Global Methyl Cellulose Market Size, Share Analysis Report By Type (Carboxymethyl Cellulose, Ethyl Cellulose, Ethyl Methyl Cellulose, Hydroxypropyl Cellulose, Hydroxyethyl Cellulose, Others), By End-use (Chemical and Petrochemical, Oil And Gas, Energy and Power, Automotive, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163539

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

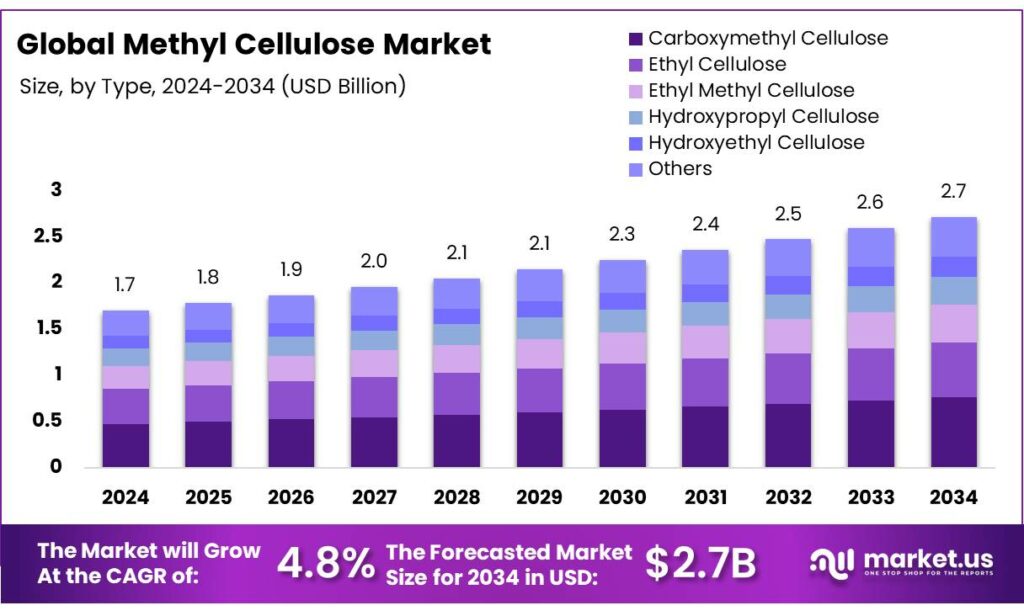

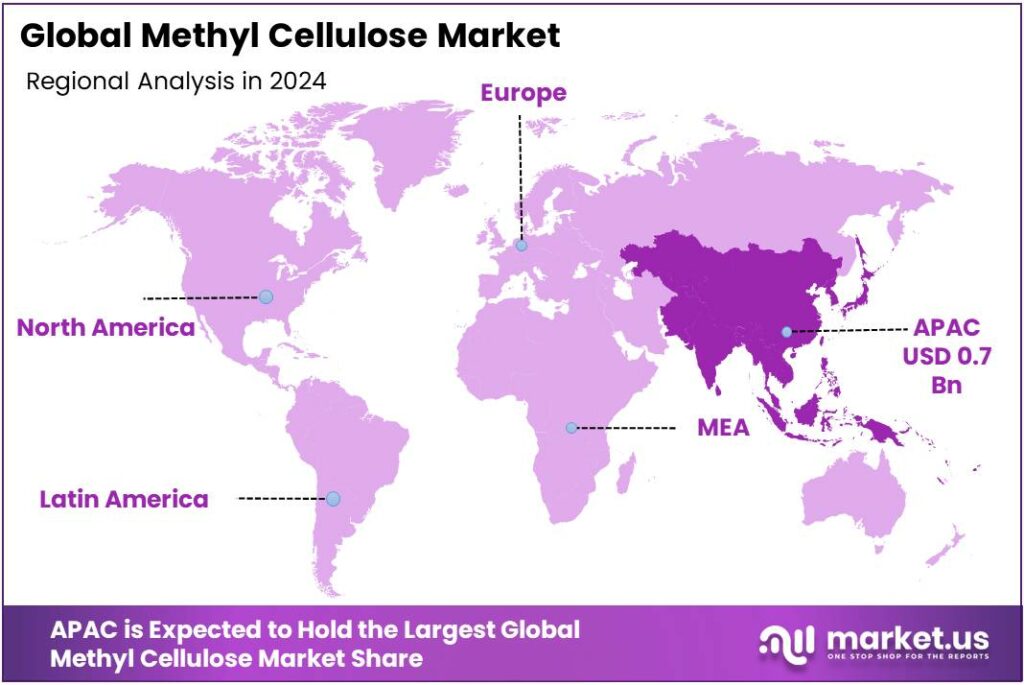

The Global Methyl Cellulose Market size is expected to be worth around USD 2.7 Billon by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 48.9% share, holding USD 13.8 Billion in revenue.

