids systems.

Trade-driven throughput is mirrored in the United States, a bellwether for processing and packaging technology adoption. According to USDA’s Foreign Agricultural Service, U.S. agricultural exports totaled USD 176.0 billion in calendar-year 2024, up USD 1.8 billion (+1%) from 2023, the third-highest value on record—evidence that packaged and value-added products continue to move at scale into overseas retail channels, pulling demand for printing inks and conversion coatings that frequently include MAK in their solvent packages.

In parallel, FDA’s food-contact framework (e.g., 21 CFR 175.300) and its chemistry guidance for Food Contact Notifications keep the industry focused on robust migration and extractives data; converters that adopt higher-solids, well-cured systems can meet those requirements while still using tightly specified solvent blends where MAK’s solvency is hard to replace for certain resins and pigments. The path forward is smarter formulation and process control—not a blanket exit from solvents.

Regional Insights

North America dominates with 34.9% share valued at USD 0.5 billion, driven by strong industrial and coatings demand

In 2024, North America held a leading position in the global Methyl N-Amyl Ketone (MAK) market, accounting for 34.9% of the total market share, valued at approximately USD 0.5 billion. The region’s dominance is primarily attributed to its well-established coatings, automotive, and chemical manufacturing sectors. MAK’s wide application in paints and coatings, particularly in industrial maintenance and automotive refinish products, continues to support steady consumption.

The United States represents the major contributor within North America, with robust growth in infrastructure renovation projects and industrial production. According to the U.S. Census Bureau, construction spending in the country surpassed USD 1.98 trillion in 2024, reflecting consistent activity in both residential and non-residential sectors, which directly drives the need for solvent-based coatings.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

JX Nippon Oil & Energy Corporation plays a significant role in the global Methyl N-Amyl Ketone market, leveraging its advanced petrochemical production technologies. The company’s strong integration across solvent manufacturing ensures consistent supply and quality standards. Its focus on high-purity solvents aligns with industrial applications in paints, coatings, and adhesives. In 2024, the company expanded its specialty chemical capacity across Japan and Southeast Asia to meet increasing demand for high-performance solvents in the automotive and construction sectors.

Solvay SA is a key participant in the Methyl N-Amyl Ketone market, focusing on high-performance chemical intermediates and specialty solvents. The company’s strong manufacturing presence in Europe supports its distribution network across global industrial and coatings markets. In 2024, Solvay prioritized the production of environmentally compliant solvents while investing in process efficiency and energy optimization. Its solvent solutions cater to demanding coating and adhesive formulations, aligning with sustainability goals and increasing regulatory requirements for reduced environmental impact in solvent-based industries.

BASF SE operates as one of the world’s largest chemical producers, with a strong portfolio that includes Methyl N-Amyl Ketone used in coatings, inks, and adhesives. The company’s advanced solvent technologies are backed by integrated production systems and sustainable development strategies. In 2024, BASF enhanced its solvent capacity in Europe and Asia to address growing regional needs. Its focus on low-emission, high-purity solvents aligns with environmental regulations, ensuring steady market presence and customer trust in industrial and specialty chemical sectors.

Top Key Players Outlook

- JX Nippon Oil & Energy

- Eastman Chemical

- Solvay

- ExxonMobil

- BASF

- Kraton

- Others

Recent Industry Developments

In 2024, BASF reported group sales of €65,260 million compared with €68,902 million in 2023, marking a decline in total revenue.

In FY 2024, ENEOS reported segment net sales of ¥347.0 billion and operating income of ¥17.7 billion for High Performance Materials, framing the scale at which specialty materials—including solvent intermediates—are managed, even though product-level detail like MAK isn’t specified.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 3.4 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (98% Puriy, 99% Purity), By Application (Paints And Coatings, Process Solvents, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape JX Nippon Oil & Energy, Eastman Chemical, Solvay, ExxonMobil, BASF, Kraton, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Methyl N-Amyl Ketone MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Methyl N-Amyl Ketone MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- JX Nippon Oil & Energy

- Eastman Chemical

- Solvay

- ExxonMobil

- BASF

- Kraton

- Others