Methyl cellulose (MC) is a multifunctional cellulose ether used across construction, food, pharmaceuticals, personal care, ceramics, and paper. In dry-mix mortars and cementitious systems, MC provides water retention, workability, and sag resistance; in tablets and capsules it acts as a binder and disintegrant; in foods it is authorised in the EU as additive E 461 for specified uses. These roles align with structural policy and energy trends reshaping end-markets. The buildings sector alone accounts for 30% of global final energy use and 26% of energy-related CO₂ emissions, making performance-enhancing materials in construction a persistent priority.

Energy-efficiency agendas translate into concrete renovation targets that expand demand for high-performance mortars, tile adhesives, renders, and external insulation systems—key outlets for MC. The IEA indicates that to stay on a net-zero pathway, energy consumed per square metre in buildings must be ~35% lower in 2030 than in 2022, implying faster adoption of envelope upgrades and heat-loss mitigation—projects where MC-modified mortars help deliver quality and durability. In parallel, the IEA calls for deep renovation rates above 2% annually by 2030, a material demand signal for specialty admixtures and rheology modifiers.

In Europe, the Commission’s Renovation Wave aims to renovate 35 million buildings by 2030 and at least double energy-renovation rates, directly underpinning volumes of cement-based systems that benefit from MC’s water-retention and open-time control. The Commission also estimates a need for €275 billion per year of additional building-renovation investment to 2030, supporting a sustained pipeline of projects.

In the United States, policy support extends beyond targets to funding. The U.S. Department of Energy’s Home Energy Rebates under the Inflation Reduction Act allocate $8.8 billion for home efficiency and electrification upgrades administered by states and tribes—programs that typically drive air-sealing, insulation, window replacements, and envelope retrofits, all of which consume mortars, sealants, and patching compounds where MC adds performance.

- On the supply and adjacent-demand side, construction material fundamentals remain large-scale: according to the U.S. Geological Survey, world cement production was about 4.1 billion metric tons in 2023, anchoring the massive downstream market for mortars and concrete modifiers in which MC is embedded.

Key Takeaways

- Methyl Cellulose Market size is expected to be worth around USD 2.7 Billon by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 4.8%.

- Carboxymethyl Cellulose (CMC) held a dominant market position, capturing more than 28.4% share of the overall methyl cellulose market.

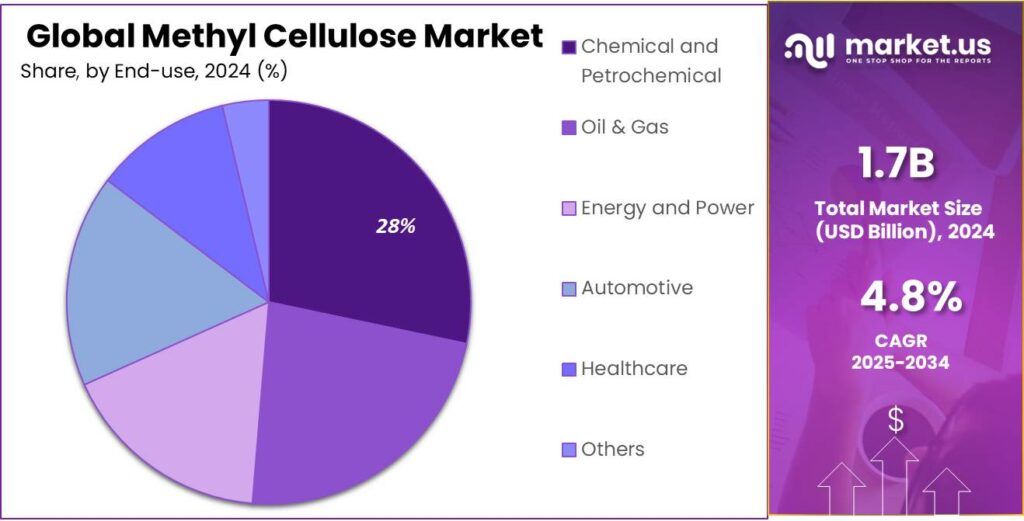

- Chemical and Petrochemical segment held a dominant position in the methyl cellulose market, capturing more than 28.3% share.

- Asia-Pacific (APAC) region dominated the global methyl cellulose market, accounting for 43.8% of total revenue, valued at approximately USD 0.7 billion.

By Type Analysis

Carboxymethyl Cellulose Leads the Segment with 28.4% Market Share in 2024

In 2024, Carboxymethyl Cellulose (CMC) held a dominant market position, capturing more than 28.4% share of the overall methyl cellulose market. Its strong presence can be attributed to its extensive use across construction, food processing, pharmaceuticals, and oil drilling applications. The product’s water retention ability, thickening properties, and film-forming nature have made it a preferred additive for adhesives, coatings, and emulsions. In the construction industry, CMC continues to be a key ingredient in tile adhesives and cement-based mortars, supporting demand from large-scale infrastructure and housing projects in emerging economies such as China and India.

Demand for CMC also gained traction in the food and beverage sector, where it is widely used as a stabilizer and viscosity enhancer in bakery, dairy, and beverage formulations. Pharmaceutical usage remained steady, driven by its role as a tablet binder and controlled-release agent. The rising focus on sustainable and bio-based polymers further strengthened its market acceptance as manufacturers gradually replace synthetic additives with cellulose-based alternatives.

By End-use Analysis

Chemical and Petrochemical Sector Leads with 28.3% Share in 2024

In 2024, the Chemical and Petrochemical segment held a dominant position in the methyl cellulose market, capturing more than 28.3% share. This leadership is largely driven by the compound’s widespread use as a thickener, stabilizer, and binding agent in multiple chemical formulations, including paints, coatings, resins, and adhesives. The segment’s strength reflects the continuous expansion of downstream chemical processing activities and the growing need for cellulose-based modifiers that enhance product consistency and thermal stability.

The petrochemical sector increasingly adopted methyl cellulose for use in drilling fluids, emulsifiers, and rheology modifiers, where its water-retention capacity and eco-friendly nature supported a gradual shift from synthetic polymers to bio-based alternatives. The rising investment in oilfield exploration and refining operations across regions such as the Middle East and Asia also contributed to stronger industrial consumption.

Key Market Segments

By Type

- Carboxymethyl Cellulose

- Ethyl Cellulose

- Ethyl Methyl Cellulose

- Hydroxypropyl Cellulose

- Hydroxyethyl Cellulose

- Others

By End-use

- Chemical and Petrochemical

- Oil & Gas

- Energy and Power

- Automotive

- Healthcare

- Others

Emerging Trends

Quiet sodium cuts are reshaping recipes—and MC is the texture safety net

A clear trend in food manufacturing is quiet sodium cuts: brands are lowering salt without fanfare to meet new public-health targets, yet still need foods to feel satisfying. Regulators set the numeric guardrails. The WHO advises adults to keep sodium below 2,000 mg/day (under 5 g/day salt), a benchmark now used by health agencies and retailers worldwide. In the U.S., the FDA fixes the Nutrition Facts Daily Value for sodium at 2,300 mg, so a serving that shows 20% DV or more is high.

When salt drops, textures can thin, weep, or turn rubbery. Here, methyl cellulose (MC) earns its keep: it thickens, emulsifies, and—crucially—heat-gels during cooking, so burgers, nuggets, dumpling fillings, and reheatable meals hold together even as sodium steps down. The FDA’s consumer guidance (2024) re-states the 2,300 mg/day DV and educates shoppers on %DV, making high-sodium items stand out on shelf and nudging demand toward reformulated options that rely on functional fibers like MC to keep mouthfeel right.

Policy is moving from advice to measurable targets. In August 2024, the FDA issued Phase II draft guidance with 3-year sodium targets across 163 food categories, aiming to pull average intake toward ≈2,750 mg/day—a practical step on the path to 2,300 mg. That puts a premium on ingredients that replace salt’s work without adding off-notes. MC’s low-dose viscosity and thermal gelation make it a go-to in reduced-sodium sauces, savory fillings, and plant-forward items where protein matrices are delicate.

The USDA reports U.S. consumers’ share of disposable income spent on food-away-from-home rose to 5.9% in 2023, while food-at-home fell to 5.3%—a shift toward restaurants, quick-service, and prepared meals that must survive holding, delivery, and reheat. Stable sauces that don’t split and patties that don’t crumble—despite lower salt—translate into fewer complaints and fewer returns.

Drivers

The global push to close the fiber gap in foods

A powerful demand driver for methyl cellulose in foods is the worldwide push to raise dietary-fiber intake while reformulating products for better texture and lower fat. Health authorities now set clear numeric targets. The World Health Organization recommends adults consume at least 25 g of naturally occurring dietary fiber per day; it also urges higher intake of whole grains, fruit, vegetables and pulses.

In the United States, the Food and Drug Administration pegs the Daily Value for fiber at 28 g on Nutrition Facts labels, orienting manufacturers toward recipes that help shoppers reach that benchmark. Yet intake still lags. Analyses shared by the American Society for Nutrition show only about 7% of U.S. adults meet fiber recommendations, underscoring a large “fiber gap” that food companies are trying to close with reformulation.

Methyl cellulose (MC) directly supports this policy-led reformulation. As a non-digestible cellulose ether, it contributes fiber while delivering heat-gelation, thickening and emulsification—functionalities that allow fat-reduction and plant-forward recipes without sacrificing mouthfeel. The CDC’s guidance—22–34 g/day depending on age and sex—keeps fiber in front of consumers and retailers, favoring products that list meaningful grams of fiber per serving.

MC’s unique gelation (gels when heated, melts when cooled) helps designers create juicy textures in plant-based meats, stabilize dairy alternatives, and deliver lower-oil dressings or sauces that still feel rich—practical levers for meeting the 28 g/DV target on pack.

Governments and regulators also reinforce MC’s adoption by affirming safety and permitted uses. In the EU, EFSA’s comprehensive re-evaluation of celluloses (E 460–E 469) found no carcinogenic properties and reported NOAEL values up to 9,000 mg/kg bw/day in chronic studies—evidence that supports continued, confident use in foods. In the U.S., the FDA’s ingredient inventory lists methyl cellulose across applicable food additive and GRAS contexts, giving formulators a well-defined regulatory path.

These numeric targets and approvals translate into a pragmatic brief for R&D teams: raise on-label fiber grams, trim fat and stabilize new plant-based matrices—without losing consumer-preferred texture. WHO’s ≥25 g/day recommendation, FDA’s 28 g/DV, and the reality that ~93% of adults fall short create sustained incentives to use functional fibers like methyl cellulose in bakery, meat alternatives, soups, sauces and nutrition bars.

Restraints

Strict regulatory ceilings and consumer perception hurdles

One of the major restraining factors for the use of methyl cellulose (MC) in food applications is the complex regulatory environment coupled with growing consumer scepticism regarding additives. In several jurisdictions, MC (often listed as E 461 in the EU) is subjected to explicit usage limits. For instance, in Japan’s “Standards for Use of Food Additives,” MC is allowed in “all foods” but the total amount when used together with other cellulose derivatives must not exceed 2.0 % of the final food product.

Moreover, in the European Union, food additives authorised before 20 January 2009—including MC and other celluloses—are under a re-evaluation programme mandated by European Food Safety Authority (EFSA). This re-evaluation process creates regulatory uncertainty: while MC is currently permitted “at quantum satis” for certain uses, future recommendations or exposure assessments could prompt tighter restrictions, additional labelling, or revised maximum levels. Such regulatory ambiguity can discourage food manufacturers from investing in MC-rich formulations or entering new geographic markets.

On the consumer side, additive fatigue is growing. According to the Center for Science in the Public Interest (CSPI), there are concerns that large parts of the food industry use “Generally Recognised as Safe” (GRAS) substances—including some cellulose derivatives—without full pre-market review by regulatory bodies. This feeds into consumer wariness and clean-label demands. Many brands are now marketing “no celluloses,” “no artificial thickeners,” or “plant-only” claims, which can sideline MC even when it could serve functional roles.

Opportunity

Waste-smart, gluten-safe reformulation across mainstream foods

A large, near-term growth lane for methyl cellulose (MC) is helping brands cut food waste while meeting fast-maturing gluten-free rules. Waste is now quantified at global scale, which is pushing retailers and manufacturers to change how foods are formulated and stabilized. The UN Environment Programme reports 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers, with households at 631 million tonnes, food service 290 million, and retail 131 million. That is “over a billion meals a day” thrown out—a visible problem that companies are pressed to solve with better textures, thermal stability, and freeze–thaw tolerance.

MC’s heat-gelation and water-binding are practical tools against these losses: it helps sauces resist syneresis after reheating, keeps gluten-free breads from crumbling, stabilizes plant-based meats in hot hold, and supports freeze–thaw cycles in ready meals. The policy tailwind is strong. Many governments have aligned with SDG 12.3 to halve food waste by 2030, and retailers are now setting numeric targets that cascade to suppliers; this translates into procurement briefs that reward shelf-life gains and lower return rates—exactly where MC’s functionality pays off. UNEP’s 2024 Food Waste Index gives decision-makers hard baselines to track reductions, making MC-enabled reformulation a measurable route to compliance.

The second leg of this opportunity is regulatory clarity in gluten-free. The U.S. FDA enforces a < 20 ppm gluten threshold for foods labeled “gluten-free,” “without gluten,” or similar claims (21 CFR 101.91). This is now the de-facto compliance floor for large retailers and co-packers. At the same time, the NIH’s NIDDK estimates ~2 million people in the U.S. live with celiac disease, and ~1% of people worldwide are affected—figures that anchor steady demand for gluten-free staples well beyond niche channels.

The numbers define a clear growth story. Tackling 1.05 billion tonnes of waste and 14% upstream losses requires robust textures and moisture control; serving a gluten-free population anchored by ~2 million U.S. celiac patients demands reliable structure at < 20 ppm gluten. MC’s specific physics—heat-set gels, viscosity control at low dosage, freeze–thaw resilience—map directly to these quantified goals. Brands that use MC to extend shelf-life and deliver gluten-safe quality can meet government-tracked waste targets and labeling rules, turning compliance into consumer-visible performance and a durable source of category growth.

Regional Insights

Asia-Pacific Leads the Global Methyl Cellulose Market with 43.8% Share Valued at USD 0.7 Billion in 2024

In 2024, the Asia-Pacific (APAC) region dominated the global methyl cellulose market, accounting for 43.8% of total revenue, valued at approximately USD 0.7 billion. The region’s leadership is primarily driven by rapid industrialization, infrastructure expansion, and growing demand across construction, pharmaceuticals, and food processing sectors. Countries such as China, India, Japan, and South Korea serve as major consumption hubs, with large-scale production of cellulose derivatives supported by abundant raw material availability and favorable government policies promoting sustainable and bio-based materials.

In China, continuous investments in residential and commercial infrastructure have significantly increased the use of methyl cellulose in construction products such as tile adhesives, mortars, and coatings. India’s booming pharmaceutical manufacturing sector, which contributes over 3.5% of global pharmaceutical exports (source: Ministry of Commerce, India), has further fueled demand for methyl cellulose as an excipient and stabilizer. Meanwhile, Japan and South Korea continue to advance high-performance chemical and cosmetic applications, where the compound is utilized as a thickening and emulsifying agent.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE, headquartered in Ludwigshafen, Germany, is a diversified chemical company with broad global operations. Although direct methyl-cellulose specific data is limited, the company is noted among the key players in cellulose-ether markets, leveraging its strong R&D, sustainability focus and large asset base. The firm’s involvement in cellulosic material collaborations signals its strategic positioning in the supply of bio-based additives and thickeners.

The Dow Chemical Company (Dow) offers the METHOCEL™ and WALOCEL™ lines of cellulose ethers, including methyl cellulose grades, used widely in construction materials and industrial applications. For example, the company announced an additional 19,000-metric-ton capacity for cellulose ether production in Germany, highlighting its growth strategy in the additive segment.

Barzaghi Srl is an Italian family-owned specialty chemicals producer, founded in 1924 and based in Arluno (Milan-Turin corridor). The company manufactures cellulose ethers including CMC and other derivatives, with flexible production lines suited for small-batch and tailor-made formulations. It has around 3,000 t/year powder capacity and offers customized grades.

Top Key Players Outlook

- BASF SE

- The Dow Chemical Company

- Barzaghi Srl

- Daicel Corp

- Ashland Global Holdings Inc

- LOTTE Fine Chemical

- Shin-Etsu Chemical Co., Ltd

- Patel Industries

Recent Industry Developments

BASF SE holds a meaningful place in the methyl cellulose (and broader cellulose-ether) sector, leveraging its global chemical-additive operations and sustainability agenda. In 2023 the group reported total sales of €68.9 billion across all its segments.

September 30, 2024, Ashland reported total sales of approximately USD 2.10 billion, with full-year adjusted EBITDA projected in the range of USD 465-475 million.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 2.7 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carboxymethyl Cellulose, Ethyl Cellulose, Ethyl Methyl Cellulose, Hydroxypropyl Cellulose, Hydroxyethyl Cellulose, Others), By End-use (Chemical and Petrochemical, Oil And Gas, Energy and Power, Automotive, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, The Dow Chemical Company, Barzaghi Srl, Daicel Corp, Ashland Global Holdings Inc, LOTTE Fine Chemical, Shin-Etsu Chemical Co., Ltd, Patel Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- The Dow Chemical Company

- Barzaghi Srl

- Daicel Corp

- Ashland Global Holdings Inc

- LOTTE Fine Chemical

- Shin-Etsu Chemical Co., Ltd

- Patel Industries